“In 2023, the export credit industry saw over USD3 trillion in new support, with a 40% increase in MLT business and record renewable energy commitments. The strong growth promises a positive outlook for 2024 and beyond.”

The trade and credit and credit insurance universe are in flux with potentially game changing developments over the next two years, which governments, international gatekeeper organisations, multilateral and private insurers, export credit agencies, financial institutions and the export/import fraternity would ignore at their peril. These include trade digitalisation, transitioning to ISO 20022, embedding Climate and ESG considerations in the trade playbook, the adoption of Electronic Trade Documentation, the implications of the Net-Zero Export Credit Agencies Alliance (NZECA) launched at COP28, and advancing the role of women in credit insurance. Dr. Khalid Khalafalla, Officer-in-Charge, ICIEC explores the above structural regulatory trends and initiatives for the credit and PRI industry.

It is not surprising that the Berne Union (BU) Spring Meeting in Oslo in April 2024 focussed on innovation in its various forms – covering topics ranging from technology to new and innovative products and how the export credit insurance industry is adapting to a swiftly changing global environment.

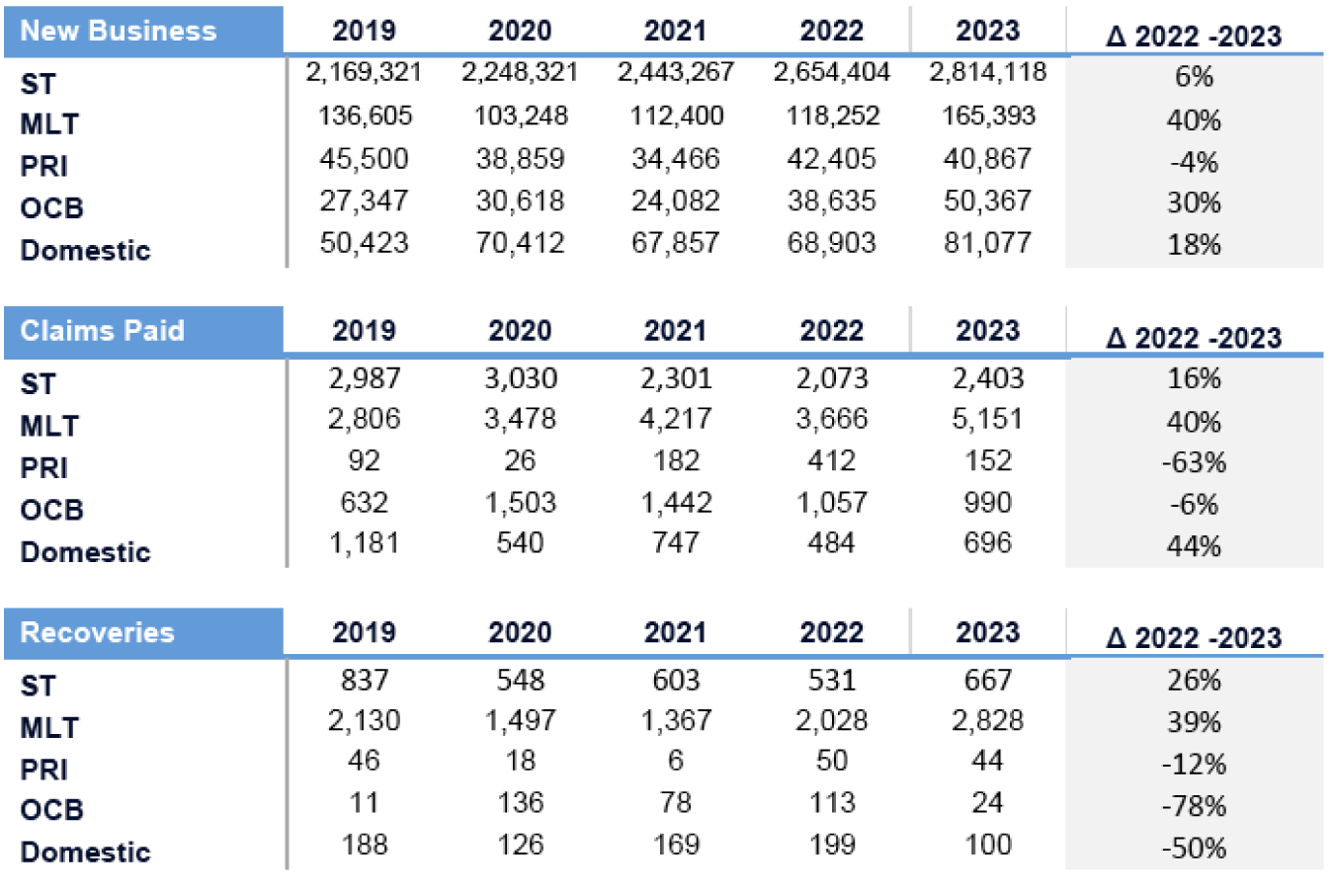

The export credit industry, says the Union, emerged from the pandemic strong with substantial growth in support provided for cross-border trade and investment as members ramp up commitments across key sectors and geographies. In fact, 2023 was an encouraging year for export credit with BU members providing over USD3 trillion in new support for cross-border trade, with expansion across almost all business lines, which augurs well for 2024 and beyond. The overall performance metrics for the industry in 2023 include:

- A 40% increase to over USD165 billion for MLT business, following strong growth in manufacturing, infrastructure, and transport sectors alongside a continuing rapid growth in renewable energy investments.

- A particularly strong year for ECAs who grew their MLT business by 50% following several years of relative stagnation throughout the pandemic. Private CPRI underwriters continue to build on the strong year-on-year growth they have recorded since 2020.

- The industry is drawing upon an increasingly flexible product suite with volumes of untied credit support increasing 30% to over USD50 billion in new commitments in 2023.

- Climate and the green transition are the main drivers of new opportunities with a record USD20.5 billion in reported new commitments for renewable energy across 68 countries in 2023.

- BU members provided an estimated USD98 billion in total support for wider green, climate and energy-transition related transactions in 2023 – 5 times the commitments to renewable energy production alone and a significant portion of total long-term finance supported across MLT and PRI business.

- Members are attuned to a heightened political risk environment, with both sovereign defaults and corporate insolvencies driving an uptick in claims. Over USD9 billion of claims were paid, with a significant spike in MLT political risk claims in FY 2023 largely due to a distressed period for sovereign debt.

- Geopolitical risk and armed conflict have become an increasing concern for members.

- ST claims continued to rise along with insolvencies, with levels manageable. MLT commercial claims continued to fall with strong recoveries in the transport sector.

ST: Short Term Export Credit – Export Credit / Trade-Finance Credit lending and Insurance of which the repayment term is less than 360 days.

MLT: Medium / Long-Term Export Credit – Insurance, Guarantees and lending for Export/Trade-Finance Credit of which the repayment term is greater than 360 days.

PRI: Political Risk Insurance – Insurance or Guarantee that indemnifies an equity investor or a bank financing the equity investment for losses incurred to a cross-border investment as a result of political risks.

OCB: Other Cross-border Credit – Insurance or Guarantee or direct loan relating to a debt-finance instrument, of which the debt obligor resides in a different country than the debt counterparty, AND the debt obligation is provided without any requirement that the debt capital be used to finance an export or international trade.

The key takeaways could not be clearer – the macro risk environment remains volatile and full of uncertainty, with businesses challenged by elevated interest rates and increased costs as well as pressures around energy transition and disruption emerging from both direct conflict and wider geopolitical tensions. Trade remains one of the most powerful tools for promoting positive economic development and although it continues to grow, the risks and costs of financing this are increasingly challenging, and the technology and innovation needed to deliver a climate transition in line with the goals of the Paris Agreement requires huge volumes of finance from both public and private sources.

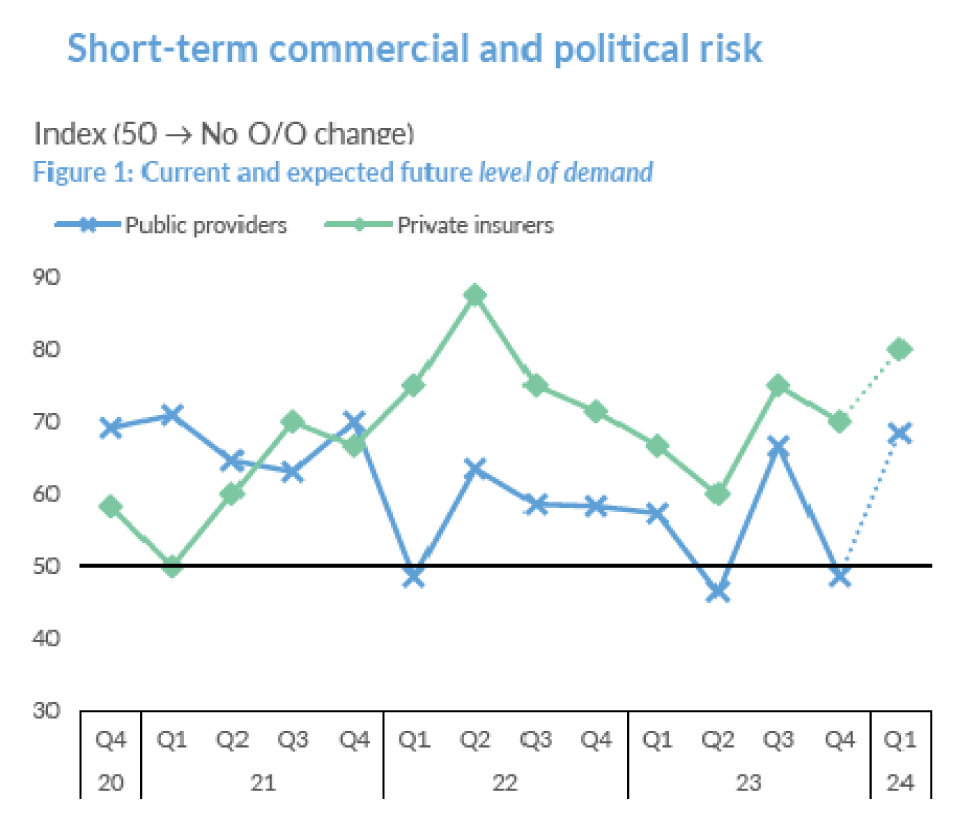

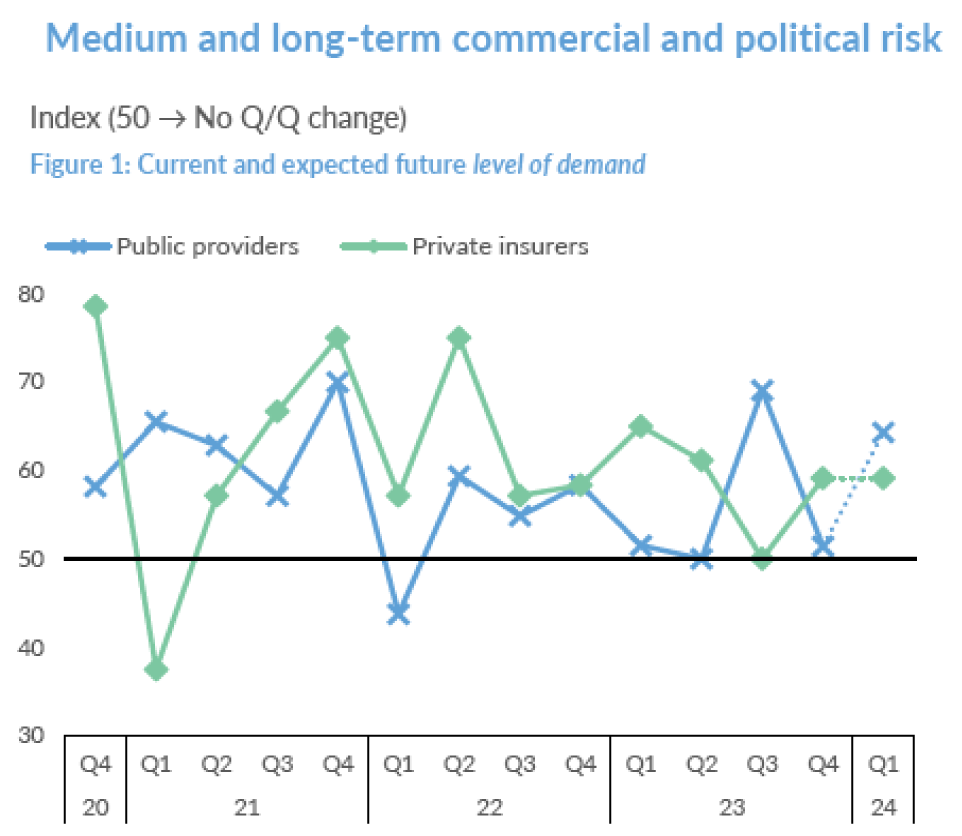

Berne Union Business Confidence Survey, 1st Quarter 2024

That the export credit insurance industry is well placed to play an important role in tackling the above challenges – not only mitigating trade risks and unlocking finance, but also in helping guide economic transformation and supporting green supply chains – is not in doubt.

Opportunities and Risks

The table below clearly identifies the perceptions of BU members about the opportunities and risks for export credit and PRI business in 2024 and beyond with Green and transition projects, renewable energy, new supply chains and markets, SME support, and innovative risk-sharing structures the top priorities. This is against the top risk perceptions of geopolitical tensions, global economic slowdown, conflicts, emerging markets sovereign debt crises, and high interest rates.

Greatest Opportunities and Risks for Export Credit and PRI Industry in 2024

| Greatest Opportunities | |

|---|---|

| 1 | Green/Transition (Excluding Renewables) |

| 2 | Renewable Energy |

| 3 | New Supply Chains/Markets |

| 4 | SME Support |

| 5 | Innovative Risk-Sharing Structures |

| 6 | Energy Sector Investment |

| 7 | Blended Finance |

| 8 | Digital Transformation (Including AI) |

| 9 | New Financial Products |

| 10 | New Technologies in Goods and Services |

| 11 | Recommencement of Paused Projects |

| 12 | Alternative Capital |

| Greatest Risks | |

|---|---|

| 1 | Geopolitical Risk |

| 2 | Global Economic Slowdown/Recession |

| 3 | Impact of Conflicts |

| 4 | Emerging Market Debt Crises |

| 5 | High Interest Rates |

| 6 | High Inflation (or Deflation) |

| 7 | Rising Barriers to Trade |

| 8 | Corporate Leverage/Liquidity |

| 9 | Energy Market Disruption |

| 10 | Negative Impacts of Regulation |

| 11 | Commodity Volatility |

| 12 | Physical Climate Risks |

An important initiative that emerged out of COP28 in Dubai could potentially be a game changer in the role and ways de-risking solutions are contributing to the Net Zero ambitions.

The Net Zero Export Credit Agencies Alliance (NZECAA) launched by a group of ECAs led by UK Export Finance (UKEF) under the aegis of the United Nations Environment Programme Finance Initiative (UNEP-FI) has the simple mandate of promoting the role of export credit in achieving net zero emissions by 2050 and limiting global warming to 1.5°C, in collaboration with the Glasgow Financial Alliance for Net Zero (GFANZ).

UN Under-Secretary-General and UNEP Executive Director, Inger Andersen could not have been more to the point at the launch of the Alliance. ECAs, she reminded, are in a strong position to deliver more sustainable global trade and to complement the work already being undertaken by the private finance sector, helping to address market gaps to deliver net-zero economies by 2050. “This Alliance will play an important role in supporting tangible economic transition and help countries implement their commitments under the Paris Agreement. Large private financial institutions are powerful, but they cannot deliver net-zero alone. Public finance is the missing piece in net-zero financial landscape. We need the full might of the global financial system to combat and adapt to climate change,” she maintained.

UKEF, has gone one step further by unveiling a multi-million-pound support for transactions supporting climate adaptation and sustainability across Africa and the Middle East, including a GBP226 million facility for the Iraqi Government to develop clean water and sewage treatment infrastructure in Hillah City.

UKEF has declared that it is committed to reaching net-zero in terms of its total financed emissions by 2050, it ended all new support for overseas fossil-fuel projects in 2021, except in very limited circumstances, and recently introduced more flexible and competitive terms for British exporters as part of the Government’s drive to encourage them to use and offer finance solutions and other options which are consistent with the Green Finance agenda in line with the UN SDGs and the Paris Net Zero ambitions. According to the British ECA, it can now offer longer repayment terms and more flexible repayment structures for an expanded range of renewable and green transactions, and for standard transactions.

Embedding Climate and ESG in the Trade Playbook

ICIEC embodies an ideal example of embedding Climate and ESG considerations in its business ethos and operational playbook. The Corporation launched its Climate Change Policy and ESG Framework at COP28, which marks the commencement of a transformative results-oriented process where ICIEC’s operations, insurance, physical assets and human capital and focus are addressing the Climate Crisis at their core, based on the needs of ICIEC’s member states, the Islamic Development Bank (IsDB) Group synergies, the role of the private sector in climate finance and industry best practice.

ICIEC is committed to helping its 49 Member States achieve their development goals, including resilience, mitigation and adaptation to the threats posed by climate change. ICIEC cover is directed towards various sectors, with USD2.35 billion in 2023 going specifically into clean energy initiatives such as solar energy systems and wind farms – assisting with their importation and use in national infrastructure projects. At COP28, IsDB President, H.E. Dr. Muhammad Al Jasser, unveiled a USD1 billion climate finance initiative for fragile and conflict-affected member countries over the next three years.

The ICIEC Climate Change Policy reinforces the Corporation’s unwavering commitment to combatting climate change and serves as a blueprint for ICIEC to increase its intervention in sustainable projects and programs. Anchored on this policy, ICIEC pledges to upscale its support to initiatives aimed at reducing carbon emissions, safeguarding nature, and fostering sustainable economic growth. To advance the role of climate action, ICIEC commits to assisting Member States in meeting their obligations under the Paris Agreement and champion investment and trade opportunities that enhance resilience and increase adaptability to climate change, emphasized H.E. Dr. Muhammad Al Jasser.

The ICIEC ESG Framework similarly is a holistic tool showcasing our strong dedication to ESG principles. The framework emphasizes embedding ESG principles to ICIEC’s operations, developing ESG-centric products and services, incorporating ESG imperatives into risk assessment and underwriting. Measures are implemented to promote sustainability throughout internal processes, including sourcing and resource usage practices. The launch of our Climate Change Policy and ESG Framework reflects ICIEC’s commitment to sustainability. We aim to drive positive change, contribute to global climate objectives, and set new benchmarks for ESG excellence in insurance and development.

The Corporation aims to fully integrate considerations on the impacts of climate change into its operations and to adapt its operating model. In doing so, it may better support its clients, Member States, and their societies. It will also adopt new policies and approaches to reorient its business model in a manner that is coherent with the policies and practices of the whole IsDB Group, fully integrated into the ecosystem, and in line with the principles set forth under the Paris Agreement and the MDB Framework Alignment.

Crucially, ICIEC also commits to incentivizing climate change actions and investment initiatives, and to decreasing the climate footprint of its operations.

At the core of ICIEC’s Climate Action Policy are the importance of partnerships and the recognition that export credit and political risk insurance are essential tools to bridge the Climate Action finance gap by de-risking investments and access to capital goods and green technology.

ICIEC’s Climate Change Policy and ESG Framework mark the commencement of a transformative results-oriented process where ICIEC’s operations, insurance, physical assets and human capital and focus are addressing the Climate Crisis at their core, based on the needs of ICIEC’s member states, IsDB Group synergies, the role of the private sector in climate finance and industry best practice. The year 2024 sees the second phase of the Climate Change project which is dedicated to screening, monitoring and evaluation based on practical, achievable and industry benchmarked parameters that covers ICIEC’s business lines.

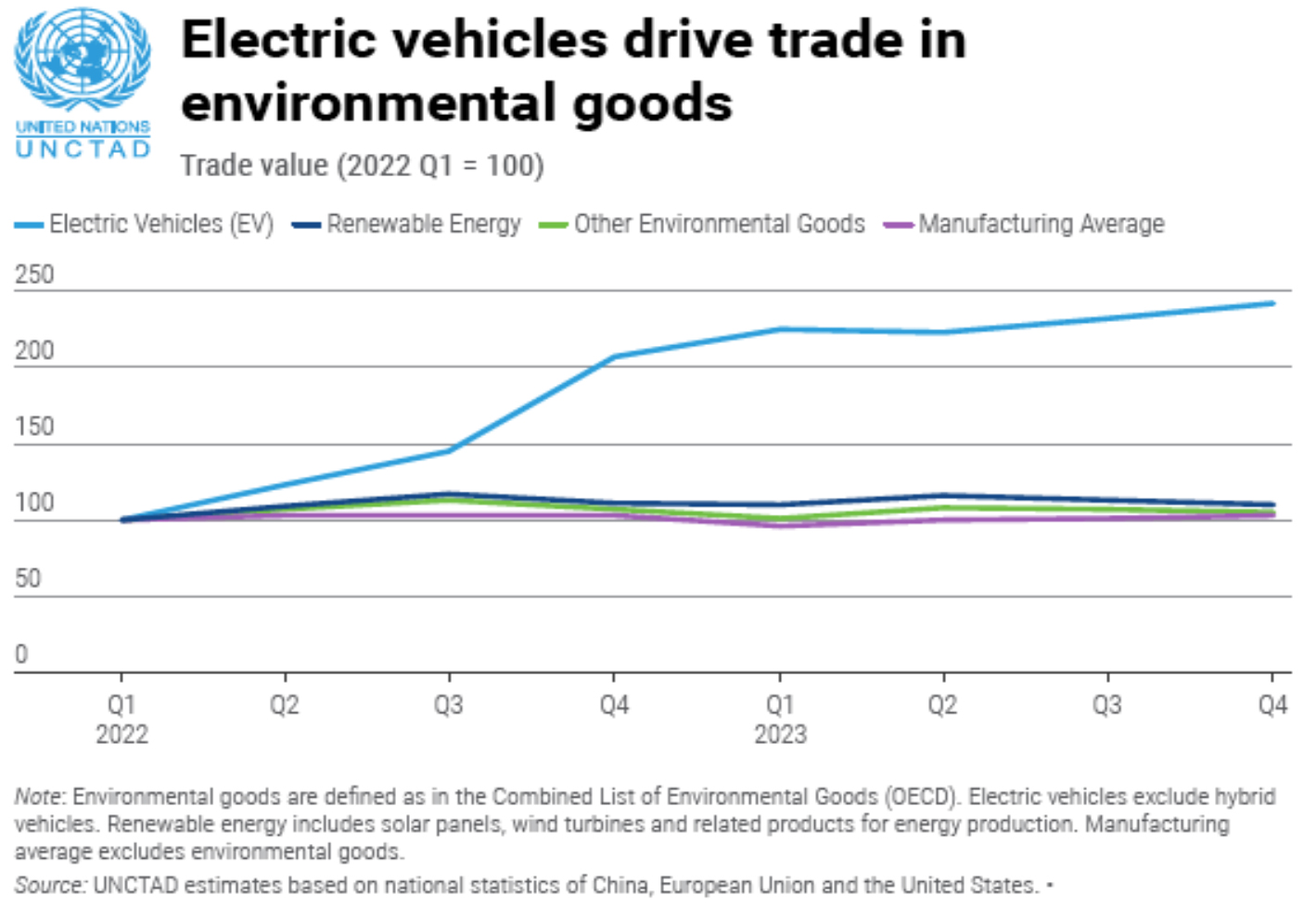

The trends are clear and present. The global surge in demand for electric vehicles is driving trade in environmental goods.

It is noteworthy that the Berne Union Climate Working Group (BU CWG) which is doing important work in supporting the climate goals of the wider export credit community, has come up with a “refreshed BU CWG workplan for 2024” in the wake of the developments at COP28. At the same time, Export Finance for Future (E3F), an international coalition, is working to align public export finance with climate change and goals.

Another major development is the allocation of up to USD50 billion to help build resilient infrastructure and inclusive societies in the African continent by the Arab Coordination Group (ACG) at the recent Arab-Africa and Saudi-Africa Summits’ Economic Conference in Riyadh. The ACG is a strategic alliance that provides a coordinated response to development finance. Current members are the Abu Dhabi Fund for Development, the Arab Bank for Economic Development in Africa, the Arab Fund for Economic and Social Development, the Arab Gulf Program for Development, the Arab Monetary Fund, the Islamic Development Bank, the Kuwait Fund for Arab Economic Development, the OPEC Fund for International Development, the Qatar Fund for Development, and the Saudi Fund for Development.

The ACG has been a long-standing supporter of African partner countries and has cumulatively invested over USD220 billion in the region to date. “We reaffirm our commitment to supporting the sustainable development of countries in Africa. Recognizing that the link between sustainable development and climate financing is cross-cutting and complex, the ACG reaffirms its commitment to scaling up financial assistance for climate change in line with the Paris Climate Agreement and to helping bridge investment gaps in energy access, including low-carbon energy sources, climate mitigation, adaptation, and resilience, as well as food security,” said the Group in a statement.

Proactive digitalization must be embraced as a core component of any new development agenda which multilateral institutions too must prioritize beyond their usual playbook. ICIEC has done so in its strategy which puts digitalization at par with its other development aims such as food security, energy transition, climate adaptation and mitigation, and poverty alleviation.

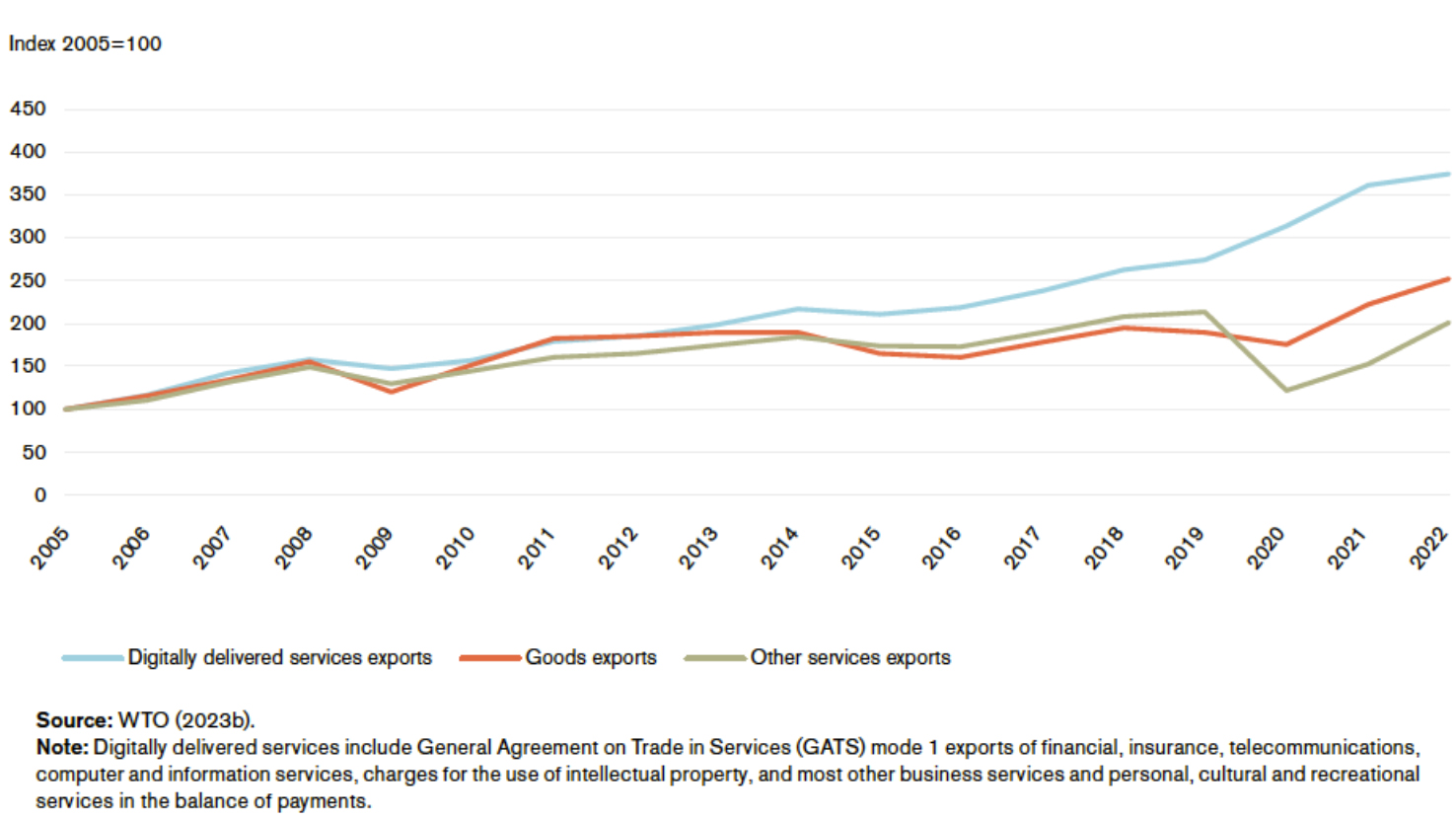

The post-COVID-19 acceleration in digitalization across economic and societal sectors presents not only a source of growth opportunities and new efficiencies, but also a spate of new risk for the insurance industry, especially the credit and investment insurance cohort. Trade, according to the WTO and industry organizations, has also become more digital, green, and inclusive. The digital revolution has bolstered trade in digitally delivered services by sharply reducing the costs of trading these services. The value of global trade in environmental goods and services has increased rapidly, outpacing total goods trade, and global value chains (GVCs) have expanded to encompass more economies.

The UN Global Sustainable Development Report (GSDR) 2023 similarly identifies digitalization as one of the six dynamic conditions shaping the achievement of the 17 Sustainable Development Goals (SDGs) by 2030 to which ICIEC is committed to helping its 49 member states progress towards achieving the goals in their development agenda through its financing, credit enhancement and risk mitigation solutions. The other five conditions include climate change, biodiversity and nature loss, demographic change, and inequality, all of which are also embedded in the policies and services offered by ICIEC.

Two further major developments in this respect are the launch in April 2024 by a coalition of ten MDBs, which includes the World Bank and IsDB, of a new co-financing platform – The Global Collaborative Co-Financing Platform (GCCP) that will enable them to channel additional capital for development scale and impact, and the IsDB and ICIEC’s accession to the Energy Transition Accelerator Financing Platform (ETAF) of the International Renewable Energy Agency (IRENA) in December 2023.

IRENA is creating a pipeline of energy transition projects and pairing them with investors to accelerate renewable energy deployment. The platform, established in 2021 with support from the United Arab Emirates, aims to scale up renewable energy projects that contribute to Nationally Determined Contributions (NDCs) in developing countries, while also bringing benefits to communities through enhanced energy access and security, and promoting economic growth and diversification.

According to Francesco La Camera, Director-General of IRENA, “today, the ETAF family is 13 partners strong, with collective pledges surpassing USD4 billion at COP28. The ETAF Platform also stands out for its inclusivity, offering a broad range of financial solutions and risk mitigation products. As members of ETAF, the Islamic Development Bank (IsDB) and the Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC) have broadened the platform’s toolkit further with Islamic finance options, enhancing ETAF’s capacity to tailor its support to the unique requirements of numerous developing countries in the Islamic world.”

The Global Collaborative Co-Financing Platform will consist of the digital Co-Financing Portal which will create a secure platform for registered co-financiers to share project pipelines.

This tool, hosted at the World Bank, will increase efficiency and transparency, and make it easier for MDBs to share information and identify opportunities for co-financing. The Co-Financing Forum which will also provide a space for participants to discuss co-financing opportunities, best practices, and common issues, and will support ongoing efforts to coordinate policies to reduce the burden on partner countries.

According to the promoters, the GCCP will reduce the administrative burden and transaction costs and enable better coordinated financing in line with their priorities—resulting in greater development impact. By leveraging partnerships and promoting transparency, the platform will enable MDBs, partner agencies, and client countries to address global challenges including climate action more effectively and efficiently.

In the wider trade finance market, digitization is going from strength to strength, with most market players investing heavily in their trade and supply chain infrastructure. The real economy impact for ICIEC member states is implicit.

Growth of digitally delivered services exports, 2005-22

Digitisation has also been enabled by growth in platform-based trade, where FinTechs and challengers are innovating on new ways to capture market share and scale. Many banks are now participating in digital trade platforms, e.g., for e-invoicing, payables automation, supply chain financing and working capital management. These platforms vary by geographic reach, product and client focus, and underlying technology, but the market has been somewhat bifurcated.

“While digitisation supports the shift to open account through the development of new products, it also improves the efficiency and security of documentary trade, underpinning its continued importance in the product mix. Moreover, digitisation not only facilitates broad industry growth but also supports inclusive growth. It is seen as key to reducing the “trade finance gap” for SMEs, which has widened recently due to higher interest rates,” observed Boston Consulting Group (BCG) in a recent report.

The Power of Electronic Trade Documentation and Messaging

The UK’s Lloyds Bank in April 2024 completed its first transaction using an electronic Bill of Lading (eBL) on the WaveBL trade documentation platform, in a cross-border deal that featured entirely digital exchanges of documentation to support a British company in a trade deal with an Indian supplier.

The implications are game-changing. The operational impact of the deal revealed enormous cost and time-reduction implications, which the industry would not be able to ignore as the various platforms take off and mature. According to Lloyds Bank, eBL reduced transaction completion times from 15 days to just over 24 hours, which in turn reduced working capital costs and, together with the use of a digital promissory note (dPN), made the trade deal entirely paper-free. The WaveBL network boasts members in 136 countries and includes four of the world’s ten largest container shipping carriers.

The three other major developments in the electronic trade documentation architecture are:

- The Electronic Trade Documents Act (ETDA) 2023 in the UK receiving Royal Assent from King Charles III last July, legally effective on 20 September 2023, to make Global Britain’s trade with partners all over the world seamless, efficient, and sustainable.

- The enhancement of the Model Law on Electronic Transferable Records (MLETR).

- The WTO’s initiative in including work on trade-related aspects of e-commerce as part of the organization’s Joint Statement Initiative (JSI) on E-commerce in future WTO negotiations.

There is no doubt that a major boost can come from the UK’s ETDA with the British Government’s initial estimate that the UK economy is set to receive a GBP1.14 billion boost over the next decade. With less chance of sensitive paper documents being lost, and stronger safeguards using technology, digitalizing trade documents are set to give businesses that trade internationally greater security.

With English law being the very foundation of international trade, including several Islamic finance contracts such as the Commodity and Syndicated Murabaha and Sukuk issuance, it has important implications for the global Islamic finance industry. The UK is widely seen as a leader in digital trade and this new act will make it easier for businesses to trade efficiently with each other, cutting costs and growing the UK economy by billions over time.

According to the WTO, the UK’s EDTA removes requirements for the majority of paper trade documentation. Varying degrees of progress are also being made towards implementation in the remaining G7 countries, with each taking unique approaches to amend and introduce legislation.

Another important development is the successful testing of an interoperability solution capable of enabling the widespread use of electronic documents that are critical to digitise trade by Swift, in collaboration with BNY Mellon, Deutsche Bank and four electronic Bills of Lading (eBL) platforms.

According to Shirish Wadivkar Global Head, Wholesale Payments and Trade Strategy at Swift, “standards set with the industry – combined with global interoperability facilitated by Swift – can enable eBL providers and digital trade platforms to seamlessly interact with banks, corporates, and the wider trade ecosystem. Such industry-wide collaboration is essential to achieve a ‘zero paper trade’ future.”

The Lack of Technical of Interoperability Between Platforms

According to Swift, there is much to gain by digitising global trade, from reducing costs and improving transparency to mitigating fraud and addressing the USD2.5 trillion trade finance gap. Paper-based Bills of Lading – associated with lengthy delays and inefficient processes – offer a significant opportunity for improvement.

Compared to their paper equivalent, eBLs reduce the risk of document loss and fraud, speed up the transfer of documents and shrink the carbon footprint associated with paper processes. McKinsey predicts that adopting eBL could save the industry USD6.5 billion a year and enable USD40 billion in global trade by 2030. However, while the need for eBL adoption is generally recognised, the data according to the FTI Alliance, shows that in 2022, only 2.1% of bills and lading and waybills in the container trade were electronic.

The good news is that some 80 institutions have signed up to FIT Alliance’s ‘Declaration of the Electronic Bill of Lading’ which commits international trade stakeholders to drive digitalisation within their industries, starting with eBL. With a significant proportion of global trade conducted using English law documents, an important milestone was the passing of the UK ETDA, which grants electronic trade documents the same legal significance as the paper equivalent and gives eBL created under different systems legal equivalency for the first time.

The current lack of technical interoperability between existing eBL platforms, says Swift, presents a significant obstacle to wholesale adoption. The nine eBL providers authorised by the International Group of Protection and Indemnity Clubs (IGP&I), for instance, each have their own rules and customer bases, meaning that customers of one eBL system can’t take part in transactions handled by another eBL system. Instead, financial institutions, corporates, and others involved in each trade transaction, need to connect to multiple systems – an approach which is both inefficient and costly. Such ‘digital islands’ are not sustainable.

“Interoperability is needed between different eBL platforms so that users can interact with each other using a single identity. Given our long history of enabling global interoperability – and recent initiatives such as our solution to interlink central bank digital currencies (CBDCs) – we believe Swift can play an important part in addressing the eBL challenge,” maintains Swift’s Shirish Wadivkar.

Swift in fact started working with FIT Alliance partners and eBL platform providers in 2022 to develop an API-based eBL interoperability model. Under this approach, firms could leverage a single connection to Swift to interact with trade transactions carried out using multiple different eBL platforms. In 2023 the partners ran a Proof of Concept (PoC) to test how an interoperability solution could work in practice, collaborating with eBL platforms edoxOnline and CargoX in the first phase to test the use of a single ubiquitous API contract to open a secure channel with Swift, and expanding the PoC to include two additional eBL platform providers – TradeGo and WaveBL – as well as BNY Mellon and Deutsche Bank. Using the same API layer, participants were able to successfully reproduce the end-to-end flow transfer process of an eBL in a simulated trade transaction.

The Beguiling Lure of Generative AI in Trade

Perhaps the biggest potential change in the near-to-medium term may come in digital underwriting and digitalization in commercial insurance lines using targeted Generative AI, according to Swiss Re. But for trade cohorts, it is important in the current climate of AI hype not to over-think nor over-talk the significance of AI to facilitate an orderly transformation to this very disruptive and yet inevitable technology.

“Along with the use of big data,” says Swiss Re, “AI is expected to be eventually used widely in risk assessment and underwriting. Given the level of confidence needed to deploy new technologies in underwriting, fully digitalized/automated AI, and Machine Learning (ML) enabled systems are still not accurate enough for use at scale. This also means that algorithms cannot be relied on to fully replace traditional risk assessment, except in simpler lines of business such as motor. This said, digitalization can complement existing processes, including classifying and segmenting risk as finely as possible for more accurate risk pricing.”

Increasingly, commercial insurers are making use of digital technology in portfolio steering and risk selection. The benefits are important. “By leveraging third-party digital data overlaid with their own information,” stresses Swiss Re, “they can derive insights on potential risk accumulation, such as that caused by a concentration of high-value properties exposed to specific hazards. For example, the utility sectors’ liability exposure is increasing due to infrastructure that can spark fires. Utilities may operate in wildfire prone regions (such as network operators, tree cutters). Using third-party digital data on, for instance, locating sources of ignition such as power lines and rail tracks, insurers have a deeper view as to areas of potential fire risk accumulation.”

The WTO Informal Working Group on Micro-and-Small-and Medium-sized-Enterprises (MSMEs) initiative involves 89 (as of July 2023) member states, accounting for over 90% of global trade. These negotiations span a broad range of critical topics such as online consumer protection, electronic signatures and authentication, electronic contracts, transparency, paperless trading, open internet access, and data flows and data localization. The Group continues to discuss challenges for MSME access to digital trade, including cyber readiness, standardizing trade digitalization, and single windows (or access points) to access trade information.

In this respect, the recent launch by the World Bank Group’s private sector funding arm, the International Finance Corporation (IFC), of the USD4 billion MSME Finance Platform to aid financial service providers in delivering funds to small businesses in emerging markets through banks, non-bank financial institutions, microfinance institutions, and innovative digital lenders, with a particular focus on those owned by women and those in the agriculture and climate sectors, assumes much greater importance. The Platform, according to Makhtar Diop, Managing Director of IFC, will also use various forms of credit enhancement to mobilise private capital, including an innovative Catalytic First Loss Guarantee, aiming to attract an additional USD4 billion in financing from eligible financial service providers to expand lending to these businesses.

Digitalization of trade could be a great equalizer and facilitator by providing new opportunities for those economies that have so far been left behind by allowing them to overcome some of the most important barriers to trade that they face, such as transportation costs and institutional disadvantages.

Transitioning to ISO 20022

The introduction of ISO 20022 by the International Organization for Standardization (ISO), as “a single standardisation approach (methodology, process, repository) to be used by all financial standards initiatives,” is a key development and challenge for the trade finance and credit insurance industry.

ISO 20022 (MX), which comes into effect in November 2025, is the next generation of financial messaging standards given its key characteristics of a common language with rich and structured data. The Swift MT format has been the standard for trade finance messages for the last four decades.

According to Trade Finance Global, (TFG), Swift (the world’s leading provider of secure financial messaging services) is “already in the process of migrating payment and cash management messages from the legacy MT format to MX. In November 2025, when the current MT and MX coexistence period is set to end, all Swift traffic for cross-border payments and reporting (CBPR+) will be on an ISO 20022 standard.

As the payments and cash management industry is finding out in real time, there are benefits, challenges and costs associated with such a wholesale transition. It is however something which banks, insurers and other stakeholders in the trade finance and insurance community would ignore or delay preparedness at their peril.

Some Positive Developments

The WTO and the International Credit Insurance and Surety Association (ICISA), which brings together the world’s leading companies that provide credit insurance and/or surety bonds, have trade and gender working groups. The problem is that these are Informal Working Groups (IWGs) set up by involved and activist women as opposed to permanent structures within the articles of association of the entities.

They have their work cut out given that it was only the 13th WTO Ministerial Conference (MC13) Declaration which recognized the importance of promoting women’s participation in trade. Another problem is that often women’s participation in trade is merely side lined as a Financial Inclusion initiative for female entrepreneurs, traders, and Micro, Small and Medium-sized Enterprises (MSMEs) as important as it is to help policymakers design gender-responsive trade policies, as opposed to a mainstream activity across the trade ecosystem.

The WTO’s IWG is also spearheading proposals on developing gender-disaggregated data and statistics relating to women in world trade.

Similarly, ICISA’s Women in Credit Insurance (WICI), founded in 2023, is an informal association of individuals, which strives to increase the representation of women in the trade credit insurance industry especially in leadership roles, through mentorship, speed networking and training. Members include high-flying women experts from Allianz Trade, Aon, Atradius, Coface, FinCred, Marsh and TokioMarine HCC.

The Gambia, a member state of ICIEC, has recently showcased several initiatives under its National Development Plan (2023–2027), including the SheTrades programme and the Jokallenteh Market platform, which connects women farmers to markets. These programmes aim to economically empower women and to achieve significant milestones in training, market linkages, access to finance and public procurement. Notable successes include supporting over 130 women-owned businesses in food safety and quality and securing USD3 million in public tenders for women bidders, specifically for food aid supply.

Diversity and gender balance is an important consideration for ICIEC, which has 49 member states as shareholders. The Corporation has a total number of 85 employees, of which 14 are female employees, which rightly suggests that there is much room for improvement. Currently Fatma Gamze Sarioglu, serves as the Senior Country Manager for Türkiye at ICIEC, Khady Seye as Country Manager for Senegal, Sabah Al Harbi as Country Manager for the MENA Region, and Eman A. Mahmoud, Country Manager, IsDB and ICIEC’s Cairo Regional Hub.

The consensus remains that there are significant gender disparities in export activities which underscore the imperative of providing enhanced support for women in the realm of international trade. Securing gender equality in domestic legislation is consistent with providing equal conditions for men and women to access economic opportunities brought by international trade whether in business, finance, credit insurance and surety and policy making.

In this context the WTO-sponsored World Trade Congress on Gender on 24-27 June 2025, under the theme “Gender Equality and Innovation: The Keys to Sustainable Trade,” assumed a much greater urgency and importance.