Investment Insurance For Banks & Financial Institutions

– Non-Honoring of Sovereign Financial Obligations / Political Risk Insurance of Cross-Border Loans

Political Risk Insurance for Equity Investments, Debt Finance and Loan Guarantees

- Currency inconvertibility and transfer restrictions.

- Expropriation.

- War or civil disturbance.

- Breach of contract.

Non-Honoring of Sovereign Financial Obligations / Political Risk Insurance of Cross-Border Loans

- Non-Honoring of Financial Obligations by the sovereign / sub-sovereign / State-owned Enterprises (SOEs)

- Facilitates access to finance.

- Protects balance sheet against losses due to non-commercial (i.e. political) risks.

- Attracts additional project capital.

- Enables the penetration of high-risk markets.

- Reduces cost of funding

- New investments, acquisition or expansion of existing investments / projects.

- Investment not prohibited by Shariah.

- Investments being undertaken in a Member Country.

- Up to 20 years

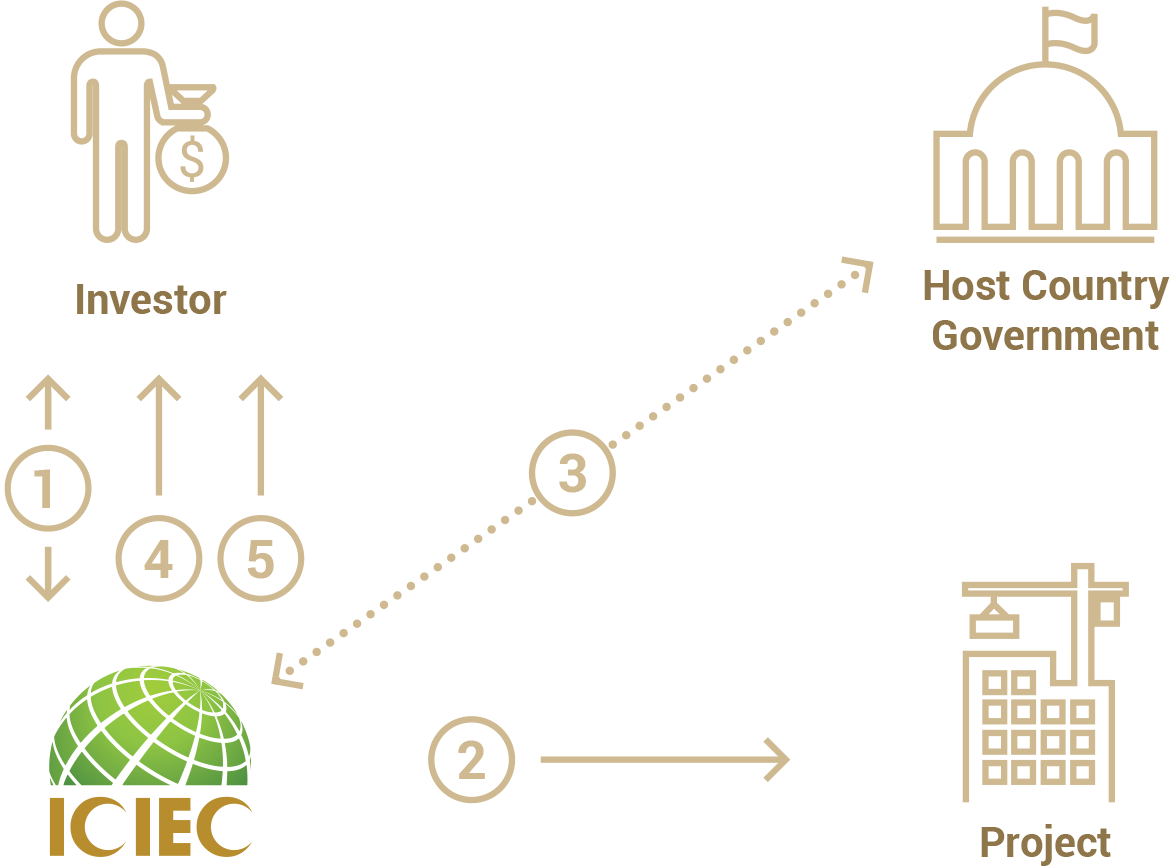

How It Works ?

- Investor submits a preliminary application to ICIEC, ICIEC gives its initial ‘in-principle’

approval and requests a full detailed application and payment of applicable fees. - Applicant submits completed Main Application. On the basis of the detailed

application, ICIEC will assess the project / country risks. - Should ICIEC management approve the insurance, ICIEC will issue an investment

insurance policy to the investor. - ICIEC will obtain the non-objection of the government of the host country.

- In case of risk occurrence, the investor submits a claim to ICIEC and ICIEC pays the

compensation.