Credit Insurance For Banks & Financial Institutions

– Insurance of Letters of Credit / Buyer Credit Insurance

- Insolvency of the obligor.

- Failure or refusal of the obligor to pay on due date.

- Currency inconvertibility and transfer restrictions imposed by the obligor’s country.

- Expropriation, confiscation or adverse government intervention in the business of the obligor.

- War or civil disturbance in the obligor’s country.

- Protects balance sheet against losses due to commercial and non-commercial (i.e. political) risks.

- Improves capital adequacy via capital relief.

- Optimizes Balance Sheet by de-risking a portion of the portfolio.

- Better reflection in ICAAP and CRM techniques.

- Provides additional headroom capacity.

- Reduces portfolio cost using the credit rating of a highly rated multilateral institution.

- Minimizes non-performing assets.

- Enhances business volume.

- Helps in structuring Shariah compliant financing facilities.

- Banks / Financial Institutions domiciled in ICIEC Member Countries.

- Banks / Financial Institutions domiciled in ICIEC Non-member Countries, owned not less than 50% by the IsDB or by Member Country.

- Banks / Financial Institutions offering Shari’ah compliant products.

- Banks that finance strategic exports to member countries.

- Up to 7 years

How It Works ?

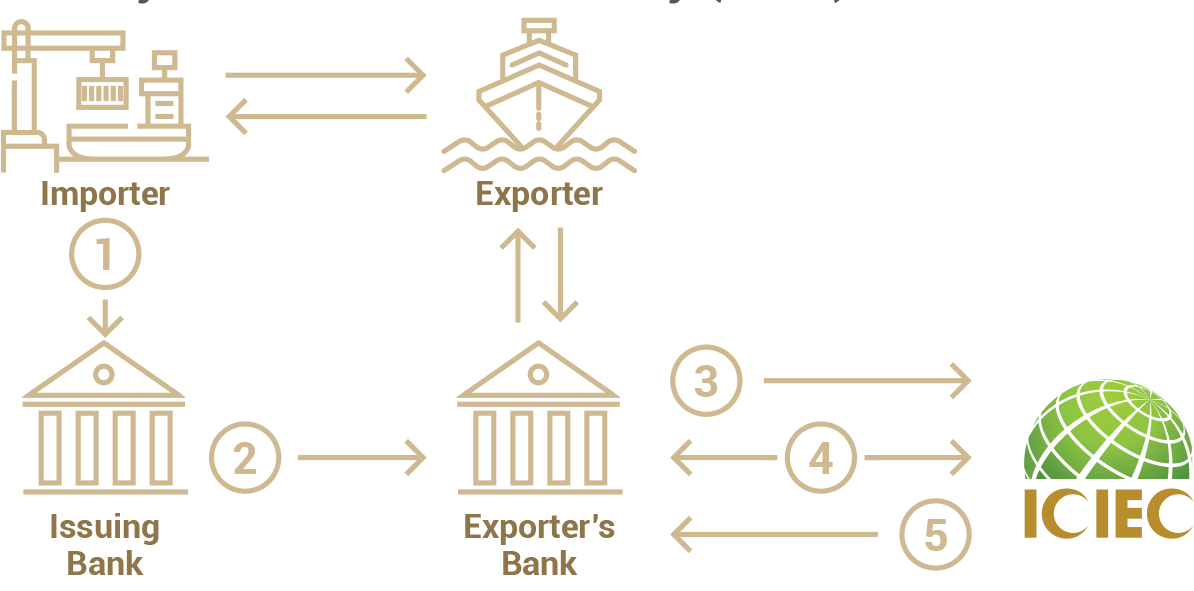

Documentary Credit Insurance Policy (DCIP)

- Importer arranges issuance of LC.

- The issuing bank issues an LC to the exporter’s banks.

- The exporter’s bank applies to ICIEC to insure the LC. ICIEC insures the LC up to a certain percentage (e.g. 90%). The Insured is required to keep the uninsured amount on its own account.

- In case of non-payment by issuing bank, the exporter’s bank submits claim and ICIEC pays compensation (90% of the loss).

- ICIEC recovers from the issuing bank and pays 10% back to the exporter’s bank.

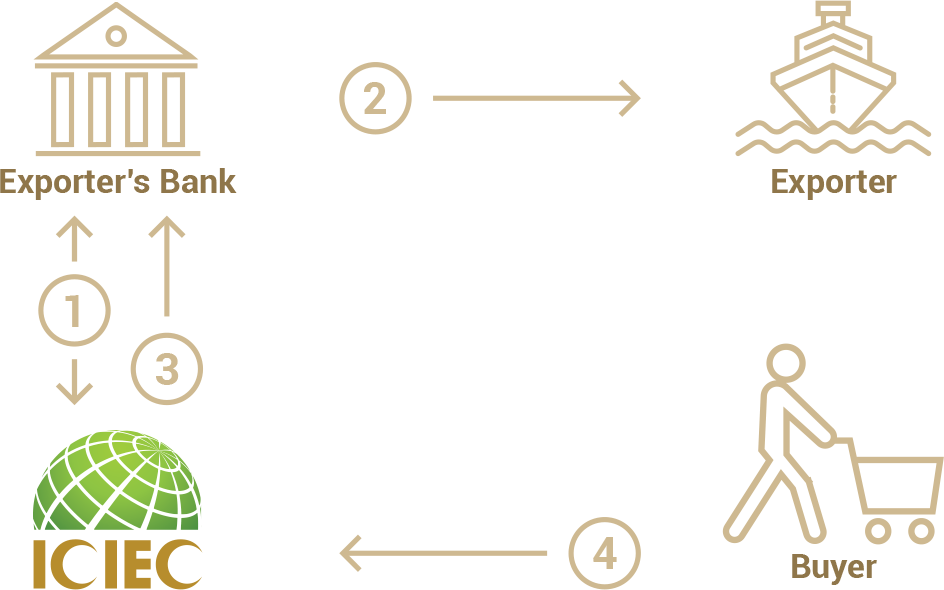

Bank Master Policy (BMP)

- The exporter’s bank concludes an insurance contract with ICIEC up to a certain insured percentage (e.g. 90%) and pays the premium.

- The bank provides Islamic financing to the exporter with the purchase contract as security.

- In case the buyer fails to pay, the bank files a claim with ICIEC, which indemnifies the bank for up to 90% of the loss.

- ICIEC recovers from the buyer and returns the 10% uninsured share to the bank.