The International Credit Insurance and Surety Association (ICISA), founded in 1928, is the first and leading trade association representing trade credit insurance and surety companies internationally. Its current members account for the great majority of the world’s private credit insurance business. The Schiphol, Netherlands headquartered Association also serves as an important platform for collaboration and the development of best practices in the industry. Today, with almost USD3 trillion in trade receivables insured and billions of dollars’ worth of construction, services and infrastructure guaranteed, ICISA members play a central role in facilitating trade and economic development on all five continents and practically every country in the world. In an exclusive interview, Richard Wulff, Executive Director of the International Credit Insurance and Surety Association (ICISA), discusses the current state of the credit and investment insurance landscape, the potential impact of manifold risks emerging in the global geopolitical, trade and investment landscape, the significance of the recent strategic collaboration signed between ICISA and the AMAN UNION to advance credit and investment insurance initiatives in member states common to both, and despite talk of deglobalization and fragmentation, why he maintains that trade and credit insurance remains one of the binding factors of our world and the way to bring people together.

ICIEC Newsletter: What is the current state of the credit and investment insurance landscape especially in an era of polycrises and growing uncertainties and risks? Is there room for much greater collaboration between government insurers through state-owned insurers and ECAs, and private sector re/insurers?

Insurance & Surety Association (ICISA)

The current landscape of credit insurance is marked by significant uncertainty and heightened risks due to a multitude of overlapping crises, often referred to as polycrises. These include geopolitical tensions, such as trade wars and regional conflicts, economic instability characterized by fluctuating markets and recession threats, and environmental challenges like climate change and natural disasters

In this complex environment, there is indeed substantial room for enhanced collaboration between government insurers, including state-owned entities and Export Credit Agencies (ECAs) and Development Financial Institutions (DFIs), and private sector re/insurers. Such collaboration can lead to the development of more comprehensive risk mitigation strategies by leveraging the strengths of both sectors

Government insurers and multi-lateral institutions bring stability and regulatory support, while private insurers contribute agility and innovative risk management solutions. By sharing expertise, pooling resources, and engaging in public-private partnerships, the industry can better address the increasing complexity of global risks, improve market penetration, and provide more robust support for businesses navigating these diverse challenges.

Another example of public-private partnership is found on the reinsurance market. Government and multi-lateral institutions utilize the reinsurance market to increase the capacity that these institutions can bring to their clients. Reinsurers tend to be inclined to reinsure projects insured by the public market because of the government-to-government relations the public institutions have.

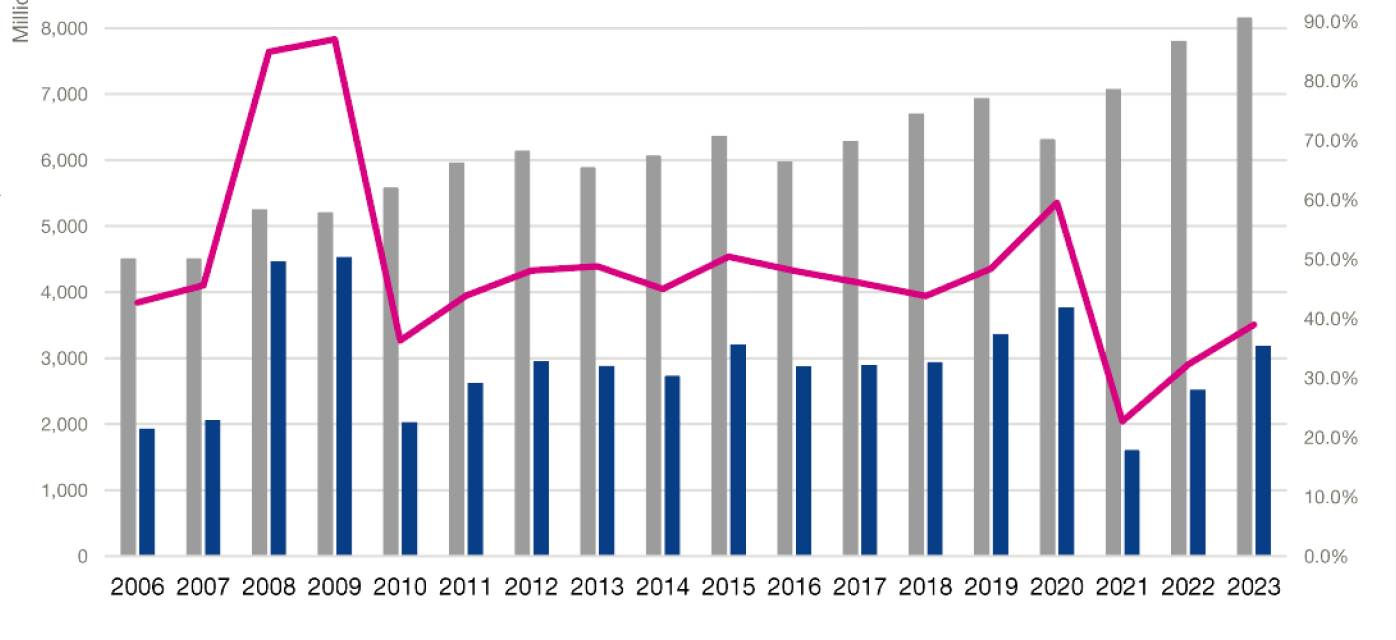

Trade Credit Insurance – Premiums, Claims and Claims Ratio ICISA Members (excl reinsurance members)

Given the manifold risks and tensions in the global geopolitical, economic, trade and investment, climate-related and catastrophic events landscape, how is this affecting the business side of credit and investment underwriting in terms of premiums, claims, claims ratio, and insured exposure?

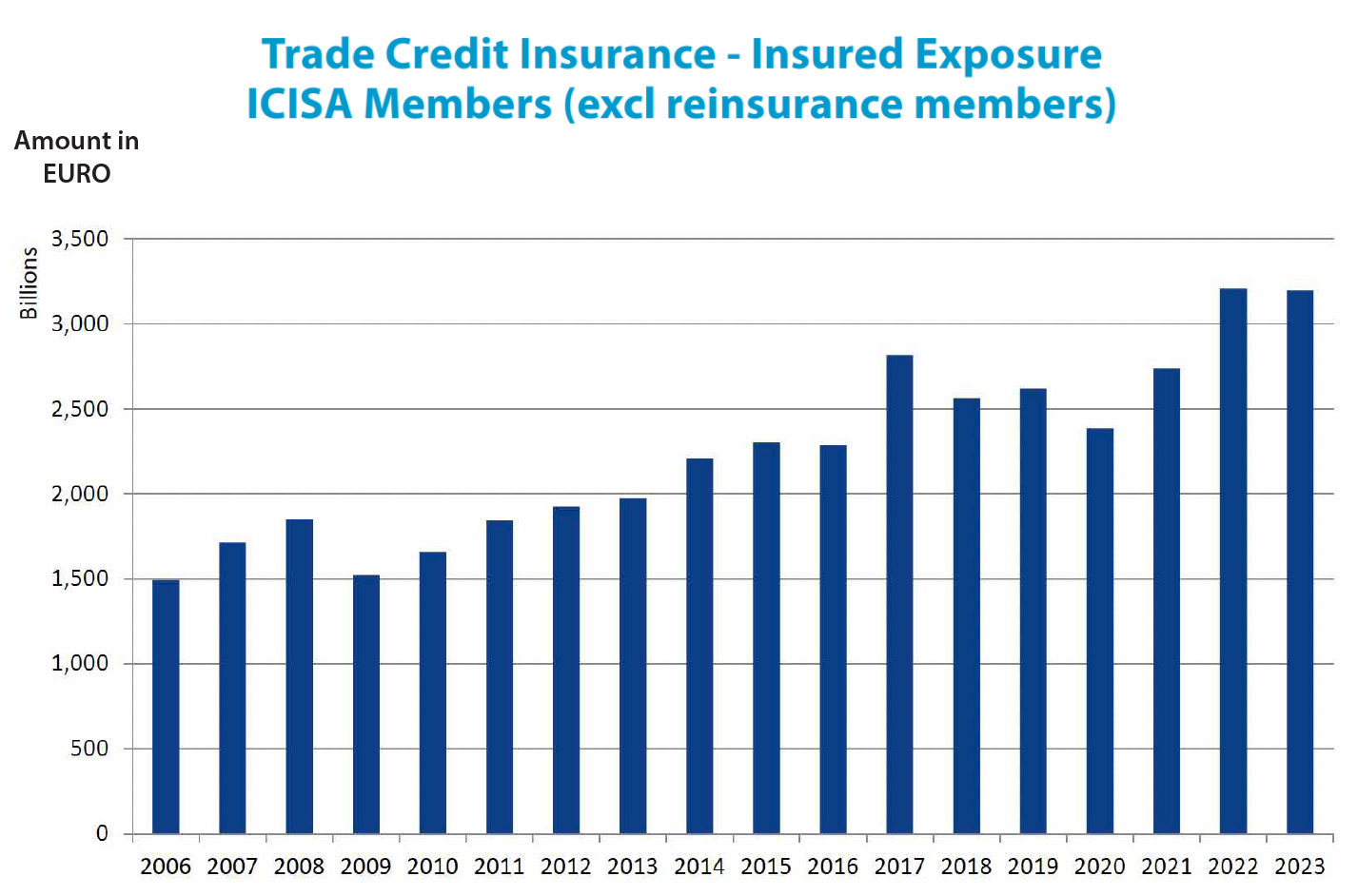

The myriad of risks and tensions in the global landscape—ranging from geopolitical and economic upheavals to climate-related and catastrophic events — may have profound effects on the credit underwriting business. ICISA members, in response to heightened risk levels, have had to adjust their premiums upwards to adequately reflect the increased uncertainties.

This risk-sensitive pricing ensures that insurers can maintain solvency and continue providing coverage. We have seen over the past years since COVID, that the insured exposure has increased by more than 25% since 1-1-2022. This has led to the claims ratio stabilizing at a sustainable levels, comparable to the level before COVID. This is also due to insurers continuously reassessing their risk models and pricing strategies, incorporating more sophisticated data analytics to stay financially stable and responsive to client needs in this dynamic environment.

Credit and investment insurance provision is rightly or wrongly perceived as operations largely prevalent in the developed and in high-and-middle-income emerging markets. The culture of credit insurance in developing countries for manifold reasons at best is fragmented, underdeveloped and perhaps undervalued. What is ICISA and other industry bodies doing to ‘democratize’ credit and investment insurance and its reach beyond traditional markets?

ICISA and other industry bodies are undertaking concerted efforts to democratize credit insurance, extending its benefits beyond traditional high-income markets to developing countries where the sector is often fragmented and undervalued. A prime reason for this is the well-publicized financing gap in the developing world.

One of the major reasons why (especially small and medium-sized) companies in the developing world have issues in getting financing from financial institutions to support their business is that they have little “hard collateral” to offer to the financier as security. A credit insurance policy written by a highly rated credit insurance company is the collateral that is needed so badly.

Initiatives Include:

Providing resources to local insurers to enhance their understanding of Trade Credit Insurance. This includes sharing best practices to improve the overall quality of insurance services offered in these regions.

Working closely with regional organizations and financial institutions to increase awareness about the value of trade credit insurance. By partnering with these entities, ICISA aims to foster a better understanding of credit insurance among businesses and policymakers, highlighting its role in facilitating trade and investment.

Conducting educational campaigns and workshops to inform businesses in developing markets about the benefits of credit insurance. These efforts are designed to dispel myths and misconceptions, demonstrating how credit insurance can protect against non-payment risks and support business growth. An example of these campaigns is the Trade Credit Insurance Week, which is a yearly celebration of trade credit insurance sector. This year, the third edition will be hosted, between 7 – 11 October, with 8 online sessions with free registration. Find out more about this initiative on www.icisa.org.

Through these strategies, ICISA aims to create a more inclusive and accessible credit insurance market, helping businesses in developing countries to manage risks effectively and participate more fully in the global economy.

ICISA recently signed an MoU with the AMAN UNION to advance credit and investment insurance initiatives in the latter’s member states. Can you expand on how you see this collaboration unfolding? What are the priorities and expectations under the MoU?

The MoU signed between ICISA, and the AMAN UNION represents a significant step towards enhancing credit and investment insurance initiatives within the member states of both organizations.

This collaboration is expected to unfold through several key avenues:

i. Exchange of Best Practices: Facilitating the exchange of best practices and experiences between ICISA and AMAN UNION. This knowledge-sharing will help both organizations enhance their operational efficiencies and service offerings, benefiting member states.

ii.Market Development Initiatives: Identifying and promoting opportunities for market development and expansion. By working together, ICISA and the AMAN UNION can help with the promotion of TCI products in developing countries.

iii. Policy Advocacy: Collaborating on policy advocacy efforts to create a better regulatory environment for credit and investment insurance, by working together with policymakers to highlight the importance of supportive regulations and incentives that can drive the growth of the insurance sector.

This partnership between ICISA and the AMAN UNION aims to create a more resilient and inclusive insurance market that supports economic growth and stability.

How do you see the prospects for the credit and investment insurance industry over the near-to-medium term? What are the most challenging evolving and future risks the industry is faced with especially in relation to trade and FDI flows and disruptions, financing infrastructure, climate action and food supply chain gaps?

We see trade credit insurance remaining an essential part of the landscape. Short-term credit insurance covers just shy of 15% of the annual value of world-wide trade. It is an essential part of doing business and affording (end) customers credit terms and offering security to financiers.

Whereas there is much talk of deglobalization, trade remains one of the binding factors of our world and the way to bring people together. Credit insurance is one of its facilitators, and therefore here to stay.