New Challenges Arising from IFRS 9 and IFRS 17 Implementation

The Takaful industry, being a risk mitigation cornerstone to many economic players adhering to Shariah principles of financial intermediation, is facing various challenges that demand profound adaptation and strategic solutions to safely navigate the current landscape.

One such challenge of interest has been the introduction of new accounting standards by the International Accounting Standards Board (IASB) to replace existing standards and enhance reporting of insurance activities and financial instruments, in an attempt, to provide stakeholders with quality information for decision making.

The newly introduced standards (namely IFRS 9 and IFRS 17) have brought about significant changes in the financial reporting for insurance companies in general.

As these standards aim to enhance financial transparency towards a clearer view of an entity’s financial health and to overcome the shortcomings of the earlier standards, their implementation, however, has not been without challenges.

I will endeavour in the subsequent sections to briefly discuss the new IFRS 9 and IFRS 17 standards and present some selected operational hurdles encountered by insurance companies as they strive to comply with these standards.

Contrary to an abundant literature, our focus would be on the challenges and implications of the new standards from an investment and ALM (Asset and Liability Management) perspective.

IFRS 9 and IFRS 17:

New Accounting Standards for Better Financial Reporting

IFRS 9, the new standards for Financial Instruments, sets out the

accounting principles for such instruments. The standard has been in force since January 1, 2018, but for listed insurance companies it became mandatory on January 1, 2023, at the same time as IFRS 17.

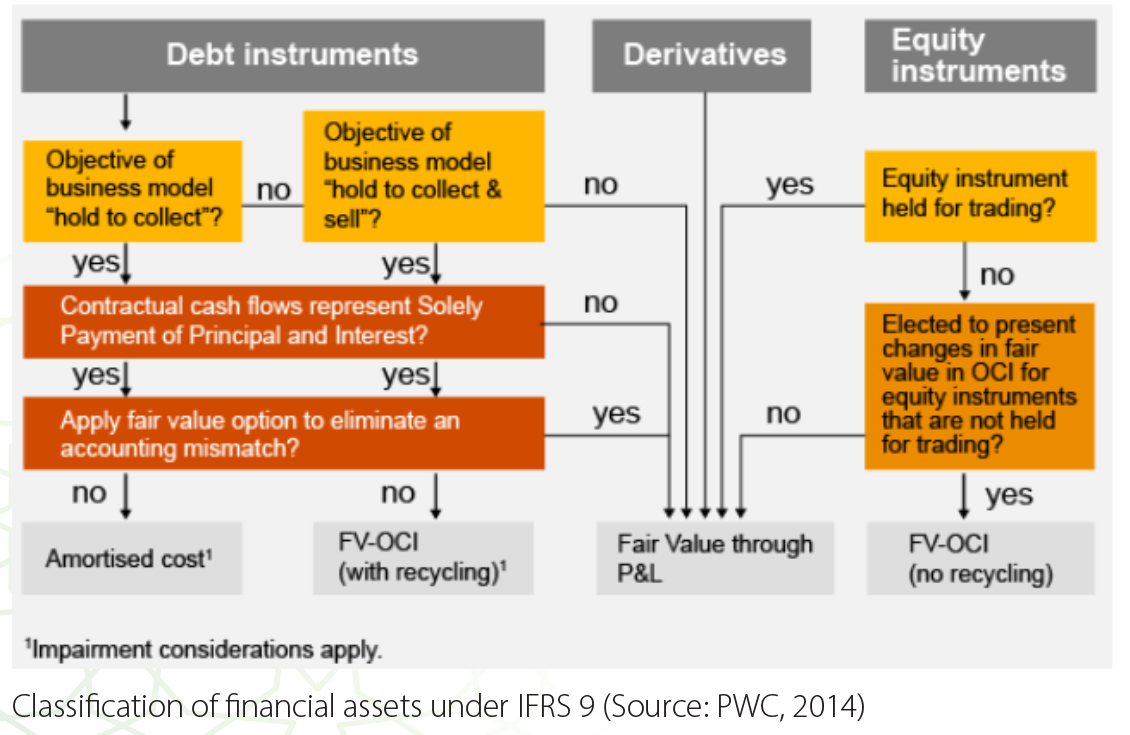

Under IFRS 9, financial instruments are to be classified according to

the following scheme.

In addition to Classification and Measurement, IFRS 9 also proposes a

new approach for Impairment of Financial Assets: Expected Credit Loss (ECL). The ECL model, which is

expected to allow for timely and more accurate recognition of credit losses, assumes a forward-looking

information approach rather than an incurred loss model.

As regards IFRS 17, which was a replacement to IFRS 4, it is an international financial reporting standard issued by IASB in May 2017 with an effective implementation date January 1, 2023. Its primary objective is to enhance transparency in the accounting for insurance contracts and improve comparability across different jurisdictions.

The new standard sets out principles for the recognition, measurement, presentation and disclosure of insurance contracts. It provides a clear definition of liabilities for future (i.e. remaining) coverage and liabilities for incurred claims. Under the general model (also called General Measurement Model-GMM or Building Block Approach-BBA), the insurance entity should consider three main elements (blocks):

- Estimates of the Fulfilment Cash Flows (FCF), discounted at a rate that prices in both time value of money and financial risks.

- The risk adjustment to compensate for bearing the uncertainty due to non-financial risks.

- The Contractual Service Margin (CSM), which is the unearned profit the insurer will be posting to the P&L over time as the insurance contract is serviced.

Better Financial Reporting but also …. More Challenges

The implementation of IFRS 9 comes with multiple challenges. Indeed, the insurance entity’s systems will need significant modifications and adjustments. For instance, the required ECL (Expected Credit Loss) model would require sophisticated procedures to make economic forecasts and assess EAD (Exposure at Default), PD (Probability of Default) and LGD (Loss Given Default) which requires human, technical, and financial resources. Additionally, integration of processes from various departments, mainly from investments and accounting, would most likely be required to ensure better data optimization and processing. All this will result in huge costs.

Similarly, IFRS 17 has also introduced significant operational complexity to the insurance world. It requires large volumes of spreadsheet calculations, huge data collection and preparation, substantial system integrations, and obviously very skilled people who would need to test, run, check, and validate sophisticated models. Significant resources have been spent on data, systems, actuarial models, accounting policy, or solution development to implement IFRS 17. All these resources come at a cost that will impact the performance of the insurance company.

Beyond these direct financial costs, which can be enormous, many insurers would still struggle for years to attain compliance rather than achieving true value creation to their shareholders. Some insurers opted to use solutions offered by external accounting service providers to separately run IFRS 17 models with less disruption to their existing finance, actuarial and accounting processes and systems. These toolboxes, usually available to run on the Cloud or on premises, would simply require data feed from the insurer. Among the problems that such solutions may cause is the one that would mainly mention data confidentiality and full dependency on external providers.

All the above challenges are visible and expected, and many insurers have already taken steps to handle them. There are, however, other consequences of the adoption of IFRS 9 and IFRS 17 that could lead to less apparent challenges. These ones, if not addressed properly, may cause serious issues to conventional and Takaful insurance operators. The next section briefly describes two of these “hidden” challenges triggered by the two new accounting standards.

New accounting standards and Strategic Asset Allocation considerations

By looking closely at the classification scheme proposed by IFRS 9, one would apprehend that the contractual cash-flow test and the business model assessment (required criteria for an amortized cost classification) are becoming key factors in deciding whether to invest in an instrument or not. This is obvious since failure in satisfying these two criteria will likely result in the financial instrument being classified in the residual group of Fair Value through Profit and Loss (FVTPL).

Following a classification of the financial instruments as per the IFRS 9 classification scheme, the Profit and Loss (P&L) as well as the Other Comprehensive Income (OCI) accounts of an insurance company can display large volatility, which may or may not be desirable. For instance, investments in mutual funds imply that the resulting revaluation gains or losses are to be posted to P&L. Such accounting treatment would not be desirable for insurers who prioritize the stability of their P&L accounts over time.

In such a context, fixed income securities passing the SPPI (Solely Payments of Principal and Interest) and the business model tests, and equity instruments elected to be accounted for at Fair Value through Other Comprehensive Income (FVOCI) would mostly find their way to the investment portfolios of insurers who are concerned about the P&L volatilities. On the contrary, for entities who are more concerned about the size of their equity on their balance sheet (i.e. those who seek stability in the OCI which is an equity reserving account) but less concerned about P&L volatility, then mutual funds, equity, and fixed income securities accounted for at FVTPL, would be more desirable.

As we can see, IFRS 9 may cause a kind of natural selection of asset classes that insurance companies need to account for. It is expected that IFRS 9 will trigger revisions and updates to investment strategies and Strategic Asset Allocation of insurers.

New Accounting Standards and ALM Considerations

IFRS 4 (the predecessor of IFRS 17) gave insurance companies, if they opt to, the possibility to value their insurance liabilities (contracts) at book value. Under IFRS 17, however, the valuation of the insurance contracts will take into consideration discounting factors and risk adjustments making it, to a much greater extent, based on market values.

Immediately, one could easily see that the new valuation of the insurance liabilities required under IFRS 17 introduces an element of “interest ratesensitivity” to the liability side of the balance sheet. It is then the role of the ALM to assess and mitigate this risk factor and take necessary actions.

One particular important element of IFRS 17 is that subsequent changes in the valuation of insurance liabilities due to market (discount) rates will normally flow into the P&L, unless the company opts to allocate the impact to the OCI instead of the P&L. Additionally, and as seen before, classification under IFRS 9 may also result in gains or losses attributed to P&L and/or OCI. Indeed, loans and receivables under IFRS 9 can be accounted for at amortized cost, FVPL, or FVOCI. Under any of the two latter cases, gains and losses are to be posted to either the P&L or the OCI accounts. Furthermore, and while equity investment can be accounted for at FVPL or FVOCI (election with no recycling), IFRS 9 stipulates that puttable instruments are to be accounted for at FVTPL.

Thus, when looking at these two standards together from an ALM perspective, it would be in the best interest of the insurance operator to simultaneously consider and align the accounting choices for the treatment of liabilities (changes due to interest rate posted to P&L or OCI) with those of the investments (assets) side. Treating insurance contracts at FVPL while accounting for assets at amortized cost for instance would appear less optimal and may result in higher P&L volatility in addition to a potential balance sheet mismatch.

What about ICIEC?

As ICIEC navigates the current dynamic economic landscape, and while encountering its inevitable challenges, the Corporation took necessary steps and measures to equip itself with strategies, policies, processes, and resources so as, to shape its trajectory towards excellence.

Indeed, ICIEC engaged in the preparation for IFRS 9 and IFRS 17 early enough to be ready for implementation and full compliance with both standards starting from January 2023. As such, internal taskforces were formed, external consultants (as needed) were hired, and timelines were defined to complete the preparation projects on time.

To optimize the ALM implications of the joint adoption of IFRS 9 and IFRS 17, the Corporation decided to enhance its organizational structure and governance framework so that the Finance Division, responsible for accounting and bookkeeping, can be in continuous communications with the Treasury & Investment Division, Risk Management Division, Underwriting Department and other relevant units within the Corporation.

Furthermore, a new Liquidity Policy, Investment Strategy, and an ALM framework have emerged for implementation in which IFRS 9 and IFRS 17 impacts were duly considered and assessed. Such a governance setup has ensured close coordination between business units and reinforces the strategy that ICIEC investment activities are creating value to its stakeholders.