“As a leading multilateral insurer, ICIEC remains committed to supporting its 50 Member States in achieving their development goals, including resilience, mitigation, and adaptation to the threats posed by climate change.”

It is no coincidence that COP29 President-Designate, Azerbaijan’s Mukhtar Babayev, in a formal letter to member states and the global community outlining the plan and expectations for the climate summit in Baku in November 2024, included Gender Equality in climate action as one of the 10 themes up for discussion during the 11-day 2024 UN Conference of the Parties, otherwise known as COP29.

Following COP27 in Sharm El Sheikh, Egypt, in 2022, COP28 in Dubai, UAE, in 2023 and COP29 in Baku, Azerbaijan, later this year, it is remarkable that for three consecutive years, the climate summits have been held in member states of ICIEC. Azerbaijan, in fact, became the 49th member state to accede to ICIEC’s membership last year.

COP29 President-Designate Mukhtar Babayev has allocated a whole day to discuss socio-climate issues including the role of gender equality, balance, leadership and responsiveness in climate action, nature and biodiversity, indigenous people, oceans and coastal zones.

Babayev’s COP29 priorities are implicit:

- Keep 1.5 degrees within reach and leave no one behind.

- National Adaptation Plans and Biennial Transparency Reports.

- 1.5-aligned Nationally Determined Contributions from all stakeholders.

- New Collective Quantified Goal (NCQG) on climate finance, starting at a floor of USD 100 billion with the aim of dramatically increasing this figure.

- Finalise Article 6 of the Paris Agreement

Azerbaijan has also launched at Climate Finance Action Fund (CFAF) to invest in climate-related adaptation and projects in the developing world, although some experts question its ambition and size. “The proposal for the CFAF indicates an initial round of USD 1billion per year by 10 countries or shareholders.

Shock Absorbers and Mitigators of Risk

Multilateral insurers such as ICIEC, alongside national export credit agencies and private sector insurers act as the shock absorbers and mitigators of a wide range of risks, exacerbated in recent years by extreme climate related events, natural disasters, catastrophic occurrences, and conflict, all of which have served to undermine progress towards the Net Zero ambitions of the Paris Climate Agreement of 2015.

The Net Zero Export Credit Agencies Alliance (NZECAA) launched by a group of ECAs led by UK Export Finance (UKEF) under the aegis of the United Nations Environment Programme Finance Initiative (UNEP-FI) has the simple mandate of promoting the role of export credit in achieving net zero emissions by 2050 and limiting global warming to 1.5°C, in collaboration with the Glasgow Financial Alliance for Net Zero (GFANZ).

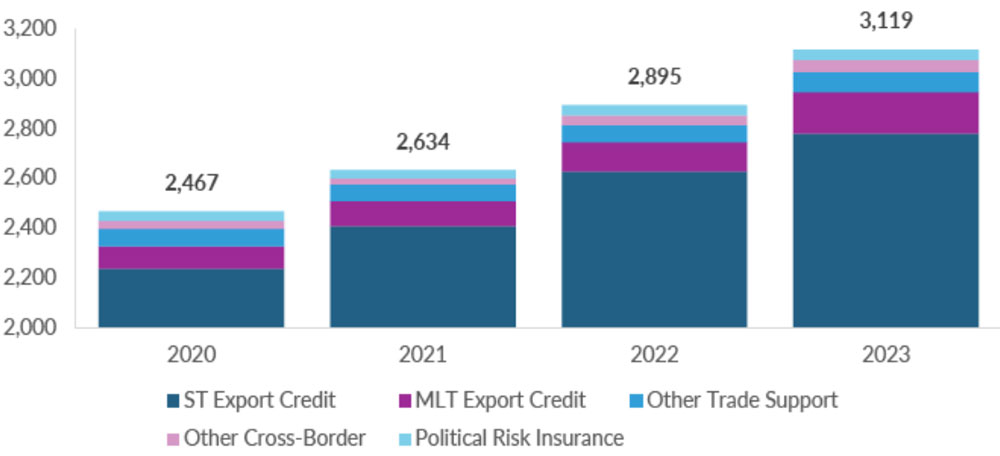

Berne Union (BU) members, of which ICIEC is one, according to the BU’s Export Credit and Investment Insurance Industry Report 2023, supported USD 3.12 trillion of finance in support of export and investment in 2023 – an impressive 8% increase overall compared to 2022. “The tools and products members deployed have been necessary for supporting trade recovery, and members now support higher values of trade than ever before,” says the report.

As a leading multilateral insurer, ICIEC remains committed to supporting its 50 Member States in achieving their development goals, including resilience, mitigation, and adaptation to the threats posed by climate change. The Corporation’s cover extends various sectors, with USD 2.35 billion in 2023 specifically directed towards clean energy initiatives, such as solar energy systems and wind farms – assisting with their importation and use in national infrastructure projects. At COP28, IsDB President, H.E. Dr. Muhammad Al Jasser, also unveiled a USD 1 billion climate finance initiative for fragile and conflict affected member countries over the next three years.

Berne Union – New Business Insured by Product Line 2020-2023

New Business by Product Line (USD bn.)

Source: Berne Union – Export Credit & Investment Insurance Industry Report 2023

Source: Berne Union – Export Credit & Investment Insurance Industry Report 2023

In contrast in 2023, ICIEC’s Business Insured (BI) reached USD13.3 billion representing a14.66% growth from the previous year. New Insurance commitments reached USD4.2 billion and Total Gross Written Premium totaled USD108 million.

Ensuring gender equality in domestic legislation is essential to providing equal conditions for men and women to access economic opportunities created by international trade, whether in business, finance, credit insurance, surety, and policy making.

COP29 and the Gender Paradigm

UN Climate Change Executive Secretary Simon Stiell, in his Q1 2024 update message to the Parties and Observers, emphasized that “2024 will need to instigate a major step up in climate finance, both in quality and quantity. At COP29, Parties are expected to set the New Collective Quantified Goal on Climate Finance (NCQG) from a floor of USD 100 billion per year, considering the needs and priorities of developing countries, advancing gender equity and bolder climate action in tandem.”

In this context, UN Climate Change, in collaboration with UN Women and UNDP, recently hosted the first-ever African regional workshop for National Gender and Climate Change Focal Points in Nairobi, Kenya, as a precursor to the Baku Summit. The agenda included the upcoming review of the UNFCCC enhanced Lima work programme on gender, highlighting opportunities for national gender-responsive climate policies and plans. This workshop saw a record-breaking 110 submissions from Parties and Observers.

There is a consensus that significant gender disparities in export activities, underscoring the imperative to provide enhanced support for women in international trade. Ensuring gender equality in domestic legislation is essential to providing equal conditions for men and women to access economic opportunities created by international trade, whether in business, finance, credit insurance, surety, and policy making.

At the same time, there are several encouraging developments aimed at closing the gaps in gender balance. For example, the World Trade Organization (WTO) and the International Credit Insurance and Surety Association (ICISA), which brings together the world’s leading companies providing credit insurance and/or surety bonds, have established trade and gender working groups. However, these are Informal Working Groups (IWGs) set up by dedicated industry women rather than permanent structures within the entities’ articles of association.

Their task was not easy, especially considering that it was only the 13th WTO Ministerial Conference (MC13) Declaration in Abu Dhabi earlier this year which recognized the importance of promoting women’s participation in trade. Another issue is that women’s participation in trade is often sidelined as a Financial Inclusion initiative targeting female entrepreneurs, traders, and Micro, Small and Medium-sized Enterprises (MSMEs) as important as it is to help policymakers design gender-responsive trade policies, as opposed to a mainstream activity across the trade ecosystem.

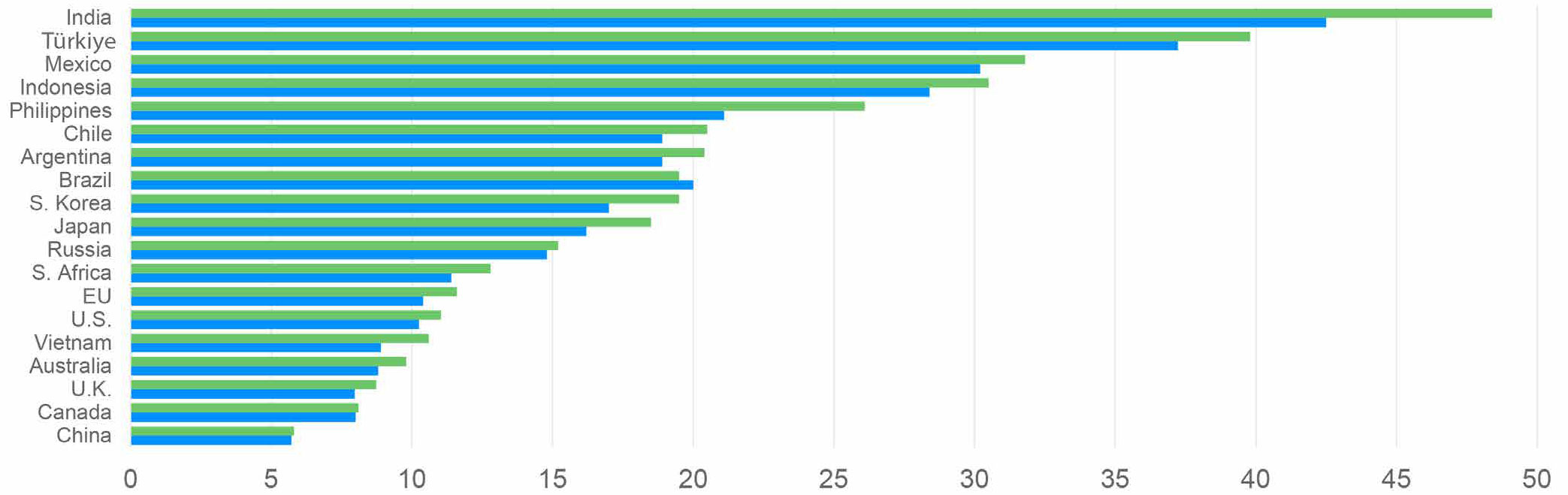

GENDER GAPS IN THE LABOUR MARKETS HAVE NARROWED

Percentage point difference between male and female labour force participation rate, all ages

Sources:Eurostat, International Labour Organization, OECD, Moody’s

Sources:Eurostat, International Labour Organization, OECD, Moody’s

The WTO’s IWG is also spearheading proposals to develop gender disaggregated data and statistics relating to women in world trade. Similarly, ICISA’s Women in Credit Insurance (WICI), founded in 2023, is an informal association of individuals, which strives to increase the representation of women in the trade credit insurance industry especially in leadership roles, through mentorship, speed networking and training. Members include women experts from Allianz Trade, AON, Atradius, Coface, FinCred, Marsh and Tokio Marine HCC.

In this context the WTO-sponsored World Trade Congress on Gender, scheduled for 24-27 June 2025, under the theme “Gender Equality and Innovation: The Keys to Sustainable Trade,” assumed a much greater urgency and importance.

ICIEC, Gender Balance, Climate Action

Diversity and gender balance are important consideration for ICIEC, which counts 50 member states as shareholders. The Corporation has a total of 85 employees, approximately of whom 15 are female, indicating room for improvement. In this issue of the Newsletter we show the experiences and career paths of four of ICIEC’s female staff.

ICIEC’s female employees are represented across various role including Country Managers, finance, underwriting, credit risk, corporate affairs, training, communications and marketing, human capital and resources, and public relations professionals. Their commitment, aspirations, knowledge, experience, expectations, and career pathways are universal, irrespective of the identity metrics, be it ethnicity, gender and creed.

Similarly, ICIEC, as a multilateral corporation, embodies an exemplary model of embedding Climate and ESG considerations into its business ethos and operational playbook. The Corporation is guided by its Climate Change Policy and ESG Framework, launched at COP28. This marks the beginning of a transformative, results-oriented process, where ICIEC’s operations, insurance, physical assets, human capital, and focus address the Climate Crisis at their core. This approach is based on the needs of ICIEC’s member states, the Islamic Development Bank (IsDB) Group synergies, the role of the private sector in climate finance and industry best practice.

The ICIEC Climate Change Policy reinforces the Corporation’s unwavering commitment to combatting climate change and serves as a blueprint for increasing its intervention in sustainable projects and programmes. Anchored in this policy, ICIEC pledges to scale up its support for initiatives aimed at reducing carbon emissions, safeguarding nature, and fostering sustainable economic growth. To advance the role of climate action, ICIEC commits to assisting Member States in meeting their obligations under the Paris Agreement and promoting investment and trade opportunities that enhance resilience and increase adaptability to climate change.

The ICIEC ESG Framework is similarly a holistic tool that showcases our strong dedication to ESG principles. The framework emphasizes embedding ESG principles to ICIEC’s operations, developing ESG-centric products and services, and incorporating ESG imperatives into risk assessment and underwriting. Measures are also implemented to promote sustainability throughout internal processes, including sourcing and resource usage practices.

Noteworthy also is the first ESG Credit Impact Score (CIS-2), assigned by Moody’s Investors Service to ICIEC, which is neutral-to-low . This score indicates a limited impact from environmental and social factors on the Corporation’s rating. ICIEC’s strong governance, combined with its predominant focus on trade credit insurance, and its diversified portfolio, help in mitigating its exposure to environmental risks.

As a signatory to the Principles of Sustainable Insurance (PSI), first introduced in 2012, ICIEC is the unique sole Shariah-based multilateral insurer in the world, gender responsiveness and balance are embedded in ICIEC’s strategic playbook, although it remains a work in progress, as in almost all multilaterals and corporates worldwide, regardless of demography and socio-economic status.

ICIEC also underwrites gender-responsive policies for transactions it supports in its 50 member states, in line with their respective development agendas, particularly in promoting women-owned-and-run Micro-and-Small-and-Medium-Sized-Enterprises (MSMEs) and women entrepreneurs. Gender responsiveness is increasingly becoming a core component of the global MDB and corporate architecture globally including the PSI.

Proactive Supporter of Gender Advancement in Development

In a recent joint article, IMF Managing Director Kristalina Georgieva and economists Nadia Calvino and Odile Renault-Basso, stressed that gender equality and equal rights are not just a matter of equity, but are also of paramount economic importance. Research from the IMF suggests that narrowing the gender gap in labor markets could increase GDP in emerging markets and developing economies by almost 8%. The gains from fully closing the gender gap would be even higher, lifting GDP in those countries by 23% on average.

Similarly, research by the European Central Bank suggests that a one-percentage-point increase in female managers at a firm leads to a 0.5% reduction in carbon dioxide emissions. Additionally, the European Investment Bank found that firms led by women have higher Environmental, Social, and Governance (ESG) scores. Likewise, IMF research shows that such firms are also more profitable, and that greater gender balance on bank boards is associated with greater financial stability and better performance.

Simply put, they emphasize, diversity and an equal role for women in the economy, in decision-making, and in policy debates lead to better results. Mobilizing all available talent maximizes productivity and competitiveness, which will be crucial for addressing climate change and promoting global prosperity. It is especially important at a time when the combined effects of the climate crisis, the COVID-19 pandemic, and on-going regional conflicts threaten to reverse many of the achievements we thought we had secured.

As for President-Designate Mukhtar Babayev, the message in his open statement to the COP29 process could not be more poignant: “There is nothing easy about this challenge or these negotiations, but this process is better than any alternative. It is our best hope, and we must now do whatever it takes to make it work.”