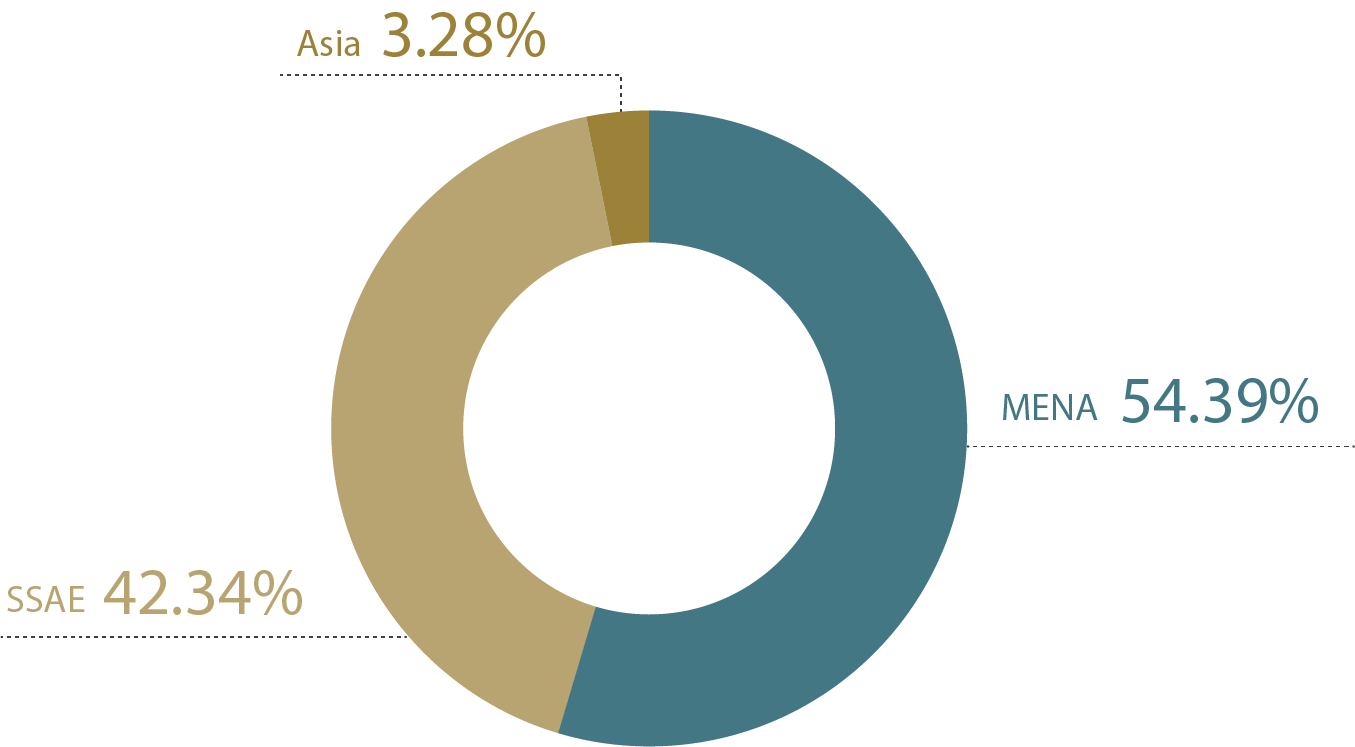

2019 Business Insured (USD)

USD 10.86 Billion

2019 Claims Paid (USD)

USD 91.38 Thousand

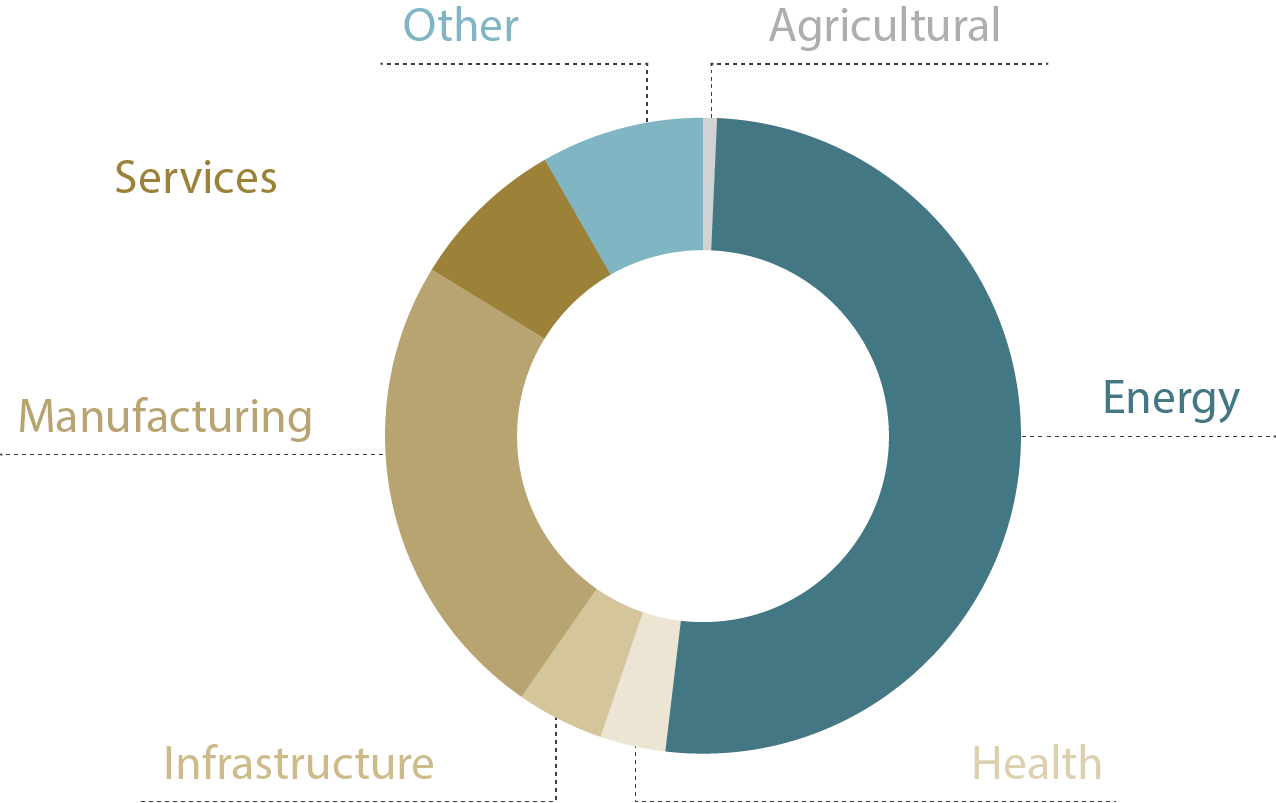

Business Insured Breakdown

Geographic Breakdown

Sectoral Breakdown

In 2019, ICIEC added 3 member countries, bringing

its total to 47. These countries are Suriname,

Uzbekistan and Turkmenistan.

Achieved 270% of the targeted net corporate result for 2019

Income and Portfolio Breakdown

Income Source – 2019

Asset Mix – 2019

To facilitate trade and investment between member countries and the world through Shariah-compliant risk mitigation tools.

To be recognised as the preferred enabler of trade and investment for sustainable economic development in member countries.

ICIEC’s mandate is to promote cross-border trade and foreign direct investment (FDI) in its member countries.

ICIEC serves its mandate by providing risk mitigation & credit enhancement solutions to member countries’ exporters selling to buyers across the world, and to investors from across the world investing in member countries.

ICIEC also supports international exporters selling to member countries, if the transactions are for capital goods or strategic commodities.

End hunger, achieve food security and improved nutrition and promote sustainable agriculture

Since inception, ICIEC has exempli ed its commitment to strengthening the agricultural sector in its member countries by insuring a total of USD 1.34 billion in this sector. Additionally, in 2019 alone, ICIEC insured USD 64 million worth of business in the agricultural sector.

Ensure healthy lives and promote well-being for all at all ages

In accordance with its commitment to improving health outcomes across the OIC, ICIEC has insured USD 1.43 billion worth of business in the healthcare sector since inception, while insuring over USD 360 million in 2019 alone.

Ensure access to affordable, reliable, sustainable and modern energy

ICIEC understands the importance of facilitating energy security in its member countries. Since inception, ICIEC has insured a total of USD 21.92 billion in the energy sector. Additionally, in 2019 alone, ICIEC insured USD 5.56 billion worth of business in the energy sector.

Promote inclusive and sustainable economic growth, employment and decent work for all

ICIEC’s commitment to spurring economic growth and supporting the creation of decent jobs has been strong since inception. ICIEC has insured a total of USD 20.81 billion in the manufacturing sector. In 2019 alone, ICIEC insured USD 2.61 billion worth of business in the manufacturing sector.

Build resilient infrastructure, promote sustainable industrialization and foster innovation

ICIEC understands that reliable infrastructure is a foundational ingredient for growth. Since inception, ICIEC has insured a total of USD 4.13 billion in the infrastructure sector. In 2019 alone, ICIEC insured USD 474 million worth of business in the infrastructure sector.

Revitalize the global partnership for sustainable development

In accordance with ICIEC’s commitment to reach the global goals through partnership, ICIEC introduced 3 new member countries in 2019 and signed partnerships with various ECAs and other financial institutions.

“The Corporation’s commitment to the UN’s Sustainable Development Goals (SDGs) was stronger than ever. Its dedication to helping member countries achieve these goals was woven into everything it did in 2019 and will continue to be a foundational focus.“

ICIEC’s innovation driving the growth of Islamic Finance

In 2019, ICIEC introduced two new Sukuk insurance products, allowing its customers to gain better access to capital through the Islamic Finance product. These two products are the Standard Sukuk Insurance Policy and the Green Sukuk Insurance Policy. ICIEC also played a prominent role at the 4th African International Conference on Islamic Finance and at the London Sukuk Summit.

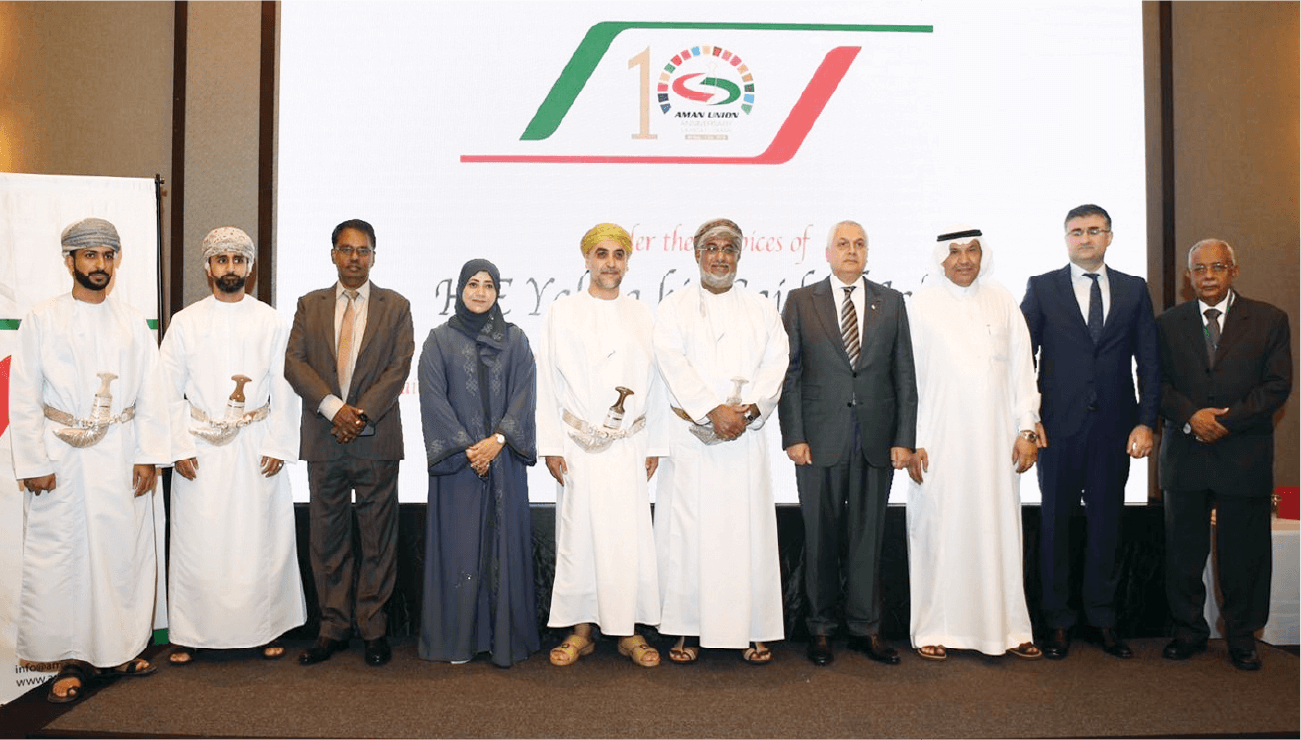

Building Lasting Partnerships

ICIEC worked hard to forge strong partnerships in 2019 and celebrated some of its longstanding initiatives for cooperation. For instance, it was the Aman Union’s 10th anniversary, marking a milestone moment in the Union’s history. Additionally, ICIEC was elected into the Management Committee of the Berne Union. Apart from this, ICIEC signed countless MoUs, both with new and longstanding partners.

Enabling Excellence, Inside and Outside of ICIEC

In 2019, ICIEC undertook various initiatives to support professional and industry development. ICIEC began implementing its new Takaful system to improve organizational efficiency. It also moved forward in developing the OIC Business Intelligence Center and participated in the OIC High-Level Public and Private Investment Conference. It also continued to support employee development through various courses.

In 2019, ICIEC supported various landmark projects and transactions in its member countries. These projects are catalytic for the development of its member countries and crucial for the fulfilment of ICIEC’s mandate.

The city of Abidjan suffers from a shortage of drinkable water. This challenge has been exacerbated by an influx of people from rural areas to the city, now home to over 5 million people. This significant population increase, in conjunction with poor water infrastructure, has caused a precarious situation as it relates to water security. ICIEC has provided Société Générale with Government non-payment cover against the default of financial obligations of a loan facility in CFA franc that it is granting to the Ministry of Finance and Budget of Côte d’Ivoire.

Côte d’Ivoire is a country determined to engender strong economic growth and ascend towards the status of a middle income country. To achieve this goal, the presence of a reliable power supply is crucial. ICIEC provided reinsurance to MIGA for its insurance of the Azito III project expansion. This guarantee for Azito III is also important for MIGA to proceed with the coverage of Azito IV investment. Hence, ICIEC cover helps the country indirectly catalyze more foreign direct investment (FDI) in

its power sector.

Abidjan suffers from a severe lack of potable water. This has devastating concerns for the local populace as countless residents suffers from water-related diseases, which often prove to be fatal for young children. To address this, ICIEC is providing a loan guarantee to Société Générale Paris for its loan facility funding the construction of a new water facility. The volume of the cover is EUR 107 million. The tenor for one tranche is for 7 years, while for the other it is 10 years.