ICIEC 2020 Annual Report

Partnerships for Recovery and Impact

“ In 2020 world trade and the global economy suffered unprecedented disruptions and uncertainties. As a result, many OIC countries faced heightened health, economic and humanitarian crises. Throughout the immense challenges caused by the global pandemic, ICIEC provided USD9.86 billion in support for cross-border transactions, delivering on its mandate and remaining a strong and reliant partner for Member Countries. Through the provision of export credit and investment insurance solutions, ICIEC continued to mitigate risk and facilitate the ongoing flow of trade and investment, particularly for essential goods and services to Member Countries in need.”

Oussama Abdul Rahman Kaissi

Chief Executive Officer

In 2020, ICIEC supported various landmark projects and transactions in its Member Countries. These projects are catalytic for the development of its Member Countries and crucial for their recovery from the COVID-19 pandemic.

ICIEC supported Côte d’Ivoire in the development of its healthcare infrastructure by covering EUR 124 million of a Deutsche Bank financing for the construction of two new hospitals and five new medical units in existing hospitals across the country. The two hospitals will employ around 600 local people and foster the development of a micro-economy in the areas surrounding them.

With a collective capacity of 400 beds, the project is bringing state-of-the-art equipment and facilities to this underserved region, greatly assisting Côte d’Ivoire battle the COVID-19 pandemic.

To address gaps in Indonesia’s 4G network coverage, ICIEC insured EUR 50 million for a transformational telecommunications project. The project allowed a major telecommunications operator to accelerate its work in the region and support the rapidly growing digital economy in Indonesia.

The project enables 90% of Indonesia’s population access to reliable voice and data coverage. The investments will be directed towards Indonesia’s underserved rural areas, ensuring broader participation in the nation’s economic growth and prosperity by reducing inequalities for access to 4G services in rural areas while helping drive the country shift to a more digital economy in light of COVID-19.

ICIEC supported Nigeria by providing USD 12.5 million in cover, issuing the Corporation’s first-ever BMP Murabaha to Bank of Africa (formerly BMCE Morocco) in support of its financing for a Nigerian bank. ICIEC’s support has played a crucial role in facilitating trade and reinforcing trust, directly supporting banks and private sector resilience through the crisis. The Corporation’s support allowed for the urgent financing needed to secure essential imports of food and refined oil to Nigeria, helping to offset the social and economic distress caused by the COVID-19 pandemic.

ICIEC’s 10 Year Strategy Framework 2015-2024 (10YSF) is half-way in its term against the backdrop of challenging and changing global economic dynamics. ICIEC conducted a Mid-Term Review of its 10 Year Strategy and as a result has re-adjusted its Strategic Pillars in order to catalyze development impact in MCs while maintaining financial sustainability.

ICIEC is committed to the achievement of 6 SDGs.

ICIEC published the third edition of the Annual Development Effectiveness Report (ADER) in 2020. The ADER records and displays the developmental impact of the Corporation’s activities.

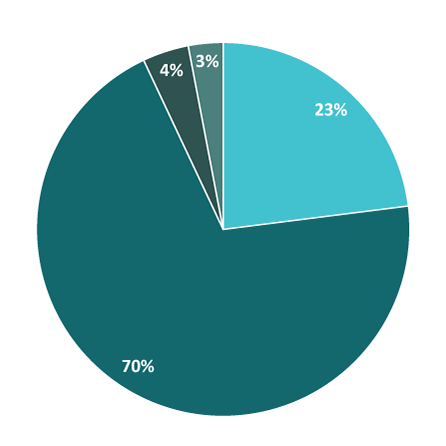

ICIEC’s Membership represents a diverse range of economic backgrounds scaling from high income economies to least developed economies.

Member Countries are classified as LI/LDCs.

Understanding the value and impact of partnerships in expanding trade, strengthening coverage, and growing economies, ICIEC will continue to make efforts to forge new partnerships, in addition to strengthening existing ones.

ICIEC is playing a leading role in the AATB as the insurance provider for trade transactions under the program.

Eximgarant of Belarus, U.K. Export Finance, CESCE, OeKB, and Uzbekinvest.

ICIEC virtually attended the AMAN UNION’s 11th Annual General Assembly Meeting in December 2020. ICIEC also participated in AMAN UNION Academy online courses.

The Corporation has proven it has the capacity to de-risk and crowd-in additional investment for climate-resilient projects and is working consistently to improve its capacity as a climate finance enabler.

ICIEC’s Shari’ah-compliant credit insurance products have been integral in supporting Islamic financial institutions in their provision of Shari’ah-compliant trade finance solutions. ICIEC supported Islamic banks with almost USD 300 million during 2020.

The Islamic banks that ICIEC supported in 2020 were in Bahrain, Kuwait, Saudi Arabia and the UAE.

ICIEC opened a new regional office in Riyadh, KSA in 2020.

ICIEC conducted an efficiency benchmarking exercise in 2020, to learn from its peers and to determine strategies how its operation can become more efficient.

In 2020 the Corporation undertook a comprehensive update of its Operations Manual and is currently in the process of automating and streamlining its end-to-end business solution.

The Corporation is at an advanced stage of implementing a Risk Capital Model that will improve capital adequacy calculations and strengthen capital planning and optimization.

ICIEC’s Risk Capital model will serve as the foundation for an enhanced and dynamic risk-based pricing system.

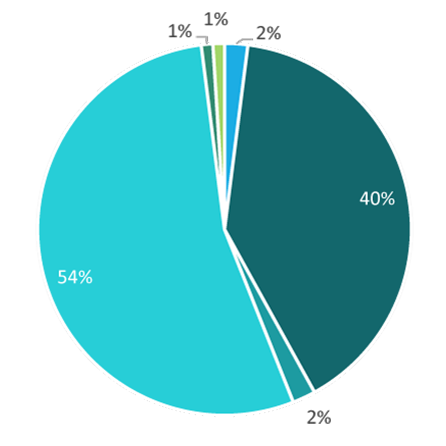

Following the rapid growth of the Investment Insurance business, ICIEC’s portfolio composition shifted towards FII.

ICIEC and ISFD have collaborated to create the ICIEC-ISFD COVID-19 Emergency Response Initiative (ICERI). The fund has structured a concessional all-in pricing mechanism to help preserve the flow of essential imports to OIC countries, prioritizing support for the import of urgent commodities such as medicine, medical equipment and foodstuffs.

The G20 Saudi Presidency mandated ICIEC, in coordination with other Multilateral Development Banks (MDBs), to prepare a Stock Take report on “Best Practices of MDBs and Specialized Multilateral Insurers in Political Risk Insurance for Equity Investments, Medium and Long-Term Debt Investments and other Insurance Solutions” for the G20’s International Financial Architecture (IFA) Working Group.

Over the past year, ICIEC has undertaken efforts to strengthen its risk management, which is timely given the uncertain risk environment posed by the onset of the COVID-19 pandemic in March 2020.

ICIEC’s risk management division undertook various initiatives to further strengthen its practices. These included enhancing its Incurred but not Reported (IBNR) claim reserving model to align with best practices and developments in international financial reporting standards.

The Corporation developed and commenced the implementation of a Risk Capital Model and Exposure Management Framework, which will allow for better management of financial risk, allocation of capital, and loss absorption capacity.