The role of FDI in MENA countries

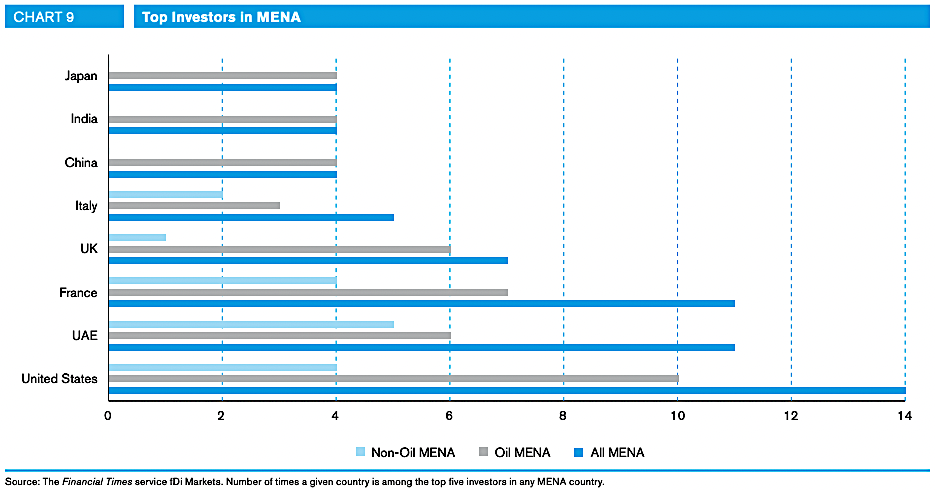

Since the early 2000s, Foreign Direct Investment (FDI) to the Middle East and North African (MENA) region has provided substantial capital and support for national development projects in MENA countries. Sectors such as oil and gas, real estate, coal, chemical manufacturing, services (particularly in tourism and hospitality), and renewable energy have been the primary recipients of this FDI, with the majority of investments coming from the United States, France, the United Kingdom, Italy, China, Japan, India, Germany, and Austria.[1]

Greenfield investment is a type of FDI in which a parent company creates a subsidiary in a different country and builds its operations from the ground up, creating jobs and contributing to economic growth. Greenfield investments represent over 80% of total FDI projects in most MENA countries, creating more than 50,000 jobs to date in Algeria, Egypt, Morocco, Saudi Arabia, Tunisia and the United Arab Emirates. On average, these investments represented 4.86% of MENA GDP from 2003-2012.[2] Gulf Corporation Council (GCC) countries are a significant source for these greenfield investments in their fellow MENA countries, contributing significantly to intra-OIC relations.

Though FDI has provided significant development support to MENA countries, it has become relatively stagnant over the last decade. On average, countries in the region struggled to secure FDI following the 2008 global financial crisis and the Arab Spring movements of 2010-2011. While inward FDI did eventually rise again in 2015, inflows plateaued by 2018, still only reaching less than half the levels of total FDI inflow found in MENA countries at their peak in 2007. Conflict-ridden countries in the MENA region have experienced further difficulties attracting FDI, reporting negative FDI inflows. By 2019, net FDI inflows to the MENA region sat at a mere USD 57.8 billion compared to USD 126.5 billion in 2007.

Factors influencing FDI into MENA countries

Several factors influence FDI flows to MENA countries. Former colonial ties, religious affiliation, and the use of a common language all act as major influences in ways unseen in the rest of the world. Furthermore, differences between the economies of oil-producing and non-oil producing MENA states play a significant role in attracting FDI. Generally, non-oil producing MENA countries attract more significant greenfield investment than their oil-producing counterparts. This can be attributable primarily to oil-producing countries utilizing their abundant in-country oil resources to generate national capital instead of seeking foreign sources.

The most significant factor influencing the limitations witnessed for FDI in many MENA countries is the perceived risk associated with the region, which results in heightened concern from foreign investors regarding immediate and long-term regional stability. These risks can include political instability, low GDP, and infrastructure deficiencies, amongst others. To mitigate against these risks and counter the decline of FDI in the region, various MENA governments have advanced policy reforms, using policy and regulation to promote and facilitate the return of foreign firms and money. Such reforms have led many MENA states to revise investment legislation, ease market entry, streamline regulations in business operations, strengthen investment promotion agencies (IPAs), and adopt policies to direct investment into under-performing regions. However, despite these efforts, many MENA governments have been unable to secure FDI at levels equal to that found amongst other emerging and developing economies, limiting sustainable development in the region. While the MENA region currently has the market, resources, and human capital potential required to attract FDI at high levels, it faces significant challenges that hinder incoming FDI’s flow and effectiveness.

MENA’s FDI and COVID-19

The onset of the COVID-19 pandemic further exasperated the issues regarding FDI inflows to the MENA region. No nation was spared from the economic impacts of the virus, as all governments had to close borders and implement lockdowns and quarantines, grinding global economic activity to a halt and causing a contraction of the global economy by 3.3% in 2020.[3] Furthermore, as a result of the pandemic, global FDI flows fell by 35% from US$ 1.5 trillion in 2019 to US$ 1 trillion in 2020.[4]

Early estimates suggested the MENA region would lose up to 45% of its FDI inflows in 2020, though varied outcomes have been suggested since this prediction. [5] Such concerns were raised primarily in response to the impact of the pandemic on greenfield investments, which had already dropped by 80% in the first six months of 2020. This was a drastic loss compared to the anticipated reduction in greenfield investments in other emerging and developing economies (42%) and amongst OECD countries (17%).[6] The projections were based on significant greenfield investment-reliant industries such as tourism and manufacturing being hit particularly hard due to lockdowns and border closures.

As oil prices dropped, greenfield investments from the GCC oil-producing countries to their MENA neighbours were also anticipated to fall drastically, primarily affecting the region’s real estate (65% of investments) and energy (14% of investments) sectors.[7] Despite these bleak projections, greenfield investment drops appear to primarily result from projects being put on hold rather than being cancelled or shelved, meaning a greater likelihood of FDI bouncing back in the region.

Despite bleak early projections, states throughout the MENA region have experienced positive and negative FDI inflows during the COVID-19 pandemic. FDI flows to West Asia increased by 9% in 2020. Meanwhile, North Africa saw FDI inflows contract by 25%. These variations in FDI have largely been sector-driven, with specific sectors seeing higher or lower investments due to the pandemic-based valuations of different industries.

Many MENA countries have worked to support select industries based on these disruptions. Some states are positioning themselves as premier destinations for FDI in specific industries. For example, the Tunisian government is encouraging international automobile manufacturers to refocus their funds away from the Chinese and American markets into the country through implementing various investment-friendly policy and regulation schemes. Furthermore, states are revising investment laws to focus on priority sectors and improve regulatory and institutional structures that facilitate increased FDI. Turkey is extending a specialized free zone programme encouraging investment in software and ICT activities to include other high value and technology-intensive activities, resulting in Ford’s recent construction of USD 2.6 billion electric automobile assembly plant.

ICIEC and FDI in MENA

ICIEC’s mandate is to bolster economic growth and sustainable development in its 47 Member Countries. With much of its Membership located within the MENA region, the Corporation is a significant support for attracting FDI flows to MENA countries, specifically for projects that boast substantial developmental impact. ICIEC supports FDI by providing investment cover against the potential risks that lead to barriers for investors through its Preferred Creditor Status and the Corporation’s Political Risk Insurance (PRI) products, namely its Foreign Investment Insurance Policy (FIIP) and Non-Honoring of Sovereign Financial Obligations (NHSFO). ICIEC’s cover helps to provide investors with increased security.

Since the Corporation’s inception in 1994, ICIEC has provided more than USD 78 billion in total business insured, including USD 15.6 billion toward investment protection. In 2020, ICIEC provided a total of USD 9.86 billion cover for trade and investment across its 47 Member Countries. Over USD 6 billion of this total is being used to provide insurance cover for transactions in the MENA region, and USD 1.98 billion is being used specifically for investment insurance cover.

ICIEC has been highly active in promoting FDI in MENA countries, providing cover for several notable investments. One such example is ICIEC’s USD 68 million FIIP cover for the construction and operation of the Benban Solar Complex in Aswan, Egypt. ICIEC’s support for this transaction promoted FDI inflow to the MENA Member Country and contributed to the growth of renewable energy sources, bolstering the nation’s energy security. ICIEC also provided USD 32.5 million in NHSO cover for the Sharjah waste-to-energy (WtE) project in the United Arab Emirates, earning the Project Finance International (PFI) Award for the Middle East Clean Energy Deal of the Year in 2019. Meanwhile, ICIEC won the PFI award for Turkish Deal of the Year in the same year for its various levels of insurance cover toward the construction of the Çanakkale bridge in Turkey, which is set to have an immense impact on both trade and development in Turkey.

As vaccines become more available and MENA countries reopen their borders to trade and promote their industries to investors, ICIEC will continue to work with our Member Countries in the region to facilitate the return of FDI. Though most MENA governments are currently working to provide responses negating the immediate impact of COVID-19 on trade and investment, now is an opportune time to implement ambitious long-term programs that encourage further investment into the region. ICIEC is ready to help MENA governments attract high-quality investments that increase jobs and capital within the region and promote an inclusive, sustainable, and resilient recovery. While the pandemic has posed a difficult stretch for FDI, ICIEC and its MENA Member Countries will work together to ensure the next decade is one of prosperity and openness for MENA-oriented FDI.

https://www.brookings.edu/blog/future-development/2019/12/13/encouraging-transformations-in-central-asia/#:~:text=Nearly%2030%20years%20ago%2C%20the,the%20middle%20of%20the%201990s

https://www.forbes.com/sites/arielcohen/2020/12/08/foreign-investment-in-renewables-and-beyond-the-last-best-hope-for-central-asias-economic-recovery/?sh=26368a2f5ebf

https://read.oecd-ilibrary.org/view/?ref=134_134467-ydi12subjo&title=Investment-in-the-MENA-region-in-the-time-of-COVID-19&_ga=2.157186872.245605971.1622493830-457525634.1622493830

https://www.iemed.org/publication/fdi-in-the-mena-region-factors-that-hinder-or-favour-investments-in-the-region/