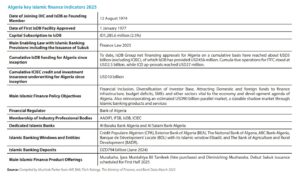

Algeria’s Islamic Banking Voyage of Discovery

Despite being a founding member of the IsDB and a member of ICIEC since 1996, Algeria is a relative latecomer to the Islamic finance industry per se. The country is keen to open up to the Islamic finance industry and the Ministry of Finance is mooting the issuance of Algeria’s debut sovereign Sukuk reportedly in First Half 2025. As Mushtak Parker maintains the potential for and the synergies between Islamic finance and a people-centred sustainable development agenda in Algeria are huge, particularly in the issuance of Sukuk for infrastructure and budget rebalancing, raising funds through Murabaha syndication for trade finance, and through the utilisation of ICIEC’s unique Shariah-compliant credit and investment insurance solutions in a world beset with growing uncertainties.

Algeria, a founding member of the OIC and the IsDB, is now poised to embrace the estimated USD5 trillion global Islamic finance industry.

Hitherto, the country has seen a modest but growing level of activity mainly through the IsDB, ICIEC and through its growing number of Islamic financial institutions including Al Baraka Bank Algeria and Al Salam Bank Algeria, and several Islamic Banking Windows of public and overseas banks such as Crédit Populaire Algérien (CPA), Exterior Bank of Algeria (BEA), the National Bank of Algeria, ABC Bank-Algeria, Banque de Dévelopment Locale (BDL) with its Islamic window Elbadil, and the Bank of Agriculture and Rural Development (BADR).

This follows the proactive policy support from Algerian President H.E. Abdelmadjid Tebboune and his government to embrace and promote Islamic finance in the country’s development agenda, which has manifested in the fact that Algeria is the host country of the 2025 Algeria key islamic finance indicators 2025 IsDB Group Annual Meetings on 19-22 May in Algiers along the theme “Diversifying Economies, Enriching Lives.” H.E. Mr. Abdelkrim Bouzred, Minister of Finance and current Chair of the IsDB Board of Governors, emphasized: “This event is of great significance for Algeria, offering an important opportunity to elevate its standing on the global economic stage by highlighting the reforms implemented and showcasing the country’s strengths in cooperation, investment, and sustainable development.”

Catching Up

The reality is that Algeria as an Islamic finance market has a lot of catching up to do in all the facets of the industry. The good news is that there is a new-found realisation in the government of President Tebboune that Islamic finance has much to offer Algeria in its development journey.

To facilitate this, the government has introduced several pieces of enabling legislation based on parity with the conventional finance sector over the last few years. The main legislation was the Finance Law 2018 which for the first time saw the facilitation of several Islamic banking products.

In October 2024, for instance the government introduced Islamic real estate and mortgage finance regulations which has allowed Algerians wishing to access Shariah-compliant mortgages for their house and commercial property as their financing choice. The government also started in 2022 to licence family and general Takaful operators and introduced legislation to facilitate Shariah-compliant auto financing products.

Islamic finance deposits according to the finance minister H.E. Laaziz Faid had reached DZD794 billion at end June 2024. In December 2024, he confirmed that the finance ministry was working on a Sukuk Issuance Framework and a new law to facilitate the offering of the country’s maiden sovereign Sukuk issuance, aimed at financing projects and infrastructure. funds for its infrastructure projects. Quoted by the local Aljumhuria newspaper, the Minister said that the plan was to issue a debut Sukuk in First Half 2025 to complement the funding needs of the 2025 National Budget, to attract a wider base of foreign investors by diversification the source of funding and investor base, and to boost confidence in the local capital market.

An important development also was in 2021 when the Bank of Algeria (the central bank) signed an MoU with the Bahrain-headquartered Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) to collaborate to enhance the Islamic finance industry in Algeria.

Financial Inclusion

But the most important recent development is the repeal of existing legislation to make way for the introduction and adoption of the 2025 Finance Law which includes provisions for regulating Islamic consumer finance products in sectors such as tourism and hospitality, education and healthcare using Murabaha, Ijara Muntahiya Bil Tamleek (hire purchase) and Diminishing Musharaka structures targeting financial inclusion objectives, SMEs, real estate and infrastructure projects, and also reincorporating an estimated USD90bn parallel market, a sizeable shadow market through Islamic banking products and services.

The Islamic Banking Window (IBW) of Crédit Populaire Algérien (CPA), for instance had over 70,000 customer accounts at end 2024 and customer savings of DZD47 billion. According to CPA these initiatives point to the fact that the Islamic finance industry is entering a new phase of offering tailored solutions to customers in key sectors of the economy.

The proposed debut sovereign Sukuk has also been approved under the 2025 Finance Law. According to Al Majalla newspaper, the debut Sukuk issuance is likely to be denominated in local currency DZD. A major problem with all nascent Islamic finance markets is the dearth of reliable and regular market data and whether the data includes the official figures and the estimates for the unofficial black economy. The current Islamic finance data landscape of Algeria is at best sparse and fragmented, and information is ad hoc, dated and sometimes exaggerated depending on the source. This makes it difficult to assess the state of the Islamic finance sector in the country. Date disclosure and transparency is really the task of the financial regulator, the Bank of Algeria, to which all authorised and licenced financial institutions obliged to report to.

According to the Bank of Algeria in a February 2024 report, Islamic banking deposits rose by more than 14% in the last two years, from around USD4 billion in 2022 to USD4.7 billion by June 2023, when there were 12 licensed providers operating in Islamic banking (six state-run,six private providers). There was no delineation of whether they were dedicated or IBWs.

Algeria’s Islamic finance journey needs to transform from a fragmented approach to a more structured one, in which policy making, enabling legislation, various frameworks and guidelines, regulatory standards, acceptance and compliance with international standards, disclosures and clarity of purpose should be paramount. Industry bodies such as IFSB, IILM, AAOIFI and others, together with the IsDB Group could play a crucial role in market education and technical expertise to ensure better understanding of and Shariah certainty and confidence in the industry, which after all has a large natural constituency for Islamic finance products.