Fast Tracking Clean Energy Transition and Food Security Through Proactive Sustainable Finance and De-risking Solutions and Alliances

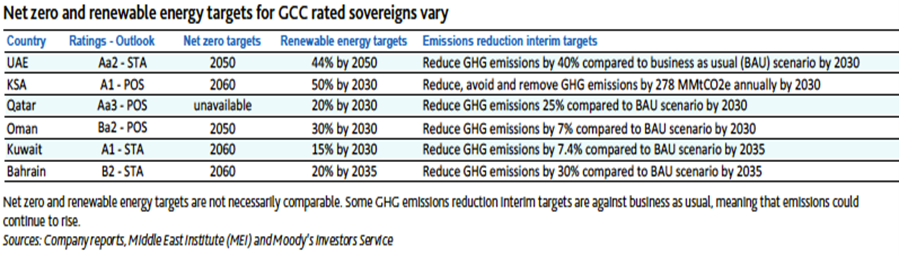

Are Multilateral Insurers and Private Credit and Investment Insurers adequately rising to the challenge of underwriting Climate Action risks and resilience? Due to a fragmented global regulatory architecture and competing taxonomies, and the seemingly contradictory demands of fossil fuel dependency to raise much-needed budget revenues or consumption for household and industrial electricity generation, do multilateral insurers and National export credit agencies (ECAs) need to revisit their climate finance and sustainability playbooks in the race towards Net Zero? Oussama Kaissi, Chief Executive Officer, ICIEC, emboldened by the Corporation’s newly launched Climate Change Strategy and ESG Framework, consider how Export Credit and Investment Insurance (ECII) can enhance the urgency and evolving and oft-competing demands of decarbonisation and just and clean energy transition against the background of geopolitical tensions, financing gaps, economic disruptions, inflationary pressures, rising inequality and an ongoing global Cost-of-Living Crisis?

While blended finance, Green, Social and Sustainability (GSS) bonds and to a lesser extent Sukuk, have proliferated at a rapid pace over the last few years and according to S&P, Global could reach a cumulative US$4 trillion by end 2023, export credit and investment insurance (ECII) hardly get a mention in the cornucopia of climate action reports and initiatives.

The tendency is to lump them together under the generic title of climate finance and risk mitigation solutions, making ECII the poor relation of the decarbonisation and sustainable finance landscape.

The general consensus is that ECAs are a critical link to support the rising ambition of governments and the private sector. While some ECII stakeholders have taken important steps to increase their support for the new green economy, the industry and their regulators are perceived as lacking greater ambition and action with more consistent methodologies and collaboration with the wider financial services sector.

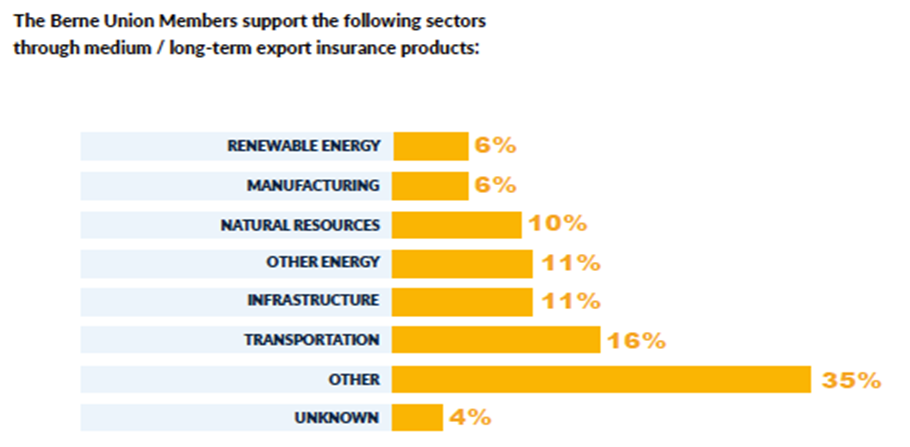

Credit insurance acts as a catalyst that provides financing to the real economy across the globe. By protecting exporters and banks against the risk of non-payment, credit insurance enables cross-border trade and investment increasingly in climate-related business, inputs and projects. The Berne Union Members collectively provide payment risk capital worth US$2.5 trillion each year, insuring approximately 13% of the value of total global cross-border trade.

The availability of finance, liquidity and underwriting is not a problem. It is a question of matching the above with acceptable and bankable projects and transactions. On the flipside is the inadequate action to mitigate climate change and biodiversity loss risks. A few weeks before COP28, a 34-strong international group of climate, environmental and consumer protection entities, including the Swiss-based WWF (Greening Financial Regulation Initiative), wrote a passionate, open letter calling on the International Association of Insurance Supervisors (IAIS) to scale up regulatory action on climate and shift away from environmentally harmful economic activities.

The signatories strongly expressed “our deep concern that the IAIS is taking insufficient action to address the risks of climate change and nature loss and their implications for the insurance sector. Unfortunately, the global regulatory environment on insurance and climate-and environment related financial risk is not yet sufficiently developed to ensure a smooth transition to a net zero, nature positive financial system.”

The Open Letter makes uneasy reading for insurers and underwriters pertaining to the proliferation of climate-related events and transactions.

- Since 2017, the insured losses from natural disasters (mostly human-made climate disasters) averaged US$110 billion per year, more than double the average amount in the previous five years.

- Reinsurance and primary insurance rates have increased rapidly, but there are growing parts of the world where other countries risk becoming “uninsurable.”

- California’s former insurance commissioner, Dave Jones, warned recently, “I do believe we’re steadily marching towards an uninsurable future, not only in California but throughout the United States.”

- In Europe, the European insurance supervisor (EIOPA) estimates that only about a quarter of climate-related catastrophe losses are currently insured and this insurance protection gap could widen in the medium to long term as a result of climate change.

- This scenario also creates serious risks to the insurance industry itself.

- Current global insurance regulations are patchy at best.

Climate Risk Proliferation for Underwriters

Climate change mitigation is falling behind, given that greenhouse gas emissions from the energy sector reached a record amount in 2022/23. Yet in spite of its powerful role as a global risk absorber and manager, the insurance industry, say the signatories is not using its influence to accelerate the transition from fossil fuels to clean energy. “Instead, it is adding fuel to the fire by underwriting the continued expansion of oil and gas extraction. As noted by the U.S. Treasury Department in a June 2023 report on climate-related risks for the insurance industry, the U.S. insurance industry’s corporate bond and equities investment exposure to high GHG-emitting industries is approximately US$439 billion, or 15% of those investments.”

The fact that fossil-fuel subsidies, according to the IMF, surged to a record US$7 trillion in 2022 as governments supported consumers and businesses during the global spike in energy prices caused by the Ukraine conflict and the economic recovery from the pandemic, remains another bottleneck in clean energy transition.

The signatories slate The Net Zero Insurance Alliance (NZIA), which was founded in 2021, for caving in to pressure from the fossil fuel lobby, under the pretence of anti-competition measures, which they claim, “poses great risks for an orderly transition in the insurance sector and requires regulators to urgently clarify the scope for collective industry action in the public interest.”

The IAIS should be commended for monitoring climate change as a key trend for the industry, setting up a disclosure workstream, and conducting consultations on updates to its guidance related to climate change. But the scale, pace and urgency are insufficient. Not surprisingly, the signatories recommend the IAIS to i) take a precautionary approach to addressing environmental risk, which remains a regulatory blind spot, ii) should offer best practice guidance to ensure that insurance companies adopt transition plans with short-, medium- and long-term targets and aligned with credible 1.5°C pathways, iii) not to let contributors to the crisis get public support, and iv) to rely on evidenced-based climate science.

With US$6.86 trillion in gross written premiums in 2021, insurance companies are an economic heavy weight with enormous potential to reduce the negative impact on climate change and nature loss through their underwriting business. Insurance regulators and supervisors have a critical leading role to play and can help advance insurance companies to reach global climate and biodiversity goals by aligning insurance regulation, policies and supervision to international best practice and ambitions.

Progress Out of Adversity

But, very often in adversity comes progressive initiatives. A Number of initiatives that have emerged out of COP28 could potentially be game changers in the role and ways de-risking solutions are contributing to the Net Zero ambitions. The first one is the launch of the Net Zero Export Credit Agencies Alliance (NZECAA) by a group of ECAs led by UK Export Finance (UKEF) under the aegis of the United Nations Environment Programme Finance Initiative (UNEP-FI) with the simple mandate of promoting the role of export credit in achieving net zero emissions by 2050 and limiting global warming to 1.5°C, in collaboration with the Glasgow Financial Alliance for Net Zero (GFANZ).

UN Under-Secretary-General and UNEP Executive Director, Inger Andersen could not have been more to the point at the launch of the Alliance. ECAs, she reminded, are in a strong position to deliver more sustainable global trade and to complement the work already being undertaken by the private finance sector, helping to address market gaps to deliver net-zero economies by 2050. “This Alliance will play an important role in supporting tangible economic transition and help countries implement their commitments under the Paris Agreement. Large private financial institutions are powerful, but they cannot deliver net-zero alone. Public finance is the missing piece in net-zero financial landscape. We need the full might of the global financial system to combat and adapt to climate change,” she maintained.

UKEF, with which ICIEC has a long-standing collaboration, recently unveiled multi-million-pound support for transactions supporting climate adaptation and sustainability across Africa and the Middle East, including a GBP226 million facility for the Iraqi Government to develop clean water and sewage treatment infrastructure in Hillah City.

UKEF has declared that it is committed to reaching net-zero in terms of its total financed emissions by 2050, it ended all new support for overseas fossil-fuel projects in 2021, except in very limited circumstances, and recently introduced more flexible and competitive terms for British exporters as part of the Government’s drive to encourage them to use and offer finance solutions and other options which are consistent with the Green Finance agenda in line with the UN SDGs and the Paris Net Zero ambitions. According to the British ECA, it can now offer longer repayment terms and more flexible repayment structures for an expanded range of renewable and green transactions, and for standard transactions.

ICIEC’s Climate Change and ESG Playbook

ICIEC similarly launched its Climate Change Policy and ESG Framework at COP28, which marks “the commencement of a transformative results-oriented process where ICIEC’s operations, insurance, de-risking, physical assets and human capital and focus are addressing the Climate Crisis at their core, based on the needs of ICIEC’s member countries, IsDB Group synergies, the role of the private sector in climate finance and industry best practice.”

ICIEC is committed to helping our 49 Member States achieve their development goals, including resilience, mitigation and adaptation to the threats posed by climate change. ICIEC cover is directed towards various sectors, with US$2.35 billion going specifically into clean energy initiatives such as solar energy systems and wind farms – assisting with their importation and use in national infrastructure projects. At COP28, IsDB President, H.E. Dr. Muhammad Al Jasser, unveiled a US$1 billion climate finance initiative for fragile and conflict-affected member countries over the next three years.

At the same time, ICIEC has granted approvals exceeding US$573 million in support of food security under the Islamic Development Bank (IsDB) Group Food Security Response Programme (FSRP), surpassing our initial commitment of US$500 million for the entire period from SH 2022 until 31 December 2025. ICIEC initiatives in this respect primarily facilitate financial transactions, facilitating the importation of essential agricultural commodities and inputs for agricultural projects, reinforcing resilience against potential food crises.

Collaboration with national, regional and international partners is a key component of ICIEC’s strategy, given the complex risk metrics involved in climate-related events. Earlier this year MUFG Securities EMEA plc structured a €1.247 billion financing package to enable institutional capital investors and syndicate lenders to collaboratively contribute to the package for Türkiye’s green Yerkoy Kayseri Highspeed Railway Project. The Project is backed by a coalition of four European ECAs led by UKEF.

ICIEC participated in this landmark transaction with an 8-year tenor by covering the risks of the Non-Honouring of Sovereign Financial Obligation (NHSFO) of the Ministry of Finance and Treasury of Türkiye of up to €134.1 million, to cover a Syndicated Financing Facility of the same amount led by MUFG Securities EMEA plc and comprising six banks including MUFG, Banco Santander, DZ Bank, Deutsche Bank, Societe Generale and ING Bank. The aim of the project is to improve the efficiency and adequacy of the transportation system in the region by addressing poor rail connectivity and the lack of alternative environmental transport modes. ICIEC played an instrumental role in this impactful transaction, confirming our unwavering commitment to supporting critical infrastructure developments in Türkiye and within ICIEC Member States.

The above developments also follow a change earlier this year to the OECD Arrangement on Officially Supported Export Credits, which allows ECAS and Exim banks to offer greater incentives for climate-friendly transactions.

The export credit industry is hugely influential globally with up to US$28 trillion – comprising 80 to 90% – of international trade relying on export financing, much of it provided by governments via export credit agencies and export-import banks. It is the height of folly that governments, international agencies, the COP process and other stakeholders have hitherto failed to capitalise on what the ECII community can bring to the table beyond their vanilla de-risking and credit enhancement solutions. On the other hand, the ECII community and their promoters and shareholders should take some responsibility for this lack of upscaling, underwriting, collaboration and urgency in underwriting climate related and catastrophe risks.

It is noteworthy that the Berne Union Climate Working Group (BU CWG) which is doing important work in supporting the climate goals of the wider export credit community, has come up with a “refreshed BU CWG workplan for 2024” in the wake of the developments at COP28. At the same time, Export Finance for Future (E3F), an international coalition working to align public export finance with climate change and goals. In Dubai, E3F under the motto “Scale Up to Phase Out” confirmed in a debate that momentum is building in its efforts of “gathering a critical mass of countries ready to accelerate the progressive phasing out of Carbon-intensive projects and significantly increase the financial support to exporters’ projects compatible with Paris Climate Agreements”. E3F is also in the process of rolling out National Phase Out Plans for official export credit support for fossil fuels, inviting external monitoring by being transparent about our transactions and now going turbo on scaling up initiatives.

A Future of Proaction and Ambition?

Looking ahead, there are several other positives that indicate a much more proactive and ambitious role for the ECII community in promoting the green economy through climate transition and decarbonization initiatives.

In trade finance, in a post-Covid dispensation, there is a continued push for digitisation, transparency and automation in an environment with increasing regulatory and compliance requirements. In September 2023, the Electronic Trade Documents Act (ETDA) 2023 in the UK received Royal Assent in an effort to make Global Britain’s trade with partners all over the world more straightforward, efficient and sustainable, and which according to the British Government’s initial estimate could give the UK economy a GBP1.14 billion boost over the next decade through the trade documentation digitalisation.

Similarly, the introduction of ISO 20022 by the International Organization for Standardization (ISO), as “a single standardisation approach (methodology, process, repository) to be used by all financial standards initiatives,” is a key development and challenge for the trade finance and credit insurance industry. ISO 20022 (MX), which comes into effect in November 2025, is the next generation of financial messaging standards, given its key characteristics of a common language with rich and structured data. The Swift MT format has been the standard for trade finance messages for the last four decades.

According to Trade Finance Global, (TFG), Swift (the world’s leading provider of secure financial messaging services) is “already in the process of migrating payment and cash management messages from the legacy MT format to MX. In November 2025, when the current MT and MX coexistence period is set to end, all Swift traffic for cross-border payments and reporting (CBPR+) will be on an ISO 20022 standard. As the payments and cash management industry is finding out in real time, there are benefits, challenges and costs associated with such a wholesale transition.

Another unexpected challenge is the consequences of the attacks on ships in the Red Sea and drought in the Panama Canal area that have more than quadrupled shipping prices moving goods since late 2023. Impacts could worsen should disruptions persist into the peak shipping season in the second half of 2024. Swiss Re Institute in its latest Insurance Insight, stressed that marine insurance contracts in affected areas are repricing higher or covers being adjusted, while some claims inflation is a further potential risk.

“For insurers, marine is one of the most impacted lines, as it selectively covers war and terrorism, though not delays. Covers have generally been held for travel through the Red Sea, but with case-by-case flexibility and significant increases in rates to account for the higher risk. Port congestion creates accumulation risks, while longer transit times mechanically raise insureds’ risk exposure, both factors that insurers may need to take into consideration. There are also risks to business interruption and related covers, including Credit & Surety. Exporters appear to be absorbing the delays and higher prices so far, but insured losses may rise if disruptions last longer or intensify. Stickier claims inflation is a risk if core goods inflation ticks up again.”

Increasing geopolitical risks may threaten trade through affected routes. More frequent droughts are likely to jeopardise transit volumes in the Panama Canal, and climate change is already affecting river shipping, as seen in the Rhine and Mississippi.