Harnessing the Next Phase of Digitalization Opportunities in Re-globalisation of World Trade and Investment

The post-Covid 19 acceleration in digitalization across economic and societal sectors presents not only a source of growth opportunities and new efficiencies, but also a spate of new risks for the insurance industry, especially the credit and investment insurance cohort. Oussama Kaissi, CEO of ICIEC, considers the state of digitalisation in trade, investment and insurance, new developments in closing the digital divide between developed and emerging economies, and the opportunities and pitfalls relating to over-reliance on digitalisation, as ICIEC member states seek to build on their trade and FDI potential, attractiveness and resilience.

The talk in the corridors of power at the World Trade Organisation (WTO) these days is that of re-globalisation instead of trade fragmentation. WTO’s 2023 World Trade Report (WTR) published in September stresses evidenced-based benefits of “broader, more inclusive economic integration as early indications of trade fragmentation threaten to unwind growth and development.” The findings, perhaps more importantly, highlight how re-globalization – or increased international cooperation and broader integration – can support security, inclusiveness, and environmental sustainability.

Trade, according to the WTO and industry organisations, has also become more digital, green and inclusive. The digital revolution has bolstered trade in digitally delivered services by sharply reducing the costs of trading these services. The value of global trade in environmental goods and services has increased rapidly, outpacing total goods trade, and global value chains (GVCs) have expanded to encompass more economies.

The UN Global Sustainable Development Report (GSDR) 2023 similarly identifies digitalization as one of the six dynamic conditions shaping the achievement of the 17 Sustainable Development Goals (SDGs) by 2030, to which ICIEC is committed to helping its 49 member states progress towards achieving the goals in their development agenda through its financing, credit enhancement and risk mitigation solutions. The other five conditions include climate change, biodiversity and nature loss, demographic change and inequality 7- all of which are also embedded in the policies and services offered by ICIEC. The Corporation, of course, is also a signatory to the Principles for Responsible Insurance.

As great as digitalisation is as a game-changing disruptor and a perceived force for socio-economic good given the latest ‘advancements’ in terms of Generative Artificial Intelligence (AI), Data Analytics, Blockchain, Internet-of-Things, Electronic Trade Documentation and so on, the reality of a digital divide between advanced economies and low-and-medium-income-countries (LMICs) is similarly evident.

Digitalisation as a Double-Edged Sword

But digitalisation like any other societal phenomenon can also be a double-edged sword. As such it needs careful and proactive harnessing, articulation, monitoring, regulation and enforcement, especially in the multi trillion-dollar finance, insurance, trade and investment universe. Inaction, delays and lack of adequate oversight could be costly and impact negatively on the global trade and investment ecosystem, which would give succour to disguised protectionism unfair trade and investment terms and conditions, which would exacerbate entrenched existing inequalities.

Digital value creation, says Swiss Re Institute (SRI), has led to an increase of insurance firms intangible assets, including digital data. At the same time, increased dependency on digital infrastructure makes such assets more vulnerable, for example, to business interruption and continuity, online fraud and scams, and malicious cyberattacks.

In a recent report titled “The economics of digitalisation in insurance”, SRI found that potential benefits across countries and throughout the insurance value chain are far from exhausted. Take, for instance Continental Africa, where some 27 IsDB member states are located, the 2023 WTR Projections based on the WTO Global Trade Model suggest that digitalization has the potential to increase African exports of services by over 7% per year or an aggregate US$74 billion from 2023 to 2040.

“Africa has been increasingly active in various joint initiatives undertaken by large groups of WTO Members,” explained WTO Deputy Director-General Angela Ellard in a recent speech. “Around 20 African members participate in our new investment facilitation for development agreement, designed to make developing countries more attractive for investment. Several African countries participate in discussions on e-commerce, and many are engaged in our e-commerce work program designed to bridge the digital divide and use digital trade as an engine for development. African countries are deeply engaged in discussions about how trade can contribute to economic sustainability. Today, 40% of funds under the WTO’s flagship Aid for Trade programme go to Africa.”

The challenges for insurers in general and credit and investment insurers in particular are clear and present. For ICIEC, uniquely the only Shariah-compliant multilateral insurer in the world, there are additional layers of compliance and operational risk metrics in play.

Digitalisation in Insurance

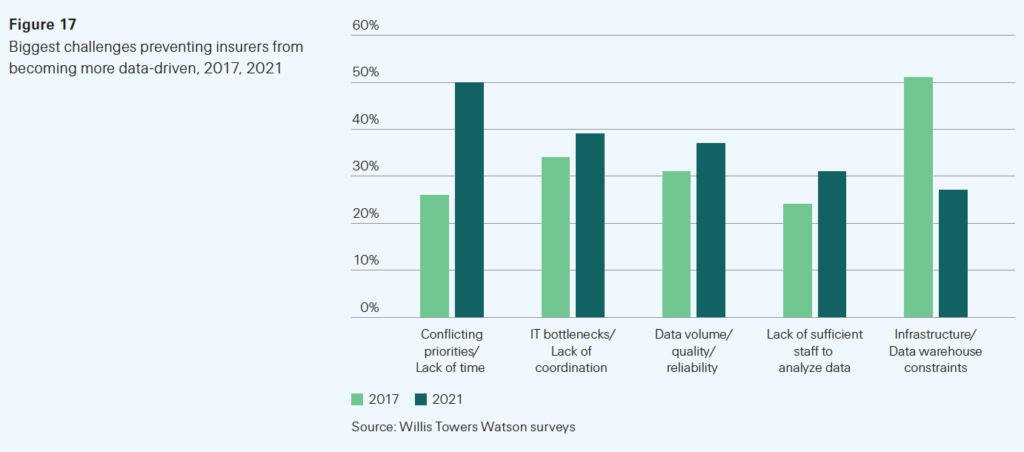

Swiss Re Institute (SRI), in “The economics of digitalisation in insurance” report, rightly stresses that digitalisation enables insurers to monitor, mitigate and price risks more efficiently, allowing for more tailored insurance solutions that can help close insurance protection gaps. Hence its call for “insurance innovation” and warning against any complacency and orthodoxy. In this respect, insurers are targeting a 3–8 percentage point improvement in loss ratios and savings of 10–20% in other parts of the value chain through digital transformation.

In the report, SRI, in fact, introduced the Insurance Digitalisation Index (IDI), which tracks the progress made in 29 sample countries with respect to the digitalisation of their insurance markets. South Korea came out on top of the index, followed by Sweden, Finland and the US. “While advanced markets with strong physical infrastructure and high internet access rates have made the most progress in digitalising their economies and insurance sectors, emerging markets should benefit from faster catch-up growth because they can jump straight into adopting newer digital technologies rather than transitioning from legacy systems,” stressed the report.

Another initiative aimed at bridging the gap between standards and adoption within the supply chain finance and insurance industry is the recent launch in Dubai by the International Chamber of Commerce (ICC) UAE Chapter of the ICC Digital Standards Initiative (DSI) as part of its expanded digital standards recommendations under its current Key Trade Documents and Data Elements (KTDDE) practice.

“The DSI’s continued efforts to expand the understanding of digital standards in international Trade,” explained Robert Beideman, Vice-Chair of the ICC DSI Industry Advisory Board, “represents a significant step forward in streamlining global commerce. By promoting data reusability and consistency across supply chains, we are facilitating more efficient and secure transactions for businesses across the globe.”

Despite the rapid digital transformation of the insurance industry, accelerated by recent advancements in cutting-edge technology, the consensus is that there are still significant potential and growth opportunities to make insurance more accessible and affordable for consumers, which behoves insurance providers and guarantors to continue investing in innovative solutions and adapting to emerging risks.

For consumers, says the SRI, online marketplaces lead to greater price transparency, present multiple insurance products and providers in a single place and allow customers to seamlessly complete the onboarding process online, making insurance more accessible and affordable. Aside from distribution, investments in insurance technology have shifted towards efficiency gains and improving underwriting and claims.

Resilience as a Function of Digitalisation

Indeed, Jerome Haegeli, Group Chief Economist at Swiss Re, maintains that there is a positive correlation between resilience and digitalisation. For society, he adds, digitalisation is a force for giving more people access to insurance and thereby closing protection gaps. For insurers, gains from better underwriting, risk mitigation and risk measurement from the digitalisation of insurance improve the quality and efficiency of their work.

The digitalisation of the wider economy, will also create new risk pools, opening up opportunities for insurers, especially in sharing-economy business models, which have resulted in fundamental shifts in operational risks and liabilities that require innovative insurance risk transfer solutions. With the shift from producing physical goods to providing information and services, the global value of intangible assets of listed companies has increased fivefold over the past 20 years, to US$76 trillion in 2021. Close to 80% of that value remains uninsured.

As such, insurers will need protection against digital risks, for example, business interruption and cyber risks, as well as the emerging liability risks related to AI. Cyber security, says Swiss Re, is a key concern for businesses globally, as reflected by the rapid growth in demand for cyber insurance. Swiss Re Institute estimates global cyber premiums will reach US$16 billion in 2023, up 60% from 2021 and US$25 billion by 2026.

Some key takeaways for insurers, according to the Swiss Re Institute, as they develop their digitalisation strategies going forward include:

- The impact of digitalisation is mis-measured which gives an underreporting of product structures, pricing, progress, challenges and market awareness and penetration.

- While workplace technology, in general, improves productivity by saving labour input, for example, through automation, the socio-economic costs can be huge. This raises the prospect of “technological unemployment”, which could put strains on existing unemployment insurance and worker’s compensation schemes.

- The correlation between the introduction of digital technology and disinflationary impact, although increasing digitalisation does not necessarily mean general deflation.

- Typically, countries that are more digital show greater resilience to health, mortality, natural catastrophes and agriculture, which affect LMICs disproportionately.

- The high value of intangible assets in business today are significantly uninsured: just an estimated 16.6% of intangibles are insured, compared with 58% of tangible assets. Digital transformation has given rise to new types of business models, most notably the sharing economy. Businesses will need more protection against the risk that intangible pose.

- Digitalisation has reshaped market dynamics, creating concentration risks. Dependencies on critical digital infrastructure create supply-chain risks. Many insurers themselves are exposed to digital infrastructure risks, although multilateral insurers such as ICIEC can mitigate these through reinsurance treaties and their special status with the ministries and agencies of member states.

- The first wave of digitalisation made the value chain more efficient. The next wave will better connect critical processes and improve digital connectivity across the processes, and thus increase operational efficiency, which potentially can reduce claims costs by 3-8%.

- Technology applications have enabled insurers to bring products significantly more quickly to market.

- Insurtechs, technological innovators in the processes of insurance business, are a good place to observe digitalisation trends in the industry’s value chain.

A Changing Global Landscape

The global trading landscape keeps evolving with advances in technology and science. The trade of tomorrow will be green and digital, and we need to make sure that our member states are able to transition smoothly to this new reality. ICIEC’s various policies, services and programmes offer an opportunity to build stronger partnerships for food security, digital connectivity, just transition to clean energy, and mainstreaming trade and investment.

Digital technology allows insurers to gather and process large sets of data using connected devices, data analytics and machine learning. This will allow more holistic and accurate risk assessments and better pricing of risks. Digital solutions can also automate standardised tasks, such as data collection and analysis for underwriting, driving down costs and ultimately leading to lower premiums. An important component of this transition includes capacity building of member states, their agencies, financial and insurance institutions and market players on the pivotal role of information sharing, business intelligence, digitalization and automation in supporting trade and investment decisions.

This initiative comes under the widely acknowledged capacity-building programme for users of the OIC Business Intelligence Centre (OBIC), whose thrusts are i) How digitalization and business intelligence can support trade and investment and the transformative potential of digitalization for economic growth and investment promotion utilizing digital transformation roadmaps for SMEs, and the digitalization of investment promotion services , ii) The importance of reliable credit information, reporting and sharing, and of digital IDs in fostering financial inclusion and trade promotion , and iii) The value of efficient utilization of statistical sources of information on credit, trade, and investment.

Addressing the Digital Divide

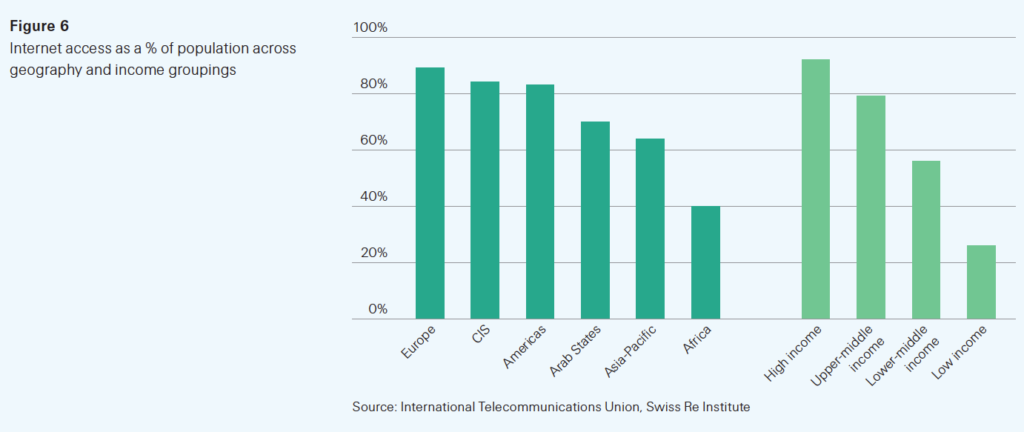

While the pandemic did give rise to an unprecedented acceleration in the digitalization of goods and services, including in the use of mobile telephony in e-commerce and payments where Africa is leading the world, all stakeholders, especially governments, multilaterals, banks, insurers, trade bodies, and digital and technology enablers and facilitators must never lose sight of the reality on the ground where, according to the International Telecommunication Union (ITU), although 66% of the global population or 5.3 billion people used the Internet in 2022, up from 54% in 2019, some 2.7 billion people globally have yet to access the Internet, including SMEs and the self-employed – often the backbone of LMICs economies.

“They are missing out on vital services provided digitally. Adequate and resilient infrastructure is a prerequisite for all the SDGs, and even before the pandemic, infrastructure was far from adequate. Some 1 billion people live more than a mile from a road, and 450 million live beyond the range of a broadband signal. With fiscal tightening and the end of low borrowing costs, infrastructure updates and investments are likely to be below what is needed. The war in Ukraine and the subdued economic growth in China is expected to continue to dampen the slow investment recovery following the pandemic,” emphasised the UN GSDR study.

As such, one way in which emerging markets can begin to close their digital divide with advanced markets at a structural level are through investments in internet accessibility. And here, the role of all stakeholders, including insurers, is not only in their immediate area of business, such as underwriting and providing guarantees as in the case of entities such as ICIEC, but also in supporting the harnessing of the wider digitalisation ecosystem, which primarily includes accessibility and infrastructure investment.

The good news is that digital transformation remains high on the insurance industry agenda. The initial focus was on distribution, seemingly to good effect. Insurers are experimenting with digitalisation across the value chain for efficiency gains. Today, 31 of the 50 largest re/insurers invest in Insurtech in pursuit of a first-mover advantage!