In 2025, we find ourselves at the cusp of “once-in-a-century” event –tariff and trade war precipitated by the world’s largest economy, the US, which is leading the global economy into a recession in which there will be no winners. Geopolitical volatility and heightened uncertainty have played havoc with current forecasts and projections from gatekeeper institutions. Dr. Khalid Khalafalla, CEO of ICIEC, ponders a global economic playbook during these times of tariff, trade and tax disruptions against a prevailing background of subdued GDP growth and FDI flows, higher inflation, and the opportunities and challenges for ICIEC with its unique offering of Shariah-compliant trade and investment Insurance.

By any standard, the year 2025 is turning out to be extremely challenging for the global economy – and we are only in its First Quarter. What has been unfolding thus far is a landscape of arbitrary disruptions by the Trump administration in the US through the unilateral imposition of punitive tariffs and taxes, and rewriting trade rules. These actions have bypassed international gatekeeper organisations such as the World Trade Organisation (WTO) and UN Trade and Development (UNCTAD), rather than utilising them as proper platforms for coordinated negotiations and dialogue on necessary reforms. In the process, it seems that the language of negotiations and diplomacy have been replaced by the confrontational rhetoric – a shift that threatens the foundations of the post-World War II global economic order, which, while imperfect, has been rooted in free trade and multilateral rules. Given the United Nations’ position as the world’s largest economy, the consequences of these developments are global in scope.

Perhaps the biggest disruption due to the above developments is that of predicting and planning for the future. Given that the second term Trump presidency will shape the next four years, economic, monetary, fiscal, corporate, financial, development and social indicators and performance will be difficult to predict. For any government. organisation, corporate and multilateral institution such unpredictability is anathema – making efforts at futureproofing even more challenging. The measures adopted under the Trump administration disproportionately affect emerging and low-and-medium-income-countries (LMICs), which constitute most of the member states of ICIEC. These countries are among the most in need of preferential tariff and trade arrangements such as the U.S. flagship African Growth and Opportunity Act (AGOA) Programme, which is set to expire on September 30, 2025, and gives some 30 Sub Saharan African (SSA) member states tariff-free access to the U.S. markets on over 6,800 products. According to U.S. data, two-way trade under AGOA in 2023, totalled USD47.5bn, with the U.S. exporting USD18.2bn worth of goods and imports amounting to USD29.3bn. It is almost certain that AGOA will be abolished if not severely curtailed which would affect the export potential of several SSA member states of ICIEC.

These are not normal times. Multilateral insurers as risk absorbers and mitigators such as ICIEC may be forced into rethinking its strategies, which would inevitably require more resources and perhaps a revised risk management approach. Above all it is important for insurers not to overthink the implications nor to over-estimate the risks, but to adopt a measured yet compassionate and collaborative approach in helping their clients over the next few years.

Shifting Policy Priorities

Against such an uncertain backdrop – and subject to future revisionsthe IMF’s World Economic Outlook Update of mid-January 2025 projects a subdued Global GDP growth of 3.3% for both 2025 and 2026. The U.S. GDP growth is projected to decline to 2.7% in 2025 and to 2.1% in 2026. Perhaps GDP can be a very deceptive measure of the state and performance of an economy. At best it should be used in conjunction with other socio-economic indicators including income disparities and a spate of other inequality gaps, access to and cost of finance, and sovereign indebtedness. Each economy has its own compelling or distressing GDP story to tell. According to IMF’s Outlook, Sub-Saharan Africa is projected to be the second-fastest growing region, with an average growth rate of 4.2% over the next two years, led by Nigeria which is expected to grow at 3.2% in 2025 and 3.0% in 2026), following Emerging and Developing Asia, which is projected to grow at 5.1%.

These high growth rates which include India and China, the highest growing economies at a projected 6.5% and 4.6% for 2025, feign to flatter. They have structural shortcomings such as high population densities, massive unemployment, a mix of first and third world infrastructure. Saudi Arabia’s GDP is projected at 3.3% and 4.1% over the next two years. In contrast the Advanced Economies will have to contend with projected GDP rates of 1.9% and 1.8% in the same period, well below the 3.5% growth rates needed for sustaining a ‘normal’ economy.

World Economic Outlook Growth Projections

Source: IMF, World Economic Outlook Update, January 2025

Note: For India, data and forecasts are presented on a fiscal year basis, with FY 2024/25 (starting in April 2024) shown in the 2024 column. India’s growth projections are 6.8 percent for 2025 and 6.5 percent for 2026 based on calendar year.

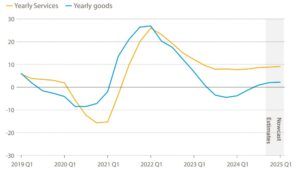

Global trade growth levels off in 4th quarter of 2024

Annual growth in the value of trade in goods and services, 2019 Q1 – 2025 Q1

Note: The annual growth is calculated using a trade-weighted moving average over the past four quarters. Figures for Q4 2024 are estimates. Q1 2025 is a nowcast as of 5 March 2025.

The response of the global credit and investment insurance industry is interesting and perhaps predictable. Leading from the front is the Berne Union (BU), the international industry body for government backed official export credit agencies, multilateral financial institutions (including ICIEC), and private credit insurers, whose members provide around USD2.5 trillion of trade credit and political risk protection to banks, exporters and investors – equivalent to 13% of world cross-border trade for goods and services (calculated with respect to WTO statistics).

The BU’s Export Credit Business Confidence Trends Index (BCI) for First Half 2025, published in March which tracks perceived demand and claims in the export credit insurance industry based on half year surveys of BU members, is implicit. Members agree that opportunities are abound in supporting exporters amid a new wave of trade protectionism, although they may disagree on the basis for their optimism.

The key takeaways include:

A. Strong confidence exists in rising demand for short-term export credit insurance – driven by global trade growth, projected to grow at its fastest pace since 2021. Sentiment toward longer-tenor coverage remains stable, aligning with its historical average.

B. Members largely agree that business growth opportunities in their short-term portfolio lie in exporters seeking to mitigate risks from the latest wave of trade tariffs – however, a hardening pricing environment continues to challenge smaller providers.

C. New demand for longer-tenor coverage is supported by defence transactions, especially in Europe, and growing demand for infrastructure projects in developing economies, with multilaterals continuing to crowd-in private insurers.

D. The outlook for claims under short-term policies remains negative, as the expected normalisation to pre-pandemic levels proves slower than expected.

E. Geopolitical risk remains a primary concern for potential shortterm claims, now compounded by uncertainty over tariffs. Buyers in Germany raise alarm due to a weakening economy, alongside the European automotive sector, grappling with weak EV demand, Chinese competition, and factory closures.

F. Claims expectations under longer-tenor coverage show little change, sovereign debt risk remains a persistent concern for emerging claims, particularly in Western Africa, as a strong dollar pressures external financing costs.

Berne Union Export Credit Business Confidence Trends Index (BCI) Demand and Claims 1H 2025

Short Term commercial and political risk insurance sentiments include:

i. For public providers, robust domestic export growth stands out as a key opportunity for business expansion.

ii. Private insurers highlighted demand from banks as a key driver of future growth, although tempered by a slowdown in new corporate business.

iii. Many providers – both public and private – cited challenges related to a competitive pricing environment, which they feel is pricing them out of new opportunities.

iv. Respondents displayed less consensus in their outlook for claims over the next six months.

v. The primary concern for most survey participants remains elevated geopolitical risk, now compounded by global trade tariffs that could lead to more payment delays—particularly for U.S. buyers facing the added burden of tariff costs, with private insurers exhibiting a deeper negative sentiment.

Similarly medium and long-term commercial and political risk sentiments include:

- Optimism persists overall for demand for longer-tenor cover, particularly among public providers. Current demand is driven by a surge in defence transactions, especially in Europe, as countries ramp up defence spending, alongside infrastructure projects in developing nations.

- Partnerships with multilaterals and development finance institutions (DFIs) continue to be a strong source of business for private insurers.

- Little movement is anticipated in claims paid out for longer-tenor cover.

- Both public and private providers expressed shared concerns about energy transition projects such as offshore wind and green technology—citing overcapacity and slower-than-expected adoption as key risks.

- Concerns persist regarding many sovereign borrowers, particularly in West Africa.

The International Credit Insurance & Surety Association (ICISA), which represents trade credit insurers, sureties, and their reinsurers and whose members accounted for over EUR3 trillion in insured exposure related to trade receivables, and billions more in surety bonds in areas such as construction, energy production, judicial processes, and other key economic activities, similarly is leading on various issues related to Trade Credit Insurance (TCI). In March 2025, it published a White Paper titled ‘Supporting the economic powerhouse – How Trade Credit Insurance supports SMEs, and how to build on this for growth and prosperity.

SMEs are the backbone of economies, and their success directly contributes to economic success and the overall wellbeing of society. Governments today are actively developing policy to support SMEs as a way of boosting productivity, innovation, jobs and growth. ICISA highlights the key role TCI plays in covering against the risk of nonpayment of trade receivables in support of these businesses, and offers recommendations to policymakers, regulators, insurers, and to SMEs themselves to benefit further from its protection. ICIEC also has a suite of similar and other risk mitigation products and solutions including the Documentary Credit Insurance Policy (DCIP), the Bank Master Policy (BMP), the Specific Transaction Policy (STP), and the Comprehensive Short-Term Policy (CSTP) available to serve TCI and SMEs.

Industry-wide, the key challenge in 2025 is to prevent global fragmentation, where nations form isolated trade blocs, while managing policy shifts without undermining long-term growth and embracing innovation through renovation and infusing a sense of urgency of action on debt restructuring or relief, climate finance including Green and blended finance and policy tools. Our international financial architecture needs to adapt to these rising challenges.![]()

![]()

nor to over-estimate the risks, but to adopt a measured yet

compassionate and collaborative approach in helping

their clients over the next few years.