Sometimes the devil is not in the detail but lurking in the divergent metrics of the global gatekeeper organisations supposed to stabilise them. When it comes to global trade metrics – finance, digitisation, insurance, and partnerships – it is no exception. Perhaps the ‘Steady but Slow: Resilience amid Divergence’ banner of the IMF’s World Economic Outlook (WEO) unveiled at the Spring 2024 Annual Meetings in Washington DC in April was no coincidence.

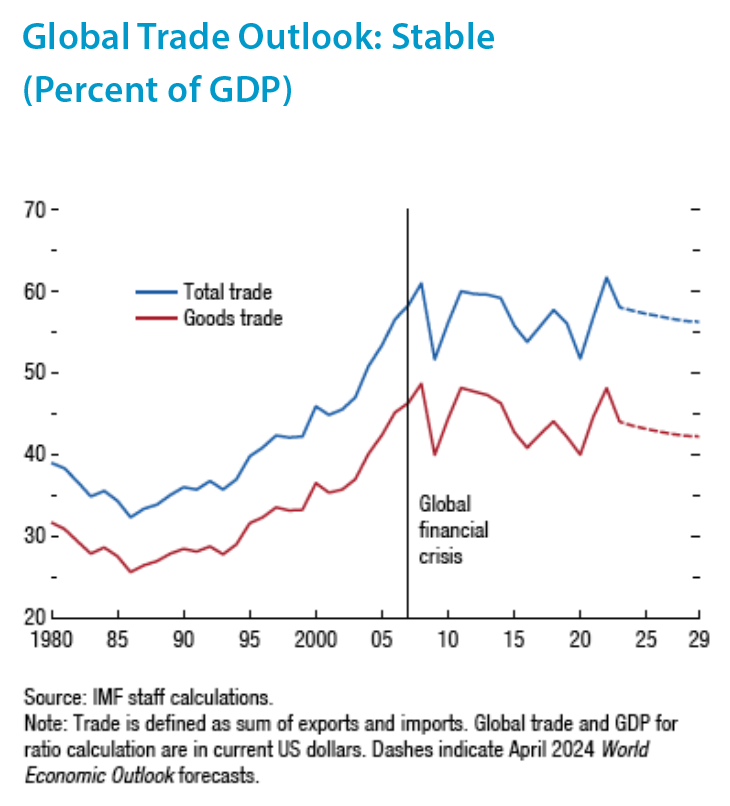

The Fund projects world trade growth at 3.0% in 2024 and 3.3% in 2025, with revisions of a 0.3 percentage point decrease for 2024 and 2025 compared with its January 2024 projections. Trade growth is expected to remain below its historical (2000–19) annual average growth rate of 4.9% over the medium term, at 3.2% in 2026. This projection implies, in the context of the relatively low outlook for economic growth, a ratio of total world trade to GDP (in current dollars) that averages 57% over the next five years, broadly in line with the evolution in trade since the global financial crisis in 2008.

However, warns the IMF, even as world trade-to-GDP ratios remain relatively stable, significant shifts in trade patterns are taking place, with increasing fractures along geopolitical lines, especially since the start of the war in Ukraine in February 2022, leading to greater trade protectionism even among allied blocs in an increasingly fragmented global economic ecosystem. Indeed, says the IMF, growth in trade flows between geopolitical blocs has declined significantly since then compared with growth of trade within blocks. “This reallocation of trade flows is occurring in the context of rising cross-border trade restrictions, with about 3,200 new restrictions on trade in 2022 and about 3,000 in 2023, up from about 1,100 in 2019, according to Global Trade Alert data, and increased concerns about supply chain resilience and national security,” added the IMF.

In contrast, according to the World Trade Organisation (WTO), the volume of world merchandise trade should increase by 2.6% in 2024 and 3.3% in 2025 after falling by 1.2% in 2023. Similarly, regional conflicts, geopolitical tensions, and economic policy uncertainty pose substantial downside risks to the forecast. The expectation is that inflationary pressures in many countries will abate in 2024 leading to a recovery in demand especially in the developed economies. There is the issue of fiscal, and policy drag, which can take years to work through – hence the feeling of an ongoing cost-of-living crisis despite the claims of remedial actions.

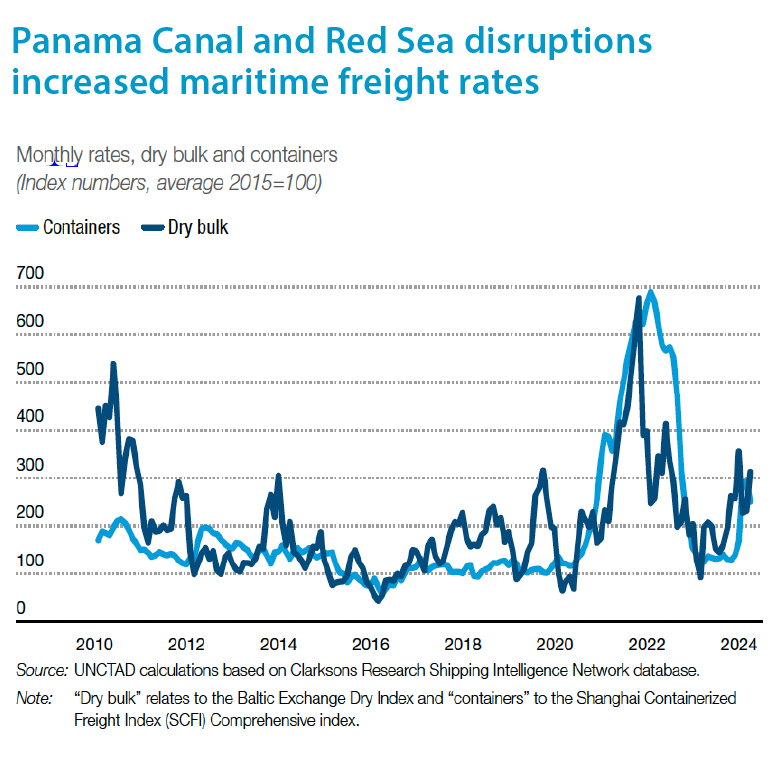

In contrast still, the UN Trade and Development’s (UNCTAD) latest Trade and Development Report Update in April 2024, reiterates that the contraction of international merchandise trade in a context of global economic expansion in 2023 is unprecedented in recent times. But since then, “two further negative shocks have hit maritime routes, the backbone of international merchandise trade. Both relate to shipping disruptions in key arteries of maritime transport: the Panama Canal and the Red Sea. The first one affected by a prolonged drought which forced the reduction in crossings, and the second one affected by attacks on shipping in the wake of the war in Gaza which compelled major ocean carriers to suspend Suez transits and to reroute through the Cape of Good Hope, adding between 12 and 20 days of transport and therefore freight costs and rising consumer prices.

The growth of merchandise trade, overall, is expected to remain subdued in 2024, albeit prospects for trade in services in 2024 look brighter even if a slowdown in some of its components cannot be ruled out. Trade like any other sector is beholden to a range of interlinked risks and uncertainties – sovereign debt levels, higher global interest rates, inflation management, calls for protectionism, continuing trade tensions and rising political uncertainty. This suggests meagre improvement in 2024 for trade in goods and services.

Total goods and services trade was only down 2%. An encouraging development for services was the global exports of digitally delivered services, which reached USD4.25 trillion in 2023, up 9% year-on-year, accounting for 13.8% of world exports of goods and services.

The value of these services — meaning services delivered digitally across borders through computer networks and encompassing everything from professional services to streaming of music and videos and including remote education — surpassed pre-pandemic levels by over 50% in 2023.

GDP Growth and Trade – a Volatile Relationship

The relationship between trade and GDP growth (output) is well established, although it can be tempestuous, volatile, unpredictable, and even stable depending on the prevailing and looming national, regional, and global macroeconomic indicators and trends.

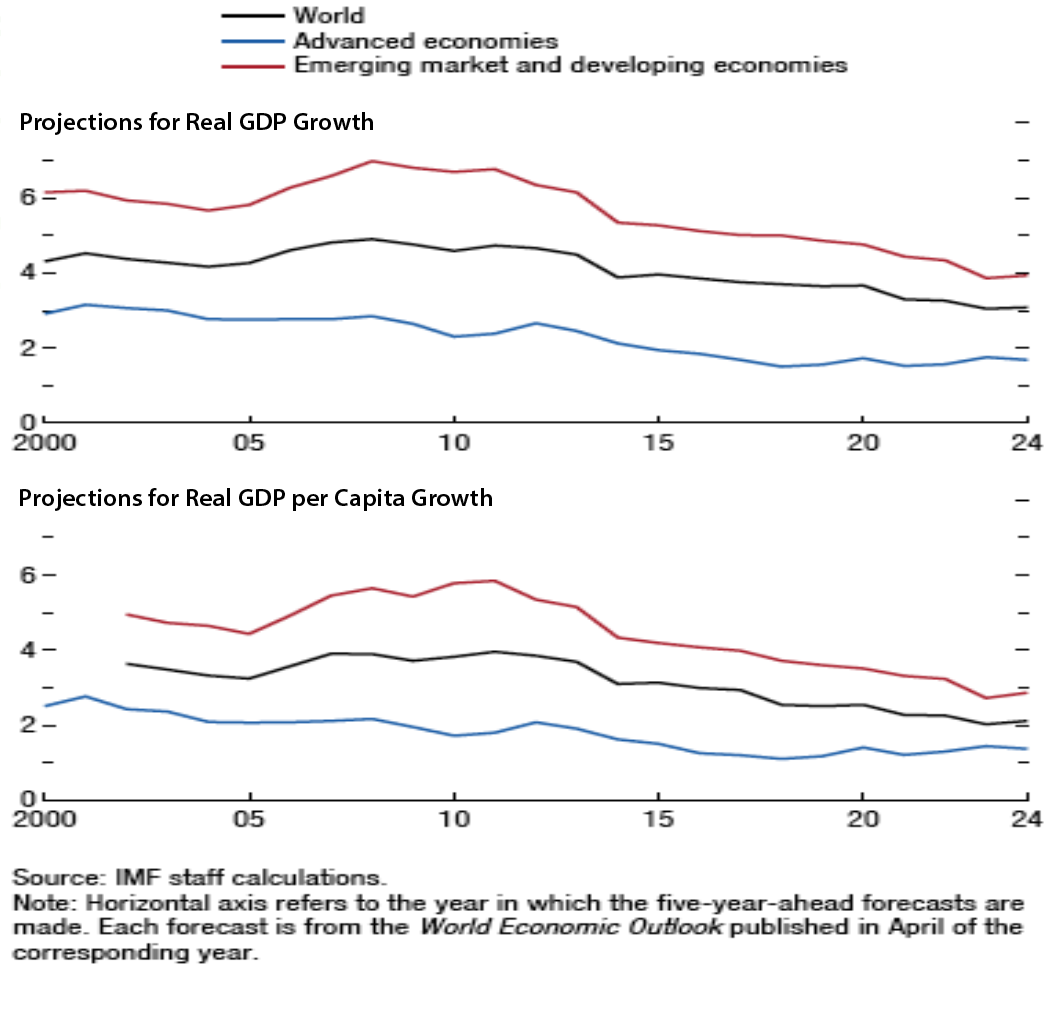

UNCTAD expects a further growth deceleration in global GDP growth in 2024 to 2.6%, slightly slower than in 2023. This makes 2024 the third consecutive year in which the global economy will grow at a slower pace than before the pandemic, when the average rate for 2015–2019 was 3.2%.

The UN body remains very critical of the obsession of the G7 countries with containing inflation. “Policy discussions continue to centre on inflation, conveying confidence that anticipated monetary easing will heal the world’s economic woes. Meanwhile, the pressing challenges of trade disruptions, climate change, low growth, underinvestment, and inequalities are growing more serious,” it lamented in its April Trade and Development Report Update.

It remains concerned that growth was largely driven by private consumption funded largely by debt in both private and public sectors. This, says UNCTAD, has led to a mismatch “between seeking financial market stability and attaining other macroeconomic goals.” Prioritizing the stability of the financial markets tends to have a negative impact on funding for the public sector, as government deficits are frequently chastised by bond markets and international financial institutions. Fast value creation by the financial markets benefits the holders of financial assets while crowding out fixed investment. Not surprisingly, observes UNCTAD, private investment globally in 2023 performed dismally and a worse one is projected for 2024.

In contrast, the IMF’s April 2024 WEO estimates global growth at 3.2% in 2023, which is projected to continue at the same pace in 2024 and 2025. The forecast for 2024 is revised up by 0.1 percentage point from the January 2024 WEO Update. “The pace of expansion,” notes the Fund, “is low by historical standards, owing to both near-term factors, such as still-high borrowing costs and withdrawal of fiscal support, and longer-term effects from the COVID-19 pandemic and Russia’s invasion of Ukraine, weak growth in productivity, and increasing geo-economic fragmentation.

At the same time, the WTO in its April “Global Trade Outlook and Statistics” report estimates global GDP growth at market exchange rates will remain mostly stable over the next two years at 2.6% in 2024 and 2.7% in 2025, after slowing to 2.7% in 2023 from 3.1% in 2022. The contrast between the steady growth of real GDP and the slowdown in real merchandise trade volume is linked to inflationary pressures, which had a downward effect on consumption of trade-intensive goods, particularly in Europe and North America.

Forecasts for Global GDP and GDP per Capita (Percent; five-year-ahead projections)

Regional Trade Outlook

If current projections hold, Africa’s exports will grow faster than those of any other region in 2024, up 5.3% according to WTO. But this, however, is from a low base since the continent’s exports remained depressed after the COVID-19 pandemic. North America (3.6%), the Middle East (3.5%), and Asia (3.4%) should all see moderate export growth. European exports are once again expected to lag those of other regions, with growth of just 1.7%.

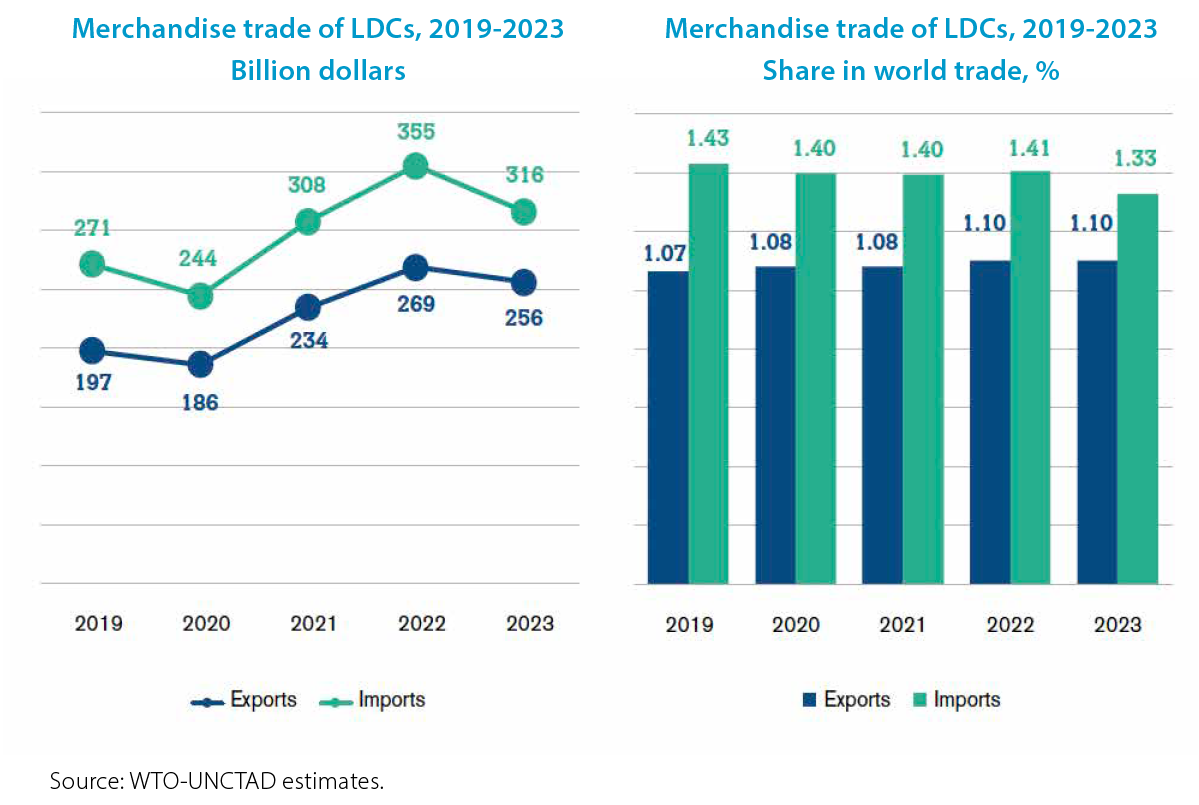

Strong import volume growth of 5.6% in Asia and 4.4% in Africa should help prop up global demand for traded goods in 2024. However, all other regions are expected to see below-average import growth, including the Middle East (1.2%), North America (1.0%), and Europe (0.1%). Merchandise exports of least-developed countries (LDCs) are projected to grow 2.7% in 2024, down from 4.1% in 2023, before growth accelerates to 4.2% in 2025. Meanwhile, imports by LDCs should grow 6.0% this year and 6.8% next year following a 3.5% contraction in 2023.

That Africa accounted for only 14% of intra-African merchandise trade in 2022 (down from 16% in 2018) – the lowest of the global regions – underlines the huge gap and challenge faced in realizing the African Union’s Agenda 2063 vision of economic integration and inclusive socio-economic development on time, and the trade-led development ambitions of the African Continental Free Trade Area (AfCFTA), which aims to bring together 55 African states and create an integrated market of 1.3 billion people, with a combined GDP of USD3 trillion.

Intra-OIC Trade and Challenges

One of the core mandates of COMCEC, the Organisation for Islamic Cooperation (OIC), and the Islamic Development Bank (IsDB) Group specifically requires all three institutions to promote intra-OIC trade and foreign direct investment (FDI) flows in their Member States. In fact, COMCEC has set a target of reaching 25% of intra-OIC trade by 2025.

The IsDB marks its 50th Anniversary and ICIEC its 30th Anniversary in 2024. The fact that intra-OIC trade and investment have not even hit 25% of their total exports and imports and FDI flows suggests what an uphill struggle it remains for Member States to upscale their bilateral and multilateral trade and investment flows.

The reasons are manifold. There is a fundamental mismatch and dissonance between the OIC economies, ranging from the wealthiest nations in terms of GDP per capita to some of the poorest nations on earth, especially in Sub-Saharan Africa and South Asia.

The huge economic disparities between the various segments of OIC cohorts exacerbate a multitude of challenges, of which intra-OIC trade and investment is high on the agenda.

Merchandise trade of LDCs, 2019-2023 Billion USD and % shares

ICIEC serves its mandate by providing risk mitigation and credit enhancement solutions to Member States’ exporters selling to buyers across the world, and to investors from across the world investing in Member States. ICIEC also supports international exporters selling to Member States if the transactions are for capital goods or strategic commodities. In this context, ICIEC’s intervention through the provision of export credit and political risk insurance is more crucial than ever to support Member States in securing strategic commodities and fostering cross-border trade and investments.

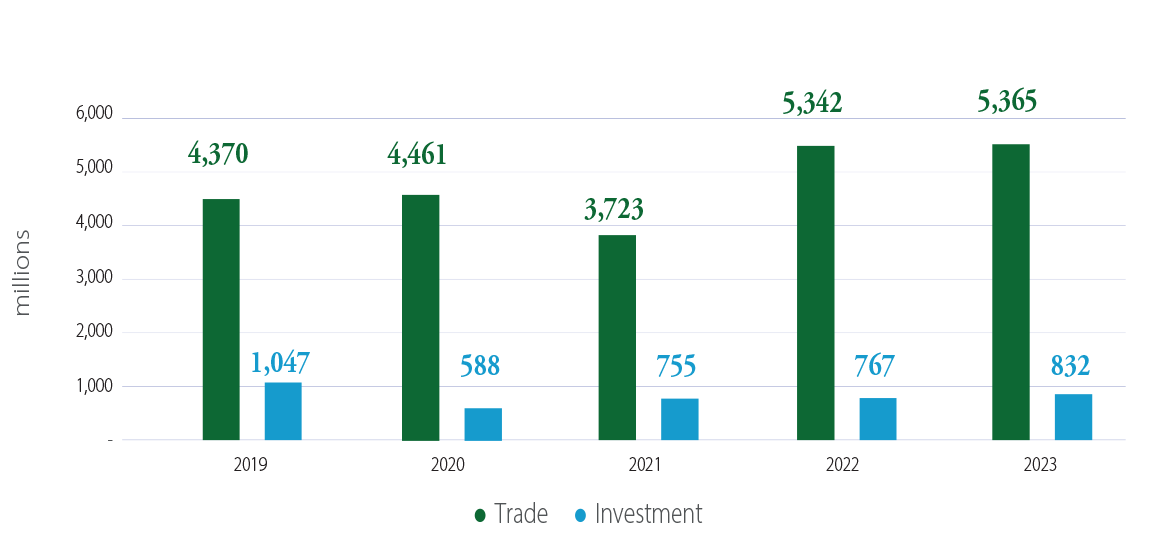

Intra-Trade and Intra-Investment Facilitated for OIC Member States During 2019 to 2023 (USD million)

According to the ICIEC 2023 Annual Report, intra-OIC trade increased from USD 4,370 million in 2019 to USD 4,461 million in 2020, reaching USD 5,365 million in 2023. Similarly, intra-OIC investments increased from USD 1,047 million in 2019 to USD 832 million in 2023.

Given that the intra-OIC trade and investment base is very low, the pathway to increased intra-OIC trade and investment flows assumes even greater challenges. The IsDB Group, including ICIEC with its risk mitigation and credit enhancement tools, can only contribute measuredly to boosting OIC trade and investment, as the Group must contend with competing priorities and demands on their finite resources.

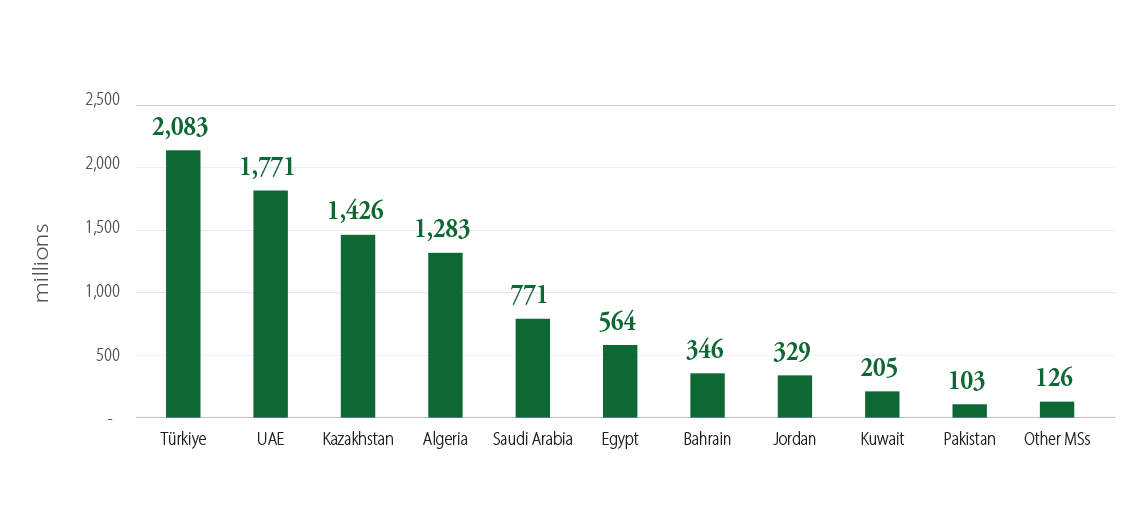

Major Member States by Export Business Facilitated in 2023 (USD million)

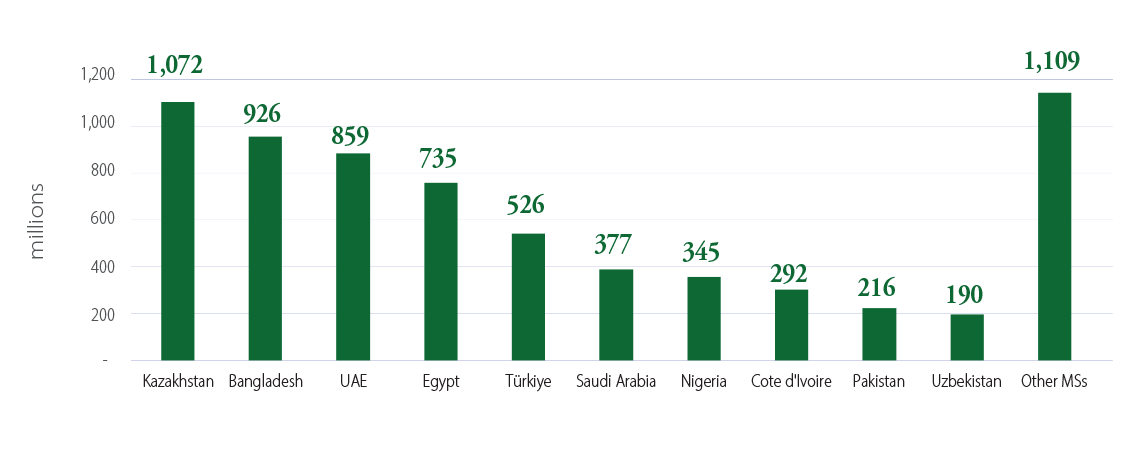

Major Member States by Import Business Facilitated in 2023 (USD million)

Governments, corporates, banks, and credit insurers can do much more to give intra-OIC trade and investment traction and a boost. They should ensure that their regulations, seamless strategies, and trade and investment incentive packages are in place, going beyond traditional bilateral and multilateral MoUs and cooperation agreements.

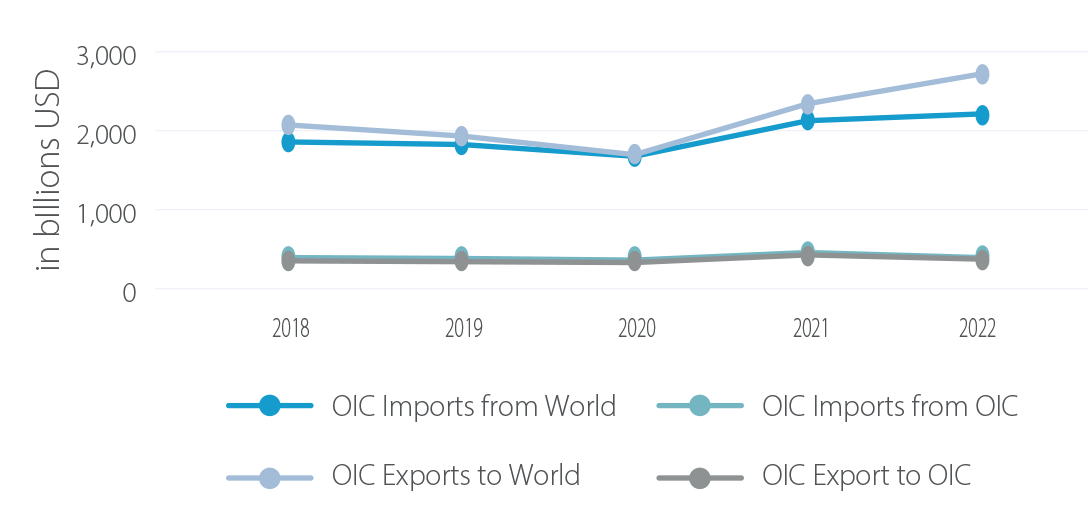

OIC Trade Snapshot

The usual caveats are the low sovereign credit rating, poor or nonexistent regulatory frameworks, the lack of facilitating institutions and qualified human capital, a lack of credit insurance market awareness and education, in conjunction with increased geopolitical risks including conflict, climate change, governance issues and natural disasters. The question remains how to mitigate this huge disequilibrium in OIC economies, their natural resource and commodities strengths and weaknesses, and a spate of associated metrics.

ICIEC’s involvement in intra-OIC trade and investment is commendable – facilitating USD51billion in intra-OIC trade and investment since inception. But the latest data for FY2023 shows that there is much room for improvement despite the various barriers to boost such facilitation. Most of the export business facilitated in 2023 came from six countries – Türkiye, UAE, Kazakhstan, Algeria, Saudi Arabia, and Egypt, with Türkiye alone accounting for USD2,083 million.

Intra-OIC trade and investment have the potential to be a gamechanging facilitator to lead the OIC economies into recovery from the impacts of the pandemic era, the subdued global economic recovery, and the vagaries of geopolitical tensions and their impacts on commodities price volatility, sovereign indebtedness, a global cost-of-living crisis and a break on reaching the UN SDG and Paris Net Zero targets – all of which affect developing countries including the IsDB ones disproportionately.

According to the ICIEC 2023 Annual Report, a deeper dive into intra OIC trade dynamics reveals an intriguing paradox. While 2021 marked a zenith for intra-OIC imports at 436.0 billion, a subsequent contraction to 365.4 billion in 2022 raises pertinent questions about the internal trade synergies and potential barriers within the OIC ecosystem. Similarly, the export narrative mirrors this trend, with intra-OIC exports peaking in 2021 but retracting in 2022. The retraction, however, is almost certainly due to the pandemic, the Ukraine conflict supply chain impacts, and the slow global economic recovery.

Outlook and Drivers

WTO Director-General Ngozi Okonjo-Iweala maintains that “we are making progress towards global trade recovery, thanks to resilient supply chains and a solid multilateral trading framework — which are vital for improving livelihoods and welfare. It’s imperative that we mitigate risks like geopolitical strife and trade fragmentation to maintain economic growth and stability.” Already some governments have become more skeptical about the benefits of trade and have taken steps aimed at reshoring production and shifting trade towards friendly nations.

However, her Chief Economist Ralph Ossa warns that “while the trade environment is clearly challenging, we should not paint too dark a picture of international trade. The volume of world merchandise trade was essentially flat throughout 2023, and the 1.2% decline in 2023 is relative to 2022. In fact, it was up 6.3% compared to the pre-pandemic peak in the third quarter of 2019, and up 19.1% compared to 2015. These figures emphasize the resilience of international trade.”

The global trade outlook for 2024 nevertheless remains subject to significant uncertainties. Persistent geopolitical tensions, rising shipping costs, and high levels of debt weighing on economic activity in many countries may still exert negative influences on global trade.

According to UNCTAD’s Global Trade Update in March 2024, some of the most relevant factors influencing global trade in 2024 and beyond include:

• Positive economic growth, but with significant disparities. Global forecasts for GDP growth remain at around 3% for 2024, but these still fall below historical averages. Furthermore, substantial disparities persist among countries and regions in terms of their anticipated economic outlook for the upcoming year. Such disparities will influence patterns of trade.

• Strong demand for both container shipping and raw materials.

During the last few months, there has been increasing demand for container shipping, as reflected by the strong increase in the Shanghai Containerized Freight Rate Index and the Baltic Dry Index on the back of a rise in global demand for raw materials.

• Commodity prices volatility. Ongoing geopolitical tensions and regional conflicts could renew volatility in energy and agricultural markets. Additionally, the increasing importance of secure access to critical minerals for the energy transition is expected to affect prices and further contribute to market volatility in these commodities.

• Lengthening of supply chains. Global trade is being influenced by the response of supply chains to shifts in trade policy and geopolitical tensions.

• Increase in subsidies and trade restrictive measures. The prioritization of domestic concerns and the urgency of meeting climate commitments are driving changes in industrial and trade policies. Trade restrictive measures and inward-looking industrial policies are anticipated to negatively impact on the growth of international trade.

• Shipping routes disruptions. Geopolitical tensions are also causing disruptions in shipping routes, particularly those related to the Red Sea and Suez Canal. Moreover, efforts to maintain water levels in reservoirs supplying the Panama Canal are anticipated to continue reducing passages in 2024. These events are driving up shipping costs,

extending voyage durations, and disrupting supply chains.