Global Trade and Digitalisation Prospects – Growth but Slower Growth

Global trade has supposedly been a force for economic recovery, resilience and near normalisation in the wake of a receding COVID-19 pandemic. But in 2022, says the latest World Trade Statistical Review (WTSR) 2023 of the World Trade Organisation (WTO), global trade has lost momentum, largely due to the supply chain disruptions due to the conflict in Ukraine and global economic shocks, including high inflation, the inevitable monetary tightening, and widespread debt distress. But can digitalisation and technology kick start trade and FDI flows recovery to pre-pandemic and its associated economic stability levels in a world of increasing and polymorphous uncertainties? Mushtak Parker explores the latest developments and prospects for digitalized global trade, especially in ICIEC member states.

There is no doubt that the prospects for global trade and investment over the short-to-medium term at best, are mixed, ranging from subdued to weak growth given the numerous downside risks exacerbated by the on-going conflict in Ukraine and, in recent weeks, the conflagration in the Middle East.

“Prior to the COVID-19 pandemic,” says WTO Director-General Ngozi Okonjo-Iweala, “we were accustomed to strong growth in global trade, which typically exceeded the rate of GDP growth. Even at the height of the pandemic, trade remained relatively resilient, and we saw a powerful rebound in 2021 as the global economy reopened and economic activity picked up. Since 2022, we have been following a different trajectory, with slower trade growth due to the disruption to supply chains in, for example, the energy and agricultural sectors as a result of the Russia-Ukraine war, and due to broader geopolitical tensions elevated global inflation and high interest rates, among other causes.”

Despite these shifts, she adds, the role of trade, as well as trade and supply chain finance products, is more important than ever. As the geopolitical and economic environment becomes more challenging, access to liquidity and risk mitigation is increasingly valued. In addition, the desire – and need – to digitise has accelerated innovation in the trade and supply chain finance space. Her optimism that “global trade growth has remained positive,” on the back of a slow-down in its underlying growth trajectory, is tempered by the stark reality that trade growth remains weak in the near term into 2023 due “to numerous downside risks, from geopolitical tensions to potential financial instability, which are clouding the medium-term outlook for both trade and overall output.”

Data dichotomy and overload lends itself to a morass of interpretations enough to suit almost any narrative in this highly complex global trade matrix. Take, for instance, the ‘volume versus value’ metric across a spectrum of cohorts – merchandise trade, intermediate trade, trade in goods and services, trade in manufacturing goods and so on. In volume terms, world merchandise trade rose by 2.7% in 2022, which is well below the 12.4% growth in value terms. This was largely reflected by the effect of high global commodity prices, which continues to affect consumers all over the world, but disproportionately in developing countries, as a cost-of-living crisis continues to bite because of stubborn food and energy price inflation. Trade in goods and services amounted to US$31 trillion in 2022, a 13% rise year-on-year. While trade in goods exceeded pre-pandemic levels already in 2021, trade in services caught up in 2022.

Any complacency over a receding pandemic and its impact on global trade too could be misplaced. The latest World Health Organisation (WHO) update on COVID-19 on 3rd August reported over one million new cases and over 3,100 deaths globally in the month of July 2023. The pandemic, at the end of July 2023, has seen over 768 million confirmed cases and over 6.9 million deaths globally. “Currently, reported cases do not accurately represent infection rates due to the reduction in testing and reporting globally. During this 28-day period, 46% (107 of 234) of countries and territories reported at least one case to WHO – a proportion that has been declining since mid-2022,” said WHO.

For a multilateral insurer such as ICIEC, global trade should also be considered in the context of food security, nutrition and global hunger – helping to alleviate it in member states, some of which are the poorest on earth, being a core mandate. The latest State of Food Security and Nutrition in the World (SOFI) report, published jointly in mid-July by five UN specialized agencies, reveals that 735 million people are currently facing hunger, compared to 613 million in 2019. This represents an increase of 122 million people compared to 2019, before the pandemic.

“If trends remain as they are, the UN Sustainable Development Goal 2 of ending hunger by 2030 will not be reached. Indeed, it is projected that almost 600 million people will still be facing hunger in 2030. While some areas have made some progress in hunger reduction, there are many places in the world facing deepening food crises. Africa remains the worst affected region with one in five people facing hunger on the continent, more than twice the global average,” concludes the SOFI report. Similarly, FAO (the Food and Agriculture Organisation of the UN) recently warned that global food commodity prices rose in July, influenced by the termination of the Black Sea Grain Initiative and new Indian export restrictions on rice.

African Challenges and Arab Development Finance Support

Not surprisingly, least-developed countries (LDCs), especially in Africa, in general, are faced with the biggest challenges in trade flows and dynamics, beholden to anachronistic world trade rules to the detriment of LDCs – a major failure of the global trade system. In 2022, for instance, resource rich Africa accounted for less than 1% share of world exports.

Even where exports of goods and services from LDCs increased by 31% between 2019 and 2022, this was more to do with a greater upside of 41% in value terms, once again reflecting higher global commodity prices. Africa’s trade deficit in intermediate goods (IG) – inputs used to produce a final product – shrank to US$4.4 billion in 2022. This is partly due to growth in its exports of IG, which totalled US$292 billion in 2022, an increase of 47% compared with its pre-COVID-19 level in 2019. Again, the rise in value terms is due to high commodity prices.

The fact that Africa accounted for only 14% of intra-African merchandise trade in 2022 (down from 16% in 2018) – the lowest of all the global regions – underlines the huge gap and challenges faced in realising the African Union’s Agenda 2063 vision of economic integration and inclusive socio-economic development on time, and the trade-led development ambitions of the African Continental Free Trade Area (AfCFTA), which seeks to bring together 55 African countries and create an integrated market of 1.3 billion people, with a combined GDP of over US$3 trillion.

A major development is the allocation of up to US$50 billion to help build resilient infrastructure and inclusive societies in the African continent by the Arab Coordination Group (ACG) at the recent Arab-Africa and Saudi-Africa Summits’ Economic Conference in Riyadh. The ACG is a strategic alliance that provides a coordinated response to development finance. Current members are the Abu Dhabi Fund for Development, the Arab Bank for Economic Development in Africa, the Arab Fund for Economic and Social Development, the Arab Gulf Programme for Development, the Arab Monetary Fund, the Islamic Development Bank, the Kuwait Fund for Arab Economic Development, the OPEC Fund for International Development, the Qatar Fund for Development, and the Saudi Fund for Development.

The ACG has been a long-standing supporter of African partner countries and has cumulatively invested over US$220 billion in the region to date. “We reaffirm our commitment to supporting the sustainable development of countries in Africa. Recognizing that the link between sustainable development and climate financing is cross-cutting and complex, the ACG reaffirms its commitment to scaling up financial assistance for climate change in line with the Paris Climate Agreement and to helping bridge investment gaps in energy access, including low-carbon energy sources, climate mitigation, adaptation, and resilience, as well as food security,” said the Group in a statement.

On the global GDP growth front, the outlook is equally mixed. Moody’s Investors Service, in its latest forecast, expects global G-20 growth to moderate in 2024 to 2.1% from 2.8% in 2023 and accelerate in 2025 to 2.6%, the firm said in its Global Macroeconomic Outlook 2024-25. “We forecast real economic activity in advanced G-20 economies to decelerate from an estimated 1.7% in 2023 to just 1.0% in 2024 and recover to 1.8% in 2025,” said Madhavi Bokil, Senior Vice President CSR, at Moody’s. “Growth in G-20 emerging markets will slow from 4.4% in 2023 to 3.7% in 2024 and 3.8% in 2025. Excluding China, G-20 EM growth will decelerate to 3.3% in 2024 from an estimated 3.5% in 2023 before accelerating to 3.5% in 2025.

The main reason, according to Dr Bokil, is that a Synchronous growth slowdown is expected in 2024 owing to the ongoing tightening in monetary and financial conditions in advanced economies. Traditional sources of strength will not buoy growth for too long – financial conditions have tightened even more in the last two months, which will further continue to dampen spending and investment. To him, economic strength across emerging market countries varies considerably, with some like India, Brazil, Mexico and Indonesia outperforming expectations, while outlooks for Türkiye and Argentina are highly uncertain.

Proliferation of Platform-base Trade

The 2023 ICC Trade Register Summary Report gives a more nuanced vista of the dynamics of global trade prospects, which will be increasingly subject to the impact of regulatory changes, especially due to the new reporting requirements from the Financial Accounting Standards Board (FASB), and the ongoing digitisation and future of platform-based trade. The geopolitical and macroeconomic challenges of 2022 have continued and have even intensified, in some cases, fueled by weak global growth, elevated inflation, and high interest rates. On the demand side, observes the ICC, consumption slowed from the post-pandemic bounce but remained strong. Households continued to spend the savings they had accumulated during the pandemic, while government spending continued apace, for example, in relation to the US Inflation Reduction Act (IRA).

On the supply side, while the shipping constraints of 2021 abated, supply chains remained disrupted, partly due to new trade policies across many countries. According to the ICC Trade Report, international goods trade flows reached US$23.8 trillion in 2022, up 10.7% from 2021. This was a softening in trade growth relative to the 25.5% jump in 2021, as the post-pandemic recovery eased in 2022. But this growth in 2022 was primarily driven by inflation rather than an increase in volume, as commodity prices jumped: in real, or inflation-adjusted, terms, goods trade flows grew only 3% in 2022 versus 2021.

The services trade tells a different story. Trade in services reached $6.8 trillion in 2022, up 14% from 2021, driven by strong growth across all regions in a continued post-pandemic recovery. Europe continues to be the regional leader, with a 53% share of global services exports in 2022. Services trade grew at a faster rate than goods trade in 2022, the opposite of what we saw in 2021 (where services trade grew at 19% vs. 26% for goods trade). This was due to a more sustained post-pandemic recovery for services than for goods. Its forecast for 2023 and beyond is to the point ‘Growth, but Slower Growth.’

Boston Consulting Group (BCG), which contributed to the ICC Trade Report, projects global exports of goods, excluding services and FX receipts, to reach US$23.8 trillion in 2023, rising by 4.6% to US$37.4 trillion in 2032.

Following the sharp increase in trade finance revenues by 28.2% in 2021 relative to 2020, BCG estimates that nominal trade and supply chain finance revenues grew a pace of 6.3% in 2021 to 2022, reaching a total of US$63 billion. The slowdown was due to softening of both volume growth and product penetration, as some businesses chose to go without trade and supply chain finance products to avoid the higher costs. A narrowing of margins also played a role in squeezing revenue growth in 2022.

The prospects for trade finance in 2023 are turning out to be a more challenging year. BCG forecasts nominal trade and supply chain finance revenues to fall by 7.4% in 2022 to 2023. Looking further ahead, trade and supply chain finance revenues are forecast to grow modestly in the year 2023 to 2024 before picking up and growing by 3.8% per annum from 2022 to 2032, reaching $91 billion by 2032 on a nominal basis. “Growth in open account products is slowing but is expected to remain strong as its speed, ease and cost effectiveness outweigh the risk mitigation properties of documentary trade. The ease of digitisation of open account also works in its favour,” said BCG.

BCG also stresses the importance of ongoing digitisation and the future of platform-based trade. Digitisation is going from strength to strength, with the majority of players investing heavily in their trade and supply chain infrastructure in order to:

- Modernise the customer experience,

- Provide new product functionalities across the full procure-to-pay value chain (e.g. pre-shipment finance, distributor finance, etc.),

- Enable greater platform and ecosystem connectivity in order to originate transactions where customers do business (rather than customers coming direct to bank),

- Enable greater modernisation to reduce cost and improve processing times, and

- Improve data and reporting and to enable balance sheet velocity of documentary trade through asset distribution which is expected to grow as legacy systems are replaced or upgraded, and data becomes more widely available.

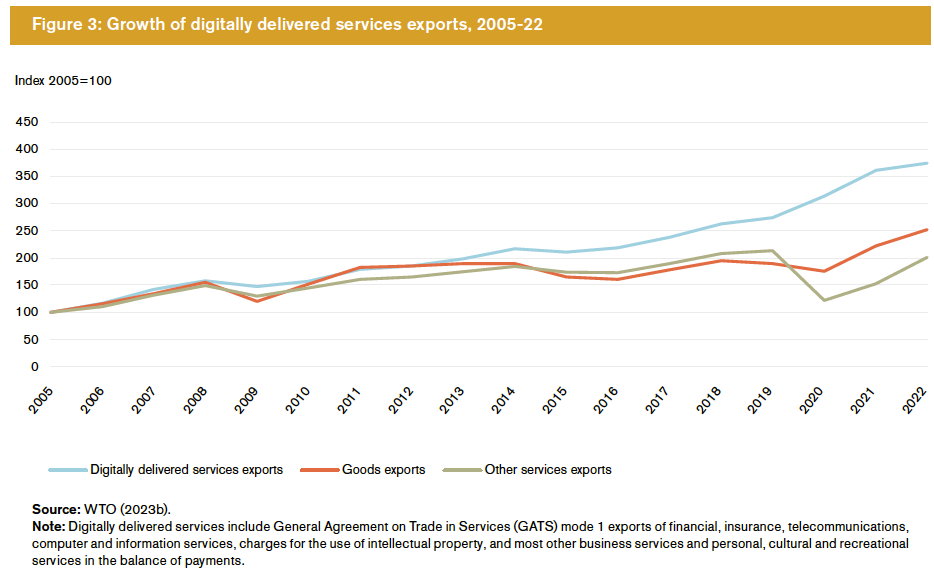

The real economy impact for ICIEC member states is implicit. According to WTO estimates, Bangladesh’s total exports of digitally delivered services for instance, have been growing by 15% annually since 2005, compared with 11% for goods, albeit from a very low base. Bangladesh has put digitalization at the core of its development. Around 14% of the online freelance global workforce originates and resides in Bangladesh, making it the top supplier of the online workforce in creative and multimedia services. As such, business-to-customer e-commerce is expected to grow by 18% per cent annually.

Digitisation has also been enabled by the growth in platform-based trade, where FinTechs and challengers are innovating on new ways to capture market share and scale. Many banks are now participating in digital trade platforms, e.g., for e-invoicing, payables automation, supply chain financing and working capital management. These platforms vary by geographic reach, product and client focus, and underlying technology, but the market has been somewhat bifurcated.

“While digitisation supports the shift to open account through the development of new products, it also improves the efficiency and security of documentary trade, underpinning its continued importance in the product mix. Moreover, digitisation not only facilitates broad industry growth but also supports inclusive growth. It is seen as key to reducing the “trade finance gap” for SMEs, which has widened recently due to higher interest rates,” maintains BCG.

Advances in Electronic Trade Documentation

The three major and potentially game-changing developments in the electronic trade documentation architecture are the Electronic Trade Documents Act (ETDC) 2023 in the UK receiving Royal Assent from King Charles the III on 20July, becoming legally effective on 20 September in an effort to make Global Britain’s trade with partners all over the world more straightforward, efficient and sustainable , the enhancement of the Model Law on Electronic Transferable Records (MLETR) , and the World Trade Organisation (WTO’s) initiative in including work on trade-related aspects of e-commerce as part of the organisation’s Joint Statement Initiative (JSI) on E-commerce in future WTO negotiations.

Perhaps the biggest potential leap change in the near-to-medium term may come in digital underwriting and digitalization in commercial insurance lines using targeted Generative AI, according to Swiss Re. It is important in the current climate of AI hype not to over-think nor over-talk the significance of AI in order to facilitate an orderly transformation to this very disruptive and yet inevitable technology.

“Along with the use of big data,” says Swiss Re, “AI is expected to be eventually used widely in risk assessment and underwriting. Given the level of confidence needed to deploy new technologies in underwriting, fully digitalised/automated AI and Machine Learning (ML) enabled systems are still not accurate enough for use at scale. This also means that algorithms cannot be relied on to fully replace traditional risk assessment, except in simpler lines of business such as motor. This said digitalisation can complement existing processes, including classifying and segmenting risk as finely as possible for more accurate risk pricing.”

Increasingly, commercial insurers are making use of digital technology in portfolio steering and risk selection. The benefits are important. “By leveraging third-party digital data overlaid with their own information,” stresses Swiss Re, “they can derive insights on potential risk accumulation, such as that caused by a concentration of high-value properties exposed to specific hazards. For example, the utility sectors’ liability exposure is increasing due to infrastructure that can spark fires. Utilities may operate in wildfire prone regions (eg, network operators, tree cutters). Using third-party digital data on, for instance, locating sources of ignition such as power lines and rail tracks, insurers have a deeper view as to areas of potential fire risk accumulation.”

The importance of the above developments cannot be ignored. The WTO initiative for instance, involves 89 (as of July 2023) member states, accounting for over 90% of global trade. These negotiations span a broad range of critical topics such as online consumer protection, electronic signatures and authentication, electronic contracts, transparency, paperless trading, open internet access, and data flows and data localization.

In this respect, the WTO Informal Working Group on Micro-and-Small-and Medium-sized-Enterprises (MSMEs) continues to discuss challenges for MSME access to digital trade, including cyber readiness, standardizing trade digitalization, and single windows (or access points) to access trade information. Recommendations like these, stressed the WTO, will be critical for increasing the inclusiveness of the international trade environment and should also be included in discussions at the WTO and in regional trade agreements (RTAs).

The benefits are real albeit incremental, and in need of urgent domestic and global trade system structural development, according to the world trade body. Automation and digitalization of production processes will continue because they increase productivity, allow firms to remain competitive in international markets, improve product quality and provide greater flexibility in responding to changes in the market.

Embracing a strengthened multilateral trading system through re-globalization would support inclusiveness by facilitating GVC-led industrialization and services-led growth. Growth in services trade, particularly digitally delivered services, needs agreements on services domestic regulation, e-commerce, and investment facilitation. WTO members can help facilitate a more inclusive global trading system by negotiating new accessions, extending their commitments, updating trade rules at the multilateral level, and working with other international organizations to ensure more people benefit from world trade.

Digitalization of trade could be a great equaliser and facilitator by providing new opportunities for those economies that have so far been left behind by allowing them to overcome some of the most important barriers to trade that they face, such as transportation costs and institutional disadvantages.

More importantly, it would also provide new opportunities for small firms, people living in remote areas, and women. Digital trade allows people globally to directly access international markets and supply their services even if there is no longer an industry domestically. Promoting more international cooperation, however, would need to be accompanied by requisite domestic policies without compromising the ethos of individual countries’ development agendas, as they play an important role in helping make globalization more inclusive.

ETDA’s £1.14 Billion Boost

There is no doubt that the biggest boost can come from the UK’s ETDA, with the British Government’s initial estimate that the UK economy is set to receive a £1.14 billion boost over the next decade through the “Innovative Trade Digitalisation Act.” With less chance of sensitive paper documents being lost, and stronger safeguards through the use of technology, digitalising trade documents is also set to give businesses that trade internationally greater security and peace of mind.

“The Electronic Trade Documents Act,” says Chris Southworth, Secretary General of the UK Chapter of the International Chamber of Commerce (ICC), “is a game changing piece of law not just for the UK but also for world trade. The act will enable companies to finally remove all the paper and inefficiency that exists in trade today and ensure that future trade is far cheaper, faster, simpler and more sustainable. This presents a once in a generation opportunity to transform the trading system and help us drive much needed economic growth.” The ICC estimates that 80% of trade documents around the world are based off English law, and this act serves as the cornerstone to truly digitalising international trade.

With English law being the very foundation of international trade, several Islamic finance contracts such as the Commodity and Syndicated Murabaha and Sukuk issuance, this act puts the UK ahead and in the lead of not only other G7 countries but almost all other countries in the world. The UK, says Minister for International Trade, Nigel Huddleston, is widely seen as a leader in digital trade, and this new act will make it easier for businesses to trade efficiently with each other, cutting costs and growing the UK economy by billions over time. “It’s exciting to see the power of technology being harnessed to benefit all industries, reduce paper waste and modernise our trading laws, an approach which the rest of the world will seek to follow,” he added.

Indeed, the Electronic Trade Documents Act recently implemented in the UK, according to the WTO, removes requirements for the majority of paper trade documentation. Varying degrees of progress are also being made towards implementation in the remaining G7 countries, with each taking unique approaches to amend and introduce legislation.

The Model Law on Electronic Transferable Records (MLETR) has already been in use since 2018 in a range of emerging markets, such as the UAE and Bahrain. The digitisation of trade finance documents has the capability to improve efficiency, reduce costs, enhance security, and diminish the extensive carbon footprint of paper documentation. More broadly, progress is being made to remove legal barriers to trade in many countries, such as France, Germany, the US under the African Growth and Opportunity Act (AGOA) and the UK.

The stakes are high for both AGOA-acceded countries and the US. Since its inception in 2000, AGOA has been at the core of US economic policy and commercial engagement with Africa. AGOA provides 32 eligible SSA countries with duty-free access to the U.S. market for over 1,800 products, in addition to over 5,000 products that are eligible for duty-free access under the WTO’s Generalized System of Preferences programme.