Upscaling Critical Mass, Market Depth and Awareness Amid Rising Risks

The 57 and 49 member states of the IsDB and ICIEC respectively could benefit from an enhanced credit and investment insurance culture and ecosystem. This pertains to the structural, policy, resource, organizational capacity realities of the industry across the spectrum – government agencies, insurers and underwriters to peer institutions, to financial sector entities, to corporates and businesses, and to SMEs. Mushtak Parker considers the challenge of how to mainstream risk mitigation and credit enhancement through increasing the provision of affordable credit and investment insurance in member states, and how ICIEC can play an enhanced market maker role in this respect through partnerships, market education and collaboration both at a national level and with international industry bodies and linkages.

Malaysian Prime Minister Anwar Ibrahim has repeatedly flagged up in recent months the vital trade finance and insurance sector. Whether at the Global Forum on Islamic Economics and Finance (GFIEF) in Kuala Lumpur on 28- 29 May 2024, at the IsDB Annual Meetings in May in Riyadh, and at the 15th International Conference on Islamic Economics and Finance in February 2024 in Kuala Lumpur, the Prime Minister has been calling for the adoption of a reformist holistic agenda to help mitigate the huge socio-economic, trade and investment challenges and opportunities faced by the 57 member states of the Organization of Islamic Cooperation (OIC) and its development finance organ, the Islamic Development Bank (IsDB).

Islamic trade finance is estimated to account for less than 5% of total trade finance in OIC member states. Reliable data is fragmented, underdeveloped, and often dated because of poor disclosure and lack of transparency.

The fact that intra-OIC trade and investment has not even hit 25% of their total exports and imports and FDI flows, indicates the uphill struggle for Member States to upscale their bilateral and multilateral trade and investment flows.

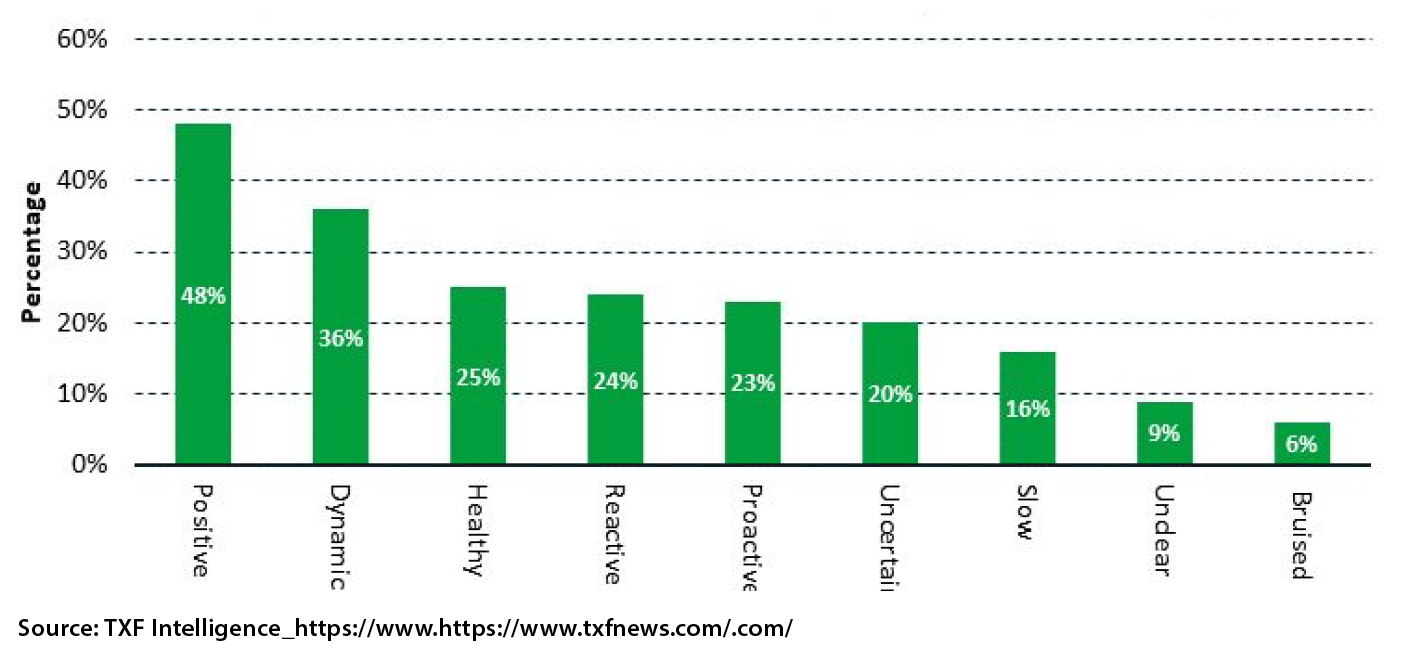

Globally market sentiments for export finance and credit and investment insurance in general is positive as the impacts of the COVID-19 pandemic continue to recede although still impacted by the supply chain disruptions of the conflict in Ukraine, the subdued resultant global economic recovery marked by low GDP growth, stubbornly high inflation rates, high interest rates, rising sovereign debt burden of Lower-Middle Income Countries (LMICs), and the ensuing global cost of living crisis. The TXF Export Finance Survey in June 2024 confirms the positivity of the export finance market although the sentiments have yet to be fully absorbed into the market operations.

What best describes the current state of the export finance industry?

A Reform Agenda for the Islamic Economy

“As we navigate the complexities and uncertainties of these post-normal times,” emphasized PM Ibrahim, “the principles of Islamic economics and finance remain even more relevant to resolve the core conundrums which the world is facing. These include lifting abject poverty, ensuring food security, mitigating climate change, and enabling equal opportunity to comprehensive education. This is why we must embark on a holistic ‘Islah’, a reform agenda for positive change and a force for good in the global economy.”

The Islamic finance ecosystem, he reiterated, needs to evolve progressively, placing greater emphasis on value-based sustainable finance, transcending the profit-driven motives or to embrace a higher purpose where wealth is not just accumulated among the few but circulated to uplift communities, protect the environment, and investment carries a balanced promise of prosperity. In Riyadh for instance, the Malaysian Ministry of Finance, Bank Negara Malaysia (BNM), the central bank, the IsDB and the World Bank, unveiled a collaborative “new blended finance innovation” – a pilot programme on greening Halal businesses. The aim is to assist halal businesses in Malaysia and elsewhere to transition to greener and sustainable practices by providing technical capacity building, tools to measure and report greenhouse gas emissions, derisking and credit enhancement solutions in trade and investment, and transition financing including certifications.

According to the ICIEC 2023 Annual Report, while 2021 marked a zenith for intra-OIC imports at USD436.0 billion, a subsequent contraction to USD365.4 billion in 2022 raises questions about the internal trade synergies and potential barriers within the OIC ecosystem. The dynamics for intra-OIC exports reflected the same trend. The retraction, however, is almost certainly due to the pandemic, the supply chain disruptions caused by the Ukraine conflict and the sluggish global economic recovery.

Prime Minister Ibrahim is right in calling for greater focus to enhance the efficiency and transparency across the end-to-end supply chain in the potentially multi-trillion-dollar Halal economy. However, the dissonance between the wider Halal economy and the estimated USD3.5 trillion Islamic finance industry is stark albeit improving incrementally. However, there is an urgent need to upscale independent reliable research and data disclosure to better inform both policy makers and the spectrum of stakeholders in the trade, investment, finance and insurance value chain.

Vanilla Murabaha, Murabaha Syndications, Tawarruq (Commodity Murabaha) and Instalment Sale, and Trade and Investment Takaful, estimated at almost USD1trillion per annum, are established Islamic trade finance and insurance contracts across the market segments and in the various hybrid Sukuk structures. They are internationally accepted mainstream trade finance products which have been accessed even by major Western, Japanese, and South Korean multinationals.

According to Dinar Standard, OIC imports are projected to reach USD3.43 trillion by 2027, while OIC exports are projected at USD4.30 trillion – indicating huge potential for credit and investment re/insurance.

The State of the Islamic Trade and Investment Insurance Market

Reliable data relating to what extent Islamic trade finance and insurance is directed to the Halal economy is simply not available. A senior official from Malaysia’s Halal Development Corporation attending a major Halal convention in London recently agreed that the global industry does have a major bottleneck in reliable and up-to-date data and research in various aspects of the value chain, including the connectivity to the Islamic finance industry.

The reality remains that while Export Credit Agencies (ECAs) and multilateral insurers, such as ICIEC, in AMAN UNION member states have generally witnessed some growth in their operations – both conventional and Shariahcompliant – largely linked to government COVID-19 mitigation emergency packages, the reality is that the culture of credit and political risk insurance (PRI) in many OIC markets remains underdeveloped. The AMAN UNION is the forum comprising Commercial and Noncommercial Risks Insurers and Reinsurers in OIC member states and of the Arab Investment and Export Credit Guarantee Corporation (DHAMAN).) ICIEC is responsible for the administration of the AMAN UNION.

Part of the problem is lack of market awareness and of a comprehensive strategy to promote and connect trade and investment Takaful to the spectrum of economic activity and market segments – trade, investment, commerce, export promotion, imports, infrastructure projects and even financial products such as Sukuk origination, housing and mortgage securitization, especially in an era of everevolving new risks. When Takaful is discussed or researched it is almost routinely confined to family and general Takaful. Credit and PRI Takaful is almost completely off the radar. This also connects with the underdeveloped state of financial journalism in member states. Yet in sheer volume and value terms, the latter is infinitely bigger as a market segment than family and general Takaful.

The perception rightly or wrongly remains that credit and investment insurance is an extra unnecessary cost, where often the premiums are prohibitive especially for companies and clients in the low-and-mediumincome-countries (LMICs), and the requisite government policy and regulatory frameworks are either not in place or underdeveloped to make transactions and projects bankable especially for the involvement of much-needed private sector capital and financing.

Towards an OIC Trade Insurance Master Plan

ICIEC, which marks its 30th anniversary this year and uniquely the only Shariah-compliant multilateral insurer in the world, has almost single-handedly shown the viability, efficacy, market potential and importance of trade and investment Takaful and Re-Takaful for OIC economies. The proof is in the pudding. The Corporation has cumulatively insured business to date surpassing USD114 billion since it started operations in 1995, comprising USD90.7billion in export credit insurance and USD23.3billion in investment insurance. ICIEC has also underwritten policies since inception totaling USD53.6 billion in support of intra-OIC trade and intra-investment.

There are several challenges ahead for the Shariah-compliant trade and investment insurance market. The main one is the lack of dedicated private Shariah-compliant providers. The architecture currently comprises ICIEC as the only Shariah-compliant multilateral insurer and a number of ECAs and private providers.

An analysis done last year by Turk Eximbank showed that the total capital base of AMAN UNION member entities was a mere USD13.6 billion at end 2021 – up on the USD10 billion in 2020, of which Saudi EXIM accounted for 59% in 2021. Total AMAN UNION Business Insured in 2021 reached a mere USD49 billion – up 17% on 2020, of which the top 5 members accounted for 83% of total business insured, led by Turk Eximbank at 48% and ICIEC at 20%.

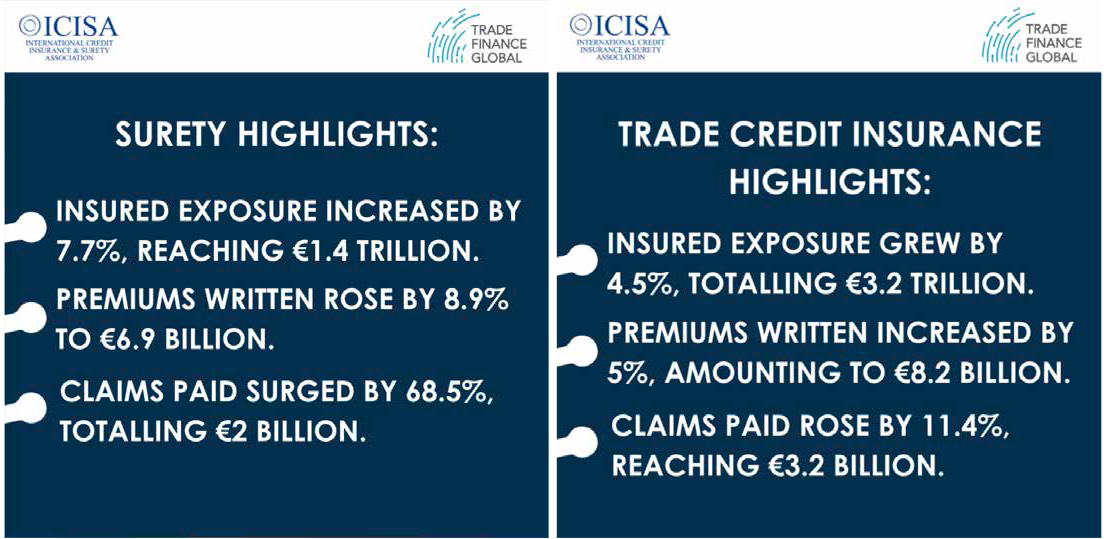

In contrast, members of the International Credit Insurance and Surety Association (ICISA), the leading industry trade association representing trade credit insurance and surety companies internationally who account for 95% of the world’s private credit insurance business, insured nearly EUR3.2 trillion (USD3.43 trillion) in trade receivables insured and billions in infrastructure guarantees in 2023 – up 4.5% YoY. According to the latest data from ICISA, premiums written in 2023 increased by 5% to EUR8.2 billion (USD8.79 billion), while claims paid increased by 11.4% reaching EUR3.2 billion (USD3.43 billion).

According to the 2023 ICISA Annual Report, throughout 2023, ICISA members reported strong business growth despite a notable rise in claims across various lines. These trends are reflective of the ongoing volatility of macroeconomic conditions.

“Despite these challenges, the industry continued to provide a safe harbour for trade and investment in the real economy while remaining robustly capitalized. Demand for protection in the face of economic headwinds understandably grew throughout 2023 for both trade credit insurance and surety markets,” said ICISA President, Benoît des Cressonnières.

However, the macro risk environment, warns ICISA, “remains volatile and uncertain. Businesses face significant challenges due to high interest rates, rising costs, the energy transition, and disruptions from conflicts and geopolitical tensions. Trade continues to drive positive economic development, but managing associated risks and financing costs is increasingly challenging. While central banks look to carefully loosen monetary policy in the coming months, ICISA members expect challenging market conditions to persist in the short term.”

Not surprisingly, against this backdrop, surety claims rose significantly from 2022 to 2023, with EUR2 billion paid out in 2023, marking a 68.5% increase. Trade credit insurance members paid out EUR 3.2 billion in claims across the same period. This was up from EUR 2.7 billion in 2022, providing a valuable lifeline to businesses worldwide.

Similarly, the latest data from The Berne Union (International Union of Credit and Investment Insurers), the not-for-profit professional association representing the global credit and political risk insurance industry, shows that 2023 was an encouraging year for export credit with members providing over USD3 trillion in new support for cross-border trade, with expansion across almost all business lines, which augurs well for 2024 and beyond.

The reality however is that the gap between the conventional and Islamic credit insurance providers in almost every aspect is stark and has cost the OIC countries billions of dollars in opportunity costs lost especially because of the lack of Shariah-compliant opportunities for their economies in general and the Halal economy specifically.

The Great Leap Forward

Looking ahead, policy proposition, prioritization, upscaling, synergizing and implementation, together with smart collaboration, must be the order for the next few years if Shariah-compliant credit and investment insurance is going to take that great green leap forward in its involvement in the development agendas of member states.

In the meantime, there are several collaborations which if maximized to their full potential could go a long way towards the eventual mainstreaming of Shariah-compliant trade and investment insurance as an alternative option for government and commercial entities in OIC member states. The Joint Strategic Collaboration signed in April 2024 between ICISA and the AMAN UNION, for instance, is a potential gamechanger in enhancing the culture and business of trade and investment insurance in ICIEC Member States.

The collaboration underscores a shared commitment to advancing the trade and investment insurance landscape, particularly within OIC Member States. By sharing their respective expertise and networks, the parties aim to facilitate enhanced knowledge exchanges and initiatives that contribute to the sustainable development of OIC Member States. Key highlights of the Joint Strategic Collaboration include: i) Facilitating knowledge exchanges on trade and investment insurance initiatives, ii) Enhancing collaboration and development of best practices in the industry. Iii) Strengthening mutual relationships among members of both associations.

Mr. Richard Wulff, Executive Director of ICISA and Mr. Oussama Kaissi, then Secretary-General of AMAN UNION and CEO of ICIEC, recognize the significant potential for cooperation to drive positive outcomes in the trade and investment insurance sector. “Through this strategic alliance, we are assured to unlock unprecedented opportunities and drive innovation within our respective spheres. The signing of this MoU signifies a transformative leap towards harmonizing our efforts and maximizing the potential for sustainable growth and prosperity on a global scale. By pooling our resources and expertise, we can drive positive change and sustainable growth for our member states,” they maintained.

Similarly, another important development is the accession of The Islamic Development Bank (IsDB) and ICIEC to the International Renewable Energy Agency (IRENA’s) Energy Transition Accelerator Financing Platform (ETAF) in December 2023 to which they have also pledged USD250 million to projects on the platform by 2030 and to provide de-risking tools to support renewable energy projects in member developing countries.

Through the ETAF Platform, a multi-stakeholder climate finance solution managed by IRENA, ICIEC will provide credit and political risk insurance solutions to support the financing of renewable energy projects recommended by IRENA for the benefit of common member states. This partnership says ICIEC leverages its expertise in credit and political risk insurance and its synergies with the broader reinsurance market and focuses on advancing just, affordable and clean energy transition in LMICs. LMICs form the largest component of the 57 member states of the IsDB and are disproportionately affected by the ravages of climate devastation even though as a group they are the lowest emitters of carbon in the world.

As such, energy transition is not only a financial, economic, technological, survival and societal imperative, but also a moral one. As part of a diverse network of partners, the ETAF Platform enables the financing of renewable energy projects giving developers access to a suite of de-risking solutions and manifold financing opportunities as a way of advancing their energy projects and making them bankable to donors, institutional and private investors.

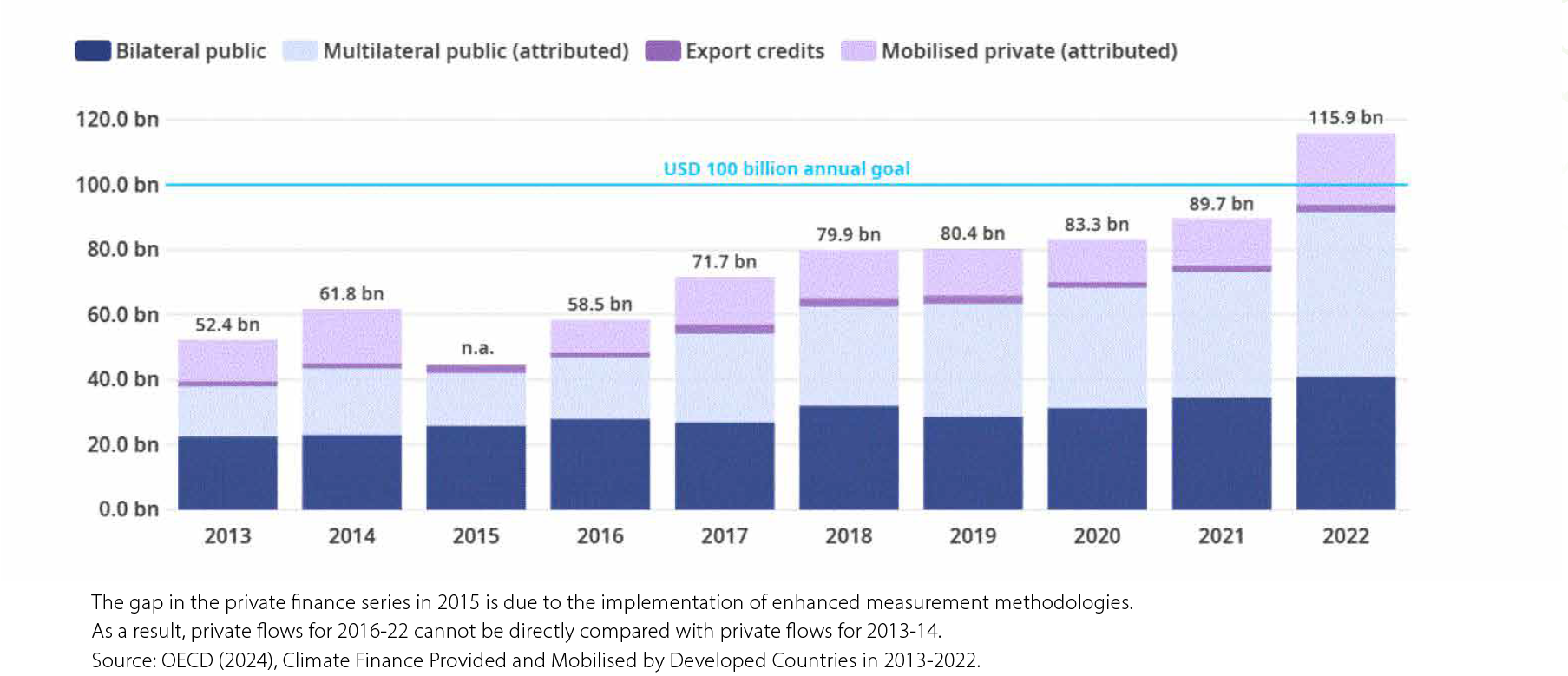

Climate finance for developing countries

Amounts provided and mobilised by developed countries, billion USD

Another interesting development is the growing interest by ECAs from non-OIC countries in using Shariah-compliant credit and investment insurance to support their exports and FDI investments to OIC markets especially in the MENA Region and Southeast Asia.

In June 2024, Italian State Export Credit Agency SACE Guaranteed its First-of-its-kind “Substantive” Commodity Murabaha Facility Provided by HSBC to UAE Food Giant, IFFCO, under its Push Programme to support Italian food and beverage value chain and exports to the Middle.

For the first time globally, SACE has guaranteed financing with an Islamic finance structure in favour of the IFFCO Group in the UAE. According to Michal Ron, Chief International Officer of SACE, “we secured financing with an Islamic financing structure (Murabaha Al Siala) for IFFCO Group, with HSBC as the sole participant. We agree that this operation will open numerous other opportunities for Italian SMEs in their respective sectors of interest. This is the first Push Strategy operation structured according to Islamic finance principles, which will enable the opening of new markets in the Middle East and other geographies, with a positive impact on Italian exports.”

IFFCO and HSBC both stressed that creating a “global first” Islamic structure under SACE’s Push Programme “exemplified designing a creative financial structure working around complex parameters to synchronize ECA clauses to fit into an Islamic structure to deliver an innovative solution versus conventional offering.”

Alexei Rybakov, HSBC’s Head of Export Finance for MENAT, sees the transaction potentially boosting Euro-Middle East trade using Islamic finance solutions. “This transaction,” he explained, “marks a further development in Sharia’h compliant structures. Innovative cross-border transactions like this are accelerating trade and investment between Europe and the Middle East. This collaboration between IFFCO, SACE, and HSBC has resulted in a ready templated solution to execute Shariahcompliant ECA financing under SACE’s Push Programme.”

The Slowing FDI Flow Rate

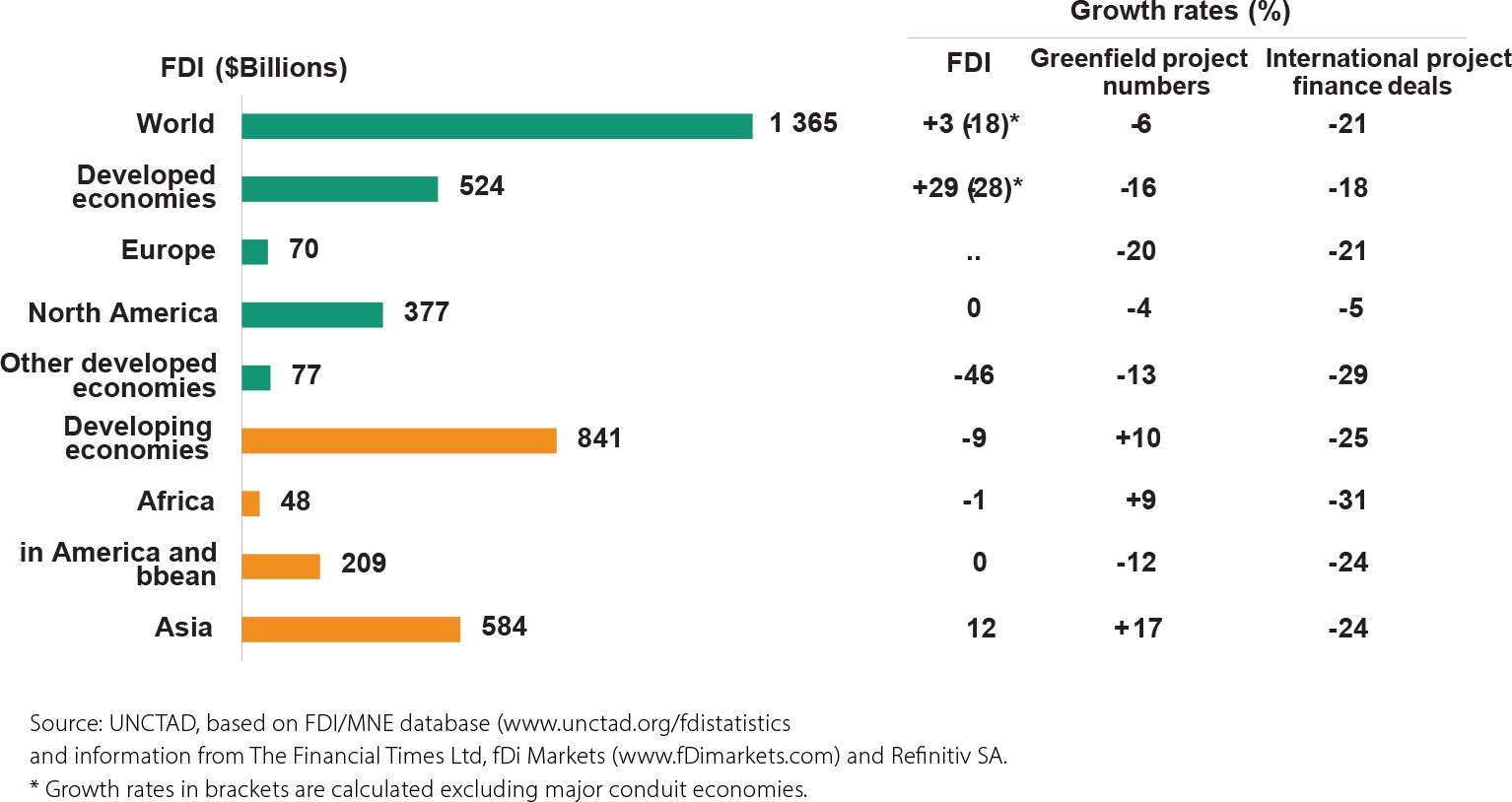

Global Foreign Direct Investment (FDI) flows, totalled an estimated USD1.37 trillion in 2023 according to the latest figures from UN Trade and Investment (UNCTAD’s) Investment Trends Monitor. This was a marginal 3% increase over 2022, defying expectations as recession fears early in the year receded and financial markets performed well. However, says UNCTAD, economic uncertainty and higher interest rates did affect global investment. FDI flows to developing countries disconcertingly fell by 9%, to USD841 billion, with declining or stagnating flows in most regions. FDI decreased by 12% in developing Asia and by 1% in Africa, here the bulk of IsDB and ICIEC member states are located.

In West Asia, FDI remained stable at 2% due to continued buoyant investment in the UAE, which saw greenfield announcements rise by 28% to the second highest number after the United States. Greenfield numbers also jumped in Saudi Arabia, by 63%.

FDI flows to Africa were almost flat at an estimated USD48 billion. Greenfield project announcements increased, mostly due to strong growth in Morocco, Kenya, and Nigeria. However, project finance deals fell by one third, more than the global average decline, weakening prospects for infrastructure finance flows, which merely highlights the growing need for project related underwriting and guarantees.

Investment trends by region, 2023 vs 2022

The importance of credit and investment insurance cannot be overstated. For an industry that has been around for over a century, the challenge ahead is to enhance awareness and market education among policy makers; regulators; multilateral, national and private sector insurers, and export credit agencies (ECAs); banking institutions, insurance providers, exporters, importers, investors, and SMEs. Today, according to the Berne Union’s Credit Insurance: Impact on Trade, Finance and the Real Economy report, around 90% of all global trade relies on some form of credit, insurance or guarantees, issued by a bank, insurer, or specialist financial institution. As it has done for over a century, the credit insurance industry will continue to evolve and adapt to meet challenges – societal, environmental, and economic – that lie ahead and support the real economy.

Credit and investment insurance typically acts as a catalyst that provides financing to the real economy through export and import flows and promotes foreign direct investment (FDI) movements across the globe. By protecting exporters and banks against the risk of non-payment, defaults and expropriation, credit insurance enables cross-border trade and investment. Perhaps this is a core challenge which industry bodies and countries in which Islamic finance is of systemic importance must embrace in how to upscale such cover dramatically both nationally, regionally and in the world of Islamic finance.

This against the background of risks and uncertainties in the global economic landscape. The latest SONAR Report published in June 2024 from the Swiss Re Institute, published since 2013, is indeed sobering – featuring 13 emerging risk themes and three trend spotlights. The emerging risk themes are what could be new or changing risks, with both up-and downside potential for insurers. The “trend spotlight” items highlight contextual developments SRI deems relevant for the industry, without necessarily profiling a specific risk.