Balancing Egypt’s Dynamic Economic Landscape with its Persistent Macroeconomic Challenges

Harnessing A Unique Relationship with the IsDB Group and ICIEC

Egypt is a key founding member of the OIC, IsDB, and ICIEC. Cairo is keen to expand its relationship with ICIEC as evidenced by the activities of the Corporation’s Hub in Cairo and the sentiments of various Egyptian ministers, officials and corporates. Egypt’s economic landscape remains dynamic, influenced by both domestic and external factors. While the country has made significant strides in recent years, challenges persist, particularly in the areas of inflation, debt, and foreign exchange reserves. Eman Mahmoud Country Manager, Cairo Regional Office, ICIEC, profiles Egypt’s Economy, its development priorities and challenges, and its long-standing relations with the IsDB Group especially ICIEC.

Eman Mahmoud,

Country Manager Egypt, ICIEC IsDB Group Regional Hub Cairo

Economic Overview

The Egyptian economy demonstrated robust growth in FY2021/22, recovering from the COVID-19 pandemic. However, recent data suggests a slowdown in economic growth in Q3 FY2023/24, reaching a low of 2.2%. Nevertheless, the outlook for FY2024/25 remains positive, with projected growth of 4.2% driven by increased investment, a recovery in the manufacturing sector, and the anticipated end of the Gaza conflict.

The government plans to cut spending in response to the economic crisis. This includes delaying state projects that require significant foreign currency funding and reducing expenses related to travel, training, and conferences for officials. The government focuses on large-scale privatisation and asset sales as part of its economic stabilisation measures. These measures aim to address balance-of-payment stresses and stabilize the economy.

The Egyptian government sealed its largest investment deal with a consortium led by Abu Dhabi Developmental Holding Company (ADQ), one of the UAE’s sovereign wealth funds, for the development of Ras El Hikma city, spread over more than 170 million square meters of land on the Mediterranean coast. The deal is expected to be risk-positive, bolstering the country’s FX reserves and ensured adequate buffers for Egyptian authorities to devalue the pound, or at least move to a more flexible exchange rate regime, thus likely satisfying International Monetary Fund (IMF) requirements for a new and enlarged financing package. However, the deal is unlikely to ensure a sustainable turnaround for Egypt’s economy and needs to be complemented by long-awaited structural reforms.

ADQ will invest USD35 bn in Egypt that will retain 35% of the project’s profits. The project’s investment value could reach USD150 bn and may generate millions of employment opportunities, according to Egypt’s prime minister. ADQ will develop Ras El Hikma city that will include a business district, residential and commercial space, hotels and tourism resorts, healthcare and education facilities, and a free economic zone for IT industries and logistics hubs, among others.

Out of the USD35 bn being paid to Egypt, USD24 bn consists of new fund transfers (representing the consortium’s acquisition of development rights) and USD11 bn consists of existing UAE deposits at Egypt’s central bank that will be transferred to local currency and invested in prime projects. The Egyptian authorities also announced they are setting the ground for similar investment deals, notably the Ras Gamila land south of Sinai on the Red Sea coast, potentially to Saudi or Qatari investors.

The World Bank Group has approved a new Country Partnership Framework (CPF) for Egypt, which aligns with the Government of Egypt’s Sustainable Development Strategy and the National Climate Change Strategy. The new CPF intends to strengthen Egypt’s role in regional integration, which has positive implications for Egypt and potentially the broader region through enhanced regional trade and greater connectivity in infrastructure, transport, energy, and labour.

Egypt and the International Monetary Fund (IMF) announced on March 6, 2024, a staff-level agreement on a set of economic policies and reforms needed to complete the first and second reviews under the Extended Fund Facility, the amount of which is being raised to USD8 bn subject to IMF board approval. Noting that the IMF report in August 2024 indicated that program performance for the third review was satisfactory.

The Memorandum of Economic and Financial Policies for Egypt included in the IMF report in August 2024, included that the government will establish a repayment strategy to reduce arrears to international oil companies. The Egyptian General Petroleum Company (EGPC) has accumulated payment arrears on supply contracts of about USD, denominated in U.S. dollars. The buildup of arrears reflects several factors including foreign exchange shortages, elevated cost of borrowing, a cyclical downturn in the domestic production of gas, higher domestic consumption reducing the scope for gas exports, significant price deviations from cost recovery, and increased subsidies from EGPC to the electricity sector. The government is developing a repayment strategy to ensure that no new arrears are accumulated and that existing arrears are cleared, noting that an anticipated payment before the end of 2024 would lower the arrears to around USD3.5–3.8 bn.

Moreover, the authorities plan a series of actions to improve EGPC’s financial situation over time. The authorities raised electricity prices by 7–20 percent in January 2024 and retail fuel prices in March by 8–20 percent. While its financial position gradually improves, EGPC has the capacity to fully service its obligations on time due to an anticipated increase of EGP10-11bn of monthly revenues from recent and upcoming energy price hikes.

It was noted in the IMF August 2024 report that the program has a target to have a Ceiling on Government Guarantees. The Ministry of Finance will report to the IMF the stock of guarantees and such data will show guarantees on domestic currency and foreign currency borrowing by Economic Authorities (EGPC, GASC, Transport, NUCA, other) and state-owned enterprises (NIB, Electricity, other). It is worth noting that Guarantees issued on behalf of EGPC account for about half of government guarantees.

The increase of the IMF aid package to USD8 bn from USD3 bn is risk-positive for the economy and is likely to help draw in further foreign investments. Egypt is likely to get USD55 bn-USD60 bn in the next few years from the Ras El Hikma deal, the IMF, the EU, the World Bank and others. In June, Egypt and the EU signed 35 agreements and memorandums of understanding worth EUR67.7 bn (around USD72.4 bn at the time of signing) aimed at intensifying private sector investments in Egypt.

It is worth noting that on November 1, 2024, Fitch Ratings has upgraded Egypt’s Long-Term Foreign-Currency Issuer Default Rating (IDR) to ‘B’ from ‘B-’, citing improved external finances supported by significant foreign investments and enhanced policy measures. Key developments include the Ras El-Hekma investment, which contributed USD24 bn, and a substantial increase in non-resident holdings of domestic debt.

Also, S&P Global Ratings has affirmed Egypt’s credit ratings at B-/B, maintaining a positive outlook on October 21, 2024, instead of stable outlook, highlighting the country’s progress in implementing reforms since the liberalization of its exchange rate regime in March.

The Inflation Challenge

Inflationary pressures persist, with an average forecast of 27% YoY in H2 2024. The Central Bank of Egypt (CBE) is expected to maintain a tight monetary policy stance to curb inflation. A significant decline in inflation is anticipated in early 2025 due to base effects, which may prompt the CBE to ease monetary policy.

The Central Bank of Egypt (CBE) policy rate reached 27.75% since March 2024, and 1,900 basis points since March 2022. And it has been stable ever since. The CBE’s policy rate hike brings monetary policy nearer to neutral after an extended period of negative real interest rates. The tightening of fiscal policy and the slowdown in infrastructure spending agreed with the IMF should over time reduce inflation and support debt sustainability while fostering an environment that enables private sector activity and restore investor confidence.

To alleviate the pressures on purchasing power, the Egyptian authorities also decided to increase minimum wages and spending on social safety programs. Government spending on interest payments, social benefits and salaries remains high and will likely offset to some extent intended investment and other spending restraints and the impact of revenue-boosting developments. Higher debt servicing costs are likely to lead the fiscal gap to peak at 7% of GDP in fiscal year 2024–25.

A Widening Current Account Deficit

Egypt’s current account deficit widened in the fiscal year FY2023/2024, which ended on 30 June, to record USD20.8 bn, against USD4.7 bn in the same period of the previous fiscal year, primarily due to the increase in trade deficit by 27.0% and the decline in Suez Canal transit receipts by 24.3%, according to the latest figures published by the Central Bank of Egypt (CBE). This performance was led by the shift of the oil-trade balance into a deficit of USD7.6 bn from a surplus of USD410 mn, as the decline in oil exports surpassed that of oil imports, according to the CBE.

Egypt’s current account balance is sensitive to import prices and the country’s ability to enhance gas exports to Europe given the current high domestic gas demand. Also, a pick-up in FDIs likely rests upon the disbursement of IMF loan tranches that would send positive signals to the investor community and entice further GCC inflows. The current account deficit is projected to narrow to 4.2% of GDP in FY2024/25, supported by increased remittances and a wider services surplus.

Egypt will be challenged with a large budget deficit in the medium term owing to high commodity prices, rising interest rates and the impact of the pound devaluation on Egypt’s import bill. Egyptian authorities expected the budget deficit for 2024/25 to record 7.3%. Noting that 2023/24 budget deficit recorded 3.6% of GDP compared to 6.1% of GDP in 2022/23, due to one-off revenue from the Ras El Hekma deal.

Fitch expects that over the medium term, the deficit to gradually narrow but to remain around 4.5% of GDP due to sticky spending profile. The forecast assumes that the elimination of fuel and electricity subsidies will take longer than the government’s plan. The authorities plan to eliminate the fuel subsidy by 2025 and the electricity subsidy by 2026 and shift to a targeted subsidy system by FY2025/26.

Foreign Exchange Liquidity

Egypt’s foreign exchange liquidity position has deteriorated in recent years, but it improved gradually during 2024. Foreign exchange reserves have strengthened and are expected to continue growing, supported by capital inflows and potential debt issuance. According to the CBE, as of the end of September 2024, Egypt’s foreign exchange reserves stood at around USD46.74 bn. This is compared to USD35.22 bn at the end of December 2023 (USD34.0 bn at the end of Dec. 2022). Reserves are expected to cover around half a year’s worth of imports in the next 12 months, above the global adequacy metrics.

On 6 March, the Central Bank of Egypt (CBE) floated the official exchange rate which converged to the parallel rate at about EGP 51 per USD from EGP30.9 per USD. While this has helped the country to progress in terms of partially clearing trade backlogs, the market has not yet been fully liberated. The CBE also announced it would allow new currency derivatives to unlock liquidity in the local market, making available instruments to hedge against risks to the pound. According to IHS September 2024 report, a clear commitment of Egyptian authorities to announced reforms and further foreign currency inflows are needed to help improve Egypt’s situation. The source of this liquidity injection could also come from accelerating asset sales deals with the Gulf Cooperation Council countries or looking for new ways to attract more foreign exchange to the market.

Egyptian authorities must show their determination to commit to a durable flexible exchange rate regime, in line with the USD8 bn IMF loan agreement announced in early March 2024, and ensure a sustainable improvement of confidence in the foreign exchange regime and the currency. Although costly in the near term (high interest rates), this trajectory would maximize the likelihood of capital inflows, ease foreign exchange liquidity shortages and help to contain a future increase in inflation from currency weakening.

Debt Sustainability

The IMF estimates that the government debt to GDP ratio remains high at around 96.4% for the year 2024, and external debt to GDP be around 46.6% by the end of June 2024.

Egypt’s overall debt declined by the end of FY2023/2024, which ended on 30 June 2024, to 89% of GDP, down from 95.7% posted at the end of the FY2022/2023, according to July’s fiscal monthly report published by the Ministry of Finance. According to the report, the local debt eased to 66.7% of the GDP at the end of FY2023/2024, compared to 70.5% at the end of FY2022/2023. Moreover, the external debt declined to 22.3% at the end of FY2023/2024, down from 25.2% at the end of FY2022/2023.

Moody’s expects domestic borrowing costs will consume almost 65% of revenue at the end of fiscal 2024, a ratio that may temporarily deteriorate further considering the observed official currency devaluation. The agreed allocation of a large share of divestiture proceeds directly to the treasury to support debt sustainability will partly mitigate the highly adverse metrics.

Egypt aims to reduce the debt-to-GDP ratio to less than 85% by the end of the next fiscal year; as stated by the Minister of Finance in August 2024. And he added that the external debt balance of the budget agencies decreased by more than USD3.5 bn by the end of June 2024, by a reduction rate of more than 4% compared to June 2023. Noting that 7 years is the average life of the external debt of the budget agencies by the end of June 2024. Egypt pledged to decrease the high debt level to below 80 percent in 2027, in line with its commitments under the International Monetary Fund’s (IMF) programme.

The CBE’s report highlighted a decrease in Egypt’s overall external debt, which fell to USD160.6 bn by March 2024 from USD164.5 bn in September 2023. The CBE announced that Egypt made payments totalling USD23.8 bn towards its external debt between July 2023 and March 2024. External debt payments amount to USD34.9 bn in 2024, USD19.4 bn in 2025, USD25.2 bn in 2026, USD12.7 bn in 2027, and USD8.1 bn in 2028, as per the latest central bank disclosures. The government remains committed to fiscal consolidation and debt reduction through measures such as tax reforms, subsidy rationalization, and expenditure control.

Egypt and the IsDB Group

Egypt joined the IsDB on 12 August 1974 as one of its founding members. Since then, the Bank’s involvement in Egypt has focused on fostering sustainable, inclusive economic growth and poverty reduction through financing projects in infrastructure and supporting Youth employment and job creation.

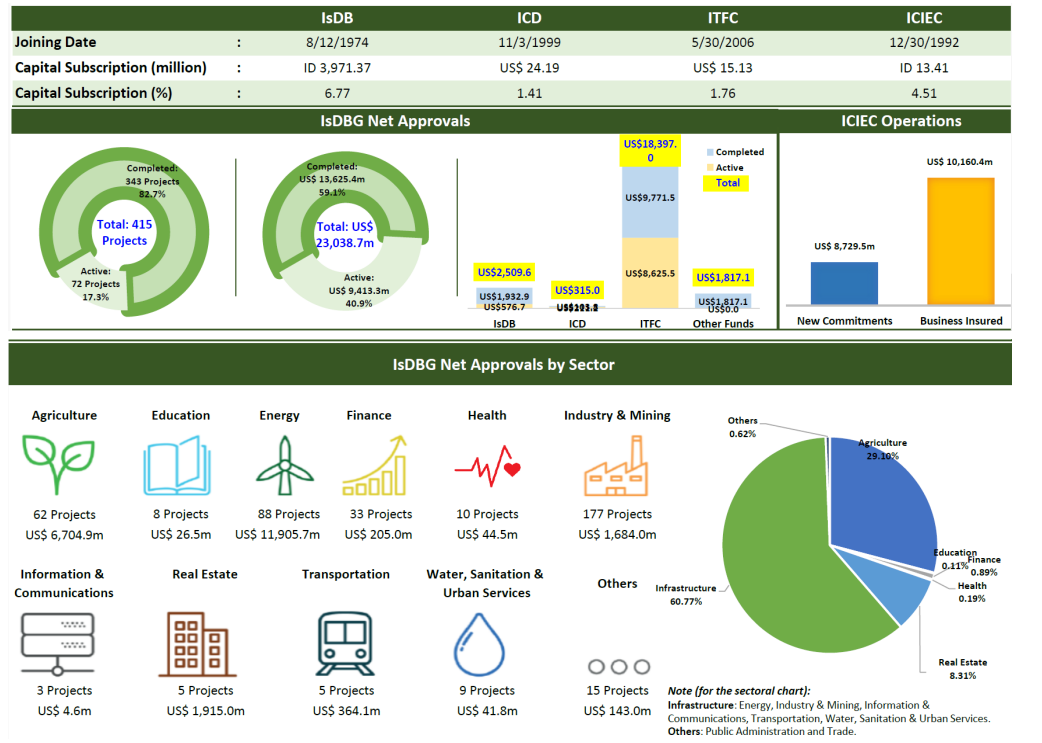

The first IsDB operation in Egypt was in September 1977. Egypt’s capital subscription to IsDB is ID3,971.37 mn, at 6.77%. Egypt is also a member of all IsDB Group Entities (ITFC, ICD, ICIEC, and IsDBi). Egypt is among the largest beneficiaries of the IsDB Group’s development financing. All IsDB Group entities have been active in Egypt. Since its inception, the IsDB Group has approved a total funding of about USD23.04 bn for Egypt. This includes about USD2.5 bn project financing by IsDB; USD315 mn supported by ICD; USD18.4 bn trade operations by ITFC, and USD1.8 bn by other IsDB Group funds and operations.

IsDB Group Cumulative Net Financing Approvals for Egypt Since Inception

Source: IsDB December 2024

Source: IsDB December 2024

Egypt’s Special Relationship with ICIEC?

Egypt has joined ICIEC since 1992 as a founding member state and has been one of its top 10 shareholders.

ICIEC and Egypt share a robust and enduring partnership, particularly with prominent entities like Elsewedy Electric, Afreximbank, and Arab Contractors. This strong foundation enables ICIEC to expand its collaboration with Egyptian businesses, unlocking new opportunities in Sub-Saharan Africa (SSA) through the Arab Africa Trade Bridges Programme. This initiative aims to facilitate trade and investment between Arab and African nations, positioning ICIEC as a key catalyst for regional economic integration. ICIEC has provided USD10.2 bn as business insured and USD8.7 bn as new commitments, as of September 2024.

Key ICIEC Transactions with Egypt?

ICIEC has made significant contributions to Egypt’s economic development through various projects and initiatives:

- Support to the government to import strategic commodities; both oil and food commodities to secure the country’s needs by collaborating with ITFC; where ITFC arranges for syndicated facilities and ICIEC insures some of the participants in those facilities to attract debt investments from foreign banks.

- Benban Solar Power Complex: ICIEC’s involvement in financing this massive solar power project in Aswan underscores its commitment to sustainable energy and infrastructure development.

- Lines of Financing to the Ministry of Finance: By providing a crucial financial support, ICIEC has helped the Egyptian government implement vital economic and social development programs.