Economic Outcomes are Steadily Improving due to an Impressive Range of Reforms and Commitment to Sound Public Finances and Inclusivity

Strategic Demography and Natural Resource Strength

Suriname, located on the northeastern coast of South America, is characterized by its ethno-culturally diverse population of approximately 600,000 people. The capital city, Paramaribo, serves as the political, economic, and cultural center of the country. The nation boasts a rich mix of ethnic groups, primarily Indo-Surinamese, Afro-Surinamese, Maroons, Javanese, and Amerindians, fostering a unique cultural tapestry that influences its social dynamics.

Natural resources are a cornerstone of Suriname’s economy, with significant deposits of bauxite (aluminum ore), gold, oil, and timber. The country is one of the largest producers of bauxite globally, and gold mining has become pivotal over recent years, contributing substantially to GDP. The abundance of tropical rainforests harbors a wealth of biodiversity, serving as both a natural asset and a potential challenge regarding conservation efforts and sustainable resource management. Water resources from the Amazon basin also highlight Suriname’s strategic geographical importance.

Government’s Economic Reform Agenda

President H.E. Mr. Chandrikapersad Santokhi’s administration is spearheading an ambitious economic reform agenda designed to restore fiscal and debt sustainability. The government’s plan emphasizes fiscal consolidation and debt restructuring aimed at reducing the national deficit while ensuring that vulnerable populations are protected through expanded social protection programs. The urgency for these reforms stems from the underlying economic challenges, exacerbated by the COVID-19 pandemic and declining commodity prices.

Key to these reforms is the establishment of a transparent fiscal framework that allows for better budget management and efficiency. The government has implemented measures to enhance governance and accountability in public finance management, ensuring that fiscal policy effectively supports sustainable growth. These reforms will be crucial in creating a stable economic environment that encourages domestic and foreign investment.

Suriname’s Debt Strategy and IMF Support

In alignment with its economic reform agenda, Suriname has initiated a comprehensive debt strategy to manage its burgeoning financial obligations. The international community, particularly the International Monetary Fund (IMF), has responded positively to Suriname’s requests for assistance.

In December 2021, the IMF approved the Extended Fund Facility (EFF) arrangement for Suriname, in an amount of equivalent to SDR472.8 million, aimed at providing financial support during this challenging economic transition.

With the currently disbursed amount of SDR337.1 million, the EFF program significantly contributed to enhanced fiscal policies leading to stabilizing the economy while simultaneously addressing social needs. One critical aspect of this strategy involved prioritizing strategic investments while managing deficits to restore confidence among stakeholders.

By engaging in these reforms supported by international financial institutions, such as the Islamic Development Bank (IsDB), Inter-American Development Bank, World Bank and others, the government is successfully navigating the challenging waters of public debt while laying a robust foundation for economic recovery.

SURINAME Key Economic and Institutional Indicators

| Country Name | Republic of Suriname |

|---|---|

| Population | 0.647 million |

| Real GDP Growth (% Change) | 2024 – 3.0% (projection), 2023 – 2.1% (estimate) |

| Inflation (Consumer Prices % Change) | 2024 – 20.7% (projection), 2023 – 51.6% (estimate) |

| Unemployment Rate | 2023 – 10.6% (estimate), 2024 – 10.3% (projection) |

| Exports Goods and Services (f.o.b.) | 2023 – USD2,534 million (estimate), 2024 – USD2,742 million (projection) |

| Imports of Goods and Services (f.o.b.) | 2023 – USD2,218 million (estimate), 2024 – USD2,339 million (projection) |

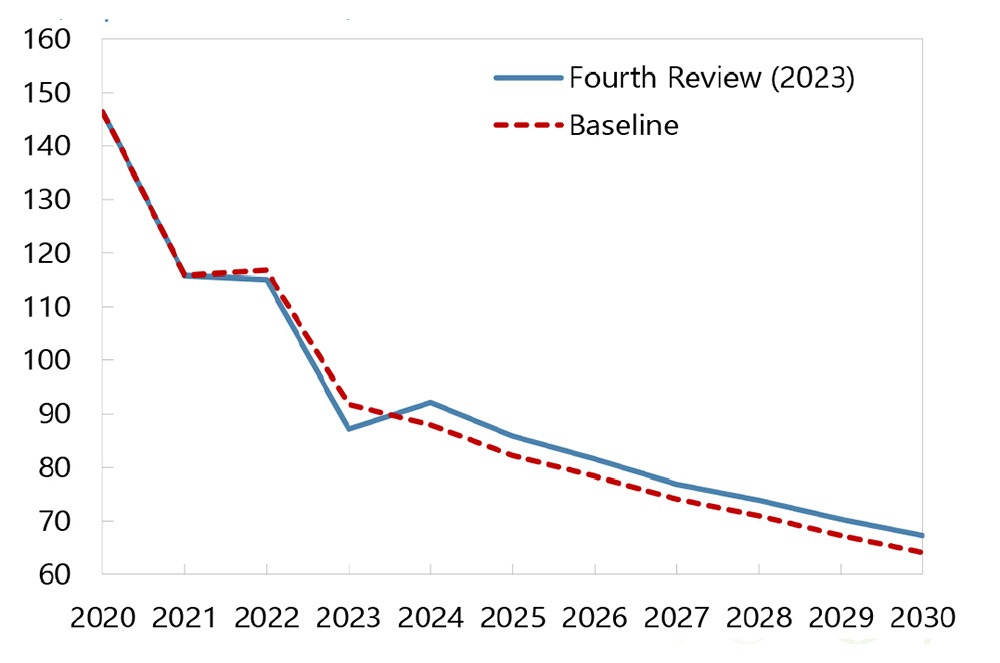

| Central Government Debt (% of GDP) | 2023 – 92.9% (estimate), 2024 – 87.9% (projection) |

| Special Drawing Rights (SDR) | 105.68 million |

| Quota (SDR: 128.9 million) | 128.9 million |

| Outstanding Purchases and Loans (SDR) | 290.4 million (June 30, 2024) |

| Number of Arrangements since Membership | 2 |

| Date of IMF Membership | 27 April 1978 |

| Date of IsDB Membership | December 1997 (as 52nd member state) |

| Subscribed Capital in IsDB | ID9.23 million (0.02% of total IsDB Capital) |

| Number of IsDB Group Projects Allocated | 36, of which 27 completed and 9 are active |

| Total volume of IsDB Group Funding to date | USD264 million |

| Date of ICIEC Membership | 21 January 2019 |

| Number of Islamic Banks | 1 – Trust Amanah Bank (2018) |

Source: Compiled by Mushtak Parker from IMF, IsDB and ICIEC data and disclosures

Date: September 2024

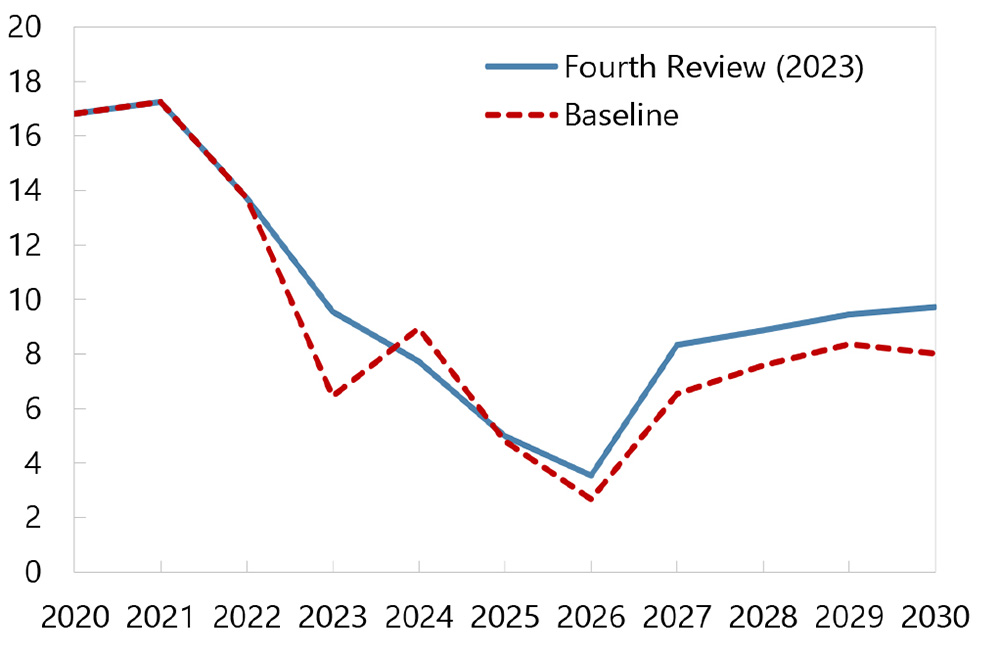

Suriname: Gross Financing Needs and Public Debt

Sources: CBvS, Ministry of Finance, and IMF staff estimates.

Sources: CBvS, Ministry of Finance, and IMF staff estimates.

Note: Gross financing needs do not include instruments used for the recapitalization of the CBvS.

Economic Agenda in the Context of Climate and Sustainable Development

Suriname is one of few countries in the world having negative carbon emissions primarily thanks to its extensive forest cover. Over 90 percent of Suriname’s land is covered by tropical rainforests of the Amazon Basin, which absorb CO2 from the atmosphere.

Suriname’s economic agenda is increasingly influenced by global priorities around climate change and sustainable development. In addition, Suriname has a relatively small population and limited sources of carbon emissions from transportation, energy production and manufacturing. Nevertheless, the government recognizes that the economy’s future lies in balancing growth with environmental sustainability.

Suriname’s wealth of natural resources can be harnessed to contribute to sustainable practices, especially with its significant forest cover that plays a vital role in carbon sequestration.

Significant efforts are underway to integrate climate considerations into national planning. The government is focusing on sustainable agriculture, eco-tourism, and renewable energy sources while committing to enhance the resilience of its infrastructure against climate-related risks.

Strategic partnerships with international organizations aim to facilitate knowledge transfer and investment in sustainable technologies, ensuring that the economic agenda aligns with the UN Sustainable Development Goals (SDGs).

However, challenges persist. Suriname faces immediate threats from deforestation, mining activities, and the ongoing impacts of climate change, such as rising sea levels, floods and extreme weather events. Balancing economic activities with environmental protection requires careful management and active engagement with local communities.

Cooperation with IsDB Group

Suriname has demonstrated a proactive approach in fostering cooperation with the IsDB Group. The Group launched the new Country Engagement Framework (CEF) for the Republic of Suriname (2024-2026) on 1st May 2024 in Riyadh on the sidelines of the 2024 IsDB Group’s Annual Meetings and the Bank’s 50th Anniversary Golden Jubilee.

Going forward, the IsDB Group will focus on two main pillars of engagement during 2024-2026: (i) Igniting Growth and Diversification will support three sectors: energy, agro-industry, and water and sanitation, and (ii) Building Human Capital for the Future will support complementary human development by focusing on health, education, and affordable housing.

Cross-cutting CEF pillars will include Islamic finance sector development and small and medium-sized enterprise (SME) support, climate change, women and youth empowerment, and capacity development.

As part of implementation of the Suriname CEF, and as a significant recent development in this partnership IsDB approved a financing for the “Expansion of Transmission and Distribution Systems” project, amounting to more than USD105.7 million, of which IsDB contributed USD47.7 million, with the participation and co-financing by the Saudi Fund for Development (SFD) and OPEC Fund for International Development (OFID).

This project is essential not only for improving energy infrastructure but also for supporting economic recovery by providing reliable electricity to both urban and rural areas. Improved energy access is critical for local businesses and overall economic activity.

Potential for Future Cooperation with IsDB Group/ ICIEC

Suriname is a member of all other IsDB Group Entities, including ICIEC joining in January 2019. The future potential for cooperation between Suriname and ICIEC holds promise, particularly in promoting investment to and international commerce with Suriname. Recent improvements in the economy reflected in steady recovery and stabilization of macroeconomic fundamentals, there is a growing interest from investors’ community in mining, agrobusiness, tourism and oil sector.

ICIEC’s risk mitigation products and services could provide Suriname with ample opportunities to attract FDI flows, boost trade and further enhance growth related sectors in the years to come.

The IsDB Group facilitated the establishment of the first and only Islamic bank in the region, Trust Amanah in 2018, while also extending Technical Assistance to the Central Bank to create an enabling environment for further expansion of the Islamic Banking and Finance industry in Suriname.