The Promise of Sukuk and ICIEC’s Sukuk Insurance Policy

Türkiye’s is the fourth largest Sukuk issuer globally and among the three G20 countries active in the Sukuk market, according to Fitch Ratings’s latest Türkiye DCM Dashboard.

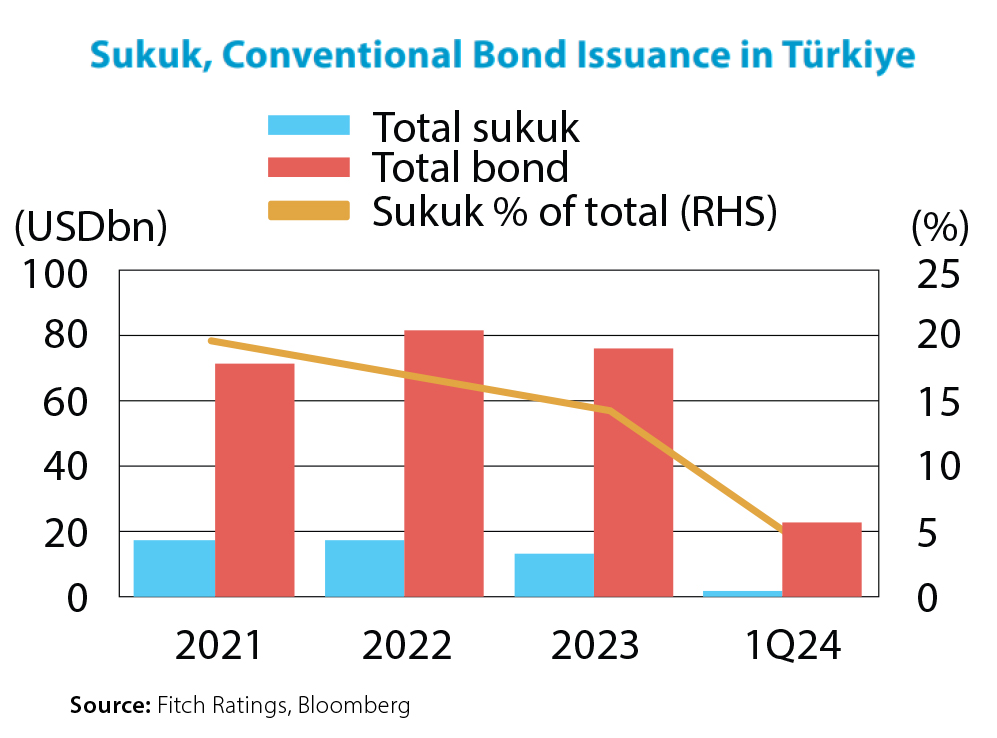

Sukuk rose to 15% of the 2023 Debt Capital Market (DCM) issuance (2018:6.2%), and 6.5% of DCM outstanding in 1Q24 (2021:4.7%). US dollar Sukuk issuers generally aim to comply with AAOIFI Sharia standards to not exclude UAE Islamic banks. In 2022, on back of the sovereign seeking alternative funding amidst weak investor demand, Sukuk peaked at 40% of US dollar DCM issues. The Turkish DCM rose 8% y-o-y to USD422.6 billion outstanding at end Q1 2024, with the majority in Turkish lira (63%), followed by US dollars (32%), and euros (5%). The recent revival in foreign-currency debt issuances is a sign of lower near-term refinancing risks due to improved investor sentiment since Türkiye’s adoption of more conventional macroeconomic policies and on the back of record export receipts.

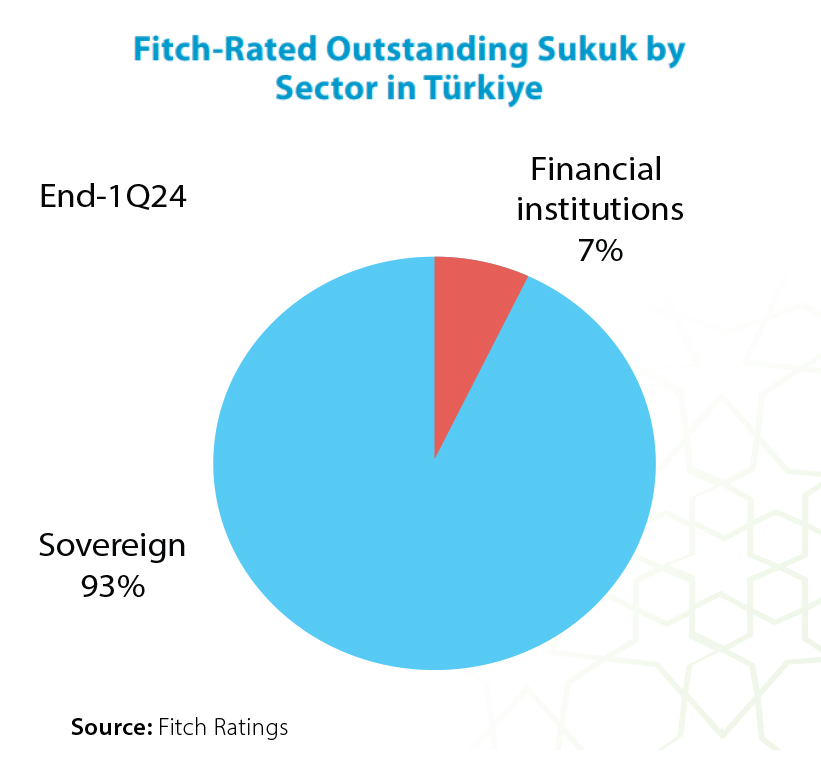

In March, Fitch upgraded Türkiye to ‘B+’/Positive. Fitch rates 90% of Turkish US dollar Sukuk (USD12.3 billion), with 93% rated ‘B+’.

According to Fitch’s Global Head of Islamic Finance, Bashar Al Natoor, there are signs of rated banks and corporates returning to the dollar debt market since 2H 2023, reflecting improved access and strategic moves to maintain their presence by locking in more acceptable, although still high, pricing, following a prolonged period of very limited issuance.

The reasons are clear – general low government debt, with a strong revenue base, manageable debt amortisations and improved financing conditions. Türkiye issued USD10 billion in external markets in 2023, and the current financing plan assumes a similar amount for 2024. The sovereign issued a USD3 billion conventional bond in February 2024 with the lowest spread of the past four years. In 2022, on back of the sovereign seeking alternative funding amidst weak investor demand, Sukuk peaked at 40% of the US dollar DCM. By Q1 2024, Lease certificates (Sukuk AlIjarah) accounted for 25.9% of fixed coupon Turkish lira-denominated issuances.

Despite the above, the Türkiye Sukuk market dynamics relative Saudi Arabia, Malaysia and the UAE has a low issuance base, and therefore a low critical mass of offerings and market depth. The involvement of bank and corporate issuers is also low. Here ICIEC’s Sukuk Insurance Policy could act as a vital facilitator/market maker especially for quasi-sovereign and other government-linked agency issuers.

The Turkish Treasury is a proactive issuer of lease certificates as part of a wider universe of government fund-raising instruments which include bonds and Sukuk – leasing certificates and bonds, FX denominated issuances and gold-backed certificates/bonds “in order to increase the domestic savings, broaden the investor base and diversify borrowing instruments.”

The Türkiye Treasury in fact raised TRY120,994.22 million (USD4,174.22 million) from the domestic market through the issuance of Fixed Rate Lease Certificate (Sukuk al Ijarah) in nine auctions in FY2023. Thus far for the first three months of 2024, the Türkiye Treasury has raised TRY2312,988.90 million (USD403.54 million) through three consecutive auctions of Fixed Rate Lease Certificates.

The Role of Digital Transformation in Türkiye’s Trade Sector

Digital transformation in Türkiye’s trade sector is pivotal in enhancing economic infrastructure and operational efficiency. The adoption of digital solutions in trade finance has streamlined processes, reduced costs, and improved security. The OBIC Workshop held in Istanbul in 2023 exemplified the importance of information sharing and business intelligence in supporting trade and investment decisions among OIC member states, highlighting the strategic use of digital technologies to foster a more integrated and efficient market environment.

Conclusion

Türkiye’s trade and economic landscape is characterized by a rich history of strategic policymaking, robust export growth, and innovative development projects. Through strategic international collaborations and a forward-looking approach to digital transformation, Türkiye is well-positioned to continue its economic growth trajectory and play a central role in the global economic arena.

Türkiye Treasury TRY Fixed Rate Lease Certificates 2023/24 to Date

| Date | Volume (TRY mns) | Tenor | Maturity Date | Fixed Rental Rate | Rental Payment Period |

|---|---|---|---|---|---|

| 25/01/2023 | TRY14,008.7 mn | 5 Years | 19/01/2028 | 4.79% | 6 months |

| 22/02/2023 | TRY9,946.00 mn | 5 Years | 16/02/2028 | 4.64% | 6 months |

| 08/03/2023 | TRY5,413.00 mn | 10 Years | 23/02/2033 | 5.71% | 6 months |

| 21/06/2023 | TRY12,086.00 mn | 5 Years | 14/06/2028 | 8.62% | 6 months |

| 08/08/2023 | TRY27,148.00 mn | 5 Years | 02/08/2028 | 9.79% | 6 months |

| 09/09/2023 | TRY12,373.00 mn | 10 Years | 07/09/2033 | 13.19% | 6 months |

| 18/10/2023 | TRY28,927.23 mn | 5 Years | 11/10/2028 | 14.26% | 6 months |

| 15/11/2023 | TRY3,566.90 mn | 5 Years | 08/11/2028 | 16.48% | 6 months |

| 13/12/2023 | TRY10,000.00 mn | 5 Years | 08/12/2028 | 14.28% | 6 months |

| 24/01/2024 | TRY5,856.10 mn | 5 Years | 17/01/2029 | 14.34% | 6 months |

| 21/02/2024 | TRY3,569.50 mn | 5 Years | 14/02/2029 | 13.79% | 6 months |

| 20/03/2024 | TRY3,562.30 mn | 5 Years | 14/03/2029 | 15.00% | 6 months |

ICIEC is committed to advancing its support for Türkiye’s development through a multifaceted strategy that emphasizes critical infrastructure, innovative financial products, and sustainable development. These include:

- Support for Critical Infrastructure: ICIEC plans to continue its robust backing of vital infrastructure projects within Türkiye, focusing on sectors such as transportation, energy, and telecommunications. These efforts are crucial for enhancing the nation’s economic foundations and connectivity.

- Innovation in Financial Products: With the introduction of Sukuk insurance products, ICIEC aims to propel the growth of Islamic finance, especially fixed income capital market debt products. This initiative is designed to attract global investors by providing secure, Shariah-compliant investment opportunities, thereby broadening the financial landscape in Türkiye.

- Environmental Sustainability and PPPs: ICIEC will actively promote environmentally sustainable projects while encouraging the formation of Public-Private Partnerships (PPPs). These endeavors are intended to leverage private sector efficiencies and foster investments that are not only economically viable but also environmentally responsible.

- Mobilization of Private Sector Capital: By acting as a catalyst for mobilizing private sector capital towards Sustainable Development Goals (SDGs), ICIEC aims to contribute significantly to global efforts in achieving these targets. This strategic focus is expected to support sustainable economic growth and social development.

- Expansion into Africa: Reflecting Türkiye’s strategic interests, ICIEC is poised to increase its active involvement in Africa. Upcoming projects on the continent will benefit from ICIEC’s expertise and support, aligning with Türkiye’s broader geopolitical and economic objectives.

Through these strategic initiatives, ICIEC not only reinforces its commitment to supporting Türkiye’s economic trajectory but also aligns its operations with broader global standards and development goals, ensuring a sustainable and prosperous future.