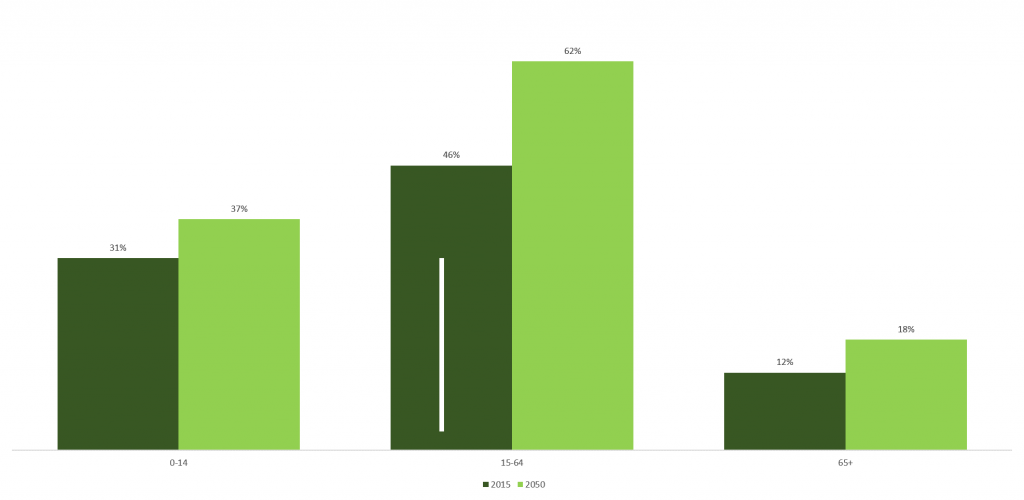

With OIC membership currently spanning 57 countries across Africa, Asia, Middle East and Latin America, ranging from Indonesia to Suriname, the Organisation of Islamic Cooperation (OIC) is a grouping of countries containing diverse economies in terms of structure and size. Amongst these economies, significant volumes of trade and investment flow, with potential for a substantial increase. The OIC market also provides immense opportunities for trade and investments, given its growing demographics. The current combined population of OIC Member Countries sits at 1.8 billion people. Recent reports suggest that this number will witness population growth across all age groups over the next 30 years, with a crucial increase in the working-age population of 15-64 years (see figure 1).

Figure 1: OIC Member Countries Population by Age Group, 2015 & 2050

Source: UN World Populations Prospects

This key demographic age group is expected to constitute more than 50% of OIC’s population by 2050. It will allow OIC Member Countries to benefit from what is referred to as “the demographic dividend[1]“. Demographic dividend occurs when a country’s population has a low child and old-age dependency ratio and a high working-age population. There is a correlation between creating adequate job opportunities to sustain the working age in countries with a sizeable working-age group and increased income per capita. The increase in income generation would result in increased consumption and higher savings rates, translating into significant economic growth. Alongside a growing population comes the demand for infrastructure development, goods, services and increased food security. This demand presents an opportunity for businesses in OIC Member Countries to grow.

The current snapshot of intra-OIC trade and investments

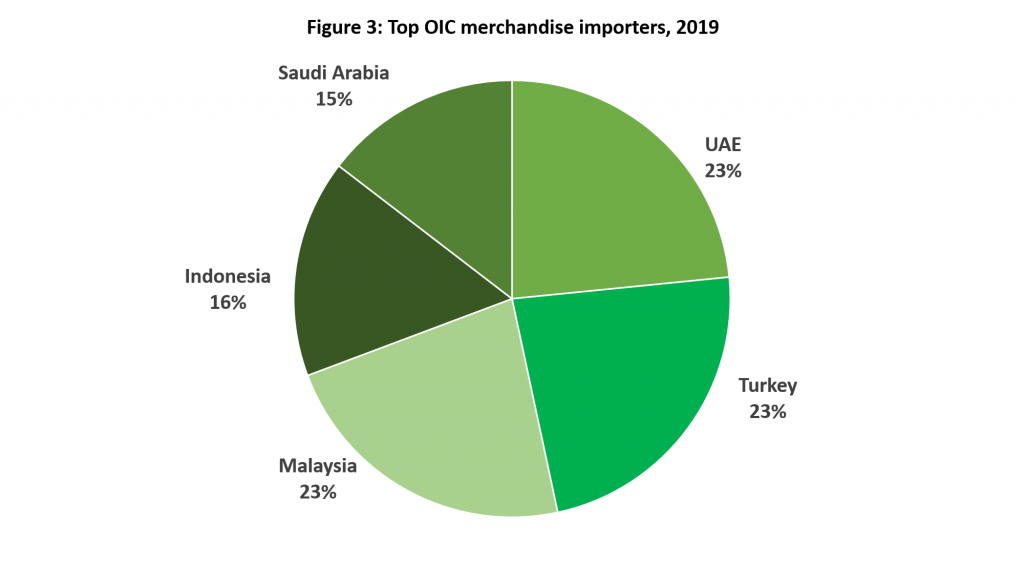

In alignment with the growing opportunities in the market, the share of intra-OIC trade has also been growing in recent years, from 17.3% in 2011 to 19.6% in 2020 (see figure 2). Intra-OIC export flows have been steadily increasing, from USD 260 billion in 2016 to USD 327 billion in 2019. The top exporters are Malaysia, United Arab Emirates, Saudi Arabia, Türkiye, and Indonesia, collectively accounting for 62.7% of all OIC exports[2].

Although intra-OIC trade has been growing in recent years, the current level of trade integration among OIC Member Countries is still lower than is desired. At the 13th Islamic Summit held in April 2016 in Istanbul, the Committee for Economic and Commercial Co-operation of the OIC (COMCEC) adopted a New Ten-Year Plan of Action to achieve a 25% intra-OIC trade share by 2025. Currently, only 28 of the OIC’s 57 Member States have attained the target of a 25% intra-OIC trade share. Given that the current figure for the OIC is 5% below the target, there is still much room for improvement. Increasing the share of intra-OIC trade is a strategic objective as it allows the region to be more resilient in the face of trade shocks, such as the one engendered by the COVID-19 pandemic. In times of crisis, it is much easier to collaborate with international partners and neighbours committed to your same ideals, customs, economic models and culture. By increasing intra-OIC trade, ICIEC will be able to fortify OIC economies, reduce their exposure to volatility, and better protect the lives and livelihoods of countless people across the Ummah.

Figure 4: Share of intra-OIC trade, 2011 – 2020

Source: Calculated using IMF Directions of Trade Statistics (DOTS)

OIC’s leading exporters and importers are concentrated in these same five countries (see figure 3 and 4). Exports are traditionally concentrated in mineral fuels and non-fuel primary commodities, which tend to involve the least technological intensity. For sustainable and long-term economic development, OIC Member Countries need to diversify exports into other sectors, hedge export revenues against volatile commodity prices.

ICIEC’s role in facilitating intra-OIC trade and investments

ICIEC plays a crucial role in promoting intra-OIC trade and investment through the strategic provision of its insurance cover. ICIEC’s Documentary Credit Insurance Policy, Credit Insurance Products, Bank Master Policy, and other solutions bridge the market failures that often inhibit intra-OIC trade and investments. These instruments catalyze impact for export sector development, Shari’ah compliant financial sector development, and support member country and human development.

In providing risk mitigation instruments and facilitating access to trade finance, ICIEC supports exporters of all sizes to grow their businesses and ultimately supports Member Countries to prosper economically. ICIEC’s presence in the financial market increases the capacity of its partner financial institutions in OIC countries to offer Shari’ah-compliant insurance services and access to finance, further setting an example as the only multilateral Takaful credit insurer. At the same time, ICIEC’s Sovereign Sukuk Insurance Policy aims to strengthen Islamic Finance capital markets and mobilize Shari’ah-compliant capital for strategic investment projects in Member Countries. ICIEC also promotes intra-OIC trade and investments by underwriting investments in strategic sectors, particularly in the least Developed Member Countries that are at higher risk and therefore not as attractive to traditional market players. By facilitating trade within OIC, ICIEC strengthens the organization and provides equal opportunities for all OIC Member Countries to trade.

Since its inception, ICIEC has insured USD 68.5 billion in imports and exports. In 2020 alone, the Corporation insured USD 4.47 billion of intra-OIC trade. ICIEC’s insurance enables Member Countries to import strategic goods such as food, export products that generate foreign currency revenue for the country and strengthen strategic sectors through infrastructure development. ICIEC’s insurance, which helps to catalyze intra-OIC trade, is also critical for assisting Member Countries in reaching the 25% intra-OIC trade target set by COMCEC for 2025, thereby enhancing regional economic integration and resilience.

Looking ahead, ICIEC is continuing to expand its operations in OIC Member Countries to strengthen intra-OIC trade. ICIEC has also instituted several initiatives to support the least developed Member Countries to participate more effectively in trade.

Toward Resilience and Prosperity Across the OIC

Enhancing the quantity of intra-OIC trade has been central to ICIEC’s operations since its inception. 2020 has exemplified just how vital this aim is to every Member Country in the OIC. The year showed OIC economies’ supply chains and trade partnerships with other actors across the globe are more fragile than once believed. There is a growing need to increase the Intra-OIC trade to bolster the resilience and prosperity of ICIEC’s Member Countries’ economies. The untapped potential of intra-OIC trade and investment can more easily be achieved through ICIEC’s steadfast dedication to ensuring that potential OIC trade partners can engage in trade and investment transactions and by being a powerful risk mitigant. As OIC countries lean on one another to exchange goods and services, the Ummah will be more economically secure, resilient to outside shocks and in harmony with its partners.

[1] https://demographicdividend.org/

[2] https://sesricdiag.blob.core.windows.net/sesric-site-blob/imgs/news/2461-SESRIC-Trade-Goods.pdf