Research suggests that renewables and green finance is the new powerhouse for trade finance and project guarantees in 2025, fuelled by rising demand for sustainability finance and investment especially from private capital, and greater regulatory, reporting and disclosure compliance standards and requirements. A new goal that emerged from the UAE Consensus at COP28 in Dubai in 2023 is the tripling of renewable power capacity by 2030 – a key role in rapidly and drastically reducing global greenhouse gas emissions to keep the world on a 1.5°C pathway. In 2024, the COP28 Presidency designated the International Renewable Energy Agency (IRENA) as the custodian agency for tracking and reporting on the various goals each year through 2030. The latest data is sobering and finds that across almost all metrics – excepting Solar PV capacity growth – the world has fallen further behind the trajectory of renewable power capacity additions and energy efficiency improvements needed to meet the UAE Consensus goals. Mushtak Parker surveys the initiatives to enable a course-correction that will re-align energy transition with the Paris Agreement goals and the 2030 UN SDG targets, and considers the role of trade finance, credit and investment insurance and ICIEC in supporting renewable energy through innovative funding and risk management solutions.

Despite a record growth in renewables in 2023, the global net zero and energy transition targets risks are falling well short. Where there is deployment, significant regional disparities emerge with the Global South increasingly being left behind.

Low-and-Medium-Income-Countries (LMICS) whose carbon emissions are miniscule compared to the Western economies and the large greenhouse gas emitters such as China, India, Russia are disproportionately affected especially in catastrophic climate-related events such as an increased incidence of floods, landslides, drought, tornadoes and hurricanes.

As Mr. Flavien Joubert, Minister for Agriculture, Climate Change and Environment of Seychelles, comprised of an archipelago of small islands and very vulnerable to rising sea levels and other climate-related events, stressed at COP29 in Baku “while the potential for renewable energy is vast, the road to harnessing it effectively is laden with obstacles. It’s imperative that we approach these challenges with determination, innovation, and solidarity.”

Several climate scientists, policymakers from the Global South, NGOs and activists maintain that what is needed is a fundamental cultural change across all stakeholders to support climate change policy, the urgency of resource mobilisation, risk management, implementation and collaboration. There are signs that global goal or tripling renewables by 2030 is starting to gain momentum uniting behind the UAE Consensus at COP28 in Dubai. The danger is without the traction and investment, this may be misconstrued as a mere gesture of doing too little too late. Institutions across the board are scurrying towards establishing committees, working groups and their own sustainability, ESG, energy transition and climate action playbooks, strategies and assessments. Platts, part of S&P Global Commodity Insights, similarly, launched Renewable Transport Fuel Certificate (RTFC) assessments Platts, has launched daily assessments for UK Renewable Transport Fuel Certificates (RTFC), effective Jan. 6.

These new assessments follow the launch of the German greenhouse gas quota (THG) assessments in November 2024 and the Netherlands renewable energy units (HBE) assessments in January 2024, reflecting the growing importance of the relevant tickets markets in determining biofuels prices in Europe.

Another major development is the introduction of the European Green Bond Standard (EGBS) by the European Union, which enabled new issuers now choosing to use the new “European Green Bond” label, launched on 21 December 2024, when marketing a euro-denominated green bond to investors. According to the Institute for Energy Economics and Financial Analysis, this could see billions of euros of green bonds aligned with the EGBS.

Part of the problem is that these playbooks are based on overlapping concepts and taxonomies which creates confusion and cynicism and gives succour to the rising populist push back against climate related and clean energy policies in some countries including the US. The number of taxonomies – more than a dozen thus far – makes a mockery of any semblance to collaboration as countries or regional groups try to jockey for ascendancy more to do with economic self-interest than climate mitigation and adaptation. Whether it is the UNEP, OECD, EU or any other gatekeeper organisation, it is high time the COP process designs and embrace a dedicated, unified and globally accepted taxonomy relating to the components of climate change perhaps in the form of a Treaty or Convention. This is vital because it would create a level playing field for all actors and deal with the issue of fragmentation and de-globalisation.

The stand-off between continued fossil fuel activities and transition to renewables is one reason why the latter has not flourished at the required pace. This so-called stand-off is NOT a zero-sum game as it is often perceived by some governments and stakeholders. We have long past the metric of “Let the Polluters Pay’ and of the large economies and carbon emitters such as China, India and Brazil crying foul over the unabashed historical emissions related to the largely western economies which fuelled their development and prosperity whether through the Industrial Revolution and the scramble for colonial largesse. While compromise should be the order of the now, progress towards the Paris and UN SDG goals will depend on the stated acknowledgement of a shared solution based on pragmatism, urgency, resource commitment and achievable goals, devoid of ideology, hubris and obfuscation.

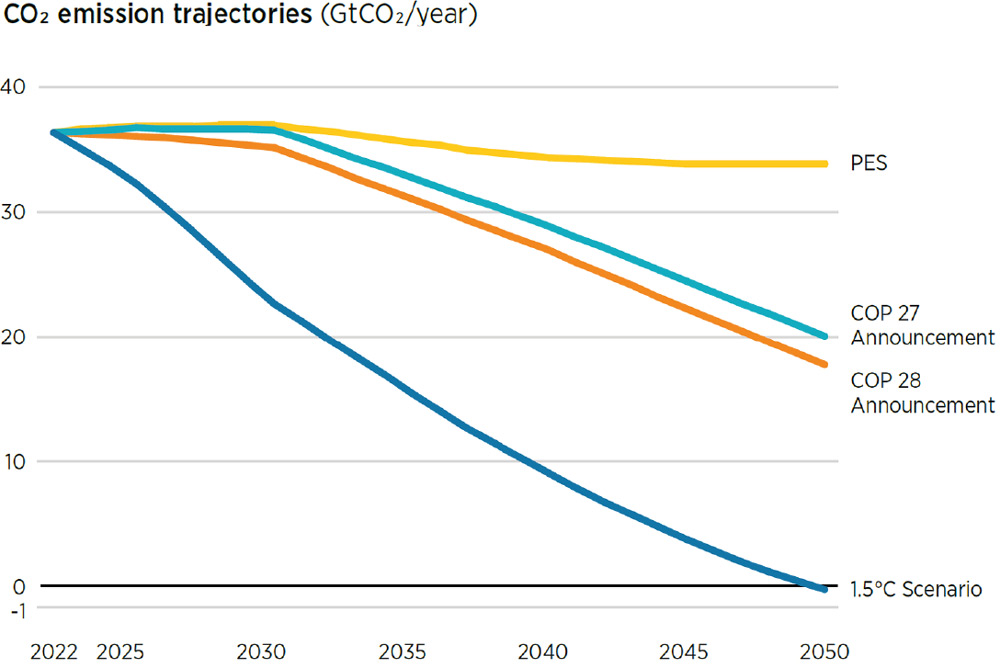

Energy-related CO2 emission trajectories

Source: IRENA (2024), World Energy Transitions Outlook at www.irena.org

Proactive Engagement on Climate Finance and Risk Mitigation

The credit and investment insurance (CII) industry has proactively engaged with the climate action ecosystem. Many multilateral insurers such as ICIEC and MIGA, and national and private export credit agencies are signed up to the Principles of Responsible Insurance. Similarly, the Net Zero Export Credit Agencies Alliance (NZECAA) launched by a group of ECAs led by UK Export Finance (UKEF) under the aegis of the United Nations Environment Programme Finance Initiative (UNEPFI) has the simple mandate of promoting the role of export credit in achieving net zero emissions by 2050 and limiting global warming to 1.5°C, in collaboration with the Glasgow Financial Alliance for Net Zero (GFANZ).UKEF, which has a long-standing collaboration with ICIEC, also launched the Greatest Opportunities and Risks for Export Credit and PRI Industry in 2024 support package for transactions supporting climate adaptation and sustainability across Africa and the Middle East, including a GBP226 mn facility for the Iraqi Government to develop clean water and sewage treatment infrastructure in Hillah City.

The Berne Union (BU), the leading global association for the export credit and investment insurance industry of which ICIEC is a proactive member, has a well-established Climate Working Group which organises regular multi-stakeholder workshops and meetings on credit insurance and climate-related topics. The latest one scheduled is at end of February 2025 in London and will focus on the practical implementation of sustainability in the export credit and investment insurance industry. “The objective,” says BU, “is to establish a dialogue which can connect the thread of sustainability implementation across the industry, from policy and strategy through technical analysis to delivery in concrete transactions.” Of note is the focus on “exploring an overarching framework for sustainability in export credit and investment insurance industry.”

Cumulative carbon dioxide emissions by region, 1850-2020

Based on: Global Carbon Budget, with major processing by Our World in Data (Andrew and Peters, 2024).

Notes: The United States had the highest share (25%) of cumulative global emissions between 1850 and 2020. It was followed by the EU27 + the United Kingdom, at 22.5%, and China, at 14%. Africa’s cumulative share is just 2.7%. Further, the average American had a carbon footprint of 14 tonnes of carbon dioxide equivalent (tCO2eq) in 2020, while the average African had a footprint of 0.95 tCO2eq. The required global per capita average to achieve the 1.5°C target is 2.0 tCO2eq (AfDB, 2022). EU27 = 27 Member States of the European Union; Gt = gigatonnes.

At the same time the 15th Assembly of IRENA themed ‘Accelerating the Renewable Energy Transition – The Way Forward (Energy security, Socio-economic development and Financing options)” convenes in Abu Dhabi in January 2025 coinciding with the 5th World Energy Transition Day, basically to evaluate progress and outline actions to accelerate the global renewable energy transition.

The various sessions aim to address emerging global trends and pressing issues, such as achieving the tripling the renewable energy goal by 2030 through international cooperation, raising ambitions for the upcoming Nationally Determined Contributions (NDC 3.0), charting energy transition pathways in emerging economies, ensuring financial flows for an inclusive transition, and leveraging innovative investment tools.

Erstwhile BU President, Ms. Maëlia Dufour, also a seasoned credit insurer as Chief International Officer, BPIfrance Assurance Export, confirmed in a recent interview with ICIEC Newsletter that “the two top priorities in demand according to our members is a big increase in demand to underwrite SME business and all aspects of climate related projects involving green and transition projects. We deal a lot with clean energy transition projects and green projects. Regarding climate action and finance, we look at three things: i) Decarbonisation of our portfolio; ii) Creating financial incentives to better insure green and transition projects; iii) Government policies and strategies and considering the statements of the various COPs.”

The phasing out of fossil fuels will take some time, she added. “The credit insurance industry is no longer interested in underwriting the coal, oil and gas industries. There are some countries that have been very clear in that that they will not support investments in fossil fuels. There are new emerging sectors such as critical minerals – nickel, manganese, lithium, cobalt etc. We see greater movement in this direction, and it is now becoming a priority sector for our members.”

Ms. Dufour’s successor, Mr. Yuichiro Akita of NEXI, who was elected as the new President of the BU in October, has lost no time in articulating his new forward-thinking “STRIDE” framework, ‘Sustainability Through Resilience, Innovation, and Diversity for Empowerment,’ which emphasises the need for deep collaboration across BU’s diverse membership base and unprecedented adaptability in confronting climate change, geopolitical shifts, digitalisation, and technological risk.

The changing landscape of the CII industry is highlighted by the latest data from the BU where the industry supported USD2.46 trillion in new export credit commitments the first half of 2024. This compared with BU members annually providing around USD2.5 trillion of payment risk protection to banks, exporters and investors – equivalent to 13% of world cross border trade for goods and services.

Thus, it is not surprising that Members of the Berne Union in its Business Confidence Index Survey (BCIS) for Second Half 2024 signalled that opportunities for growth lie in supporting SMEs and investment in renewables and the green transition. According to the Survey findings, “a recurring theme among members is the anticipated surge in demand from investment in renewable energy projects, with renewable energy and the green transition identified as the two greatest opportunities for their organizations over the next six months. Regionally, higher demand is expected to materialise in Sub-Saharan Africa and the MENA region, where many members have a strategic focus.”

These two regions are where the overwhelming majority of IsDB’s and ICIEC’s membership are located and could not illustrate the business case for more ICIEC involvement in underwriting such business. On a 1-4 scale, 4 being most important, 70% of respondents ranked Renewables as a 3 or 4, and 63% ranked Green Transition as a 3 or 4 in terms of greatest opportunities for their organisation in the next six months.

Renewables – the State of the Sector

No sooner had IRENA Director-General Francesco La Camera proclaimed that 2024 marks a year of records and a pivotal moment in the global energy transition as renewable energy surges to unprecedented heights, in the same breath he gave a health warning that “despite the remarkable progress, the pace of change remains insufficient to meet the ambitious goal of tripling renewable energy capacity by 2030 – a critical milestone for keeping global temperature rise below 1.5°C.”

The entire narrative relating to climate change, action, adaptation, mitigation and finance is couched in this fundamental dichotomy. As if the march towards a world bereft of fossil fuel generated power, towards a sustainable renewable energy dispensation encompassing hydro, solar, wing, bioenergy, geothermal and marine energy, is held hostage by this perversity of a clash of energy resources harnessing pitting the evidence-led science of global warming against the climate sceptics, distractors and deniers.

There is no doubt that the fossil fuel-driven growth model has proven to be unsustainable for both people and planet, and the immediate future is that of an evolving energy landscape – one in which fossil fuels inevitably play a diminishing role. The latest data from IRENA confirms global renewable generation capacity (GW) of 3865 GW in 2023, 16.2 million jobs created in renewable energy sector albeit almost half of them in China, and power generation costs (2023 USD/kWh) flattening out for PV, Onshore Wind, Offshore Wind, and Concentrating Solar Power since 2020.

Today, even without subsidies, says IRENA, solar and wind power stand cost-competitive with fossil fuels and have emerged as the preferred choices for new power generation. In fact, renewables accounted for 86% of all new power generation in 2022. The sector now employs more people than the fossil fuel sector. In the UK in 2024 wind power contributed more to the national grid than natural gas for the first time.

Trade route disruptions, conflicts, and economic uncertainties, have all served to undermine or at least slow down the transition to clean energy. The LMICS despair because as disproportionate victims of climate change, they want more emphasis on a just transition which incorporates a fair financial allocation for mitigation and adaptation and removing the inequalities and barriers to affordable and equitable climate finance.

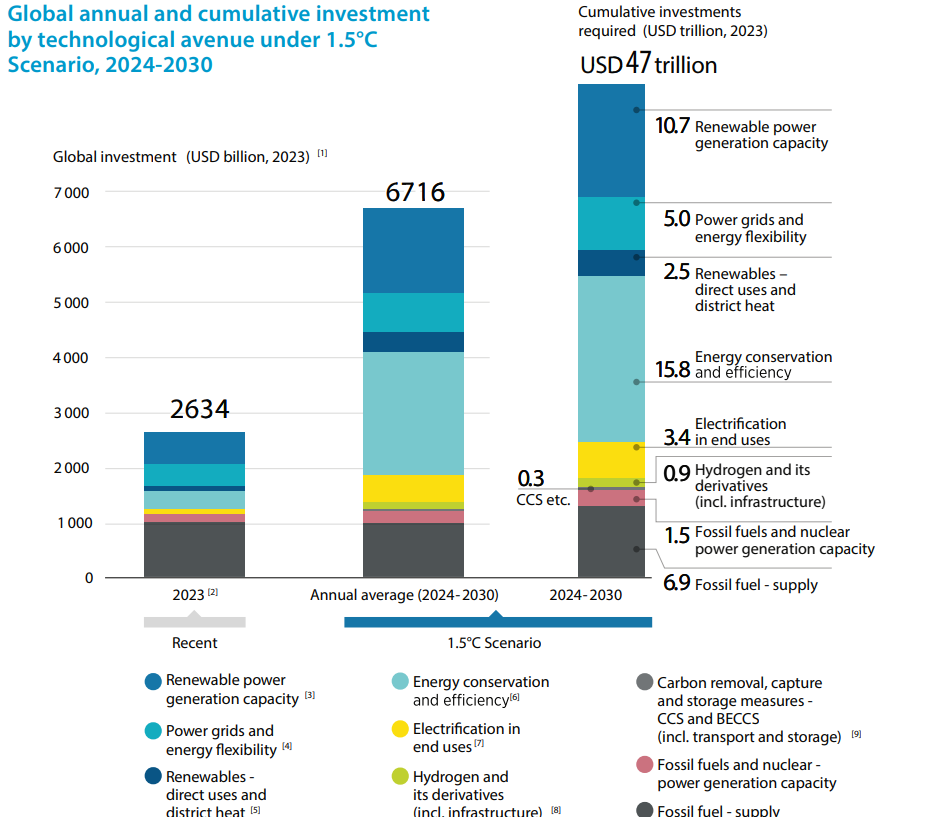

The reality according to the latest IRENA data which also draws from the International Energy Agency data, annual investment in renewable capacity would have to triple, from a new record high of USD570 bn in 2023 to USD1.5 trillion every year between 2024 and 2030, thus confirming the first official progress report of the landmark energy goals established by the UAE Consensus at COP28 in Dubai. Tripling renewable power capacity and doubling of energy efficiency to meet the global goals, installed renewable capacity would have to grow from 3.9 terawatt (TW) today to 11.2 TW by 2030, requiring an additional 7.3 TW in less than six years. Yet, current national plans are projected to leave a global collective gap of 3.8 TW by 2030, falling short of the goal by 34%.

In addition, notes the progress report, the annual energy intensity improvement rate must increase from 2% in 2022 to 4% on yearly base up to 2030. This will require faster progress in efficiency measures and electrification across multiple sectors, including transport, building and industry.by 2030 are critical enablers for keeping the 1.5°C goal within reach.

These shortfalls, says IRENA’s Francesco La Camera highlight the inadequacy of existing policies and plans to limit global temperature rise to 1.5°C, underscoring the need for urgent policy interventions and massive investment. The third round of Nationally Determined Contributions (NDCs) under the Paris Agreement in 2025 must close the gap towards 2030.

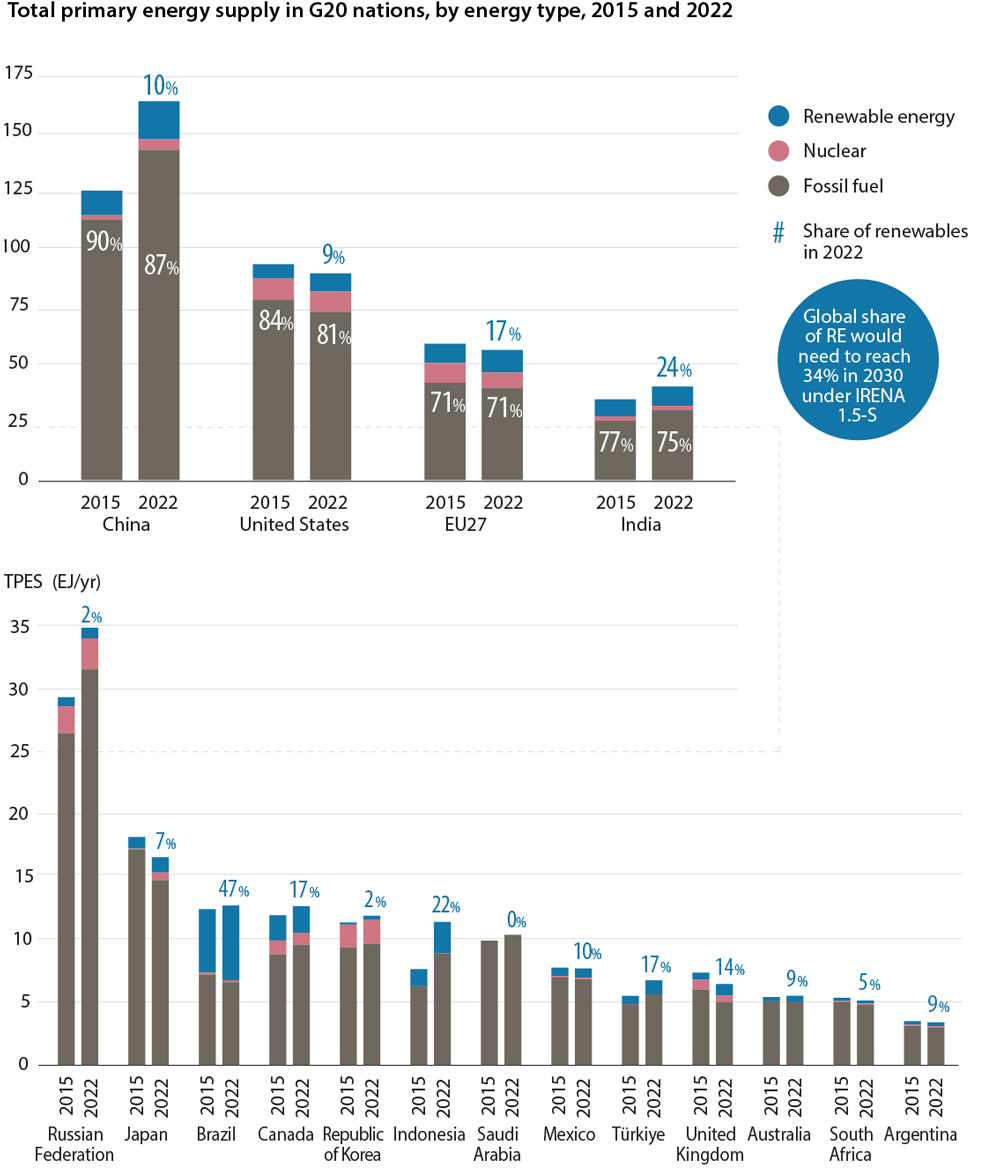

World Energy Transitions Outlook 2024

Note: Historical data from (IEA, 2024); Renewables include hydro, solar, wind, bioenergy, geothermal, and marine energy; TPES = total primary energy supply; EJ = exajoule; yr = year; RE = TPES = t otal primary energy supply; EJ = exajoule; yr = year; RE = renewable energy; 1.5-S = IRENA’s 1.5°C scenario.

Source:IRENA World Energy Transitions Outlook 2024

“While the momentum behind renewable energy is unprecedented,” says an exuberant Mr. La Camera, “it’s clear that we are still falling short of where we need to be by 2030. Industry has proven time and again that we can deliver – and even surpass –expectations when the right frameworks and policies are in place. Now is the time for governments to seize the opportunity of the NDC review, to set ambitious, specific and actionable plans that bridge the current gap and achieves the global 3xRenewables target by 2030. Our message is clear: Now Deliver Change.”

The progress report concludes that to deliver the UAE Consensus goals on the ground, significant advances will be required across the key enablers of the energy transition, namely: infrastructure and system operation, policy and regulation, supply chains, skills and capacities, finance, and international collaboration.

Source: IRENA World Energy Transitions Outlook 2024

Bruce Douglas, CEO of the Global Renewables Alliance, implies an effective apartheid system in funding renewables in developing countries. “Emerging and developing economies continue to face financing gaps that undermine access to capital-intensive energy transition technologies. Renewable power investments in Africa declined by 47% between 2022 and 2023. Sub-Saharan Africa received 40 times less than the world average per capita transition-related investment. Reducing this gap involves securing financing at better terms by mitigating country risks and increasing the availability of concessional finance, mostly from multilateral and bilateral development funds and financing institutions and philanthropies,” he stressed in the progress report. International collaboration, maintains Mr. La Camera, will be crucial to better channel funds to achieve climate, development and industrialisation goals for a more equitable world. Agreement on a robust New Collective Quantified Goal (NCQG) of climate finance at COP29 will be vital for enhancing financial support for climate action as well as inspiring ambitious targets in the NDC 3.0 submission process in 2025.

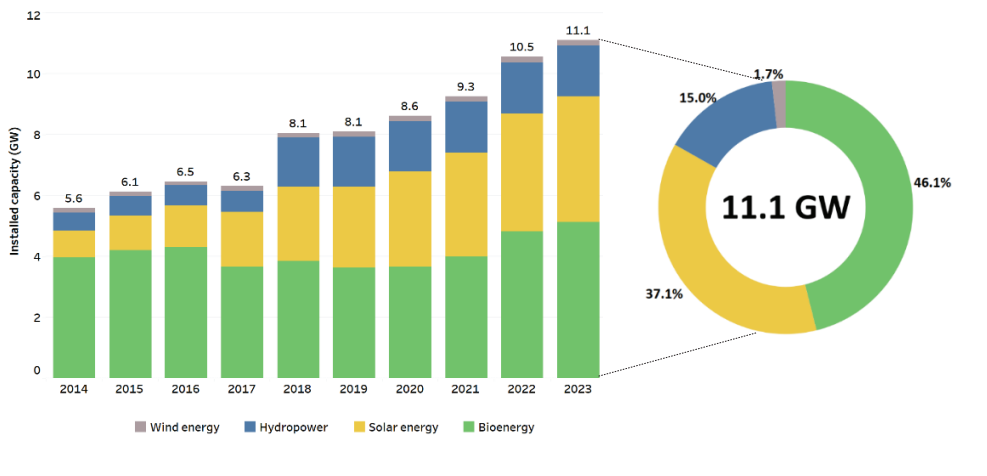

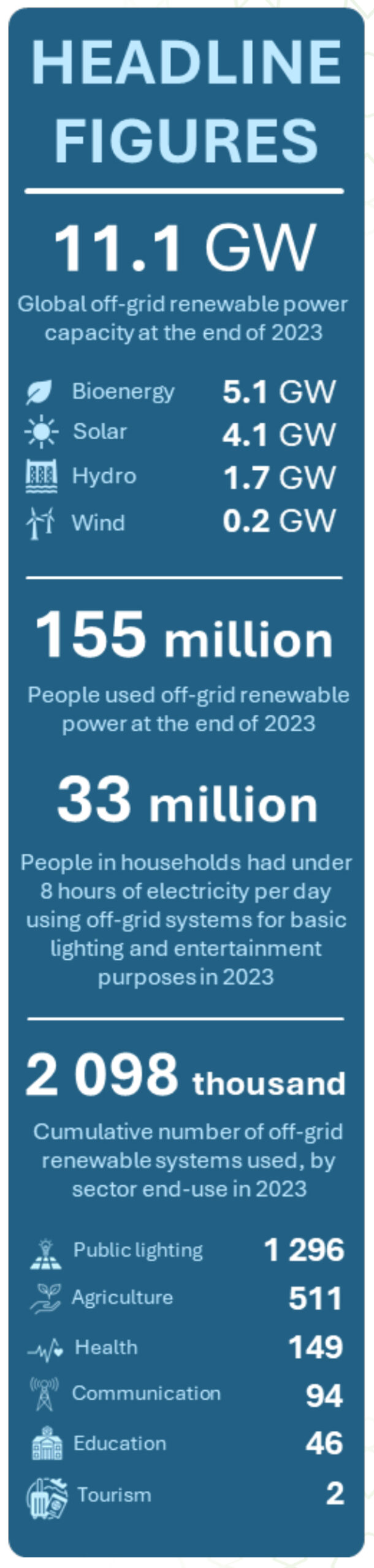

Off-grid renewable power data and capacity by technology

Renewable energy data does not include off-grid electricity production from renewables, which largely are unrecorded in most countries, and which is believed to be expanding rapidly. IRENA has started to collate data from various sources which confirms the proliferation of such renewable energy inputs. IRENA defines off-grid renewable systems as renewable technologies that serve people in rural/remote areas that have no physical connection to the national power grid. Additionally, an establishment with a physical connection to the grid that uses an off-grid system to provide backup power or reduce electricity bills is considered grid-tied and not off-grid.

The key developments in off-grid renewable energy are clear and present:

- Global off-grid renewable power capacity3 amounted to 11.1 GW at the end of 2023, doubling since 2014.

- Bioenergy, predominantly solid biofuels used in off-grid cogeneration plants, dominated the off-grid renewable capacity mix since 2014 and accounted for 5.1 GW in 2023.

- Off-grid solar capacity grew almost five folds in the same period and contributed 4.1 GW to the capacity mix by the end 2023.

- Some 155 million people used Off-grid renewable power at the end of 2023.

- The world invested a record high USD570 bn in renewable energy in 2023, of which Africa only got USD4.7 bn – down 47% on the previous year.

- Some 675 million people were without any access to electricity in 2021.

- The GCC countries especially Saudi Arabia and the UAE are some of the major drivers behind the renewables industry led by ACWA Power and Masdar with billions of dollars in investments proliferating all over Africa, Central Asia and Asia. China of course is a dominant player in the renewables sector.

Opportunities and Challenges for Islamic Climate Finance and Insurance

It is difficult to gauge the true extent of the involvement of Islamic finance and insurance in climate action, let alone renewables and Green Finance. This is because of the dearth of reliable data, its collation and the confusing and fragmented nomenclature and absence of a dedicated Shariah-compliant taxonomy relating to climate action.

Governments, sovereign wealth funds, corporates, banks and even the odd social institutions have all issued Green Sukuk, Sustainability Sukuk and ESG Sukuk, and over the last two years there has been a preference to issue Sustainability Sukuk in line with newly launched Sustainability and Green Finance Frameworks. There have also been a number of Murabaha Syndicated Financing Facilities specifically aligned with sustainable trade and green projects. Commercial banks are also introducing incentivised financing packages linked to sustainable projects and campaigns such as energy transition and the use of solar panels for heating in housing.

The industry can learn much from the engagement of Chinese companies in the renewables and clean energy sector. It was Tadau Energy Sdn Bhd, the Malaysian subsidiary of Edra Solar Sdn Bhd and Kagayaki Energy Sdn Bhd, part of the giant Chinese clean energy group, China General Nuclear Power Corporation, who closed “the World’s and Malaysia’s first green Sukuk” – the RM250 million Green Sukuk Tadau in 2017. The proceeds of the Sukuk were used to finance the construction of a 50 MWAc solar project in Kudat, Sabah under purchase agreements signed with Sabah Electricity Sdn Bhd. The Sukuk was certified as a green issuance by the Centre for International Climate & Environmental Research, Oslo, Norway.

Next it was the turn of BEWG Malaysia Sdn Bhd, a subsidiary of Hong Kong-based Beijing Enterprises Water Group Limited (BEWGL), the leading Chinese wastewater and sanitation company, with a RM400 million Sukuk Wakalah, the first ringgit Sukuk issued by a Chinese conglomerate for a water infrastructure project and the first Sukuk issued by a Chinese company. The proceeds of the Sukuk were used to part finance the RM687 million upgrading of the Bukit Sah water treatment plant in Kemaman, Terengganu.

The general Takaful sector has hitherto been modest in its engagement in climate-related risks partly because of lack of capacity, low capitalisation, paucity of relevant products, lack of experienced staff, low market penetration, a disconnect between Islamic finance and Takaful in general, and a conservative approach to insurance in general.

The outstanding exception to the rule is Shariah-compliant credit and investment insurance, of which ICIEC, the only Shariah-compliant multilateral insurer in the world and a member of the Islamic Development Bank Group, has made real impact on the development agendas, the lives and livelihoods of its 50 member states and their constituents over the last 30 years. ICIEC marked its 30th Pearl Anniversary in 2024, achieving a historic milestone in cumulative insured business surpassing USD121 bn over its 30-year history, significantly contributing to social and economic development across various sectors globally.

ICIEC in 2024 expanded strategic partnerships, notably in sustainable energy and food security, with the signing of several MoUs. The Corporation’s efforts in climate action were highlighted at COP28 and through membership of initiatives like the Energy Transition Accelerator Financing Platform (ETAF) which is managed by IRENA.

As a signatory to the Principles for Responsible Insurance, Shariah-based SRI, Sustainable Finance and ESG Finance are firmly embedded in ICIEC’s due diligence process through linking all new business insured, guarantees, and reinsurance with the UN SDG and Paris climate action indicators. ICIEC actively acts as a crowding catalyst in private sector capital mobilization and participation towards achieving the SDGs and Net Zero targets.

During 2024 several impactful transactions were closed in clean energy and sustainable development. In Senegal, ICIEC and Standard Chartered signed a EUR103 mn Non-Honouring of Sovereign Financial Obligation (NHSFO) policy agreement to support the government’s initiative to install 50,000 off-grid solar streetlamps in rural areas. This milestone advances renewable energy adoption, enhancing safety, boosting economic activities, and reducing carbon emissions while improving life quality in rural communities.

“We have a longstanding relationship of working with ICIEC in transactions which have supported key priority sectors of Member States across Africa. Supporting ESG, sustainability, energy transition and SMEs is a key priority for Standard Chartered. Our rationale for supporting these transactions is our commitment to these markets, the developmental benefits of the transactions and our relationship with both the borrowers and ICIEC,” explained Khurram Hilal, CEO, Group Islamic Banking at Standard Chartered Bank

The Senegal transaction is an important development project resulting in the electrification of remote villages where it is challenging to achieve electrification via traditional transmission lines. This project will directly facilitate increased economic activity and development in these regions. In addition, the social benefits will include improved quality of life and reduced crime, he added.

The Corporation is committed to helping its 50 Member States achieve their development goals, including resilience, mitigation and adaptation to the threats posed by climate change. The Corporation’s cover is directed towards various sectors, with USD2.35 bn in 2023 going specifically into clean energy initiatives such as solar energy systems and wind farms – assisting with their importation and use in national infrastructure projects.

At COP28, IsDB President, Dr. Muhammad Al Jasser, also unveiled a USD1 bn climate finance initiative for fragile and conflict-affected member countries over the next three years, in which ICIEC is bound to participate.

Another important development is the Service Agreement ICIEC signed with the Islamic International Trade Finance Corporation (ITFC), Jef Vincent, and ActorX GmbH to create a three-year business plan for the proposed Africa-Arab Guarantee Fund (AAGF).

This collaboration is designed to strengthen trade and investment ties between the Arab and African regions, fostering economic integration and mutual growth. The agreement was finalized at end November 2024 during the AMAN UNION Annual General Meeting. As the Coordinator of the AAGF, ICIEC is joining forces with ITFC, which represents the Secretariat of the Arab-Africa Trade Bridges (AATB) Programme, of which ICIEC is the insurance pillar.

The aim is to provide a clear roadmap for the establishment and operationalization of the Fund. The initiative will include comprehensive market analysis, consultations with stakeholders, and strategic recommendations to ensure that the Fund operates efficiently and sustainably.

ICIEC first proposed the establishment of the AAGF in 2022 under the aegis of the Arab Africa Trade Bridges (AATB) Programme, launched in 2010 by the OPEC Fund for International Development (OFID), Arab Bank for Economic Development in Africa (BADEA), IsDB, ICIEC, Afreximbank, ITFC and the Governments of Egypt, Morocco, Senegal and Tunisia.

The AAGF provides “a scalable structure that aims to mobilize financial resources and risk mitigation capacity to support trade and investment in Arab and African countries; and ensures that all-in pricing of transactions is optimized for the end beneficiaries through blended structures.” It comprises three sub-funds, including an Arab Africa Green Facility, an Arab Africa Food Security Facility, and an Arab Africa Health Facility.

Recently also ICIEC has signed MoUs with the Korea Overseas Infrastructure and Urban Development Corporation (KIND) to enhance collaboration on Public-Private Partnership (PPP) projects in ICIEC Member States and the Republic of Korea focusing on critical infrastructure, clean energy technologies, and the generation of renewable energy.

Similarly, ICIEC and the Japan Bank for International Cooperation (JBIC) signed an MoU to enhance cooperation and support the development and flows of trade and investment between ICIEC’s member states and Japan. This strategic MoU aims to establish a solid collaboration between ICIEC and JBIC by leveraging ICIEC’s insurance services and JBIC’s financial facilities. The partnership will facilitate transactions involving Japanese companies as exporters, EPC contractors, or investors in projects that promote the development of ICIEC’s member states, with a particular focus on Central Asia and climate action projects such as renewable energy generation.

The challenge for the CII Industry is that of scale and reach. The CII industry base is low, and its market penetration and premium income are subdued compared with the conventional insurance market. But some encouraging trends are emerging, albeit the differential with the conventional Green Bond market of over USD1 trillion, remains huge. Take for instance Green, ESG, SRI and Sustainable Sukuk, the estimates vary from USD20-USD50 bn.

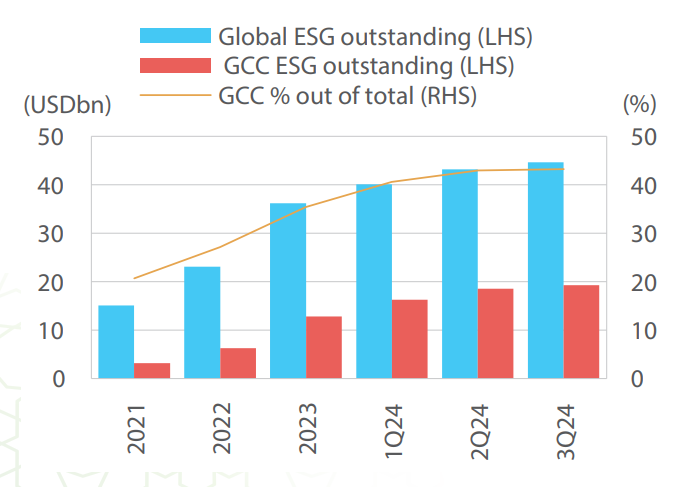

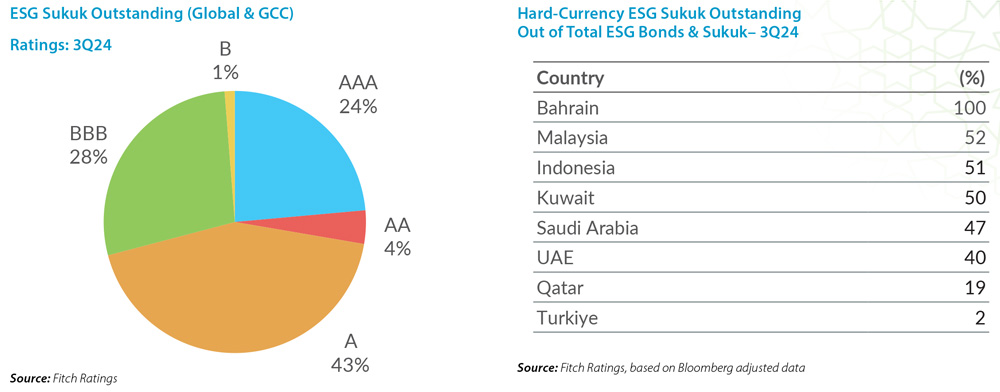

In a report published end October 2024, Fitch Ratings expects ESG Sukuk issuance to continue rising over 4Q24-2025 and cross USD50 bn outstanding, driven by investor demand, funding and diversification goals, along with sustainability initiatives in some Muslim-majority countries.

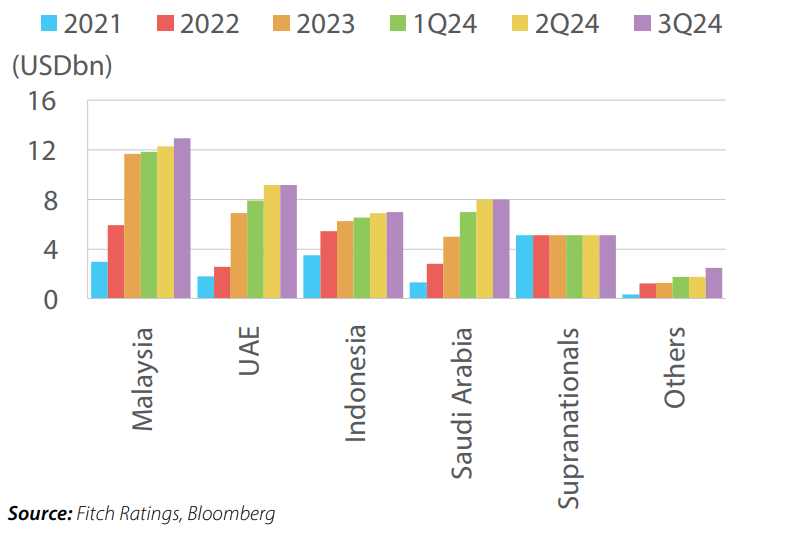

“Sukuk are becoming a key ESG funding tool in emerging markets (outside China), reaching 17.2% of all ESG US dollar debt issued in 9M24. In addition, 40% of all ESG bonds and Sukuk in EM (outside China) were issued by the core Islamic finance markets of the UAE, Saudi Arabia, Qatar, Turkiye and Indonesia. We expect this share to rise. Risks include a weakening sustainability drive, Sukuk sharia-compliance complexities, geopolitical risks and oil volatilities,” said the report.

ESG Sukuk were only 5% of global Sukuk outstanding but had expanded 34% yoy to USD44.6 bn outstanding at end-3Q24 (all currencies), outpacing the global Sukuk market growth of 8.5% yoy. In 9M24, ESG Sukuk issuance rose by 14.7% yoy in the Islamic finance core markets (the GCC, Malaysia, Indonesia, Turkiye and Pakistan) to USD8.9 bn, while ESG bond issuance fell by 18% yoy (USD12.9 bn), with outstanding ESG Sukuk at about 44% (all currencies). In the GCC, ESG debt was USD46.3 bn, with about 42% in Sukuk.

ESG Sukuk Outstanding (Global & GCC)

Source: Fitch Ratings, Bloomberg

Source: Fitch Ratings, Bloomberg

ESG Sukuk Outstanding by Country

Another important driver is that ESG Sukuk could help issuers diversify funding and tap ESG-sensitive international investors, especially for tenors beyond 7 years. A notable case says Fitch is the July 2024 Indonesian sovereign US dollar Sukuk (rated BBB). The 30-year green Sukuk tranche attracted 90% investors from Europe, the US and Asia (excluding Malaysia and Indonesia). In contrast these groups constituted 41% of investors in the five-year non-green Sukuk tranche and 31% in the 10-year non-green Sukuk tranche.

Here there are also potentially good opportunities for ICIEC in rolling out its Sukuk Insurance Policy (SEP), especially for sovereign issuers who are rated investment grade or below, or unrated. For this to happen ICIEC’s senior management led by new CEO Dr. Khalid Khalafalla, could come up with a revised strategy to operationalise the SEP to greater and proactive synergy with the Corporation’s underwriting of Green and energy transition projects especially as the demand for such projects increase incrementally.

There is also another initiative in which the IsDB Group especially ICIEC, as the insurance pillar of the Group, could play a vital role in helping to democratise access to risk mitigation Takaful products in the Member States at the MSME level to build resilience to climate change.

In this respect it was also encouraging to see the launch of The Global Takaful Alliance (TGTA) – A Shared Vision to Deliver Fin

ancial Resilience through Takaful at COP16 UNCCD in Riyadh in December 2024 under the session theme of “Harnessing the power of the market,” which essentially reinforces the importance of private sector involvement in just and clean energy transition, given that governments alone do not have resources to do so on their own. This official event was organized by the Islamic Development Bank (IsDB) in partnership with UNDP through its Insurance and Risk Finance Facility. It was an opportune time to articulate the TGTA, a public-private partnership to enhance the financial resilience of Muslim communities to rising risks, including climate change, land degradation, drought and environmental challenges, through Takaful, a Shariah-compliant alternative to mutual insurance. The Alliance aims to build Takaful markets and products with an overarching goal of reaching 100 million people by 2030.

ICIEC’s role here could be specifically aimed at MSMEs. As a multilateral insurer, it does not under its mandate get directly involved in covering individual and household risks to climate-related events, but it can support Takaful operators by offering risk and resilience mitigation micro-Takaful products. “The protection gap from disasters (the difference between losses insured or not) in most developing countries,” maintain the promoters of TGTA, is often well above 90%, and in numerous developing countries, insurance remains remarkably low, with merely 7% of individuals on average being covered by any form. The lack of financial resilience exposes households to the vulnerabilities of medical emergencies subjects small-scale farmers to the uncertainties of climate-induced crop failures, leaves SMEs susceptible to overwhelming losses caused by catastrophic events, and prevents heavily indebted countries from accessing critical financing to support recovery and reconstruction post disaster.”