Steady as It Goes – How to Uncap Algeria’s GDP Growth Potential

Algeria is country in transition. Though heavily dependent on oil and gas, its attempt to diversify its economy away from hydrocarbons remains a challenge. Mourad Mizouri, Manager, MENA Division at ICIEC profiles Algeria’s economy and its key sectors, and the close collaboration between the Corporation and Algeria, especially through CAGEX, the Algerian state Export Credit agency.

Mourad Mizouri ,

Manager, MENA Division at ICIEC

Algeria is a founding member of the OIC and the IsDB. Algeria joined the IsDB on August 12, 1974, and became a member of ICIEC in 1996.

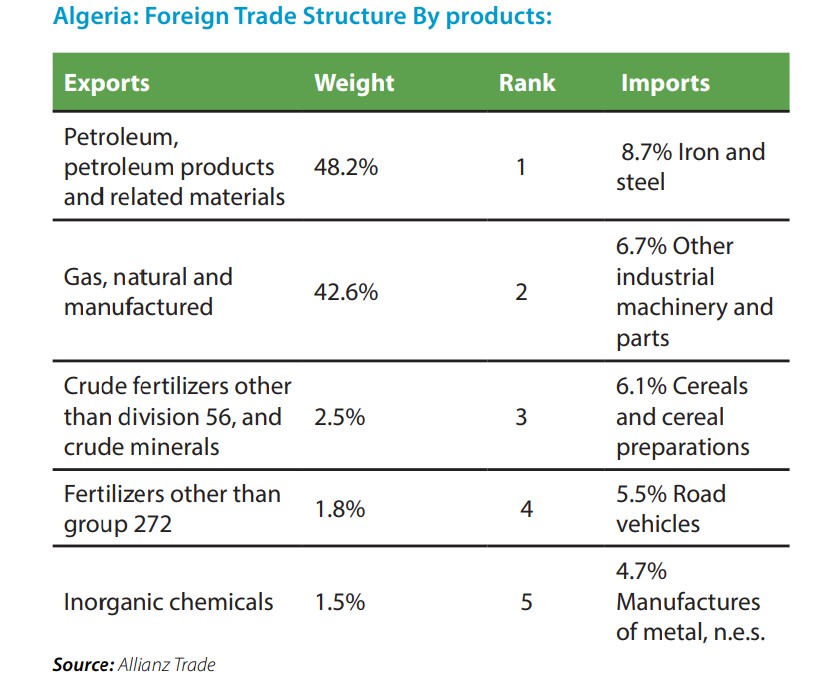

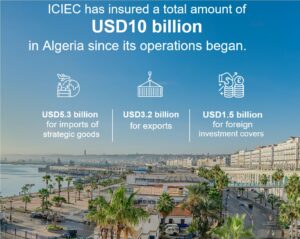

Since the commencement of its operations, ICIEC has provided insurance coverage totalling USD 10 bn in Algeria as of mid-April 2025. This cooperation with Algeria is characterized by the close coordination between ICIEC and CAGEX, Algeria’s state-owned Export Credit Agency, particularly in the areas of reinsurance as well as joint engagement under the AMAN Union Umbrella. Furthermore, ICIEC supported key sectors in Algeria, notably the pharmaceutical and steel industries.

Economic Overview

Algeria is Africa’s second-largest crude oil producer and the top natural gas producer. Strong demand for Algerian hydrocarbons, especially gas, will spur investment in the sector. The non-hydrocarbons economy will remain weak, undermined by the business environment. Real GDP growth will ease in 2025 as government spending growth slows and oil output remains constrained, but will be supported by services, industrial and construction activity, and by growth in natural gas output. Weak private-sector activity, an unstable business environment and limited economic diversification will cap Algeria’s growth potential.

Lower hydrocarbons revenue will be tempered, in part, by tax increases, and modest economic diversification, aided by foreign investment, will help to widen the tax base and boost non-hydrocarbons revenue. The fiscal deficit will remain large but will narrow modestly. The current account will remain in deficit, owing to robust import growth and declining hydrocarbons receipts as falling energy prices outpace modest output growth. Foreign exchange reserves will decline over 2025-29 but import cover will remain comfortable.

The reliance on hydrocarbons and fiscal deficit challenge

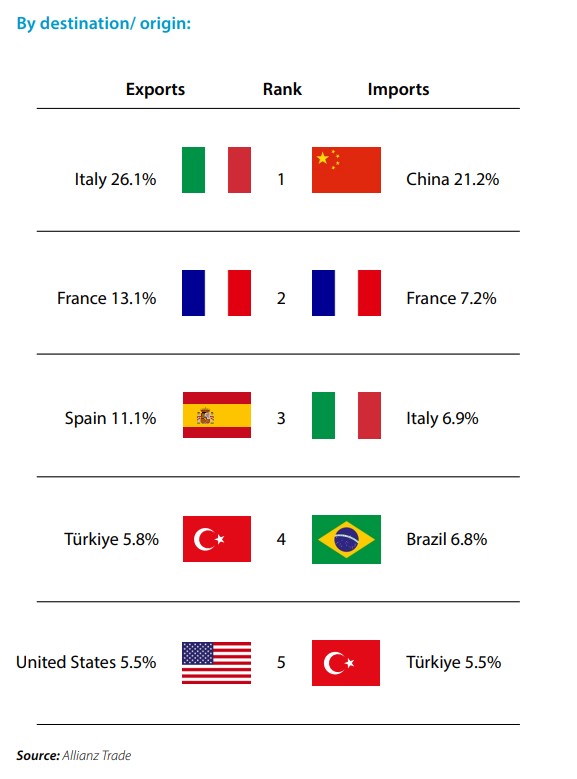

Despite efforts to diversify the economy, the hydrocarbons sector will remain the main driver of economic performance in the immediate to the medium term. Algeria is in a prime position to benefit from European demand for gas after the Ukraine war pushed European countries to seek alternative gas suppliers. Algeria’s state energy firm, Sonatrach, and Italy’s Eni have signed several agreements to gradually increase gas exports to Italy in the next few years, boost exploration efforts and develop green hydrogen in Algeria.

However, Algeria’s ability to meaningfully increase exports will remain limited, hampered by rising domestic gas consumption, which now accounts for about half of local production. The combination of elevated global prices and more involvement from foreign energy companies yielded several new oil and gas discoveries over 2022-23, but bringing these new areas into full production is likely to take four to five years, at least. The country’s modest reserves compared with some of its peers in the OPEC+ alliance will also limit production growth in the longer term.

In terms of mining, Algeria has substantial deposits of gold, zinc, phosphates and iron ore, which the government wants to develop in joint-venture agreements with foreign firms. Notable projects under development include the Gara Djebilet iron ore mine in south-western Algeria and a phosphate-processing plant in Tebessa—both involving Chinese investors—and the Tala Hamza zinc and lead mine in Bejaïa. The contribution of agriculture to the economy has increased in recent years; the sector accounts for about 12.5% of GDP. However, agricultural output remains well below its potential and local demand.

The Financial Sector

According to the World Bank, over the past decade, Algeria has attempted to modernize its financial system, despite social strife, and unique challenges posed by the large hydrocarbon sector. The banking sector is liquid, solvent, and profitable but non-performing loans (NPL) weigh on balance sheets. Aggregate solvency and liquidity ratios exceed regulatory minimums. The sector-wide NPL ratio stood at 21% at end2023. NPLs have been consistently higher for state-owned banks, with IMF data for June 23 showing NPLs at public banks reaching 21.4% of total loans, compared with 8.6% at private banks in the same period. Third-quarter 2024 data shows that annual credit growth increased to 5.7% year-on-year, sustaining its growth momentum.

Algeria and the IsDB Group

Algeria joined the IsDB on August 12, 1974, among the founding members. The Board of Executive Directors approved the first IsDB operation for Algeria on January 01, 1977, and the latest operation was approved on March 19, 2017. Its capital subscription is ID1,285.6 million (2.5%).

Given the limited recourse to external debt. IsDB engagement in Algeria is limited to capacity building, reverse linkage, regional integration and vocational training. Other group entities have ongoing operations in Algeria such as ITFC who is exploring trade financing.

ICIEC operations in Algeria

Key ICIEC Transactions with Algeria

- ICIEC provides reinsurance support to CAGEX, the Algerian national Export Credit Agency, for the export and domestic treaties. In support of Algeria’s economic efforts, ICIEC also works with CAGEX to enhance Non-Oil exports by offering tailored risk mitigation and credit enhancement solutions.

- ICIEC has been providing insurance coverage to several Jordanian pharmaceutical companies that have established separate legal entities in Algeria. This facilitated the transfer of know-how, leveraging Jordan’s strong comparative advantage in the pharmaceutical sector. Furthermore, this has supported Algeria’s domestic market by ensuring access to high-quality, affordable generic medicines, and over time contributed to the development of a solid platform for Algerian pharmaceutical exports to African countries.

- ICIEC also supported syndications led by ITFC for financing gas imports from Sonatrach, Algeria to STEG Tunisia.

- ICIEC’s facilitated Foreign Direct Investments in Algeria aligned with the National Development Plan.