The continued global economic and geopolitical uncertainty marked by subdued GDP growth of the G7 economies, a modest uptake in merchandise trade, the intensification of the conflicts in Ukraine and Middle East with its disruptions in the Red Sea trade route and separately in the Panama Canal Route, due to climate-related drought, have seen a sustained demand for risk mitigation in 2024. A cornucopia of other challenges including the evolving AI revolution, the digitalization of trade, a changing regulatory landscape, tackling the entrenched issues relating to climate action and finance, funding and insuring the transition to a just clean energy playbook, and sovereign debt sustainability developments have all served to unleash new emerging risks and to present credit and investment insurers with exciting new opportunities for their business strategies. Dr. Khalid Khalafalla, Chief Executive Officer of ICIEC, considers the state of the credit and investment insurance industry in 2024, the emerging trends which require strategy flexibility, innovation and collaboration in an evolving landscape of world trade and foreign direct investment.

If we agree with the mood music at the Annual General Meeting of the Berne Union (BU) in October in Hamburg, the leading global association for the export credit and investment insurance industry of which ICIEC is a member, then our industry was poised for a new growth phase in 2024 with opportunities in a changing global trade landscape with the beguiling lure of trade digitalisation, the adoption of electronic trade documentation and its new-found legality under UK governing law, and generative AI applications.

BU members provide over USD3 trillion in new commitments annually in support of trade – more than 10% of the total value of global exports. The data indeed point to a modest positive trajectory in 2024 despite the increased risks. The credit insurance dichotomy is that economic and geopolitical flashpoints lead to heightened risks – both perceived and real. This in turn increases demand for risk mitigation tools such as export credit and political risk insurance, surety, and guarantees.

“The year 2023 marked continued transformation in the trade finance industry. Historic levels of underwriting have led to a colossal USD3.12 trillion of support for trade over the year. As trade patterns shifted and new relationships forged companies sought protection from Berne Union members to expand their businesses in new avenues,” stressed Maëlia Dufour, the erstwhile President of the BU whose 2-year term expired at the end of October 2024, in the Union’s 2023 Year Annual Report. This growth saw a surge in demand for Medium-Term (MLT) and Other Cross-Border (OCB) solutions in a strategic shift towards longer-term solutions.

“We have uncovered a growing emphasis on larger and more complex transactions, extended tenors, and a heightened need to mitigate risks associated with intricate global supply chains amid high interest rates. Companies are increasingly seeking the stability and security our membership offers,” she added. The emphasis for 2024 is a much greater meaningful collaboration between stakeholders around public and private risk-sharing, synergy between trade and development, and the potential for innovation amid new products and emerging approaches to export support.

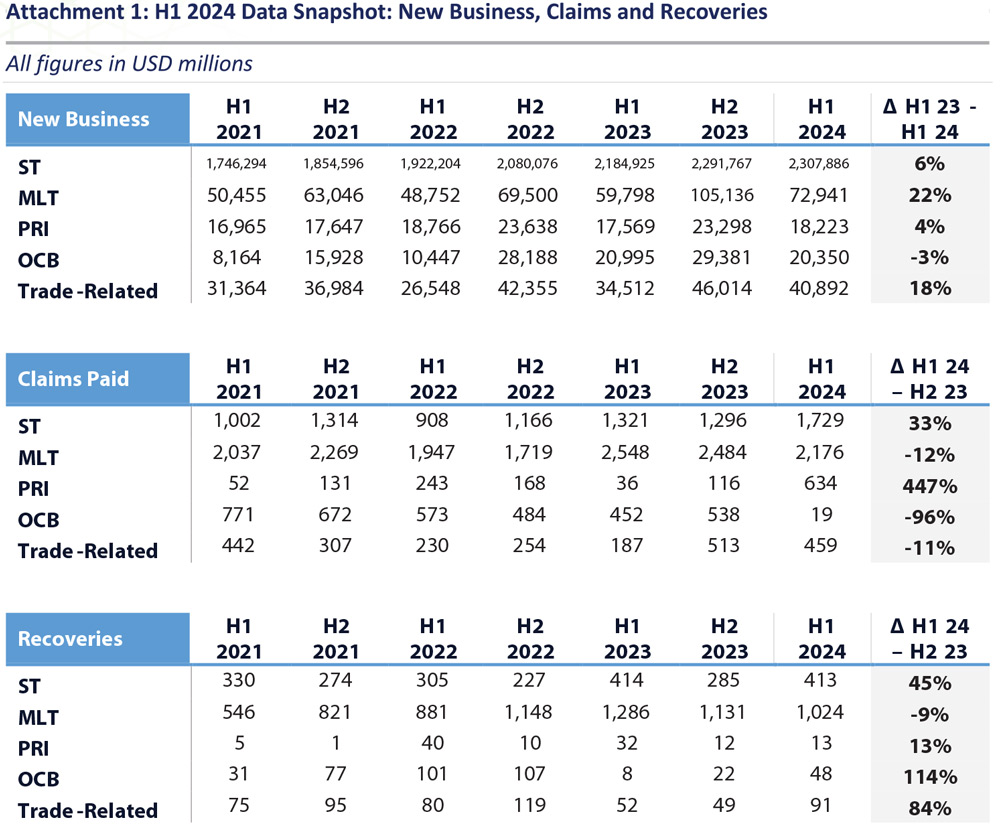

Not surprisingly, BU members reported USD2.46 trillion in new commitments in H1 2024 which shows a consolidation of a new growth phase for export credit especially medium-and-long-term (MLT) business lines as well as continued diversification across a growing array of trade support products.

MLT export credit, according to the Union, saw another historically strong period, climbing 22% to USD73 bn of new business, driven by increased ECA support and expansion of underwriting from private insurers with notable growth in Europe, the Middle East and South Asia. Ocean-going vessels and mega infrastructure projects drove MLT growth, but the industry still sees the greatest opportunities in renewable energy and green transition. Members also reported new and updated products primarily focused on green support and expanded domestic support, untied and working capital products which aim to build and enable future trade ecosystems.

Geopolitical risk and economic slowdown are the biggest concerns for members, as claims remain elevated at USD5 bn – but claims ratios remain relatively benign overall. The first half of 2024 also saw a flurry of PRI claims to Russia triggered by a range of events including: expropriation, political violence and transfer. The BU is also collaborating with Finance in Common which aims to explore and promote opportunities for closer collaboration between export credit and development finance.

Berne Union Business Lines, Claims and Recoveries Data H1 2024

Source: Berne Union October 2024

The consensus is that renewables are the new powerhouse for trade finance and investment. Fuelled by a global focus on environmental sustainability and supportive policy frameworks, the value of supported renewable energy transactions doubled in 2024 compared to the previous years – after consecutive periods of growth. This surge reflects not only the industry’s commitment to green initiatives but also the recognition of renewable energy as a stable, long-term investment, perfectly aligning with the growing demand for trade finance. This is especially in emerging and developing markets. As members continue to support renewable energy projects offering financial incentives, risk portfolios are shifting as exposures increase to this key industry.

Key Takeaways for 2024

The BU Export Credit Business Confidence Trends Index for H2 of 2024, which tracks perceived demand and claims in the export credit insurance industry based on half-year surveys of BU members, noted several key takeaways:

- Cautious optimism for H2 of 2024 as the demand for ST and MLT insurance cover is expected to rise.

- Opportunities for growth lie in supporting SMEs and investment in renewables and the green transition.

- Claims under short-term policies are expected will rise in H2 of 2024 while claims for longer term business are expected to fall.

- For ST cover, Russia-Ukraine, the Middle East, and Argentina are the regions they are most watchful of; construction and consumer goods are the sectors being closely monitored due their higher sensitivity to macroeconomic conditions

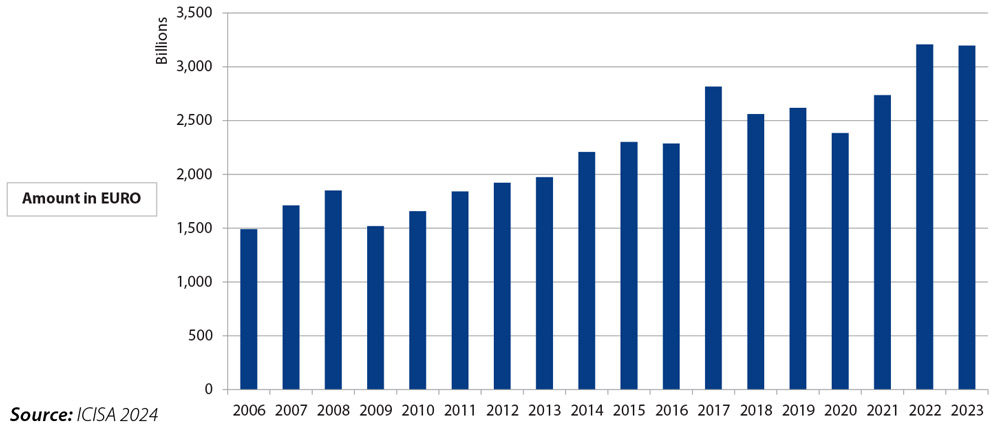

Trade Credit Insurance – Insured Exposure ICISA Members Amount in (excl reinsurance members)

- Debt sustainability developments have meant lower sovereign-related claims under longer-tenor cover, but members remain vigilant towards countries in delicate fiscal positions, predominately in Sub-Saharan Africa and South Asia.

- Overwhelming consensus that macroeconomic and geopolitical uncertainty will shape demand and claims over the next six months. As such navigating geopolitical risks and the impact of conflicts are seen by many as the biggest challenges in H2 of 2024, albeit concerns over global macroeconomic uncertainty still linger.

Given the current landscape of credit insurance is marked by significant uncertainty and heightened risks due to a multitude of overlapping crises, Richard Wulff, Executive Director of the International Credit Insurance and Surety Association (ICISA), the first and leading trade association representing trade credit insurance and surety companies internationally, whose members account for the majority of the world’s private credit insurance business, stresses that “there is substantial room for enhanced collaboration between government insurers, including stateowned entities and ECAs and Development Financial Institutions (DFIs), and private sector re/insurers. Such collaboration can lead to the development of more comprehensive risk mitigation strategies by leveraging the strengths of both sectors.”

The recent MoU signed between ICISA and the AMAN UNION of credit insurers and ECAs from the OIC countries, of which ICIEC is currently the Secretariat, is precisely aimed at advancing credit and investment insurance initiatives in member states common to both, and expanding credit insurance, extending its benefits beyond traditional high-income markets to developing countries where the sector is often fragmented and undervalued and marginalized because of the absence “hard collateral” as security.

ICISA’s data for 2020 on the role of credit insurance in global trade estimates EUR12.07 bn in total global credit insurance premium, and EUR6.35 trillion of total value of insured shipments. The percentage of World Trade in 2020 protected by credit insurance was 14.52%; the percentage of the global credit insurance market represented by private insurers was 61%, and the percentage of the private market represented by ICISA was 84%.

As the only Shariah-compliant multilateral insurer in the world and member of the Islamic Development Bank (IsDB) Group, and offering a suite of alternative risk mitigation solutions, guarantees and reinsurance akin to mutual insurance (Takaful) and (ReTakaful), ICIEC is similarly subject to the bevy of emerging risks that have evolved in the last two years in addition to the usual risks associated with trade and investment insurance, and guarantees and surety. It is also beholden to the prevailing macroeconomic conditions of the 50 member countries that it serves under its mandate. Its success has been impressive over the last three decades and in its Pearl Jubilee year in 2024 it surpassed the USD121 bn mark of cumulative business insured, investment protection and guarantees in pursuit of its mandate in providing risk mitigation solutions related to trade and investment in member countries, facilitating intra-OIC trade and investment, and promoting the alternative Islamic system of financial intermediation, in its case in the provision of Takaful.

Collaboration is in the DNA of ICIEC considering its longstanding partnerships with many peer institutions, industry professional bodies namely the Berne Union, AMAN UNION and ICISA; government export promotion agencies; with private credit insurers and a range of banks and with ECAs of member countries and beyond. The Corporation has a pivotal founding association with the AMAN UNION, which was established in 2009 and of which I am currently the Secretary General.

The 14th AMAN UNION AGM in December 2024 in Algiers showcased the critical role of fostering credit insurance and trade across Africa, the Arab, and Islamic countries. By uniting diverse stakeholders, we illustrated the power of collaboration in addressing trade challenges and driving sustainable growth. Strengthened partnerships and shared expertise are paving the way for a resilient, interconnected trade ecosystem in OIC countries to boost risk mitigation and protection in trade and investment in today’s interconnected world with its rising geopolitical and economic risks. In today’s complex global landscape, the AMAN UNION remains a vital platform for collaboration and innovation, delivering valuable insights to benefit all stakeholders.

The AMAN UNION seeks to be the comprehensive umbrella for export insurance agencies in Arab and Islamic countries, while expanding its membership to include elite international institutions, and aims to promote the exchange of experiences, the application of best practices, and the dissemination and development of a culture of assurance. In fact, in Algiers the AMAN UNION signed a Corporate Training Services Agreement with the UAE-based RISC Institute DMCC, a leading training institution specializing in talent development for the insurance, risk management, and personal finance sectors.

ICIEC unveiled its 2023 Annual Report in May 2024 in Riyadh at the IsDB Group Annual Meetings. The year 2023 was one of operational resilience and exceptional financial performance, showcasing a significant 14.4% y-o-y increase in insured trade and investment transactions, amounting to USD13.3 bn. The Corporation also reported an increase in its Gross Written Premium, which rose by 6.4% to USD98.3 mn. ICIEC’s improvement in corporate net results reflects its ability to effectively manage policyholder commitments, enhance value proposition and demonstrate fostering confidence of our Member States. This performance trajectory is set to continue in 2024, despite the various headwinds and evolving risks.

It would be a miss not to correlate the dynamics and impact of global macroeconomic indicators especially real GDP growth, trade movements and Foreign Direct Investment (FDI) trends for 2024, all of which impact the dynamics of credit and investment insurance business and market calculations. The IMF’s World Economic Outlook Real GDP Growth Projections in October 2024 reveals a subdued global growth scenario of 3.2% for 2024 and 2025. This trajectory is repeated at 1.8% for the Advanced Economies of which Canada’s economy is projected to grow at the highest percentage of 2.4%.

In contrast the Emerging and Developing Economies are projected to grow 4.2% for the same years, with India way ahead at a projected GDP growth of 7% in 2024 and 6.5% in 2025, and China weighed down by its current economic woes with projected GDP growth at 4.8% declining to 4.5% for the same period. GDP growth outlook for low-income developing countries which constitute a majority of ICIEC membership is projected at a health 4.2 per cent for the two years. Of the OIC countries, Saudi Arabia’s growth is projected to increase from 1.5% in 2024 to 4.6% in 2025 in line with the ambitions of the Saudi Vision 2030, while Nigeria’s growth prospects are projected to increase from 2.9% in 2024 to 3.2% in 2025.

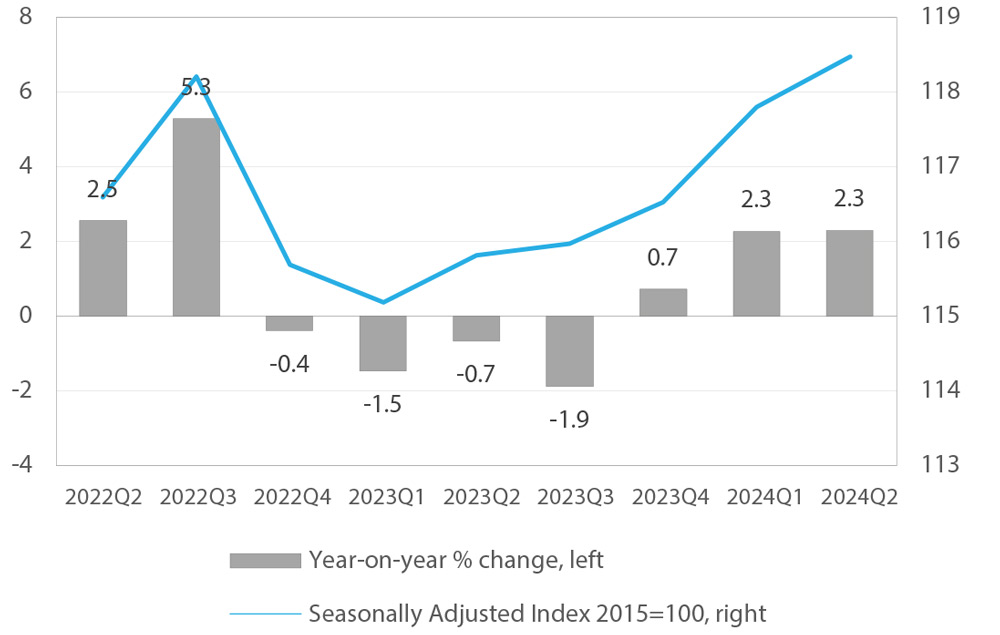

The scenario for global trade prospects in 2024 and beyond reflects a similar trajectory. The WTO’s Goods Trade Barometer published on 10 October 2024 shows moderate trade growth as uncertainty looms, including possible shifts in trade policy.

World merchandise trade volume

Source: WTO Goods Trade Barometer October 2024

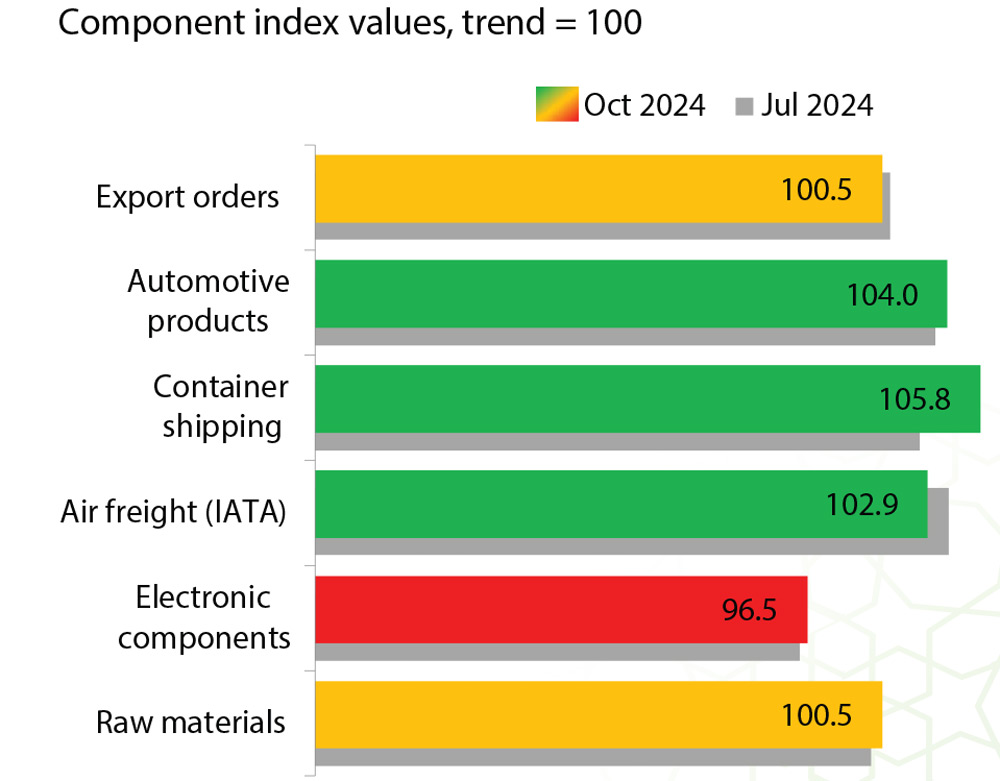

Drivers of goods trade

Source: WTO Goods Trade Barometer October 2024

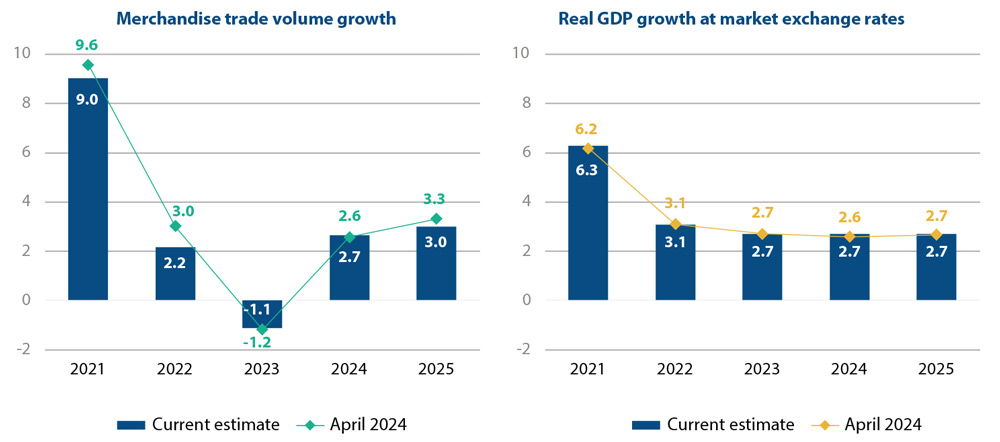

Trade volume growth for the whole of 2024 should come in at around 2.7% while growth in 2025 is expected to reach 3.0%. Exports of Asian economies and imports of North American countries grew more than expected in the first half of 2024 while European trade flows continued to decline on both the export and import sides.

The WTO’s Global Trade Outlook and Statistics Update in October 2024 projects a gradual trade recovery in 2024 despite widening regional conflicts and increased policy uncertainty. “Global merchandise trade turned upwards in FH 2024 with a 2.3% year-on-year increase, which should be followed by further moderate expansion in the rest of the year and in 2025. The rebound comes on the heels of a slump in 2023 driven by high inflation and rising interest rates. WTO economists now anticipate that the volume of world merchandise trade will increase by 2.7% in 2024 and 3.0% in 2025, while global GDP growth at market exchange rates is expected to remain at 2.7% in both years,” stressed the update.

Declining inflationary pressure, says the WTO, has allowed central banks in advanced economies to begin cutting interest rates, which should stimulate consumption, boost investment and support a gradual recovery of global trade. However, significant downside risks remain, including regional conflicts, geopolitical tensions and policy uncertainty. The revised trade forecast is consistent with the WTO’s Global Trade Outlook and Statistics report issued in April, which predicted 2.6% growth in both merchandise trade and GDP in 2024, followed by trade growth of 3.3% and GDP growth of 2.7% in 2025.

World merchandise trade volume and GDP growth, 2021-2025

Annual % change

Source: WTO for merchandise trade volume and consensus estimates for GDP.

Note: Figures for 2024 and 2025 are projections. Trade refers to average of exports and imports.

Merchandise exports of least developed countries (LDCs) are projected to increase by 1.8% in 2024, marking a slowdown from the 4.6% growth recorded in 2023. Export growth is expected to pick up in 2025, reaching 3.7%. Meanwhile, LDC imports are forecast to grow 5.9% in 2024 and 5.6% in 2025, following a 4.8% decline in 2023. These forecasts are underpinned by GDP growth estimates for LDCs of 3.3% in 2023, rising to 4.3% in 2024 and 4.7% in 2025.

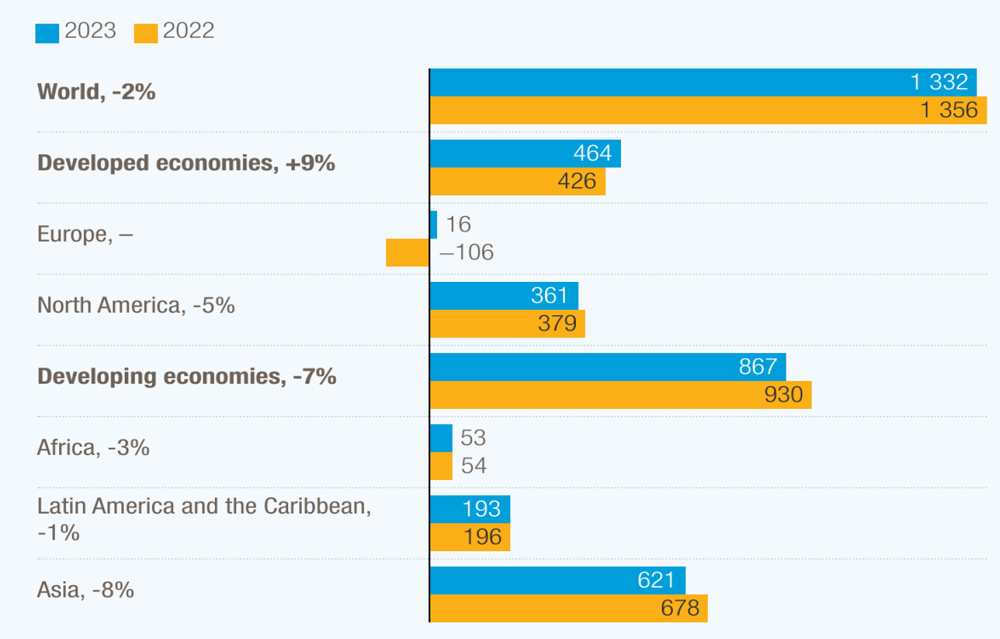

The prospects for Global FDI flows are more disconcerting. According to the UN Trade and Development (UNCTAD’s) World Investment Report 2024, FDI fell 2% to USD1.3 trillion in 2023, as trade and geopolitical tensions weighed on a slowing global economy. The report underscores that the headline figure exceeds -10% when excluding a few European conduit economies that registered large swings in investment flows. FDI flows to developing countries dropped 7% to USD867 bn, with Sub-Saharan Africa attracting only USD53 bn in FDI in 2023. The Report further highlights that:

- Tight financing conditions led to a 26% fall in international project finance deals, critical for infrastructure investment. International project finance is crucial for the poorest countries, making them more vulnerable to the global downturn in this type of investment.

- Crises, protectionist policies and regional realignments are disrupting the world economy, fragmenting trade networks, regulatory environments and global supply chains. This undermines the stability and predictability of global investment flows, creating both obstacles and isolated opportunities.

- While prospects for 2024 remain challenging, modest growth in FDI flows for the year remains possible, citing easing financial conditions and investment facilitation efforts in both national policies and international agreements.

- Investments are growing in several global value chain-intensive manufacturing sectors like automotive and electronics in regions and countries with easy access to major markets. But many developing countries remain marginalized, struggling to attract foreign investment and participate in global production networks.

Foreign direct investments declined in most regions

Foreign direct investment (FDI) inflows by economic grouping and region, billions of dollars and percentage change

Source: UN Trade and Development (UNCTAD)

Credit and Political Risk Insurers (CPRIs) also faced new challenges as the year 2024 is ending. The European Banking Authority (EBA) released its long-awaited recommendation on the treatment of credit insurance as a credit risk mitigant (CRM) tool under the Basel regulation. The EBA decided against recommending an alternative approach for banks using credit insurance for credit risk mitigation. This topic now moved to the European Commission, which must balance financing the real economy with the need for competitiveness and innovation, while considering the EBA’s strict adherence to Basel standards.

Geopolitical tensions pose downside risks to the global economy and is adding challenges to CPRI underwriters through a surge in uncertainties, from protectionism to political uncertainty in major EU countries and ongoing conflicts in Russia-Ukraine and the Middle East, including tensions in the South-China-Sea and with Taiwan. This is a moving environment which requires proactive adaptation from underwriters and guarantors.