The Economic Power of Gender Balance

A Unique Opportunity to Advance Inclusivity, Resilience, and Recovery

Insurance of Letters of Credit

Buyer Credit Insurance

Insurance of supplier credit

Non Honoring of Sovereign financial obligations

Political Risk Insurance of Cross-Border Loans

Political Risk insurance for Equity investments

Projects

Reinsurance / Co-insurance / Fronting

A Unique Opportunity to Advance Inclusivity, Resilience, and Recovery

Whether it is the McKinsey & Company’s ‘Women in the Workplace 2024’ report, OMFIF’s ‘Gender Balance Index 2024’, the ‘UN Sustainable Development Goals Report 2024’, or the observations of global leaders such as Kristalina Georgieva, the Managing Director of the International Monetary Fund (IMF), the message is consistent: promoting gender balance in the economy and workplace is beneficial for inclusive growth and higher productivity. However, while there has been real progress for women at every level of corporate activity, this progress remains slow, particularly in advancing women into managerial positions.

The positive correlation between gender balance in the workplace and the wider economy, alongside key economic indicators such as GDP growth, productivity, and social and financial inclusion is undisputed. However, the gender balance gap varies from country to country regardless of economic status, with low-and-medium-Income-countries (LMICs) often disproportionately affected.

The reality remains that women are underutilized stakeholders, with lower participation in the economy and in leadership positions, including in financial services. The fact that diversity and gender balance are smart economics, and are essential for development agendas, increasing aggregate productivity and socio-financial inclusion, while also maintaining the dignity and wellbeing of women in the workplace and society, is beyond dispute.

The IMF in a blog on ‘Inclusion and Gender’ authored by Antoinette Monsio Sayeh, Deputy Managing Director, alongside economists Alejandro Badel and Rishi Goyal, the link between narrowing the gender gap in the workplace and potentially higher global economic outcomes was highlighted, particularly amid the weakest medium-term growth outlook in more than three decades.

The IMF’s World Economic Outlook, released in July 2024, projected global GDP growth at 3.2% in 2024 and 3.3% in 2025. The average growth rates for the Developed Economies are projected at 1.7% and 1.8% for the same period, while for the Emerging Market and Developing Economies are expected to grow by 4.3% for both 2024 and 2025. The two regions where the IsDB and ICIEC membership is concentrated, the Middle East and Central Asia, and Sub-Saharan Africa (SSA), are projected to grow at 2.4% in 2024 rising to 4.0% in 2025, while SSA alone is projected to fare slightly better at 3.7% in 2024 rising to 4.1% in 2025.

For developing countries, these figures suggest disproportionality not only in the impact of the subdued global economic recovery but also in sharing the burden of any remedial policy reforms. These numbers present both challenges and opportunities for narrowing the gender balance gap in the workplace, a reform that the IMF views as crucial to reviving economies amid the weakest medium-term growth outlook in more than three decades.

“With global growth predicted to languish at just 3% over the next five years, and with traditional growth engines sputtering, many economies are missing out by not tapping into women’s potential. Only 47% of women are active in today’s labor markets, compared with 72% of men. The average global gap has fallen by only 1 percentage point annually over the past three decades and remains unacceptably wide,” maintain the authors of the IMF Blog.

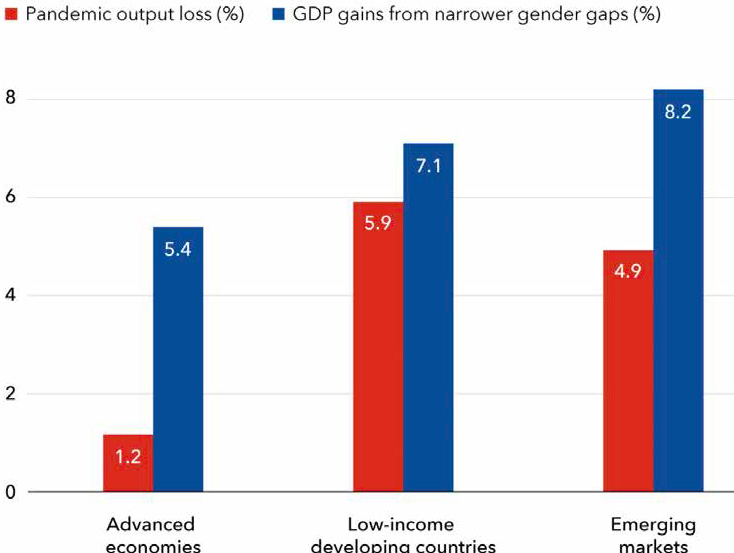

Gender Balance and GDP Growth

The IMF estimates that emerging and developing economies could boost GDP by about 8% over the next few years by raising the rate of female labor force participation by 5.9 percentage points—the average amount by which the top 5% of countries reduced the participation gap during 2014-19. This increase would more than offset the economic “scarring,” or output losses, inflicted on countries by the COVID-19 pandemic.

In search of new growth sources

Narrowing gender gaps in labor force participation could more than offset pandemic scarring.

Source: IMF Staff Calculations.

Note: Pandemic Output Loss is the percent deviation of projected real GDP in 2023 relative to the pre-pandemic (Jan. 2020) WEO projection. GDP gains are computed from narrowing the gender gap by 5.9 percentage points, which is the improvement achieved in the top 5 percent of EMDEs during 2014-19.

Policymakers can influence growth in various ways, from governance reforms to strengthen institutions, to financial and fiscal reforms, and investment incentives to unlock capital flows, for investment especially in infrastructure. However, as the IMF researchers suggests, complementing these reforms with measures to narrow gender gaps would greatly amplify these returns.

The challenge is how to enhance current policy trends at the government, institutional, and corporate levels to close gender gaps. “Our analysis of three decades of data,” says the IMF, “shows that countries have made progress increasing women’s participation, but economies of all income levels experienced several setbacks—a result of shocks, crises and policy reversals.

Countries must step up efforts to break down barriers to women’s participation in the labor market and workplace. Unfair laws, unequal access to services, discriminatory attitudes, and other obstacles prevent women from realizing their full economic potential.

The result is a shocking waste of talent, leading to losses in potential growth.”

There are other compelling reasons for pushing gender balance parity in the economy and the workplace. For instance, Global trade is poised to rebound in 2024 according to UNCTAD’s latest trade update, reversing the downward trend in 2023 when overall, the value of global trade fell by 3% to USD 31 trillion. The WTO’s July 2024 Goods Trade Barometer similarly reports signs of recovery in trade flows. After remaining flat since Q4 2022, the volume of world merchandise trade began improving in Q4 2023 and gained momentum in Q1 2024, rising 1.0% compared to the previous quarter and 1.4% year-on-year.

International gatekeeper organizations, including the Bretton Woods institutions and peer MDBs, must also reflect on their approach to gender responsiveness and balance. At the 49th Meeting of the International Monetary and Financial Committee during the 2024 Spring Meetings of the World Bank/IMF in Washington, DC, the clarion call from LMICs to the World Bank/IMF Executive Boards to “make meaningful strides” towards greater Diversity and Inclusion, particularly for gender parity in the Executive Board of the IMF, as well as enhanced gender balance on all grade levels in the offices of Executive Directors.

“We recognize the progress made on Diversity and Inclusion and accelerating gender equality and inclusion as key drivers of effective and impactful development,” reminded Lesetja Kganyago, Governor of the South African Reserve Bank (SARB). “But we call for continued commitment to make meaningful strides in tackling the ongoing challenges of greater recruitment and promotion of staff from underrepresented regions, as well as more female appointments at all levels, to ensure a level playing field and equitable treatment for staff at all grade levels across the membership.” In this respect, the World Bank Group’s new Gender Strategy assumes even greater importance in strengthening work to elevate human capital, expand economic opportunities, and engage women as leaders.

Gender outcomes were a prominent feature at the 13th Ministerial Conference (MC13) of the WTO in Abu Dhabi in March 2024, particularly concerning gender inclusivity in trade, trade finance and insurance. To mark International Women’s Day on 8 March 2024, the WTO through its Informal Working Group on Trade and Gender launched the International Prize for Gender Equality in Trade, which recognizes the most impactful gender-responsive trade policies implemented by WTO members and observers.

Looking ahead, the WTO and the WTO Gender Research Hub will organize the second edition of the World Trade Congress on Gender in 2025, focusing on innovation. The Secretariat will also release new policy tools during the Aid for Trade Global Review 2024, including incorporation of gender indicators in Aid for Trade programming and a new database mapping gender-responsive trade policies.

The Current State of Gender Balance

Research and data on gender balance and the socio-economy has flourished enormously over the last decade . The Sustainable Development Goals (SDG) Report 2024 reminds us through SDG 5 on Gender Equality, that “the world continues to lag in its pursuit of gender equality by 2030. Parity in women’s participation in public life remains elusive, and in management positions, at current rates, parity will require another 176 years. Enhancing women’s roles in leadership and decision-making and adequately scaling up investments in gender equality on national, regional, and global scales are top priorities.”

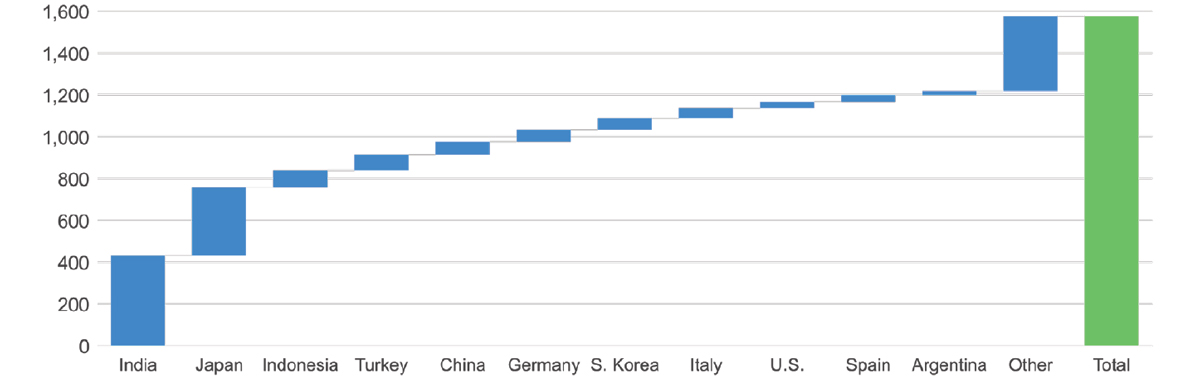

Earlier this year, Moody’s Analytics published a research study that highlights a significant shift in the global labor market. The study found that gender employment gaps are narrowing across the world due to increased female participation rates, adding USD 1.5 trillion to global income since 2019.

The female participation rate rose above its pre-pandemic level already in 2021 in the European Union, and in 2022 in the U.S. Progress in the EU has been especially remarkable, with the female labour force participation rate rising almost three percentage points in just over three years.

Moody’s Analytics identified three key forces behind the narrowing in gender gaps:

Narrowing Gender Gaps Have Added $1.5 Trillion to Global Income

Contribution to global income, $ bil international (purchasing power parity)

Source: Moody’s Analytics

Source: Moody’s Analytics

A report by Moody’s Investors Service in March A report by Moody’s Investors Service in March 2024 found that higher-rated companies tend to have a higher proportion of women on their boards. Women account for an average of 29% of the board seats of investment-grade companies (those rated Baa and above), and an average of 24% of the board seats of speculative-grade companies (those rated Ba and below). Companies based in advanced economies show a correlation between board gender diversity and credit ratings, whereas those in emerging markets do not. “The presence of women on boards – and the potential diversity of opinion they bring – supports good corporate governance, which is positive for credit quality,” emphasized Moody’s.

Another report by Sustainable Fitch indicates that companies with high gender diversity across all staff levels tend to have better overall ratings, suggesting a link between gender diversity and comprehensive ESG performance. Banks and financial institutions lead in gender diversity, while sectors such as energy, automotive, and transportation lag behind. “Board-level gender diversity,” says the report, “has risen in recent years, facilitated by supportive regulations. However, more effort is required to promote greater representation across countries and sectors. Our data indicate that European countries continue to lead in terms of the number of women on boards, with the Middle East and Latin America behind. Female board representation is also higher in insurance, healthcare, and education.”

McKinsey & Company’s ‘Women in the Workplace 2024’ report echoes the consensus that there have been important gains for women at every level of the corporate pipeline (in this case in the US for instance), particularly in senior leadership. “Research shows that companies with more women in leadership benefit from greater innovation, healthier cultures, and stronger performance. And in addition to offering valuable skills and perspectives, women leaders inspire the next generation of women to make their mark.”

However, progress toward parity remains slow for women at the manager and director levels, creating a weak middle in the pipeline and impacting most women. “At the current rate of progress, it will take almost 50 years to reach parity for all women in corporate America—and that assumes companies can translate their somewhat precarious momentum into more substantial and sustainable gains,” concludes the report.

Missed Opportunities

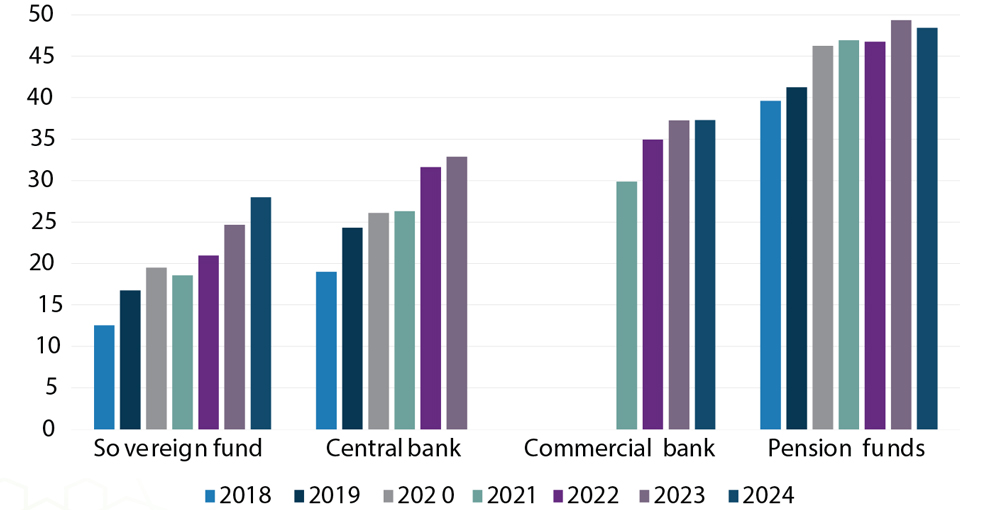

Two other reports provide sobering insights into the current and near-to-medium-term state and prospects for women in finance, the workplace, and trade. The 11th edition of the Gender Balance Index (GBI) published by OMFIF, the independent forum for central banking, economic policy, and public investment, paints a picture of missed opportunities. The index tracks the presence of men and women in senior positions in central banks, commercial banks, pension funds and sovereign funds.

“Even though there are more women in senior positions across central banks and top financial institutions in 2024, only 14% of the 63 institutions with new governors or chief executive officers in the past year appointed women. At this rate of change, the prospect of gender parity in leadership remains decades away,” states OMFIF.

However, in this landscape of gender gaps and parities, the data can be misleading. While absolute numbers may show some improvements, they often mask the fact that the base for the metrics is low and that barriers to entry remain high. These barriers are dominated by policymakers and national leaders, who are still predominantly men. According to OMFIF, in 2023, the share of new women CEOs in commercial banks and SWFs was zero, and in central banks and pension funds it was only 18% and 22% respectively.

Take, for instance, the South African Reserve Bank (SARB), the central bank. SARB’s gender balance record is mixed. Although SARB’s ranking in the GBI improved from 100 in 2022 to 63 in 2023, and its GBI score rose by 19 points year-on-year to 54. the percentage of senior female staff at the central bank was still only 35%. In March 2024, President Cyril Ramaphosa reappointed Ms. Nomfundo Tshazibana as Deputy Governor of SARB for a period of five years effective from 1 August 2024. He also appointed the prominent economist Dr. Mampho Modise as a new Deputy Governor of SARB for a period of five years effective from 1 April 2024. The gender bias has now shifted in favour of women in the Deputy Governor cohort, which now includes three female appointments.

Considerable progress across institutions in the long term

Average GBI scores

Source: OMFIF Gender Balance Index 2018-24Note: Commercial banks were included in the index from 2021 onwards. The sample of pension funds and sovereign funds included in the index changed in 2022 to cover 50 of the largest institutions by assets under management across regions.

Source: OMFIF Gender Balance Index 2018-24Note: Commercial banks were included in the index from 2021 onwards. The sample of pension funds and sovereign funds included in the index changed in 2022 to cover 50 of the largest institutions by assets under management across regions.

The proportion of female leaders in the 335 institutions in the GBI increased to 16% – its highest ever share. Most of the progress was seen in central banks, where the number of female governors increased to 29 (16%) from 23 (15%) in 2023. Pension funds hold the highest share of women in the top rank, –rising to 28% from 24% in 2023. However, commercial banks and insurance companies have regressed: the share of female CEOs fell to 12% this year from 16% in 2023. Sovereign Wealth Funds (SWFs) have an even lower representation, with 10% led by women.

However, in this landscape of gender gaps and parities, the data can be misleading. While absolute numbers may show some improvements, they often mask the fact that the base for the metrics is low and that barriers to entry remain high. These barriers are dominated by policymakers and national leaders, who are still predominantly men. According to OMFIF, in 2023, the share of new women CEOs in commercial banks and SWFs was zero, and in central banks and pension funds it was only 18% and 22% respectively.

Take, for instance, the South African Reserve Bank (SARB), the central bank. SARB’s gender balance record is mixed. Although SARB’s ranking in the GBI improved from 100 in 2022 to 63 in 2023, and its GBI score rose by 19 points year-on-year to 54. the percentage of senior female staff at the central bank was still only 35%. In March 2024, President Cyril Ramaphosa reappointed Ms. Nomfundo Tshazibana as Deputy Governor of SARB for a period of five years effective from 1 August 2024. He also appointed the prominent economist Dr. Mampho Modise as a new Deputy Governor of SARB for a period of five years effective from 1 April 2024. The gender bias has now shifted in favour of women in the Deputy Governor cohort, which now includes three female appointments.

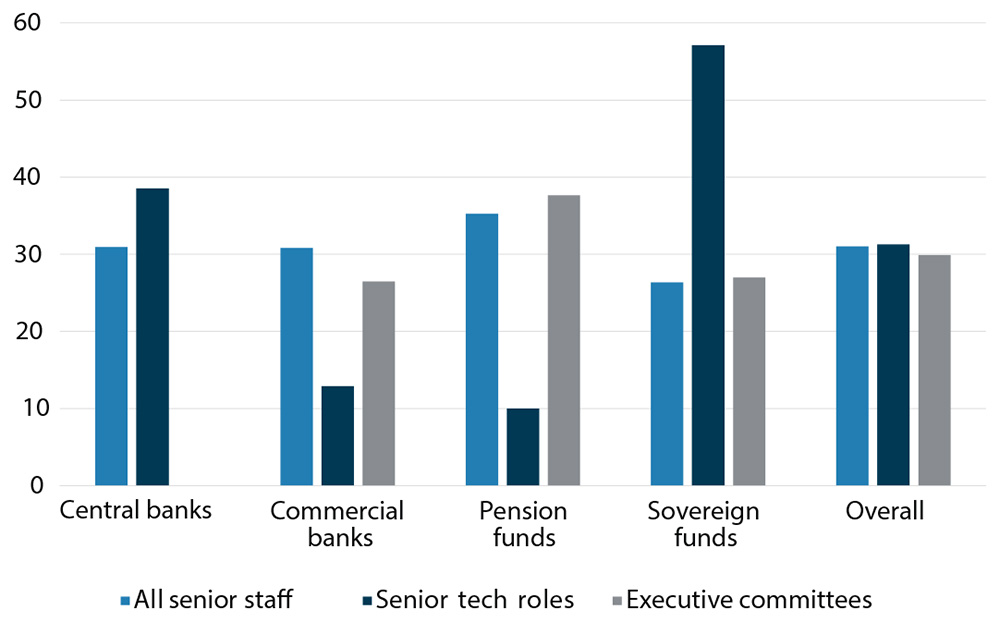

Women in Technology

Senior technology roles in financial institutions present a promising avenue for women in leadership, with encouraging signs for women in technology. Of the seven sovereign fund Chief Technology Officers (CTOs) included in the OMFIF’s GBI index, four are women. Two out of five African sovereign funds have women in leading technology roles, including Makano Mosidi CTO of South Africa’s Public Investment Corporation (PIC) and Sheila Malebogo Sealetsa, adviser on banking and currency digitisation of Botswana’s Pula Fund. In fact, the Central Bank of Seychelles and Bank of Namibia were the two highest ranked African countries in the GBI, with 54% senior staff comprised of women professionals. In contrast, the PIC has 17 female executives but no women on its board. Meanwhile, Absa and Standard Bank had 43 and 29 female board members, respectively, and 23 female executives each.

Share of women in tech is on par with industry trends

Share of women in senior positions, %

Source: OMFIF analysis

Note: Executive committee data unavallable for central banks.

The biggest challenge for women in the workplace may be reflected in the World Bank Group’s ‘Women, Business and the Law’ Report launched in March 2024. The report confirms that “the global gender gap for women in the workplace is far wider than previously thought. When legal differences involving violence and childcare are included, women on average enjoy just 64% of the legal protections and rights that men do—far fewer than the previous estimate of 77%. No country provides equal opportunity for women, -not even the wealthiest economies.”

The Report reveals a disconcerting implementation gap. Although laws suggest women enjoy roughly two-thirds of the rights men do, countries have established less than 40% of the systems needed for full implementation. For example, 98 economies enacted legislation mandating equal pay for women for work of equal value. Yet only 35 economies – fewer than one out of every five – have adopted pay-transparency measures or enforcement mechanisms to address the pay gap. The gender and implementation gaps highlight how much hard work lies ahead towards achieving parity.

New Trade and Gender Initiatives for MSMEs

In the field of trade, members of the World Trade Organisation (WTO) are increasingly discussing how to make trade more inclusive by fostering the greater participation of women and Micro-and-Small-and-Medium-Sized Enterprises (MSMEs) in trade. The recognition of the specific constraints of MSMEs and businesses owned by women in integrating global trade and leveraging trade for economic empowerment has resulted in the establishment of the WTO Informal Working Groups on MSMEs and on Trade and Gender.

According to the WTO, the Informal Working Group on MSMEs provides a forum to exchange information and experiences on ways in which WTO members could better support the participation of MSMEs in global trade. The Informal Working Group on Trade and Gender aims to enhance women’s participation in international trade by sharing best practices and exploring how women can benefit from the Aid for Trade initiative, among others. Discussions on inclusive trade have also gained significant importance in other WTO committees and working groups.

In this respect, the International Finance Corporation (IFC), the private sector funding arm of the World Bank Group, recently launched a new MSME Finance Platform initiative to aid financial service providers in delivering funds to small businesses in emerging markets, with a particular focus on those owned by women and those in the agriculture and climate sectors.

The Platform will include a financing package of up to USD4 billion from IFC’s own account to banks, non-bank financial institutions, microfinance institutions, and innovative digital lenders that focus on MSMEs. It will also utilize various forms of credit enhancement to mobilize private capital, including an innovative Catalytic First Loss Guarantee, which together aim to crowd in an additional USD4 billion in financing from eligible financial service providers to expand lending to these businesses.

“Micro, small, and medium enterprises.” explained Makhtar Diop, Managing Director of IFC, “form the backbone of most developing economies, yet they face significant financial barriers that hinder their potential. Our new financing platform addresses these challenges head-on, empowering financial service providers to extend critical support to these businesses, particularly those that are women-led or environmentally focused.” MSMEs, according to the IFC, make up over 90% of all firms and account, on average, for 60-70% of total employment and 50% of GDP worldwide. Still, according to the SME Finance Forum, there is currently a roughly USD5.7 trillion financing gap for MSMEs.

In emerging markets, MSMEs and the informal sector are essential to economic growth, job creation, and poverty alleviation. Recent crises have weakened financial service providers financially, constraining their ability to meet increasingly stringent lending requirements. As a result, businesses are seeing a credit contraction in emerging markets and developing economies due to tighter credit conditions, rising interest rates, and a limited appetite for risk.

The IFC will leverage its risk capital to extend first loss protection to eligible financial service providers, which often have ample local currency liquidity but have limited exposure to MSMEs due to the segment’s perceived high risk. Through this mobilization approach, the MSME Platform aims to create a financing solution through capital optimization structures and potentially redirect significant amounts of local currency financing to businesses.

The Platform will be supported by the International Development Association’s Private Sector Window (IDA PSW) to help de-risk the credit and foreign currency exposures in projects in low-income countries. Up to USD100 million will come from the IDA PSW Blended Finance Facility (BFF). In addition, resources from the Global SME Finance Facility (GSMEF) and the Women Entrepreneurs Opportunity Facility (WEOF) will be allocated to support and incentivize lending to businesses in the agriculture sector and women-owned MSMEs.

Looking ahead, as IMF Managing Director, Kristalina Georgieva and her co-authors Nadia Calvino and Odile Renaud-Basso stressed in a recent article titled ‘The Economic Power of Gender Equality,’ “women’s talent is a driving force behind economic progress and an essential part of the solution to climate change. Women already lead some of the world’s most influential financial bodies and play a growing role in the political arena. Now women must lead the shift to a more inclusive and sustainable growth model. We have a unique opportunity to advance inclusion, to inspire similar commitments from others, and to shape the future for the better.”