Rao Farid Khan,

Lead Legal Counsel and Head of

Claims and Recoveries at ICIEC

With some USD4 to USD64 trillion dollars wiped off US, European and global stocks in the two days after President Donald Trump’s declaration of “economic independence” and the imposition of a range of tariffs starting with a baseline 25% on steel and aluminium imports to the US, 10% tariffs for certain countries and a range of tariffs for other countries, the second-term Trump administration has disrupted the existing world trade, investment and business order. There are no signs of a retreat from this unilateral and isolationist US playbook which will impact every corner of the world including the US. Rao Farid Khan, Lead Legal Counsel and Head of Claims and Recoveries at ICIEC, considers the potential fallout for the credit and investment insurance industry and how the Corporation is positioning itself as a unique stabiliser and enabler of global and intra-OIC trade and investment.

President Donald Trump’s recent return to office and the policy shifts of his current administration have once again marked a critical juncture in the global economic landscape. Building on the disruptive strategies of his previous term, the renewed focus on protectionist trade policies, strategic decoupling, and a retreat from multilateral cooperation have intensified global economic uncertainty.

Actions such as renegotiating international trade agreements, reasserting national sovereignty over global institutions, and limiting U.S. engagement in global initiatives continue to challenge the foundations of international economic governance. These developments hold significant implications for global trade, investment flows, and credit insurance, potentially affecting the role and operations of multilateral institutions like ICIEC.

As a specialized multilateral insurer dedicated to promoting investment and trade among its 50 member states from the Global South, ICIEC now stands at a critical juncture. The current geopolitical and economic climate presents both elevated risks and profound strategic opportunities. The reinstatement of trade protectionism under Trump 2.0, marked by tariffs on imports from China, Europe, and various developing economies, has disrupted global supply chains and increased transaction costs. These changes have retendered cross-border commerce more unpredictable and significantly heightened the risk of defaults in international transactions. For the credit insurance industry, including ICIEC, this has led to a surge in demand for trade credit insurance, particularly from exporters in emerging markets who are increasingly seeking protection against non-payment risks and contractual disruptions.

In response to the current market challenges, ICIEC is uniquely positioned to play a crucial role in stabilizing and enabling trade. By enhancing its short-term credit insurance offerings and expanding its technical assistance services, ICIEC can develop robust credit insurance products tailored for high-risk markets, including the United States. This will provide vital support to exporters from its member states, helping them to remain resilient in the face of market volatility. Through these efforts, ICIEC not only fulfils its developmental mandate but also establishes itself as a dependable partner in an increasingly unpredictable trade environment.

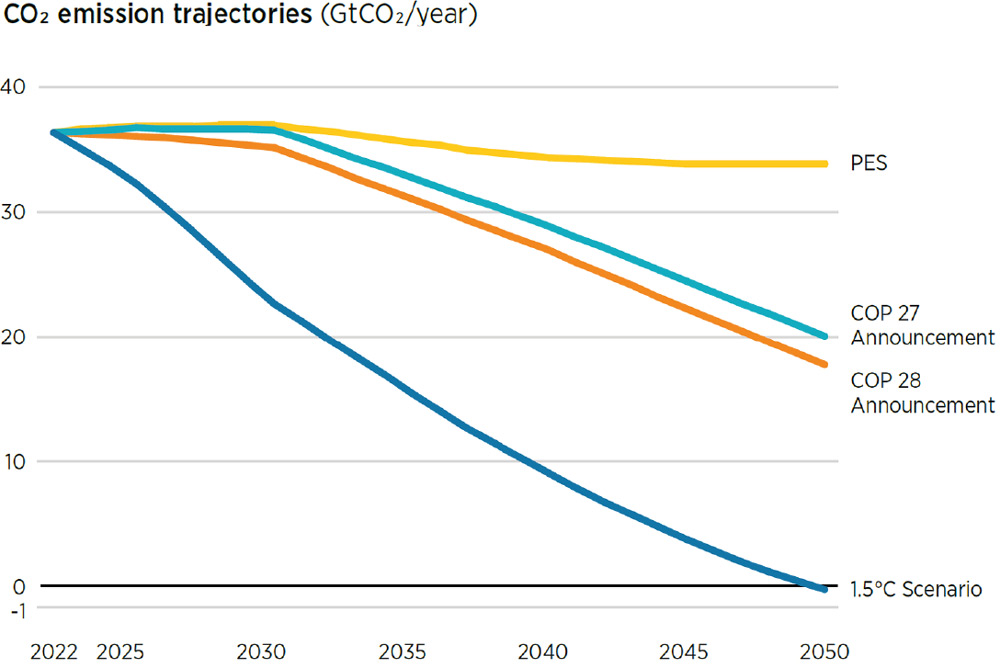

Moreover, the U.S. retreat from key multilateral frameworks, such as the Paris Climate Accord and the World Health Organization (WHO), under President Trump has weakened the foundations of international cooperation. The diminished role of the United States in global governance has created institutional voids, particularly in areas such as public health and climate change. For multilateral insurers, this fragmentation imposes coordination challenges, undermining collective responses to systemic risks. However, this also presents a unique opportunity for ICIEC to assert leadership within its member states by deepening regional integration and fostering South-South cooperation.

ICIEC’s mission, grounded in Islamic principles of financial and insurance intermediation, allows it to offer a compelling alternative to the nationalist and isolationist rhetoric that has gained prominence. By promoting inclusive trade and investment models that prioritize sustainable development, ICIEC can emerge as a beacon of multilateralism and collaborative resilience amongst its member states. ICIEC’s ability to foster intra-OIC economic ties through innovative insurance mechanisms will be pivotal in offsetting the impact of global fragmentation.

Simultaneously, the Trump administration’s aggressive posture toward geopolitical hotspots such as Iran and China, has contributed to heightened regional instability and a more precarious global investment climate. These developments increase demand for Political Risk Insurance (PRI), which offers protection against risks such as expropriation, political violence, currency inconvertibility, and contract frustration. ICIEC can respond to this rising demand by broadening its PRI offerings and enhancing its insurance products tailored to infrastructure, energy, and social development projects in member states. By engaging in co-insurance and reinsurance partnerships with other Export Credit Agencies (ECAs) and private reinsurers, ICIEC effectively manages largescale exposures while supporting transformational projects that align with national development priorities.

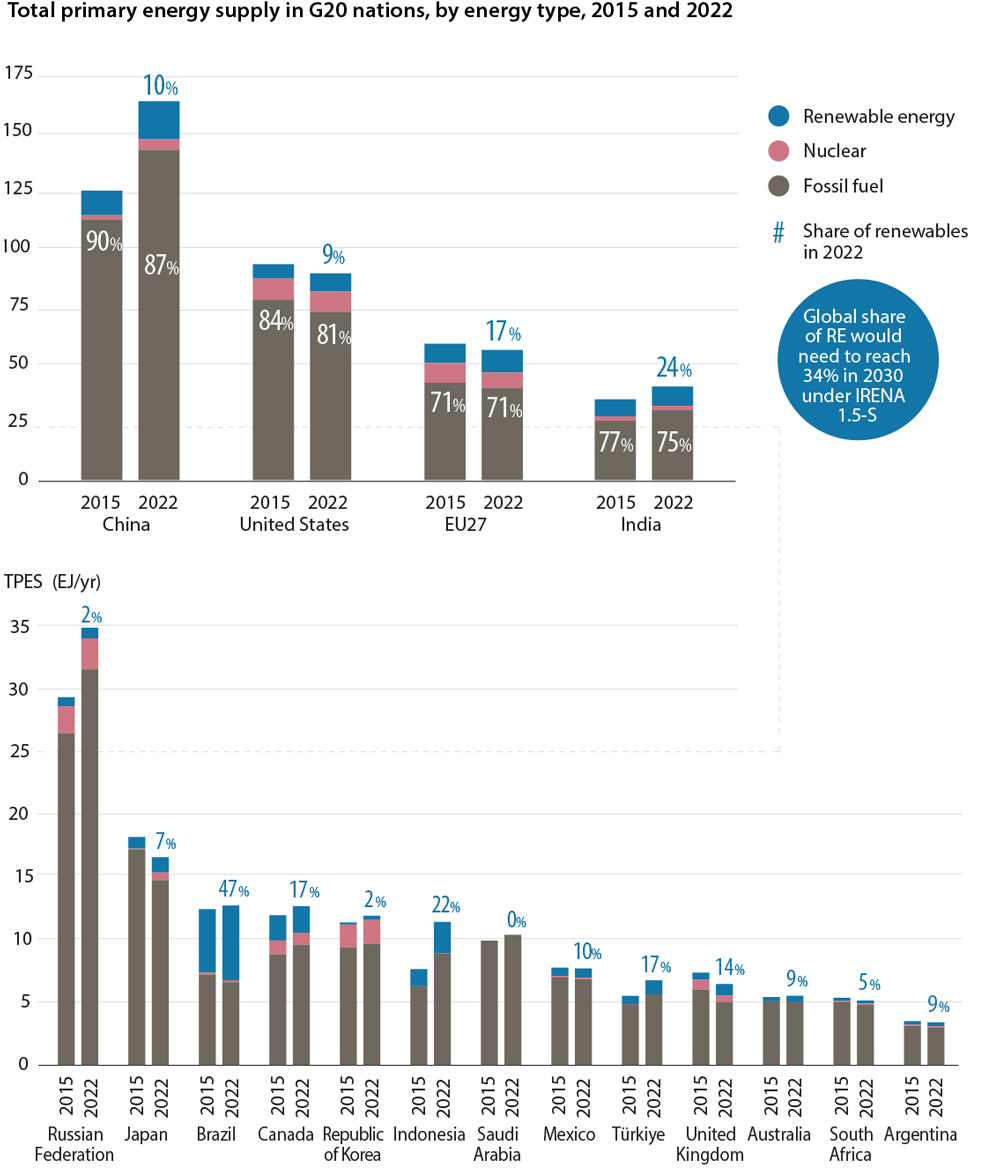

The third pillar of the IsDB Group Strategic Realignment 2023-2025 focuses on driving green economic growth. By supporting climateresilient infrastructure projects and offering insurance solutions for green Sukuk and ESG-compliant investments, ICIEC facilitates sustainable development while managing emerging climate-related risks. This aligns with the strategic objective of driving green economic growth, as it promotes investments in sustainable and environmentally friendly projects, thereby contributing to the overall goal of green economic development. ICIEC’s Sukuk Insurance Policy, alongside its Non-Honouring of Sovereign/Sub-sovereign Policy, offers a framework through which it can mobilize capital for environmentally responsible projects and attract private sector participation in sustainable investment.

Perhaps the most defining feature of Trump-era economic policy is its unpredictability – a trait that intensifies demand for comprehensive risk mitigation instruments. In such a volatile global environment, credit and political risk insurance are not mere tools of financial prudence; they are essential components of resilience and continuity for governments, corporations, and SMEs alike. ICIEC can respond to this need by offering bundled insurance solutions that address both commercial and political risks, particularly in high-volatility markets. ICIEC’s ability to support small and medium enterprises (SMEs), which often lack the capacity to absorb shocks, will be critical in maintaining inclusive trade and investment flows.

Further, ICIEC can expand its capacity-building initiatives to enhance the risk mitigation capabilities of stakeholders in member states, thereby contributing to greater institutional and economic resilience.

The reality of Trump’s presidency and its current policies introduces new layers of complexity into the global trade and investment landscape, with potential trade wars, a NATO rethink, and the deportation of millions of migrants. Nevertheless, within this turbulence lies an opportunity for ICIEC to redefine its role and expand its influence. By embracing innovation, reinforcing strategic partnerships, and aligning its offerings with the values and aspirations of its member states, ICIEC can rise as a leader in the global credit and investment insurance domain. Its ability to navigate uncertainty while remaining committed to sustainable, inclusive, and ethical development will determine its trajectory in the years to come.

As the world continues to fragment and global leadership remains in flux, institutions like ICIEC are not only tasked with protecting trade and investment flows but also with enabling them in ways that are just, resilient, and aligned with long-term development goals. By scaling up support for SMEs through agile credit insurance, diversifying political risk coverage, deepening regional collaboration, and pioneering climate-aligned insurance instruments, ICIEC can help build a more equitable and sustainable global economy. The path forward demands strategic foresight, bold innovation, and a steadfast commitment to the developmental aspirations of the IsDB Group member countries. In this mission, ICIEC is not merely an insurer—it is also a catalyst for stability, growth, and shared prosperity.

Harnessing Algeria’s Multifaceted Potential in Islamic Finance

Lotfi Zairi,

Associate Manager, Operations,

Sovereign Risks at ICIEC

Lotfi Zairi, Associate Manager, Operations, Sovereign Risks at ICIEC, considers the important supportive and technical role that the IsDB Group and ICIEC could play in developing the Islamic finance industry in Algeria by enhancing its existing cooperation in trade and project finance and credit and political risk policy cover for Algerian entities through the Group’s Country Engagement Framework (CEF) and ICIEC’s pioneering Green Sukuk Insurance Policy.

Economic Context

In last July 2024, Algeria has gained back its position within the uppermiddle income category under the World Bank’s country income classification. The merits of this classification invoke the advances made by the country in “economic and human development, investing in infrastructure projects and introducing redistributive social policies that alleviated poverty and significantly improved human development indicators.”

A recent World Bank report highlighted Algeria’s “strong” economic performance in 2024. Growth in the first half of the year reached 3.9 percent, driven by “resilient” agricultural output.

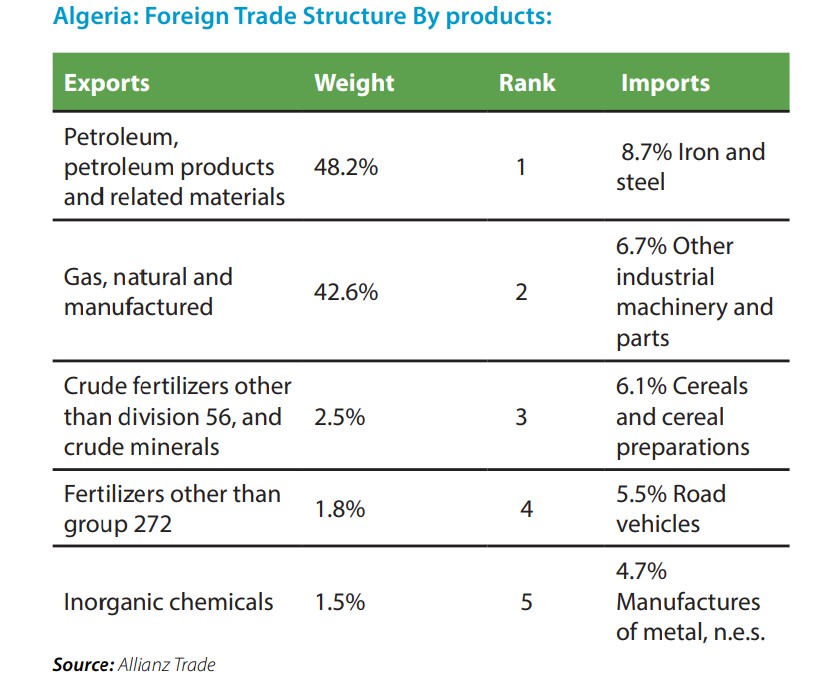

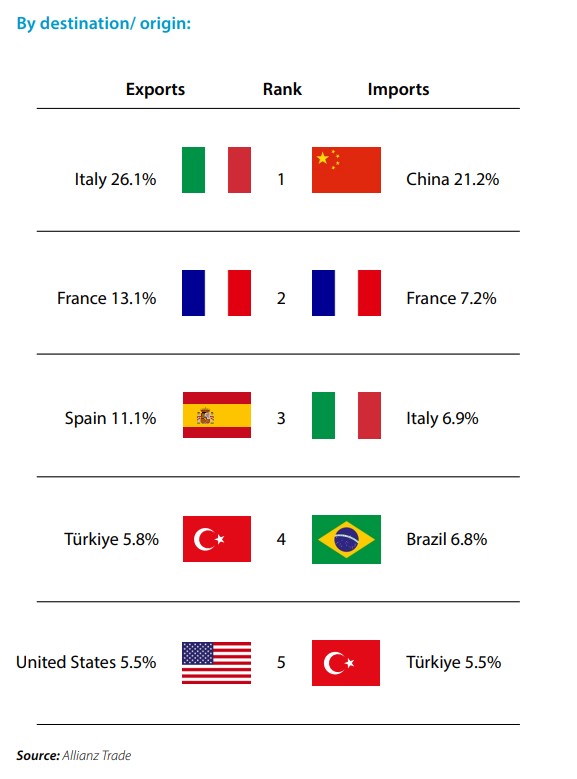

Algeria is the largest country in Africa and the third largest economy in the Arab world. Aiming at addressing the predominance of the hydrocarbons in the economy which counts for almost 95 % of exports and 14% of GDP, Algeria has taken major steps to diversify its sources of revenues and improve employment prospects since 2020.

New laws on Hydrocarbons, on Investment, and on Money and Credit have been promulgated, lifting restrictions on the foreign ownership of domestic firms, to boost foreign and domestic investment. The country has clearly adopted a transition strategy towards private sector-led growth, rationalized public-spending, optimized imports and further developed non-hydrocarbon exports.

The government is optimistic about the economic and financial situation, guided by an expected increase in the exports of goods and hydrocarbons and a forecasted growth in non-oil economic activity around 5% during the next three years 2025-27. The 2025 budget amounts to a projected USD126bn with 4.5% growth forecast compared to 4.2 percent in 2024. Public spending includes the revitalization of the oil sector both in terms of exploration and recovery. In addition, the 2025 Budget includes several infrastructure projects and other socially oriented sectors such as health, education, transportation, housing, and support for vulnerable communities accounting for 35.3%.

The country has brought its debt down from the highs of recent years and now has relatively low levels of external debt. To optimize its external debt, the government is exploring new funding channels to cover the growing budget deficit estimated at USD62bn, compared to USD45bn in 2024. In that respect, Algiers is arranging to promote the sustainable financing of strategic projects and to stimulate local investment. The Treasury is authorised to issue sovereign bonds, to let investors participate in the financing of infrastructure programs.

Islamic Finance Sector Development

While the international market offers significant potential, the government is focusing in the first instance on reintegrating the USD90bn parallel market, a sizeable shadow market that is hindering growth. The Islamic Finance industry is seriously considered by the Government for that purpose, counting on its efficient role in achieving a maximum financial inclusion of Muslim populations. Developing the Islamic banking sector, Takaful and Islamic Capital Market seems to be the battle horse in that respect.

The Finance Ministry expressed firm intention to issue Sukuk in early 2025 as part of the country’s budget. In that regard, Algeria can benefit from the services of ICIEC, which offers a Sukuk Insurance Policy (SIP) in full compliance with the Islamic Shariah.

Sukuk is an efficient financial instrument for resource mobilization from the international capital market, in full compliance with Islamic finance principles. Member Countries are using it for the funding of their infrastructure projects and other developmental initiatives including renewable energy and environment friendly projects. For these latter categories, ICIEC has also developed a Green Sukuk Insurance Policy. As such, the Sukuk Insurance Policy will contribute to the economic and social development of Member Countries.

The development of the Sukuk Insurance Policy has been widely appreciated by Member Countries as well by Islamic finance organisations, financial institutions and international reinsurance companies. It is expected to create an additional flow of Sovereign Sukuk issuances in the Islamic capital market based on the ICIEC third-party guarantee structure, in full compliance with Shariah principles.

Thanks to its AA- credit rating and to its remarkable track record in covering the risk of Non-Honouring of Sovereign Financial Obligations, ICIEC can provide a strong credit enhancement to Sukuk issued by Member Countries such as Algeria, lowering their dividend and cost, and facilitating their subscription across the international capital market.

IsDB Group Technical Assistance

The government is preparing a comprehensive legal framework for the Shariah-compliant finance industry, aiming to position Algeria as a regional hub for sukuk issuance within African, Arab, and European free trade zones, thereby increasing its financial importance in the Algerian economy.

In 2021, the Islamic Development Bank Institute (IsDBI) and the Central Bank of Algeria signed a technical assistance agreement valued at USD270,000 to develop the legal and regulatory framework for Islamic banking in Algeria. This project, once completed, will lay the foundation for the development of Islamic banking in Algeria. The technical assistance is in an advanced stage of implementation, and once completed, Algeria will have a comprehensive framework conducive for the development of Islamic banking activities and with the required tools for the central bank and regulators to supervise the system.

Furthermore, a second technical assistance grant of USD272,000, signed in 2022, is being provided to the Ministry of Finance to assist the country in issuing sovereign Sukuk. Algeria is trying to tap the Islamic Capital Market with sovereign Sukuk, and this technical assistance is intended to update the legal framework to accommodate Sukuk structures and to guide the country through the process of Sukuk issuance.

In addition, in collaboration with the Government, the Islamic Development Bank Group launched the first Country Engagement Framework (CEF) for Algeria in the period 2025-2027. This framework is designed to develop a short-term country engagement strategy and interventions in support of Algeria’s development programme.

Under its Re-aligned Strategy 2023-2025, the IsDB will support priority development projects and initiatives under two strategic pillars:

A. Enhancing the competitiveness of the economy and the private sector for an efficient renewal and diversification of economy

B. Partnering for capacity development and south-south cooperation

The envisioned CEF would provide a robust platform that would enable not only the IsDB, but also the Group entities to align and intervene, in complementarity, to contribute to the implementation of Algeria’s Development objectives. The CEF would thus be at the nexus of (i) national development priorities as highlighted in the Government Action Plan, and (ii) IsDB’s realigned strategy.

Pillars 1 and 2 complement each other and include both hard and soft interventions for the comprehensive development of the pre-requisites for Algeria’s Economic Development Programme. In addition, they will be supported by the cross-cutting pillars of:

- Islamic Finance.

- Women & Youth Empowerment.

- Climate Change adaptation and mitigation.

- Capacity Development to address the needs.

ICIEC Support to the Economy

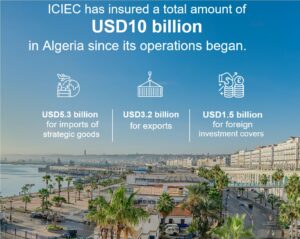

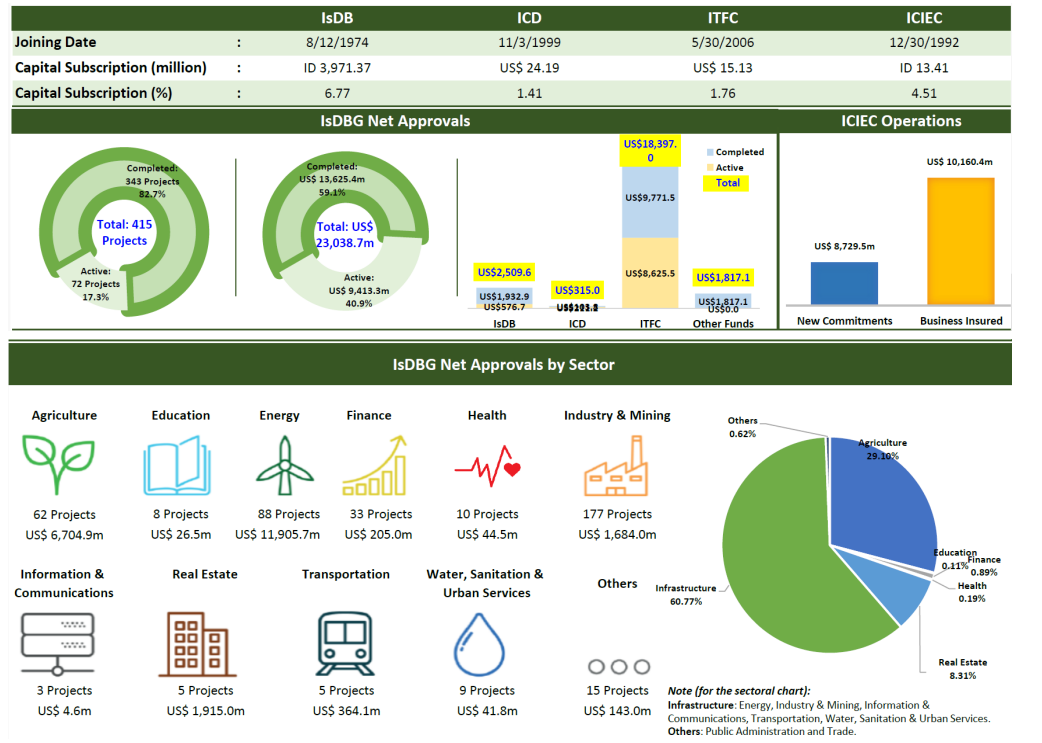

ICIEC has insured a total amount of USD10 bn in Algeria since inception. ICIEC has facilitated USD5.3bn for imports of strategic goods, USD3.2bn for exports, and USD1.5bn for foreign investment inflows.

ICIEC provides reinsurance support to CAGEX, the Algerian national ECA, for the export and domestic treaties. To boost Algerian exports, CAGEX and ICIEC are closely cooperating in offering required support to Algerian Non-Oil exports allowing them to diversify the Algerian economy.

Furthermore, ICIEC has been insuring several Jordanian pharmaceutical companies having established separate legal entities in Algeria. This allowed the transfer of know-how especially Jordan’s remarkable comparative advantage in the pharmaceutical sector.

Furthermore, it helped to accommodate the market needs in terms of good quality generic products at affordable costs and helped at later stage to create a good platform for Algerian pharmaceutical exports to African countries.

Lately, ICIEC insured financing provided by ITFC and a pool of commercial banks to STEG Tunisia to import gas from Sonatrach, Algeria. The cooperation with Algeria is characterized by the close coordination between ICIEC and CAGEX under the framework of the AMAN Union, which is an association of commercial and non-commercial credit insurance providers in the OIC member countries. In this regard, ICIEC, as the responsible entity for managing the AMAN Union Secretariat General during the years 2023-2024, organized in partnership with CAGEX the 14th Aman Union Annual Meeting in Algiers, in December 2024.

In addition, ICIEC catalysed a Foreign Investment in Algeria for the expansion of Tosyali Steel Factory, a large steel production project promoted by Turkish Investors.

ICIEC Support to Tosyali Steel Project -Algeria

The collaboration between Tosyali Holding and ICIEC demonstrates the potential for successful large-scale industrial projects supported by robust financial and insurance frameworks. This partnership not only benefits the involved parties but also serves as a model for other companies and investors looking to explore opportunities in emerging markets, taking advantage of ICIEC support in terms of risk mitigation as well as capacity building.

In 2018, Tosyali Holding, a prominent Turkish steel manufacturer, received substantial support from the Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC). ICIEC issued a 5-year equity investment insurance policy to back Tosyali Holding’s ambitious 3rd phase of development for its steel factory project in Algeria, valued at USD 450 million.

This project represented the largest foreign investment ever made by a Turkish company, highlighting Tosyali Holding’s significant role in the global steel industry. It was the most substantial Foreign Direct Investment (FDI) in Algeria outside the petrochemical sector, underscoring its strategic importance for the country’s industrial diversification.

The support from ICIEC not only provided financial security to Tosyali Holding as a foreign investor but also demonstrated a high-level confidence in the capability of quality investors from the Organisation of Islamic Cooperation (OIC) to execute large-scale international projects. This collaboration marked a landmark milestone in strengthening economic ties between Türkiye and Algeria, paving the way for future investments, industrial growth, regional economic integration and more Intra-OIC Investments.

By securing the production of 70% of Algeria’s building materials needs, Tosyali steel project has largely contributed to reducing the country’s imports of steel, enabling remarkable currency savings. In addition, the project has provided over 4,000 direct jobs and thousands of indirect jobs.

Tosyali Holding initiated its Algerian operations in 2013 through affiliate company Tosyali Iron Steel Industry Algerie A.Ş. (Tosyali Algerie). The complex covers 4 million square meters and has easy access to the Mediterranean Sea.

Phase 1 included a 1.5 Mt/y EAF steel meltshop and a 1.2 Mt/y rolling mill. The initial production capacity of reinforcing bar (rebar) was 1.2 million tons and represented 28% of demand at this time. Like reinforcing bars, wire rods are in high demand and a vital product for development.

Phase 2, which was completed in 2015, added a 0.5 Mt/y wire rod mill, which met 60% of the total needs of Algeria at that time. Wire rods are used for the manufacture of dozens of products such as wire mesh, wire, nails, and screws.

The third phase of development started in 2018 aimed at completing the integration of iron ore into the finished product process. In this phase, Tosyali Algerie set up a 4 Mt/y iron ore plant and a 4 Mt/y pellet production unit to transform iron ore fines into iron oxide pellets.

Phase 4 of the Tosyali Algerie steel complex, a DRI-EAF integrated flat steel production facility, began in 2022. In July 2021, Tosyali Holding awarded Midrex and its partner Paul Wurth a contract to build a second DRI plant at the Tosyali Algerie steelworks. The new DRI plant is to produce 2.5 million tons of HDRI and CDRI with the capability to operate with increased percentages of hydrogen in the future. HDRI will be fed via a hot transport conveyor to the new 2.4 Mt/y EAF melt shop, providing greater EAF productivity and energy savings. During melt shop outages, the MIDREX Plant can continue producing CDRI up to full capacity.

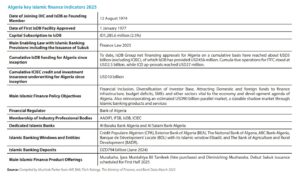

Algeria – Islamic Finance and Takaful Snapshot

Algeria’s Islamic Banking Voyage of Discovery

Despite being a founding member of the IsDB and a member of ICIEC since 1996, Algeria is a relative latecomer to the Islamic finance industry per se. The country is keen to open up to the Islamic finance industry and the Ministry of Finance is mooting the issuance of Algeria’s debut sovereign Sukuk reportedly in First Half 2025. As Mushtak Parker maintains the potential for and the synergies between Islamic finance and a people-centred sustainable development agenda in Algeria are huge, particularly in the issuance of Sukuk for infrastructure and budget rebalancing, raising funds through Murabaha syndication for trade finance, and through the utilisation of ICIEC’s unique Shariah-compliant credit and investment insurance solutions in a world beset with growing uncertainties.

Algeria, a founding member of the OIC and the IsDB, is now poised to embrace the estimated USD5 trillion global Islamic finance industry.

Hitherto, the country has seen a modest but growing level of activity mainly through the IsDB, ICIEC and through its growing number of Islamic financial institutions including Al Baraka Bank Algeria and Al Salam Bank Algeria, and several Islamic Banking Windows of public and overseas banks such as Crédit Populaire Algérien (CPA), Exterior Bank of Algeria (BEA), the National Bank of Algeria, ABC Bank-Algeria, Banque de Dévelopment Locale (BDL) with its Islamic window Elbadil, and the Bank of Agriculture and Rural Development (BADR).

This follows the proactive policy support from Algerian President H.E. Abdelmadjid Tebboune and his government to embrace and promote Islamic finance in the country’s development agenda, which has manifested in the fact that Algeria is the host country of the 2025 Algeria key islamic finance indicators 2025 IsDB Group Annual Meetings on 19-22 May in Algiers along the theme “Diversifying Economies, Enriching Lives.” H.E. Mr. Abdelkrim Bouzred, Minister of Finance and current Chair of the IsDB Board of Governors, emphasized: “This event is of great significance for Algeria, offering an important opportunity to elevate its standing on the global economic stage by highlighting the reforms implemented and showcasing the country’s strengths in cooperation, investment, and sustainable development.”

Catching Up

The reality is that Algeria as an Islamic finance market has a lot of catching up to do in all the facets of the industry. The good news is that there is a new-found realisation in the government of President Tebboune that Islamic finance has much to offer Algeria in its development journey.

To facilitate this, the government has introduced several pieces of enabling legislation based on parity with the conventional finance sector over the last few years. The main legislation was the Finance Law 2018 which for the first time saw the facilitation of several Islamic banking products.

In October 2024, for instance the government introduced Islamic real estate and mortgage finance regulations which has allowed Algerians wishing to access Shariah-compliant mortgages for their house and commercial property as their financing choice. The government also started in 2022 to licence family and general Takaful operators and introduced legislation to facilitate Shariah-compliant auto financing products.

Islamic finance deposits according to the finance minister H.E. Laaziz Faid had reached DZD794 billion at end June 2024. In December 2024, he confirmed that the finance ministry was working on a Sukuk Issuance Framework and a new law to facilitate the offering of the country’s maiden sovereign Sukuk issuance, aimed at financing projects and infrastructure. funds for its infrastructure projects. Quoted by the local Aljumhuria newspaper, the Minister said that the plan was to issue a debut Sukuk in First Half 2025 to complement the funding needs of the 2025 National Budget, to attract a wider base of foreign investors by diversification the source of funding and investor base, and to boost confidence in the local capital market.

An important development also was in 2021 when the Bank of Algeria (the central bank) signed an MoU with the Bahrain-headquartered Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) to collaborate to enhance the Islamic finance industry in Algeria.

Financial Inclusion

But the most important recent development is the repeal of existing legislation to make way for the introduction and adoption of the 2025 Finance Law which includes provisions for regulating Islamic consumer finance products in sectors such as tourism and hospitality, education and healthcare using Murabaha, Ijara Muntahiya Bil Tamleek (hire purchase) and Diminishing Musharaka structures targeting financial inclusion objectives, SMEs, real estate and infrastructure projects, and also reincorporating an estimated USD90bn parallel market, a sizeable shadow market through Islamic banking products and services.

The Islamic Banking Window (IBW) of Crédit Populaire Algérien (CPA), for instance had over 70,000 customer accounts at end 2024 and customer savings of DZD47 billion. According to CPA these initiatives point to the fact that the Islamic finance industry is entering a new phase of offering tailored solutions to customers in key sectors of the economy.

The proposed debut sovereign Sukuk has also been approved under the 2025 Finance Law. According to Al Majalla newspaper, the debut Sukuk issuance is likely to be denominated in local currency DZD. A major problem with all nascent Islamic finance markets is the dearth of reliable and regular market data and whether the data includes the official figures and the estimates for the unofficial black economy. The current Islamic finance data landscape of Algeria is at best sparse and fragmented, and information is ad hoc, dated and sometimes exaggerated depending on the source. This makes it difficult to assess the state of the Islamic finance sector in the country. Date disclosure and transparency is really the task of the financial regulator, the Bank of Algeria, to which all authorised and licenced financial institutions obliged to report to.

According to the Bank of Algeria in a February 2024 report, Islamic banking deposits rose by more than 14% in the last two years, from around USD4 billion in 2022 to USD4.7 billion by June 2023, when there were 12 licensed providers operating in Islamic banking (six state-run,six private providers). There was no delineation of whether they were dedicated or IBWs.

Algeria’s Islamic finance journey needs to transform from a fragmented approach to a more structured one, in which policy making, enabling legislation, various frameworks and guidelines, regulatory standards, acceptance and compliance with international standards, disclosures and clarity of purpose should be paramount. Industry bodies such as IFSB, IILM, AAOIFI and others, together with the IsDB Group could play a crucial role in market education and technical expertise to ensure better understanding of and Shariah certainty and confidence in the industry, which after all has a large natural constituency for Islamic finance products.

Exclusive Interview

Algeria’s Growing Interest in Islamic Finance and Development Tempered by a Lack of Structured Growth and Regulatory Developments

Mr. Zohir Laiche,

CEO of CAGEX

The State-owned Algerian Export Credit

Insurance Agency (ECA)

ICIEC Newsletter: To what extent is the culture of credit and political risk insurance embedded in the Algerian trade, investment and business architecture? What are the gaps and how is CAGEX trying to fill these gaps? What role can the AMAN Union and The Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC) play to enhance the culture of credit insurance?

Mr. Zohir Laiche: Credit and political risk insurance (CPRI) is still developing in Algeria and have not yet been fully integrated into the country’s trade, investment, and business ecosystem. Although awareness is growing thanks to CAGEX’s effort and action on the spot, many companies, particularly SMEs, remain relatively unfamiliar with the benefits of credit insurance. The main gaps include limited market penetration, insufficiently structured demand from exporters, and a greater need for a risk management culture within companies.

CAGEX is actively working to bridge these gaps by strengthening its awareness programs, offering tailored insurance solutions and developing partnerships with banks and financial institutions to integrate credit insurance into their offerings. In addition, our credit insurance company is collaborating with regional and international stakeholders, such as the AMAN Union and ICIEC, to promote best practices, build capacity, and increase market visibility.

AMAN Union and ICIEC play a key role in promoting the culture of credit insurance in Algeria and beyond. Through their technical assistance, knowledge-sharing platforms, and reinsurance solutions, they contribute to assist national agencies such as CAGEX to strengthen their resilience and expand their reach. ICIEC brings valuable expertise in Shariah-compliant credit insurance, which aligns with Algeria’s growing interest in Islamic Finance.

CAGEX has a close collaboration with ICIEC, partly through its landmark Reinsurance Agreement signed during the 14th Annual General Meeting of the AMAN Union in Algiers last December. What is the status and progress of this collaboration as you expand your geographical reach and footprint beyond Algeria into new markets all over the world especially in Sub-Saharan African, where there are ever-evolving demands, geopolitical uncertainties and risks?

The partnership between CAGEX and ICIEC has just taken an important step forward after the signature of the Reinsurance Agreement at the 14th Annual General Meeting of the AMAN Union in Algiers. This agreement strengthened our risk-sharing mechanisms, enabling us to increase our underwriting capacity and provide more effective support to Algerian exporters.

As we expand, our geographic footprint beyond Algeria, particularly in Sub-Saharan Africa, our collaboration with ICIEC remains essential. This region offers numerous opportunities, not only but also complex challenges, such as constantly evolving geopolitical risks and liquidity constraints. By leveraging ICIEC’s multilateral expertise and reinsurance support, CAGEX may offer more robust coverage to Algerian and Regional exporters mitigating, in this way, commercial risks and facilitating access to new markets. We also work closely with ICIEC on capacity building and market information sharing initiatives, so that our clients benefit from risk management solutions adapted to the realities of emerging markets.

ICIEC is unique in that it is the only multilateral Shariah-complaint credit and Investment insurer in the world. Algeria is a latecomer to the global Islamic finance industry despite being a founder member of the OIC and the Islamic Development Bank (IsDB). Does Islamic finance and investment, credit and political risk insurance (PRI), fundraising through syndicated Murabaha and Sukuk, have a role to play in the Algerian economy and financial and business sectors? If so, what is CAGEX doing to promote the industry per se and the credit and PRI sector in particular?

Islamic finance is steadily growing in Algeria, despite the country’s late arrival at the global level. The government has taken steps to develop the industry, including launching Islamic banking products and exploring alternative financing mechanisms such as Sukuk. However, structured growth and regulatory developments are still needed.

Credit and political risk insurance (CPRI) within the framework of Islamic Finance plays a crucial role in securing investments and trade transactions, particularly for Algerian exporters seeking to enter OIC markets.

CAGEX is committed to support this development by collaborating with ICIEC and other Islamic financial institutions to promote Shariah-compliant credit insurance solutions. Additionally, CAGEX is actively working with local financial institutions to integrate Islamic credit insurance into their offerings, ensuring to businesses seeking Islamic financing to get appropriate risk management tools.

As the country explores syndicated Murabaha structures and Sukuk for raising capital, we see an opportunity for insurance mechanisms to complement these initiatives, thereby strengthening investor confidence and financial stability.

Algeria is hosting the IsDB Group Annual Meetings in May 2025. Do you think this will open the economy and market to further cooperation in Islamic trade, investment and development finance? Which countries and regions are the priorities for Algerian exporters and importers?

The organization of the IsDB Group’s Annual Meetings in May 2025 represents a strategic opportunity for Algeria to strengthen its role as a key player in Islamic trade, investment, and development finance. This event will bring together policymakers, investors, and financial institutions, creating a platform conducive to enhanced cooperation and new investment opportunities.

We expect increased interest from IsDB member states in exploring trade and investment partnerships with Algeria. This could lead to strengthened cooperation in export credit insurance, infrastructure financing, and SME’s development. For CAGEX, this is an opportunity to showcase Algeria’s potential as a trade hub and reaffirm our role in facilitating cross-border transactions.

Priority markets for Algerian exporters and importers include North Africa, West Africa, the Middle East, and selected Asian economies within the OIC. Strengthening trade ties with these regions will be essential to diversify Algeria’s economic partners and reduce dependence on traditional markets.

Looking ahead, what the priorities for CAGEX, its ongoing relations with ICIEC, the rest of the IsDB Group and in its efforts to expand to new markets especially in the OIC fraternity and beyond.

Looking ahead, CAGEX has set several strategic priorities:

- Strengthening our collaboration with ICIEC and the IsDB Group: We aim to deepen our partnership with ICIEC to improve our reinsurance capabilities, expand our product range and facilitate trade finance solutions for Algerian exporters.

- Expanding into new markets: We are focusing our efforts on expanding beyond Algeria, particularly in OIC countries and Africa, by developing solutions tailored to the needs of exporters operating in high-risk markets.

- Promoting the culture of credit insurance: One of our main challenges remains increasing the penetration of credit insurance in Algeria by conducting awareness campaigns and collaborating with financial institutions, mainly, banks.

- Investing in digitalization and innovation: We are implementing digital solutions to optimize our processes, improve the customer experience and improve our risk assessments.

- Managing economic and geopolitical uncertainties: CAGEX will continue to adapt its strategies to protect Algerian exporters against global risks.

In the end, our ambition is to position CAGEX as a regional leader in credit insurance industry building on our partnerships with ICIEC, AMAN Union and the IsDB Group.

Member Country Profile Algeria

Steady as It Goes – How to Uncap Algeria’s GDP Growth Potential

Algeria is country in transition. Though heavily dependent on oil and gas, its attempt to diversify its economy away from hydrocarbons remains a challenge. Mourad Mizouri, Manager, MENA Division at ICIEC profiles Algeria’s economy and its key sectors, and the close collaboration between the Corporation and Algeria, especially through CAGEX, the Algerian state Export Credit agency.

Mourad Mizouri ,

Manager, MENA Division at ICIEC

Algeria is a founding member of the OIC and the IsDB. Algeria joined the IsDB on August 12, 1974, and became a member of ICIEC in 1996.

Since the commencement of its operations, ICIEC has provided insurance coverage totalling USD 10 bn in Algeria as of mid-April 2025. This cooperation with Algeria is characterized by the close coordination between ICIEC and CAGEX, Algeria’s state-owned Export Credit Agency, particularly in the areas of reinsurance as well as joint engagement under the AMAN Union Umbrella. Furthermore, ICIEC supported key sectors in Algeria, notably the pharmaceutical and steel industries.

Economic Overview

Algeria is Africa’s second-largest crude oil producer and the top natural gas producer. Strong demand for Algerian hydrocarbons, especially gas, will spur investment in the sector. The non-hydrocarbons economy will remain weak, undermined by the business environment. Real GDP growth will ease in 2025 as government spending growth slows and oil output remains constrained, but will be supported by services, industrial and construction activity, and by growth in natural gas output. Weak private-sector activity, an unstable business environment and limited economic diversification will cap Algeria’s growth potential.

Lower hydrocarbons revenue will be tempered, in part, by tax increases, and modest economic diversification, aided by foreign investment, will help to widen the tax base and boost non-hydrocarbons revenue. The fiscal deficit will remain large but will narrow modestly. The current account will remain in deficit, owing to robust import growth and declining hydrocarbons receipts as falling energy prices outpace modest output growth. Foreign exchange reserves will decline over 2025-29 but import cover will remain comfortable.

The reliance on hydrocarbons and fiscal deficit challenge

Despite efforts to diversify the economy, the hydrocarbons sector will remain the main driver of economic performance in the immediate to the medium term. Algeria is in a prime position to benefit from European demand for gas after the Ukraine war pushed European countries to seek alternative gas suppliers. Algeria’s state energy firm, Sonatrach, and Italy’s Eni have signed several agreements to gradually increase gas exports to Italy in the next few years, boost exploration efforts and develop green hydrogen in Algeria.

However, Algeria’s ability to meaningfully increase exports will remain limited, hampered by rising domestic gas consumption, which now accounts for about half of local production. The combination of elevated global prices and more involvement from foreign energy companies yielded several new oil and gas discoveries over 2022-23, but bringing these new areas into full production is likely to take four to five years, at least. The country’s modest reserves compared with some of its peers in the OPEC+ alliance will also limit production growth in the longer term.

In terms of mining, Algeria has substantial deposits of gold, zinc, phosphates and iron ore, which the government wants to develop in joint-venture agreements with foreign firms. Notable projects under development include the Gara Djebilet iron ore mine in south-western Algeria and a phosphate-processing plant in Tebessa—both involving Chinese investors—and the Tala Hamza zinc and lead mine in Bejaïa. The contribution of agriculture to the economy has increased in recent years; the sector accounts for about 12.5% of GDP. However, agricultural output remains well below its potential and local demand.

The Financial Sector

According to the World Bank, over the past decade, Algeria has attempted to modernize its financial system, despite social strife, and unique challenges posed by the large hydrocarbon sector. The banking sector is liquid, solvent, and profitable but non-performing loans (NPL) weigh on balance sheets. Aggregate solvency and liquidity ratios exceed regulatory minimums. The sector-wide NPL ratio stood at 21% at end2023. NPLs have been consistently higher for state-owned banks, with IMF data for June 23 showing NPLs at public banks reaching 21.4% of total loans, compared with 8.6% at private banks in the same period. Third-quarter 2024 data shows that annual credit growth increased to 5.7% year-on-year, sustaining its growth momentum.

Algeria and the IsDB Group

Algeria joined the IsDB on August 12, 1974, among the founding members. The Board of Executive Directors approved the first IsDB operation for Algeria on January 01, 1977, and the latest operation was approved on March 19, 2017. Its capital subscription is ID1,285.6 million (2.5%).

Given the limited recourse to external debt. IsDB engagement in Algeria is limited to capacity building, reverse linkage, regional integration and vocational training. Other group entities have ongoing operations in Algeria such as ITFC who is exploring trade financing.

ICIEC operations in Algeria

Key ICIEC Transactions with Algeria

- ICIEC provides reinsurance support to CAGEX, the Algerian national Export Credit Agency, for the export and domestic treaties. In support of Algeria’s economic efforts, ICIEC also works with CAGEX to enhance Non-Oil exports by offering tailored risk mitigation and credit enhancement solutions.

- ICIEC has been providing insurance coverage to several Jordanian pharmaceutical companies that have established separate legal entities in Algeria. This facilitated the transfer of know-how, leveraging Jordan’s strong comparative advantage in the pharmaceutical sector. Furthermore, this has supported Algeria’s domestic market by ensuring access to high-quality, affordable generic medicines, and over time contributed to the development of a solid platform for Algerian pharmaceutical exports to African countries.

- ICIEC also supported syndications led by ITFC for financing gas imports from Sonatrach, Algeria to STEG Tunisia.

- ICIEC’s facilitated Foreign Direct Investments in Algeria aligned with the National Development Plan.

Re-imaging the Role of Murabaha Syndications and Sukuk as Development Drivers

The theme of the ICIEC Quarterly magazine’s Q1 2025 edition, ‘Unlocking Development Finance – The Power of Sukuk and Syndicated Murabaha’ could not be more pertinent and opportune. At a time of great uncertainties in the global geopolitical, economic and financial landscape, largely exacerbated by the US administration’s tariff rises on 2 April , decision makers in the 57 OIC member countries could do well by re-thinking their development fund raising strategies – both for sovereign and corporate debt – to urgently embrace alternative mechanisms such as Sukuk and Murabaha transactions. Mushtak Parker, Consultant Editor, considers how the Islamic finance sectors in general and the takaful-based credit and investment insurance industry in particular can enhance the synergy of these instruments with the wider trade and infrastructure sectors and help withstand macro volatilities and crises.

It has already been illustrated in an iconic paper published by then IMF economists Mohsin Khan and Abbas Mirakhor a few decades ago that in times of crises the Islamic system of financial intermediation may be in a better position to withstand the associated shocks than its conventional counterparts. Similarly, at the G20 meeting in Antalya in November 2015, the leaders in their final communiqué stressed the suitability of “alternative financing structures, including asset-based financing (namely Sukuk),” for urban regeneration and infrastructure investment, and for funding SMEs, usually the backbone of economies. It was the first time Islamic finance was so mentioned by the organisation.

Fast forward to 2023 when ICIEC, the only Shariah-compliant multilateral credit and political risk insurer in the world, member of the Islamic Development Bank (IsDB) Group, surpassed the USD100 billion landmark with a cumulative business insured since inception of USD121billion and going strong.

Sukuk Market Dynamics

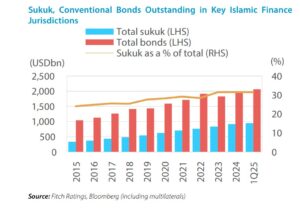

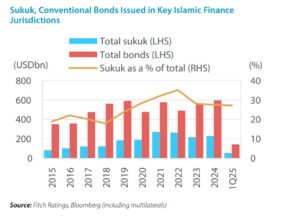

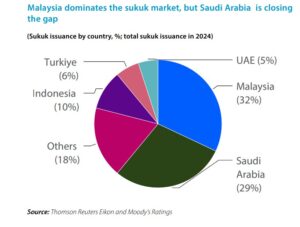

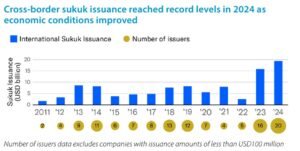

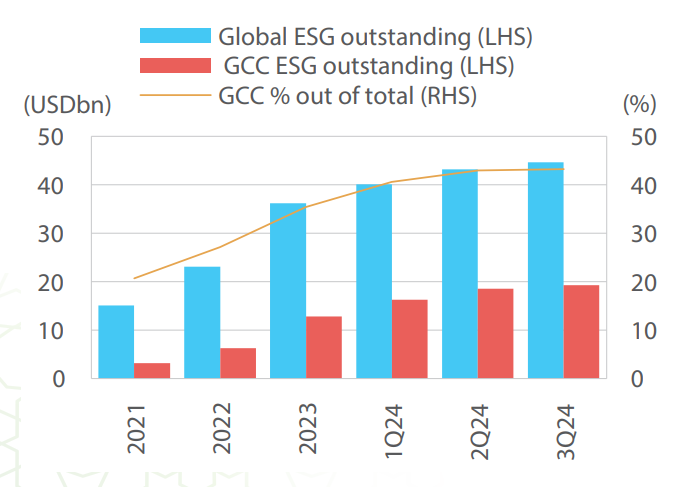

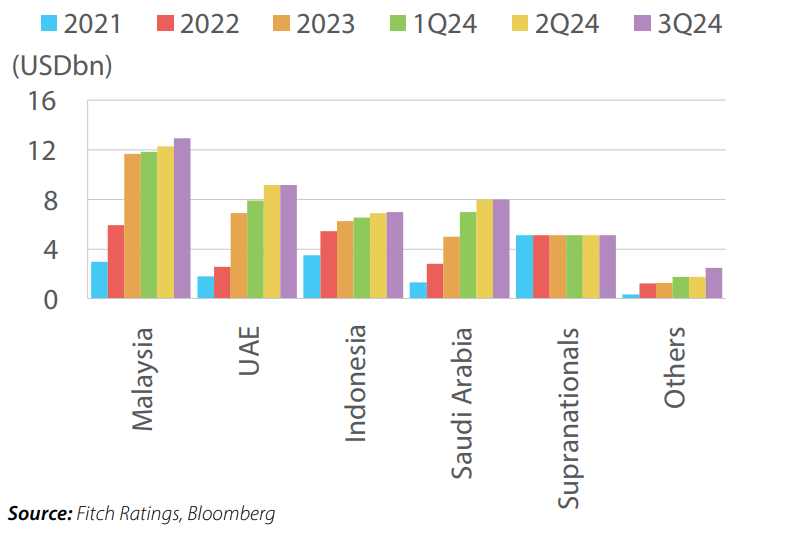

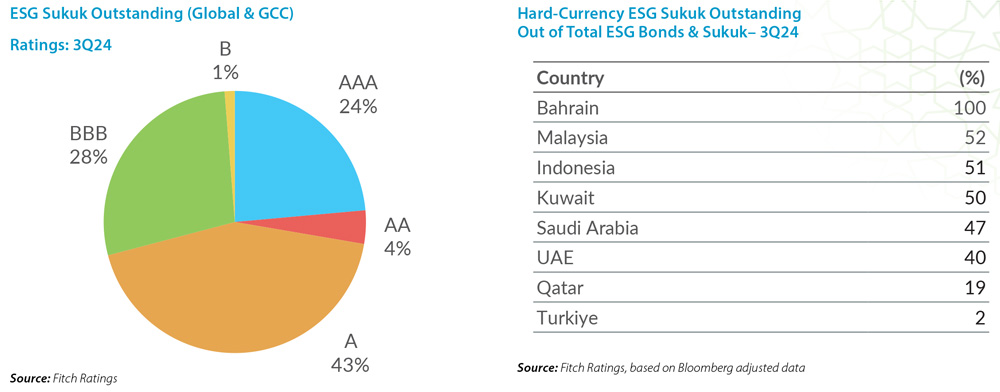

The data for the global Sukuk market is outstanding. According to Fitch Rating’s ‘Global Sukuk Market Monitor: 1Q25’, global Sukuk volumes grew by 10.8% y-o-y to USD961 billion, despite geopolitical escalations.

Going forward, Global Sukuk is set to surpass USD1 trillion outstanding in 2025, solidifying its role in OIC countries and emerging markets. Sukuk will remain a key part of the debt capital markets (DCM) in several OIC countries, and stay significant in emerging markets (EM), after representing 12% of all EM US dollar debt issued in 2024 (excluding China). However, growth could be affected by risks including Shariahcompliance requirements, geopolitical events, rising rates, and higher oil prices,” emphasises Bashar Al Natoor, Global Head of Islamic Finance at Fitch Ratings.

Sukuk were 25% of total dollar DCM issuance in the core markets of GCC countries, Malaysia, Indonesia, Türkiye, and Pakistan. ESG Sukuk reached USD44.5 billion outstanding, up 23% y-o-y.

Despite the current vagaries of the Sino-US tariff and trade war, the overall Sukuk funding environment seems favourable, driven by local demand and domestic issuance conditions. Around 28% of global Sukuk outstanding will mature in 2025–2027 with good potential of new issuances, supported by lower oil prices expected in 2025. While not their traditional funding source, Islamic banks and corporates could opportunistically diversify through Sukuk.

Sukuk Standards

AAOIFI Shariah Standard No. 62 (Draft) requires ownership transfer of the underlying sukuk assets to sukuk holders. which after initial consultations with the market will hold two final hearings in the coming months to present the draft developments. Among key proposals are the transfer of legal ownership and associated risks of the underlying Sukuk assets to the Sukuk holders, granting investors asset recourse to ensure closer adherence to Shariah principles.

“Any impact of AAOIFI Standard 62 implementation on Sukuk pricing compared to bonds,” maintains Bashar Al Natoor, “depends on the final version, which jurisdictions and entities adopt it, and, most importantly, how it is incorporated in Sukuk documentation. New Shariah-related requirements in Sukuk documents, which are not usually seen in conventional bonds, did not appear to have an impact on pricing in 2024. These includes terms in the Sukuk documentation related to asset-inspection, asset takeover, Shariah-compliant hedging, and partial payment of the periodical distribution amount in certain circumstances and for limited period.”

From a rating point of view, these factors will determine impact on Sukuk credit profiles, debt rankings, obligor IDRs, Sukuk issuance trends, issuer willingness, and market appetite. Investors however like clarity and certainty especially in policy, regulatory, accounting and legal matters. In the Islamic debt and capital market this pertains to documentation, standards and Shariah matters and governance. The question arises who regulates the Islamic Capital Market? Is it the securities regulators such as the Capital Markets Authorities or the Securities Commissions or the standard setting bodies and their Shariah advisories? The sooner the issues pertaining to AAOIFI Standard 62 are resolved the better for the market. It is not clear to what extent the regulators of those countries in which Islamic finance and Sukuk are of systemic importance are involved in the AAOIFI consultation.

Standard setting bodies and Shariah advisories are important players in the financial ecosystem and its stability and growth. All Islamic Finance standard setting bodies need to cooperate together in a synergetic framework in order to efficiently contribute to providing full transparency to the market.

No doubt, the assets ownership by the Sukuk investors substantiates the specific nature of Sukuk as an Islamic financial paper and differentiates it from the conventional Bond. It is quite expectable to witness some market resistance as it is not a familiar requirement in the conventional bonds. The gestation with the market regarding the Sharia standards is normally driven by the market players perspectives and should remain under the Islamic Finance precepts and fundamentals.

The Islamic Financial Services Board (IFSB) as the standard-setting body of regulatory and supervisory agencies that have vested interest in ensuring the soundness and stability of the Islamic financial services industry, should complement AAOIFI standards to cover this aspect. Indeed, IFSB has already issued standard 21 dealing with the Core Principles for Islamic Finance Regulation related to the Islamic Capital Market Segment. IFSB should clearly guide the financial supervisory authorities on the Sukuk structure including the required ownership transfer of the Sukuk underlying assets to the investors.

Democratising Capital Markets to Ultra Retail Investors

Two interesting trends are in democratising access to capital markets for SMEs and ultra retail investors in infrastructure related projects under financial inclusion policies. In Malaysia, for instance, Dana Infra Nasional, the infrastructure financing entity, has issued a number of Sukuk aimed at ultra retail investors which are guaranteed by the Ministry of Finance complete with tax and stamp duty remission incentives, the proceeds of which were used to fund the MRT1 Sungai Buloh-Kajang section, MRT2 Sungai Buloh-Serdang-Putrajaya section, and Phase 1 of the Pan Borneo Sarawak highway project.

Similarly, the Nigerian Debt Management Office of the Ministry of Finance in the period 2017 to 2023, has to date raised NGN 1,092.557 billion (USD1.43 billion) though six Naira-denominated Sukuk Al Ijarah issuances which are guaranteed by the Federal Government of Nigeria (FGN).

In a potentially important development in Saudi Sukuk origination, small and medium-sized enterprises (SMEs) are now turning to raise funds through small ticket Sukuk issuances. Hitherto, the preferred route to raising funds and credit facilities was through Murabaha credit facilities.

Saudi Arabia’s Rawasi Albina Investment Co. issued a 5-Year SAR50mn (USD13.3mn) in February 2025, the first in a series of riyal denominated Sukuk programme worth a total SAR500mn.

The total number of Sukuk subscriptions was 249,491 Sak, with a Bid-toCover ratio of 499.0%, and 15,991 subscribers.

Saudi multi-sector company Waja similarly issued a 2-year SAR10mn (USD2.7mn) Sukuk offering on 13 February 2025 via a private placement. The minimum subscription amount for both Sukuk transactions was pegged at SAR1,000, thus making the offering available to a wider universe of qualified retail and individual investors.

Murabaha Syndications Trend

Sukuk may yet turn out to be a preferred choice for Saudi SMEs to raise funds than even the seasoned Murabaha credit facilities which are dominated by the Kingdom’s Islamic banks and conventional banks’ Islamic banking windows.

Not that the days of Big Ticket Murabaha Syndications are numbered. On the contrary these have seen a huge proliferation in Q1 2025 with major new corporates now regularly accessing Murabaha financing in addition to Sukuk issuances as part of their fund-raising mix, which in some instances also include bond issuances and financing facility syndications. A case in point is the massive debut USD7bn Commodity Murabaha facility raised by the Public Investment Fund (PIF), the Saudi sovereign wealth fund (SWF) in January 2025.

In fact, the three main trends in the global Islamic finance market in Q1 2025 has been:

- Proliferation of Big Ticket Syndicated Murabaha transactions.

- The entry of Sovereign wealth funds into the Sukuk market.

- Sovereign Sukuk offerings continue to dominate.

Big ticket Murabaha transactions in Q1 2025 include:

A. The USD7 billion Syndicated Commodity Murabaha Facility raised by the Public Investment Fund (PIF), the sixth largest Sovereign Wealth Fund (SWF) in the world from a syndicate of 20 international, regional and local banks. The proceeds will be used to further diversify its sources of funding under its medium-term capital strategy, ensuring flexibility, competitive financing terms, and risk mitigation – initiatives which are all aligned with the Kingdom’s Vision 2030 plan.

B. The SAR3bn (USD800mn) Murabaha facility arranged by Al Rajhi Bank for Bahri, an affiliated company of the Saudi sovereign wealth fund, PIF, and a global leader in maritime transportation and logistics.

C. Renewal of an existing Murabaha credit facility amounting to SAR8.1bn (USD2.1bn) in March for Saudi Kayan Petrochemical Company by Alinma Bank, Saudi National Bank, and Banque Saudi Fransi.

D. The five-year SAR1.934bn (USD515mn) Murabaha credit facility extended by Al Rajhi Bank in February to Mobile Telecommunication Company Saudi Arabia (Zain KSA) the proceeds of which will be used to repay a current Murabaha facility with the Saudi Ministry of Finance.

E. A similar SAR2.5bn (USD670mn) Murabaha credit facility extended by Al Rajhi Bank in February to real estate developer Tatweer Company KSA) to support its expansion and development projects.

F. A USD400 million Commodity Murabaha facility for Africa Finance Corporation arranged by a consortium of 11 banks led by ADIB, Al Rajhi Bank and Emirates Islamic in February.

G. Ittihad International Investment LLC, an investment firm based in Abu Dhabi, successfully completed the arrangement of a USD450mn Islamic revolving credit facility (RCF), further strengthening its liquidity and working capital position.

H. Al Moammar Information Systems Co. (MIS), a regular user of Islamic finance facilities, renewed with amendments a 5-Year SAR1.65bn (USD440mn) Murabaha facility with Banque Saudi Fransi on 2 February 2025.

Sukuk Issuances in Q1 2025:

Perhaps the most important development is the entry of PIF in Sukuk origination, which opens huge new possibilities across the Sukuk playbook including increased Sukuk volumes and Assets Under Management thus also attracting new investor cohorts, unlocking of liquidity through secondary trading especially of AAA-rated debt paper, risk mitigation and credit enhancement opportunities.

The standout SWF Sukuk issuances in Q1 2025 include:

- The USD2.75bn dual-tranche senior unsecured Reg S Sukuk Murabaha/ Ijara issued in February by Saudi Electricity Company (SEC), majority owned by PIF.

- The maiden USD1.25bn Sukuk Ijarah/Murabaha issued by Ma’aden, the largest multi-commodity mining and metals company in the Middle East and one of the fastest growing in the world and also a subsidiary of PIF.

- The aggregate maiden USD2bn Sukuk issued by The Saudi Real Estate Refinance Company, similarly a subsidiary of the Public Investment Fund (PIF) in February.

- The National Central Cooling Company (Tabreed’s) USD500mn Sukuk Ijarah/Murabaha. Tabreed is majority owned by Abu Dhabi SWF, Mubadala Investment Company.

Similarly, the standout Sovereign Sukuk issuances in Q1 2025 include:

- Kingdom of Bahrain 7-year USD1.25bn Sukuk Ijarah/Murabaha.

- Bapco, the energy investment and development holding entity of the Government of Bahrain, issued a USD1bn Sukuk Ijarah/Murabaha.

- The Government of Ras Al Khaimah (RAK) USD1bn Sukuk Ijarah.

- The aggregate SAR9,434.322mn (USD2,515.36mn) raised in the First Quarter of 2025 by the National Debt Management Center of the Saudi Ministry of Finance through three Saudi riyal-denominated sovereign Sukuk issuances consecutively in January, February and March.

These issuances were complemented by regular Sukuk offerings by seasoned issuers in Q1 2025 such as Al Rajhi Bank (USD1.5bn AT1 Capital Sukuk), Kuwait Finance House (USD1bn Sukuk Wakala/Murabaha), First Abu Dhabi Bank (USD600mn Wakala/Murabaha), Banque Saudi Fransi (BSF) (USD750mn Wakala/Murabaha), Bank Al Jazira (SAR1bn AT1 Capital Sukuk), Riyad Bank (SAR2bn AT1 Capital Sukuk), DAMAC Real Estate Development Limited (USD750mn Sukuk Ijarah/Murabaha), Sharjah Islamic Bank (USD500mn Sukuk Ijarah/Murabaha), Aldar Investment Properties (USD500mn Green Sukuk Wakala/Murabaha), Emirates Islamic (5-year fixed rate USD750mn Sukuk Murabaha), and Arab National Bank (SAR3.35bn (USD 890mn AT1 Capital Sukuk)

By far the most proactive Sukuk issuer is the supranational IsDB which issued its first offering of 2025 in March – a USD1.75bn SOFR Public Benchmark Wakala Sukuk with a tenor of 5 years. The proceeds of this issuance will be used by the Bank continue supporting projects that deliver socio-economic growth in its 57 Member Countries and Muslim communities globally.

The projects are aligned with the Bank’s three overarching objectives under the Bank’s Realigned Strategy, i.e., (a) boosting recovery, (b) tackling poverty and building resilience, and (c) driving green economic growth.

The Way Forward

Looking ahead, the challenges are clear and present. The Sukuk market is at its most dynamic phase and the trend will continue for the next few years if not beyond. There is an urgent need for dramatically upscaling both the Sukuk market and the syndicated Murabaha market. This can be done through committed policy adoption, capacity building, technical advice, market education and synergies among the entities of the IsDB Group.

A significant development for the IsDB Group synergy and cooperation, is the signing of a landmark Documentary Credit Insurance Policy (DCIP) agreement on 2 March 2025 between ICIEC, and ITFC. “The policy will provide critical coverage for ITFC transactions, enhancing trade confidence and facilitating smoother financial operations in global trade involving Shariah-compliant products and services, thereby benefiting the broader economic landscape of the member states. It is designed to provide ITFC with a comprehensive risk management tool to safeguard its LCs Confirmation transactions,” explained Dr. Khalid Khalafalla, CEO of ICIEC.

ICIEC as a risk absorber and mitigator has an impressive business development and risk underwriting record for transactions whether Murabaha facilities, or lines of financing or any other such trade and project financing facilities, very often successfully crowding in private sector funding and making transactions and projects both ‘bankable’ and ‘affordable’.

The importance and efficacy of ICIEC risk mitigation and credit enhancement for its member states cannot be underestimated. Indeed, through its dedicated Sukuk Insurance Policy (SIP), ICIEC is willing to help sovereign Sukuk origination in member states especially those unrated or rated below investment grade, which has since also been refined and expanded into Green Sukuk Insurance Policy as Risk Mitigation, Credit Enhancement and Shariah-Compliant Third-Party Guarantee Solutions.

Therefore, the IsDB Group including a Shariah-Compliant Third-Party Guarantor, such as ICIEC is in a unique position to act as a market maker and help attract a new cohort of potential investors in member country sovereign Sukuk, especially the low-and-medium-incomecountries (LMICs). The knock-on effect could be positive through greater involvement in helping to develop the Islamic Capital Market in LMICs, and in the process dispel the biased, over valuation and hype of sovereign risk metrics about LMICs harboured by the major international credit rating agencies.

Future Proofing Current Volatilities in Tariffs, Trade and Taxes in the Global Economy by De-escalation and Preventing Fragmentation

In 2025, we find ourselves at the cusp of “once-in-a-century” event –tariff and trade war precipitated by the world’s largest economy, the US, which is leading the global economy into a recession in which there will be no winners. Geopolitical volatility and heightened uncertainty have played havoc with current forecasts and projections from gatekeeper institutions. Dr. Khalid Khalafalla, CEO of ICIEC, ponders a global economic playbook during these times of tariff, trade and tax disruptions against a prevailing background of subdued GDP growth and FDI flows, higher inflation, and the opportunities and challenges for ICIEC with its unique offering of Shariah-compliant trade and investment Insurance.

By any standard, the year 2025 is turning out to be extremely challenging for the global economy – and we are only in its First Quarter. What has been unfolding thus far is a landscape of arbitrary disruptions by the Trump administration in the US through the unilateral imposition of punitive tariffs and taxes, and rewriting trade rules. These actions have bypassed international gatekeeper organisations such as the World Trade Organisation (WTO) and UN Trade and Development (UNCTAD), rather than utilising them as proper platforms for coordinated negotiations and dialogue on necessary reforms. In the process, it seems that the language of negotiations and diplomacy have been replaced by the confrontational rhetoric – a shift that threatens the foundations of the post-World War II global economic order, which, while imperfect, has been rooted in free trade and multilateral rules. Given the United Nations’ position as the world’s largest economy, the consequences of these developments are global in scope.

Perhaps the biggest disruption due to the above developments is that of predicting and planning for the future. Given that the second term Trump presidency will shape the next four years, economic, monetary, fiscal, corporate, financial, development and social indicators and performance will be difficult to predict. For any government. organisation, corporate and multilateral institution such unpredictability is anathema – making efforts at futureproofing even more challenging. The measures adopted under the Trump administration disproportionately affect emerging and low-and-medium-income-countries (LMICs), which constitute most of the member states of ICIEC. These countries are among the most in need of preferential tariff and trade arrangements such as the U.S. flagship African Growth and Opportunity Act (AGOA) Programme, which is set to expire on September 30, 2025, and gives some 30 Sub Saharan African (SSA) member states tariff-free access to the U.S. markets on over 6,800 products. According to U.S. data, two-way trade under AGOA in 2023, totalled USD47.5bn, with the U.S. exporting USD18.2bn worth of goods and imports amounting to USD29.3bn. It is almost certain that AGOA will be abolished if not severely curtailed which would affect the export potential of several SSA member states of ICIEC.

These are not normal times. Multilateral insurers as risk absorbers and mitigators such as ICIEC may be forced into rethinking its strategies, which would inevitably require more resources and perhaps a revised risk management approach. Above all it is important for insurers not to overthink the implications nor to over-estimate the risks, but to adopt a measured yet compassionate and collaborative approach in helping their clients over the next few years.

Shifting Policy Priorities

Against such an uncertain backdrop – and subject to future revisionsthe IMF’s World Economic Outlook Update of mid-January 2025 projects a subdued Global GDP growth of 3.3% for both 2025 and 2026. The U.S. GDP growth is projected to decline to 2.7% in 2025 and to 2.1% in 2026. Perhaps GDP can be a very deceptive measure of the state and performance of an economy. At best it should be used in conjunction with other socio-economic indicators including income disparities and a spate of other inequality gaps, access to and cost of finance, and sovereign indebtedness. Each economy has its own compelling or distressing GDP story to tell. According to IMF’s Outlook, Sub-Saharan Africa is projected to be the second-fastest growing region, with an average growth rate of 4.2% over the next two years, led by Nigeria which is expected to grow at 3.2% in 2025 and 3.0% in 2026), following Emerging and Developing Asia, which is projected to grow at 5.1%.

These high growth rates which include India and China, the highest growing economies at a projected 6.5% and 4.6% for 2025, feign to flatter. They have structural shortcomings such as high population densities, massive unemployment, a mix of first and third world infrastructure. Saudi Arabia’s GDP is projected at 3.3% and 4.1% over the next two years. In contrast the Advanced Economies will have to contend with projected GDP rates of 1.9% and 1.8% in the same period, well below the 3.5% growth rates needed for sustaining a ‘normal’ economy.

World Economic Outlook Growth Projections

Source: IMF, World Economic Outlook Update, January 2025

Note: For India, data and forecasts are presented on a fiscal year basis, with FY 2024/25 (starting in April 2024) shown in the 2024 column. India’s growth projections are 6.8 percent for 2025 and 6.5 percent for 2026 based on calendar year.

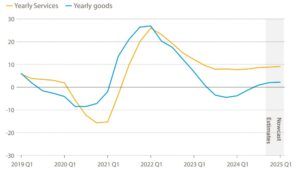

Global trade growth levels off in 4th quarter of 2024

Annual growth in the value of trade in goods and services, 2019 Q1 – 2025 Q1

Note: The annual growth is calculated using a trade-weighted moving average over the past four quarters. Figures for Q4 2024 are estimates. Q1 2025 is a nowcast as of 5 March 2025.

The response of the global credit and investment insurance industry is interesting and perhaps predictable. Leading from the front is the Berne Union (BU), the international industry body for government backed official export credit agencies, multilateral financial institutions (including ICIEC), and private credit insurers, whose members provide around USD2.5 trillion of trade credit and political risk protection to banks, exporters and investors – equivalent to 13% of world cross-border trade for goods and services (calculated with respect to WTO statistics).

The BU’s Export Credit Business Confidence Trends Index (BCI) for First Half 2025, published in March which tracks perceived demand and claims in the export credit insurance industry based on half year surveys of BU members, is implicit. Members agree that opportunities are abound in supporting exporters amid a new wave of trade protectionism, although they may disagree on the basis for their optimism.

The key takeaways include:

A. Strong confidence exists in rising demand for short-term export credit insurance – driven by global trade growth, projected to grow at its fastest pace since 2021. Sentiment toward longer-tenor coverage remains stable, aligning with its historical average.

B. Members largely agree that business growth opportunities in their short-term portfolio lie in exporters seeking to mitigate risks from the latest wave of trade tariffs – however, a hardening pricing environment continues to challenge smaller providers.

C. New demand for longer-tenor coverage is supported by defence transactions, especially in Europe, and growing demand for infrastructure projects in developing economies, with multilaterals continuing to crowd-in private insurers.

D. The outlook for claims under short-term policies remains negative, as the expected normalisation to pre-pandemic levels proves slower than expected.

E. Geopolitical risk remains a primary concern for potential shortterm claims, now compounded by uncertainty over tariffs. Buyers in Germany raise alarm due to a weakening economy, alongside the European automotive sector, grappling with weak EV demand, Chinese competition, and factory closures.

F. Claims expectations under longer-tenor coverage show little change, sovereign debt risk remains a persistent concern for emerging claims, particularly in Western Africa, as a strong dollar pressures external financing costs.

Berne Union Export Credit Business Confidence Trends Index (BCI) Demand and Claims 1H 2025

Short Term commercial and political risk insurance sentiments include:

i. For public providers, robust domestic export growth stands out as a key opportunity for business expansion.

ii. Private insurers highlighted demand from banks as a key driver of future growth, although tempered by a slowdown in new corporate business.

iii. Many providers – both public and private – cited challenges related to a competitive pricing environment, which they feel is pricing them out of new opportunities.

iv. Respondents displayed less consensus in their outlook for claims over the next six months.

v. The primary concern for most survey participants remains elevated geopolitical risk, now compounded by global trade tariffs that could lead to more payment delays—particularly for U.S. buyers facing the added burden of tariff costs, with private insurers exhibiting a deeper negative sentiment.

Similarly medium and long-term commercial and political risk sentiments include:

- Optimism persists overall for demand for longer-tenor cover, particularly among public providers. Current demand is driven by a surge in defence transactions, especially in Europe, as countries ramp up defence spending, alongside infrastructure projects in developing nations.

- Partnerships with multilaterals and development finance institutions (DFIs) continue to be a strong source of business for private insurers.

- Little movement is anticipated in claims paid out for longer-tenor cover.

- Both public and private providers expressed shared concerns about energy transition projects such as offshore wind and green technology—citing overcapacity and slower-than-expected adoption as key risks.

- Concerns persist regarding many sovereign borrowers, particularly in West Africa.

The International Credit Insurance & Surety Association (ICISA), which represents trade credit insurers, sureties, and their reinsurers and whose members accounted for over EUR3 trillion in insured exposure related to trade receivables, and billions more in surety bonds in areas such as construction, energy production, judicial processes, and other key economic activities, similarly is leading on various issues related to Trade Credit Insurance (TCI). In March 2025, it published a White Paper titled ‘Supporting the economic powerhouse – How Trade Credit Insurance supports SMEs, and how to build on this for growth and prosperity.

SMEs are the backbone of economies, and their success directly contributes to economic success and the overall wellbeing of society. Governments today are actively developing policy to support SMEs as a way of boosting productivity, innovation, jobs and growth. ICISA highlights the key role TCI plays in covering against the risk of nonpayment of trade receivables in support of these businesses, and offers recommendations to policymakers, regulators, insurers, and to SMEs themselves to benefit further from its protection. ICIEC also has a suite of similar and other risk mitigation products and solutions including the Documentary Credit Insurance Policy (DCIP), the Bank Master Policy (BMP), the Specific Transaction Policy (STP), and the Comprehensive Short-Term Policy (CSTP) available to serve TCI and SMEs.

Industry-wide, the key challenge in 2025 is to prevent global fragmentation, where nations form isolated trade blocs, while managing policy shifts without undermining long-term growth and embracing innovation through renovation and infusing a sense of urgency of action on debt restructuring or relief, climate finance including Green and blended finance and policy tools. Our international financial architecture needs to adapt to these rising challenges.![]()

![]()

nor to over-estimate the risks, but to adopt a measured yet

compassionate and collaborative approach in helping

their clients over the next few years.

MEMBER COUNTRY PROFILE EGYPT

Balancing Egypt’s Dynamic Economic Landscape with its Persistent Macroeconomic Challenges

Harnessing A Unique Relationship with the IsDB Group and ICIEC

Egypt is a key founding member of the OIC, IsDB, and ICIEC. Cairo is keen to expand its relationship with ICIEC as evidenced by the activities of the Corporation’s Hub in Cairo and the sentiments of various Egyptian ministers, officials and corporates. Egypt’s economic landscape remains dynamic, influenced by both domestic and external factors. While the country has made significant strides in recent years, challenges persist, particularly in the areas of inflation, debt, and foreign exchange reserves. Eman Mahmoud Country Manager, Cairo Regional Office, ICIEC, profiles Egypt’s Economy, its development priorities and challenges, and its long-standing relations with the IsDB Group especially ICIEC.

Eman Mahmoud,

Country Manager Egypt, ICIEC IsDB Group Regional Hub Cairo

Economic Overview

The Egyptian economy demonstrated robust growth in FY2021/22, recovering from the COVID-19 pandemic. However, recent data suggests a slowdown in economic growth in Q3 FY2023/24, reaching a low of 2.2%. Nevertheless, the outlook for FY2024/25 remains positive, with projected growth of 4.2% driven by increased investment, a recovery in the manufacturing sector, and the anticipated end of the Gaza conflict.

The government plans to cut spending in response to the economic crisis. This includes delaying state projects that require significant foreign currency funding and reducing expenses related to travel, training, and conferences for officials. The government focuses on large-scale privatisation and asset sales as part of its economic stabilisation measures. These measures aim to address balance-of-payment stresses and stabilize the economy.

The Egyptian government sealed its largest investment deal with a consortium led by Abu Dhabi Developmental Holding Company (ADQ), one of the UAE’s sovereign wealth funds, for the development of Ras El Hikma city, spread over more than 170 million square meters of land on the Mediterranean coast. The deal is expected to be risk-positive, bolstering the country’s FX reserves and ensured adequate buffers for Egyptian authorities to devalue the pound, or at least move to a more flexible exchange rate regime, thus likely satisfying International Monetary Fund (IMF) requirements for a new and enlarged financing package. However, the deal is unlikely to ensure a sustainable turnaround for Egypt’s economy and needs to be complemented by long-awaited structural reforms.

ADQ will invest USD35 bn in Egypt that will retain 35% of the project’s profits. The project’s investment value could reach USD150 bn and may generate millions of employment opportunities, according to Egypt’s prime minister. ADQ will develop Ras El Hikma city that will include a business district, residential and commercial space, hotels and tourism resorts, healthcare and education facilities, and a free economic zone for IT industries and logistics hubs, among others.

Out of the USD35 bn being paid to Egypt, USD24 bn consists of new fund transfers (representing the consortium’s acquisition of development rights) and USD11 bn consists of existing UAE deposits at Egypt’s central bank that will be transferred to local currency and invested in prime projects. The Egyptian authorities also announced they are setting the ground for similar investment deals, notably the Ras Gamila land south of Sinai on the Red Sea coast, potentially to Saudi or Qatari investors.

The World Bank Group has approved a new Country Partnership Framework (CPF) for Egypt, which aligns with the Government of Egypt’s Sustainable Development Strategy and the National Climate Change Strategy. The new CPF intends to strengthen Egypt’s role in regional integration, which has positive implications for Egypt and potentially the broader region through enhanced regional trade and greater connectivity in infrastructure, transport, energy, and labour.

Egypt and the International Monetary Fund (IMF) announced on March 6, 2024, a staff-level agreement on a set of economic policies and reforms needed to complete the first and second reviews under the Extended Fund Facility, the amount of which is being raised to USD8 bn subject to IMF board approval. Noting that the IMF report in August 2024 indicated that program performance for the third review was satisfactory.