ICIEC 2021 Annual

Report

Building Resilience in Times of Uncertainty

2021 Business Insured (USD)

9.79 Billion

Key Results

2021 Credit Rating

2020 GIFA Award

The Global Islamic Export Credit and Political Risk Insurance Award for 2020

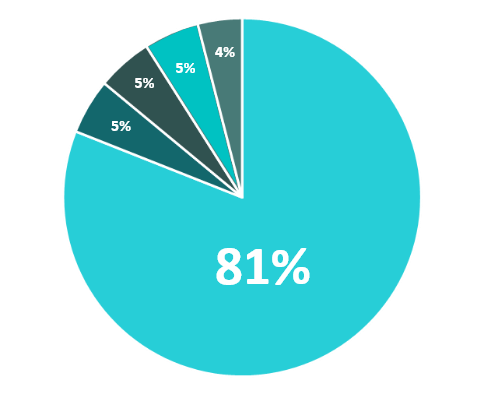

Business Insured by Sector

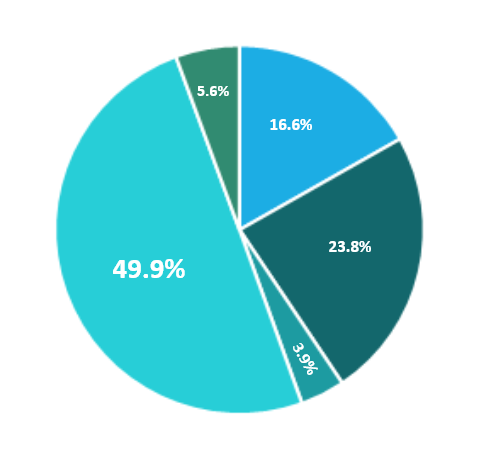

2021 Business Insured Breakdowns

Business Line Breakdown

Geographic Breakdowns

Message From CEO

At ICIEC, we are deeply concerned about the tragic human losses, the socio-economic disruptions, and the strain on MSs caused by the COVID-19 pandemic. ICIEC expresses solidarity with our 48 MSs and has been working closely with the IsDB Group and the Corporation’s deep network of partners to bolster capacity for MSs recovery. ICIEC provides credit and political risk insurance to boost exports, sustain imports of strategic commodities, ensure investment protection, and minimize volatility. We also remain committed to the UN’s Sustainable Development Goals (SDGs) and helping our MSs achieve these goals.

Oussama Abdul Rahman Kaissi

Chief Executive Officer

ICIEC COVID-19 Response

In response to the global COVID-19 pandemic and to mitigate its impact in Member States, ICIEC has taken and continues to

take a balanced approach, supporting Member States to combat COVID-19 while safeguarding a sustainable portfolio.

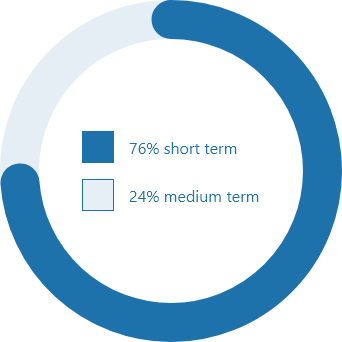

The overall COVID-19 response program for IsDB Group has three stages: Respond, Restore, and Restart (known as 3Rs).

The program covers Member States’ needs in the short, medium and long-term respectively.

RESPOND

Immediate and Fast Disbursing Actions to Assist MCs Response to the Health and Social Emergency.

RESTORE / SUSTAIN

Medium Term Actions to overcome the Pandemic's peak effects on Health & Economy.

RESTART

Long Term Actions to Build Preparedness for Future; support revival of industries, and economic recovery through project financing.

Response Highlights

ICIEC is leveraging its leading role in industry associations,

existing partnerships and networks to support Member States

during the global pandemic.

Major Transactions

In 2021, ICIEC supported various landmark projects and transactions in its Member States. These projects are catalytic for the development of its Member States and crucial for their recovery from the COVID-19 pandemic.

Supporting Imports of Essential

Commodities to Pakistan

ICIEC has provided USD 50 million in coverage under the Bank Master Policy to TAIC to import essential commodities, such as crude oil, refined products, and liquified natural gas. These commodities are critical to Pakistan’s residential, commercial and industrial sectors for various purposes, including heating, cooking, generating electricity, and manufacturing a wide variety of products.

The development impact of this project is in supporting energy creation which in turn will help the industrial and economic growth of Pakistan.

ICIEC Reinsurance Supports the

Manufacturing Sector in Uzbekistan

ICIEC provided EUR 30 million in reinsurance cover to Russian ECA, EXIAR, for their policy with Russia Exim Bank (Roseximbank) for a loan facility to the Joint Stock Commercial Bank, Sanoat Qurilish Bank (SQB), a state-owned bank in Uzbekistan.

The proceeds are used for funding the construction of a Metallurgical Plant in Tashkent to produce cold-rolled metal for use in the automotive industry. The plant will have an annual production capacity of 500 thousand tons and create 672 new jobs. The transaction was executed under the framework of the Reciprocal Reinsurance Agreement signed between ICIEC and EXIAR.

Supporting the Green Projects in Egypt

ICIEC has provided an NHSO policy for USD 56 million covering the SMBC participation in the syndicated Green Term Loan arranged by Emirates NBD Capital Limited and First Abu Dhabi Bank PJSC, amounting to USD 1.5 billion in favour of the Ministry of Finance (MOF) of Egypt. The Eligible Green Projects are expected to have a significant positive impact on the environmental and social programs of Egypt.

The projects include seawater desalination plants with the most energy-efficient technologies that reduce water consumption and improve the efficiency of resources (such as collection, treatment, recycling, or reuse of water).

2021 Strategic Developments

Impact Developments

Sustainable Development Goals Impact

ICIEC is committed to the achievement of 6 SDGs.

ICIEC published the 4th edition of the Annual Development Effectiveness Report (ADER) in 2021. The ADER records and displays the developmental impact of the Corporation’s activities.

Growing Membership

ICIEC’s Membership represents a diverse range of economic backgrounds scaling from high income economies to least developed economies.

16

Member Countries are classified as LI/LDCs

Partnering for Impact

Understanding the value and impact of partnerships in expanding trade, strengthening coverage, and growing economies, ICIEC will continue to make efforts to forge new partnerships, in addition to strengthening existing ones.

Agreements and MoUs signed

Member State Partnerships

Reinsurance agreement with Saudi Eximbank, KazakhExport. Partnerships & MoU with IFPA, IOFS, UzIPA, BANK OF AFRICA BMCE Group.

Non-Member State Partnerships

Reinsurance agreement with EXIAR. MoU

with NEXI, KUKE.

Islamic Finance Impact

ICIEC is the only multilateral Export Credit Agency (ECA) in the world offering and promoting Shari’ah-compliant export credit and investment insurance solutions in the world. ICIEC remains dedicated to growing the Islamic finance industry through its product offerings, partnerships, and participation in international events aimed at deepening the awareness of Islamic finance and its benefits.

Efficiency Developments

Peer Benchmarking

ICIEC conducted an efficiency benchmarking exercise in 2021, to learn from its peers and to determine strategies how its operation can become more efficient.

Innovating Technology to Improve

Productivity

The Corporation undertook a comprehensive update of its Operations Manual and is currently in the process of automating and streamlining its end-to-end business solution.

Resilience Developments

Advancements in Risk Management and Reinsurance

The pivotal role of Risk Management helped the Corporation to successfully navigate the crisis period and uphold its strong credit profile thus far.

ICIEC Strategic Risk Priorities (2021-2024)

The Corporation’s target of implementing a fully-fledged Enterprise Risk Management (ERM) architecture as an enabler to achieving its strategic goals sets the foundation for the priorities for the coming Five-Year Risk Strategy.

Diversifying products

To optimize capital, ICIEC seeks to maintain a relevant product mix that addresses needs and builds on trends.

ICIEC has taken a balanced approach and has been able to maintain the Corporation’s strong Aa3 credit rating by Moody’s for the 14th consecutive year.

IsDB

Synergy

Developments

Risk Management

Several activities and initiatives were embarked upon, which have contributed significantly to the realignment of strategic objectives of the Corporation in managing risks throughout the crisis period and during the recovery phase. Some of the major milestones of ICIEC that have contributed to the strengthening of its risk management include the development and implementation of models and frameworks viz: Risk Management Framework, Risk Capital Model, Exposure Management Framework, Portfolio Reserving.

Download Annual Report 2021

Download Annual Report 2021 Download Financial statements 2021

Download Financial statements 2021