The continued global economic and geopolitical uncertainty marked by subdued GDP growth of the G7 economies, a modest uptake in merchandise trade, the intensification of the conflicts in Ukraine and Middle East with its disruptions in the Red Sea trade route and separately in the Panama Canal Route, due to climate-related drought, have seen a sustained demand for risk mitigation in 2024. A cornucopia of other challenges including the evolving AI revolution, the digitalization of trade, a changing regulatory landscape, tackling the entrenched issues relating to climate action and finance, funding and insuring the transition to a just clean energy playbook, and sovereign debt sustainability developments have all served to unleash new emerging risks and to present credit and investment insurers with exciting new opportunities for their business strategies. Dr. Khalid Khalafalla, Chief Executive Officer of ICIEC, considers the state of the credit and investment insurance industry in 2024, the emerging trends which require strategy flexibility, innovation and collaboration in an evolving landscape of world trade and foreign direct investment.

If we agree with the mood music at the Annual General Meeting of the Berne Union (BU) in October in Hamburg, the leading global association for the export credit and investment insurance industry of which ICIEC is a member, then our industry was poised for a new growth phase in 2024 with opportunities in a changing global trade landscape with the beguiling lure of trade digitalisation, the adoption of electronic trade documentation and its new-found legality under UK governing law, and generative AI applications.

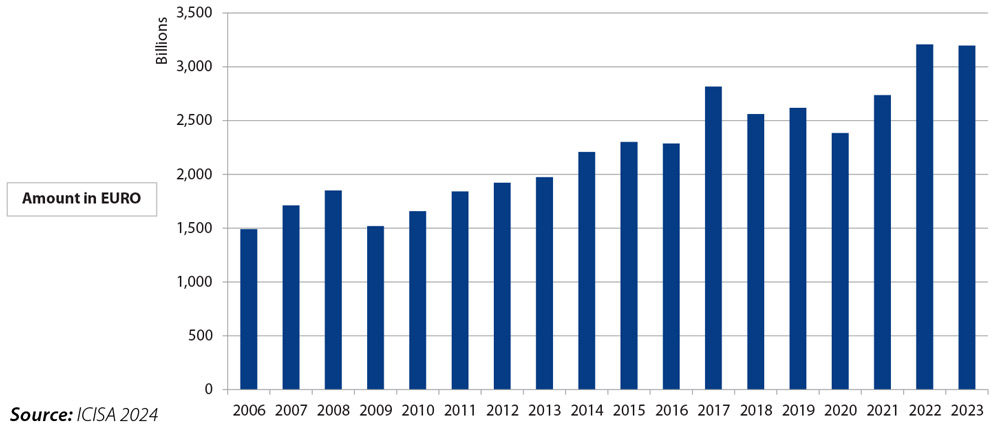

BU members provide over USD3 trillion in new commitments annually in support of trade – more than 10% of the total value of global exports. The data indeed point to a modest positive trajectory in 2024 despite the increased risks. The credit insurance dichotomy is that economic and geopolitical flashpoints lead to heightened risks – both perceived and real. This in turn increases demand for risk mitigation tools such as export credit and political risk insurance, surety, and guarantees.

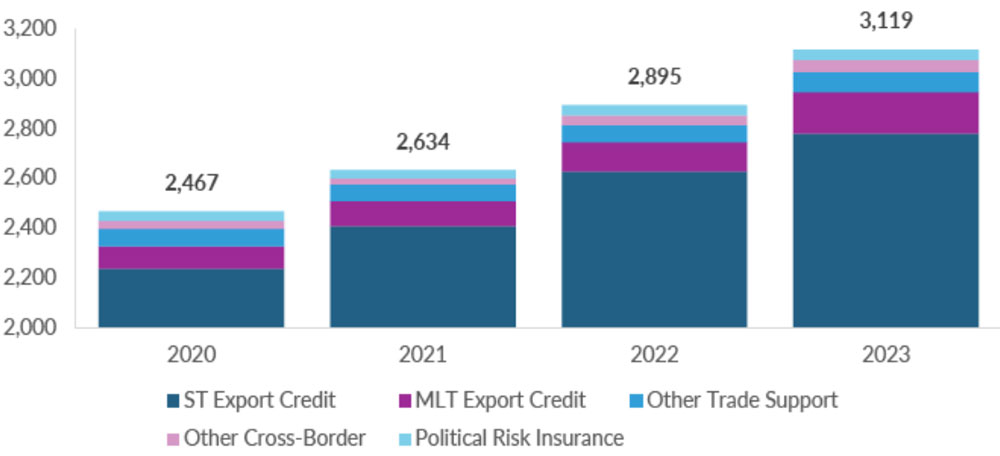

“The year 2023 marked continued transformation in the trade finance industry. Historic levels of underwriting have led to a colossal USD3.12 trillion of support for trade over the year. As trade patterns shifted and new relationships forged companies sought protection from Berne Union members to expand their businesses in new avenues,” stressed Maëlia Dufour, the erstwhile President of the BU whose 2-year term expired at the end of October 2024, in the Union’s 2023 Year Annual Report. This growth saw a surge in demand for Medium-Term (MLT) and Other Cross-Border (OCB) solutions in a strategic shift towards longer-term solutions.

“We have uncovered a growing emphasis on larger and more complex transactions, extended tenors, and a heightened need to mitigate risks associated with intricate global supply chains amid high interest rates. Companies are increasingly seeking the stability and security our membership offers,” she added. The emphasis for 2024 is a much greater meaningful collaboration between stakeholders around public and private risk-sharing, synergy between trade and development, and the potential for innovation amid new products and emerging approaches to export support.

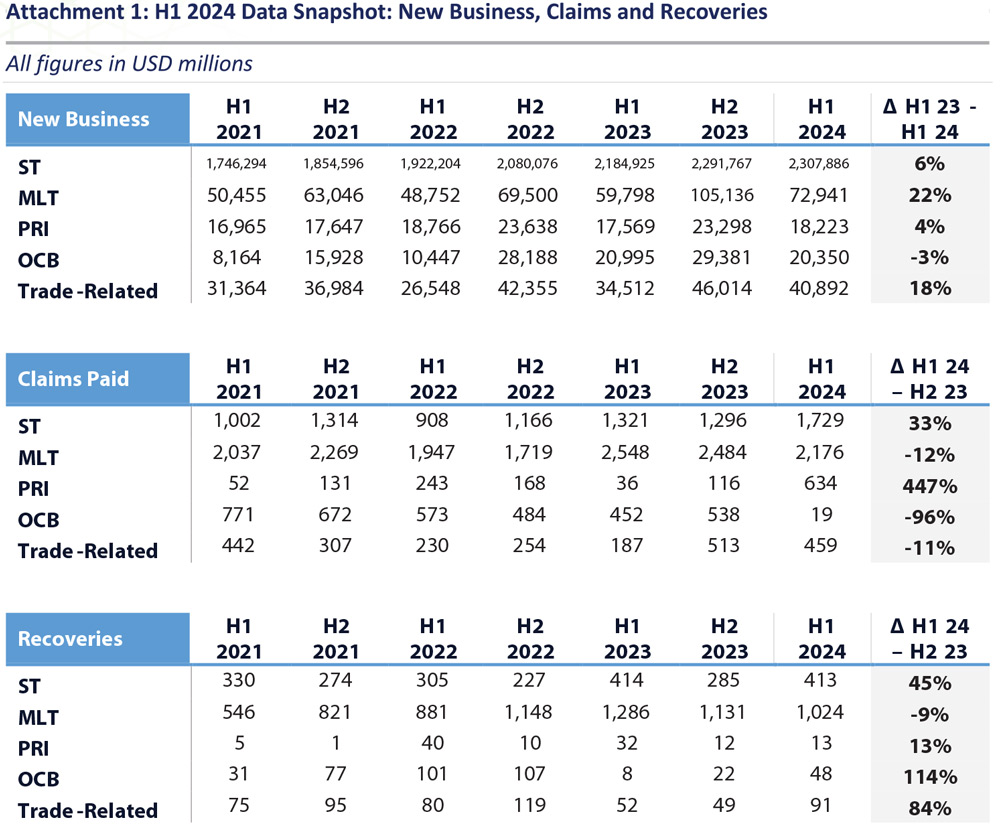

Not surprisingly, BU members reported USD2.46 trillion in new commitments in H1 2024 which shows a consolidation of a new growth phase for export credit especially medium-and-long-term (MLT) business lines as well as continued diversification across a growing array of trade support products.

MLT export credit, according to the Union, saw another historically strong period, climbing 22% to USD73 bn of new business, driven by increased ECA support and expansion of underwriting from private insurers with notable growth in Europe, the Middle East and South Asia. Ocean-going vessels and mega infrastructure projects drove MLT growth, but the industry still sees the greatest opportunities in renewable energy and green transition. Members also reported new and updated products primarily focused on green support and expanded domestic support, untied and working capital products which aim to build and enable future trade ecosystems.

Geopolitical risk and economic slowdown are the biggest concerns for members, as claims remain elevated at USD5 bn – but claims ratios remain relatively benign overall. The first half of 2024 also saw a flurry of PRI claims to Russia triggered by a range of events including: expropriation, political violence and transfer. The BU is also collaborating with Finance in Common which aims to explore and promote opportunities for closer collaboration between export credit and development finance.

Berne Union Business Lines, Claims and Recoveries Data H1 2024

Source: Berne Union October 2024

The consensus is that renewables are the new powerhouse for trade finance and investment. Fuelled by a global focus on environmental sustainability and supportive policy frameworks, the value of supported renewable energy transactions doubled in 2024 compared to the previous years – after consecutive periods of growth. This surge reflects not only the industry’s commitment to green initiatives but also the recognition of renewable energy as a stable, long-term investment, perfectly aligning with the growing demand for trade finance. This is especially in emerging and developing markets. As members continue to support renewable energy projects offering financial incentives, risk portfolios are shifting as exposures increase to this key industry.

Key Takeaways for 2024

The BU Export Credit Business Confidence Trends Index for H2 of 2024, which tracks perceived demand and claims in the export credit insurance industry based on half-year surveys of BU members, noted several key takeaways:

- Cautious optimism for H2 of 2024 as the demand for ST and MLT insurance cover is expected to rise.

- Opportunities for growth lie in supporting SMEs and investment in renewables and the green transition.

- Claims under short-term policies are expected will rise in H2 of 2024 while claims for longer term business are expected to fall.

- For ST cover, Russia-Ukraine, the Middle East, and Argentina are the regions they are most watchful of; construction and consumer goods are the sectors being closely monitored due their higher sensitivity to macroeconomic conditions

Trade Credit Insurance – Insured Exposure ICISA Members Amount in (excl reinsurance members)

- Debt sustainability developments have meant lower sovereign-related claims under longer-tenor cover, but members remain vigilant towards countries in delicate fiscal positions, predominately in Sub-Saharan Africa and South Asia.

- Overwhelming consensus that macroeconomic and geopolitical uncertainty will shape demand and claims over the next six months. As such navigating geopolitical risks and the impact of conflicts are seen by many as the biggest challenges in H2 of 2024, albeit concerns over global macroeconomic uncertainty still linger.

Given the current landscape of credit insurance is marked by significant uncertainty and heightened risks due to a multitude of overlapping crises, Richard Wulff, Executive Director of the International Credit Insurance and Surety Association (ICISA), the first and leading trade association representing trade credit insurance and surety companies internationally, whose members account for the majority of the world’s private credit insurance business, stresses that “there is substantial room for enhanced collaboration between government insurers, including stateowned entities and ECAs and Development Financial Institutions (DFIs), and private sector re/insurers. Such collaboration can lead to the development of more comprehensive risk mitigation strategies by leveraging the strengths of both sectors.”

The recent MoU signed between ICISA and the AMAN UNION of credit insurers and ECAs from the OIC countries, of which ICIEC is currently the Secretariat, is precisely aimed at advancing credit and investment insurance initiatives in member states common to both, and expanding credit insurance, extending its benefits beyond traditional high-income markets to developing countries where the sector is often fragmented and undervalued and marginalized because of the absence “hard collateral” as security.

ICISA’s data for 2020 on the role of credit insurance in global trade estimates EUR12.07 bn in total global credit insurance premium, and EUR6.35 trillion of total value of insured shipments. The percentage of World Trade in 2020 protected by credit insurance was 14.52%; the percentage of the global credit insurance market represented by private insurers was 61%, and the percentage of the private market represented by ICISA was 84%.

As the only Shariah-compliant multilateral insurer in the world and member of the Islamic Development Bank (IsDB) Group, and offering a suite of alternative risk mitigation solutions, guarantees and reinsurance akin to mutual insurance (Takaful) and (ReTakaful), ICIEC is similarly subject to the bevy of emerging risks that have evolved in the last two years in addition to the usual risks associated with trade and investment insurance, and guarantees and surety. It is also beholden to the prevailing macroeconomic conditions of the 50 member countries that it serves under its mandate. Its success has been impressive over the last three decades and in its Pearl Jubilee year in 2024 it surpassed the USD121 bn mark of cumulative business insured, investment protection and guarantees in pursuit of its mandate in providing risk mitigation solutions related to trade and investment in member countries, facilitating intra-OIC trade and investment, and promoting the alternative Islamic system of financial intermediation, in its case in the provision of Takaful.

Collaboration is in the DNA of ICIEC considering its longstanding partnerships with many peer institutions, industry professional bodies namely the Berne Union, AMAN UNION and ICISA; government export promotion agencies; with private credit insurers and a range of banks and with ECAs of member countries and beyond. The Corporation has a pivotal founding association with the AMAN UNION, which was established in 2009 and of which I am currently the Secretary General.

The 14th AMAN UNION AGM in December 2024 in Algiers showcased the critical role of fostering credit insurance and trade across Africa, the Arab, and Islamic countries. By uniting diverse stakeholders, we illustrated the power of collaboration in addressing trade challenges and driving sustainable growth. Strengthened partnerships and shared expertise are paving the way for a resilient, interconnected trade ecosystem in OIC countries to boost risk mitigation and protection in trade and investment in today’s interconnected world with its rising geopolitical and economic risks. In today’s complex global landscape, the AMAN UNION remains a vital platform for collaboration and innovation, delivering valuable insights to benefit all stakeholders.

The AMAN UNION seeks to be the comprehensive umbrella for export insurance agencies in Arab and Islamic countries, while expanding its membership to include elite international institutions, and aims to promote the exchange of experiences, the application of best practices, and the dissemination and development of a culture of assurance. In fact, in Algiers the AMAN UNION signed a Corporate Training Services Agreement with the UAE-based RISC Institute DMCC, a leading training institution specializing in talent development for the insurance, risk management, and personal finance sectors.

ICIEC unveiled its 2023 Annual Report in May 2024 in Riyadh at the IsDB Group Annual Meetings. The year 2023 was one of operational resilience and exceptional financial performance, showcasing a significant 14.4% y-o-y increase in insured trade and investment transactions, amounting to USD13.3 bn. The Corporation also reported an increase in its Gross Written Premium, which rose by 6.4% to USD98.3 mn. ICIEC’s improvement in corporate net results reflects its ability to effectively manage policyholder commitments, enhance value proposition and demonstrate fostering confidence of our Member States. This performance trajectory is set to continue in 2024, despite the various headwinds and evolving risks.

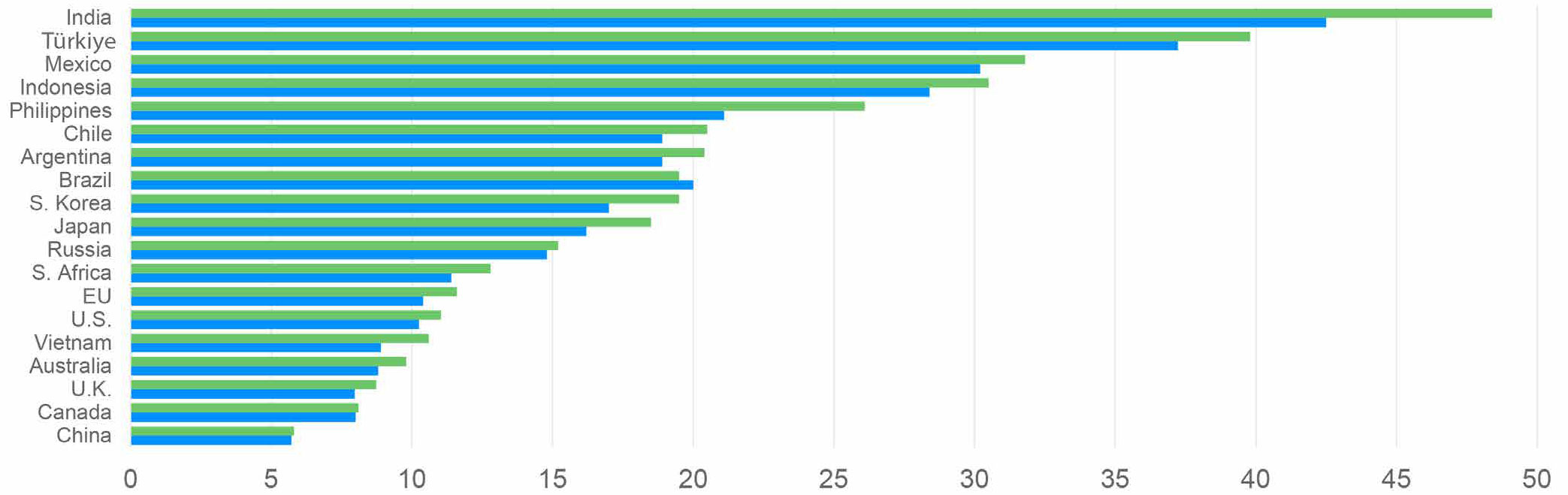

It would be a miss not to correlate the dynamics and impact of global macroeconomic indicators especially real GDP growth, trade movements and Foreign Direct Investment (FDI) trends for 2024, all of which impact the dynamics of credit and investment insurance business and market calculations. The IMF’s World Economic Outlook Real GDP Growth Projections in October 2024 reveals a subdued global growth scenario of 3.2% for 2024 and 2025. This trajectory is repeated at 1.8% for the Advanced Economies of which Canada’s economy is projected to grow at the highest percentage of 2.4%.

In contrast the Emerging and Developing Economies are projected to grow 4.2% for the same years, with India way ahead at a projected GDP growth of 7% in 2024 and 6.5% in 2025, and China weighed down by its current economic woes with projected GDP growth at 4.8% declining to 4.5% for the same period. GDP growth outlook for low-income developing countries which constitute a majority of ICIEC membership is projected at a health 4.2 per cent for the two years. Of the OIC countries, Saudi Arabia’s growth is projected to increase from 1.5% in 2024 to 4.6% in 2025 in line with the ambitions of the Saudi Vision 2030, while Nigeria’s growth prospects are projected to increase from 2.9% in 2024 to 3.2% in 2025.

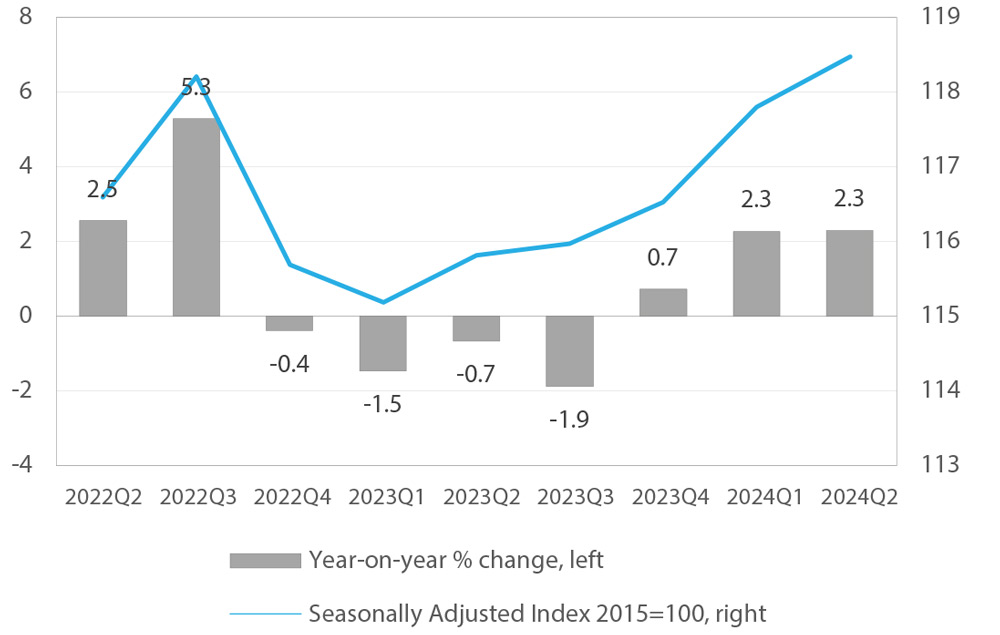

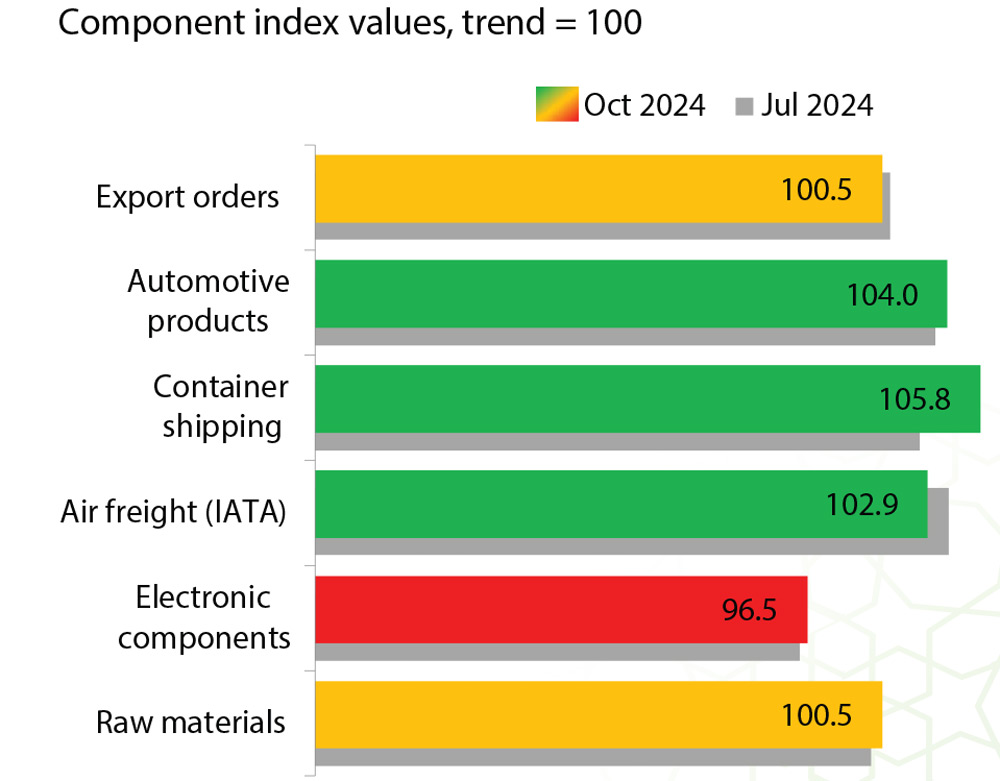

The scenario for global trade prospects in 2024 and beyond reflects a similar trajectory. The WTO’s Goods Trade Barometer published on 10 October 2024 shows moderate trade growth as uncertainty looms, including possible shifts in trade policy.

World merchandise trade volume

Source: WTO Goods Trade Barometer October 2024

Drivers of goods trade

Source: WTO Goods Trade Barometer October 2024

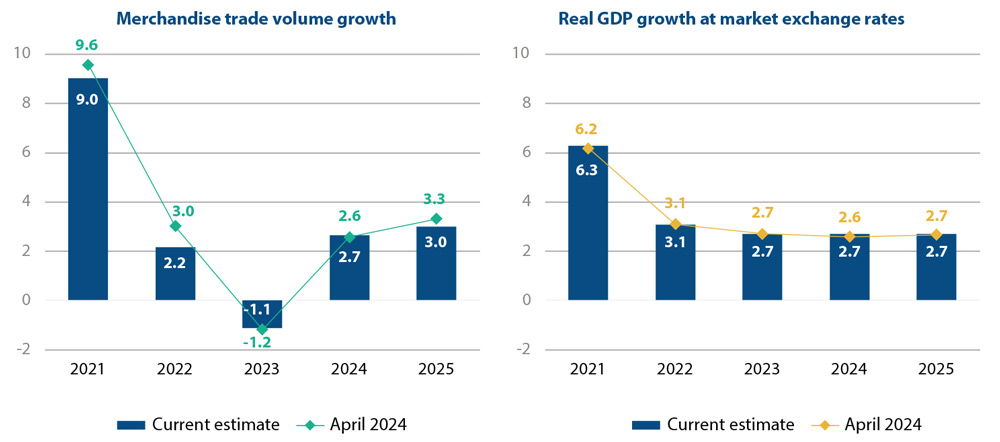

Trade volume growth for the whole of 2024 should come in at around 2.7% while growth in 2025 is expected to reach 3.0%. Exports of Asian economies and imports of North American countries grew more than expected in the first half of 2024 while European trade flows continued to decline on both the export and import sides.

The WTO’s Global Trade Outlook and Statistics Update in October 2024 projects a gradual trade recovery in 2024 despite widening regional conflicts and increased policy uncertainty. “Global merchandise trade turned upwards in FH 2024 with a 2.3% year-on-year increase, which should be followed by further moderate expansion in the rest of the year and in 2025. The rebound comes on the heels of a slump in 2023 driven by high inflation and rising interest rates. WTO economists now anticipate that the volume of world merchandise trade will increase by 2.7% in 2024 and 3.0% in 2025, while global GDP growth at market exchange rates is expected to remain at 2.7% in both years,” stressed the update.

Declining inflationary pressure, says the WTO, has allowed central banks in advanced economies to begin cutting interest rates, which should stimulate consumption, boost investment and support a gradual recovery of global trade. However, significant downside risks remain, including regional conflicts, geopolitical tensions and policy uncertainty. The revised trade forecast is consistent with the WTO’s Global Trade Outlook and Statistics report issued in April, which predicted 2.6% growth in both merchandise trade and GDP in 2024, followed by trade growth of 3.3% and GDP growth of 2.7% in 2025.

World merchandise trade volume and GDP growth, 2021-2025

Annual % change

Source: WTO for merchandise trade volume and consensus estimates for GDP.

Note: Figures for 2024 and 2025 are projections. Trade refers to average of exports and imports.

Merchandise exports of least developed countries (LDCs) are projected to increase by 1.8% in 2024, marking a slowdown from the 4.6% growth recorded in 2023. Export growth is expected to pick up in 2025, reaching 3.7%. Meanwhile, LDC imports are forecast to grow 5.9% in 2024 and 5.6% in 2025, following a 4.8% decline in 2023. These forecasts are underpinned by GDP growth estimates for LDCs of 3.3% in 2023, rising to 4.3% in 2024 and 4.7% in 2025.

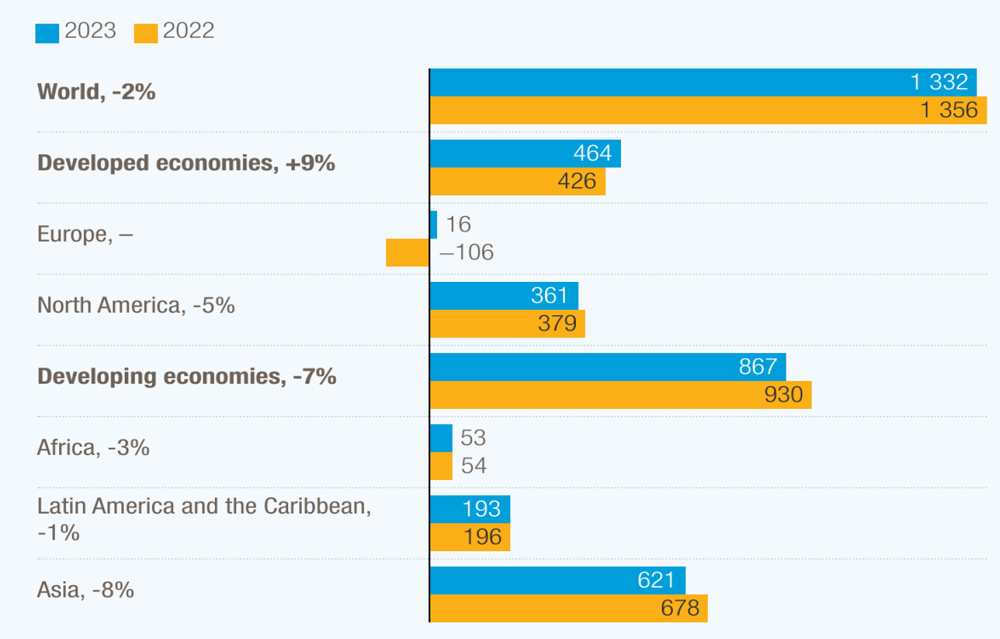

The prospects for Global FDI flows are more disconcerting. According to the UN Trade and Development (UNCTAD’s) World Investment Report 2024, FDI fell 2% to USD1.3 trillion in 2023, as trade and geopolitical tensions weighed on a slowing global economy. The report underscores that the headline figure exceeds -10% when excluding a few European conduit economies that registered large swings in investment flows. FDI flows to developing countries dropped 7% to USD867 bn, with Sub-Saharan Africa attracting only USD53 bn in FDI in 2023. The Report further highlights that:

- Tight financing conditions led to a 26% fall in international project finance deals, critical for infrastructure investment. International project finance is crucial for the poorest countries, making them more vulnerable to the global downturn in this type of investment.

- Crises, protectionist policies and regional realignments are disrupting the world economy, fragmenting trade networks, regulatory environments and global supply chains. This undermines the stability and predictability of global investment flows, creating both obstacles and isolated opportunities.

- While prospects for 2024 remain challenging, modest growth in FDI flows for the year remains possible, citing easing financial conditions and investment facilitation efforts in both national policies and international agreements.

- Investments are growing in several global value chain-intensive manufacturing sectors like automotive and electronics in regions and countries with easy access to major markets. But many developing countries remain marginalized, struggling to attract foreign investment and participate in global production networks.

Foreign direct investments declined in most regions

Foreign direct investment (FDI) inflows by economic grouping and region, billions of dollars and percentage change

Source: UN Trade and Development (UNCTAD)

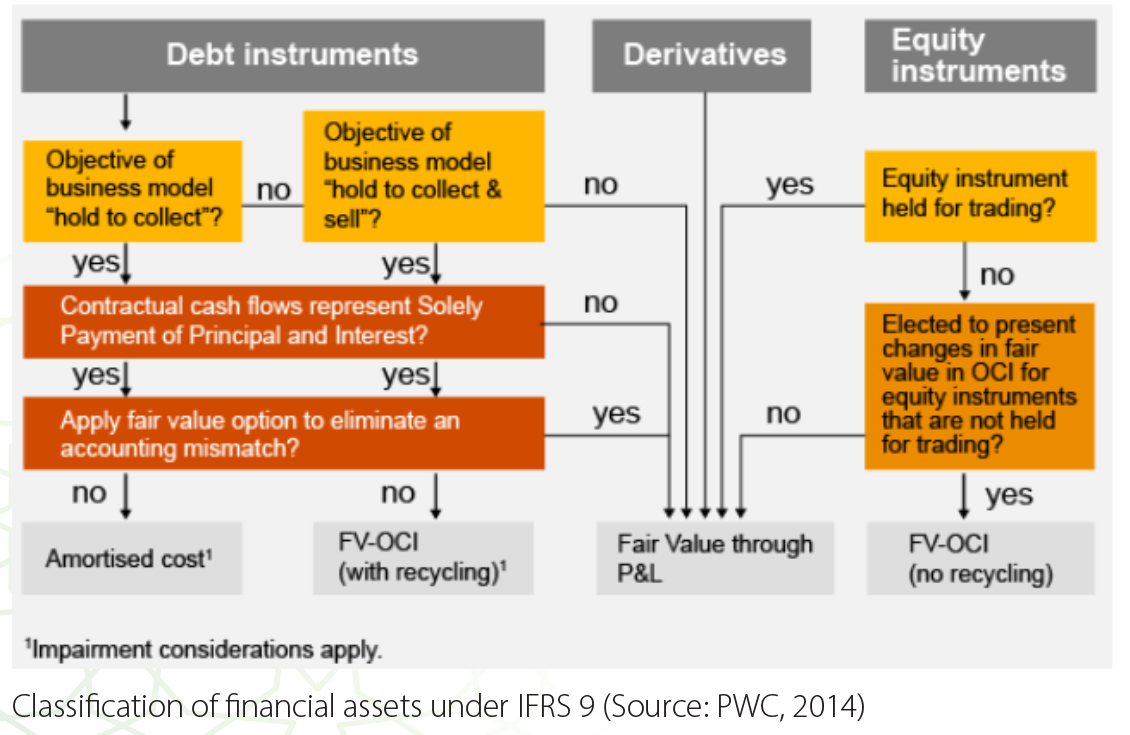

Credit and Political Risk Insurers (CPRIs) also faced new challenges as the year 2024 is ending. The European Banking Authority (EBA) released its long-awaited recommendation on the treatment of credit insurance as a credit risk mitigant (CRM) tool under the Basel regulation. The EBA decided against recommending an alternative approach for banks using credit insurance for credit risk mitigation. This topic now moved to the European Commission, which must balance financing the real economy with the need for competitiveness and innovation, while considering the EBA’s strict adherence to Basel standards.

Geopolitical tensions pose downside risks to the global economy and is adding challenges to CPRI underwriters through a surge in uncertainties, from protectionism to political uncertainty in major EU countries and ongoing conflicts in Russia-Ukraine and the Middle East, including tensions in the South-China-Sea and with Taiwan. This is a moving environment which requires proactive adaptation from underwriters and guarantors.

ICIEC MEET THE TEAM

ICIEC’s Women in Credit and Investment Insurance

A Trajectory for Gender Responsiveness and Balance in the Workplace

Of the current cohort of ICIEC’s 85 staff 15 are women. They vary from Country Managers, four of whom are featured in this article, to finance, underwriting, credit risk, corporate affairs, training, communications and marketing, human capital and resources, and public relations professionals. Their commitment, aspirations, knowledge, experience, expectations, and career pathways are universal, irrespective of the various metrics of identity, be it ethnicity, gender and creed.

As a signatory to the Principles of Sustainable Insurance (PSI), first introduced in 2012, and being the unique sole Shariah-compliant multilateral insurer in the world, and a member of the Islamic Development Bank (IsDB) Group, and of industry bodies such as the Berne Union, the AMAN Union and the International Credit Insurance and Surety Association (ICISA), gender responsiveness and balance are embedded in ICIEC’s playbook, at least in strategy terms, although in reality it is also a work in progress, as in almost all multilaterals and corporates around the world irrespective of demography and socio-economic status.

ICIEC of course does underwrite gender-responsive policies for transactions it supports in its 50 member states in line with their respective development agendas, especially in promoting women-owned-and-run Micro-and-Small-and-Medium-Sized-Enterprises (MSMEs) and women entrepreneurs. Gender responsiveness is increasingly becoming a core component of the gamut of the MDB and corporate architecture globally including the PSI.

The experiences and career paths of Sabah Alharbi, Eman A Mahmoud, Khady Seye, and Christelle Rivera in support of women in credit and investment insurance, sustainable finance and impact investment in developing markets, speak for themselves.

Ms. Sabah Alharbi, Country Manager, MENA Region, ICIEC

“I have over 18 years of extensive business experience in the Credit and Political Risk Insurance (PRI) business. This includes diversified experience in Policy Administration, Customer Relations to Country Manager and sales roles with key ICIEC accounts in MENA countries.

My Professional Experience at ICIEC spans as a Sales Assistant, then as a Policy Administration Officer, between 2008 to 2012, before moving on to become a Customer Relations Specialist till end of 2016, and then promoted to a pivotal role as Country Manager for the MENA region in 2017, a position I continue to hold.

My journey in the business world began in policy administration not to forget when our IMS had developed a portal online, I was among the top pioneers who trained clients on the system. With this massive development we were able to ease the process of workflow. Through my dedication, hard work and speed of learning, I was transferred to professional level, being a key staff member within the Customer Relations Department, where I managed relationships with existing clients and helped to resolve process obstacles and customer issues and feedback. This path ultimately led me to my current role as a Country Manager, where I oversee and support sales across specified countries in the Middle East and North Africa.

My personal interaction with clients helped me to increase our business not only in the MENA region, but also in the ASIA and SSAE regions, in close interaction with our sister organisation in the IsDB Group, The International Islamic Trade Finance Corporation (ITFC). Within this synergy, we will impact in positive way for the business portfolio not only in my division but as well to other divisions in ASIA and SSAE.

My motivation is also to continue improving my skills set through professional development and further qualifications and certifications. These include participating in ICIEC’s “Woman Leadership Programme in 2023,” courses on “Climate Change Fundamentals,” “Role of Credit Information Sharing & Business Intelligence in Supporting Trade & Investment Decisions (OBIC),” “Sukuk Structuring and Risk,” and “Buyer and Banking Underwriting.”

The fact that I am also a Certified International Credit Professional and a Certified Islamic Banker has helped me in my work for a dedicated Shariah-compliant multilateral insurer. In my current role, I am responsible for driving business growth by attracting new customers and enhancing relationships with existing clients. By implementing region-specific sales strategies, I had significantly contributed to increasing business insured and premium income, aligning with the corporation’s overall goals.

My forte is in generating business, ensuring the quality of insured business, and assisting customers in understanding new policies. With a strong ability to develop market intelligence, I provided valuable input for the continuous improvement of existing products. I am known for being highly motivated and self-directed, which has impacted in consistently delivering positive results that have led to increasing responsibilities and notable recognition throughout my career.”

Ms. Eman Mahmoud, Country Manager Egypt, ICIEC

“I have a strong foundation in finance and credit analysis, having completed a BCom from Cairo University and a MA in Business from The Ohio State University. I am also a certified Credit Analyst and a Certified Financial Modelling and Valuation Analyst.

My professional journey has been marked by a focus on credit and investment analysis, with experience spanning both commercial banks and a multilateral development finance institution. My current role as Country Manager for ICIEC has further honed my skills in these areas.

In my capacity as Country Manager at ICIEC, I have been instrumental in driving business development as part of the MENA region team. My responsibilities encompass establishing and maintaining relationships with strategic partners, origination, new project screening, appraisal, due diligence, and presenting new transactions for technical committee approval. This role has provided me with invaluable experience in credit and political risk assessment, project evaluation, and transaction structuring.

My expertise extends to several key areas such as Credit and Origination, Sustainable Finance and Development, Impact Investment, and Credit Risk Management. Recently, I presented a Paper titled ‘Insuring a Sustainable Future: An ICIEC Perspective’ at the BDC International Banking conference in Cairo, Egypt.

While the field of credit and investment insurance offers numerous opportunities, barriers include the need for specialized knowledge and experience, as well as a strong understanding of the regulatory, political and economic landscape. Additionally, building relationships with strategic partners and developing a strong network within the industry can be challenging.

Given my strong track record and expertise in credit and investment insurance, sustainable finance, and impact investment, I believe there is significant potential for career advancement within ICIEC. I am glad to have participated in the “Women Leadership Programme” at the Corporation to support women assume leadership roles.

I am excited about the future and the opportunities that lie ahead. I aspire to continue to contribute to the growth of ICIEC, while leveraging my expertise to drive sustainable development and promote inclusive economic growth. I am also keen to explore opportunities for leadership and management roles within the organization.

Ms. Khady Seye, Country Manager Senegal, ICIEC

“As far back as I can remember, I’ve always wanted to work in the financial sector, thus all my academic choices were made in this direction. In 2010, I obtained my MBA in Finance from Laval University in Quebec, Canada. Even then, I was one of the few women in our graduating class to take up this challenge. Nevertheless, obtaining a degree from a faculty with 2 international accreditations that place it among the top 1% of business schools worldwide was a daily motivation.

In 2010, with an MBA and CFA (Chartered Financial Analyst) Level 1 designation in my pocket, I began my career in Quebec at Desjardins as an account manager whose main mission was to offer financing solutions to companies in a variety of sectors. Always looking for new challenges, I joined Export Development Canada, one of the largest Export Credit Agencies (ECAs) in terms of assets which task is to support and develop Canada’s export trade by helping Canadian companies.

It was in August 2023 that I joined the ICIEC team in Senegal. As I was already familiar with credit insurance from my previous experiences, my integration was straightforward. Our sector is still very male-dominated, so I see my role as a mission: to pave the way for other women to reach positions of responsibility and be more represented in the management team.

Ms. Christelle Rivera, Sales Administration Associate, UAE, ICIEC

“My journey began during my undergraduate years at University of Saint Anthony in the Philippines, where I pursued a degree in Accounting and Finance. I was fascinated by the mechanisms of financial markets and the impact of strategic financial decisions on business success. This initial spark of interest led me to seek out roles in the financial sector, where I could gain hands-on experience.

I started my career as a Policy Administration Associate at ICIEC, where I was introduced to the intricacies of trade credit and investment insurance. This position allows me to develop a robust understanding of the sector including the different risk mitigation tools and impact of Investment and Credit Risk Management in global economic markets.

My role at ICIEC plays a crucial part in managing and maintaining the various insurance policies including the account management and direct collaboration with the Reinsurance Partners. My expertise extends to Financial and Management Reporting, Account Reconciliations, Reinsurance Portfolio Management, and Trade Credit and Investment Insurance.

As I continued to advance in my career, I took a Certified Management Accountant (CMA) certification course which is highly regarded in the fields of management accounting and demonstrates expertise in financial and strategic planning. By leveraging the expertise gained through the CMA certification, I believe I can contribute to overall operational efficiency and support ICIEC’s success and continuous growth.

The Trade Credit and Investment Insurance industry plays a vital role in facilitating international trade and investment in global markets, however, given the high importance of the business, it requires specialized knowledge in the sector such as compliance, regulatory changes, technological aspects and fostering a strong understanding of market dynamics.

I am looking forward to continuously advancing my career in this strategic institution that supports the economic development of its member states and enhances global economic relations and cooperation.”

MEMBER COUNTRY PROFILE SURINAME

Economic Outcomes are Steadily Improving due to an Impressive Range of Reforms and Commitment to Sound Public Finances and Inclusivity

Strategic Demography and Natural Resource Strength

Suriname, located on the northeastern coast of South America, is characterized by its ethno-culturally diverse population of approximately 600,000 people. The capital city, Paramaribo, serves as the political, economic, and cultural center of the country. The nation boasts a rich mix of ethnic groups, primarily Indo-Surinamese, Afro-Surinamese, Maroons, Javanese, and Amerindians, fostering a unique cultural tapestry that influences its social dynamics.

Natural resources are a cornerstone of Suriname’s economy, with significant deposits of bauxite (aluminum ore), gold, oil, and timber. The country is one of the largest producers of bauxite globally, and gold mining has become pivotal over recent years, contributing substantially to GDP. The abundance of tropical rainforests harbors a wealth of biodiversity, serving as both a natural asset and a potential challenge regarding conservation efforts and sustainable resource management. Water resources from the Amazon basin also highlight Suriname’s strategic geographical importance.

Government’s Economic Reform Agenda

President H.E. Mr. Chandrikapersad Santokhi’s administration is spearheading an ambitious economic reform agenda designed to restore fiscal and debt sustainability. The government’s plan emphasizes fiscal consolidation and debt restructuring aimed at reducing the national deficit while ensuring that vulnerable populations are protected through expanded social protection programs. The urgency for these reforms stems from the underlying economic challenges, exacerbated by the COVID-19 pandemic and declining commodity prices.

Key to these reforms is the establishment of a transparent fiscal framework that allows for better budget management and efficiency. The government has implemented measures to enhance governance and accountability in public finance management, ensuring that fiscal policy effectively supports sustainable growth. These reforms will be crucial in creating a stable economic environment that encourages domestic and foreign investment.

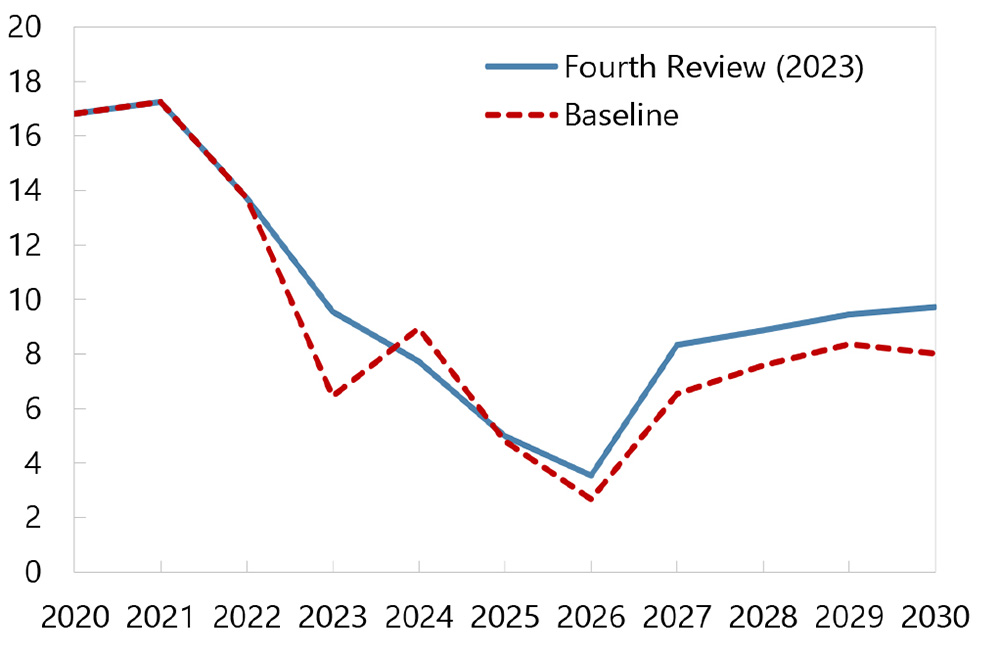

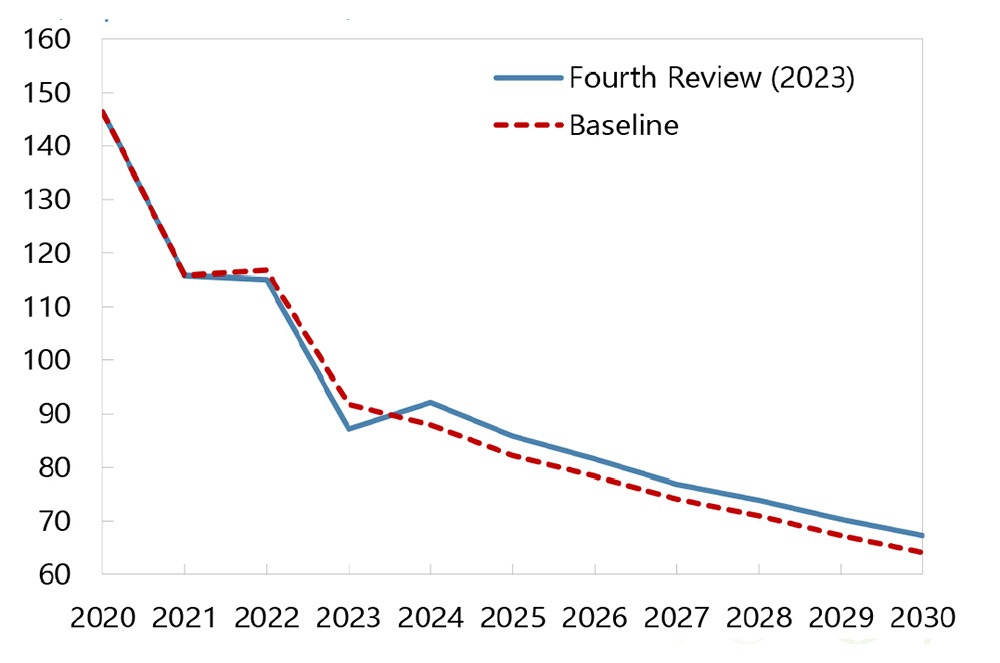

Suriname’s Debt Strategy and IMF Support

In alignment with its economic reform agenda, Suriname has initiated a comprehensive debt strategy to manage its burgeoning financial obligations. The international community, particularly the International Monetary Fund (IMF), has responded positively to Suriname’s requests for assistance.

In December 2021, the IMF approved the Extended Fund Facility (EFF) arrangement for Suriname, in an amount of equivalent to SDR472.8 million, aimed at providing financial support during this challenging economic transition.

With the currently disbursed amount of SDR337.1 million, the EFF program significantly contributed to enhanced fiscal policies leading to stabilizing the economy while simultaneously addressing social needs. One critical aspect of this strategy involved prioritizing strategic investments while managing deficits to restore confidence among stakeholders.

By engaging in these reforms supported by international financial institutions, such as the Islamic Development Bank (IsDB), Inter-American Development Bank, World Bank and others, the government is successfully navigating the challenging waters of public debt while laying a robust foundation for economic recovery.

SURINAME Key Economic and Institutional Indicators

| Country Name | Republic of Suriname |

|---|---|

| Population | 0.647 million |

| Real GDP Growth (% Change) | 2024 – 3.0% (projection), 2023 – 2.1% (estimate) |

| Inflation (Consumer Prices % Change) | 2024 – 20.7% (projection), 2023 – 51.6% (estimate) |

| Unemployment Rate | 2023 – 10.6% (estimate), 2024 – 10.3% (projection) |

| Exports Goods and Services (f.o.b.) | 2023 – USD2,534 million (estimate), 2024 – USD2,742 million (projection) |

| Imports of Goods and Services (f.o.b.) | 2023 – USD2,218 million (estimate), 2024 – USD2,339 million (projection) |

| Central Government Debt (% of GDP) | 2023 – 92.9% (estimate), 2024 – 87.9% (projection) |

| Special Drawing Rights (SDR) | 105.68 million |

| Quota (SDR: 128.9 million) | 128.9 million |

| Outstanding Purchases and Loans (SDR) | 290.4 million (June 30, 2024) |

| Number of Arrangements since Membership | 2 |

| Date of IMF Membership | 27 April 1978 |

| Date of IsDB Membership | December 1997 (as 52nd member state) |

| Subscribed Capital in IsDB | ID9.23 million (0.02% of total IsDB Capital) |

| Number of IsDB Group Projects Allocated | 36, of which 27 completed and 9 are active |

| Total volume of IsDB Group Funding to date | USD264 million |

| Date of ICIEC Membership | 21 January 2019 |

| Number of Islamic Banks | 1 – Trust Amanah Bank (2018) |

Source: Compiled by Mushtak Parker from IMF, IsDB and ICIEC data and disclosures

Date: September 2024

Suriname: Gross Financing Needs and Public Debt

Sources: CBvS, Ministry of Finance, and IMF staff estimates.

Sources: CBvS, Ministry of Finance, and IMF staff estimates.

Note: Gross financing needs do not include instruments used for the recapitalization of the CBvS.

Economic Agenda in the Context of Climate and Sustainable Development

Suriname is one of few countries in the world having negative carbon emissions primarily thanks to its extensive forest cover. Over 90 percent of Suriname’s land is covered by tropical rainforests of the Amazon Basin, which absorb CO2 from the atmosphere.

Suriname’s economic agenda is increasingly influenced by global priorities around climate change and sustainable development. In addition, Suriname has a relatively small population and limited sources of carbon emissions from transportation, energy production and manufacturing. Nevertheless, the government recognizes that the economy’s future lies in balancing growth with environmental sustainability.

Suriname’s wealth of natural resources can be harnessed to contribute to sustainable practices, especially with its significant forest cover that plays a vital role in carbon sequestration.

Significant efforts are underway to integrate climate considerations into national planning. The government is focusing on sustainable agriculture, eco-tourism, and renewable energy sources while committing to enhance the resilience of its infrastructure against climate-related risks.

Strategic partnerships with international organizations aim to facilitate knowledge transfer and investment in sustainable technologies, ensuring that the economic agenda aligns with the UN Sustainable Development Goals (SDGs).

However, challenges persist. Suriname faces immediate threats from deforestation, mining activities, and the ongoing impacts of climate change, such as rising sea levels, floods and extreme weather events. Balancing economic activities with environmental protection requires careful management and active engagement with local communities.

Cooperation with IsDB Group

Suriname has demonstrated a proactive approach in fostering cooperation with the IsDB Group. The Group launched the new Country Engagement Framework (CEF) for the Republic of Suriname (2024-2026) on 1st May 2024 in Riyadh on the sidelines of the 2024 IsDB Group’s Annual Meetings and the Bank’s 50th Anniversary Golden Jubilee.

Going forward, the IsDB Group will focus on two main pillars of engagement during 2024-2026: (i) Igniting Growth and Diversification will support three sectors: energy, agro-industry, and water and sanitation, and (ii) Building Human Capital for the Future will support complementary human development by focusing on health, education, and affordable housing.

Cross-cutting CEF pillars will include Islamic finance sector development and small and medium-sized enterprise (SME) support, climate change, women and youth empowerment, and capacity development.

As part of implementation of the Suriname CEF, and as a significant recent development in this partnership IsDB approved a financing for the “Expansion of Transmission and Distribution Systems” project, amounting to more than USD105.7 million, of which IsDB contributed USD47.7 million, with the participation and co-financing by the Saudi Fund for Development (SFD) and OPEC Fund for International Development (OFID).

This project is essential not only for improving energy infrastructure but also for supporting economic recovery by providing reliable electricity to both urban and rural areas. Improved energy access is critical for local businesses and overall economic activity.

Potential for Future Cooperation with IsDB Group/ ICIEC

Suriname is a member of all other IsDB Group Entities, including ICIEC joining in January 2019. The future potential for cooperation between Suriname and ICIEC holds promise, particularly in promoting investment to and international commerce with Suriname. Recent improvements in the economy reflected in steady recovery and stabilization of macroeconomic fundamentals, there is a growing interest from investors’ community in mining, agrobusiness, tourism and oil sector.

ICIEC’s risk mitigation products and services could provide Suriname with ample opportunities to attract FDI flows, boost trade and further enhance growth related sectors in the years to come.

The IsDB Group facilitated the establishment of the first and only Islamic bank in the region, Trust Amanah in 2018, while also extending Technical Assistance to the Central Bank to create an enabling environment for further expansion of the Islamic Banking and Finance industry in Suriname.

PROFILE INTERVIEW EXCLUSIVE

A Bright Future Built on Resilience, Embracing Digitalisation and AI, and Empowering the Next Generation of Credit InsurersThe Berne Union is the industry body of the International Union of Credit and Investment Insurers, of which ICIEC is a member. Despite the geopolitical tensions, the sluggish global economic recovery, and supply chain disruptions, 2023 was a “huge” year for export credit. BU members provided over USD3 trillion new support for international trade in 2023, expanded across business lines. All this happened under the stewardship of Ms. Maëlia Dufour, President of the Berne Union, and seasoned credit insurer in her other role as Chief International Officer, BPIfrance Assurance Export. With her two-year term ending on 31 October, Ms. Dufour discusses with Mushtak Parker in an exclusive interview in her capacity as President of the Berne Union, the state of the credit and investment insurance industry, the challenges of digitalization and AI, the economic power of gender balance, the priorities going forward, but at the same time looking back at the achievements of the last two years

One observation of our members is that contract timeline is longer and therefore contract close takes longer. The contract pipeline is dominated by big ticket transactions in defence, aviation and cruise ships, and other sectors too. But the two top priorities in demand according to our members is a big increase in demand to underwrite SME business and all aspects of climate related projects involving green and transition projects. Another priority that often comes up is digitalisation and AI with the aim of simplifying and speeding up the process for clients to give answers quicker, communicating and matchmaking between exporters and buyers.

We are seeing many potential disruptions in supply chain such as the trade route disruptions in the Red Sea (due to the conflict in the Middle East) and the Panama Canal (due to severe drought), and of course the conflict in Ukraine, the subdued global economic recovery and GDP growth. To what extent have these factors affected the industry and the business of your members?

Our members have been around for many years. They have been faced with several crisis before including the financial crisis of 2008, the Middle East Crisis, the COVID-19 crisis, the Supply Chain Crisis because of the Ukraine conflict. What we have realised is that we have always been very resilient, and always been there for our clients. During crisis we always ask clients about their needs. If the need changes, then we brainstorm and create new products. As such we have come up with new products depending on the various tensions.

If we look ahead, we have had a record number of general and presidential elections in 2024 in various parts of the world. We are all looking ahead to the US elections in November 2024. This is the one that counts. In other markets such as in Africa, we have the sovereign debt issue. As a result, it is true more exporters are asking for support and guarantees on African contracts. There is a lot of risk involved, but being an insurance provider, you must take risks.

Ukraine is very important. Many ECAs have signed MoUs with Ukraine to tell them we are ready to help in the reconstruction of the country. I know some governments have provided big loans for Ukraine, but the biggest problem we have heard is that there are some short-term contracts, but we don’t have any demand for medium-and-long-term contracts. The reason is that onsite visits especially for projects such as hospitals and roads are important. You need to have people on the ground. But because of the conflict, the security of the people is at risk. In France, for instance we look at this security issue very tightly compared to some other countries. The security of staff on the ground is a major concern for members of the Berne Union. Another problem is that they would find it difficult to get financing from the bank, unless the bank is 100% covered. BU members however have expressed their will to help in the reconstruction of Ukraine.

Developing countries consistently stress the high cost of credit and investment insurance which deters market entry and penetration. They talk about exaggerated risk perceptions of the international credit rating agencies about their markets which they say is unfair. This has led to the payment of extra premiums and higher cost of finance. Do you think that developing countries are getting a fair deal on credit and investment insurance and is there a two-tier system in pricing risk between developed and developing markets?

It is true that the cost of premium is a major issue. As you know we follow the OECD rating scale of Categories 0 to 7. If the country is rated 5, 6 or 7, the premium would be higher. It is a decision taken by economists inside the OECD. We cannot tell them why you rated a country 6 and not 5. Not surprisingly, it is the country that says we deserve a 5 and not a 6 rating.

You are right this is an issue for the developing countries, but we must take it as it is. Talking about a premium, Ukraine was saying that their premium was too high. They are at war, so they are in Category 7. They would like to be in Category 6, but we must comply with the OECD rating.

You have flagged climate action and finance as a key priority for Berne Union members. Especially as the world approaches COP29 in Baku. What about other areas such as food insecurity, post-pandemic health systems and clean energy transition?

We deal a lot with clean energy transition projects and green projects. Regarding climate action and finance, we look at three things: i) Decarbonisation of our portfolio, ii) Creating financial incentives to better insure green and transition projects, iii) Government policies and strategies and considering the statements of the various COPs.

Food security is very important. Some members do short term underwriting of agriculture business and for healthcare projects, both of which we support. There have been discussions with the OECD to give some financial incentives in support for healthcare contracts.

The phasing out of fossil fuels will take some time. The credit insurance industry is no longer interested in underwriting the coal, oil and gas industries. There are some countries that have been very clear in that that they will not support investments in fossil fuels. There are new emerging sectors such as critical minerals – nickel, manganese, lithium, cobalt etc. We see greater movement in this direction, and it is now becoming a priority sector for our members.

How important is adopting digitalization in across-the-board applications for the de-risking industry to embrace the defining challenges in the world – trade, investment, food security, climate action, clean energy transition, mitigating catastrophic climate events and natural disasters? Generative and/or extractive AI, Blockchain and Tokenisation are the great disruptors currently albeit they are all at their nascent stages of evolution. Digital trade has grown rapidly reaching USD4.25 trillion in 2023. The passing of the UK Electronic Trade Documentation Act 2023 is fast gaining traction as a global model. What are the implications for trade, trade finance and trade insurance ecosystem?

I can tell you no one ignores the challenge and opportunities of digitalisation. Nevertheless, the biggest markets such as the UK, France, Germany and so on can invest in digitalisation infrastructure and the cost is always very high especially for IT budgets. Some of the smaller nations such as Poland are very much advanced in digitalisation despite their size. Everybody wants to digitalise. We also have the rapid emergence of generative and extractive AI, Blockchain and Tokenisation. The Chinese are more advanced in this. They know that it is a pain for the client to have to write down the information on an application form. If everything is digitalised, then it goes quicker for them. Digitalization is vital for our clients and of course for the teams working inside the insurance institutions. There is a correlation between the increase in digital trade and uptake of digitalisation in insurance institutions.

Of course, we must look at AI and its applications for the credit insurance industry. We must use it in an appropriate manner. It is too early to say how it will impact the industry because we are still at the early stage. Everything is moving so fast. We must catch up otherwise we might be left behind. For AI, I can see an adoption timeline within the next year. There is also the issue of cybersecurity, online fraud and the various emerging risks. A lot of Berne Union members are looking at this. It is a very important issue for our members.

What is the current state of women in credit and investment insurance including among BU members? What measures are the BU and its members adopting to enhance the role of women in the industry across the spectrum?

I am very happy about the status and role of women inside the Berne Union. We have had three women serving as President consecutively for the last three terms. My term expires at the end of October 2024. The next President I believe following the annual meeting will be a man. In the industry, there are almost as many women as men. There is a balance between men and women. It is true when it comes to executive members, it is dominated by men. Nevertheless, if I look at some of major ECAs then there are several women who are Presidents. In our industry there is not really a problem of gender balance.

The latest OMFIF Gender Balance Index 2023 relating to central banking and financial services concluded that although progress has been made, the gap between men and women especially in senior positions in finance is still huge.

I can tell you only what I see inside the Berne Union – the dignity and institutional culture we have with almost 300 people working at the organisation. We create a working group if we have a problem. When there is no problem why create a working group?

One thing I am very passionate about is our Young Professional Group of credit insurance cohorts because they are the future, the next generation, and about how to retain new talent. I have supported a positive engagement with our young professionals, establishing and encouraging them to speak at panel discussions, sometimes including with senior professionals. The young professional working group is about 100 strong. They learn from managers who attend the panel discussions on a range of topics – from products, processes to even human and wellbeing issues. I told them I don’t want it to be only top down but also bottom up. From their feedback, the defining areas of interest are digitalisation and the onset of AI.

The Berne Union is celebrating its 90th anniversary and ICIEC its 30th anniversary. ICIEC is a multilateral insurer with 50 member countries which uniquely operates under alternative Islamic insurance principles. Do the two institutions have something to learn from each and further their cooperation?

I am very happy ICIEC is a member of the Berne Union. We have members from all areas of the world, so we can learn more about their countries and institutions. It is very important to have member ECAs from all over the world. At the next annual meeting, our Chief Economist will give us an industry update from all parts of the world. There will be a member from the Middle East who will give an update on the region.

There is one thing that is very important inside the Berne Union in that before the annual meeting we send surveys to all members for them to tell us how they are organising, developing new products, what are the figures in ST and MLT business, for investment and so on. We get to learn a lot from these surveys. If there is something ICIEC has written as a new product, for example, another member might ask for more information. We have a lot of exchanges and networking at the annual meeting. We ask the members to give us some feedback on what they would like to talk about to create breakout sessions. I encourage ICIEC to write down what is relevant for them in the survey, so that we can take it into account.

Often the perception is that credit insurance is too expensive, so we won’t bother with it. The culture of credit and investment insurance and market penetration is still underdeveloped especially in the developing markets. What is the Berne Union doing in general in spreading the message of credit and investment insurance?

I agree about the perception that credit insurance is too expensive. It is difficult to ride seven horses at the same time. We do what we can. I think we have done it well. But there is always room for improvement. We do interact with peer international institutions such as the IMF, World Bank, OECD, WTO through speaking at conferences on these issues.

I think we must improve on our communication and engagement with member ECAs. During my presidency I have been asked to speak at many conferences which I have done. This contributes to spreading our message and what we can do for export trade and insurance. Another of my objectives is to leverage the huge data resource we have at the Berne Union and communicate much more what we are doing and how we can help.

As you come to the end of your two-year term in office as President of the Berne Union at the end of October 2024, what will be the legacy of Maëlia Dufour? What are the achievements you are most proud of?

I am very proud of what we have done on climate action, especially in facilitating green projects and transition, and giving financial incentives for such projects. I am also proud of the Young Professional Group I introduced at the Berne Union to ensure continuity and the next generation of credit and investment insurers, and to ensure knowledge transfer to them.

I am proud of the extensive data resource we have developed at the Berne Union. Every member must report its data. I am also proud of creating a much more interactive AGM where we can engage on a whole range of issues. I call them my export family. I am confident that the Berne Union will continue to excel as the voice of the industry, articulating its successes, achievements, and concerns whether in technical matters, product innovations and emerging risks.

Last year, our members underwrote USD3 trillion of trade and investment business. I expect this to increase over the next three years. I have been in this industry for decades and have come across many crises. The fact that we are still in business, reflects our resilience. I am sure we will come across other crises. If I look at the figures for the last two years, business insured in fact has increased despite the impact of the pandemic or Ukraine. The defining impacts which have affected our business are geopolitical tensions and climate change. Before the Ukraine conflict, our members did a lot of business with both Russia and Ukraine. The war has stopped all that.

The Economic Power of Gender Balance

A Unique Opportunity to Advance Inclusivity, Resilience, and Recovery

Whether it is the McKinsey & Company’s ‘Women in the Workplace 2024’ report, OMFIF’s ‘Gender Balance Index 2024’, the ‘UN Sustainable Development Goals Report 2024’, or the observations of global leaders such as Kristalina Georgieva, the Managing Director of the International Monetary Fund (IMF), the message is consistent: promoting gender balance in the economy and workplace is beneficial for inclusive growth and higher productivity. However, while there has been real progress for women at every level of corporate activity, this progress remains slow, particularly in advancing women into managerial positions.

The positive correlation between gender balance in the workplace and the wider economy, alongside key economic indicators such as GDP growth, productivity, and social and financial inclusion is undisputed. However, the gender balance gap varies from country to country regardless of economic status, with low-and-medium-Income-countries (LMICs) often disproportionately affected.

The reality remains that women are underutilized stakeholders, with lower participation in the economy and in leadership positions, including in financial services. The fact that diversity and gender balance are smart economics, and are essential for development agendas, increasing aggregate productivity and socio-financial inclusion, while also maintaining the dignity and wellbeing of women in the workplace and society, is beyond dispute.

The IMF in a blog on ‘Inclusion and Gender’ authored by Antoinette Monsio Sayeh, Deputy Managing Director, alongside economists Alejandro Badel and Rishi Goyal, the link between narrowing the gender gap in the workplace and potentially higher global economic outcomes was highlighted, particularly amid the weakest medium-term growth outlook in more than three decades.

The IMF’s World Economic Outlook, released in July 2024, projected global GDP growth at 3.2% in 2024 and 3.3% in 2025. The average growth rates for the Developed Economies are projected at 1.7% and 1.8% for the same period, while for the Emerging Market and Developing Economies are expected to grow by 4.3% for both 2024 and 2025. The two regions where the IsDB and ICIEC membership is concentrated, the Middle East and Central Asia, and Sub-Saharan Africa (SSA), are projected to grow at 2.4% in 2024 rising to 4.0% in 2025, while SSA alone is projected to fare slightly better at 3.7% in 2024 rising to 4.1% in 2025.

For developing countries, these figures suggest disproportionality not only in the impact of the subdued global economic recovery but also in sharing the burden of any remedial policy reforms. These numbers present both challenges and opportunities for narrowing the gender balance gap in the workplace, a reform that the IMF views as crucial to reviving economies amid the weakest medium-term growth outlook in more than three decades.

“With global growth predicted to languish at just 3% over the next five years, and with traditional growth engines sputtering, many economies are missing out by not tapping into women’s potential. Only 47% of women are active in today’s labor markets, compared with 72% of men. The average global gap has fallen by only 1 percentage point annually over the past three decades and remains unacceptably wide,” maintain the authors of the IMF Blog.

Gender Balance and GDP Growth

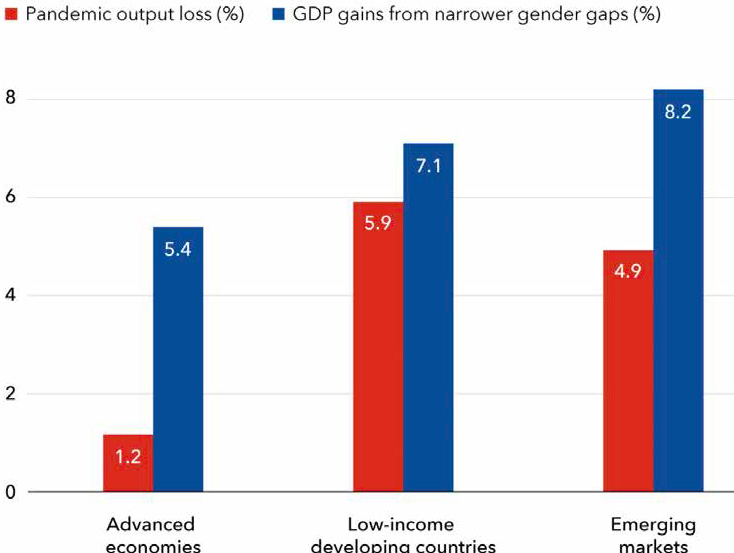

The IMF estimates that emerging and developing economies could boost GDP by about 8% over the next few years by raising the rate of female labor force participation by 5.9 percentage points—the average amount by which the top 5% of countries reduced the participation gap during 2014-19. This increase would more than offset the economic “scarring,” or output losses, inflicted on countries by the COVID-19 pandemic.

In search of new growth sources

Narrowing gender gaps in labor force participation could more than offset pandemic scarring.

Source: IMF Staff Calculations.

Note: Pandemic Output Loss is the percent deviation of projected real GDP in 2023 relative to the pre-pandemic (Jan. 2020) WEO projection. GDP gains are computed from narrowing the gender gap by 5.9 percentage points, which is the improvement achieved in the top 5 percent of EMDEs during 2014-19.

Policymakers can influence growth in various ways, from governance reforms to strengthen institutions, to financial and fiscal reforms, and investment incentives to unlock capital flows, for investment especially in infrastructure. However, as the IMF researchers suggests, complementing these reforms with measures to narrow gender gaps would greatly amplify these returns.

The challenge is how to enhance current policy trends at the government, institutional, and corporate levels to close gender gaps. “Our analysis of three decades of data,” says the IMF, “shows that countries have made progress increasing women’s participation, but economies of all income levels experienced several setbacks—a result of shocks, crises and policy reversals.

Countries must step up efforts to break down barriers to women’s participation in the labor market and workplace. Unfair laws, unequal access to services, discriminatory attitudes, and other obstacles prevent women from realizing their full economic potential.

The result is a shocking waste of talent, leading to losses in potential growth.”

There are other compelling reasons for pushing gender balance parity in the economy and the workplace. For instance, Global trade is poised to rebound in 2024 according to UNCTAD’s latest trade update, reversing the downward trend in 2023 when overall, the value of global trade fell by 3% to USD 31 trillion. The WTO’s July 2024 Goods Trade Barometer similarly reports signs of recovery in trade flows. After remaining flat since Q4 2022, the volume of world merchandise trade began improving in Q4 2023 and gained momentum in Q1 2024, rising 1.0% compared to the previous quarter and 1.4% year-on-year.

International gatekeeper organizations, including the Bretton Woods institutions and peer MDBs, must also reflect on their approach to gender responsiveness and balance. At the 49th Meeting of the International Monetary and Financial Committee during the 2024 Spring Meetings of the World Bank/IMF in Washington, DC, the clarion call from LMICs to the World Bank/IMF Executive Boards to “make meaningful strides” towards greater Diversity and Inclusion, particularly for gender parity in the Executive Board of the IMF, as well as enhanced gender balance on all grade levels in the offices of Executive Directors.

“We recognize the progress made on Diversity and Inclusion and accelerating gender equality and inclusion as key drivers of effective and impactful development,” reminded Lesetja Kganyago, Governor of the South African Reserve Bank (SARB). “But we call for continued commitment to make meaningful strides in tackling the ongoing challenges of greater recruitment and promotion of staff from underrepresented regions, as well as more female appointments at all levels, to ensure a level playing field and equitable treatment for staff at all grade levels across the membership.” In this respect, the World Bank Group’s new Gender Strategy assumes even greater importance in strengthening work to elevate human capital, expand economic opportunities, and engage women as leaders.

Gender outcomes were a prominent feature at the 13th Ministerial Conference (MC13) of the WTO in Abu Dhabi in March 2024, particularly concerning gender inclusivity in trade, trade finance and insurance. To mark International Women’s Day on 8 March 2024, the WTO through its Informal Working Group on Trade and Gender launched the International Prize for Gender Equality in Trade, which recognizes the most impactful gender-responsive trade policies implemented by WTO members and observers.

Looking ahead, the WTO and the WTO Gender Research Hub will organize the second edition of the World Trade Congress on Gender in 2025, focusing on innovation. The Secretariat will also release new policy tools during the Aid for Trade Global Review 2024, including incorporation of gender indicators in Aid for Trade programming and a new database mapping gender-responsive trade policies.

The Current State of Gender Balance

Research and data on gender balance and the socio-economy has flourished enormously over the last decade . The Sustainable Development Goals (SDG) Report 2024 reminds us through SDG 5 on Gender Equality, that “the world continues to lag in its pursuit of gender equality by 2030. Parity in women’s participation in public life remains elusive, and in management positions, at current rates, parity will require another 176 years. Enhancing women’s roles in leadership and decision-making and adequately scaling up investments in gender equality on national, regional, and global scales are top priorities.”

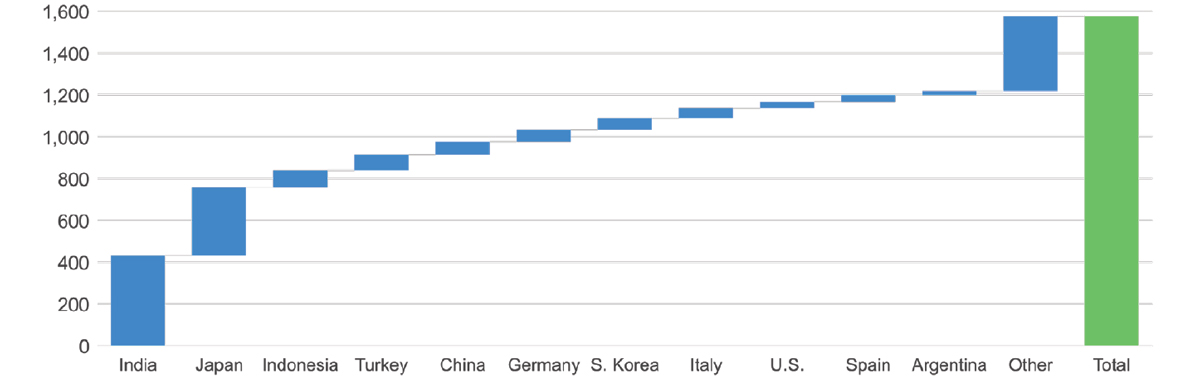

Earlier this year, Moody’s Analytics published a research study that highlights a significant shift in the global labor market. The study found that gender employment gaps are narrowing across the world due to increased female participation rates, adding USD 1.5 trillion to global income since 2019.

The female participation rate rose above its pre-pandemic level already in 2021 in the European Union, and in 2022 in the U.S. Progress in the EU has been especially remarkable, with the female labour force participation rate rising almost three percentage points in just over three years.

Moody’s Analytics identified three key forces behind the narrowing in gender gaps:

- Tight labour markets – unemployment rates are at or near record lows in many countries. To attract talent, employers may be offering higher wages or incentives, drawing participants into the labor market.

- Cost of living increases – high inflation and interest rates have squeezed household budgets, promoting new entrants into workforce to make ends meet.

- More flexible working conditions – the post-pandemic shift towards remote working and more flexible work arrangements has increased labor participation.

Narrowing Gender Gaps Have Added $1.5 Trillion to Global Income

Contribution to global income, $ bil international (purchasing power parity)

Source: Moody’s Analytics

Source: Moody’s Analytics

A report by Moody’s Investors Service in March A report by Moody’s Investors Service in March 2024 found that higher-rated companies tend to have a higher proportion of women on their boards. Women account for an average of 29% of the board seats of investment-grade companies (those rated Baa and above), and an average of 24% of the board seats of speculative-grade companies (those rated Ba and below). Companies based in advanced economies show a correlation between board gender diversity and credit ratings, whereas those in emerging markets do not. “The presence of women on boards – and the potential diversity of opinion they bring – supports good corporate governance, which is positive for credit quality,” emphasized Moody’s.

Another report by Sustainable Fitch indicates that companies with high gender diversity across all staff levels tend to have better overall ratings, suggesting a link between gender diversity and comprehensive ESG performance. Banks and financial institutions lead in gender diversity, while sectors such as energy, automotive, and transportation lag behind. “Board-level gender diversity,” says the report, “has risen in recent years, facilitated by supportive regulations. However, more effort is required to promote greater representation across countries and sectors. Our data indicate that European countries continue to lead in terms of the number of women on boards, with the Middle East and Latin America behind. Female board representation is also higher in insurance, healthcare, and education.”

McKinsey & Company’s ‘Women in the Workplace 2024’ report echoes the consensus that there have been important gains for women at every level of the corporate pipeline (in this case in the US for instance), particularly in senior leadership. “Research shows that companies with more women in leadership benefit from greater innovation, healthier cultures, and stronger performance. And in addition to offering valuable skills and perspectives, women leaders inspire the next generation of women to make their mark.”

However, progress toward parity remains slow for women at the manager and director levels, creating a weak middle in the pipeline and impacting most women. “At the current rate of progress, it will take almost 50 years to reach parity for all women in corporate America—and that assumes companies can translate their somewhat precarious momentum into more substantial and sustainable gains,” concludes the report.

Missed Opportunities

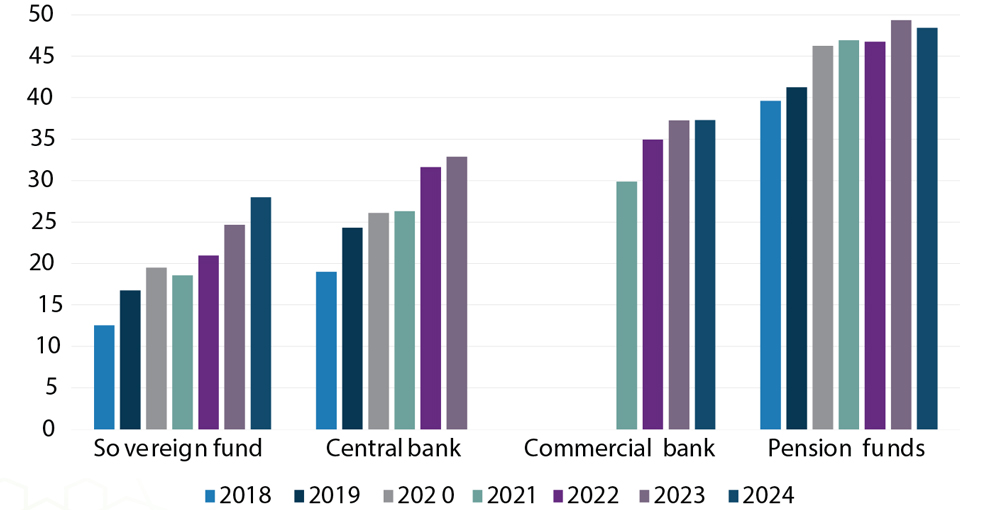

Two other reports provide sobering insights into the current and near-to-medium-term state and prospects for women in finance, the workplace, and trade. The 11th edition of the Gender Balance Index (GBI) published by OMFIF, the independent forum for central banking, economic policy, and public investment, paints a picture of missed opportunities. The index tracks the presence of men and women in senior positions in central banks, commercial banks, pension funds and sovereign funds.

“Even though there are more women in senior positions across central banks and top financial institutions in 2024, only 14% of the 63 institutions with new governors or chief executive officers in the past year appointed women. At this rate of change, the prospect of gender parity in leadership remains decades away,” states OMFIF.

However, in this landscape of gender gaps and parities, the data can be misleading. While absolute numbers may show some improvements, they often mask the fact that the base for the metrics is low and that barriers to entry remain high. These barriers are dominated by policymakers and national leaders, who are still predominantly men. According to OMFIF, in 2023, the share of new women CEOs in commercial banks and SWFs was zero, and in central banks and pension funds it was only 18% and 22% respectively.

Take, for instance, the South African Reserve Bank (SARB), the central bank. SARB’s gender balance record is mixed. Although SARB’s ranking in the GBI improved from 100 in 2022 to 63 in 2023, and its GBI score rose by 19 points year-on-year to 54. the percentage of senior female staff at the central bank was still only 35%. In March 2024, President Cyril Ramaphosa reappointed Ms. Nomfundo Tshazibana as Deputy Governor of SARB for a period of five years effective from 1 August 2024. He also appointed the prominent economist Dr. Mampho Modise as a new Deputy Governor of SARB for a period of five years effective from 1 April 2024. The gender bias has now shifted in favour of women in the Deputy Governor cohort, which now includes three female appointments.

Considerable progress across institutions in the long term

Average GBI scores

Source: OMFIF Gender Balance Index 2018-24Note: Commercial banks were included in the index from 2021 onwards. The sample of pension funds and sovereign funds included in the index changed in 2022 to cover 50 of the largest institutions by assets under management across regions.

Source: OMFIF Gender Balance Index 2018-24Note: Commercial banks were included in the index from 2021 onwards. The sample of pension funds and sovereign funds included in the index changed in 2022 to cover 50 of the largest institutions by assets under management across regions.

The proportion of female leaders in the 335 institutions in the GBI increased to 16% – its highest ever share. Most of the progress was seen in central banks, where the number of female governors increased to 29 (16%) from 23 (15%) in 2023. Pension funds hold the highest share of women in the top rank, –rising to 28% from 24% in 2023. However, commercial banks and insurance companies have regressed: the share of female CEOs fell to 12% this year from 16% in 2023. Sovereign Wealth Funds (SWFs) have an even lower representation, with 10% led by women.

However, in this landscape of gender gaps and parities, the data can be misleading. While absolute numbers may show some improvements, they often mask the fact that the base for the metrics is low and that barriers to entry remain high. These barriers are dominated by policymakers and national leaders, who are still predominantly men. According to OMFIF, in 2023, the share of new women CEOs in commercial banks and SWFs was zero, and in central banks and pension funds it was only 18% and 22% respectively.

Take, for instance, the South African Reserve Bank (SARB), the central bank. SARB’s gender balance record is mixed. Although SARB’s ranking in the GBI improved from 100 in 2022 to 63 in 2023, and its GBI score rose by 19 points year-on-year to 54. the percentage of senior female staff at the central bank was still only 35%. In March 2024, President Cyril Ramaphosa reappointed Ms. Nomfundo Tshazibana as Deputy Governor of SARB for a period of five years effective from 1 August 2024. He also appointed the prominent economist Dr. Mampho Modise as a new Deputy Governor of SARB for a period of five years effective from 1 April 2024. The gender bias has now shifted in favour of women in the Deputy Governor cohort, which now includes three female appointments.

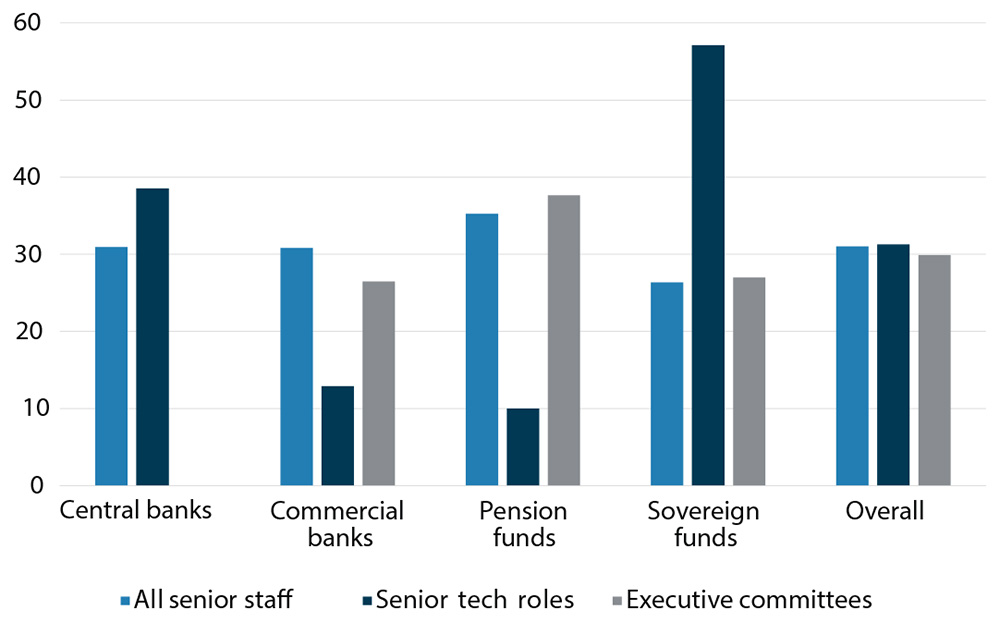

Women in Technology

Senior technology roles in financial institutions present a promising avenue for women in leadership, with encouraging signs for women in technology. Of the seven sovereign fund Chief Technology Officers (CTOs) included in the OMFIF’s GBI index, four are women. Two out of five African sovereign funds have women in leading technology roles, including Makano Mosidi CTO of South Africa’s Public Investment Corporation (PIC) and Sheila Malebogo Sealetsa, adviser on banking and currency digitisation of Botswana’s Pula Fund. In fact, the Central Bank of Seychelles and Bank of Namibia were the two highest ranked African countries in the GBI, with 54% senior staff comprised of women professionals. In contrast, the PIC has 17 female executives but no women on its board. Meanwhile, Absa and Standard Bank had 43 and 29 female board members, respectively, and 23 female executives each.

Share of women in tech is on par with industry trends

Share of women in senior positions, %

Source: OMFIF analysis

Note: Executive committee data unavallable for central banks.

The biggest challenge for women in the workplace may be reflected in the World Bank Group’s ‘Women, Business and the Law’ Report launched in March 2024. The report confirms that “the global gender gap for women in the workplace is far wider than previously thought. When legal differences involving violence and childcare are included, women on average enjoy just 64% of the legal protections and rights that men do—far fewer than the previous estimate of 77%. No country provides equal opportunity for women, -not even the wealthiest economies.”

The Report reveals a disconcerting implementation gap. Although laws suggest women enjoy roughly two-thirds of the rights men do, countries have established less than 40% of the systems needed for full implementation. For example, 98 economies enacted legislation mandating equal pay for women for work of equal value. Yet only 35 economies – fewer than one out of every five – have adopted pay-transparency measures or enforcement mechanisms to address the pay gap. The gender and implementation gaps highlight how much hard work lies ahead towards achieving parity.

New Trade and Gender Initiatives for MSMEs

In the field of trade, members of the World Trade Organisation (WTO) are increasingly discussing how to make trade more inclusive by fostering the greater participation of women and Micro-and-Small-and-Medium-Sized Enterprises (MSMEs) in trade. The recognition of the specific constraints of MSMEs and businesses owned by women in integrating global trade and leveraging trade for economic empowerment has resulted in the establishment of the WTO Informal Working Groups on MSMEs and on Trade and Gender.

According to the WTO, the Informal Working Group on MSMEs provides a forum to exchange information and experiences on ways in which WTO members could better support the participation of MSMEs in global trade. The Informal Working Group on Trade and Gender aims to enhance women’s participation in international trade by sharing best practices and exploring how women can benefit from the Aid for Trade initiative, among others. Discussions on inclusive trade have also gained significant importance in other WTO committees and working groups.

In this respect, the International Finance Corporation (IFC), the private sector funding arm of the World Bank Group, recently launched a new MSME Finance Platform initiative to aid financial service providers in delivering funds to small businesses in emerging markets, with a particular focus on those owned by women and those in the agriculture and climate sectors.

The Platform will include a financing package of up to USD4 billion from IFC’s own account to banks, non-bank financial institutions, microfinance institutions, and innovative digital lenders that focus on MSMEs. It will also utilize various forms of credit enhancement to mobilize private capital, including an innovative Catalytic First Loss Guarantee, which together aim to crowd in an additional USD4 billion in financing from eligible financial service providers to expand lending to these businesses.

“Micro, small, and medium enterprises.” explained Makhtar Diop, Managing Director of IFC, “form the backbone of most developing economies, yet they face significant financial barriers that hinder their potential. Our new financing platform addresses these challenges head-on, empowering financial service providers to extend critical support to these businesses, particularly those that are women-led or environmentally focused.” MSMEs, according to the IFC, make up over 90% of all firms and account, on average, for 60-70% of total employment and 50% of GDP worldwide. Still, according to the SME Finance Forum, there is currently a roughly USD5.7 trillion financing gap for MSMEs.

In emerging markets, MSMEs and the informal sector are essential to economic growth, job creation, and poverty alleviation. Recent crises have weakened financial service providers financially, constraining their ability to meet increasingly stringent lending requirements. As a result, businesses are seeing a credit contraction in emerging markets and developing economies due to tighter credit conditions, rising interest rates, and a limited appetite for risk.

The IFC will leverage its risk capital to extend first loss protection to eligible financial service providers, which often have ample local currency liquidity but have limited exposure to MSMEs due to the segment’s perceived high risk. Through this mobilization approach, the MSME Platform aims to create a financing solution through capital optimization structures and potentially redirect significant amounts of local currency financing to businesses.