The International Credit Insurance and Surety Association (ICISA), founded in 1928, is the first and leading trade association representing trade credit insurance and surety companies internationally. Its current members account for the great majority of the world’s private credit insurance business. The Schiphol, Netherlands headquartered Association also serves as an important platform for collaboration and the development of best practices in the industry. Today, with almost USD3 trillion in trade receivables insured and billions of dollars’ worth of construction, services and infrastructure guaranteed, ICISA members play a central role in facilitating trade and economic development on all five continents and practically every country in the world. In an exclusive interview, Richard Wulff, Executive Director of the International Credit Insurance and Surety Association (ICISA), discusses the current state of the credit and investment insurance landscape, the potential impact of manifold risks emerging in the global geopolitical, trade and investment landscape, the significance of the recent strategic collaboration signed between ICISA and the AMAN UNION to advance credit and investment insurance initiatives in member states common to both, and despite talk of deglobalization and fragmentation, why he maintains that trade and credit insurance remains one of the binding factors of our world and the way to bring people together.

ICIEC Newsletter: What is the current state of the credit and investment insurance landscape especially in an era of polycrises and growing uncertainties and risks? Is there room for much greater collaboration between government insurers through state-owned insurers and ECAs, and private sector re/insurers?

Insurance & Surety Association (ICISA)

The current landscape of credit insurance is marked by significant uncertainty and heightened risks due to a multitude of overlapping crises, often referred to as polycrises. These include geopolitical tensions, such as trade wars and regional conflicts, economic instability characterized by fluctuating markets and recession threats, and environmental challenges like climate change and natural disasters

In this complex environment, there is indeed substantial room for enhanced collaboration between government insurers, including state-owned entities and Export Credit Agencies (ECAs) and Development Financial Institutions (DFIs), and private sector re/insurers. Such collaboration can lead to the development of more comprehensive risk mitigation strategies by leveraging the strengths of both sectors

Government insurers and multi-lateral institutions bring stability and regulatory support, while private insurers contribute agility and innovative risk management solutions. By sharing expertise, pooling resources, and engaging in public-private partnerships, the industry can better address the increasing complexity of global risks, improve market penetration, and provide more robust support for businesses navigating these diverse challenges.

Another example of public-private partnership is found on the reinsurance market. Government and multi-lateral institutions utilize the reinsurance market to increase the capacity that these institutions can bring to their clients. Reinsurers tend to be inclined to reinsure projects insured by the public market because of the government-to-government relations the public institutions have.

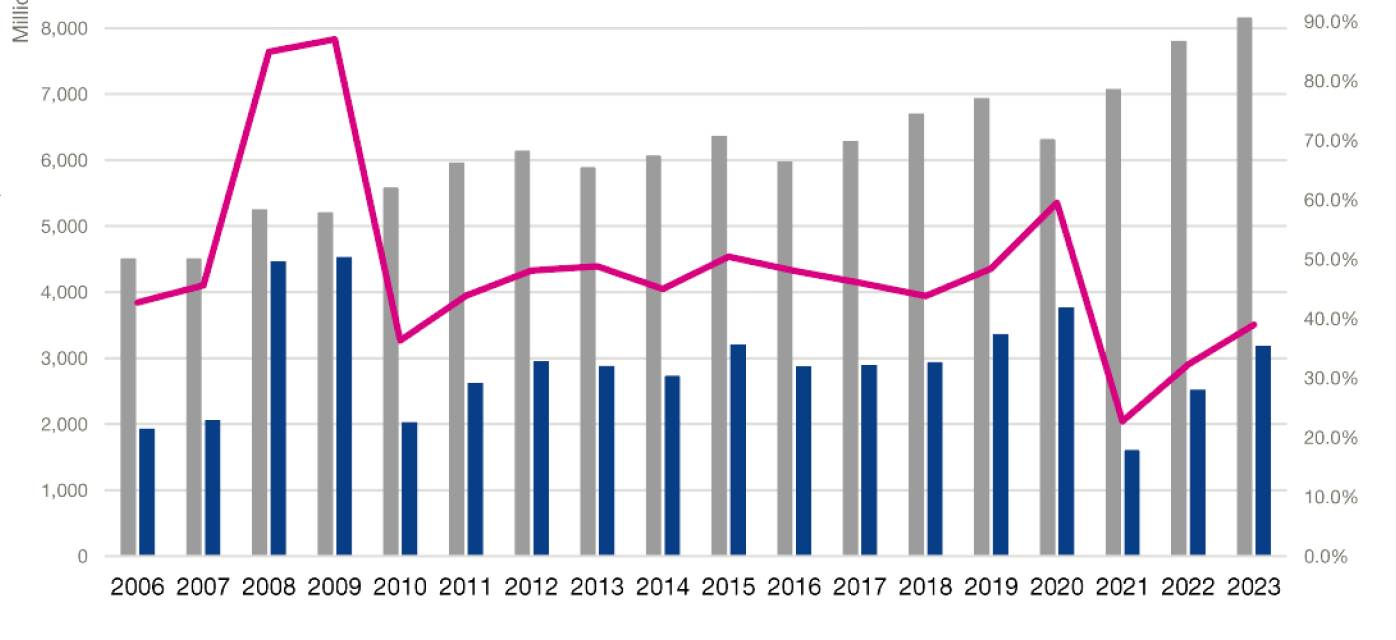

Trade Credit Insurance – Premiums, Claims and Claims Ratio ICISA Members (excl reinsurance members)

Given the manifold risks and tensions in the global geopolitical, economic, trade and investment, climate-related and catastrophic events landscape, how is this affecting the business side of credit and investment underwriting in terms of premiums, claims, claims ratio, and insured exposure?

The myriad of risks and tensions in the global landscape—ranging from geopolitical and economic upheavals to climate-related and catastrophic events — may have profound effects on the credit underwriting business. ICISA members, in response to heightened risk levels, have had to adjust their premiums upwards to adequately reflect the increased uncertainties.

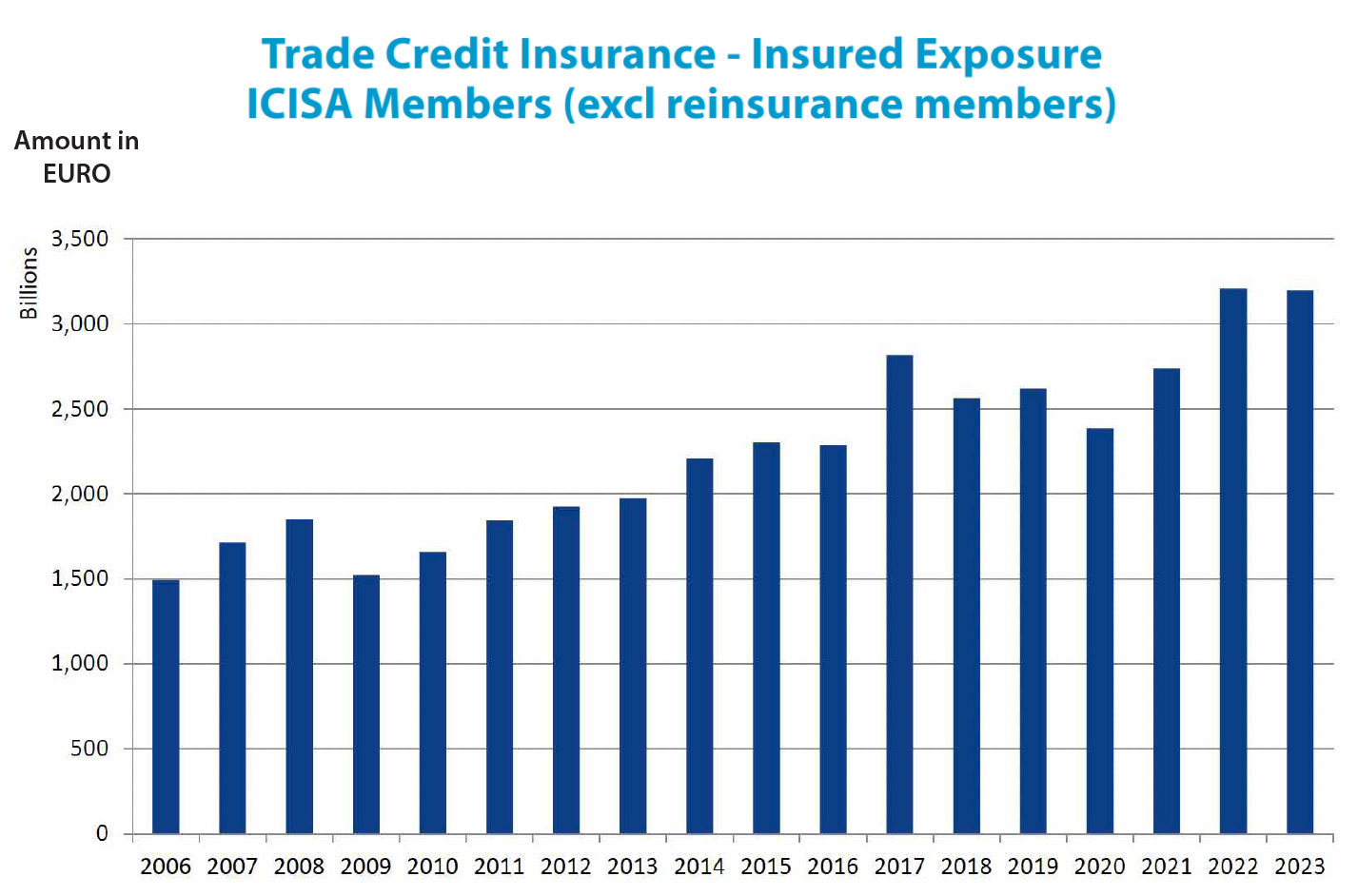

This risk-sensitive pricing ensures that insurers can maintain solvency and continue providing coverage. We have seen over the past years since COVID, that the insured exposure has increased by more than 25% since 1-1-2022. This has led to the claims ratio stabilizing at a sustainable levels, comparable to the level before COVID. This is also due to insurers continuously reassessing their risk models and pricing strategies, incorporating more sophisticated data analytics to stay financially stable and responsive to client needs in this dynamic environment.

Credit and investment insurance provision is rightly or wrongly perceived as operations largely prevalent in the developed and in high-and-middle-income emerging markets. The culture of credit insurance in developing countries for manifold reasons at best is fragmented, underdeveloped and perhaps undervalued. What is ICISA and other industry bodies doing to ‘democratize’ credit and investment insurance and its reach beyond traditional markets?

ICISA and other industry bodies are undertaking concerted efforts to democratize credit insurance, extending its benefits beyond traditional high-income markets to developing countries where the sector is often fragmented and undervalued. A prime reason for this is the well-publicized financing gap in the developing world.

One of the major reasons why (especially small and medium-sized) companies in the developing world have issues in getting financing from financial institutions to support their business is that they have little “hard collateral” to offer to the financier as security. A credit insurance policy written by a highly rated credit insurance company is the collateral that is needed so badly.

Initiatives Include:

Providing resources to local insurers to enhance their understanding of Trade Credit Insurance. This includes sharing best practices to improve the overall quality of insurance services offered in these regions.

Working closely with regional organizations and financial institutions to increase awareness about the value of trade credit insurance. By partnering with these entities, ICISA aims to foster a better understanding of credit insurance among businesses and policymakers, highlighting its role in facilitating trade and investment.

Conducting educational campaigns and workshops to inform businesses in developing markets about the benefits of credit insurance. These efforts are designed to dispel myths and misconceptions, demonstrating how credit insurance can protect against non-payment risks and support business growth. An example of these campaigns is the Trade Credit Insurance Week, which is a yearly celebration of trade credit insurance sector. This year, the third edition will be hosted, between 7 – 11 October, with 8 online sessions with free registration. Find out more about this initiative on www.icisa.org.

Through these strategies, ICISA aims to create a more inclusive and accessible credit insurance market, helping businesses in developing countries to manage risks effectively and participate more fully in the global economy.

ICISA recently signed an MoU with the AMAN UNION to advance credit and investment insurance initiatives in the latter’s member states. Can you expand on how you see this collaboration unfolding? What are the priorities and expectations under the MoU?

The MoU signed between ICISA, and the AMAN UNION represents a significant step towards enhancing credit and investment insurance initiatives within the member states of both organizations.

This collaboration is expected to unfold through several key avenues:

i. Exchange of Best Practices: Facilitating the exchange of best practices and experiences between ICISA and AMAN UNION. This knowledge-sharing will help both organizations enhance their operational efficiencies and service offerings, benefiting member states.

ii.Market Development Initiatives: Identifying and promoting opportunities for market development and expansion. By working together, ICISA and the AMAN UNION can help with the promotion of TCI products in developing countries.

iii. Policy Advocacy: Collaborating on policy advocacy efforts to create a better regulatory environment for credit and investment insurance, by working together with policymakers to highlight the importance of supportive regulations and incentives that can drive the growth of the insurance sector.

This partnership between ICISA and the AMAN UNION aims to create a more resilient and inclusive insurance market that supports economic growth and stability.

How do you see the prospects for the credit and investment insurance industry over the near-to-medium term? What are the most challenging evolving and future risks the industry is faced with especially in relation to trade and FDI flows and disruptions, financing infrastructure, climate action and food supply chain gaps?

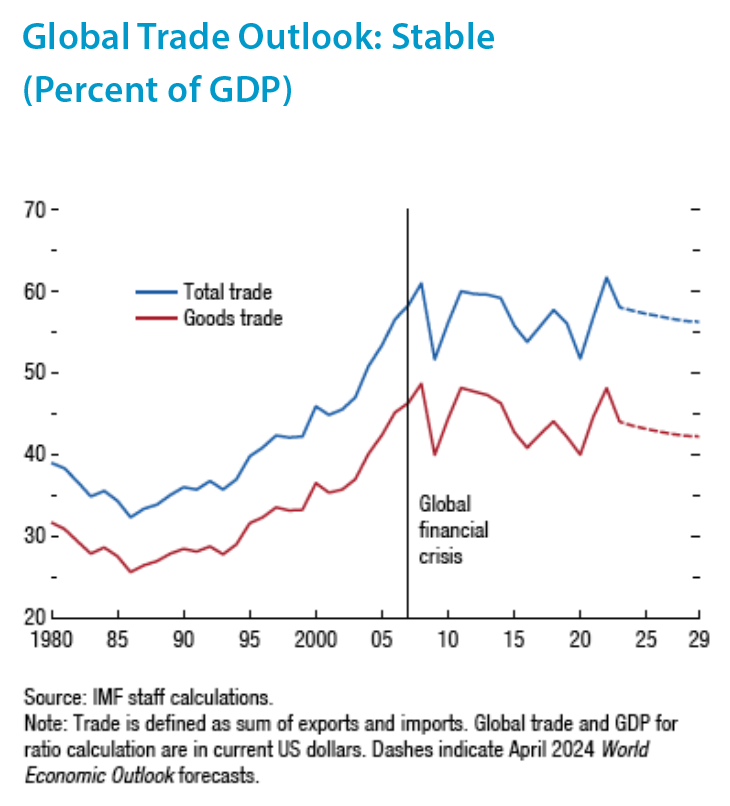

We see trade credit insurance remaining an essential part of the landscape. Short-term credit insurance covers just shy of 15% of the annual value of world-wide trade. It is an essential part of doing business and affording (end) customers credit terms and offering security to financiers.

Whereas there is much talk of deglobalization, trade remains one of the binding factors of our world and the way to bring people together. Credit insurance is one of its facilitators, and therefore here to stay.

Global Trade Shows Resilience, amid Subdued GDP Outlook and Geopolitical Tensions

Sometimes the devil is not in the detail but lurking in the divergent metrics of the global gatekeeper organisations supposed to stabilise them. When it comes to global trade metrics – finance, digitisation, insurance, and partnerships – it is no exception. Perhaps the ‘Steady but Slow: Resilience amid Divergence’ banner of the IMF’s World Economic Outlook (WEO) unveiled at the Spring 2024 Annual Meetings in Washington DC in April was no coincidence.

The Fund projects world trade growth at 3.0% in 2024 and 3.3% in 2025, with revisions of a 0.3 percentage point decrease for 2024 and 2025 compared with its January 2024 projections. Trade growth is expected to remain below its historical (2000–19) annual average growth rate of 4.9% over the medium term, at 3.2% in 2026. This projection implies, in the context of the relatively low outlook for economic growth, a ratio of total world trade to GDP (in current dollars) that averages 57% over the next five years, broadly in line with the evolution in trade since the global financial crisis in 2008.

However, warns the IMF, even as world trade-to-GDP ratios remain relatively stable, significant shifts in trade patterns are taking place, with increasing fractures along geopolitical lines, especially since the start of the war in Ukraine in February 2022, leading to greater trade protectionism even among allied blocs in an increasingly fragmented global economic ecosystem. Indeed, says the IMF, growth in trade flows between geopolitical blocs has declined significantly since then compared with growth of trade within blocks. “This reallocation of trade flows is occurring in the context of rising cross-border trade restrictions, with about 3,200 new restrictions on trade in 2022 and about 3,000 in 2023, up from about 1,100 in 2019, according to Global Trade Alert data, and increased concerns about supply chain resilience and national security,” added the IMF.

In contrast, according to the World Trade Organisation (WTO), the volume of world merchandise trade should increase by 2.6% in 2024 and 3.3% in 2025 after falling by 1.2% in 2023. Similarly, regional conflicts, geopolitical tensions, and economic policy uncertainty pose substantial downside risks to the forecast. The expectation is that inflationary pressures in many countries will abate in 2024 leading to a recovery in demand especially in the developed economies. There is the issue of fiscal, and policy drag, which can take years to work through – hence the feeling of an ongoing cost-of-living crisis despite the claims of remedial actions.

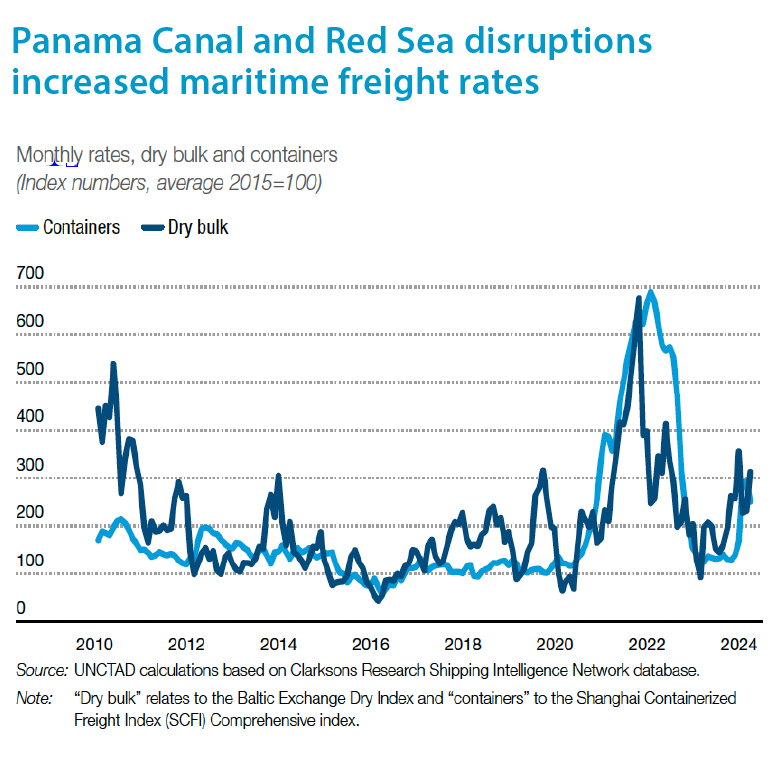

In contrast still, the UN Trade and Development’s (UNCTAD) latest Trade and Development Report Update in April 2024, reiterates that the contraction of international merchandise trade in a context of global economic expansion in 2023 is unprecedented in recent times. But since then, “two further negative shocks have hit maritime routes, the backbone of international merchandise trade. Both relate to shipping disruptions in key arteries of maritime transport: the Panama Canal and the Red Sea. The first one affected by a prolonged drought which forced the reduction in crossings, and the second one affected by attacks on shipping in the wake of the war in Gaza which compelled major ocean carriers to suspend Suez transits and to reroute through the Cape of Good Hope, adding between 12 and 20 days of transport and therefore freight costs and rising consumer prices.

The growth of merchandise trade, overall, is expected to remain subdued in 2024, albeit prospects for trade in services in 2024 look brighter even if a slowdown in some of its components cannot be ruled out. Trade like any other sector is beholden to a range of interlinked risks and uncertainties – sovereign debt levels, higher global interest rates, inflation management, calls for protectionism, continuing trade tensions and rising political uncertainty. This suggests meagre improvement in 2024 for trade in goods and services.

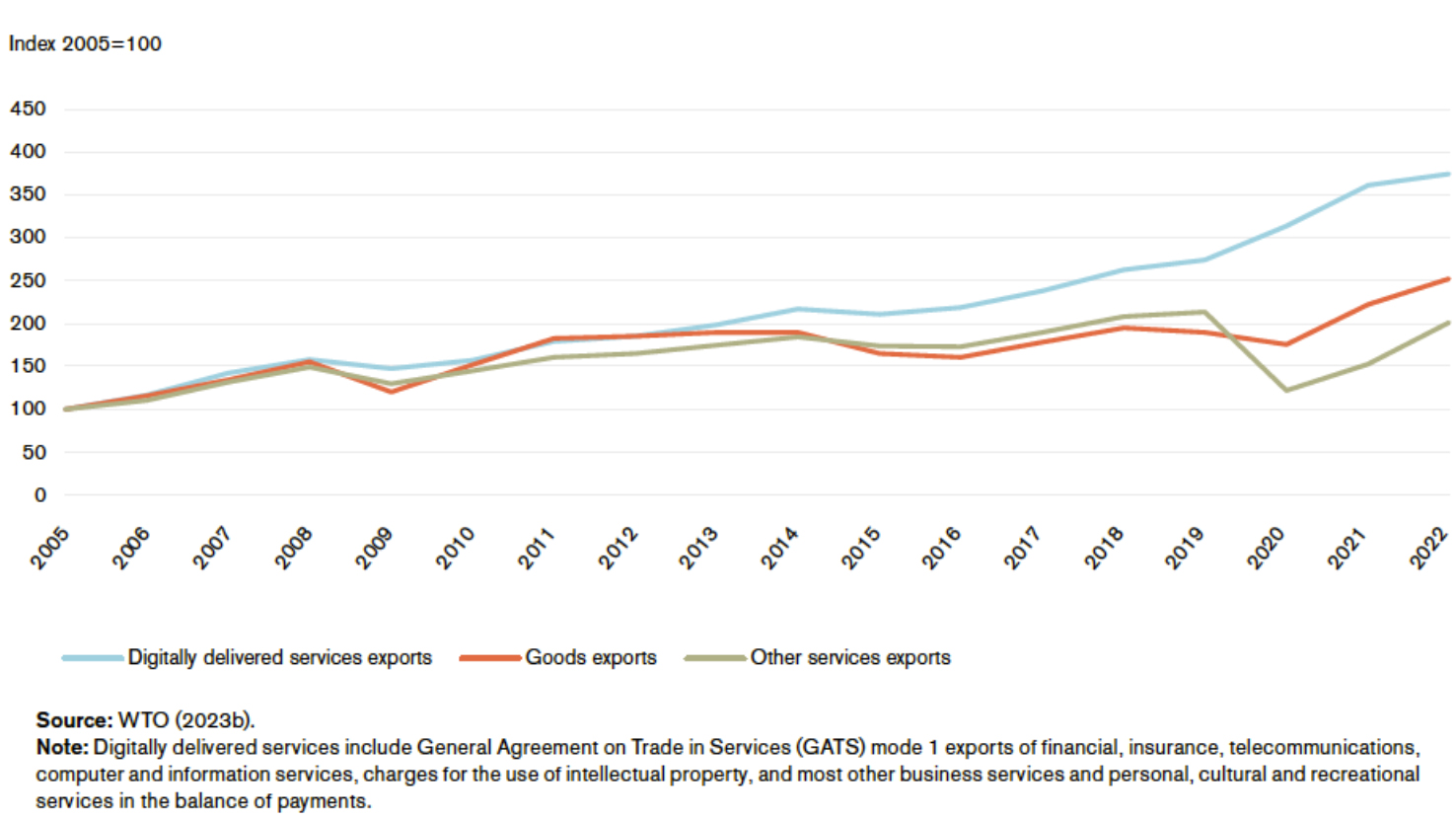

Total goods and services trade was only down 2%. An encouraging development for services was the global exports of digitally delivered services, which reached USD4.25 trillion in 2023, up 9% year-on-year, accounting for 13.8% of world exports of goods and services.

The value of these services — meaning services delivered digitally across borders through computer networks and encompassing everything from professional services to streaming of music and videos and including remote education — surpassed pre-pandemic levels by over 50% in 2023.

GDP Growth and Trade – a Volatile Relationship

The relationship between trade and GDP growth (output) is well established, although it can be tempestuous, volatile, unpredictable, and even stable depending on the prevailing and looming national, regional, and global macroeconomic indicators and trends.

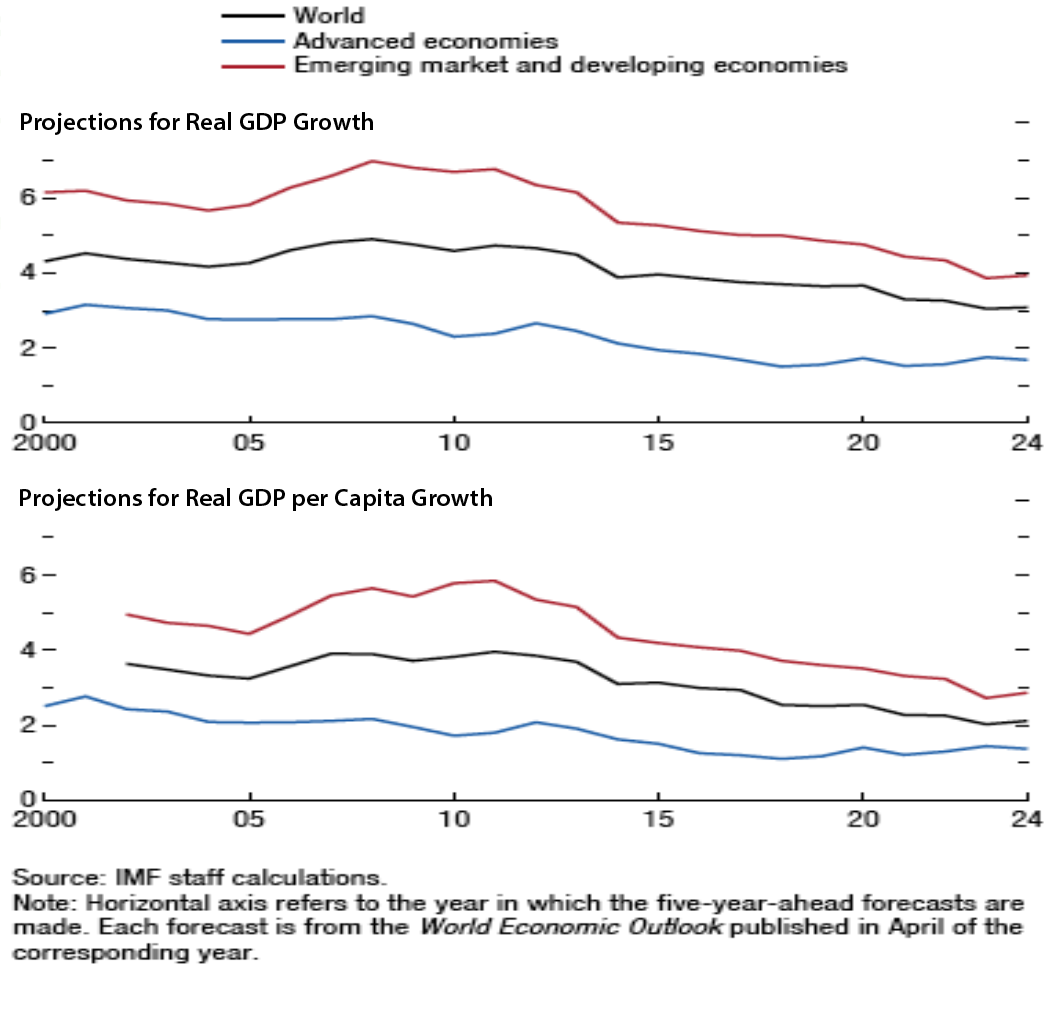

UNCTAD expects a further growth deceleration in global GDP growth in 2024 to 2.6%, slightly slower than in 2023. This makes 2024 the third consecutive year in which the global economy will grow at a slower pace than before the pandemic, when the average rate for 2015–2019 was 3.2%.

The UN body remains very critical of the obsession of the G7 countries with containing inflation. “Policy discussions continue to centre on inflation, conveying confidence that anticipated monetary easing will heal the world’s economic woes. Meanwhile, the pressing challenges of trade disruptions, climate change, low growth, underinvestment, and inequalities are growing more serious,” it lamented in its April Trade and Development Report Update.

It remains concerned that growth was largely driven by private consumption funded largely by debt in both private and public sectors. This, says UNCTAD, has led to a mismatch “between seeking financial market stability and attaining other macroeconomic goals.” Prioritizing the stability of the financial markets tends to have a negative impact on funding for the public sector, as government deficits are frequently chastised by bond markets and international financial institutions. Fast value creation by the financial markets benefits the holders of financial assets while crowding out fixed investment. Not surprisingly, observes UNCTAD, private investment globally in 2023 performed dismally and a worse one is projected for 2024.

In contrast, the IMF’s April 2024 WEO estimates global growth at 3.2% in 2023, which is projected to continue at the same pace in 2024 and 2025. The forecast for 2024 is revised up by 0.1 percentage point from the January 2024 WEO Update. “The pace of expansion,” notes the Fund, “is low by historical standards, owing to both near-term factors, such as still-high borrowing costs and withdrawal of fiscal support, and longer-term effects from the COVID-19 pandemic and Russia’s invasion of Ukraine, weak growth in productivity, and increasing geo-economic fragmentation.

At the same time, the WTO in its April “Global Trade Outlook and Statistics” report estimates global GDP growth at market exchange rates will remain mostly stable over the next two years at 2.6% in 2024 and 2.7% in 2025, after slowing to 2.7% in 2023 from 3.1% in 2022. The contrast between the steady growth of real GDP and the slowdown in real merchandise trade volume is linked to inflationary pressures, which had a downward effect on consumption of trade-intensive goods, particularly in Europe and North America.

Forecasts for Global GDP and GDP per Capita (Percent; five-year-ahead projections)

Regional Trade Outlook

If current projections hold, Africa’s exports will grow faster than those of any other region in 2024, up 5.3% according to WTO. But this, however, is from a low base since the continent’s exports remained depressed after the COVID-19 pandemic. North America (3.6%), the Middle East (3.5%), and Asia (3.4%) should all see moderate export growth. European exports are once again expected to lag those of other regions, with growth of just 1.7%.

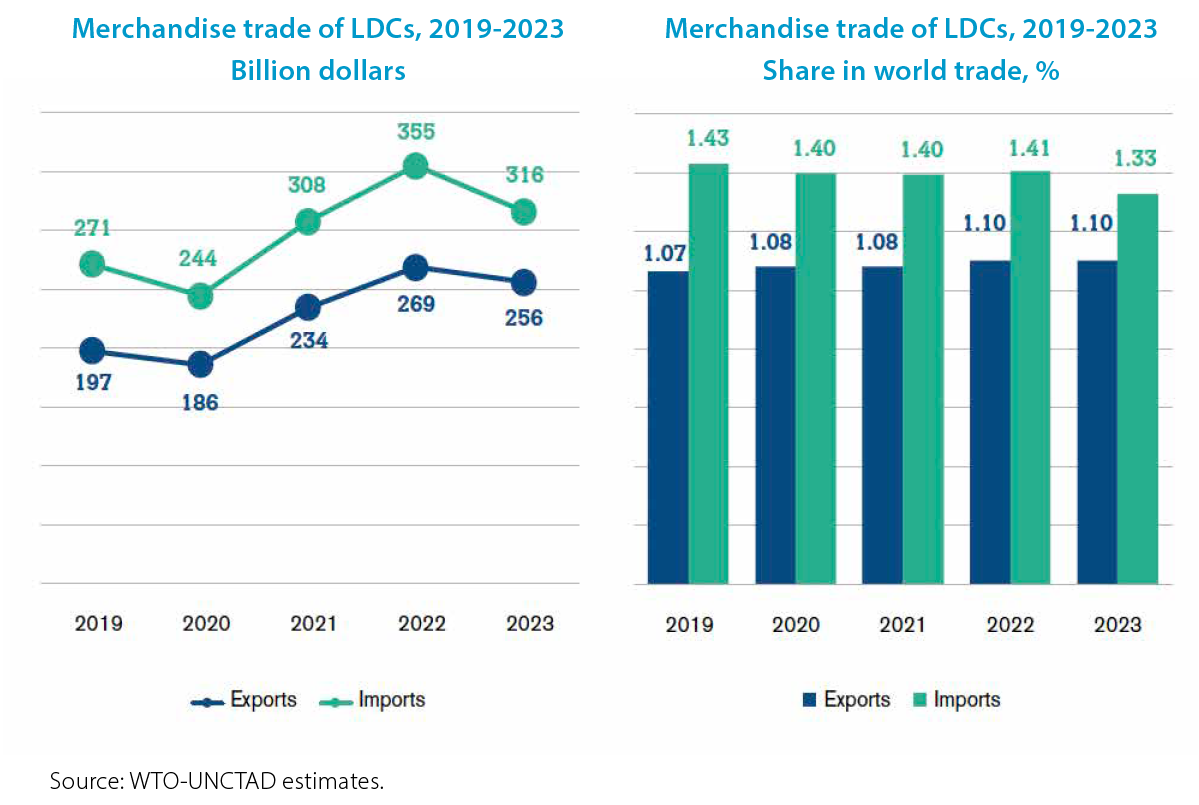

Strong import volume growth of 5.6% in Asia and 4.4% in Africa should help prop up global demand for traded goods in 2024. However, all other regions are expected to see below-average import growth, including the Middle East (1.2%), North America (1.0%), and Europe (0.1%). Merchandise exports of least-developed countries (LDCs) are projected to grow 2.7% in 2024, down from 4.1% in 2023, before growth accelerates to 4.2% in 2025. Meanwhile, imports by LDCs should grow 6.0% this year and 6.8% next year following a 3.5% contraction in 2023.

That Africa accounted for only 14% of intra-African merchandise trade in 2022 (down from 16% in 2018) – the lowest of the global regions – underlines the huge gap and challenge faced in realizing the African Union’s Agenda 2063 vision of economic integration and inclusive socio-economic development on time, and the trade-led development ambitions of the African Continental Free Trade Area (AfCFTA), which aims to bring together 55 African states and create an integrated market of 1.3 billion people, with a combined GDP of USD3 trillion.

Intra-OIC Trade and Challenges

One of the core mandates of COMCEC, the Organisation for Islamic Cooperation (OIC), and the Islamic Development Bank (IsDB) Group specifically requires all three institutions to promote intra-OIC trade and foreign direct investment (FDI) flows in their Member States. In fact, COMCEC has set a target of reaching 25% of intra-OIC trade by 2025.

The IsDB marks its 50th Anniversary and ICIEC its 30th Anniversary in 2024. The fact that intra-OIC trade and investment have not even hit 25% of their total exports and imports and FDI flows suggests what an uphill struggle it remains for Member States to upscale their bilateral and multilateral trade and investment flows.

The reasons are manifold. There is a fundamental mismatch and dissonance between the OIC economies, ranging from the wealthiest nations in terms of GDP per capita to some of the poorest nations on earth, especially in Sub-Saharan Africa and South Asia.

The huge economic disparities between the various segments of OIC cohorts exacerbate a multitude of challenges, of which intra-OIC trade and investment is high on the agenda.

Merchandise trade of LDCs, 2019-2023 Billion USD and % shares

ICIEC serves its mandate by providing risk mitigation and credit enhancement solutions to Member States’ exporters selling to buyers across the world, and to investors from across the world investing in Member States. ICIEC also supports international exporters selling to Member States if the transactions are for capital goods or strategic commodities. In this context, ICIEC’s intervention through the provision of export credit and political risk insurance is more crucial than ever to support Member States in securing strategic commodities and fostering cross-border trade and investments.

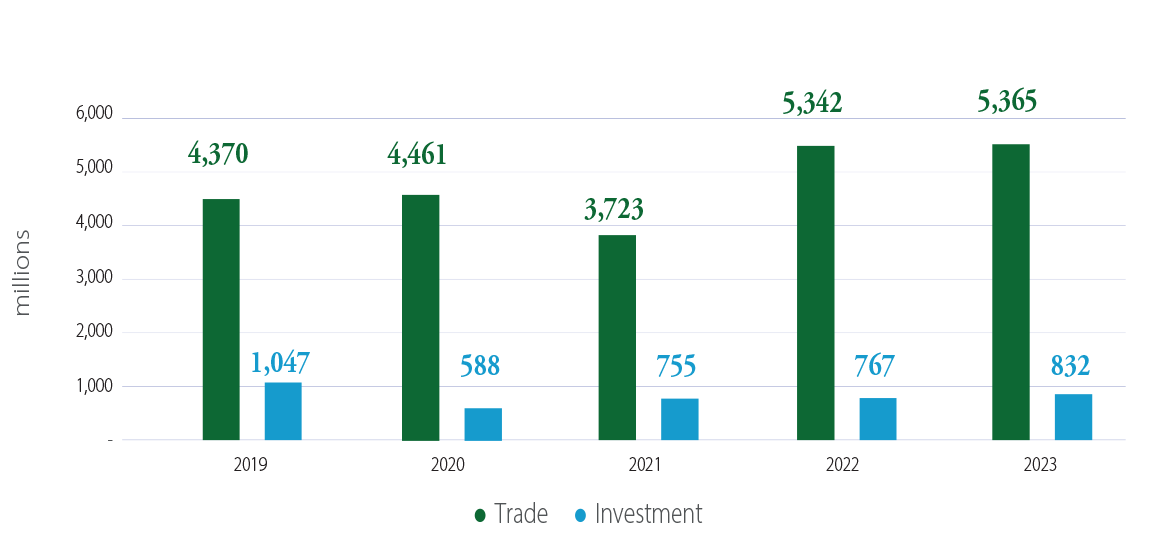

Intra-Trade and Intra-Investment Facilitated for OIC Member States During 2019 to 2023 (USD million)

According to the ICIEC 2023 Annual Report, intra-OIC trade increased from USD 4,370 million in 2019 to USD 4,461 million in 2020, reaching USD 5,365 million in 2023. Similarly, intra-OIC investments increased from USD 1,047 million in 2019 to USD 832 million in 2023.

Given that the intra-OIC trade and investment base is very low, the pathway to increased intra-OIC trade and investment flows assumes even greater challenges. The IsDB Group, including ICIEC with its risk mitigation and credit enhancement tools, can only contribute measuredly to boosting OIC trade and investment, as the Group must contend with competing priorities and demands on their finite resources.

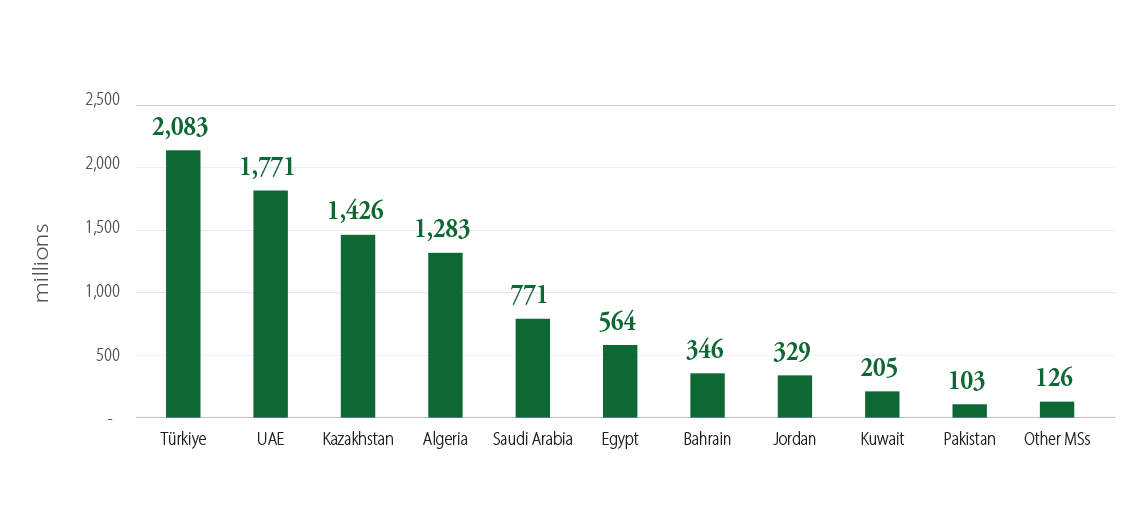

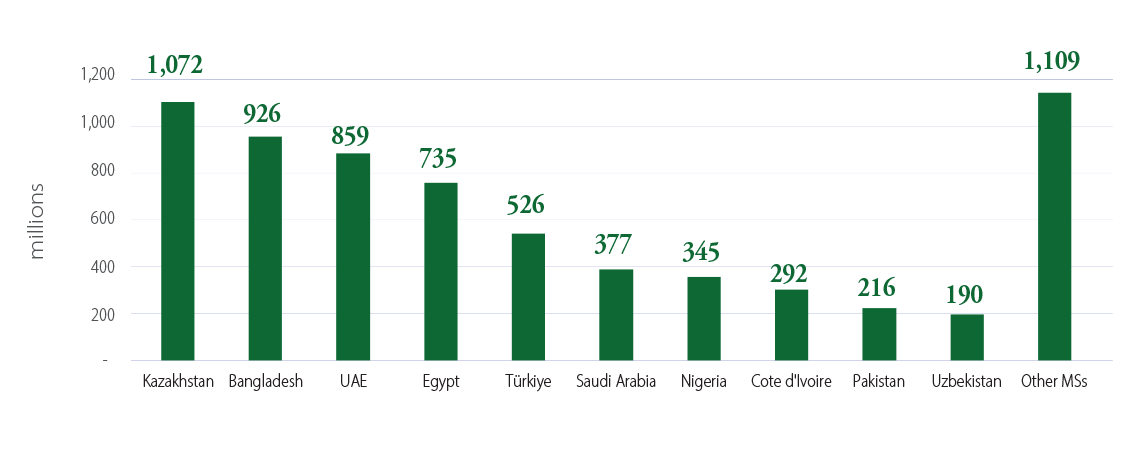

Major Member States by Export Business Facilitated in 2023 (USD million)

Major Member States by Import Business Facilitated in 2023 (USD million)

Governments, corporates, banks, and credit insurers can do much more to give intra-OIC trade and investment traction and a boost. They should ensure that their regulations, seamless strategies, and trade and investment incentive packages are in place, going beyond traditional bilateral and multilateral MoUs and cooperation agreements.

OIC Trade Snapshot

The usual caveats are the low sovereign credit rating, poor or nonexistent regulatory frameworks, the lack of facilitating institutions and qualified human capital, a lack of credit insurance market awareness and education, in conjunction with increased geopolitical risks including conflict, climate change, governance issues and natural disasters. The question remains how to mitigate this huge disequilibrium in OIC economies, their natural resource and commodities strengths and weaknesses, and a spate of associated metrics.

ICIEC’s involvement in intra-OIC trade and investment is commendable – facilitating USD51billion in intra-OIC trade and investment since inception. But the latest data for FY2023 shows that there is much room for improvement despite the various barriers to boost such facilitation. Most of the export business facilitated in 2023 came from six countries – Türkiye, UAE, Kazakhstan, Algeria, Saudi Arabia, and Egypt, with Türkiye alone accounting for USD2,083 million.

Intra-OIC trade and investment have the potential to be a gamechanging facilitator to lead the OIC economies into recovery from the impacts of the pandemic era, the subdued global economic recovery, and the vagaries of geopolitical tensions and their impacts on commodities price volatility, sovereign indebtedness, a global cost-of-living crisis and a break on reaching the UN SDG and Paris Net Zero targets – all of which affect developing countries including the IsDB ones disproportionately.

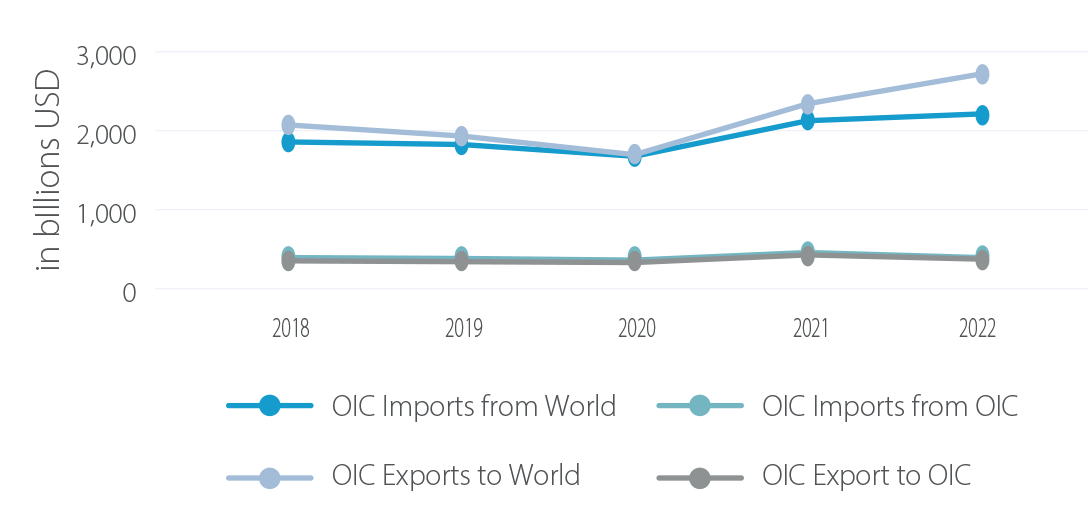

According to the ICIEC 2023 Annual Report, a deeper dive into intra OIC trade dynamics reveals an intriguing paradox. While 2021 marked a zenith for intra-OIC imports at 436.0 billion, a subsequent contraction to 365.4 billion in 2022 raises pertinent questions about the internal trade synergies and potential barriers within the OIC ecosystem. Similarly, the export narrative mirrors this trend, with intra-OIC exports peaking in 2021 but retracting in 2022. The retraction, however, is almost certainly due to the pandemic, the Ukraine conflict supply chain impacts, and the slow global economic recovery.

Outlook and Drivers

WTO Director-General Ngozi Okonjo-Iweala maintains that “we are making progress towards global trade recovery, thanks to resilient supply chains and a solid multilateral trading framework — which are vital for improving livelihoods and welfare. It’s imperative that we mitigate risks like geopolitical strife and trade fragmentation to maintain economic growth and stability.” Already some governments have become more skeptical about the benefits of trade and have taken steps aimed at reshoring production and shifting trade towards friendly nations.

However, her Chief Economist Ralph Ossa warns that “while the trade environment is clearly challenging, we should not paint too dark a picture of international trade. The volume of world merchandise trade was essentially flat throughout 2023, and the 1.2% decline in 2023 is relative to 2022. In fact, it was up 6.3% compared to the pre-pandemic peak in the third quarter of 2019, and up 19.1% compared to 2015. These figures emphasize the resilience of international trade.”

The global trade outlook for 2024 nevertheless remains subject to significant uncertainties. Persistent geopolitical tensions, rising shipping costs, and high levels of debt weighing on economic activity in many countries may still exert negative influences on global trade.

According to UNCTAD’s Global Trade Update in March 2024, some of the most relevant factors influencing global trade in 2024 and beyond include:

• Positive economic growth, but with significant disparities. Global forecasts for GDP growth remain at around 3% for 2024, but these still fall below historical averages. Furthermore, substantial disparities persist among countries and regions in terms of their anticipated economic outlook for the upcoming year. Such disparities will influence patterns of trade.

• Strong demand for both container shipping and raw materials.

During the last few months, there has been increasing demand for container shipping, as reflected by the strong increase in the Shanghai Containerized Freight Rate Index and the Baltic Dry Index on the back of a rise in global demand for raw materials.

• Commodity prices volatility. Ongoing geopolitical tensions and regional conflicts could renew volatility in energy and agricultural markets. Additionally, the increasing importance of secure access to critical minerals for the energy transition is expected to affect prices and further contribute to market volatility in these commodities.

• Lengthening of supply chains. Global trade is being influenced by the response of supply chains to shifts in trade policy and geopolitical tensions.

• Increase in subsidies and trade restrictive measures. The prioritization of domestic concerns and the urgency of meeting climate commitments are driving changes in industrial and trade policies. Trade restrictive measures and inward-looking industrial policies are anticipated to negatively impact on the growth of international trade.

• Shipping routes disruptions. Geopolitical tensions are also causing disruptions in shipping routes, particularly those related to the Red Sea and Suez Canal. Moreover, efforts to maintain water levels in reservoirs supplying the Panama Canal are anticipated to continue reducing passages in 2024. These events are driving up shipping costs,

extending voyage durations, and disrupting supply chains.

Profile Interview Khurram Hilal

Standard Chartered signed a Non-Honouring of Sovereign Financial Obligation (NHSFO) agreement with ICIEC to fund a EUR103 million solar electrification project through the installation of 50,000 off-grid solar-powered streetlamps in rural areas across Senegal. Furthermore, Standard Chartered is also cooperating with ICIEC and Agrobank of Uzbekistan to bolster economic development in the central Asian country through Islamic financing products. This is expected to yield EUR150 million in support of SMEs in Uzbekistan. Can you expand on the rationale for this cooperation? How important is ESG, sustainability, energy transition and SME funding in your project pipelines and portfolios?

We have a longstanding relationship of working with ICIEC in transactions which have supported key priority sectors of Member States across Africa. Supporting ESG, sustainability, energy transition and SMEs is a key priority for Standard Chartered. Our rationale for supporting these transactions is our commitment to these markets, the developmental benefits of the transactions and our relationship with both the borrowers and ICIEC.

The Senegal transaction is a highly development project resulting in the electrification of remote villages where it is challenging to achieve electrification via traditional transmission lines. This project will directly facilitate increased economic activity and development in these regions. In addition, the social benefits will include improved quality of life and reduced crime. In relation to Agrobank of Uzbekistan the proceeds will be used for funding SMEs which will also have major development impact through supporting SMEs to expand, increasing employment and economic activity across the country.

We believe ICIEC is an ideal partner for cooperation in these transactions given its commitment to support such sustainable and developmental projects. In addition, ICIEC has a flexible approach and willingness to execute these transactions in a tight timeline. We would like to thank ICIEC for their cooperation which has contributed to the successful financial close of many such projects.

As ICIEC celebrates its 30th anniversary in 2024, its role as the only Shariah-based multilateral export credit and investment insurance provider continues to be crucial given that it has facilitated over USD108 billion in trade and investments, promoting growth, and development in its member states since its inception. The challenge is to upscale ICIEC’s operations and also to enhance the culture of credit and investment insurance in OIC member states. From the vista of a major international bank, with a history of involvement in the Islamic finance industry, how could this be achieved, especially in an era of rising uncertainties and geopolitical challenges?

We believe that there is a lot of opportunity for further collaboration with ICIEC to financing sustainable projects in member states. We see great potential across our footprint markets in Africa, Asia and the Middle East, which includes many ICIEC member states. Whilst most of our recent successes have been in Africa and most recently in Uzbekistan with the MoU signing, we are exploring further opportunities in many of the ICIEC member states including Türkiye, Pakistan, Malaysia, and Indonesia. In addition to supporting member states directly on sovereign financing, ICIEC is supporting on lending transactions to development banks in member states which has benefits beyond these countries.

“Supporting ESG, sustainability, energy transition and SMEs is a key priority for Standard Chartered. Our rationale for supporting these transactions is our commitment to these markets, the developmental benefits of the transactions and our relationship with both the borrowers and ICIEC.”

MEMBER COUNTRY PROFILE TÜRKIYE

A Resurgent Türkiye Riding the Crest of an Export Boom Beckoning Innovative Trade Finance and De-risking Solutions

Türkiye is riding the crest of an export boom. It’s just over 40 years since then Turkish Undersecretary of Treasury Turgut Ozal, who went on to become Prime Minister and then President of the Republic, urged Turkish business to “Export or Die.” The rationale was to emphasise the importance of trade and manufacturing to an economy. With greater exports comes greater demand for export finance, credit insurance and guarantees. According to official Turkish trade data released in January 2024, the country’s exports increased for a third consecutive year reaching USD255.8 billion in 2023, up by 0.6% year-on-year from the USD254 billion in 2022. Türkiye exported to an impressive 70 countries in the year. ICIEC and the IsDB Group has enjoyed very close relations with Türkiye and its various agencies especially Turk EXIM, the state ECA, corporates and banks. The IsDB Group has an important regional hub in Istanbul, where ICIEC also has a dedicated regional office. Last year for instance the Hub hosted a ground-breaking three-day immersive Workshop to explore the pivotal role of information sharing and business intelligence in supporting trade and investment decisions in the member states of the Organization of Islamic Cooperation (OIC). Fatma Gamze Sarioglu, Senior Country Manager for Türkiye at ICIEC, delves into the foundational policies and contemporary dynamics shaping Türkiye’s trade and economic landscape and examines the historical context of modern trade initiatives, the current export landscape, strategic international collaborations, the impact of digital transformation on the trade sector, and the potential for ICIEC’s Sukuk Insurance Policy in upscaling issuances.

The roots of modern Turkish trade policies can be traced back to the reforms initiated by then Prime Minister Turgut Ozal in the 1980s, who went on to become President of the Republic between 1989 to 1993. Ozal’s economic liberalization and pro-market reforms catalyzed Türkiye’s integration into the global economy, setting the stage for the contemporary economic strategies that drive the nation today. These foundational policies have not only enhanced Türkiye’s economic resilience but also its adaptability to global trade dynamics.

Current Export Landscape and Economic Growth

Recent data on Türkiye’s exports illustrate a robust trajectory of growth, underscored by a diversification in both products and export destinations. This continuous expansion is a testament to Türkiye’s strategic positioning and its ability to adapt to changing global market demands. The diversity of export destinations highlights the country’s extensive trade network and its pivotal role in regional and global supply chains.

In February 2024, Türkiye’s leading exports included a diverse range of high-value products. Automobiles, including cars, tractors, trucks, and related parts, topped the list with exports valued at USD2.62 billion. This was followed by machinery, mechanical appliances, and their parts, which brought in USD1.8 billion. Electrical machinery and electronics also featured prominently, generating USD1.12 billion in export revenue.

Additionally, the exports of iron and steel contributed USD890 million to the economy, while precious stones, metals, and pearls accounted for USD874 million. These figures underscore the breadth and diversity of Türkiye’s export sector, highlighting its capability to compete in various high-demand markets globally.

The notable increase in Türkiye’s year-onyear exports in 2024 was primarily driven by significant gains in key markets and product categories. Exports to Iraq surged by USD329 million or 53.3%, while exports to the United Kingdom and the United States rose by USD204 million (25.2%) and USD198 million (20.4%), respectively. Among products, automobiles— including cars, tractors, trucks, and their parts—saw an increase of USD445 million or 20.5%. Iron and steel exports grew by USD281 million or 46.1%, and mineral fuels, oils, and their products rose by USD227 million or 35.2%.

In terms of destination, Türkiye’s largest export markets in 2024 were Germany (USD1.56 billion), the United States (USD1.17 billion), Italy (USD1.08 billion), the United Kingdom (USD1.02 billion), and Iraq (USD945 million). On the import side, Türkiye’s major sources included Russia (USD3.97 billion), China (USD3.21 billion), Germany (USD2.05 billion), the rest of the world (USD1.53 billion), and Italy (USD1.37 billion). This robust trade activity highlights Türkiye’s dynamic engagement in international trade, balancing a diverse range of export products with strategic import relations to support its economic growth.

ICIEC’s Strategic Engagement in Türkiye

The Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC) and the Islamic Development Bank (IsDB) Group have been instrumental in fostering trade and financial services in Türkiye through strategic partnerships with local entities like Turk EXIM Bank. These cooperative efforts are geared towards enhancing economic stability and facilitating sustainable development projects within the country.

Türkiye has established itself as a pivotal partner of ICIEC, fulfilling multiple roles as a shareholder, client, and collaborator. Since ICIEC began its operations in Türkiye, it has insured transactions totaling USD24.32 billion, underscoring the significant scale of its involvement in the Turkish market.

The establishment of the ICIEC office in Istanbul, Türkiye in 2015 marked a new era of enhanced cooperation, with exposure growing substantially. To date, ICIEC has provided insurance coverage for USD12.68 billion in exports from Türkiye and USD3.62 billion for the imports of strategic goods into the country.

Furthermore, the coverage extends to significant investments, insuring USD4.23 billion for foreign investments in Türkiye and USD3.77 billion for Turkish investments abroad. This support is critical not only for large enterprises but also for small and medium-sized enterprises (SMEs) through strategic partnerships with institutions like Turk Eximbank.

The impact of ICIEC’s local office in Türkiye is evident from the remarkable increase in the country’s exposure within ICIEC, which has escalated from USD217 million at the time of the office’s opening to USD1.45 billion today. This growth highlights the deepening relationship between Türkiye and ICIEC, and the significant role ICIEC plays in supporting the Turkish economy’s integration into global trade networks.

Turk Eximbank plays a crucial role as a strategic partner for ICIEC in Türkiye, effectively enhancing the support provided to the Turkish economy. The synergy between ICIEC and Turk Eximbank is manifest in several key areas:

- Reinsurance of Export Transactions: ICIEC provides reinsurance support for short to medium-term export transactions facilitated by Turk Eximbank, bolstering the latter’s capacity to back a larger volume and variety of export activities.

- Insurance of International Project Finance: ICIEC insures international project finance loans for Turkish contractors involved in significant projects in ICIEC member countries. Notable projects include the Douala Japoma Stadium in Cameroon, the Diamniadio Sports Arena, Cicad Business Hotel and Exhibition Center, and the Dakar Market and Truck Station – all in Senegal. This insurance coverage mitigates risks associated with overseas construction projects and enhances the competitiveness of Turkish contractors abroad.

-

Support for International Borrowing: ICIEC supports Turk Eximbank’s international borrowing efforts by insuring the risks associated with these financial activities. This insurance provision enhances Turk Eximbank’s ability to secure funding on favorable terms, thereby extending its capacity to support larger and more impactful projects.

Together, these collaborative efforts not only strengthen Turk Eximbank’s role in supporting Türkiye’s economic expansion but also solidify ICIEC’s impact as a complementary force in fostering secure and sustainable international trade and investment activities for Türkiye.

Innovative Projects and Regional Contributions

Türkiye’s commitment to sustainable and innovative development is evident in projects such as the Yerköy-Kayseri High-Speed Railway and various wind farm initiatives. These projects not only bolster regional connectivity and energy sustainability but also contribute significantly to the country’s economic growth and environmental goals.

ICIEC in late 2023 participated in a landmark Green Railway transaction through issuing a EUR134.1 million insurance cover for the Yerköy-Kayseri High-Speed Railway project in Türkiye, which is being built between Yerköy YHT Station in Yerköy District of Yozgat and Kayseri YHT Station in the Kocasinan District of Kayseri and which will be integrated with the Ankara-Sivas high-speed railway when completed. The cover was for a Syndicated Financing Facility led by MUFG Securities EMEA plc and comprising six 6 banks including MUFG, Banco Santander, DZ Bank, Deutsche Bank, Societe Generale and ING Bank.

Ensuring that ICIEC’s support remains robust and effective is crucial within Türkiye’s rapidly evolving economic landscape. This involves continuous adaptation to the changing needs and growth trajectories of the Turkish economy to maintain alignment with national development goals and global market dynamics. It is imperative to proactively address global economic challenges that could influence Türkiye’s trade and investment activities. This includes navigating disruptions in international trade, fluctuations in global markets, and geopolitical tensions, all of which can impact Türkiye’s economic stability and growth prospects.

In addition, there is a growing necessity to respond to the potential impacts of climate change on investments in Türkiye. This involves supporting the transition to a green economy by fostering investments in sustainable infrastructure, renewable energy, and environmentally friendly technologies. Such strategic initiatives not only mitigate the adverse effects of climate change but also position Türkiye as a leader in sustainable development, ensuring long-term economic resilience and environmental stewardship.

MEMBER COUNTRY PROFILE TÜRKIYE

The Promise of Sukuk and ICIEC’s Sukuk Insurance Policy

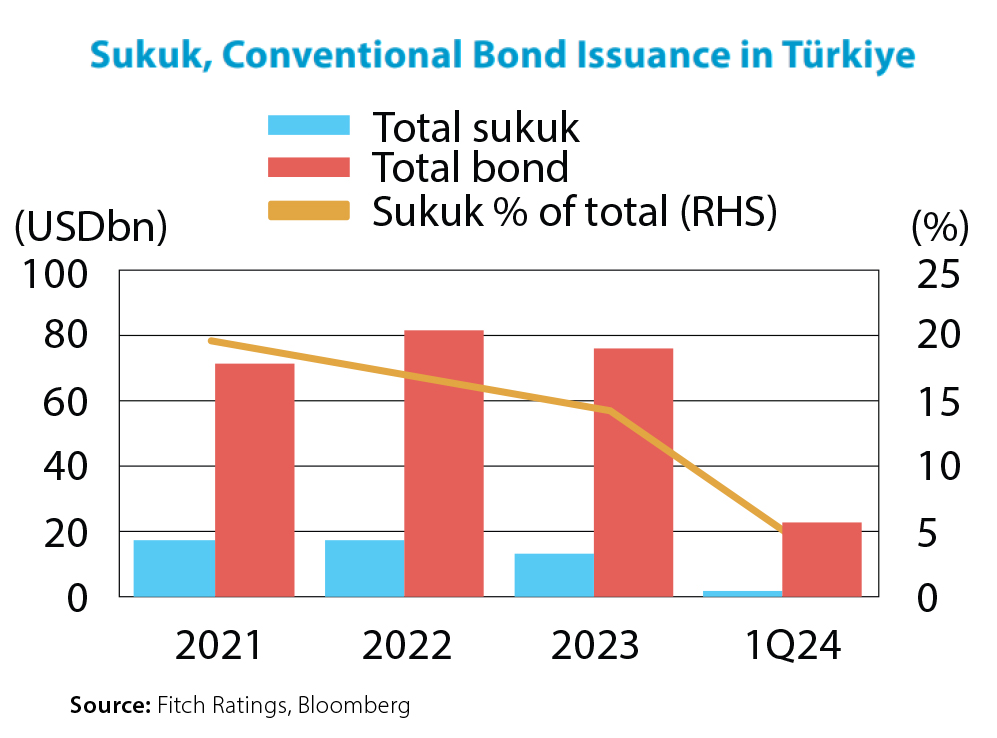

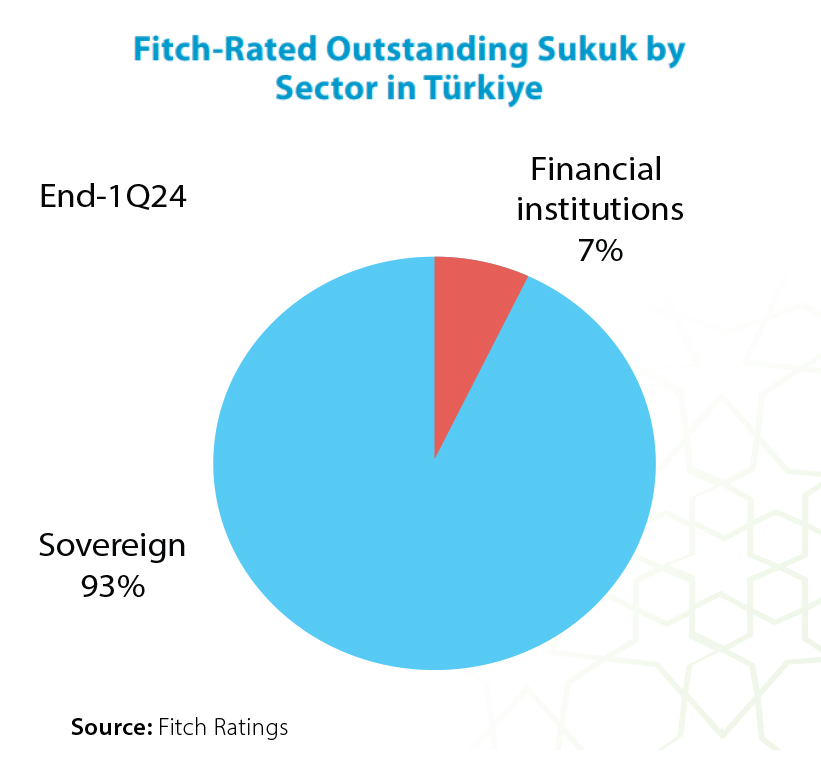

Türkiye’s is the fourth largest Sukuk issuer globally and among the three G20 countries active in the Sukuk market, according to Fitch Ratings’s latest Türkiye DCM Dashboard.

Sukuk rose to 15% of the 2023 Debt Capital Market (DCM) issuance (2018:6.2%), and 6.5% of DCM outstanding in 1Q24 (2021:4.7%). US dollar Sukuk issuers generally aim to comply with AAOIFI Sharia standards to not exclude UAE Islamic banks. In 2022, on back of the sovereign seeking alternative funding amidst weak investor demand, Sukuk peaked at 40% of US dollar DCM issues. The Turkish DCM rose 8% y-o-y to USD422.6 billion outstanding at end Q1 2024, with the majority in Turkish lira (63%), followed by US dollars (32%), and euros (5%). The recent revival in foreign-currency debt issuances is a sign of lower near-term refinancing risks due to improved investor sentiment since Türkiye’s adoption of more conventional macroeconomic policies and on the back of record export receipts.

In March, Fitch upgraded Türkiye to ‘B+’/Positive. Fitch rates 90% of Turkish US dollar Sukuk (USD12.3 billion), with 93% rated ‘B+’.

According to Fitch’s Global Head of Islamic Finance, Bashar Al Natoor, there are signs of rated banks and corporates returning to the dollar debt market since 2H 2023, reflecting improved access and strategic moves to maintain their presence by locking in more acceptable, although still high, pricing, following a prolonged period of very limited issuance.

The reasons are clear – general low government debt, with a strong revenue base, manageable debt amortisations and improved financing conditions. Türkiye issued USD10 billion in external markets in 2023, and the current financing plan assumes a similar amount for 2024. The sovereign issued a USD3 billion conventional bond in February 2024 with the lowest spread of the past four years. In 2022, on back of the sovereign seeking alternative funding amidst weak investor demand, Sukuk peaked at 40% of the US dollar DCM. By Q1 2024, Lease certificates (Sukuk AlIjarah) accounted for 25.9% of fixed coupon Turkish lira-denominated issuances.

Despite the above, the Türkiye Sukuk market dynamics relative Saudi Arabia, Malaysia and the UAE has a low issuance base, and therefore a low critical mass of offerings and market depth. The involvement of bank and corporate issuers is also low. Here ICIEC’s Sukuk Insurance Policy could act as a vital facilitator/market maker especially for quasi-sovereign and other government-linked agency issuers.

The Turkish Treasury is a proactive issuer of lease certificates as part of a wider universe of government fund-raising instruments which include bonds and Sukuk – leasing certificates and bonds, FX denominated issuances and gold-backed certificates/bonds “in order to increase the domestic savings, broaden the investor base and diversify borrowing instruments.”

The Türkiye Treasury in fact raised TRY120,994.22 million (USD4,174.22 million) from the domestic market through the issuance of Fixed Rate Lease Certificate (Sukuk al Ijarah) in nine auctions in FY2023. Thus far for the first three months of 2024, the Türkiye Treasury has raised TRY2312,988.90 million (USD403.54 million) through three consecutive auctions of Fixed Rate Lease Certificates.

The Role of Digital Transformation in Türkiye’s Trade Sector

Digital transformation in Türkiye’s trade sector is pivotal in enhancing economic infrastructure and operational efficiency. The adoption of digital solutions in trade finance has streamlined processes, reduced costs, and improved security. The OBIC Workshop held in Istanbul in 2023 exemplified the importance of information sharing and business intelligence in supporting trade and investment decisions among OIC member states, highlighting the strategic use of digital technologies to foster a more integrated and efficient market environment.

Conclusion

Türkiye’s trade and economic landscape is characterized by a rich history of strategic policymaking, robust export growth, and innovative development projects. Through strategic international collaborations and a forward-looking approach to digital transformation, Türkiye is well-positioned to continue its economic growth trajectory and play a central role in the global economic arena.

Türkiye Treasury TRY Fixed Rate Lease Certificates 2023/24 to Date

| Date | Volume (TRY mns) | Tenor | Maturity Date | Fixed Rental Rate | Rental Payment Period |

|---|---|---|---|---|---|

| 25/01/2023 | TRY14,008.7 mn | 5 Years | 19/01/2028 | 4.79% | 6 months |

| 22/02/2023 | TRY9,946.00 mn | 5 Years | 16/02/2028 | 4.64% | 6 months |

| 08/03/2023 | TRY5,413.00 mn | 10 Years | 23/02/2033 | 5.71% | 6 months |

| 21/06/2023 | TRY12,086.00 mn | 5 Years | 14/06/2028 | 8.62% | 6 months |

| 08/08/2023 | TRY27,148.00 mn | 5 Years | 02/08/2028 | 9.79% | 6 months |

| 09/09/2023 | TRY12,373.00 mn | 10 Years | 07/09/2033 | 13.19% | 6 months |

| 18/10/2023 | TRY28,927.23 mn | 5 Years | 11/10/2028 | 14.26% | 6 months |

| 15/11/2023 | TRY3,566.90 mn | 5 Years | 08/11/2028 | 16.48% | 6 months |

| 13/12/2023 | TRY10,000.00 mn | 5 Years | 08/12/2028 | 14.28% | 6 months |

| 24/01/2024 | TRY5,856.10 mn | 5 Years | 17/01/2029 | 14.34% | 6 months |

| 21/02/2024 | TRY3,569.50 mn | 5 Years | 14/02/2029 | 13.79% | 6 months |

| 20/03/2024 | TRY3,562.30 mn | 5 Years | 14/03/2029 | 15.00% | 6 months |

ICIEC is committed to advancing its support for Türkiye’s development through a multifaceted strategy that emphasizes critical infrastructure, innovative financial products, and sustainable development. These include:

- Support for Critical Infrastructure: ICIEC plans to continue its robust backing of vital infrastructure projects within Türkiye, focusing on sectors such as transportation, energy, and telecommunications. These efforts are crucial for enhancing the nation’s economic foundations and connectivity.

- Innovation in Financial Products: With the introduction of Sukuk insurance products, ICIEC aims to propel the growth of Islamic finance, especially fixed income capital market debt products. This initiative is designed to attract global investors by providing secure, Shariah-compliant investment opportunities, thereby broadening the financial landscape in Türkiye.

- Environmental Sustainability and PPPs: ICIEC will actively promote environmentally sustainable projects while encouraging the formation of Public-Private Partnerships (PPPs). These endeavors are intended to leverage private sector efficiencies and foster investments that are not only economically viable but also environmentally responsible.

- Mobilization of Private Sector Capital: By acting as a catalyst for mobilizing private sector capital towards Sustainable Development Goals (SDGs), ICIEC aims to contribute significantly to global efforts in achieving these targets. This strategic focus is expected to support sustainable economic growth and social development.

- Expansion into Africa: Reflecting Türkiye’s strategic interests, ICIEC is poised to increase its active involvement in Africa. Upcoming projects on the continent will benefit from ICIEC’s expertise and support, aligning with Türkiye’s broader geopolitical and economic objectives.

Through these strategic initiatives, ICIEC not only reinforces its commitment to supporting Türkiye’s economic trajectory but also aligns its operations with broader global standards and development goals, ensuring a sustainable and prosperous future.

Mainstreaming Affordable Credit Insurance in ICIEC Member States

Upscaling Critical Mass, Market Depth and Awareness Amid Rising Risks

The 57 and 49 member states of the IsDB and ICIEC respectively could benefit from an enhanced credit and investment insurance culture and ecosystem. This pertains to the structural, policy, resource, organizational capacity realities of the industry across the spectrum – government agencies, insurers and underwriters to peer institutions, to financial sector entities, to corporates and businesses, and to SMEs. Mushtak Parker considers the challenge of how to mainstream risk mitigation and credit enhancement through increasing the provision of affordable credit and investment insurance in member states, and how ICIEC can play an enhanced market maker role in this respect through partnerships, market education and collaboration both at a national level and with international industry bodies and linkages.

Malaysian Prime Minister Anwar Ibrahim has repeatedly flagged up in recent months the vital trade finance and insurance sector. Whether at the Global Forum on Islamic Economics and Finance (GFIEF) in Kuala Lumpur on 28- 29 May 2024, at the IsDB Annual Meetings in May in Riyadh, and at the 15th International Conference on Islamic Economics and Finance in February 2024 in Kuala Lumpur, the Prime Minister has been calling for the adoption of a reformist holistic agenda to help mitigate the huge socio-economic, trade and investment challenges and opportunities faced by the 57 member states of the Organization of Islamic Cooperation (OIC) and its development finance organ, the Islamic Development Bank (IsDB).

Islamic trade finance is estimated to account for less than 5% of total trade finance in OIC member states. Reliable data is fragmented, underdeveloped, and often dated because of poor disclosure and lack of transparency.

The fact that intra-OIC trade and investment has not even hit 25% of their total exports and imports and FDI flows, indicates the uphill struggle for Member States to upscale their bilateral and multilateral trade and investment flows.

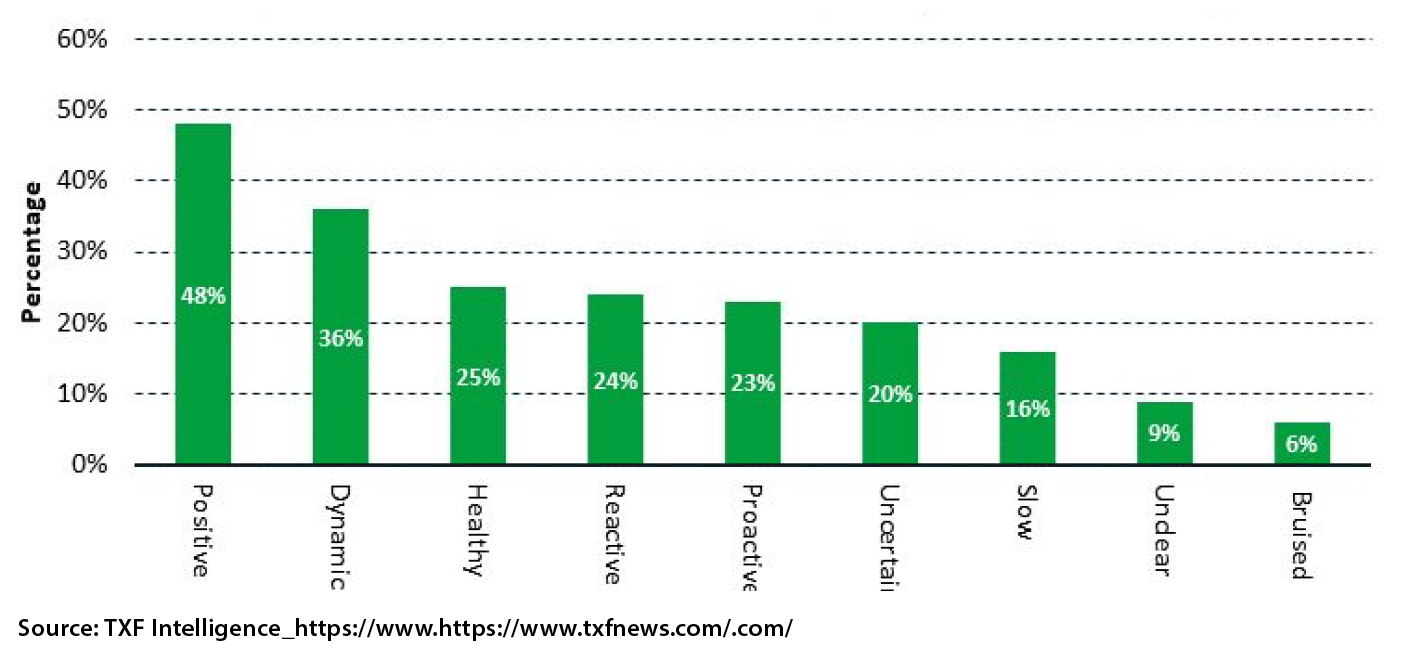

Globally market sentiments for export finance and credit and investment insurance in general is positive as the impacts of the COVID-19 pandemic continue to recede although still impacted by the supply chain disruptions of the conflict in Ukraine, the subdued resultant global economic recovery marked by low GDP growth, stubbornly high inflation rates, high interest rates, rising sovereign debt burden of Lower-Middle Income Countries (LMICs), and the ensuing global cost of living crisis. The TXF Export Finance Survey in June 2024 confirms the positivity of the export finance market although the sentiments have yet to be fully absorbed into the market operations.

What best describes the current state of the export finance industry?

A Reform Agenda for the Islamic Economy

“As we navigate the complexities and uncertainties of these post-normal times,” emphasized PM Ibrahim, “the principles of Islamic economics and finance remain even more relevant to resolve the core conundrums which the world is facing. These include lifting abject poverty, ensuring food security, mitigating climate change, and enabling equal opportunity to comprehensive education. This is why we must embark on a holistic ‘Islah’, a reform agenda for positive change and a force for good in the global economy.”

The Islamic finance ecosystem, he reiterated, needs to evolve progressively, placing greater emphasis on value-based sustainable finance, transcending the profit-driven motives or to embrace a higher purpose where wealth is not just accumulated among the few but circulated to uplift communities, protect the environment, and investment carries a balanced promise of prosperity. In Riyadh for instance, the Malaysian Ministry of Finance, Bank Negara Malaysia (BNM), the central bank, the IsDB and the World Bank, unveiled a collaborative “new blended finance innovation” – a pilot programme on greening Halal businesses. The aim is to assist halal businesses in Malaysia and elsewhere to transition to greener and sustainable practices by providing technical capacity building, tools to measure and report greenhouse gas emissions, derisking and credit enhancement solutions in trade and investment, and transition financing including certifications.

According to the ICIEC 2023 Annual Report, while 2021 marked a zenith for intra-OIC imports at USD436.0 billion, a subsequent contraction to USD365.4 billion in 2022 raises questions about the internal trade synergies and potential barriers within the OIC ecosystem. The dynamics for intra-OIC exports reflected the same trend. The retraction, however, is almost certainly due to the pandemic, the supply chain disruptions caused by the Ukraine conflict and the sluggish global economic recovery.

Prime Minister Ibrahim is right in calling for greater focus to enhance the efficiency and transparency across the end-to-end supply chain in the potentially multi-trillion-dollar Halal economy. However, the dissonance between the wider Halal economy and the estimated USD3.5 trillion Islamic finance industry is stark albeit improving incrementally. However, there is an urgent need to upscale independent reliable research and data disclosure to better inform both policy makers and the spectrum of stakeholders in the trade, investment, finance and insurance value chain.

Vanilla Murabaha, Murabaha Syndications, Tawarruq (Commodity Murabaha) and Instalment Sale, and Trade and Investment Takaful, estimated at almost USD1trillion per annum, are established Islamic trade finance and insurance contracts across the market segments and in the various hybrid Sukuk structures. They are internationally accepted mainstream trade finance products which have been accessed even by major Western, Japanese, and South Korean multinationals.

According to Dinar Standard, OIC imports are projected to reach USD3.43 trillion by 2027, while OIC exports are projected at USD4.30 trillion – indicating huge potential for credit and investment re/insurance.

The State of the Islamic Trade and Investment Insurance Market

Reliable data relating to what extent Islamic trade finance and insurance is directed to the Halal economy is simply not available. A senior official from Malaysia’s Halal Development Corporation attending a major Halal convention in London recently agreed that the global industry does have a major bottleneck in reliable and up-to-date data and research in various aspects of the value chain, including the connectivity to the Islamic finance industry.

The reality remains that while Export Credit Agencies (ECAs) and multilateral insurers, such as ICIEC, in AMAN UNION member states have generally witnessed some growth in their operations – both conventional and Shariahcompliant – largely linked to government COVID-19 mitigation emergency packages, the reality is that the culture of credit and political risk insurance (PRI) in many OIC markets remains underdeveloped. The AMAN UNION is the forum comprising Commercial and Noncommercial Risks Insurers and Reinsurers in OIC member states and of the Arab Investment and Export Credit Guarantee Corporation (DHAMAN).) ICIEC is responsible for the administration of the AMAN UNION.

Part of the problem is lack of market awareness and of a comprehensive strategy to promote and connect trade and investment Takaful to the spectrum of economic activity and market segments – trade, investment, commerce, export promotion, imports, infrastructure projects and even financial products such as Sukuk origination, housing and mortgage securitization, especially in an era of everevolving new risks. When Takaful is discussed or researched it is almost routinely confined to family and general Takaful. Credit and PRI Takaful is almost completely off the radar. This also connects with the underdeveloped state of financial journalism in member states. Yet in sheer volume and value terms, the latter is infinitely bigger as a market segment than family and general Takaful.

The perception rightly or wrongly remains that credit and investment insurance is an extra unnecessary cost, where often the premiums are prohibitive especially for companies and clients in the low-and-mediumincome-countries (LMICs), and the requisite government policy and regulatory frameworks are either not in place or underdeveloped to make transactions and projects bankable especially for the involvement of much-needed private sector capital and financing.

Towards an OIC Trade Insurance Master Plan

ICIEC, which marks its 30th anniversary this year and uniquely the only Shariah-compliant multilateral insurer in the world, has almost single-handedly shown the viability, efficacy, market potential and importance of trade and investment Takaful and Re-Takaful for OIC economies. The proof is in the pudding. The Corporation has cumulatively insured business to date surpassing USD114 billion since it started operations in 1995, comprising USD90.7billion in export credit insurance and USD23.3billion in investment insurance. ICIEC has also underwritten policies since inception totaling USD53.6 billion in support of intra-OIC trade and intra-investment.

There are several challenges ahead for the Shariah-compliant trade and investment insurance market. The main one is the lack of dedicated private Shariah-compliant providers. The architecture currently comprises ICIEC as the only Shariah-compliant multilateral insurer and a number of ECAs and private providers.

An analysis done last year by Turk Eximbank showed that the total capital base of AMAN UNION member entities was a mere USD13.6 billion at end 2021 – up on the USD10 billion in 2020, of which Saudi EXIM accounted for 59% in 2021. Total AMAN UNION Business Insured in 2021 reached a mere USD49 billion – up 17% on 2020, of which the top 5 members accounted for 83% of total business insured, led by Turk Eximbank at 48% and ICIEC at 20%.

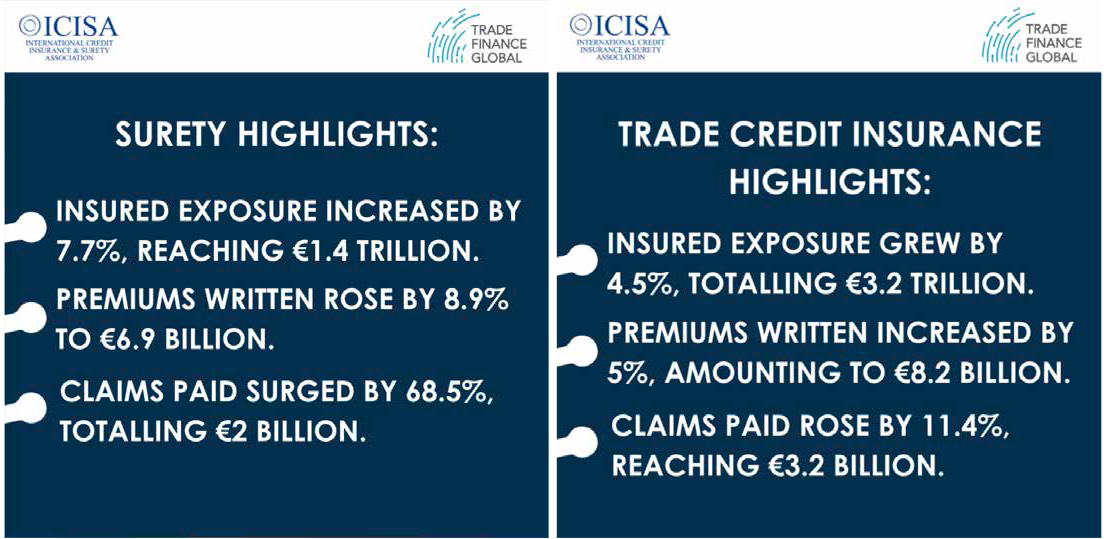

In contrast, members of the International Credit Insurance and Surety Association (ICISA), the leading industry trade association representing trade credit insurance and surety companies internationally who account for 95% of the world’s private credit insurance business, insured nearly EUR3.2 trillion (USD3.43 trillion) in trade receivables insured and billions in infrastructure guarantees in 2023 – up 4.5% YoY. According to the latest data from ICISA, premiums written in 2023 increased by 5% to EUR8.2 billion (USD8.79 billion), while claims paid increased by 11.4% reaching EUR3.2 billion (USD3.43 billion).

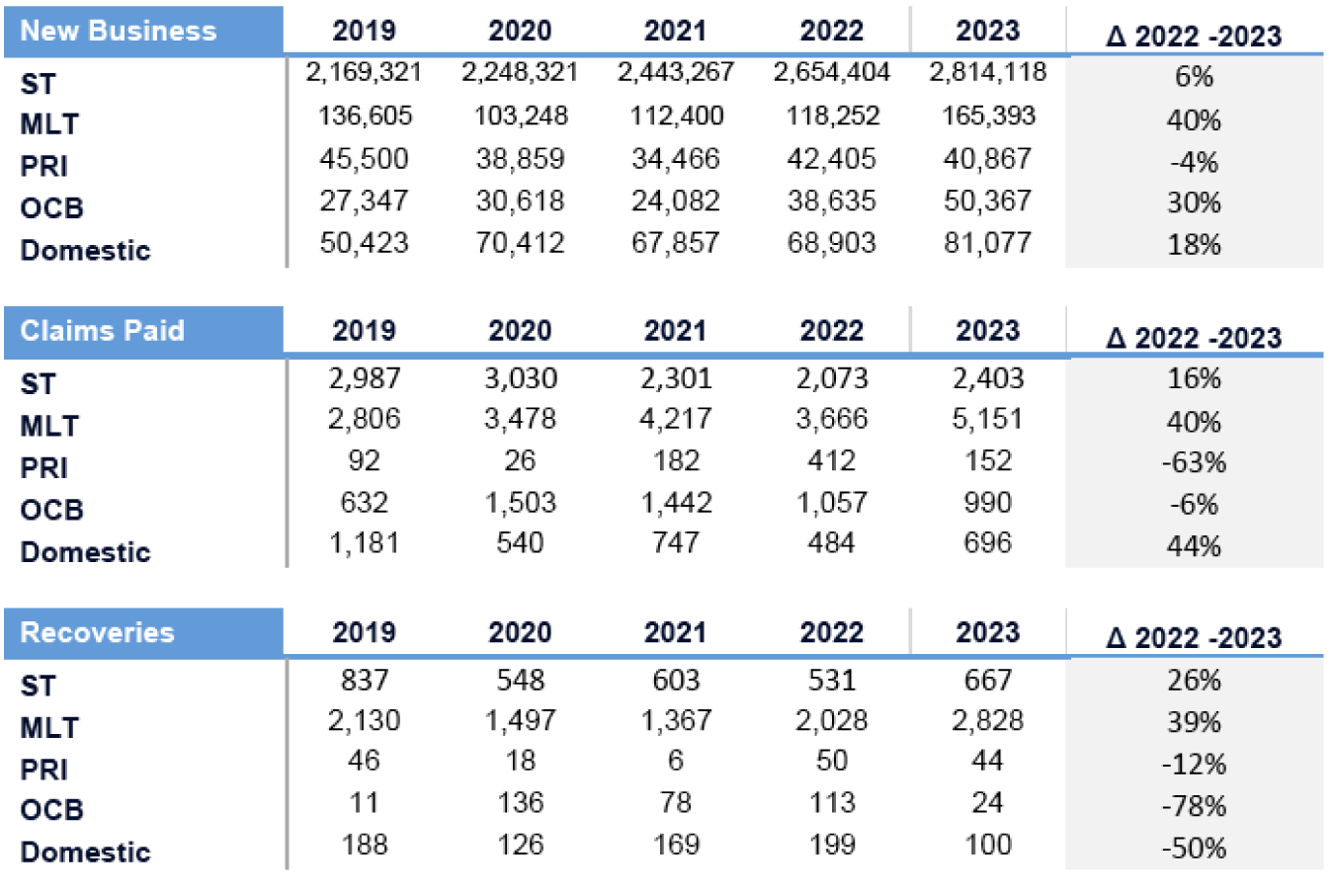

According to the 2023 ICISA Annual Report, throughout 2023, ICISA members reported strong business growth despite a notable rise in claims across various lines. These trends are reflective of the ongoing volatility of macroeconomic conditions.

“Despite these challenges, the industry continued to provide a safe harbour for trade and investment in the real economy while remaining robustly capitalized. Demand for protection in the face of economic headwinds understandably grew throughout 2023 for both trade credit insurance and surety markets,” said ICISA President, Benoît des Cressonnières.

However, the macro risk environment, warns ICISA, “remains volatile and uncertain. Businesses face significant challenges due to high interest rates, rising costs, the energy transition, and disruptions from conflicts and geopolitical tensions. Trade continues to drive positive economic development, but managing associated risks and financing costs is increasingly challenging. While central banks look to carefully loosen monetary policy in the coming months, ICISA members expect challenging market conditions to persist in the short term.”

Not surprisingly, against this backdrop, surety claims rose significantly from 2022 to 2023, with EUR2 billion paid out in 2023, marking a 68.5% increase. Trade credit insurance members paid out EUR 3.2 billion in claims across the same period. This was up from EUR 2.7 billion in 2022, providing a valuable lifeline to businesses worldwide.

Similarly, the latest data from The Berne Union (International Union of Credit and Investment Insurers), the not-for-profit professional association representing the global credit and political risk insurance industry, shows that 2023 was an encouraging year for export credit with members providing over USD3 trillion in new support for cross-border trade, with expansion across almost all business lines, which augurs well for 2024 and beyond.

The reality however is that the gap between the conventional and Islamic credit insurance providers in almost every aspect is stark and has cost the OIC countries billions of dollars in opportunity costs lost especially because of the lack of Shariah-compliant opportunities for their economies in general and the Halal economy specifically.

The Great Leap Forward

Looking ahead, policy proposition, prioritization, upscaling, synergizing and implementation, together with smart collaboration, must be the order for the next few years if Shariah-compliant credit and investment insurance is going to take that great green leap forward in its involvement in the development agendas of member states.

In the meantime, there are several collaborations which if maximized to their full potential could go a long way towards the eventual mainstreaming of Shariah-compliant trade and investment insurance as an alternative option for government and commercial entities in OIC member states. The Joint Strategic Collaboration signed in April 2024 between ICISA and the AMAN UNION, for instance, is a potential gamechanger in enhancing the culture and business of trade and investment insurance in ICIEC Member States.

The collaboration underscores a shared commitment to advancing the trade and investment insurance landscape, particularly within OIC Member States. By sharing their respective expertise and networks, the parties aim to facilitate enhanced knowledge exchanges and initiatives that contribute to the sustainable development of OIC Member States. Key highlights of the Joint Strategic Collaboration include: i) Facilitating knowledge exchanges on trade and investment insurance initiatives, ii) Enhancing collaboration and development of best practices in the industry. Iii) Strengthening mutual relationships among members of both associations.

Mr. Richard Wulff, Executive Director of ICISA and Mr. Oussama Kaissi, then Secretary-General of AMAN UNION and CEO of ICIEC, recognize the significant potential for cooperation to drive positive outcomes in the trade and investment insurance sector. “Through this strategic alliance, we are assured to unlock unprecedented opportunities and drive innovation within our respective spheres. The signing of this MoU signifies a transformative leap towards harmonizing our efforts and maximizing the potential for sustainable growth and prosperity on a global scale. By pooling our resources and expertise, we can drive positive change and sustainable growth for our member states,” they maintained.

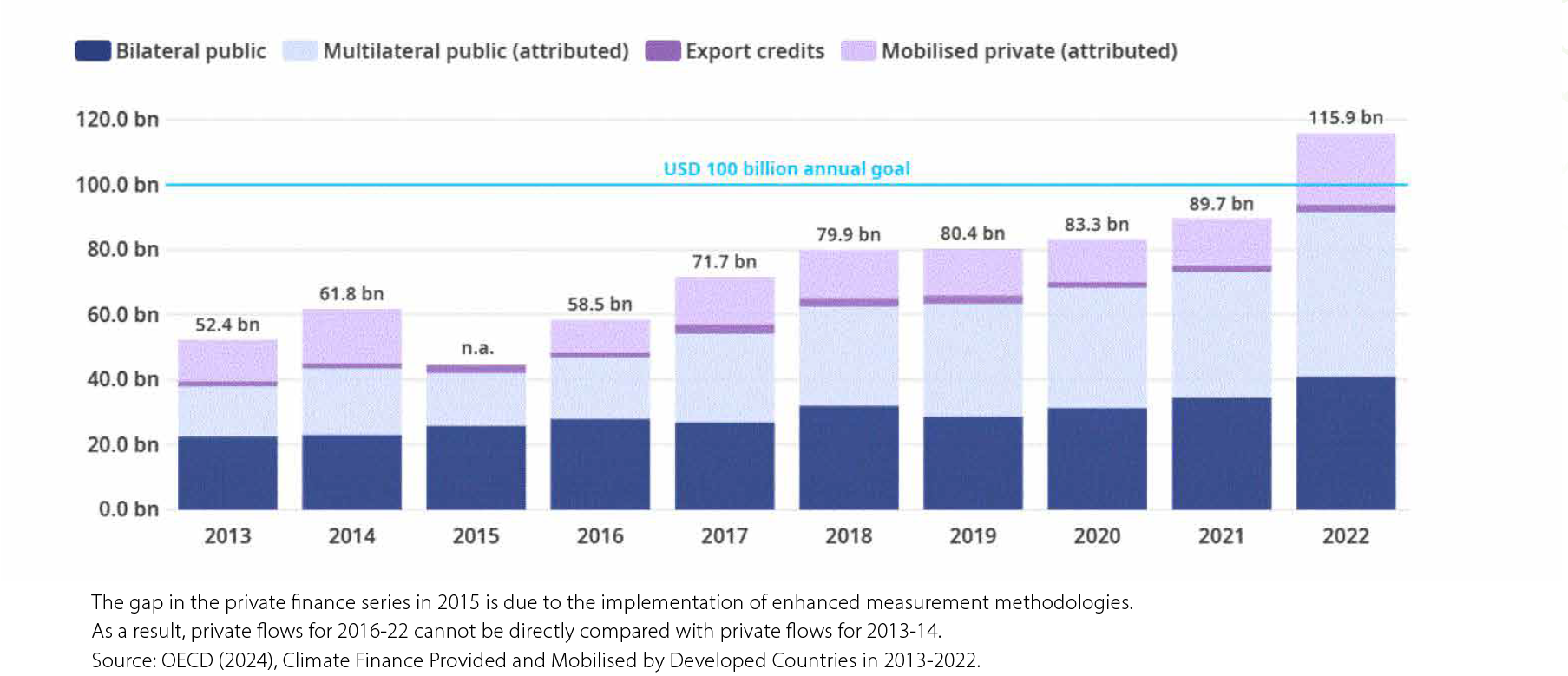

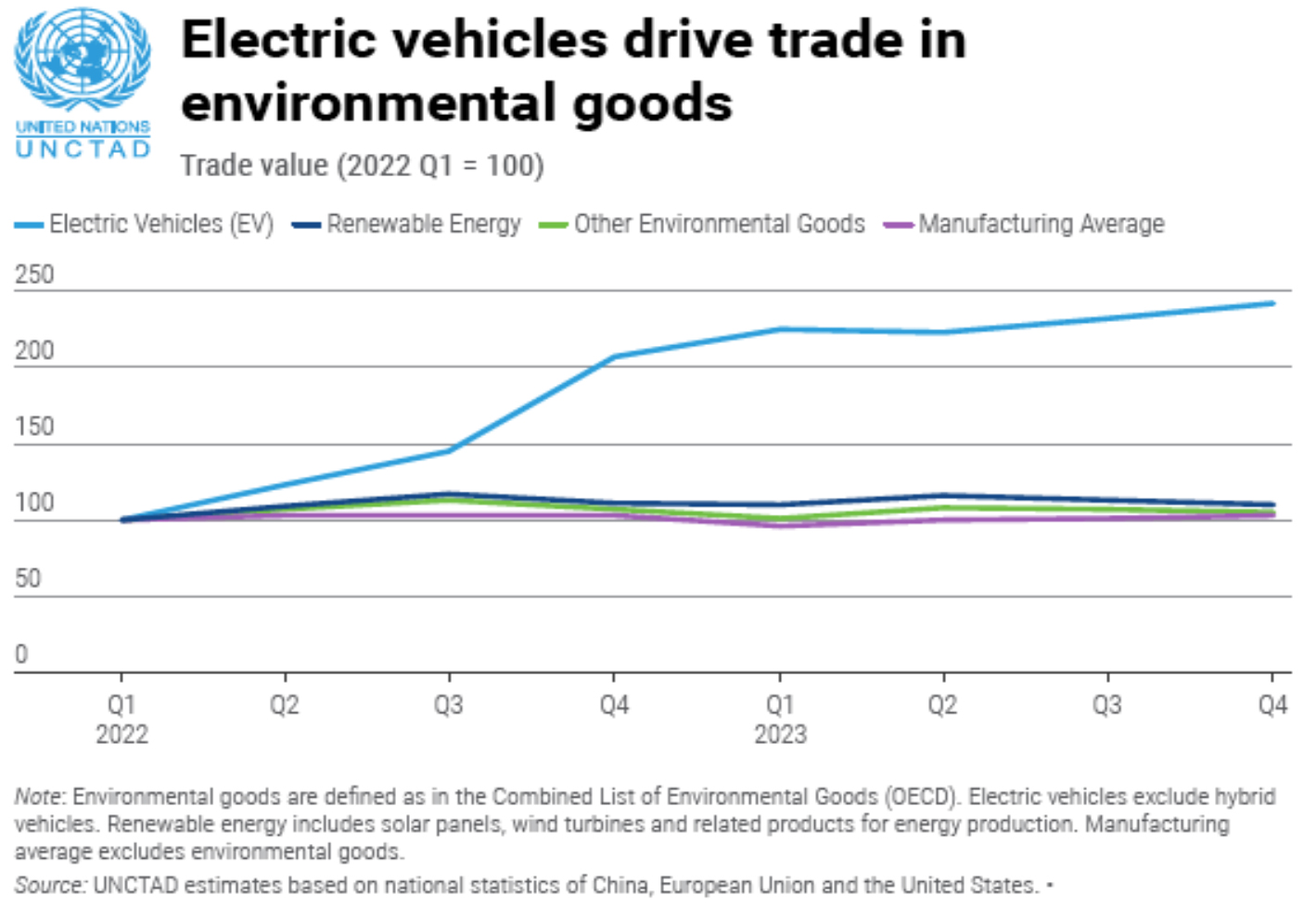

Similarly, another important development is the accession of The Islamic Development Bank (IsDB) and ICIEC to the International Renewable Energy Agency (IRENA’s) Energy Transition Accelerator Financing Platform (ETAF) in December 2023 to which they have also pledged USD250 million to projects on the platform by 2030 and to provide de-risking tools to support renewable energy projects in member developing countries.

Through the ETAF Platform, a multi-stakeholder climate finance solution managed by IRENA, ICIEC will provide credit and political risk insurance solutions to support the financing of renewable energy projects recommended by IRENA for the benefit of common member states. This partnership says ICIEC leverages its expertise in credit and political risk insurance and its synergies with the broader reinsurance market and focuses on advancing just, affordable and clean energy transition in LMICs. LMICs form the largest component of the 57 member states of the IsDB and are disproportionately affected by the ravages of climate devastation even though as a group they are the lowest emitters of carbon in the world.

As such, energy transition is not only a financial, economic, technological, survival and societal imperative, but also a moral one. As part of a diverse network of partners, the ETAF Platform enables the financing of renewable energy projects giving developers access to a suite of de-risking solutions and manifold financing opportunities as a way of advancing their energy projects and making them bankable to donors, institutional and private investors.

Climate finance for developing countries

Amounts provided and mobilised by developed countries, billion USD

Another interesting development is the growing interest by ECAs from non-OIC countries in using Shariah-compliant credit and investment insurance to support their exports and FDI investments to OIC markets especially in the MENA Region and Southeast Asia.

In June 2024, Italian State Export Credit Agency SACE Guaranteed its First-of-its-kind “Substantive” Commodity Murabaha Facility Provided by HSBC to UAE Food Giant, IFFCO, under its Push Programme to support Italian food and beverage value chain and exports to the Middle.

For the first time globally, SACE has guaranteed financing with an Islamic finance structure in favour of the IFFCO Group in the UAE. According to Michal Ron, Chief International Officer of SACE, “we secured financing with an Islamic financing structure (Murabaha Al Siala) for IFFCO Group, with HSBC as the sole participant. We agree that this operation will open numerous other opportunities for Italian SMEs in their respective sectors of interest. This is the first Push Strategy operation structured according to Islamic finance principles, which will enable the opening of new markets in the Middle East and other geographies, with a positive impact on Italian exports.”

IFFCO and HSBC both stressed that creating a “global first” Islamic structure under SACE’s Push Programme “exemplified designing a creative financial structure working around complex parameters to synchronize ECA clauses to fit into an Islamic structure to deliver an innovative solution versus conventional offering.”

Alexei Rybakov, HSBC’s Head of Export Finance for MENAT, sees the transaction potentially boosting Euro-Middle East trade using Islamic finance solutions. “This transaction,” he explained, “marks a further development in Sharia’h compliant structures. Innovative cross-border transactions like this are accelerating trade and investment between Europe and the Middle East. This collaboration between IFFCO, SACE, and HSBC has resulted in a ready templated solution to execute Shariahcompliant ECA financing under SACE’s Push Programme.”

The Slowing FDI Flow Rate

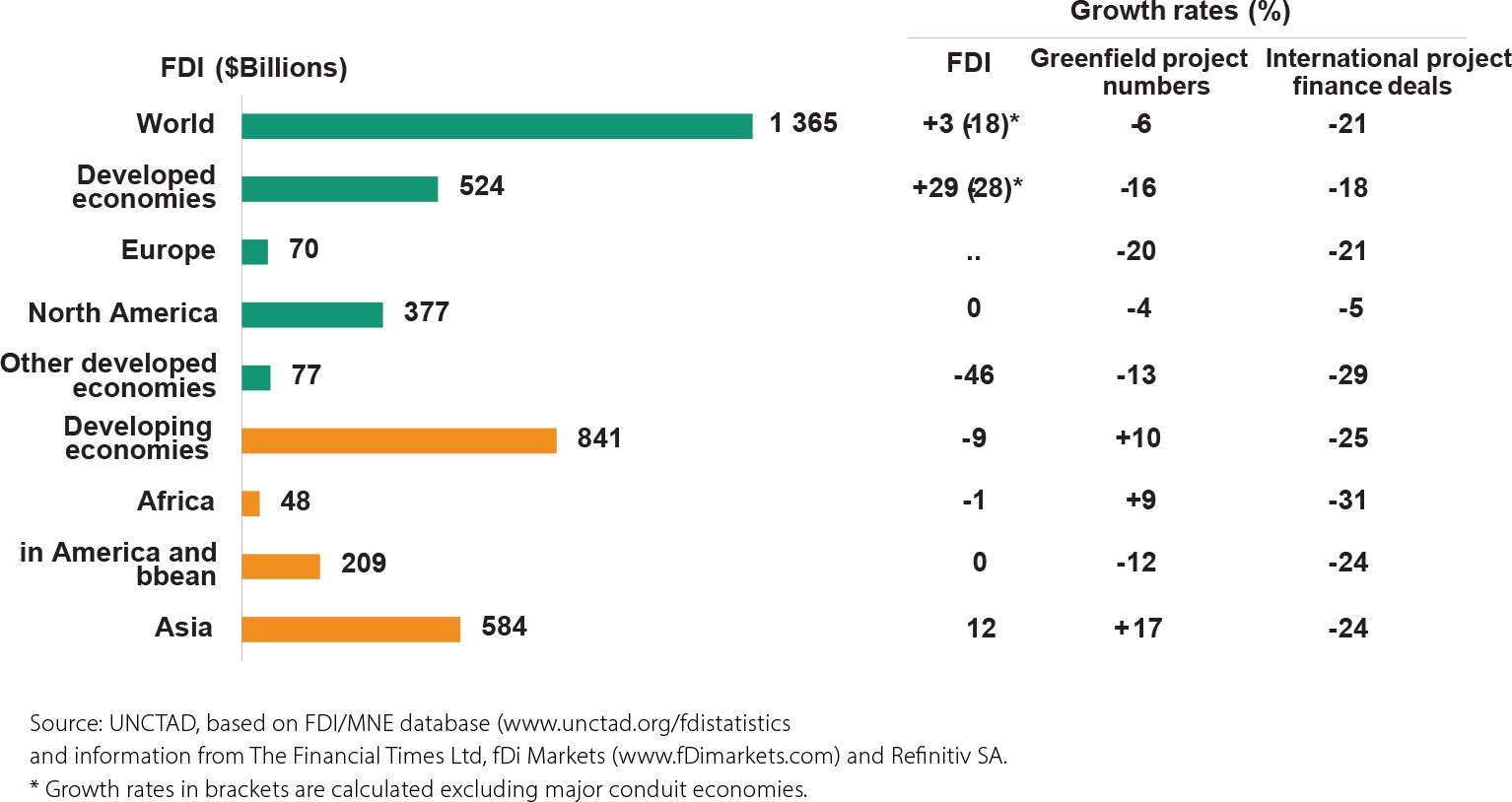

Global Foreign Direct Investment (FDI) flows, totalled an estimated USD1.37 trillion in 2023 according to the latest figures from UN Trade and Investment (UNCTAD’s) Investment Trends Monitor. This was a marginal 3% increase over 2022, defying expectations as recession fears early in the year receded and financial markets performed well. However, says UNCTAD, economic uncertainty and higher interest rates did affect global investment. FDI flows to developing countries disconcertingly fell by 9%, to USD841 billion, with declining or stagnating flows in most regions. FDI decreased by 12% in developing Asia and by 1% in Africa, here the bulk of IsDB and ICIEC member states are located.

In West Asia, FDI remained stable at 2% due to continued buoyant investment in the UAE, which saw greenfield announcements rise by 28% to the second highest number after the United States. Greenfield numbers also jumped in Saudi Arabia, by 63%.

FDI flows to Africa were almost flat at an estimated USD48 billion. Greenfield project announcements increased, mostly due to strong growth in Morocco, Kenya, and Nigeria. However, project finance deals fell by one third, more than the global average decline, weakening prospects for infrastructure finance flows, which merely highlights the growing need for project related underwriting and guarantees.

Investment trends by region, 2023 vs 2022

The importance of credit and investment insurance cannot be overstated. For an industry that has been around for over a century, the challenge ahead is to enhance awareness and market education among policy makers; regulators; multilateral, national and private sector insurers, and export credit agencies (ECAs); banking institutions, insurance providers, exporters, importers, investors, and SMEs. Today, according to the Berne Union’s Credit Insurance: Impact on Trade, Finance and the Real Economy report, around 90% of all global trade relies on some form of credit, insurance or guarantees, issued by a bank, insurer, or specialist financial institution. As it has done for over a century, the credit insurance industry will continue to evolve and adapt to meet challenges – societal, environmental, and economic – that lie ahead and support the real economy.

Credit and investment insurance typically acts as a catalyst that provides financing to the real economy through export and import flows and promotes foreign direct investment (FDI) movements across the globe. By protecting exporters and banks against the risk of non-payment, defaults and expropriation, credit insurance enables cross-border trade and investment. Perhaps this is a core challenge which industry bodies and countries in which Islamic finance is of systemic importance must embrace in how to upscale such cover dramatically both nationally, regionally and in the world of Islamic finance.

This against the background of risks and uncertainties in the global economic landscape. The latest SONAR Report published in June 2024 from the Swiss Re Institute, published since 2013, is indeed sobering – featuring 13 emerging risk themes and three trend spotlights. The emerging risk themes are what could be new or changing risks, with both up-and downside potential for insurers. The “trend spotlight” items highlight contextual developments SRI deems relevant for the industry, without necessarily profiling a specific risk.

Embracing Growing Opportunities for Credit Insurance and PRI in Uncertain Times

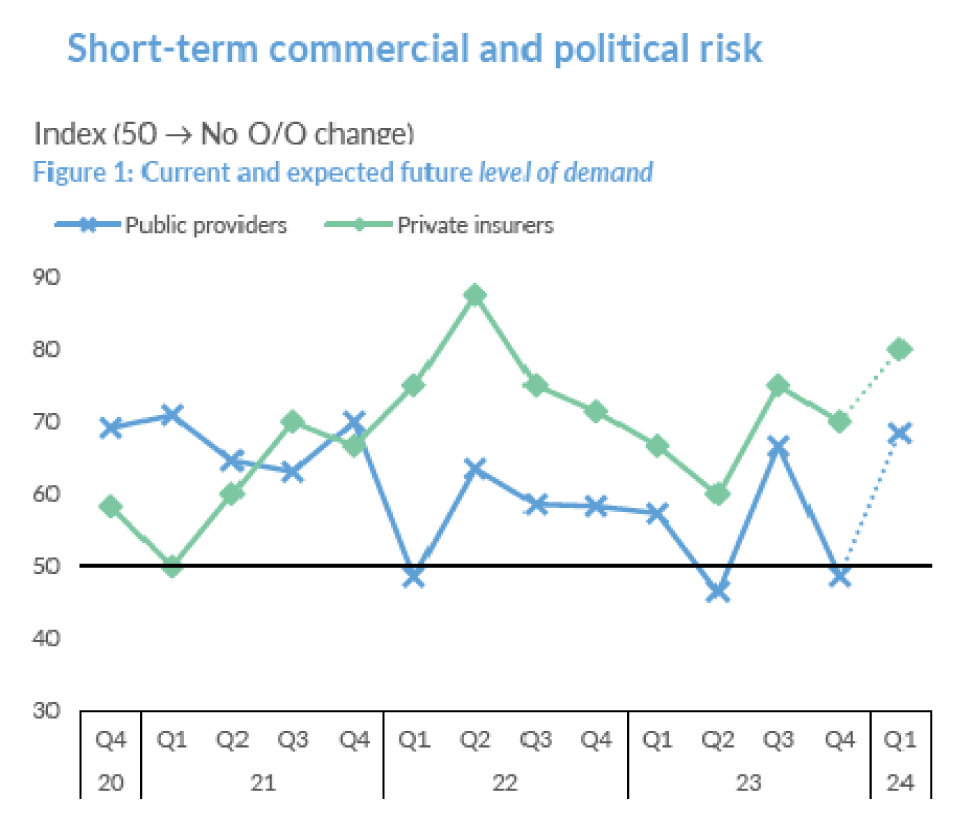

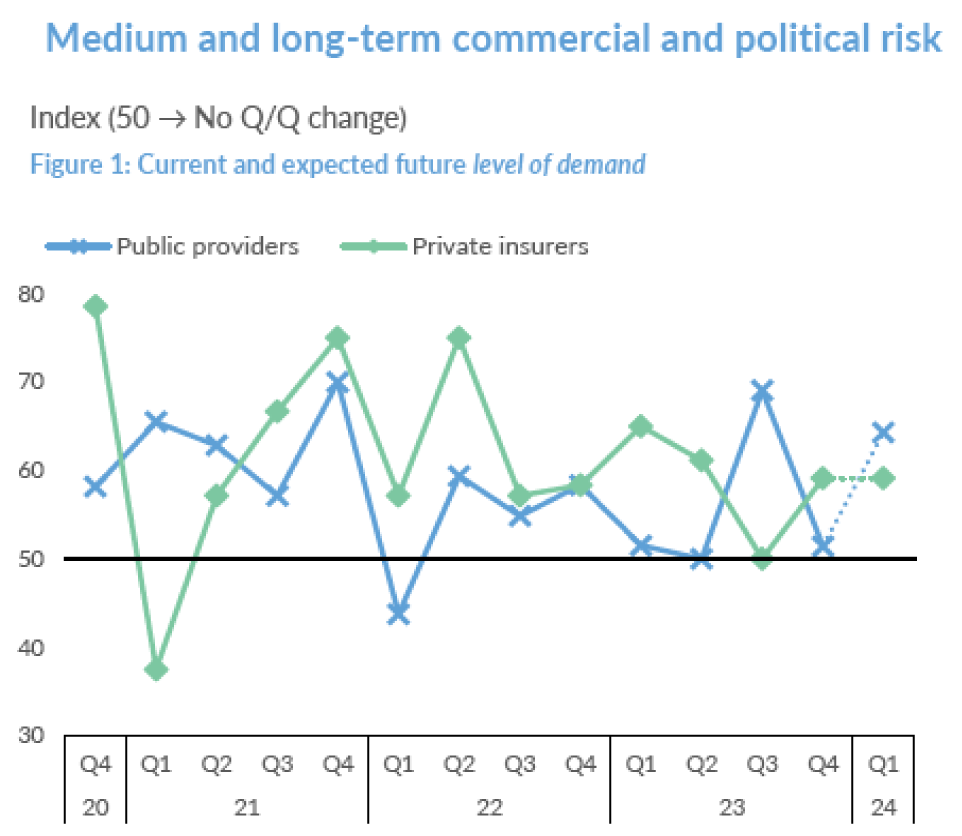

“In 2023, the export credit industry saw over USD3 trillion in new support, with a 40% increase in MLT business and record renewable energy commitments. The strong growth promises a positive outlook for 2024 and beyond.”

The trade and credit and credit insurance universe are in flux with potentially game changing developments over the next two years, which governments, international gatekeeper organisations, multilateral and private insurers, export credit agencies, financial institutions and the export/import fraternity would ignore at their peril. These include trade digitalisation, transitioning to ISO 20022, embedding Climate and ESG considerations in the trade playbook, the adoption of Electronic Trade Documentation, the implications of the Net-Zero Export Credit Agencies Alliance (NZECA) launched at COP28, and advancing the role of women in credit insurance. Dr. Khalid Khalafalla, Officer-in-Charge, ICIEC explores the above structural regulatory trends and initiatives for the credit and PRI industry.

It is not surprising that the Berne Union (BU) Spring Meeting in Oslo in April 2024 focussed on innovation in its various forms – covering topics ranging from technology to new and innovative products and how the export credit insurance industry is adapting to a swiftly changing global environment.

The export credit industry, says the Union, emerged from the pandemic strong with substantial growth in support provided for cross-border trade and investment as members ramp up commitments across key sectors and geographies. In fact, 2023 was an encouraging year for export credit with BU members providing over USD3 trillion in new support for cross-border trade, with expansion across almost all business lines, which augurs well for 2024 and beyond. The overall performance metrics for the industry in 2023 include:

- A 40% increase to over USD165 billion for MLT business, following strong growth in manufacturing, infrastructure, and transport sectors alongside a continuing rapid growth in renewable energy investments.

- A particularly strong year for ECAs who grew their MLT business by 50% following several years of relative stagnation throughout the pandemic. Private CPRI underwriters continue to build on the strong year-on-year growth they have recorded since 2020.

- The industry is drawing upon an increasingly flexible product suite with volumes of untied credit support increasing 30% to over USD50 billion in new commitments in 2023.

- Climate and the green transition are the main drivers of new opportunities with a record USD20.5 billion in reported new commitments for renewable energy across 68 countries in 2023.

- BU members provided an estimated USD98 billion in total support for wider green, climate and energy-transition related transactions in 2023 – 5 times the commitments to renewable energy production alone and a significant portion of total long-term finance supported across MLT and PRI business.

- Members are attuned to a heightened political risk environment, with both sovereign defaults and corporate insolvencies driving an uptick in claims. Over USD9 billion of claims were paid, with a significant spike in MLT political risk claims in FY 2023 largely due to a distressed period for sovereign debt.

- Geopolitical risk and armed conflict have become an increasing concern for members.

- ST claims continued to rise along with insolvencies, with levels manageable. MLT commercial claims continued to fall with strong recoveries in the transport sector.

ST: Short Term Export Credit – Export Credit / Trade-Finance Credit lending and Insurance of which the repayment term is less than 360 days.

MLT: Medium / Long-Term Export Credit – Insurance, Guarantees and lending for Export/Trade-Finance Credit of which the repayment term is greater than 360 days.

PRI: Political Risk Insurance – Insurance or Guarantee that indemnifies an equity investor or a bank financing the equity investment for losses incurred to a cross-border investment as a result of political risks.

OCB: Other Cross-border Credit – Insurance or Guarantee or direct loan relating to a debt-finance instrument, of which the debt obligor resides in a different country than the debt counterparty, AND the debt obligation is provided without any requirement that the debt capital be used to finance an export or international trade.

The key takeaways could not be clearer – the macro risk environment remains volatile and full of uncertainty, with businesses challenged by elevated interest rates and increased costs as well as pressures around energy transition and disruption emerging from both direct conflict and wider geopolitical tensions. Trade remains one of the most powerful tools for promoting positive economic development and although it continues to grow, the risks and costs of financing this are increasingly challenging, and the technology and innovation needed to deliver a climate transition in line with the goals of the Paris Agreement requires huge volumes of finance from both public and private sources.

Berne Union Business Confidence Survey, 1st Quarter 2024

That the export credit insurance industry is well placed to play an important role in tackling the above challenges – not only mitigating trade risks and unlocking finance, but also in helping guide economic transformation and supporting green supply chains – is not in doubt.

Opportunities and Risks

The table below clearly identifies the perceptions of BU members about the opportunities and risks for export credit and PRI business in 2024 and beyond with Green and transition projects, renewable energy, new supply chains and markets, SME support, and innovative risk-sharing structures the top priorities. This is against the top risk perceptions of geopolitical tensions, global economic slowdown, conflicts, emerging markets sovereign debt crises, and high interest rates.

Greatest Opportunities and Risks for Export Credit and PRI Industry in 2024

| Greatest Opportunities | |

|---|---|

| 1 | Green/Transition (Excluding Renewables) |

| 2 | Renewable Energy |

| 3 | New Supply Chains/Markets |

| 4 | SME Support |

| 5 | Innovative Risk-Sharing Structures |

| 6 | Energy Sector Investment |

| 7 | Blended Finance |

| 8 | Digital Transformation (Including AI) |

| 9 | New Financial Products |

| 10 | New Technologies in Goods and Services |

| 11 | Recommencement of Paused Projects |

| 12 | Alternative Capital |

| Greatest Risks | |

|---|---|

| 1 | Geopolitical Risk |

| 2 | Global Economic Slowdown/Recession |

| 3 | Impact of Conflicts |

| 4 | Emerging Market Debt Crises |

| 5 | High Interest Rates |

| 6 | High Inflation (or Deflation) |

| 7 | Rising Barriers to Trade |

| 8 | Corporate Leverage/Liquidity |

| 9 | Energy Market Disruption |

| 10 | Negative Impacts of Regulation |

| 11 | Commodity Volatility |

| 12 | Physical Climate Risks |

An important initiative that emerged out of COP28 in Dubai could potentially be a game changer in the role and ways de-risking solutions are contributing to the Net Zero ambitions.