Reconciling the Harsh Realities of the First Ever Global Stocktake of Climate Goals Progress with the Semantics of COP28 and the Promise of NDC 2025

One of the perennial features of the COP process is expectations management. Fuelled by a frenzy of rhetoric of aspirations, of must-do measures to achieve often perceived arbitrary targets, of a motely of climate sceptics, deniers and vacillators, a cohort of climate lobbyers ranging from eco-activists, NGOs and interest groups, self-styled ecowarriors and worriers, neoliberal dissenters, climate technology promoters, fossil fuel champions, and lip service paying governments of every ilk, a bevy of international agencies and self-interest groups, and a fanfare of funding announcements and commitments, the Conference of the Parties in Dubai – COP28, under the aegis of The UN Framework Convention on Climate Change (UNFCCC), was no exception. Amid the claims and counterclaims of the progress or failures of the Dubai climate discourse, Mushtak Parker dispassionately assesses the outcomes – successes and shortcomings – of COP28.

In some respect, the thunder of the anticipated outcomes of the main COP28 proceedings in Dubai in December 2023 was captured by the first ever Global Stocktake (FGS), a comprehensive evaluation of progress against climate goals, of The Conference of the Parties serving as the meeting of the Parties to the Paris Agreement, which convened concurrently from 30 November to 13 December 2023.

The euphoria of 150 countries agreeing for the first time to “transition away from fossil fuels in energy systems” in a “just, orderly and equitable manner” as per the final communiqué, instead of a clear and present commitment to phase out fossil fuels once and for all, was soon lost in the semantics of COP speak, let alone the agreement doesn’t compel countries to take action, and no timescale is specified. Whether the Dubai Declaration is an important recognition that richer countries are expected to move away from coal, oil and gas more quickly is a moot point. The reality is whether a collaborative political will and global leadership to affect such a transformation existed and whether countries are committed to act beyond their mere national and self-interest as opposed to the current fragmented and in some respects competing pathway to climate action.

The FGS is a comprehensive compact document of principles, aspirations, actions, observations, recommendations and warnings which effectively define the complexities of the global climate action playbook and spells out in no uncertain terms the dire implications to humanity of non-compliance with the evidenced-based climate science findings and targets, and any delays in implementing them in an urgent, orderly and committed fashion.

The language of FGS contrasts sharply with the guarded exuberance (some would say misplaced optimism) of the COP28 Presidency and process. Article 5 of the first section of FGS, for instance, “expresses serious concern that 2023 is set to be the warmest year on record and that impacts from climate change are rapidly accelerating and emphasizes the need for urgent action and support to keep the 1.5 °C goal within reach and to address the climate crisis in this critical decade.” Failing this, the risks and impacts of climate change are significantly increased, especially in the absence of drastic reductions in global greenhouse gas (GHG) emissions.

The FGS in a rejoinder to the developed countries “notes with deep regret that the goal of developed country Parties to mobilize jointly US$100 billion per year by 2020 in the context of meaningful mitigation actions and transparency on implementation was not met in 2021, including owing to challenges in mobilizing finance from private sources, and welcomes the ongoing efforts of developed country Parties towards achieving the goal of mobilizing jointly US$100 billion per year.”

It also fears that the climate adaptation finance gap is widening, and that current levels of climate finance, technology development and transfer, and capacity-building for adaptation remain insufficient to respond to worsening climate change impacts in developing country Parties, especially those that are particularly vulnerable to the adverse effects of climate change.

The Stocktake also champions the needs of developing country Parties, in particular those disproportionately affected by and vulnerable to the impacts of climate change, including support provided and mobilized for their efforts to implement their nationally determined contributions (NDCs) – a need estimated at US$5.8–5.9 trillion for the pre-2030 period. Similarly, the FGS estimates the adaptation finance needs of developing countries at US$215–387 billion annually up until 2030, and that about US$4.3 trillion per year needs to be invested in clean energy up until 2030.

Supporters of the Global Stocktake stress the importance of uniting the three core elements of the climate agenda, bringing together mitigation, adaptation, and means of implementation, which includes finance, under one umbrella: united around higher ambition, giving clear direction on NDCs, and connecting everything agreed to practical action in the real world.

The reality of the FGS approved in Dubai is that there is no timeline, no strategy to compel countries to take action, no future finance structures and de-risking solutions, no SDG-driven real economy commitment to a “transitioning away” playbook, which merely reinforces the feeling that COP28 was a missed opportunity and raises questions about the very raison d’etre and the perversity of the process itself. With some 97,000 registered delegates for the Dubai meeting, easily making it the largest event in COP history since the inaugural one in Berlin in 1995, including an estimated 2,456 representatives of the oil, gas and coal industries and related organisations according to research by the Coalition of Green Groups – this compared with 600 such attendees at COP27 in Sharm El Sheikh last year – is the COP process itself in need of urgent reform and restructuring?

Moral Conscience of the Climate Discourse

It is a far cry from a “just, orderly and equitable” transition espoused in the Global Stocktake which calls on Parties to take actions towards achieving, at a global scale, a tripling of renewable energy capacity, and the phasing down of unabated coal power, with China committed to opening two coal-fired power plants per year over the next few years in addition to those in the UK, Indonesia, India and South Africa, and doubling energy efficiency improvements by 2030. Perhaps the FGS can be seen as the moral conscience of the climate discourse, whereas the individual Conference of the Parties the ambition of implementation based on the specific and sometimes competing policy, economic, electoral, financial, demographic, geographic spatial and societal needs.

No amount of reports, declarations, pledges and replenishments, disbursements from the US$792 million Loss and Damage Fund and the cornucopia of 175 announcements – all commendable microcosms towards the holy grail of limiting global warming to 1.5°C – will detract from the fact that it is the insanities of the climate discourse that needs to be exorcised.

One has to have some sympathy for COP28 President Sultan al-Jaber when he stressed in his closing speech that “I know that there are strong views among some parties about the phase down or phase out of fossil fuels. And allow me to say this again, this is the first presidency ever to actively call on parties to come forward with language on all fossil fuels for the negotiated task text.” Indeed, far from being a seamless process, COPs are beholden to the agendas of the previous ones.

Their very modus operandi is based on almost continuous negotiations and compromise. For all their flaws, perceived abuses and issues, COPs are the only structured multilateral mechanism to address the daunting task of global climate governance. So, we all await with abated breath the new NDCs that are due no later than early 2025.

COP28 was much trumpeted to be an “inclusive” discourse. So much for climate inclusion, when the 39 delegates from the Alliance of Small Island States who are particularly vulnerable to climate change and whose very survival is threatened because of rising sea levels, were not even in the room when the final agreement was “gavelled” by Sultan Al-Jaber and his colleagues.

Eight donor governments announced new commitments to the Least Developed Countries Fund and Special Climate Change Fund totalling more than US$174 million to date, while new pledges, totalling nearly US$188 million, were made to the Adaptation Fund at COP28 – nowhere near the real cost of adaptation required for mitigating catastrophic climate events to which their donor countries were more historical contributors.

Ambitious but Achievable Renewables Pledge

One of the commendable developments is the fact that Heads of State agreed to triple global renewable energy capacity by 2030, aligning with the International Renewable Energy Agency’s (IRENA) World Energy Transitions Outlook on how to close the energy transition gap to stay on a 1.5°C Pathway. It particularly calls for a tripling of installed renewable capacity from around 3,400 GW today to over 11,000 GW by 2030, adding on average an ambitious 1,000 GW annually till the end of this century.

IRENA Director-General Francesco La Camera spelt out the caveats in Dubai: “Commitments must translate into concrete actions considering varied national circumstances. The forthcoming round of NDCs in 2025 represent a prime opportunity to make a transformative leap forward. As the custodian of today’s pledge, IRENA supports countries in advancing their energy transitions to ensure progress is made every year towards 2030. Achieving the global pledge requires stronger policy actions, investment and global collaboration, reiterating the criticality of the next seven years for bringing the world back on track towards the 1.5°C pathway and realizing the SDGs.”

Deeply entrenched barriers across infrastructure, policy and institutional capacities, remnants of the fossil-fuel era, he added, must be overcome to scale and speed up the deployment of renewables. And a reform of the global financial architecture should recognise the role of multilateral financial institutions in prioritising the infrastructure needed for a new energy system run on renewables.

According to Anna Mosby, Head of Environmental Policy Analytics at S&P Global, the COP28 pledge to triple renewables by 2030 is “ambitious but achievable.” Some 4.6 TW of solar and wind capacity is forecast to be added between now and 2030, with a projected US$4.7 trillion investment. Despite impressive gains in wind and solar deployment in recent years, however, the target requires an unprecedented acceleration in deployment from today’s 2.3 TW total for the two fastest growing technologies. The latest Clean Energy Technology forecast by S&P Global Commodity Insights sees 3.4 TWac (4.2 TWdc) of solar capacity added over the next eight years. This would more than triple the current installed solar capacity, the biggest increase across green technologies. The global wind sector would see some 1.2 TW added to more than double installed capacity, including some 264 GW offshore wind by 2030.

Outside the Global Stocktake, the main COP28 outcomes, albeit ‘works in progress, and largely based on ‘yet-to-materialise’ pledges, include:

- Operationalization of the Loss and Damage Fund to help vulnerable developing countries mitigating historical climate change impacts, which has thus far secured US$792 million of funding pledges.

- Establishing a framework for the Global Goal on Adaptation (GGA), albeit the Adaptation Fund aimed at developing countries only attracted pledges and contributions totalling US$134 million.

- Mobilizing US$85 billion in new commitments and 11 pledges and declarations of support under the UAE Presidency’s total Action Agenda at COP28, which spans four pillars: fast tracking a just and orderly energy transition, fixing climate finance to make it more available, affordable, and accessible, focusing on people, nature, lives and livelihoods, and fostering full inclusivity in climate action.

- The launch of ALTÉRRA, the UAE’s US$30 billion catalytic private finance vehicle, which seeks to mobilize a total of US$250 billion for dedicated global climate action.

- Adopting the Oil and Gas Decarbonization Charter (OGDC), which commits signatories to zero methane emissions and ending routine flaring by 2030, and to net-zero operations by 2050 at the latest. To date, 52 companies, representing over 40% of global oil production have signed up to it.

- Boosting the Second Replenishment of the Green Climate Fund (GCF) with six countries pledging new funding at COP28, with total pledges now standing at a record US$12.8 billion from 31 countries, with further contributions expected.

- The World Bank announced an increase of US$9 billion annually for 2024 and 2025 to finance climate-related projects. Multilateral Development Banks (MDBs) announced a cumulative increase of over US$22.6 billion toward climate action.

As COP29 in Baku beckons in 2024, the clear trend over the last four years is that oil producing states have been setting the COP agenda. How perverse since the host countries play the crucial role of navigating the agenda. Azerbaijan, one of the largest oil and gas producers in the Caspian Basin, in 2024 is no exception.

The credibility of the UN Framework Convention on Climate Change (UNFCC), under whose aegis the annual jamboree is convened, itself is at stake. COP28 instead of being the champion for genuine inclusive climate action soon became evident that it was a bastion for selective and limited ambitions in preserving vested interests – a classic case of febrile form over stunted substance. COP28 in essence was transition lite!

One can perhaps excuse the gratuitous hyperbole and exuberance of COP28 President Sultan Al Jaber in his closing Plenary address: “We have delivered a comprehensive response to the Global Stocktake and all the other mandates. Together, we have confronted realities and we have set the world in the right direction. We have given it a robust action plan to keep1.5°C within reach. It is a plan that is led by the science. It is a balanced plan, that tackles emissions, bridges the gap on adaptation, reimagines global finance, and delivers on loss and damage. It is built on common ground. It is strengthened by inclusivity. And it is reinforced by collaboration.”

The COP28 Presidency has been clear in its intention to ensure that the agreements made at COP28 are delivered and followed through to COP29 in Baku and COP30 in Belem, with mechanisms to track progress against implementation. Perhaps a ‘Triumvirate of the Willing’!

The next two years will be critical. The message of UN Climate Change Executive Secretary Simon Stiell in Dubai was unequivocal: “At COP29, governments must establish a new climate finance goal, reflecting the scale and urgency of the climate challenge. And at COP30, they must come prepared with new nationally determined contributions that are economy-wide, cover all greenhouse gases and are fully aligned with the 1.5°C temperature limit.”

In the interim though on the road to Baku and Belem, in early 2025, countries must deliver new Nationally Determined Contributions, aimed at bringing every single commitment – on finance, adaptation, and mitigation – in line with a 1.5°C world. That surely will reveal the real intent of progress towards Net Zero and expose or reinforce any gaps or achievements in humanity’s ‘do-or-die’ climate action journey.

Business Unusual to Boost Climate Insurance Ambition and Urgency

Fast Tracking Clean Energy Transition and Food Security Through Proactive Sustainable Finance and De-risking Solutions and Alliances

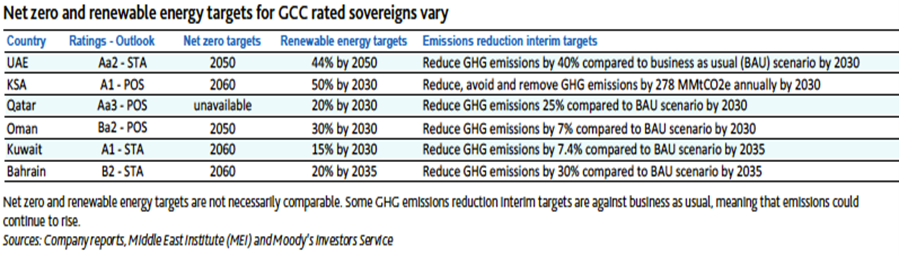

Are Multilateral Insurers and Private Credit and Investment Insurers adequately rising to the challenge of underwriting Climate Action risks and resilience? Due to a fragmented global regulatory architecture and competing taxonomies, and the seemingly contradictory demands of fossil fuel dependency to raise much-needed budget revenues or consumption for household and industrial electricity generation, do multilateral insurers and National export credit agencies (ECAs) need to revisit their climate finance and sustainability playbooks in the race towards Net Zero? Oussama Kaissi, Chief Executive Officer, ICIEC, emboldened by the Corporation’s newly launched Climate Change Strategy and ESG Framework, consider how Export Credit and Investment Insurance (ECII) can enhance the urgency and evolving and oft-competing demands of decarbonisation and just and clean energy transition against the background of geopolitical tensions, financing gaps, economic disruptions, inflationary pressures, rising inequality and an ongoing global Cost-of-Living Crisis?

While blended finance, Green, Social and Sustainability (GSS) bonds and to a lesser extent Sukuk, have proliferated at a rapid pace over the last few years and according to S&P, Global could reach a cumulative US$4 trillion by end 2023, export credit and investment insurance (ECII) hardly get a mention in the cornucopia of climate action reports and initiatives.

The tendency is to lump them together under the generic title of climate finance and risk mitigation solutions, making ECII the poor relation of the decarbonisation and sustainable finance landscape.

The general consensus is that ECAs are a critical link to support the rising ambition of governments and the private sector. While some ECII stakeholders have taken important steps to increase their support for the new green economy, the industry and their regulators are perceived as lacking greater ambition and action with more consistent methodologies and collaboration with the wider financial services sector.

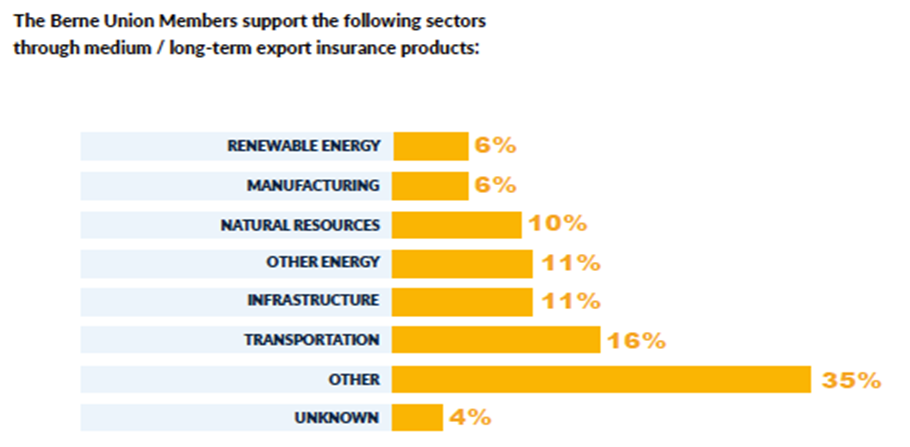

Credit insurance acts as a catalyst that provides financing to the real economy across the globe. By protecting exporters and banks against the risk of non-payment, credit insurance enables cross-border trade and investment increasingly in climate-related business, inputs and projects. The Berne Union Members collectively provide payment risk capital worth US$2.5 trillion each year, insuring approximately 13% of the value of total global cross-border trade.

The availability of finance, liquidity and underwriting is not a problem. It is a question of matching the above with acceptable and bankable projects and transactions. On the flipside is the inadequate action to mitigate climate change and biodiversity loss risks. A few weeks before COP28, a 34-strong international group of climate, environmental and consumer protection entities, including the Swiss-based WWF (Greening Financial Regulation Initiative), wrote a passionate, open letter calling on the International Association of Insurance Supervisors (IAIS) to scale up regulatory action on climate and shift away from environmentally harmful economic activities.

The signatories strongly expressed “our deep concern that the IAIS is taking insufficient action to address the risks of climate change and nature loss and their implications for the insurance sector. Unfortunately, the global regulatory environment on insurance and climate-and environment related financial risk is not yet sufficiently developed to ensure a smooth transition to a net zero, nature positive financial system.”

The Open Letter makes uneasy reading for insurers and underwriters pertaining to the proliferation of climate-related events and transactions.

- Since 2017, the insured losses from natural disasters (mostly human-made climate disasters) averaged US$110 billion per year, more than double the average amount in the previous five years.

- Reinsurance and primary insurance rates have increased rapidly, but there are growing parts of the world where other countries risk becoming “uninsurable.”

- California’s former insurance commissioner, Dave Jones, warned recently, “I do believe we’re steadily marching towards an uninsurable future, not only in California but throughout the United States.”

- In Europe, the European insurance supervisor (EIOPA) estimates that only about a quarter of climate-related catastrophe losses are currently insured and this insurance protection gap could widen in the medium to long term as a result of climate change.

- This scenario also creates serious risks to the insurance industry itself.

- Current global insurance regulations are patchy at best.

Climate Risk Proliferation for Underwriters

Climate change mitigation is falling behind, given that greenhouse gas emissions from the energy sector reached a record amount in 2022/23. Yet in spite of its powerful role as a global risk absorber and manager, the insurance industry, say the signatories is not using its influence to accelerate the transition from fossil fuels to clean energy. “Instead, it is adding fuel to the fire by underwriting the continued expansion of oil and gas extraction. As noted by the U.S. Treasury Department in a June 2023 report on climate-related risks for the insurance industry, the U.S. insurance industry’s corporate bond and equities investment exposure to high GHG-emitting industries is approximately US$439 billion, or 15% of those investments.”

The fact that fossil-fuel subsidies, according to the IMF, surged to a record US$7 trillion in 2022 as governments supported consumers and businesses during the global spike in energy prices caused by the Ukraine conflict and the economic recovery from the pandemic, remains another bottleneck in clean energy transition.

The signatories slate The Net Zero Insurance Alliance (NZIA), which was founded in 2021, for caving in to pressure from the fossil fuel lobby, under the pretence of anti-competition measures, which they claim, “poses great risks for an orderly transition in the insurance sector and requires regulators to urgently clarify the scope for collective industry action in the public interest.”

The IAIS should be commended for monitoring climate change as a key trend for the industry, setting up a disclosure workstream, and conducting consultations on updates to its guidance related to climate change. But the scale, pace and urgency are insufficient. Not surprisingly, the signatories recommend the IAIS to i) take a precautionary approach to addressing environmental risk, which remains a regulatory blind spot, ii) should offer best practice guidance to ensure that insurance companies adopt transition plans with short-, medium- and long-term targets and aligned with credible 1.5°C pathways, iii) not to let contributors to the crisis get public support, and iv) to rely on evidenced-based climate science.

With US$6.86 trillion in gross written premiums in 2021, insurance companies are an economic heavy weight with enormous potential to reduce the negative impact on climate change and nature loss through their underwriting business. Insurance regulators and supervisors have a critical leading role to play and can help advance insurance companies to reach global climate and biodiversity goals by aligning insurance regulation, policies and supervision to international best practice and ambitions.

Progress Out of Adversity

But, very often in adversity comes progressive initiatives. A Number of initiatives that have emerged out of COP28 could potentially be game changers in the role and ways de-risking solutions are contributing to the Net Zero ambitions. The first one is the launch of the Net Zero Export Credit Agencies Alliance (NZECAA) by a group of ECAs led by UK Export Finance (UKEF) under the aegis of the United Nations Environment Programme Finance Initiative (UNEP-FI) with the simple mandate of promoting the role of export credit in achieving net zero emissions by 2050 and limiting global warming to 1.5°C, in collaboration with the Glasgow Financial Alliance for Net Zero (GFANZ).

UN Under-Secretary-General and UNEP Executive Director, Inger Andersen could not have been more to the point at the launch of the Alliance. ECAs, she reminded, are in a strong position to deliver more sustainable global trade and to complement the work already being undertaken by the private finance sector, helping to address market gaps to deliver net-zero economies by 2050. “This Alliance will play an important role in supporting tangible economic transition and help countries implement their commitments under the Paris Agreement. Large private financial institutions are powerful, but they cannot deliver net-zero alone. Public finance is the missing piece in net-zero financial landscape. We need the full might of the global financial system to combat and adapt to climate change,” she maintained.

UKEF, with which ICIEC has a long-standing collaboration, recently unveiled multi-million-pound support for transactions supporting climate adaptation and sustainability across Africa and the Middle East, including a GBP226 million facility for the Iraqi Government to develop clean water and sewage treatment infrastructure in Hillah City.

UKEF has declared that it is committed to reaching net-zero in terms of its total financed emissions by 2050, it ended all new support for overseas fossil-fuel projects in 2021, except in very limited circumstances, and recently introduced more flexible and competitive terms for British exporters as part of the Government’s drive to encourage them to use and offer finance solutions and other options which are consistent with the Green Finance agenda in line with the UN SDGs and the Paris Net Zero ambitions. According to the British ECA, it can now offer longer repayment terms and more flexible repayment structures for an expanded range of renewable and green transactions, and for standard transactions.

ICIEC’s Climate Change and ESG Playbook

ICIEC similarly launched its Climate Change Policy and ESG Framework at COP28, which marks “the commencement of a transformative results-oriented process where ICIEC’s operations, insurance, de-risking, physical assets and human capital and focus are addressing the Climate Crisis at their core, based on the needs of ICIEC’s member countries, IsDB Group synergies, the role of the private sector in climate finance and industry best practice.”

ICIEC is committed to helping our 49 Member States achieve their development goals, including resilience, mitigation and adaptation to the threats posed by climate change. ICIEC cover is directed towards various sectors, with US$2.35 billion going specifically into clean energy initiatives such as solar energy systems and wind farms – assisting with their importation and use in national infrastructure projects. At COP28, IsDB President, H.E. Dr. Muhammad Al Jasser, unveiled a US$1 billion climate finance initiative for fragile and conflict-affected member countries over the next three years.

At the same time, ICIEC has granted approvals exceeding US$573 million in support of food security under the Islamic Development Bank (IsDB) Group Food Security Response Programme (FSRP), surpassing our initial commitment of US$500 million for the entire period from SH 2022 until 31 December 2025. ICIEC initiatives in this respect primarily facilitate financial transactions, facilitating the importation of essential agricultural commodities and inputs for agricultural projects, reinforcing resilience against potential food crises.

Collaboration with national, regional and international partners is a key component of ICIEC’s strategy, given the complex risk metrics involved in climate-related events. Earlier this year MUFG Securities EMEA plc structured a €1.247 billion financing package to enable institutional capital investors and syndicate lenders to collaboratively contribute to the package for Türkiye’s green Yerkoy Kayseri Highspeed Railway Project. The Project is backed by a coalition of four European ECAs led by UKEF.

ICIEC participated in this landmark transaction with an 8-year tenor by covering the risks of the Non-Honouring of Sovereign Financial Obligation (NHSFO) of the Ministry of Finance and Treasury of Türkiye of up to €134.1 million, to cover a Syndicated Financing Facility of the same amount led by MUFG Securities EMEA plc and comprising six banks including MUFG, Banco Santander, DZ Bank, Deutsche Bank, Societe Generale and ING Bank. The aim of the project is to improve the efficiency and adequacy of the transportation system in the region by addressing poor rail connectivity and the lack of alternative environmental transport modes. ICIEC played an instrumental role in this impactful transaction, confirming our unwavering commitment to supporting critical infrastructure developments in Türkiye and within ICIEC Member States.

The above developments also follow a change earlier this year to the OECD Arrangement on Officially Supported Export Credits, which allows ECAS and Exim banks to offer greater incentives for climate-friendly transactions.

The export credit industry is hugely influential globally with up to US$28 trillion – comprising 80 to 90% – of international trade relying on export financing, much of it provided by governments via export credit agencies and export-import banks. It is the height of folly that governments, international agencies, the COP process and other stakeholders have hitherto failed to capitalise on what the ECII community can bring to the table beyond their vanilla de-risking and credit enhancement solutions. On the other hand, the ECII community and their promoters and shareholders should take some responsibility for this lack of upscaling, underwriting, collaboration and urgency in underwriting climate related and catastrophe risks.

It is noteworthy that the Berne Union Climate Working Group (BU CWG) which is doing important work in supporting the climate goals of the wider export credit community, has come up with a “refreshed BU CWG workplan for 2024” in the wake of the developments at COP28. At the same time, Export Finance for Future (E3F), an international coalition working to align public export finance with climate change and goals. In Dubai, E3F under the motto “Scale Up to Phase Out” confirmed in a debate that momentum is building in its efforts of “gathering a critical mass of countries ready to accelerate the progressive phasing out of Carbon-intensive projects and significantly increase the financial support to exporters’ projects compatible with Paris Climate Agreements”. E3F is also in the process of rolling out National Phase Out Plans for official export credit support for fossil fuels, inviting external monitoring by being transparent about our transactions and now going turbo on scaling up initiatives.

A Future of Proaction and Ambition?

Looking ahead, there are several other positives that indicate a much more proactive and ambitious role for the ECII community in promoting the green economy through climate transition and decarbonization initiatives.

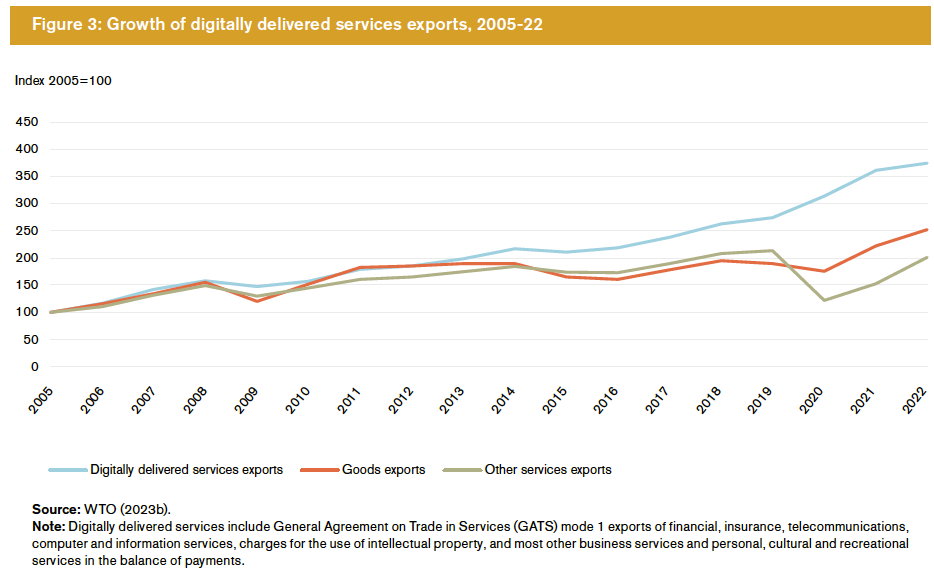

In trade finance, in a post-Covid dispensation, there is a continued push for digitisation, transparency and automation in an environment with increasing regulatory and compliance requirements. In September 2023, the Electronic Trade Documents Act (ETDA) 2023 in the UK received Royal Assent in an effort to make Global Britain’s trade with partners all over the world more straightforward, efficient and sustainable, and which according to the British Government’s initial estimate could give the UK economy a GBP1.14 billion boost over the next decade through the trade documentation digitalisation.

Similarly, the introduction of ISO 20022 by the International Organization for Standardization (ISO), as “a single standardisation approach (methodology, process, repository) to be used by all financial standards initiatives,” is a key development and challenge for the trade finance and credit insurance industry. ISO 20022 (MX), which comes into effect in November 2025, is the next generation of financial messaging standards, given its key characteristics of a common language with rich and structured data. The Swift MT format has been the standard for trade finance messages for the last four decades.

According to Trade Finance Global, (TFG), Swift (the world’s leading provider of secure financial messaging services) is “already in the process of migrating payment and cash management messages from the legacy MT format to MX. In November 2025, when the current MT and MX coexistence period is set to end, all Swift traffic for cross-border payments and reporting (CBPR+) will be on an ISO 20022 standard. As the payments and cash management industry is finding out in real time, there are benefits, challenges and costs associated with such a wholesale transition.

Another unexpected challenge is the consequences of the attacks on ships in the Red Sea and drought in the Panama Canal area that have more than quadrupled shipping prices moving goods since late 2023. Impacts could worsen should disruptions persist into the peak shipping season in the second half of 2024. Swiss Re Institute in its latest Insurance Insight, stressed that marine insurance contracts in affected areas are repricing higher or covers being adjusted, while some claims inflation is a further potential risk.

“For insurers, marine is one of the most impacted lines, as it selectively covers war and terrorism, though not delays. Covers have generally been held for travel through the Red Sea, but with case-by-case flexibility and significant increases in rates to account for the higher risk. Port congestion creates accumulation risks, while longer transit times mechanically raise insureds’ risk exposure, both factors that insurers may need to take into consideration. There are also risks to business interruption and related covers, including Credit & Surety. Exporters appear to be absorbing the delays and higher prices so far, but insured losses may rise if disruptions last longer or intensify. Stickier claims inflation is a risk if core goods inflation ticks up again.”

Increasing geopolitical risks may threaten trade through affected routes. More frequent droughts are likely to jeopardise transit volumes in the Panama Canal, and climate change is already affecting river shipping, as seen in the Rhine and Mississippi.

Navigating the Future: The UAE’s Digitalization and Technology Adoption Strategy Unveiled

In the realm of economic recovery, resilience, de-risking, and inclusive growth, the United Arab Emirates (UAE) stands as a pioneering force, steering its trajectory through a robust Digitalization and Technology Adoption Strategy. Here Raphael Fofana, Acting Head of the UAE office of the Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC) in Dubai, delves into the transformative journey the UAE is undertaking in leveraging technology for a prosperous and inclusive future.

At the core of the UAE’s digital transformation lies a ground-breaking shift in e-Government initiatives catalysed by the visionary Smart Dubai project. This strategic undertaking represents more than a technological evolution; it signifies a reimagining of governance, where advanced technologies such as artificial intelligence (AI) and blockchain are seamlessly integrated into public services. The Smart Dubai initiative stands as a testament to the nation’s commitment to innovation, efficiency, and transparency.

Artificial intelligence, with its advanced algorithms and machine learning capabilities, is revolutionizing governmental processes. Tasks are not only automated but optimized for precision, enhancing the overall efficacy of public service delivery. Concurrently, the integration of blockchain technology ensures the security and integrity of critical government data. Its decentralized nature creates an immutable ledger, instilling a new level of trust and setting unprecedented benchmarks for data reliability and security.

This digital evolution is not confined to efficiency gains alone; it is reshaping the very essence of governance by fostering transparency and accessibility. By making information readily available to the public, the UAE is setting new standards for open governance, where citizens can scrutinize government actions, fostering a culture of accountability. As ICIEC actively collaborates with government entities, our mission harmoniously aligns with the UAE’s vision, contributing to an ecosystem where advancements in e-Government become catalysts for economic growth and robust investment protection.

Insurtech Revolution

The UAE’s unwavering commitment to technological innovation is notably evident in the insurance sector, where the convergence of insurance and technology, commonly referred to as Insurtech, is orchestrating a transformative shift. Insurtech has emerged as a dynamic force, reshaping the traditional landscape by integrating advanced technological solutions. Key among these advancements is the utilization of data analytics, which empowers insurers with the tools to conduct precise risk assessments.

This analytical prowess enables a more nuanced understanding of potential risks, enhancing decision-making processes and ultimately fortifying the resilience of the insurance sector in the face of evolving and complex risks.

Moreover, the adoption of blockchain technology within Insurtech initiatives brings an additional layer of security and transparency to insurance transactions. Blockchain ensures the integrity of contracts and facilitates secure, tamper-proof record-keeping, thereby fostering trust among stakeholders.

In this landscape of rapid technological evolution, Insurtech stands as a strategic frontier, embracing innovation to streamline operations, improve efficiency, and offer tailored solutions to the dynamic needs of businesses and individuals alike.

As a pivotal player in the realm of investment insurance, ICIEC is acutely aware of the transformative role technology plays in the de-risking process. Embracing these technological advancements aligns with our mission of supporting sustainable economic development by providing robust insurance solutions. In recognizing the synergies between Insurtech and investment protection, ICIEC continues to contribute significantly to the resilience and innovation of the insurance sector within the UAE and beyond.

Government Agencies, SWFs, and Development Banks

The UAE’s strategic vision extends beyond individual efforts to encompass a collective, collaborative approach that actively engages government agencies, sovereign wealth funds (SWFs), and development banks. This concerted effort reflects a commitment to fostering an environment conducive to growth and innovation. The collaboration between these entities forms a synergistic alliance, pooling resources and expertise to drive transformative initiatives that propel the nation forward.

In this collaborative landscape, government agencies play a pivotal role in setting the strategic direction, crafting policies, and providing regulatory frameworks that facilitate innovation and sustainable growth. Sovereign wealth funds, as strategic financial vehicles, contribute substantial resources to fuel economic development projects. Development banks, with their focus on financing initiatives that promote long-term economic growth, complement this synergy by providing crucial funding and expertise.

ICIEC actively participates in and mirrors this collective effort through collaborative endeavors with government bodies. Our collaboration aligns seamlessly with the overarching national strategy, working hand in hand to safeguard investments and encourage economic development. By forging these partnerships, ICIEC contributes to the nation’s economic resilience, fostering an environment where collective innovation and collaboration lay the foundation for sustained growth and prosperity. This collaborative model not only amplifies the impact of individual initiatives but also exemplifies the UAE’s dedication to a holistic and inclusive approach to national development.

Banking Sector’s Digital Leap

The pervasive digital transformation sweeping across industries has reached the very heart of the financial sector, inducing a profound shift within the banking industry. This transformative journey encompasses a spectrum of advancements, ranging from the ubiquity of mobile banking to strategic fintech partnerships, as financial institutions actively embrace technology to redefine their service offerings. The motive behind this shift is clear – to provide more efficient, secure, and customer-centric financial services that align with the expectations of a digitally savvy clientele.

Mobile banking has become a cornerstone, empowering customers with the convenience of managing their finances on-the-go. Simultaneously, strategic collaborations with fintech entities inject innovation into traditional banking practices, fostering a dynamic landscape that adapts to the evolving needs of the modern market. These technological integrations not only enhance operational efficiency but also elevate the overall customer experience.

The alignment of ICIEC’s mission with this financial sector transformation is palpable. As a key player in investment insurance, ICIEC recognizes the symbiotic relationship between its mission and the ongoing digitalization in banking. The digital transformation contributes significantly to the de-risking of financial transactions, introducing sophisticated risk management mechanisms that bolster the security and integrity of investment activities. In turn, this proactive embrace of technology within the banking sector promotes investment protection, aligning seamlessly with ICIEC’s commitment to facilitating sustainable economic development through robust insurance solutions.

Credit and Investment Insurers in the Digital Era

Within the intricate fabric of the economic resilience framework, credit and investment insurers emerge as pivotal players actively harnessing the power of digitalization. This strategic integration of advanced technologies is instrumental in reshaping traditional approaches, focusing on streamlining processes, enhancing risk assessment methodologies through data analytics, and ensuring agile responses to the ever-evolving challenges within the dynamic economic landscape.

The digitization of credit and investment insurance processes introduces unprecedented efficiencies. By automating and optimizing workflows, insurers can provide quicker, more responsive services, reducing turnaround times and enhancing the overall customer experience. The utilization of data analytics amplifies risk assessment capabilities, enabling a more nuanced understanding of potential risks and allowing for tailored, data-driven solutions that resonate with the specific needs of businesses and investors.

In this digital era, where economic landscapes are characterized by rapid changes and uncertainties, the commitment to innovation is paramount. ICIEC exemplifies this commitment by mirroring the industry’s embrace of digitalization. We actively engage in providing comprehensive insurance solutions that align seamlessly with the digital aspirations of our stakeholders. Through technology-driven initiatives, ICIEC not only fortifies its role as a key player in investment insurance but also contributes to shaping a resilient economic environment that thrives amidst the complexities of the contemporary business landscape. The synthesis of innovation and digitalization within the realm of credit and investment insurance lays the foundation for a more adaptive, responsive, and robust economic framework.

Corporate Sector’s Digital Drive:

The corporate sector in the UAE stands at the forefront of the ongoing digital evolution, transcending the role of a mere observer to become an active participant in this transformative journey. Across various facets, from supply chain optimization to elevated customer engagement strategies, businesses are embracing technology to enhance operational efficiency and navigate the complexities of the modern marketplace. This proactive adoption of technological advancements not only fosters innovation within individual enterprises but collectively contributes to fortifying the overall resilience of the economy.

Supply chain optimization, facilitated by digital technologies, ensures a more streamlined and responsive flow of goods and services. Businesses leverage data analytics, artificial intelligence, and blockchain to enhance the visibility and efficiency of their supply chains, thereby reducing costs and minimizing disruptions. Simultaneously, the incorporation of technology in customer engagement strategies enhances communication, personalization, and overall satisfaction, fostering lasting relationships and loyalty.

As a stalwart supporter of international trade and investment, ICIEC recognizes the strategic importance of a digitally empowered corporate sector in achieving sustained economic sustainability. The digital transformation of businesses not only aligns with ICIEC’s mission but also plays a crucial role in fostering an environment where international trade and investment can flourish. Through its commitment to providing comprehensive insurance solutions, ICIEC actively contributes to the resilience and growth of the digitally empowered corporate landscape, ensuring a sustainable and dynamic economic future for the UAE.

Benefits to the UAE’s Economy and Development Agenda:

The Digitalization and Technology Adoption Strategy of the UAE stands as a catalyst for a multitude of benefits that extend beyond mere efficiency gains and cost savings. At its core, the strategy creates an environment that acts as a magnet for foreign direct investment (FDI). By leveraging advanced technologies, the UAE positions itself as an attractive destination for global investors seeking a dynamic and digitally mature ecosystem.

The strategy’s emphasis on efficiency translates into substantial cost savings for businesses, enabling them to operate with increased effectiveness and competitiveness. Moreover, the digital ecosystem created by this strategy serves as a testament to the nation’s commitment to innovation, fostering an environment that not only retains existing investors but also entices new ones. Foreign direct investment is drawn to the prospect of operating within a technologically advanced and forward-thinking landscape.

In this transformative landscape, the role of ICIEC is paramount. The Corporation acts as a crucial facilitator, providing insurance solutions that align seamlessly with the digital ambitions of investors. By mitigating risks associated with investments, ICIEC contributes significantly to sustainable economic development and resilience. As a strategic partner in this digital journey, ICIEC plays a pivotal role in ensuring that the benefits of the UAE’s Digitalization and Technology Adoption Strategy are not only realized but also safeguarded, fostering a robust and secure investment environment that propels the nation toward enduring economic prosperity.

Emerging Risks and Challenges:

As the UAE boldly strides into the vast landscape of the digital future, it encounters a spectrum of challenges intrinsic to this transformative journey. Foremost among these challenges are the persistent threats posed by cybersecurity vulnerabilities, data privacy concerns, and the imperative need for adaptive regulatory frameworks. The interconnected nature of the digital realm exposes entities to evolving cyber threats, necessitating a vigilant approach to safeguard sensitive information and critical infrastructure. Data privacy concerns further intensify as digitalization amplifies the volume and complexity of personal and corporate data.

Addressing these challenges requires not only technological fortification but also adaptive regulatory measures that keep pace with the dynamic digital landscape. Recognizing the multifaceted risks inherent in the digital era, ICIEC proactively engages in a continuous dialogue.

This proactive approach aims to craft innovative insurance solutions tailored to address the emerging challenges of the digital age effectively. By doing so, ICIEC fulfils its pivotal role in providing a secure environment for investments, reassuring stakeholders that their ventures are shielded against the complexities of the ever-evolving digital risk landscape. In this commitment to risk mitigation, ICIEC not only safeguards investments but also contributes to the overall resilience and sustainability of the UAE’s digital ambitions.

In conclusion, the UAE’s Digitalization and Technology Adoption Strategy heralds a new era of economic prosperity, resilience, de-risking, and inclusion. As ICIEC aligns its mission with the UAE’s vision, we recognize the transformative power of technology in shaping a robust and inclusive future. The collaborative efforts across sectors, coupled with ICIEC’s commitment to investment protection, position the UAE as a global leader in navigating the digital frontier, ensuring a dynamic and resilient economic landscape for generations to come.

ICIEC Meet the Team – Mohamad El Sayed, Manager, Information Technology Management Division, ICIEC

Embracing Zero-Trust Cybersecurity

A Comprehensive Approach to Protecting and Enhancing

Resilience of the Modern Organization

The Evolution of Cybersecurity

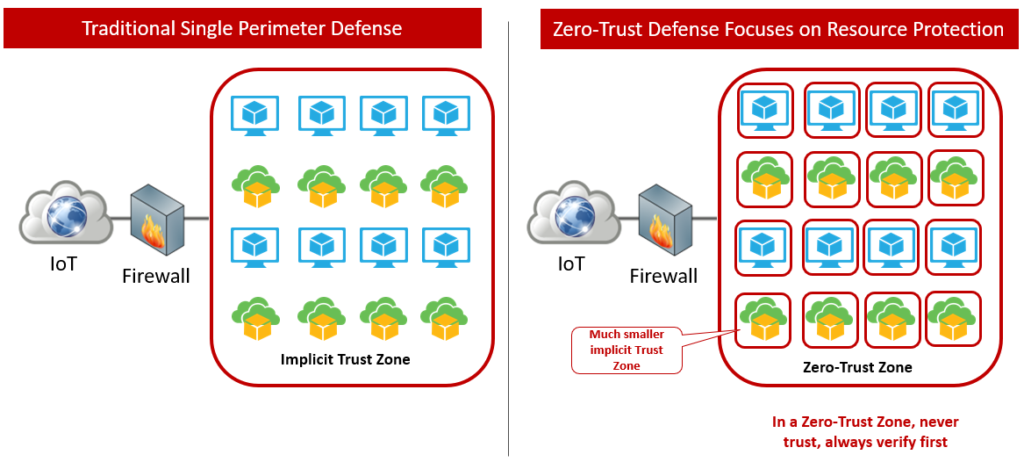

In today’s interconnected world, where data breaches and cyberattacks have become commonplace, traditional perimeter-based security measures are no longer sufficient to protect organizations from advanced threats. Advanced Persistent Threats (APTs) and insider threats have demonstrated that the traditional approach is no longer effective. The consequences of a breach in this context can be devastating, leading to data theft, financial losses, and reputational damage. The need for a more robust and adaptable approach to cybersecurity has led to the rise of the Zero-Trust approach.

The Zero-Trust approach challenges the conventional wisdom of “trust but verify” by assuming that no entity, whether inside or outside the network, can be trusted implicitly. Instead, it advocates the complete abandonment of the implicit trust in any entity, whether inside or outside an organization’s network. This approach assumes that no device, user, or application can be trusted by default, and every access request must be authenticated, authorized, and continuously monitored, regardless of its source.

The Zero-Trust Approach: Unravelling the Core Principles

Zero-Trust is not just another buzzword , it’s a comprehensive and adaptable security framework designed to address the evolving threat landscape. To understand the Zero-Trust approach better, let’s delve into its core principles:

- Never Trust, Always Verify: The fundamental premise of Zero-Trust is to reject the assumption that anything, or anyone, is inherently trustworthy. Instead, it promotes continuous verification of every user, device, application, and network connection trying to access resources within the network. Users and devices must authenticate themselves before gaining access to resources. Multi-factor authentication (MFA) is commonly used to strengthen identity verification.

- Least Privilege Access: Zero-Trust minimizes the privileges granted to users and devices. Users are only given access to the resources necessary for their job, limiting lateral movement within the network for potential attackers. Access privileges are granted on a need-to-know basis. Users and systems only receive the minimum permissions necessary to perform their tasks.

- Micro-Segmentation: In a Zero-Trust architecture, the network is divided into smaller segments, each with specific security policies. This way, even if a breach occurs in one segment, it is contained, preventing lateral movement.

- Real-time Monitoring: Continuous monitoring of user and device behavior, network traffic, and system activity is a cornerstone of Zero-Trust. Any deviations from the established norms trigger alerts and potential security responses.

- Contextual Access Control: Access decisions are based on contextual information, such as user identity, device health, location, and the sensitivity of the data or resource being accessed. Access is dynamically adjusted based on changing conditions. All access requests are explicitly approved or denied based on policies, not based on trust or location.

To implement a Zero-Trust cybersecurity approach, organizations need to consider several key components and strategies:

- Identity and Access Management (IAM): A robust IAM system is essential for verifying the identity of users and devices. It includes Single Sign-On (SSO), Multi-Factor Authentication (MFA), and role-based access control.

- Network Micro-Segmentation: This involves dividing the network into smaller, isolated segments or zones. Each segment can have its own set of access controls and security policies, reducing the lateral movement of threats.

- Security Analytics and Threat Detection: Utilizing advanced security analytics and machine learning, organizations can continuously monitor network traffic and user behavior to detect anomalies and potential threats in real-time.

- Application Security: Applications must be secured at the code level, and access should be controlled based on a user’s privileges and the least privilege principle.

- Secure Access Service Edge (SASE): SASE is an emerging technology integrating network security and Wide-Area Networking (WAN) capabilities. It extends Zero-Trust principles to remote users and cloud services.

Benefits of Zero-Trust

Implementing a Zero-Trust approach offers numerous advantages that significantly enhance an organization’s security posture:

- Minimized Attack Surface: The attack surface is significantly reduced by implementing least privilege access and micro-segmentation. Attackers have difficulty moving laterally within the network and accessing critical assets.

- Improved Data Protection: Zero-Trust ensures that sensitive data is protected from unauthorized access. Access controls adapt to changing conditions and user behavior in real time, reducing the risk of data breaches.

- Enhanced Security Posture: The continuous monitoring and real-time access control provided by Zero-Trust allow organizations to respond to threats quickly and effectively. This proactive approach to security minimizes the impact of potential breaches.

- Adaptability: Zero-Trust is scalable and can be tailored to an organization’s needs. Whether a small business or a large organization, the principles of Zero-Trust can be applied effectively.

- Compliance Alignment and Risk Mitigation: Many industry regulations and standards, such as the General Data Protection Regulation (GDPR), require organizations to implement strong security controls. Zero-Trust helps organizations align with these compliance requirements. Organizations adopting a Zero-Trust model can better protect sensitive data and reduce the risk of data breaches and associated financial and reputational damage.

- User-Friendly: Despite its robust security measures, Zero-Trust can be implemented to minimize disruption to user experiences, ensuring that security doesn’t hinder productivity

Challenges in Implementing Zero-Trust

While the benefits of a Zero-Trust approach are compelling, implementing it is not without its challenges:

- Complexity: Transitioning to a Zero-Trust architecture can be complex and disruptive. It may require changes in infrastructure, policies, and a cultural shift within the organization. Organizations must carefully plan and execute this transition to avoid service disruptions.

- Integration: Integrating Zero-Trust into existing systems and processes can be challenging. Legacy systems may not easily support the principles of Zero-Trust, requiring additional investments in technology and training.

- User Experience: The strict access controls and continuous verification can sometimes hinder user experience. Organizations must strike a balance between security and usability.

- Cost: The initial investment in Zero-Trust technology and training can be high, particularly for smaller organizations with limited resources. The investment in new technologies and training can be significant. However, the long-term benefits often outweigh the upfront costs.

- Change Management: Adopting a Zero-Trust approach often requires a cultural shift within the organization. Employees may resist additional security measures, such as MFA and more frequent authentication requests, which can slow their workflow. Employees need to understand and embrace the new security mindset.

- Skill Shortages: Finding and retaining cybersecurity professionals with expertise in Zero-Trust can be challenging, as the demand for these skills is rising.

Zero-Trust in Action: Practical Use Cases

To illustrate the real-world applications of Zero-Trust, consider a few use cases where organizations can successfully adopt this approach:

- Cloud Security: As more organizations migrate their services to the cloud, Zero-Trust provides a secure way to access cloud resources. Users and devices are continuously authenticated and authorized before connecting to cloud-based applications and data.

- Remote Work: The rise of remote work has created new security challenges. Zero-Trust allows organizations to secure remote access to corporate resources, ensuring that only authorized users with the proper credentials can access sensitive data and applications.

- Mobile Device Security: In the age of “Bring Your Own Device” (BYOD), Zero-Trust helps organizations secure mobile devices. Users are authenticated, and their devices are checked for compliance with security policies before accessing corporate resources.

- Insider Threat Mitigation: Zero-Trust is effective in mitigating insider threats. Employees with valid credentials are continuously monitored to detect unusual behaviour or data access, reducing the risk of insider data breaches.

- Network Security: Traditional network security often relies on perimeter defences. Zero-Trust takes a more holistic approach by applying security controls at the network level, with real-time monitoring and access control.

- IoT Security: The proliferation of IoT devices presents new security challenges. Zero-Trust can help by ensuring that IoT devices are authenticated, authorized, and segregated from critical systems to prevent potential threats.

As the cybersecurity landscape continues to evolve, Zero-Trust is expected to become the standard approach for securing organizations of all sizes. The principles of least privilege, continuous monitoring, and strict access control will remain central to safeguarding against cyber threats. Additionally, the following trends will likely shape the future of Zero-Trust:

- Identity and Access Management (IAM) Solutions: IAM solutions are crucial in verifying user identities and enforcing access policies. They are integral to Zero-Trust architecture.

- Integration with Artificial Intelligence (AI) and Machine Learning (ML): AI and ML will play a more significant role in threat detection and anomaly identification within the Zero-Trust framework.

- Blockchain: Blockchain can be used to create a tamper-proof audit trail of access and changes to sensitive data. This ensures data integrity and accountability within a Zero-Trust network.

- Software-Defined Perimeter (SDP): SDP solutions create a secure and isolated network overlay, ensuring that only authorized users and devices can access network resources. This technology simplifies the implementation of Zero-Trust principles.

- Convergence of Network and Security: Zero-Trust and security networking will merge further, with solutions like Secure Access Service Edge (SASE) becoming more prevalent.

- Industry-Specific Adoption: Different industries like insurance, healthcare, banking, and finance will tailor their Zero-Trust implementations to meet their specific regulatory and security requirements.

- Zero-Trust as a Service: Managed service providers will offer Zero-Trust to help organizations implement and maintain this complex security model.

- User Education: Increasing user awareness and education on Zero-Trust principles will be essential to minimize user resistance and ensure successful adoption.

In today’s digital age, organizations need to adopt and adapt to the principles of Zero-Trust to safeguard their valuable assets and ensure their continued success. Zero-Trust is a buzzword and a strategic approach to cybersecurity, becoming the standard for modern organizations facing ever-evolving cyber threats.

While implementing Zero-Trust can be challenging and complex, the benefits, including enhanced security, improved compliance, and risk mitigation, make it a worthwhile investment. Many successful organizations are already reaping the rewards of this approach and maintaining the trust of their customers and stakeholders in an increasingly digital and interconnected world.

The Nourishing Role of Digitalisation in Nurturing Resilient Food Security and Systems, Agriculture and Water Management

Technology and digitalisation possess significant potential in addressing the increasing demand for safe and nutritious food, efficient natural resource management, fostering high-quality productivity growth, and contributing to the attainment of the UN Sustainable Development Goals (SDG) Agenda. But the state of digitalisation in agriculture, water, and food systems in low-and-medium-countries (LMICs) in particular, varies widely, with ongoing efforts to leverage technology for sustainable development. Maher Salman, Team Lead, Agricultural Water Management, Food and Agriculture Organization (FAO) of the UN, in an exclusive interview discusses the importance of digital innovation in agriculture, water management, and building resilience in food systems, and emphasises its distinctive capabilities to bridge the rural-urban gap, create employment opportunities, enhance resilience in rural areas, and empower youth and women by providing access to information, technology, and markets.

ICIEC Quarterly Newsletter: Technology is critical to affecting change and driving development. In agriculture, it is said that digitalisation could be a game changer in boosting productivity, profitability, and resilience to climate change. An inclusive, digitally enabled agricultural transformation could help achieve meaningful livelihood improvements inter alia for smallholder farmers and pastoralists and could drive greater engagement in agriculture of women and youth and employment. What is the state of digitalisation in agriculture, water, and food systems in the low-and-medium-income countries (LMICs)? What is the economics of digitalisation in agriculture?

Maher Salman: Technologies and digitalisation possess significant potential in addressing the increasing demand for safe and nutritious food, efficient natural resource management, and fostering high-quality productivity growth. Furthermore, they play a crucial role in ensuring inclusivity and contributing to the attainment of Sustainable Development Goals. Digital innovation in particular has distinctive capabilities to bridge the rural-urban gap, create employment opportunities, enhance resilience in rural areas, and empower youth and women by providing access to information, technology, and markets.

The state of digitalisation in agriculture, water, and food systems in low- and medium-countries varied widely over the most recent years, with ongoing efforts to leverage technology for sustainable development. Digitalisation in these sectors holds significant potential for addressing key challenges linked to agricultural development, and hence to broader economic growth for several countries whereby agriculture is the leading sector. The status of digitalisation in these contexts is dynamic and shows both opportunities and challenges.

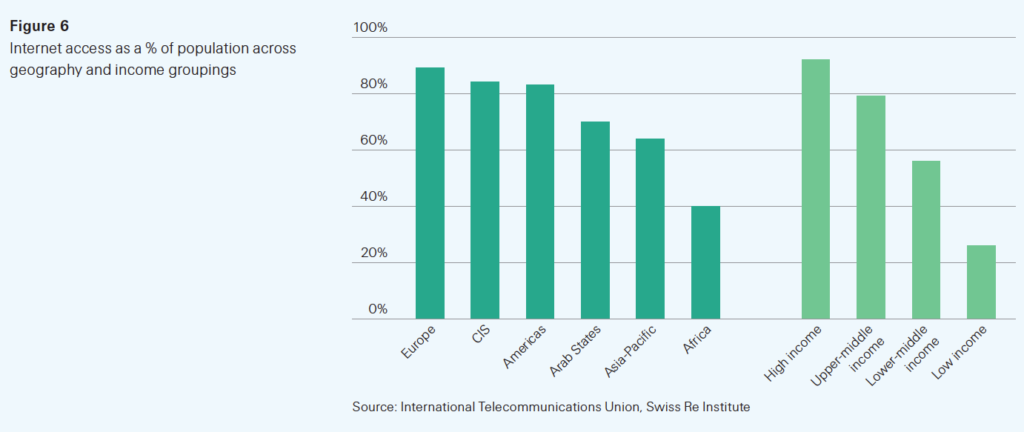

The adoption rate, for instance, varies across regions and countries, whereby some areas have made significant strides, while others may be lagging due to factors such as infrastructure limitations, education, and access to technology. Furthermore, technology in agriculture is becoming more and more a critical aid in decision-making. The collection and analysis of data is increasingly informing management processes, as well as investment decisions.

The economics of digitalisation in agriculture, on the other hand, involves a delicate balance of investment and returns. While initial costs are associated with adopting digital tools, the potential benefits include increased efficiency, improved market access, and elevated livelihoods for smallholder farmers and pastoralists. The inclusive nature of digitally enabled agricultural transformation also holds the promise of engaging a broader range of stakeholders, including women and youth, offering not only improved economic prospects but contributing to broader social and employment objectives.

In the face of economic slowdown and uncertainty, FAO has been playing a key role in advocating for the use of digital technologies to transform agrifood systems and agribusinesses. This involves advising on and promoting a policy agenda to address the digital divide and extend digital benefits on a mass scale, with a commitment to leaving no one behind. As part of its Digital Agriculture Program Priority Area, FAO has already initiated various programs to translate this vision into tangible support for its Member States.

To further advance this trajectory and bring digital innovation’s benefits closer to people, technology-based solutions need to be taken at scale and developed with inputs from final beneficiaries and local partners. FAO has been working in this direction, for instance, in Lebanon, with the development of the BlueHouse-Leb application that provides timely information on the irrigation needs of crops in unheated plastic greenhouses and thus contributes to improve the farm profitability and household-level food security of farmers.

What are the biggest threats, challenges and needs for sustainable agricultural development, quality land improvement and management, water and irrigation systems management, crop and land water productivity – in other words, for sustainable agri-food system transformation?

The sustainability and resilience of agri-food systems is seriously under threat unless current trends of drivers that are affecting them do change. An increase of food crises can be expected if we do not act immediately to transform the way we produce our food. Factors like the growing population and urbanization, economic uncertainties, poverty and disparities, conflicts, intensified competition for natural resources, are causing significant disruptions in socioeconomic structures and harmful effects on environmental systems.

Furthermore, the escalating threat of climate change, posing risks to crop yields, water availability, and overall land productivity poses serious challenges to the pursuit of sustainable agricultural development. Ensuring sustainable land management is hindered by factors such as soil degradation, deforestation, and inadequate land-use planning. The effective management of water and irrigation systems, critical for agricultural productivity, faces challenges related to water scarcity, inefficient irrigation practices, and the need for sustainable water resource governance.

Additionally, achieving optimal crop water productivity is impeded by the lack of access to advanced agricultural technologies, limited farmer education, and unequal distribution of resources. The overarching need lies in developing holistic approaches that integrate climate-resilient practices, advance sustainable land management, and promote efficient water resource utilization. The 2022 FAO “The Future of Food and Agriculture” report identifies four key triggers for the transformation of agri-food systems toward these objectives: improved governance; increased consumer awareness; better income and wealth distribution; widespread technological, social, and institutional innovations.

Moreover, the implementation of appropriate public strategies and policies, involving the active participation of all stakeholders are crucial. Addressing these challenges requires collaborative efforts, technology dissemination, policy support, and capacity building to foster a sustainable agri-food system transformation that is resilient, equitable, and environmentally sound.

The world is plagued by a cornucopia of negative metrics which tend to undermine progress towards achieving the 17 UN SDGs, of which sustainable agriculture, food security and universal digitalisation are key goals. I refer to policy inertia; lack of convergence on trade policies and tariffs; hidden protectionism through subsidies and other barriers to market entry; national interest; supply chain disruptions, land degradation and water pollution due to conflict, civil unrest, terrorism, polluting heavy industries, illegal mining, and logging; rising inequalities, and of course the impacts of the Covid-19 pandemic. What is the real economy, social, health and opportunity cost lost, and how do we future proof such challenges?

The number of challenges indeed poses formidable obstacles to the attainment of the Sustainable Development Goals, particularly in the domains of sustainable agriculture, food security, and universal digitalization. As pointed out by the UN Secretary-General and confirmed by the FAO report “Tracking Progress on Food and Agriculture-related SDG Indicators 2023”, many SDGs are off-track, including those to which agri-food systems are expected to contribute.

Issues like policy inertia, divergent trade policies, and hidden protectionism through subsidies are impeding global progress. Additionally, disruptions in supply chains, land degradation, water pollution from various sources including conflict, civil unrest, terrorism, and polluting industries intensify the complexity. The exacerbation of inequalities and the profound impacts of the Covid-19 pandemic further compound these challenges. The real costs, spanning the economy, society, and health sectors are highly significant, but so are the opportunities.

To future-proof against these challenges, a comprehensive approach is needed. This involves fostering international collaboration to address policy gaps, promoting transparent trade policies, and develop management and technical capacities of stakeholders at different levels. Moreover, investing in resilient supply chains, sustainable practices, and leveraging digital technologies for equitable access to resources are crucial steps. Building robust multipurpose infrastructures for both health and agricultural uses, and implementing social safety nets can enhance resilience, ensuring a more inclusive and sustainable future despite the multifaceted challenges we are confronted with.

The role of water is highlighted in the theme, “Water is life, Water is food. Leave no one behind,” of World Food Day 2023. There are over 2.4 billion people in water-stressed countries and 600 million reliant on aquatic food systems who face pollution, ecosystem degradation, and climate change impacts. Water scarcity, shortages and rationing are on the increase, and no country, irrespective of economic status and wealth, is spared. How did we get it so wrong, and in a world of poly-crises with competing demands for finance, how are we going to finance the remedial mechanisms required?

The thematic emphasis posed on water in this year World Food Day underscores the critical role of water in global food security. The statistics of over 2.4 billion people in water-stressed nations and 20% decline in the availability of freshwater resources are alarming. The escalating challenges of water scarcity, shortages, and accessibility are pervasive, and affect populations across nations and along economic spectrums. The question of how we reached this critical juncture prompts reflection on past resource management and policy decisions. In the contemporary context of poly-crises and competing financial demands, financing the necessary remedial mechanisms becomes a paramount concern.

Addressing water-related challenges requires innovative, collaborative solutions, a reallocation of financial resources, and a commitment to sustainable practices to ensure equitable access to water, safeguard aquatic ecosystems, and mitigate the impacts of climate change. The urgency of the situation calls for a global commitment to responsible water management, transcending economic boundaries to leave no one behind in the quest for water security and sustainable food systems. Agriculture, as the largest consumer of freshwater, has the biggest potential for impact, by changing the ways we produce our food.

In terms of governance, we need to strengthen partnerships between governments, researchers, business, and civil society to design science and evidence-based policies and improve coordination among sectors for better planning and management of water resources. As for financial solutions, more investment are required to enhance the efficiency of water resources and the development of irrigation systems based on ground-truth data, to be made available through accessible knowledge platforms.

Global water demand is likely to grow in the next three decades due to agriculture intensification, population growth, urbanization, and climate change. In water-stress regions, future demand will require the reallocation of 25 to 40 percent of water from lower to higher productivity and employment-oriented activities. These reallocations are likely to come from the agriculture sector due to its high share of current water use. Are you confident that new actions such as Smart Irrigation, Smart Wash, Land and Water Rehabilitation, Soil Enrichment will help to enhance increase water use efficiency, especially in irrigation, and enhance agricultural production and productivity?

The projection of increasing global water demand over the next three decades, driven by factors such as agricultural intensification, population growth, urbanization, and climate change, underscores the imperative for innovative solutions. The World Bank estimates that between 25 to 40 percent of water will need to be re-allocated from lower to higher productivity and employment-oriented activities in water-stressed regions.

Agriculture, once more can play a pivotal role and the FAO Strategic Framework hence indicates the need to increase global agricultural production by at least 40 percent by 2050, given the limited availability of water resources. Initiatives like the ones mentioned holds promise in enhancing water use efficiency and boosting agricultural production and productivity. In particular, the Smart Irrigation-Smart WASH approach, which was promoted under my lead by the Land and Water Division of FAO, addresses the concept of multiple water use and proposes solutions to enhance irrigation and provide WASH facilities to vulnerable communities, thus, responding to the critical needs in times of pandemic crisis.

With the Covid-19 emergency behind us, our focus is redirected to irrigation and its development to support the most efficient management of water resources. The “Irrigation Mapping of need and potential” initiative aims at supporting countries to mobilize sufficient resources for irrigation development and to sustain sound irrigation strategies with well-justified, prepared, and targeted action plans.

The objective is to ensure that irrigation meets actual needs, leverages untapped potential, and accommodates potential future scenarios, planning and decision-making processes. The initiative is developed by FAO through a broad partnership, including global and national stakeholders who share similar concerns about the need to enhance irrigation efficiency and are ready to promote effective solutions in countries worldwide.

In one of your recent papers, ‘Enabling pathways for intensifying drought finance flows’, you seem to suggest an important correlation between digitalisation and financial actors and recipients, and information management as the enabler of this process. Technology needs assessment, you stressed, can lead to the identification of bankable projects and support investors in establishing portfolios. You also mention customer clustering and value chain management. Making projects bankable, especially in drought prevention and mitigation is dependent on a whole range of metrics which are not readily evident in LMICs – credit enhancement, de-risking solutions, integrated policies and so on. Given that droughts are an increasing phenomenon in FAO member states, what is the outlook for increased drought finance and underwriting of the associated risks?

The report is formulated under the framework of the “Enabling Activities for Implementing UNCCD COP Drought Decisions.” project, executed in partnership with the United Nations Convention to Combat Desertification (UNCCD) and financially supported by the Global Environment Facility (GEF).

The primary focus of the publication is to delve into the complexities, alternatives, and mechanisms associated with drought finance. It is meant as a contribution to the creation of a conducive framework for the comprehensive management of drought, aligning with the overarching goal of integrated drought management. In the publication a number of short-term and readily implemented strategies are presented as pathways to drive drought finance forward, which include information management, digitalization, drought awareness, technology needs assessment, customer clustering and value chain management.

Recognizing the complexities inherent in drought prevention and mitigation projects, such alternative enablers of drought finance should be considered, especially in low- and middle-income countries (LMICs), where metrics like credit enhancement, de-risking solutions, and integrated policies are not always available. The growing recognition of the urgency and severity of drought occurrences confirms the need for increased drought finance and underwriting of associated risks, but the outlook is still far from the requirement.