We caught up with Mr Mohamud Khalif, ICIEC’s Senior Manager for Underwriting, to shed more light on ICIEC’s core business function, emerging insurance trends, ICIEC’s role in the Berne Union and the department’s future goals.

Q: Can you please tell us about yourself and, more broadly, your role at ICIEC?

MK: My official title is Senior Manager, and I have been with ICIEC for close to 19 years. I joined the Corporation as a young professional, and in the beginning, I also did some work within the Islamic Development Bank (IsDB) itself. Over the years, I’ve had the opportunity to work in several different positions with ICIEC, gaining experience across various functions, including conducting country risk assessments as part of the Risk Management department at the time. Currently, I head the Corporation’s Underwriting department, a team of 15 people in total, and I also work very closely with the departments of Business Development, Risk Management, Reinsurance, and Legal. The Underwriting department is divided into two teams: one team deals with underwriting activities for commercial risk transactions, and the other deals with underwriting for sovereign risk, sub-sovereign risk, and state-owned enterprise risk.

Q: As the Head of Underwriting, can you briefly describe underwriting and its role in ICIEC’s broader mandate?

MK: Underwriting is a core function of any insurance institution. The role of the Underwriting department at ICIEC is to receive applications submitted by potential clients and review their project and transaction documentation to assess the risk associated with the transaction. The risk assessment outcome is firstly to evaluate if ICIEC should cover the risk and issue a policy to the client. The second outcome is deciding which of ICIEC’s policies or products would be most suitable for the client and transaction and which risks or perils should be covered under the policy. We then decide the tenor, how long we should cover the risk, and under what terms and conditions we should cover, including the pricing. In summary, our department determines what type of risks we should take, the magnitude of the risks ICIEC can underwrite, for how long, and at what price.

Underwriting is essential more broadly within ICIEC’s mandate; underwriting is crucial as it supports our clients by assuming some of the transaction risks, especially when conducting cross-border business. When businesses engage in activities in new countries, they don’t know the culture, rules, laws, and systems work. They sometimes have insecurities about their ability to succeed in that country. In these situations, businesses typically undertake feasibility studies to assess the project’s profitability and how they will help the host country through job creation, facilitate the transfer of technology and many other benefits. However, what these businesses cannot manage is the political risk. This is where ICIEC’s underwriters come in with our knowledge of and relationships with, Member Countries. Throughout the whole transaction, we develop strong relationships with all the parties involved, including project staff on the ground and key government officials. This puts us in a privileged position to help avoid any potential problems, in addition to the insurance we provide. For example, we actively engage with the involved parties and resolve the matter when something goes wrong. In some cases, we can even arrange meetings between our CEO and the respective minister of finance, for example, to resolve any issues or disputes.

Q: What is ICIEC’s risk appetite like in the current market?

MK: Risk appetite is not something static but is rather dynamic. It is affected by the economic and political environment at the global, country and sector levels. Last year, our risk appetite was revisited to support most impacted member countries due to the pandemic. Now, as the pandemic is slowly clearing up and we see the mass roll-out of vaccines, our risk appetite is returning to the normal baseline again. In general, I can say that our risk appetite is determined through a defined written process. Thus our risk management department determines our level of risk appetite scientifically, analyzing available information at different levels.

Q: What are some of the trends in structuring transactions you have observed recently? Are there any new players, or is there any shift in the share of risk being taken on by other players, e.g. ECAs, private financial institutions etc.?

MK: The COVID-19 pandemic certainly has had a visible impact on the different players in the market. The risk appetites of private financial institutions have decreased significantly. As a result, ECAs and multilateral development finance institutions, including ICIEC, have done a great deal of work filling the gaps left by the private sector players taking more of the share of financing. Member Countries’ governments also played a crucial role by providing stimulus measures to the economy, specifically towards the trade and investment sectors, which also helped mitigate some of the risks caused by the pandemic. Without government interventions, the impact of the pandemic would have been much worse on the economy.

Furthermore, COVID-19 had far-reaching implications for the trade and investment industries globally. We know, for instance, that trade declined in 2020 by close to 10%, whereas some studies indicate that FDI went down by about 40%. These declines were much higher than those observed during the global financial crisis in 2008-09. The upshot of the pandemic and the panic it created scared away a lot of the private sector capital used to support development projects, especially those in countries already perceived to be high risk even before the pandemic. This led multilateral development institutions such as ICIEC and other Islamic Development Bank entities to take center stage and modestly try to fill the gaps left by the private sector capital flight. The trend emerging from this process has been the numerous initiatives that MDBs and ECAs have implemented to provide support to projects that traditionally would have been able to access private finance before the pandemic.

Q: What are some sectors or regions you see the potential for growing ICIEC’s support?

MK: The majority of ICIEC’s Member Countries are developing or emerging economies, which means there is a high potential for growth in these countries. Thus, the need for support from institutions like ICIEC is quite significant. Recently we have seen increased demand for Political Risk Insurance (PRI) in several regions, such as with our three Central Asian Member Countries. We have also seen increased demand in Sub-Saharan Africa, specifically in Cote d’Ivoire, Senegal and Nigeria. In the MENA region, with the political situation getting better in Libya, we expect demand to pick up very quickly, resulting from the need for reconstruction in the country. Indeed, we are ready to play our part in supporting that reconstruction process in the future. We also see a lot of demand in South Asia. In Bangladesh, for example, the economy has been growing very fast, specifically in the banking sector and the textile sector. We also see some increased demand in Indonesia as well. There is a lot of potential for ICIEC services right now.

The global integration of economies is fueling this demand. Many Member Countries are now more in touch with the rest of the world from a business perspective. For example, many Member Countries are trading capital goods with non-Member Countries. We often see this quite often, whether it is exports from these Member Countries or imports of strategic commodities and capital goods.

We see an increase in demand in the health sector, of course stemming from the pandemic. We also see growth in digital technologies because of the new trends emerging as the result of lockdowns. For example, new technologies to adapt operations for people working from home. Another sector in which we see growth picking up is renewable energy. The push for this happening globally, to mitigate against climate change, but the real action is trickling down to Member Countries through climate-related transactions. These are the main sectors in which we see a lot of growth and potential happening.

Q: ICIEC is an active member of the Berne Union; what do you see as ICIEC’s main contributions to the Union, and what are some of the benefits ICIEC gets from being a member?

MK: The Berne Union is an important association for ICIEC. It compromises Investment and Export Credit insurers worldwide from both the private and public sectors (national ECAs and specialized multilateral insurers, like ICIEC). The Union organizes annual meetings which serve as learning and networking opportunities for ICIEC staff. Being a member of the Union affords ICIEC numerous opportunities for actual collaborations. For example, we work with non-Member Country ECAs in Russia, China, the US, Netherlands, France, Belgium, and ECAs in our Member Countries through the Berne Union. In terms of what we contribute to the Union, we partake actively in all the meetings, send staff in for training, and share industry data and information. Over the last two years, we have been a member of the Management Committee, which means we are part of the decision-making process of the leadership of the Union itself and are a very active participant. Previously, ICIEC held the Vice-Chair position for the short-term committee, the biggest committee in the Union. We also actively participate in data collection and surveys used for publications. Lastly, we provide ideas and topics for discussion and use the Union as a platform for us to showcase what we are doing. In these areas, we see opportunities for collaboration among members. So, the Union for us is a forum that we believe is very helpful for us and at the same time, ICIEC plays a crucial role in making it a lively and valuable forum for everyone.

Q: What are some of the short- and long-term goals for ICIEC’s underwriting?

MK: To summarize, we would like to improve our overall efficiency and cost-effectiveness. The most crucial function of an underwriting department is always the quality of the underwriting, the efficiency by which it is done, the cost-effectiveness, and the results achieved. We have sound quality underwriting and robust results. As such, our short- and long-term goals are to increase the efficiency to serve our clients. Currently, we are expecting to roll out a new digital system to do so. Here it is important to note that our department has two sets of clients – internal and external. The internal clients are our colleagues in the business development unit prospecting for business opportunities that they bring to us to process. However, there are some aspects where we are inefficient in developing the deal. Efficiency and timeliness are essential. Additionally, as a development institution, we also have to be very selective in the projects we choose. We have to make sure that the projects we choose have a clear and measurable development impact. Hence, our long-term goal is to enhance the collaboration agreements with our Member Countries, peer institutions, private sector insurance providers, companies, ECAs and all the other stakeholders in this industry.

Supporting Economic Growth: Foreign Direct Investment in the MENA region

The role of FDI in MENA countries

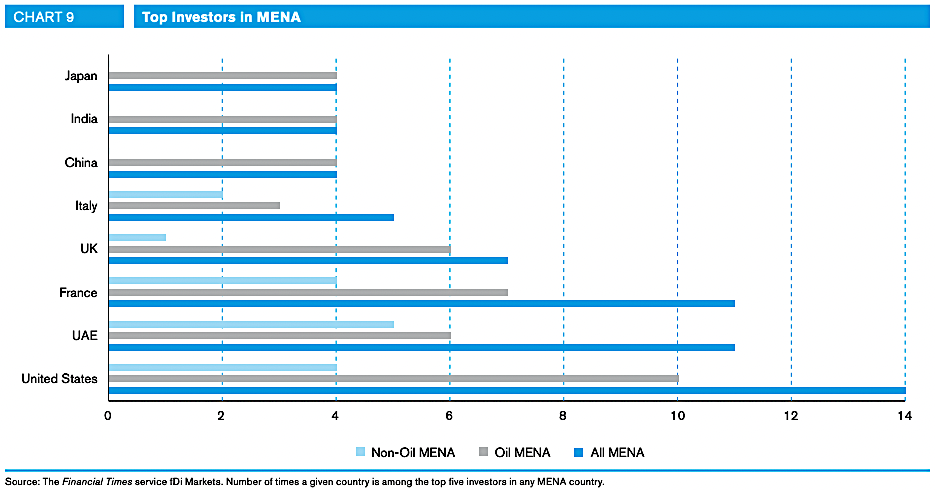

Since the early 2000s, Foreign Direct Investment (FDI) to the Middle East and North African (MENA) region has provided substantial capital and support for national development projects in MENA countries. Sectors such as oil and gas, real estate, coal, chemical manufacturing, services (particularly in tourism and hospitality), and renewable energy have been the primary recipients of this FDI, with the majority of investments coming from the United States, France, the United Kingdom, Italy, China, Japan, India, Germany, and Austria.[1]

Greenfield investment is a type of FDI in which a parent company creates a subsidiary in a different country and builds its operations from the ground up, creating jobs and contributing to economic growth. Greenfield investments represent over 80% of total FDI projects in most MENA countries, creating more than 50,000 jobs to date in Algeria, Egypt, Morocco, Saudi Arabia, Tunisia and the United Arab Emirates. On average, these investments represented 4.86% of MENA GDP from 2003-2012.[2] Gulf Corporation Council (GCC) countries are a significant source for these greenfield investments in their fellow MENA countries, contributing significantly to intra-OIC relations.

Though FDI has provided significant development support to MENA countries, it has become relatively stagnant over the last decade. On average, countries in the region struggled to secure FDI following the 2008 global financial crisis and the Arab Spring movements of 2010-2011. While inward FDI did eventually rise again in 2015, inflows plateaued by 2018, still only reaching less than half the levels of total FDI inflow found in MENA countries at their peak in 2007. Conflict-ridden countries in the MENA region have experienced further difficulties attracting FDI, reporting negative FDI inflows. By 2019, net FDI inflows to the MENA region sat at a mere USD 57.8 billion compared to USD 126.5 billion in 2007.

Factors influencing FDI into MENA countries

Several factors influence FDI flows to MENA countries. Former colonial ties, religious affiliation, and the use of a common language all act as major influences in ways unseen in the rest of the world. Furthermore, differences between the economies of oil-producing and non-oil producing MENA states play a significant role in attracting FDI. Generally, non-oil producing MENA countries attract more significant greenfield investment than their oil-producing counterparts. This can be attributable primarily to oil-producing countries utilizing their abundant in-country oil resources to generate national capital instead of seeking foreign sources.

The most significant factor influencing the limitations witnessed for FDI in many MENA countries is the perceived risk associated with the region, which results in heightened concern from foreign investors regarding immediate and long-term regional stability. These risks can include political instability, low GDP, and infrastructure deficiencies, amongst others. To mitigate against these risks and counter the decline of FDI in the region, various MENA governments have advanced policy reforms, using policy and regulation to promote and facilitate the return of foreign firms and money. Such reforms have led many MENA states to revise investment legislation, ease market entry, streamline regulations in business operations, strengthen investment promotion agencies (IPAs), and adopt policies to direct investment into under-performing regions. However, despite these efforts, many MENA governments have been unable to secure FDI at levels equal to that found amongst other emerging and developing economies, limiting sustainable development in the region. While the MENA region currently has the market, resources, and human capital potential required to attract FDI at high levels, it faces significant challenges that hinder incoming FDI’s flow and effectiveness.

MENA’s FDI and COVID-19

The onset of the COVID-19 pandemic further exasperated the issues regarding FDI inflows to the MENA region. No nation was spared from the economic impacts of the virus, as all governments had to close borders and implement lockdowns and quarantines, grinding global economic activity to a halt and causing a contraction of the global economy by 3.3% in 2020.[3] Furthermore, as a result of the pandemic, global FDI flows fell by 35% from US$ 1.5 trillion in 2019 to US$ 1 trillion in 2020.[4]

Early estimates suggested the MENA region would lose up to 45% of its FDI inflows in 2020, though varied outcomes have been suggested since this prediction. [5] Such concerns were raised primarily in response to the impact of the pandemic on greenfield investments, which had already dropped by 80% in the first six months of 2020. This was a drastic loss compared to the anticipated reduction in greenfield investments in other emerging and developing economies (42%) and amongst OECD countries (17%).[6] The projections were based on significant greenfield investment-reliant industries such as tourism and manufacturing being hit particularly hard due to lockdowns and border closures.

As oil prices dropped, greenfield investments from the GCC oil-producing countries to their MENA neighbours were also anticipated to fall drastically, primarily affecting the region’s real estate (65% of investments) and energy (14% of investments) sectors.[7] Despite these bleak projections, greenfield investment drops appear to primarily result from projects being put on hold rather than being cancelled or shelved, meaning a greater likelihood of FDI bouncing back in the region.

Despite bleak early projections, states throughout the MENA region have experienced positive and negative FDI inflows during the COVID-19 pandemic. FDI flows to West Asia increased by 9% in 2020. Meanwhile, North Africa saw FDI inflows contract by 25%. These variations in FDI have largely been sector-driven, with specific sectors seeing higher or lower investments due to the pandemic-based valuations of different industries.

Many MENA countries have worked to support select industries based on these disruptions. Some states are positioning themselves as premier destinations for FDI in specific industries. For example, the Tunisian government is encouraging international automobile manufacturers to refocus their funds away from the Chinese and American markets into the country through implementing various investment-friendly policy and regulation schemes. Furthermore, states are revising investment laws to focus on priority sectors and improve regulatory and institutional structures that facilitate increased FDI. Turkey is extending a specialized free zone programme encouraging investment in software and ICT activities to include other high value and technology-intensive activities, resulting in Ford’s recent construction of USD 2.6 billion electric automobile assembly plant.

ICIEC and FDI in MENA

ICIEC’s mandate is to bolster economic growth and sustainable development in its 47 Member Countries. With much of its Membership located within the MENA region, the Corporation is a significant support for attracting FDI flows to MENA countries, specifically for projects that boast substantial developmental impact. ICIEC supports FDI by providing investment cover against the potential risks that lead to barriers for investors through its Preferred Creditor Status and the Corporation’s Political Risk Insurance (PRI) products, namely its Foreign Investment Insurance Policy (FIIP) and Non-Honoring of Sovereign Financial Obligations (NHSFO). ICIEC’s cover helps to provide investors with increased security.

Since the Corporation’s inception in 1994, ICIEC has provided more than USD 78 billion in total business insured, including USD 15.6 billion toward investment protection. In 2020, ICIEC provided a total of USD 9.86 billion cover for trade and investment across its 47 Member Countries. Over USD 6 billion of this total is being used to provide insurance cover for transactions in the MENA region, and USD 1.98 billion is being used specifically for investment insurance cover.

ICIEC has been highly active in promoting FDI in MENA countries, providing cover for several notable investments. One such example is ICIEC’s USD 68 million FIIP cover for the construction and operation of the Benban Solar Complex in Aswan, Egypt. ICIEC’s support for this transaction promoted FDI inflow to the MENA Member Country and contributed to the growth of renewable energy sources, bolstering the nation’s energy security. ICIEC also provided USD 32.5 million in NHSO cover for the Sharjah waste-to-energy (WtE) project in the United Arab Emirates, earning the Project Finance International (PFI) Award for the Middle East Clean Energy Deal of the Year in 2019. Meanwhile, ICIEC won the PFI award for Turkish Deal of the Year in the same year for its various levels of insurance cover toward the construction of the Çanakkale bridge in Turkey, which is set to have an immense impact on both trade and development in Turkey.

As vaccines become more available and MENA countries reopen their borders to trade and promote their industries to investors, ICIEC will continue to work with our Member Countries in the region to facilitate the return of FDI. Though most MENA governments are currently working to provide responses negating the immediate impact of COVID-19 on trade and investment, now is an opportune time to implement ambitious long-term programs that encourage further investment into the region. ICIEC is ready to help MENA governments attract high-quality investments that increase jobs and capital within the region and promote an inclusive, sustainable, and resilient recovery. While the pandemic has posed a difficult stretch for FDI, ICIEC and its MENA Member Countries will work together to ensure the next decade is one of prosperity and openness for MENA-oriented FDI.

https://www.brookings.edu/blog/future-development/2019/12/13/encouraging-transformations-in-central-asia/#:~:text=Nearly%2030%20years%20ago%2C%20the,the%20middle%20of%20the%201990s

https://www.forbes.com/sites/arielcohen/2020/12/08/foreign-investment-in-renewables-and-beyond-the-last-best-hope-for-central-asias-economic-recovery/?sh=26368a2f5ebf

https://read.oecd-ilibrary.org/view/?ref=134_134467-ydi12subjo&title=Investment-in-the-MENA-region-in-the-time-of-COVID-19&_ga=2.157186872.245605971.1622493830-457525634.1622493830

https://www.iemed.org/publication/fdi-in-the-mena-region-factors-that-hinder-or-favour-investments-in-the-region/

A Growing Presence: ICIEC and Central Asia

Central Asia as a Strategic Region for Trade and Investment

The geographical region widely considered as Central Asia comprises Kazakhstan, Azerbaijan, Kyrgyz Republic, Tajikistan, Turkmenistan, and Uzbekistan. The diverse region boasts a mix of upper-middle- and low-income countries with significant strategic importance due to their geographic location and abundant natural resources[1]. The region has a long history as a central area for global trade, dating back to the Silk Road trade network during China’s Han Dynasty over 2000 years ago. These historic routes extended more than four thousand miles from China to Europe, connecting eastern and western markets and putting Central Asia at the epicentre of trade and globalization, generating immense wealth[2].

The modern-day Central Asia region still benefits from its strategic geographic position between China and Europe and the abundant natural resources, low public debt, a young population, and a growing labour force found in the countries that comprise it. These countries have also benefited through their increased integration into the global economy over the last decade, driven mainly by natural resources and labour. During the 2000s, the Central Asia region emerged as one of the most dynamic global economic regions, trading goods and services globally to help support domestic demand, reduce poverty, and share prosperity throughout the region. These resource-rich countries have already achieved or are approaching the upper-middle-income status, mainly on the back of solid demand for their natural resources[3].

Being such an important geopolitical and economic region, Central Asia has been swiftly developing; thanks to foreign direct investments (FDI), the gross inflow totalled $378.2 billion between 2007-2019[4]. The European Union (EU) countries invested 40 per cent of total FDI in Central Asia. China has been developing logistics and transit routes through projects as part of its Belt and Road Initiative (BRI), sometimes referred to as the New Silk Road. In addition to investments, the EU and the United States provide significant grant funds to support public and political institutions, projects for environmental protection, and civil society development. The EU alone provided the region with approximately $1.2 billion in aid between 2014 and 2020[5]. These initiatives recognize the importance being placed on integrating Central Asian countries into the global economic arena.

Economic Development and Opportunities in the Region

While the investment activities in Central Asian countries have been picking up, there are still significant opportunities for economic growth and sustainable development within the region. With its plethora of natural resources and location as one of the main transit passages between EU countries, China, and Russia, the region has many inviting attributes for further investments.

Despite being a central trade route between Europe and China, improving conditions for trade within the Central Asia region itself is particularly critical, given some of the inherently challenging conditions. The economic structure of Central Asia is one of low density and long distances. The combined population of the countries in Central Asia is approximately 75 million[6], spread unequally over a relatively large geographical area, including large deserts and high mountains with limited connectivity[7]. The landlocked and remote location of the Central Asia region paired with its rugged topography means there are additional transport costs and transit times needed for regional and international shipments within the region[8].

Despite these barriers, the economic expansion of other nearby countries, such as China and Russia, creates an unprecedented opportunity for Central Asia to emerge as a hub for trade and commerce. The region should benefit from closer intra-regional connectivity, deeper ties with traditional partners, and growing trade relations with some fast-growing nearby economies such as China, India, and Turkey[9].

Although each Central Asian country pursues its own individual development paths, they share similar challenges regarding cross-border resource management, underinvestment in sustainable infrastructure, and economic diversification and growth challenges. Since Central Asian countries are all relatively small economies, they will need to promote regional trade policies and closely integrate into the international trading system to achieve sustainable economic development[10].

ICIEC’s Role in Central Asia

Currently, three of the five Central Asian countries are ICIEC Member Countries – Kazakhstan, Turkmenistan, and Uzbekistan. ICIEC supports trade and investment flow for these Member Countries by providing insurance solutions to mitigate political and commercial risks. Through its range of solutions and its preferred creditor status, ICIEC also assists Member Countries in attracting FDI for projects in critical sectors for their sustainable development and national objectives.

ICIEC plays a critical role in promoting intra-OIC trade between Central Asian Member Countries and Member Countries in other regions. As part of its mission, ICIEC seeks to increase global trade integration, foster cooperation among markets in the Global South, and support in periods of trade turmoil. To achieve this, ICIEC is working closely with its IsDB Group peers, namely IsDB, ITFC and ICD, to enhance the Group’s synergy and expand joint operations in Central Asia.

Kazakhstan

Kazakhstan attained ICIEC Membership in 2003. Since joining, ICIEC has insured a total of USD 1.94 billion for trade and investment in Kazakhstan: USD 996 million in coverage for the import of strategic goods into Kazakhstan and USD 939 million in cover for exports out of Kazakhstan.

During this time, ICIEC has maintained an excellent relationship with Kazakhstan’s national Export Credit Agency to help them support their national exports. In 2014, ICIEC signed a Memorandum of Understanding for cooperation with KazakhExport to promote collaboration and expand the insurance capacity of both institutions. In 2015, ICIEC extended USD 21 million in reinsurance support to KazakhExport to export locomotives to Azerbaijan Railways.

In 2020, ICIEC worked with Eurasian Machinery, the official distributor of Hitachi Construction Machinery (HCM) in Kazakhstan and Central Asia, extending USD 9.5 million in Specific Transaction Policy, covering 80% of the total sales contract and assisting in the import of capital goods. This cover provided Eurasian Machinery with four Hitachi excavators to the Kazakhstan mining sector and helped support Kazakhstan’s mining sector by increasing production capacity and securing new jobs.

ICIEC is also closely following the PPP projects in Kazakhstan and is contacting the Kazakhstan PPP Center and international banks to support PPP projects in Kazakhstan.

Turkmenistan

Turkmenistan is the most recent Central Asian country to join ICIEC membership in 2019. Since then, ICIEC has been growing its presence within the country, seeking opportunities to promote foreign direct investment, expand Turkmenistan’s exports, and prioritize support for projects that contribute to Turkmenistan’s strategic development goals. The Corporation stands ready to catalyze support in Turkmenistan by mitigating political and commercial risks for trade and investment by providing its Shari’ah compliant insurance solutions for banks, corporates, export credit agencies, and other insurers.

Currently, ICIEC is engaging with several international banks to support transportation and agricultural sector projects.

Uzbekistan

Uzbekistan joined ICIEC Membership in 2019. ICIEC has since facilitated several seminal sustainable development projects in Uzbekistan, amounting to USD 126 million in total cover. ICIEC contributes to foreign direct investment and advances Uzbekistan’s specific development goals by facilitating investments in strategic sectors.

In one such project, ICIEC provided a total cover of USD 54 million in Specific Transaction Policy for transactions between two of China’s largest telecommunications equipment manufacturers and Uzbekistan’s state-owned telecommunication operator in line with the Government’s National Development Strategy for 2017-21. The two projects involved modernizing the mobile broadband access network in the Eastern and Western regions of Uzbekistan, expanding the data storage and processing centre, and supporting new technology that will increase access to critical services.

ICIEC’s continued support of infrastructure-related projects in Uzbekistan can help mobilize the private sector and financial resources from abroad. For example, ICIEC is in contact with the PPP Development Agency and international banks to explore opportunities to support PPP projects such as energy and hospital projects in Uzbekistan. ICIEC is cooperating with international banks for their lines of finance to Uzbek banks and entities. ICIEC is also in dialogue with the Investment Promotion Agency under the Ministry of Investments and Foreign Trade to sign an MoU to attract FDI into the country.

In June 2020, ICIEC and Uzbekinvest, the Export-Import Insurance Company of Uzbekistan, signed a Memorandum of Understanding that supports joint efforts, expanding the insurance capacity of both institutions.

Looking Ahead

The diverse natural resources, plentiful human capital, and burgeoning SME sector in the Central Asia region are grabbing investors’ attention, providing many promising future opportunities. To enhance growth and overcome the existing challenges of a lack of sustainable infrastructure and economic diversification, the Central Asia region will have to implement new policies and strategies and lean on political risk insurers, such as ICIEC, to support ventures into new markets.

Greater infrastructure development could give Central Asian economies a critical boost by enhancing growth, poverty eradication, climate change mitigation, and recovery from the impacts of the COVID-19 pandemic. Effective infrastructure projects, such as ICIEC’s reinsurance support to KazakhExport to export locomotives to Azerbaijan Railways, can induce positive spillover effects on economic growth, employment, and trade. The Central Asia and Caucasus region require a combination of the soft and physical infrastructure to achieve a sustained growth pattern. This will require financing solutions and new funding sources to tackle the region’s infrastructure investment gap. Along with infrastructure development, regional connectivity barriers need to be scaled down so that potential inter-, intra-, and extra-regional trade can be expanded[11].

Central Asian countries and their respective governments should also seek to expand economic diversification, having primarily integrated with the world economy through their natural resources, which account for about 65 per cent of exports in Kyrgyzstan, Tajikistan, and Uzbekistan, and more than 90 per cent in Kazakhstan and Turkmenistan[12]. This heavy reliance on a few primary commodities exports makes the Central Asian region vulnerable to abrupt swings in volatile world prices for these commodities and complicates economic management. To counter this, some of Central Asia’s more advanced economies have already begun pursuing economic diversification and advancement accompanied by structural reforms to invite further new investments in the region[13]. This will help expand FDI flows beyond extractive industries. ICIEC’s services in the region can also expand FDI flows and foster economic diversification by supporting local exporters of non-oil commodities in reaching new markets.

ICIEC will continue to support its Member Countries, businesses, and citizens in the Central Asia region by facilitating sustainable development projects in both soft and hard infrastructure, by encouraging investments in strategic sectors, and by offering a range of risk mitigation solutions to help increase global trade integration and prosperity in the region.

[1]https://www.worldbank.org/en/region/eca/brief/central-asia

[2]https://www.cfr.org/backgrounder/chinas-massive-belt-and-road-initiative

[3]https://www.wto.org/english/thewto_e/acc_e/Session1SarojKumarJha12stCenturySilkRoad.pdf

[4]https://astanatimes.com/2020/12/fdi-to-central-asia-reached-378-2-billion-over-past-13-years/#:~:text=NUR%2DSULTAN%20%E2%80%93%20The%20Central%20Asian,of%20which%20totaled%20%24378.2%20billion.&text=FDI%20to%20Kazakhstan%20reached%20%243.6,important%20geopolitical%20and%20economic%20region

[5]https://astanatimes.com/2020/12/fdi-to-central-asia-reached-378-2-billion-over-past-13-years/#:~:text=NUR%2DSULTAN%20%E2%80%93%20The%20Central%20Asian,of%20which%20totaled%20%24378.2%20billion.&text=FDI%20to%20Kazakhstan%20reached%20%243.6,important%20geopolitical%20and%20economic%20region

[6]https://www.worldometers.info/world-population/central-asia-population/#:~:text=Countries%20in%20Central%20Asia&text=The%20current%20population%20of%20Central,among%20subregions%20ranked%20by%20Population

[7]https://www.wto.org/english/thewto_e/acc_e/Session1SarojKumarJha12stCenturySilkRoad.pdf

[8]https://www.adb.org/sites/default/files/publication/29927/central-asia-trade-policy.pdf

[9]https://www.wto.org/english/thewto_e/acc_e/Session1SarojKumarJha12stCenturySilkRoad.pdf

[10]https://www.adb.org/sites/default/files/publication/29927/central-asia-trade-policy.pdf

[11]https://www.adb.org/sites/default/files/publication/688061/adbi-book-developing-infrastructure-central-asia.pdf

[12]https://www.brookings.edu/blog/future-development/2019/12/13/encouraging-transformations-in-central-asia/#:~:text=Nearly%2030%20years%20ago%2C%20the,the%20middle%20of%20the%201990s

[13]https://www.forbes.com/sites/arielcohen/2020/12/08/foreign-investment-in-renewables-and-beyond-the-last-best-hope-for-central-asias-economic-recovery/?sh=26368a2f5ebf

Catalyzing Access to Healthcare in Cote D’Ivoire

The World Health Organization (WHO) declared a Public Health Emergency of International Concern on 30 January 2020 due to the fast spread of COVID-19. With the threat of a pandemic looming and noting the crumbling health infrastructure in Côte d’Ivoire, on 5 March 2020, Deutsche Bank and ICIEC signed a financing facility agreement to support Côte d’Ivoire’s health infrastructure through the construction of two new regional hospitals as well as five new medical units in five additional hospitals. The agreement was signed a few days before the WHO declared the pandemic on 11 March 2020; the same day, the first case of COVID-19 was detected in Côte d’Ivoire.

Mr Raphael Fofana, Underwriter in ICIEC’s Underwriting Department, Sovereign Risks Division, provided some insight on the Corporation’s involvement in this award-winning project.

Q: Could you please briefly introduce the overall project and financing structure?

RF: Of course. The government of Côte d’Ivoire mandated Deutsche Bank to mobilize financing of around 142 million Euros to fund the construction of two regional hospitals, with approximately 200 beds each. One of the hospitals is located in Adozpé (100 KM north of Abidjan) and Aboisso (100 KM east of Abidjan). The project also funded five new medical units in five additional hospitals located across the country.

Deutsche Bank sought insurance from ICIEC for capital relief to more comfortably finance the transaction given the size. ICIEC’s cover provides Deutsche Bank with increased security against the risk of default. If the bank were to fund such a transaction without ICIEC’s cover, the transaction would have been too expensive for the Government of Côte d’Ivoire to bear.

Q: Why was ICIEC sought as a partner over other insurers?

RF: ICIEC was the clear choice of insurer for this project from the start. Based on the considerable value of the transaction, few insurers would have the risk appetite for this project in the first place. As a long-standing partner and client of ICIEC, Deutsche Bank is familiar with the unique added value we offer as a multilateral institution. We have additional tools to make our clients more comfortable.

One such unique aspect of our coverage is ICIEC’s Preferred Creditor Status (PCS), which helps ICIEC mitigate the risk of default in transactions. When a government knows that ICIEC is involved in a project, they are less likely to default on payments. And, if for any reason they do default, and they only have a limited amount of funds available to pay us or any private banks involved, they would be required to pay us before other creditors.

Our clients also appreciate that we hold high standards and implement a rigorous due diligence process in terms of developmental impact and environmental and social issues. ICIEC brings a development lens to the transaction because we make sure that the projects we support are impactful and that the results of our transactions benefit a broader population of our Member Countries.

Q: What was the developmental rationale for ICIEC to get involved in this transaction, and how does it align with Côte d’Ivoire’s national development plans?

RF: Under Côte d’Ivoire’s President, Alassane Ouattara, who was elected in 2010, the construction and renovation of the country’s hospitals were highlighted in the country’s national development plan. An additional, and more specific, National Health Development Plan was also prepared with the clear objective to build and renovate hospitals with an estimated cost of EUR 1.5 billion. The two hospitals and five medical units covered in this project are part of this program.

When assessing the project, ICIEC recognized the priority placed by the government of Côte d’Ivoire on renovating the existing healthcare infrastructure and building new facilities. It was an easy choice for us to proceed. As a multilateral insurer, part of our role is to support the private sector in financing seminal Government projects and bolster investments in critical sectors. In addition to this project, we support Cote d’Ivoire in constructing a potable water plant and renovating the country’s education infrastructure.

Q: What was the development impact of this project on the healthcare sector?

RF: The state of healthcare infrastructure in Côte d’Ivoire before this project was less than ideal. Malaria, yellow fever, sleeping sickness, leprosy, trachoma, and meningitis are all endemic to the Member Country. While government programs exist to control these and other diseases, the healthcare sector suffered from insufficient and deteriorated infrastructure. Therefore, strides in the government’s National Health Development Plan, of which this project is a part, significantly impact citizens’ access to healthcare. The project created 400 new hospital beds in the two hospitals and brought in state-of-the-art equipment and facilities, enhancing access to and healthcare quality in the typically underserved regions. Additionally, five new medical units in five other hospitals have been built. By insuring the financing of this project, ICIEC is supporting better health and well-being for citizens of our Member Country.

Q: What was the development impact of this project beyond the healthcare sector? Are there any links to SDGs you can make?

RF: The development of basic infrastructure in the health sector is crucial to achieving sustainable development and empowering communities in Côte d’Ivoire and beyond. The two new hospitals contribute to job creation, employing around 600 local people and fostering a micro economy in the surrounding areas. The construction element of the project also facilitates the trade of services and human capital between Côte d’Ivoire and Morocco.

By insuring the financing for the hospitals and medical units, ICIEC contributes to the achievement of the United Nations’ Sustainable Development Goals (SDG), specifically to SDG3 – Ensure good health and well-being for all. However, the project contributes broader impacts to SDG1 – End poverty in all its forms everywhere; SDG9 – Build infrastructure, promote sustainable industrialization and foster innovation; and SDG10 – Reduce inequalities between social categories.

Q: What were some additional unique features of the project that piqued ICIEC’s interest?

RF: An extraordinary bonus feature of this project was that it is an intra Organisation of Islamic Cooperation (OIC) investment. The Engineering, Procurement, and Construction (EPC) contractor was Moroccan. As Côte d’Ivoire and Morocco are both OIC members, this makes the transaction eligible to be classified as an intra OIC investment. This is precisely the collaborative type of transactions that ICIEC seeks to encourage.

Another unique feature of this project was the sheer size of the transaction. It is the most significant direct cover for the healthcare sector in ICIEC’s history, and the largest transaction ICIEC has closed in Côte d’Ivoire.

Q: This project started right when the COVID-19 pandemic started. How has the project contributed to Côte d’Ivoire’s COVID-19 response?

RF: The COVID-19 pandemic is ongoing in Côte d’Ivoire, and the two new hospitals will naturally be used as part of the national response. They will be operational any day now and will, of course, receive and treat COVID-19 patients as necessary. There will also be some designated facilities for COVID-19 testing and treatment.

The five additional medical units have also been integrated into the national response since their respective operationalizations. In these critical times, any reinforcement to the healthcare system will significantly impact citizens.

Q: Were there any specific challenges or lessons learned you would like to reflect on?

RF: On the financing side, it was very straightforward. There is direct financing from a bank to the government, and ICIEC provides insurance against the government’s default. This is something we inherently do.

The main challenge was in the execution of the project, which took place in the middle of the COVID-19 pandemic. The construction was planned before the virus took the world by storm. While the crisis created a sense of urgency given the critical nature of the healthcare infrastructure being developed, there was a period of adjustment to ensure workers’ safety and mitigate any challenges to the logistics, such as access to materials.

Q: Finally, this project won the Islamic Finance News Sovereign & Multilateral Deal of the Year 2020; can you tell us about what made this project so notable?

RF: This reflects how dire the healthcare situation in Côte d’Ivoire was before the project and highlights just how impactful investments in critical sectors could be. The size of the transaction and the intra-OIC nature of the project also contributed to this becoming a high-profile and award-winning project. ICIEC is proving that there is a need for Shariah-compliant insurance solutions and demonstrating how impactful its involvement can be.

One for All and All for One: ICIEC’s focus on growing intra-OIC trade and investment

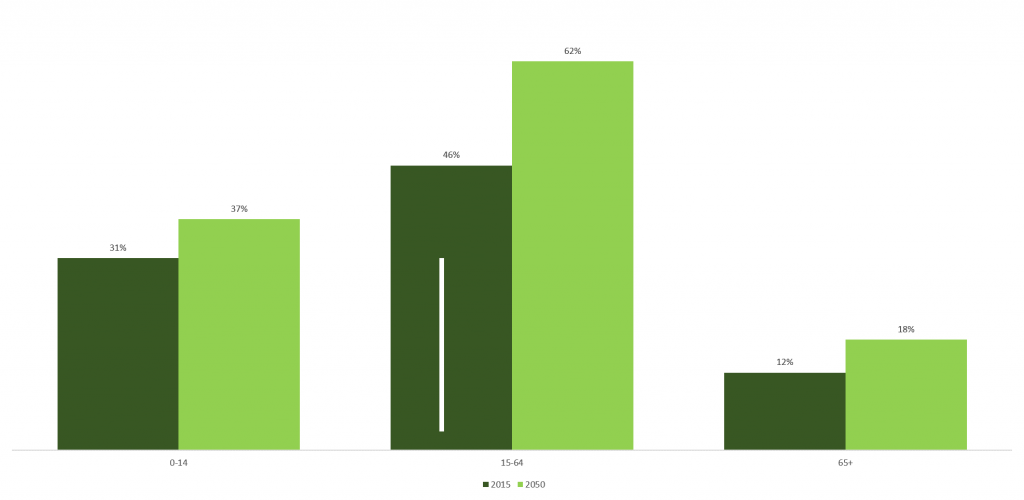

With OIC membership currently spanning 57 countries across Africa, Asia, Middle East and Latin America, ranging from Indonesia to Suriname, the Organisation of Islamic Cooperation (OIC) is a grouping of countries containing diverse economies in terms of structure and size. Amongst these economies, significant volumes of trade and investment flow, with potential for a substantial increase. The OIC market also provides immense opportunities for trade and investments, given its growing demographics. The current combined population of OIC Member Countries sits at 1.8 billion people. Recent reports suggest that this number will witness population growth across all age groups over the next 30 years, with a crucial increase in the working-age population of 15-64 years (see figure 1).

Figure 1: OIC Member Countries Population by Age Group, 2015 & 2050

Source: UN World Populations Prospects

This key demographic age group is expected to constitute more than 50% of OIC’s population by 2050. It will allow OIC Member Countries to benefit from what is referred to as “the demographic dividend[1]“. Demographic dividend occurs when a country’s population has a low child and old-age dependency ratio and a high working-age population. There is a correlation between creating adequate job opportunities to sustain the working age in countries with a sizeable working-age group and increased income per capita. The increase in income generation would result in increased consumption and higher savings rates, translating into significant economic growth. Alongside a growing population comes the demand for infrastructure development, goods, services and increased food security. This demand presents an opportunity for businesses in OIC Member Countries to grow.

The current snapshot of intra-OIC trade and investments

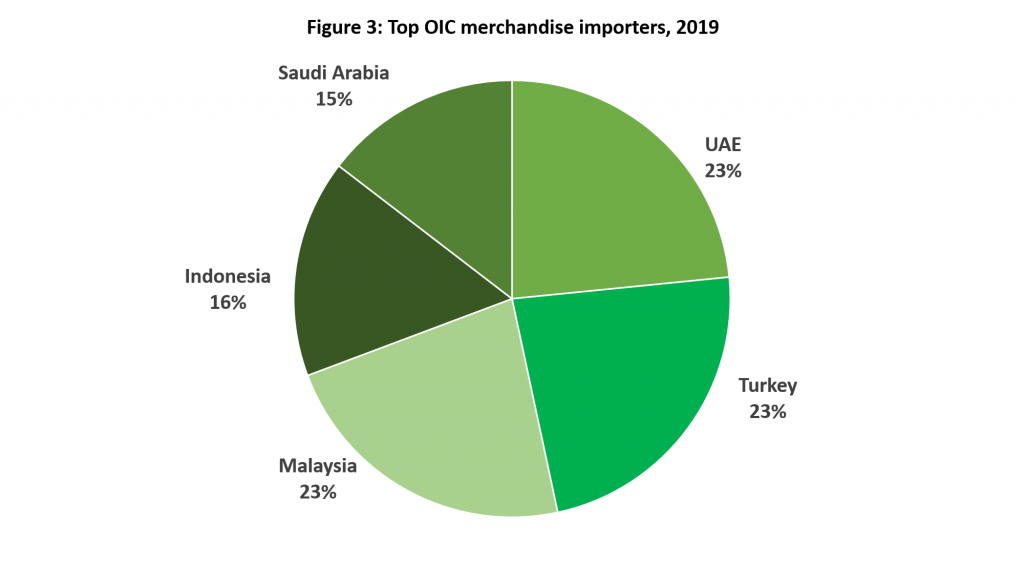

In alignment with the growing opportunities in the market, the share of intra-OIC trade has also been growing in recent years, from 17.3% in 2011 to 19.6% in 2020 (see figure 2). Intra-OIC export flows have been steadily increasing, from USD 260 billion in 2016 to USD 327 billion in 2019. The top exporters are Malaysia, United Arab Emirates, Saudi Arabia, Türkiye, and Indonesia, collectively accounting for 62.7% of all OIC exports[2].

Although intra-OIC trade has been growing in recent years, the current level of trade integration among OIC Member Countries is still lower than is desired. At the 13th Islamic Summit held in April 2016 in Istanbul, the Committee for Economic and Commercial Co-operation of the OIC (COMCEC) adopted a New Ten-Year Plan of Action to achieve a 25% intra-OIC trade share by 2025. Currently, only 28 of the OIC’s 57 Member States have attained the target of a 25% intra-OIC trade share. Given that the current figure for the OIC is 5% below the target, there is still much room for improvement. Increasing the share of intra-OIC trade is a strategic objective as it allows the region to be more resilient in the face of trade shocks, such as the one engendered by the COVID-19 pandemic. In times of crisis, it is much easier to collaborate with international partners and neighbours committed to your same ideals, customs, economic models and culture. By increasing intra-OIC trade, ICIEC will be able to fortify OIC economies, reduce their exposure to volatility, and better protect the lives and livelihoods of countless people across the Ummah.

Figure 4: Share of intra-OIC trade, 2011 – 2020

Source: Calculated using IMF Directions of Trade Statistics (DOTS)

OIC’s leading exporters and importers are concentrated in these same five countries (see figure 3 and 4). Exports are traditionally concentrated in mineral fuels and non-fuel primary commodities, which tend to involve the least technological intensity. For sustainable and long-term economic development, OIC Member Countries need to diversify exports into other sectors, hedge export revenues against volatile commodity prices.

ICIEC’s role in facilitating intra-OIC trade and investments

ICIEC plays a crucial role in promoting intra-OIC trade and investment through the strategic provision of its insurance cover. ICIEC’s Documentary Credit Insurance Policy, Credit Insurance Products, Bank Master Policy, and other solutions bridge the market failures that often inhibit intra-OIC trade and investments. These instruments catalyze impact for export sector development, Shari’ah compliant financial sector development, and support member country and human development.

In providing risk mitigation instruments and facilitating access to trade finance, ICIEC supports exporters of all sizes to grow their businesses and ultimately supports Member Countries to prosper economically. ICIEC’s presence in the financial market increases the capacity of its partner financial institutions in OIC countries to offer Shari’ah-compliant insurance services and access to finance, further setting an example as the only multilateral Takaful credit insurer. At the same time, ICIEC’s Sovereign Sukuk Insurance Policy aims to strengthen Islamic Finance capital markets and mobilize Shari’ah-compliant capital for strategic investment projects in Member Countries. ICIEC also promotes intra-OIC trade and investments by underwriting investments in strategic sectors, particularly in the least Developed Member Countries that are at higher risk and therefore not as attractive to traditional market players. By facilitating trade within OIC, ICIEC strengthens the organization and provides equal opportunities for all OIC Member Countries to trade.

Since its inception, ICIEC has insured USD 68.5 billion in imports and exports. In 2020 alone, the Corporation insured USD 4.47 billion of intra-OIC trade. ICIEC’s insurance enables Member Countries to import strategic goods such as food, export products that generate foreign currency revenue for the country and strengthen strategic sectors through infrastructure development. ICIEC’s insurance, which helps to catalyze intra-OIC trade, is also critical for assisting Member Countries in reaching the 25% intra-OIC trade target set by COMCEC for 2025, thereby enhancing regional economic integration and resilience.

Looking ahead, ICIEC is continuing to expand its operations in OIC Member Countries to strengthen intra-OIC trade. ICIEC has also instituted several initiatives to support the least developed Member Countries to participate more effectively in trade.

Toward Resilience and Prosperity Across the OIC

Enhancing the quantity of intra-OIC trade has been central to ICIEC’s operations since its inception. 2020 has exemplified just how vital this aim is to every Member Country in the OIC. The year showed OIC economies’ supply chains and trade partnerships with other actors across the globe are more fragile than once believed. There is a growing need to increase the Intra-OIC trade to bolster the resilience and prosperity of ICIEC’s Member Countries’ economies. The untapped potential of intra-OIC trade and investment can more easily be achieved through ICIEC’s steadfast dedication to ensuring that potential OIC trade partners can engage in trade and investment transactions and by being a powerful risk mitigant. As OIC countries lean on one another to exchange goods and services, the Ummah will be more economically secure, resilient to outside shocks and in harmony with its partners.

[1] https://demographicdividend.org/

[2] https://sesricdiag.blob.core.windows.net/sesric-site-blob/imgs/news/2461-SESRIC-Trade-Goods.pdf

A New Year: The 2021 Insurance Market

2020 Recap

The year 2020 will always be associated with the global COVID-19 pandemic and the resulting socio-economic fallout worldwide. Like other industries, the trade credit and political risk insurance industry experienced broad and deep impacts financially, operationally, and strategically. Trade credit and political risk insurers had to adapt quickly to mobilize tools and develop policies that would maintain essential trade flows of goods and services and help alleviate the economic impacts of the pandemic. The OECD estimates that 2020 saw a reduction of global GDP by 3.4% and a global trade contraction by 10.9%[1]. Such negative economic outlooks remain concerning for many governments and businesses.

Aside from the pandemic, other factors were at play in 2020, including macroeconomic conditions, geopolitical developments, and technological advancements, which also affected trends in the insurance industry and forced insurers to rethink their core strategies, including which products they offer, which markets they serve, and how they operate.

Challenges and Risks

It comes as no surprise that 2020 ranked pandemics and infectious diseases as the top perceived risk in the insurance market worldwide. The pandemic also accelerated the perception of other existing risks, such as public debt, cybersecurity, geopolitical tensions, unemployment, and inequality. Due to the speed and severity of the pandemic, scenarios that would typically have unfolded over many years instead took place over just a few months. These jolts increase the potential for risks to influence each other in unpredictable ways.

The pandemic’s initial shock in early 2020 saw a sharp increase in the number of insolvencies and the number of claims reported by credit insurers, but this decreased later in the year, thanks to the support that governments, and importantly, the coordinated nature of the responses, across the world offered to businesses[2]. Swift government assistance helped credit insurers improve their resilience to shocks and withstand most of the negative impacts on their business. However, there are concerns that a future reduction in government support could trigger economic instability and a spike in claims.

Overall, in 2020 the insurance industry had to develop innovative ways to mitigate the risks caused and accelerated by the pandemic. Trade credit insurance remained essential in 2020 for supporting trade flows and supply chains that are crucial for economic recovery, providing security to businesses and investors. However, the long-term implications of the pandemic are still ultimately unknown, and caution is still highly warranted going forward.

ICIEC’s Response to the Challenges and Risks

In the face of the global pandemic, ICIEC was fast to respond, forging strategic partnerships, ensuring the continuance of critical trade flows, and creating innovative solutions to help mitigate the fallout in Member Countries. ICIEC had to adapt quickly to the challenges of the COVID-19 pandemic to ensure the economic and social stability of its Member Countries by introducing several measures and initiatives to combat the negative impact of the pandemic on the economies of the member countries. These measures included introducing new products and insurance capacity. ICIEC’s total amount of business insured for 2020 amounted to USD 9.86 billion.

As part of the Islamic Development Bank Group’s ‘Strategic Preparedness and Response Facility’ (SPRF), ICIEC’s COVID-19 response to date reached USD 450 million in insurance, helping to minimize the adverse health and socio-economic impacts of the pandemic in Member Countries, especially for the most vulnerable populations. In addition to the SPRF, ICIEC also collaborated with IsDB on the innovative USD 2 billion COVID-19 Guarantee Facility designed to support the private sector and the Islamic Solidarity Fund for Development (ISFD) to create the ICIEC-ISFD COVID-19 Emergency Response Initiative’ (ICERI). The ICERI is a rapid COVID-19 response and resilience initiative with USD 400 million in funding, supporting import-dependent and developing Member Countries. These collaborative efforts continue to help Member Countries meet their essential import needs of pharmaceuticals, healthcare equipment, agricultural commodities, energy commodities, and other crucial materials and resources necessary to combat the negative impacts of the pandemic.

Successes and Opportunities

The disruptions caused by the COVID-19 pandemic in 2020 also presented opportunities for the export credit insurance industry to position itself in line with new societal realities and market needs. One of the most significant opportunities to arise from the pandemic is the digital transformation’s acceleration in the insurance market that started over the past two decades. At the onset of the pandemic, the industry underwent rapid virtualization of operations to meet employee and client needs. This progression will enable data-driven transformation across the industry and cost-efficient organizational models in the future.

Besides implementing technology for ICIEC’s Business Continuity Management throughout 2020, ICIEC worked on implementing a new IT System to improve institutional performance, capacity, and responsiveness by digitizing its business processes. This new system will play a crucial role in increasing the volume of intra-OIC trade and the inflow of investment into Member Countries, in line with ICIEC’s 10-Year Strategic Plan. Additionally, the IT System will ensure that Takaful products are easier to access and easier to use. The system will improve ICIEC’s customer service experience through shorter processing times and improved information availability, making ICIEC’s products more attractive to prospective customers.

The increased digitization will bring about transformational changes to the industry by reducing operating expenses, automating internal processes, and boosting revenues. While the effects of the pandemic will be felt for years to come, and considerable uncertainty remains, including lingering obstacles to growth and profitability, there are still reasons to be cautiously optimistic for the future of the insurance market.

Early 2021

The 2021 overall outlook for the trade credit and political risk insurance market remains unclear as the effects of the pandemic still need to materialize fully. However, many of the trends witnessed in 2020 are continuing into the new year, presenting continued challenges and abundant growth opportunities. There is a lot of hopefulness worldwide as vaccines and control measures are slowly starting to have positive effects in some regions.

The uncertainty and protectionism in global trade sparked by the pandemic are poised to continue increasing the demand for trade credit products. The rise in focus toward protecting and mitigating risk from non-payment risks and expanding trade into different regions are becoming major growth factors in the market[3].

In a survey conducted by Trade Finance Global of trade credit members of the International Credit Insurance & Surety Association (ICISA), most respondents anticipate an increase in demand for credit insurance cover in 2021, and growth is expected for political risk underwriters in OECD countries. This survey also saw the majority of underwriters expecting an increase in claims paid, as well as the expectation that payment defaults will rise sharply this year[4]. Pricing is also likely to be affected by the COVID-19 pandemic. New types of covers will likely be developed this year in response to the pandemic, such as the launch of more parametric policies.

While the pandemic continues to dominate the policies and strategies of the insurance market in 2021, we can expect related and unrelated trends to make an impact. Environmental, social, and governance (ESG) concerns will likely take centre stage, focusing on promoting sustainability and the continuing digitization of the industry.

Looking Ahead

The long shadow cast by the pandemic will impact the assessment of future risks and opportunities when looking forward to the rest of 2021 and beyond. For the coming year, political decisions on COVID-19 and climate change will significantly impact risk. The biggest challenge is the ability to prepare for many unknowns as economies struggle to recover and the distribution of vaccines continue across the globe. Even as world economies recover their footing, it is unlikely that the market will go back to the previous ‘normal’ with the end of the global outbreak.

Due to the challenging economic conditions ahead, insurers should adopt strategies and policies to accelerate long-term recovery and growth. How insurers’ respond not just to the impacts of COVID-19 but the longer-term shifts in technology, the economy, and consumer preferences will be critical. Generating continuous innovation in insurance policies, strategies, operations, products, and customer experience could turn out to be the biggest differentiator in 2021 and beyond.

Despite all the uncertainties, the outlook for the years to come still shows growth opportunities. According to the Global Opportunity Analysis and Industry Forecast, 2020–2027, the compound annual growth rate (CAGR) of the trade credit insurance market estimated to grow at 8.6% from 2020 to 2027, and the market value of the trade credit insurance market projected to reach USD 18.14 billion by 2027[5].

The Islamic Finance Market

The COVID-19 pandemic caused many challenges for the Islamic finance market, especially with the current volatility in oil prices and the uncertain macroeconomic environment. Islamic finance also has a much larger exposure to SMEs, microfinance, and retail lending, exposing it to a greater risk of client default or increased claims entering 2021. However, the outlook for Islamic finance remains promising in the new year, as it has proven to be resilient to previous crises due to the nature of its offerings and instruments.

Islamic banks encourage transparency between institutions and their customers, and they continue to provide interest-free services and prohibit unethical and high-risk transactions. In addition, all cash flows are tangible assets in the economy, which makes it very difficult to create unsustainable levels of debt, unlike conventional banking, where debt is created without much of a limit. These principles will likely insulate Islamic finance institutions from the risk of bankruptcy in the coming year, even in the face of so much economic uncertainty.

The impacts of COVID-19 are also creating new opportunities by forcing the Islamic finance industry to adapt to rapidly evolving market conditions and speeding up the pace of emerging trends in socially responsible investing, sustainability, and digitalization to mitigate the impact of the outbreak. There is ample room for Islamic banking solutions to become critical in aiding the recovery following the crisis, aiding in the industry’s growth. The ultimate outlook will depend on the longevity and severity of the COVID-19 pandemic and its effects – particularly in OIC countries.

ICIEC’s Focus for the Year

As a leader in multilateral Shariah-compliant insurance solutions, ICIEC has been working to mitigate the effects of COVID-19 in Member Countries. The Corporation stands ready to unite with relevant partners and continue to grow the Islamic finance industry throughout 2021.

ICIEC continues to serve its mandate of promoting cross-border trade and support foreign direct investment (FDI) by providing risk mitigation and credit enhancement solutions to Member Country exporters selling to buyers across the world, to investors from around the globe investing in Member Countries, and to international exporters selling to Member Countries in transactions for capital goods and strategic commodities.

ICIEC’s promotion of intra-OIC relationships will remain essential in the year to combat the rise of protectionism as a trend in global trade. Many nations turned inward and implemented protectionist policies throughout the pandemic, especially regarding medical supplies and essential commodities. Several ICIEC’s Member Countries, classified as Low-Income Countries (LICs), has been hit the hardest by these protectionist policies. ICIEC will continue to address the effects of protectionism throughout 2021 by facilitating trade among businesses in the OIC and beyond. One such example is ICIEC’s support of the Arab-Africa Trade Bridges (AATB) Program. AATB is a multi-donor, multi-country, and multi-organizations program designed to leverage new trade partnerships, strengthen existing ones, and increase trade and investment flow between the Arab and African regions. ICIEC supports the AATB Program with investment and export credit insurance for Islamic Countries to strengthen the economic relations between OIC member countries.

ICIEC will also continue to support its Member Countries by continuing its COVID-19 funds and initiatives, aiming to mitigate challenges while also delivering development impact. One of ICIEC’s key strategic priorities is to support Member Countries in achieving their development agendas. ICIEC continues as well to support the achievement of the UN’s Sustainable Development Goals (SDGs). ICIEC continues to act as a catalyst for private sector capital to be mobilized and directed towards the achievement of the SDGs, which will have profound positive impacts in the OIC region and the rest of the world as they recover from the fallout of the pandemic. The pandemic provides an opportunity to recover more sustainably by growing economies, job creation, combating climate change, reducing inequality, and improving public health. ICIEC remains committed to prioritizing projects in Member Countries to build a more vital, resilient and inclusive ecosystem.

[1] https://www.oecd.org/coronavirus/policy-responses/trade-finance-in-the-covid-era-current-and-future-challenges-79daca94/

[2] https://www.moodys.com/research/Moodys-affirms-the-ratings-of-five-trade-credit-insurers-with–PR_1000004086

[3] https://www.alliedmarketresearch.com/trade-credit-insurance-market-A08305

[4] https://www.tradefinanceglobal.com/posts/what-does-2021-hold-in-store-for-credit-insurance/

[5] https://www.alliedmarketresearch.com/trade-credit-insurance-market-A08305

Sharing the Risk: The Benefits of Reinsurance

An interview with ICIEC’s Head of Reinsurance, Rahmatnor bin Mohamed

ICIEC was established in 1994 under the Islamic Development Bank Group to promote international trade and facilitate foreign direct investment in OIC countries through the provision of Shari’ah-compliant trade credit and investment insurance. For over 27 years, ICIEC has built its trusted reputation as a leading multilateral insurer, catalyzing trade and investments in its Member Countries. ICIEC aims to bridge market gaps and step in where the private market capacity and risk appetite has limitations. In addition to serving corporates and banks across ICIEC’s Member Countries, the Corporation also works with national, regional, and multilateral Credit and Political Risk insurers to create additional insurance capacity for mega and higher-risk projects through active use of reinsurance.

Reinsurance has become one of ICIEC’s staple products. Through its reinsurance solutions, the Corporation offers risk-sharing support to Member Country ECAs and enhances their capacity to catalyze development. To provide deeper insight into the Corporation’s reinsurance activities, ICIEC’s Head of Reinsurance, Mr Rahmatnor bin Mohamed, responded to some questions regarding the use and provision of reinsurance and the future of the reinsurance market.

Since taking on the role in 2008, Mr Rahmatnor bin Mohamad has led ICIEC’s reinsurance team and is responsible for overseeing all reinsurance activities.

What is reinsurance, and why is it used?

Rahmatnor: Essentially, reinsurance is insurance for direct insurers. It is an enabling partnership with the Reinsurers allowing Insurers to share risk and increase capacity. Reinsurance is a tool used by insurance companies providing them with financial flexibility. Reinsurance, therefore, can be seen as “shadow capital”, extending an insurer’s risk appetite and capacity.

What is the importance of reinsurance for ICIEC, and how do ICIEC’s clients and partners benefit from it?

Rahmatnor: ICIEC is in the business of providing Trade Credit and Political Risk Insurance (TC&PRI). For businesses conducting trade and making investments in an uncertain economic and political environment can be challenging. To manage these risks, companies around the world rely on TC&PRI. Credit Insurance provides coverage for a range of commercial and political risks that might lead to non-payment risk. In contrast, Political Risk Insurance covers political violence, Breach of Contract, War, expropriation, and currency inconvertibility, as well as Non-honoring of Sovereign Financial Obligation. It helps mitigate the financial blow from the loss or damage of commercial assets, income or property due to political events. While commercial and political risks are often difficult to predict, TC&PRI can provide peace of mind for policyholders.

Due to the current global political and economic environment and the higher-risk nature of some of ICIEC’s Member Countries, insurers providing cover for commercial and political risks may be hesitant to cover risks in certain instances.

Multilateral Insurance Institutions like ICIEC can be better suited than private insurers or ECAs to issue an insurance policy covering high-risk investment and trade destinations due to our mandate, political leverage, financial capacity, and ownership structure. As such, ICIEC and other multilateral insurance providers can expand the total market capacity for these destinations by seeking outward reinsurance or providing inward reinsurance to private insurers and ECAs, helping to boost investment and trade in high-risk states and regions. Inward reinsurance for ICIEC refers to when an insurance provider or national ECA seek ICIEC’s support to reinsure a risk they have covered, thus sharing the risk between the insurer and ICIEC as a Reinsurer. Usually, ICIEC shares the risk on inward reinsurance arrangements based on a predetermined agreement in these cases. Outward reinsurance is when the Corporation seeks to share risk or expand its insuring capacity for a particular project or portfolio. When ICIEC pursues outward reinsurance, it then looks for partners from the larger reinsurance market, such as the Lloyd’s of London. With outward reinsurance, we can enhance our capacity to take on additional risk and increase our capacity to insuring significant investments volumes and trade transactions.

When does ICIEC seek outward reinsurance?

Rahmatnor: ICIEC reinsures all its transactions via a treaty program and facultative arrangement or both. ICIEC seeks outward facultative reinsurance for megaprojects and trade transactions considered too large for ICIEC to undertake alone. This determination is based on actuarial assessment and risk profiling. ICIEC seeks to support these large-scale projects expressly if they deliver significant development impact, enabling the Corporation to fulfil its mandate. ICIEC’s main partners for outward reinsurance are from the European continent and Bermuda. However, ICIEC constantly explores the availability of rated security in non-traditional markets. These non-traditional reinsurance markets provide needed capacity for specific risks that otherwise cannot be insured on the continent and UK. ICIEC enjoys strong partnerships with other multilaterals who share similar mandates with ICIEC and, as such, often share risks. Our Strategy is to pursue all avenues that may secure additional risk capacity for ICIEC and make sure we have several options.

How is ICIEC benefiting from reinsurance treaties?

Rahmatnor: ICIEC has several treaty programmes covering all lines of business underwritten by the Corporation. Highly rated Reinsurance companies back these treaty programmes. Products included in the treaty programmes are – amongst others – STP, BMP, and FIIP. These treaty reinsurance programmes have provided ICIEC with automatic facilities and additional capacity, reducing the rising transaction costs of setting up facultative reinsurance.

In what cases does ICIEC use facultative reinsurance?

Rahmatnor: While ICIEC typically works with reinsurers on a treaty basis, we remain open to the reinsurance market on a facultative basis. The facultative market helps us stay in touch with the market to understand the current status of risk appetite and pricing. Facultative reinsurance is often used for transactions that do not meet treaty terms and conditions and typically reserved for large-scale transactions with profound development impact. Thanks to ICIEC’s outward facultative partnerships, investors, traders, and banks receive much-needed insurance cover, enabling the execution of trade transaction and inflow of investment to our member countries.

Can you speak more on ICIEC’s role in providing inward reinsurance?

Rahmatnor: Certainly. ICIEC serves as an essential reinsurance partner for the national ECAs of Member Countries in terms of inward reinsurance. These ECAs are often relatively small and are in need not only of financial capacity but also require technical support. These ECAs reach out to ICIEC for reinsurance to support their countries’ export activities and project financing. For these ECAs, ICIEC provides inward reinsurance agreements through facultative and treaty arrangements covering development impact-oriented projects that might not materialize otherwise.

2020 has been a challenging year for everyone. Besides the widespread hardships COVID-19 created in various capacities, how did the pandemic impact the reinsurance market and ICIEC?

Rahmatnor: 2020 was a challenging year in general for the reinsurance market, with significant concerns and outcomes of non-payment. With such uncertainty in the market for political and commercial risk, underwriters mainly focused on their existing portfolios. They did not have an appetite for underwriting new business. In 2020, ICIEC insured USD 9.9 billion worth of business and secured a reinsurance capacity totalling USD 6.081 billion through our treaties, the facultative reinsurance market and other insurance partners. In terms of inward reinsurance, ICIEC participated as a reinsurer for the Inward Quota Share Treaty programs with Turk Eximbank (Turkey), CAGEX (Algeria), COTUNACE (Tunisia), NAIFE (Sudan), Indonesia Eximbank (Indonesia), EGE (Egypt), JLGC (Jordan) and ASEI (Indonesia). In December 2020, ICIEC notably renewed its outward Quota Share Treaties based on expiring terms and conditions despite the world’s challenging pandemic period. ICIEC is particularly proud of this achievement, as we believe it shows how valued ICIEC is as an insurance partner.

Putting 2020 into the rear-view mirror, what is your outlook on the market for reinsurance entering 2021?

Rahmatnor: In 2021, the political risk landscape is particularly tumultuous. The COVID-19 pandemic continues to wreak havoc across the globe, killing and infecting millions, stressing healthcare systems, straining supply chains, troubling economies, and exposing deficiencies in all levels of government worldwide. Various geopolitical conflicts are causing significant risks, while the deterioration of US-Sino relations is providing concerning risk implications for global security and trade. Meanwhile, domestic forms of political strife are exceptionally high, with large protests and unrest occurring in various states worldwide. Despite the conditions in 2021 being somewhat unpredictable, we expect more reinsurance capacity to be released as vaccines reach those in need and governments slowly open their countries from extended lockdowns. These actions will help boost business going forward and encourage investment and trade in the post-COVID-19 world.

Lastly, what should ICIEC’s stakeholders expect from the Corporation’s reinsurance team in the future?

Rahmatnor: As we continue to deal with the ramifications of the pandemic, the reinsurance team at ICIEC is working diligently to strengthen our existing reinsurance partnerships and seek new opportunities to enhance ICIEC’s capacity in support of our Member Countries achieving their development vision and programmes. Despite the current difficulties, we are excited and prepared to help enable an insurance market that can assume more risk, further enhance trade and investment, and support life-altering projects for those most in need. We will continue strengthening ICIEC’s reinsurance capacity as we come out of this challenging period, and I am excited for the potential I see in the world post-COVID. Thank you.

Partnerships for OIC Development: Collaborations Between ICIEC and the IsDB Group

Introduction

Collaboration and partnerships are potent enablers of economic development. One inherent and highly influential collaboration for ICIEC stems from being a member of the Islamic Development Bank Group (IsDB Group). All the IsDB Group member institutions work together towards the same goal – delivering economic prosperity across the OIC by supporting sustainable development through Shari’ah-compliant solutions. Enhancing synergies between ICIEC and the IsDB Group is a strategic priority for the Corporation. It allows ICIEC and its group entities to deliver on both their shared and individual goals more effectively. Partners in the IsDB Group are integral to ensuring ICIEC’s success as the Corporation works to deliver on its mandate to support trade and development throughout the OIC.

The Islamic Development Bank (IsDB) and the IsDB Group: