Credit Insurance For Corporates

– Insurance of Supplier Credit

- Insolvency of the buyer / issuing bank.

- Failure or refusal of the buyer to pay.

- Refusal of the buyer to accept goods after shipment.

- Arbitrary cancellation of the contract by the buyer.

- Currency transfer restrictions by the buyer’s country / issuing bank’s country.

- Expropriation by the government of the buyer.

- War or civil disturbance in the buyer / issuing bank’s country.

- Protects balance sheet against non-payment of export receivables.

- Enhances competitiveness.

- Increases international sales by offering flexible payment terms to overseas customers.

- Offers to customers open account credit terms while protecting the insured against credit risk.

- Helps access working capital facilities from banks by assigning the insurance policy to the banks as security.

- Nationals of a Member Country.

- Corporations or other juridical entities located in ICIEC member countries or owned at least 50% by the IsDB or by a Member Country if located in Non-member countries.

- Goods should have at least 20-30% value-added from one or more Member Countries.

- In case of capital goods or strategic commodities, the above criteria are not applicable. However, the buyer should be in a Member Country.

- Goods not prohibited by Islamic Shari’ah.

- Up to 7 years

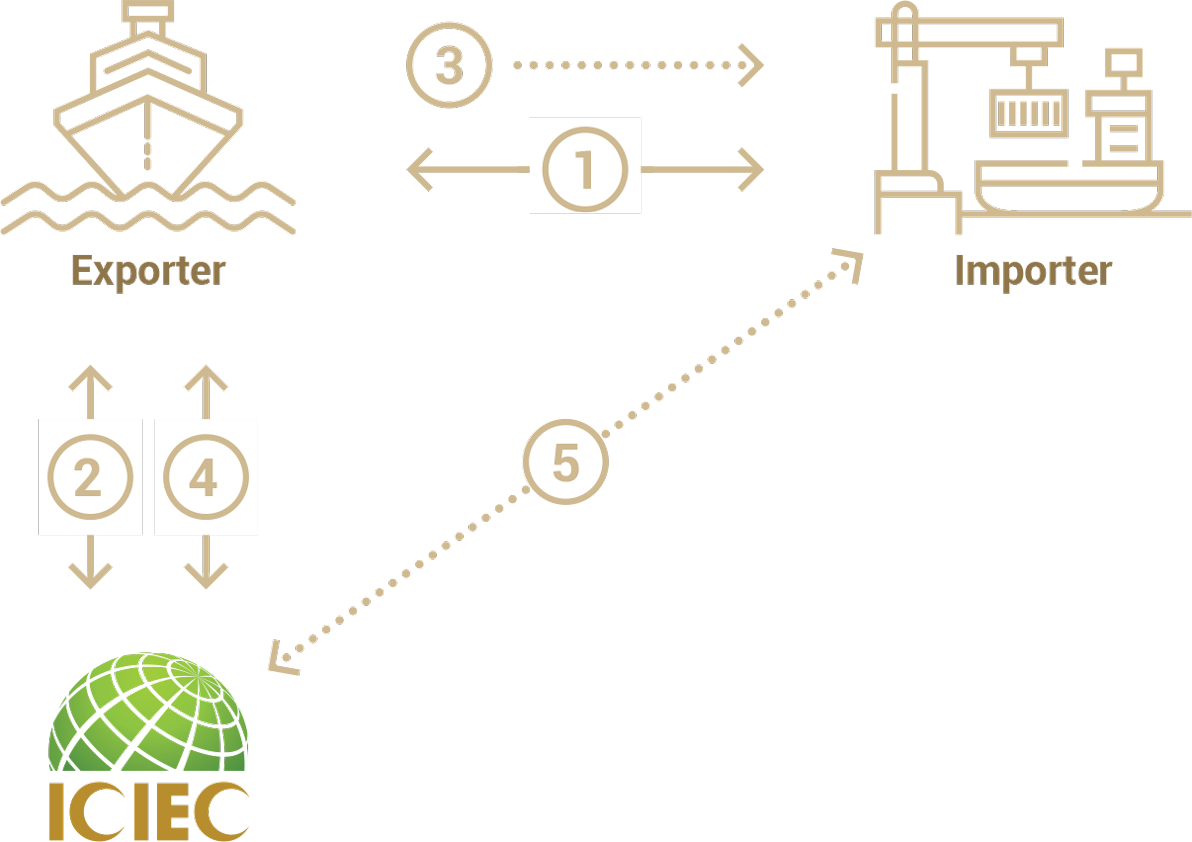

How It Works ?

- Exporter enters into a sale contract with importers / buyers.

- The exporter concludes an insurance contract with ICIEC to cover non-payment risks of up to a certain percentage (e.g. 90%) and pays the premium.

- The exporter ships the goods to the buyers and declares the shipments to ICIEC

- In case one of the buyers fails to pay, the exporter submits a claim to ICIEC which indemnifies the exporter for up to 90% of the covered amount.

- ICIEC recovers from the buyer and pays 10% share to the exporter.